CBIZ Bundle

How Did CBIZ Transform into a Professional Services Powerhouse?

Ever wondered how a company becomes a national leader in financial and advisory services? CBIZ, Inc. offers a compelling story of strategic growth and market adaptation. From its humble beginnings in 1996 to its current status as a major player, CBIZ's journey is marked by significant CBIZ SWOT Analysis and key acquisitions. Discover the pivotal moments that shaped CBIZ's rise.

The CBIZ history is a testament to its ability to anticipate and respond to market demands. This brief history of CBIZ Inc. will delve into the company's early years, exploring the CBIZ company timeline and the strategic decisions that fueled its expansion. Examining the CBIZ acquisitions and the evolution of its CBIZ services provides valuable insights into its enduring success and its current market position as a prominent national professional services advisor. The CBIZ leadership has been instrumental in navigating the company through various stages of growth.

What is the CBIZ Founding Story?

The story of the CBIZ company began in 1996, initially as Century Business Services, Inc., headquartered in Cleveland, Ohio. The core idea was to bring together various professional services, including accounting and insurance, under one roof. While the exact initial investment isn't public, CBIZ started through strategic acquisitions, suggesting strong financial backing from the start. This approach helped establish a diversified service portfolio quickly.

The roots of CBIZ go back to 1987 with Stout Environmental, Inc. This company was acquired by Republic Industries in 1992. In 1995, Republic Industries spun off the business into Republic Environmental Systems, which then merged with Century Surety Company in 1996, forming International Alliance Services, Inc. (IASI). In 1997, IASI sold its environmental services and became Century Business Services, Inc., trading on the NYSE under the symbol 'CBZ'. The company rebranded to CBIZ, Inc. in August 2005.

CBIZ's early business model was a 'roll-up strategy.' This meant rapidly expanding across the country by buying up many regional and local accounting firms and business service providers. This allowed CBIZ to quickly establish a diversified service portfolio. A notable aspect of its structure is the alternative practice arrangement with CBIZ CPAs (formerly Mayer Hoffman McCann P.C.), operating as separate, independent legal entities that collaborate to provide accounting services, sharing a tax and consulting practice, CBIZ MHM LLC, which is a division of CBIZ.

CBIZ's journey is marked by strategic acquisitions and name changes, reflecting its growth and evolution in the business services sector. The company's early years were focused on building a national presence through a roll-up strategy, acquiring numerous regional and local firms.

- 1987: Stout Environmental, Inc. is formed, laying the groundwork for future developments.

- 1996: Century Business Services, Inc. is established, marking the official founding of CBIZ.

- 1997: Century Business Services, Inc. begins trading on the NYSE under the symbol 'CBZ'.

- 2005: The company rebrands to CBIZ, Inc., reflecting its expanded service offerings.

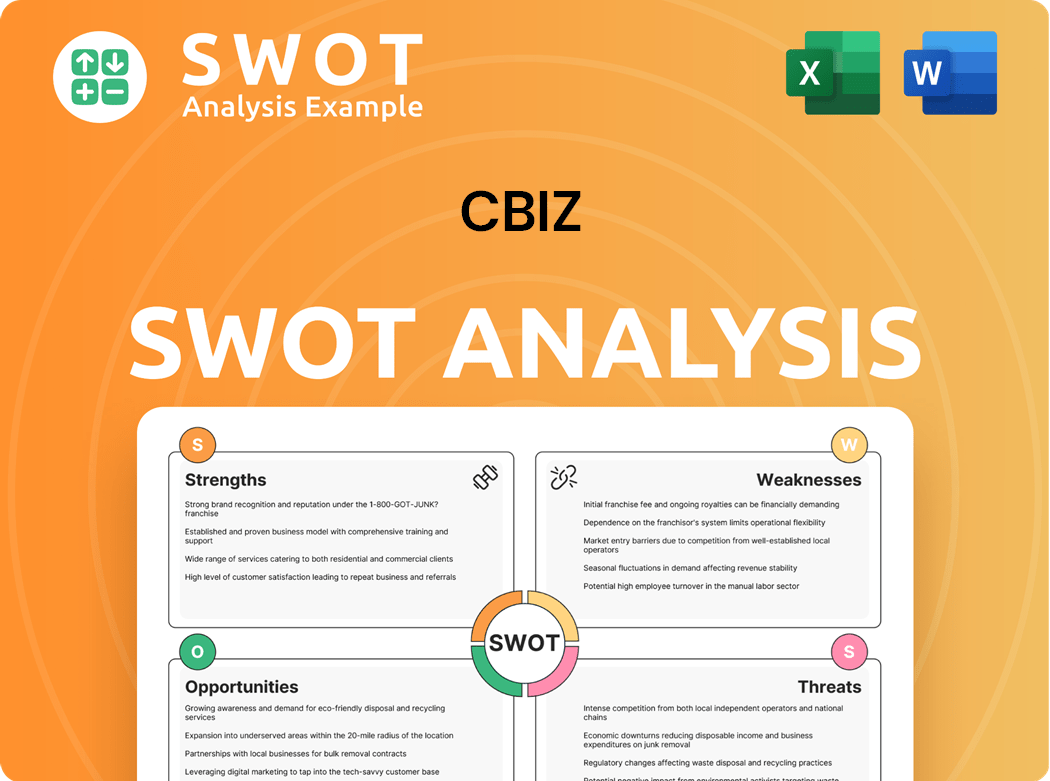

CBIZ SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of CBIZ?

The early growth of CBIZ, a company with a rich CBIZ history, was marked by an aggressive acquisition strategy. This strategy, particularly from 1997 to 1999, rapidly expanded its national footprint. This 'roll-up strategy' was crucial in establishing a strong national presence in the professional services market. The company's early years were defined by this rapid expansion.

CBIZ's early strategy involved numerous CBIZ acquisitions to build a national presence. This approach quickly diversified its service offerings beyond traditional accounting. The company expanded into employee benefits, insurance, and valuