Carrols Bundle

Unlocking the Secrets of Carrols Company: How Does It Thrive?

Carrols Restaurant Group, the titan behind a massive network of Burger King franchises, commands a significant presence in the fast food industry. Its success hinges on a complex interplay of operations, strategic decisions, and market dynamics. Understanding Carrols SWOT Analysis is crucial for anyone looking to understand the inner workings of a major player in the quick-service restaurant (QSR) world.

This exploration into Carrols Company delves into its core operations, revealing how it manages its extensive Burger King franchise portfolio. We'll examine its business model, analyze its revenue streams, and assess its strategic moves within the competitive fast food industry. By understanding Carrols operations, we can gain insights into its financial performance and long-term viability, crucial for investors and industry observers alike, including its impact on the fast food industry.

What Are the Key Operations Driving Carrols’s Success?

Carrols Restaurant Group's core operations are centered on owning and operating Burger King restaurants. This focuses on providing convenient, affordable, and consistent fast-food experiences to a wide customer base across the United States. The company's value proposition lies in delivering a familiar and reliable dining experience.

The company's offerings primarily include Burger King's well-known menu items like the Whopper, along with other burgers, chicken sandwiches, fries, and beverages. Carrols serves a diverse demographic, from individuals and families looking for quick meals to those seeking value-oriented options. This operational model has allowed Carrols to become a significant player in the fast food industry.

Carrols' operational processes are multifaceted, involving rigorous supply chain management, standardized food preparation, and efficient customer service. The company leverages Burger King's established brand and operational support systems. Its ability to manage a large portfolio of franchised restaurants effectively contributes to its market differentiation and sustained presence. The company's success is closely tied to its operational efficiency and its deep understanding of the fast-food market.

Carrols relies on an efficient supply chain to ensure a consistent flow of ingredients to its restaurants. This includes sourcing from Burger King's broader network, benefiting from economies of scale. Distribution networks are optimized for freshness and efficiency, ensuring restaurants receive supplies promptly.

The company focuses on optimizing store-level profitability and executing consistent brand standards across numerous locations. This operational efficiency helps translate core capabilities into customer benefits such as quick service and consistent product quality. Carrols' expertise in managing franchised restaurants is a key factor.

Carrols emphasizes efficient customer service protocols to enhance the dining experience. This is a critical element in maintaining customer satisfaction and loyalty. The company's approach includes quick service and accessible dining options.

Consistency in brand standards is a cornerstone of Carrols' operations. This involves maintaining standardized food preparation procedures to ensure product consistency across all locations. Carrols' commitment to brand standards helps build customer trust and loyalty.

Carrols' operations are characterized by efficient supply chain management, standardized food preparation, and effective customer service. These elements are crucial for maintaining the quality and consistency that customers expect from Burger King. The company's ability to manage a large number of units contributes to its market position.

- Supply Chain Optimization: Ensures timely delivery of ingredients.

- Standardized Procedures: Maintains consistent product quality.

- Customer Service Protocols: Enhances the overall dining experience.

- Franchise Management: Optimizes store-level profitability.

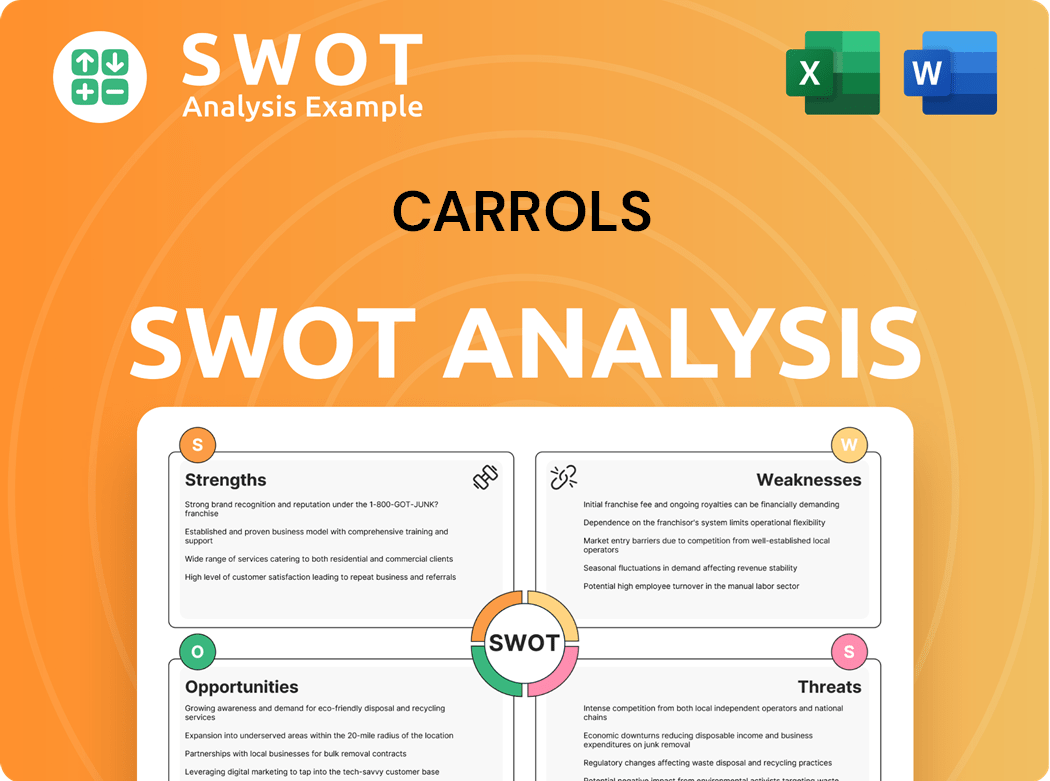

Carrols SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Carrols Make Money?

The core of the Carrols Restaurant Group's revenue generation lies in the direct sales of food and beverages. This is primarily achieved through its network of company-operated Burger King franchise locations. The Carrols operations are heavily reliant on the volume of transactions at the point of sale.

Carrols Company's monetization strategy is centered on driving sales volume. This involves strategies like promotions and digital ordering to increase customer traffic. The company's revenue mix is heavily concentrated on direct consumer transactions.

The company's revenue is primarily influenced by same-store sales growth, restaurant acquisitions or dispositions, and shifts in consumer spending within the fast food industry. The company continuously adjusts its operational strategies to maximize sales and profitability, responding to market conditions and consumer preferences.

Direct sales of food and beverages at Burger King restaurants constitute the primary revenue stream. This is the main source of income for Carrols Restaurant Group. The company's business model relies on high-volume sales.

Monetization focuses on increasing customer traffic and average check size. This includes localized promotions, value menus, and digital ordering incentives. The company leverages system-wide and regional marketing efforts.

Changes in revenue reflect fluctuations in same-store sales growth. Acquisitions or dispositions of restaurants and shifts in consumer spending habits in the fast-food sector also play a role. The company adapts to market conditions.

The company continuously adapts operational strategies to maximize sales per restaurant. It responds to market conditions and consumer preferences. The goal is to enhance overall profitability.

As a franchisee, Carrols Company does not have significant licensing fees or subscription revenues. The focus is on direct consumer transactions. This distinguishes it from franchisor models.

The restaurant business model is affected by consumer behavior. Market trends and economic conditions influence revenue. The company's strategies are adjusted accordingly.

Carrols Company's financial performance is closely tied to its ability to drive sales at its Burger King franchise locations. The company focuses on operational efficiency and adapting to changing consumer preferences. The Carrols operations are designed to maximize profitability within the fast-food sector.

- Same-Store Sales Growth: Increases in sales at existing restaurants are a primary driver of revenue.

- Menu Innovation: Introducing new menu items and promotions to attract customers.

- Digital Initiatives: Utilizing online ordering, mobile apps, and loyalty programs to boost sales.

- Operational Efficiency: Streamlining operations to reduce costs and improve profitability.

- Marketing and Advertising: Implementing effective marketing campaigns to drive customer traffic.

For more insights, you can explore the Competitors Landscape of Carrols to understand how Carrols positions itself in the market and how it compares to its competitors.

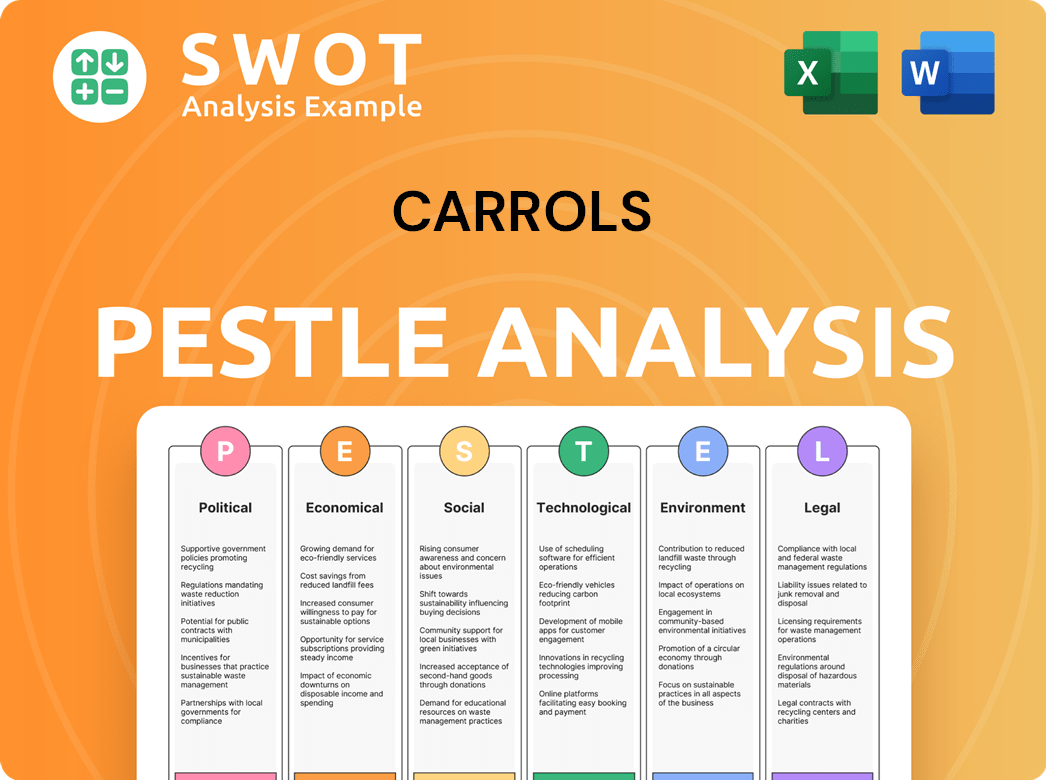

Carrols PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Carrols’s Business Model?

Carrols Restaurant Group has built its story primarily through its role as a major Burger King franchise operator. A key move in its strategy has been the acquisition of additional Burger King locations, which has cemented its place as the largest franchisee in the U.S. This expansion has been critical in shaping its operational scale and financial results. The company has also adapted to operational challenges, such as supply chain disruptions and changing consumer preferences, by optimizing restaurant operations and investing in technology.

The company’s competitive advantages come from several factors. Its scale allows for economies of scale in purchasing, marketing, and overhead, leading to better pricing from suppliers and more efficient resource allocation. Its long-standing relationship with the Burger King brand provides strong brand recognition and a built-in customer base, reducing marketing costs and building customer loyalty. Furthermore, its expertise in managing a large portfolio of fast-food restaurants, including site selection, operational efficiency, and staff training, contributes to its competitive edge. You can read more about this in Brief History of Carrols.

The company continues to adapt to new trends, such as the increasing demand for digital ordering and delivery services, by integrating these capabilities into its operations. It also responds to competitive threats from other QSR chains by focusing on operational excellence, customer service, and leveraging the strength of the Burger King brand to maintain its market position.

Carrols has grown substantially by acquiring more Burger King restaurants. This has significantly increased its operational footprint. This expansion has been a core element of its strategy.

The company has focused on operational efficiency to handle supply chain issues. It has also embraced digital ordering to adapt to changing consumer behaviors. These moves have helped it stay competitive in the fast food industry.

Its large scale provides economies of scale in purchasing and marketing. Its relationship with Burger King provides brand recognition and a loyal customer base. Expertise in managing fast-food restaurants contributes to its competitive advantage.

Carrols is integrating digital ordering and delivery services. It is also focusing on operational excellence and customer service. These efforts help it maintain its market position.

Carrols Restaurant Group manages a large number of Burger King restaurants. They focus on operational efficiency and customer service. The company continually adapts to market changes.

- Large Franchise Network: Operates a significant number of Burger King locations.

- Operational Efficiency: Focuses on streamlining operations to improve profitability.

- Customer Service: Prioritizes customer satisfaction to build loyalty.

- Adaptability: Adjusts to market trends, such as digital ordering and delivery.

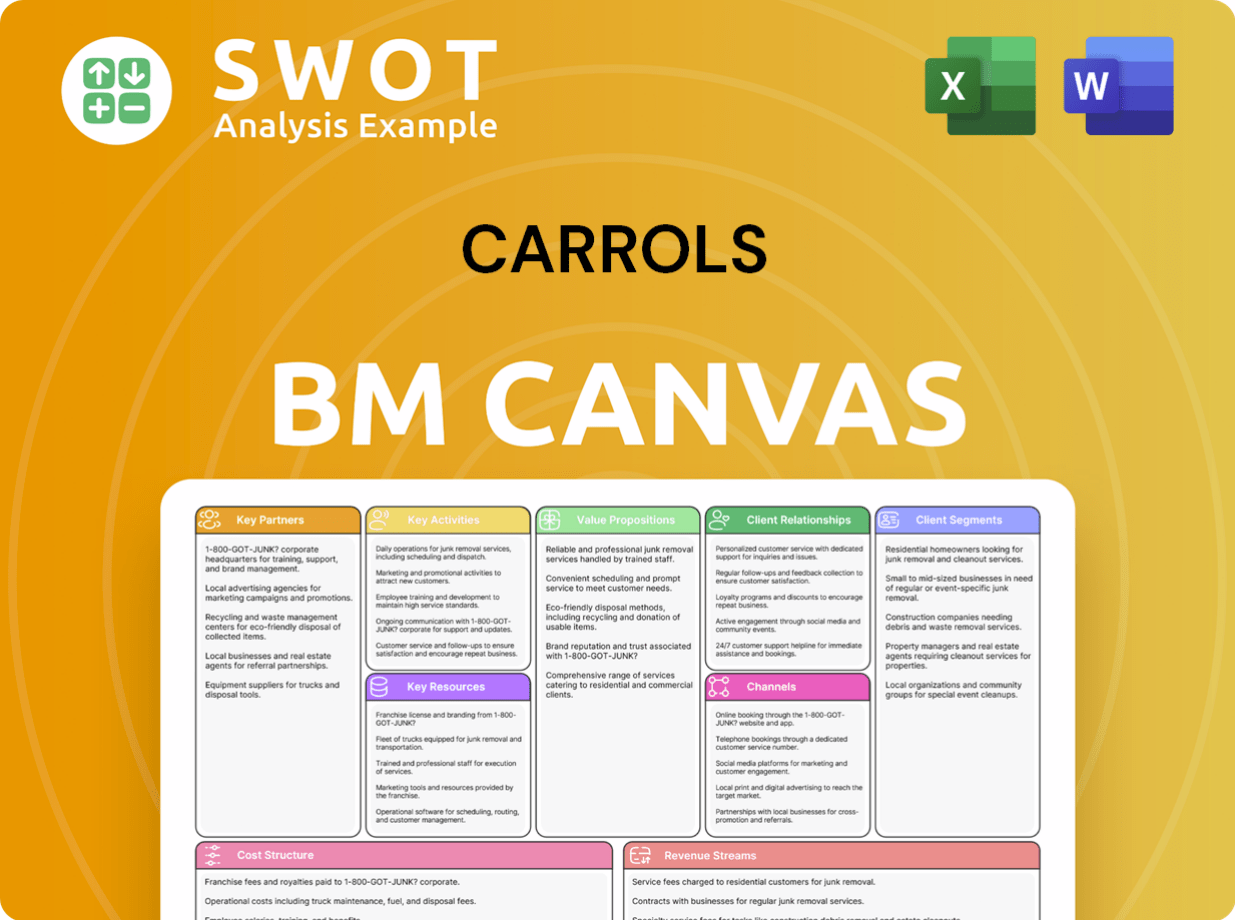

Carrols Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Carrols Positioning Itself for Continued Success?

Carrols Restaurant Group holds a significant position within the Burger King franchise system. It's the largest franchisee in the United States, which gives it considerable market share in the quick-service restaurant industry. The company's extensive network of restaurants across several states reflects its wide geographical presence. Understanding the dynamics of the Growth Strategy of Carrols is crucial for investors and stakeholders.

The company's operations are subject to various risks, including fluctuating costs and intense competition within the fast-food sector. Changes in consumer preferences and technological disruptions also pose challenges. The future outlook for Carrols depends on its ability to adapt and maintain operational efficiency.

Carrols Restaurant Group is the largest Burger King franchisee in the U.S., with a substantial market share. Its wide presence across numerous states underscores its significant footprint in the restaurant business model. The company benefits from the established brand recognition of Burger King.

Key risks include fluctuating food and labor costs, which directly impact profitability. The fast food industry's competitive landscape also presents challenges. Consumer preference shifts and technological advancements, such as mobile ordering, influence its performance.

Carrols Company is likely to focus on optimizing existing restaurant performance and managing costs. The company's ability to sustain sales growth and adapt to industry changes will be critical. Further integration of digital channels and delivery services is expected.

As of 2024, Carrols Restaurant Group's financial performance reflects the challenges and opportunities within the fast food industry. Specific financial figures, such as revenue and profit margins, vary based on market conditions and operational strategies.

Carrols Company's strategic initiatives involve operational improvements and cost management. The company aims to leverage the Burger King brand's initiatives to drive growth. Expansion strategies may include restaurant renovations and technology upgrades.

- Optimize existing restaurant performance through renovations and technology upgrades.

- Manage cost structure efficiently.

- Adapt to the dynamic landscape of the fast-food industry.

- Further integrate digital channels and delivery services.

Carrols Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Carrols Company?

- What is Competitive Landscape of Carrols Company?

- What is Growth Strategy and Future Prospects of Carrols Company?

- What is Sales and Marketing Strategy of Carrols Company?

- What is Brief History of Carrols Company?

- Who Owns Carrols Company?

- What is Customer Demographics and Target Market of Carrols Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.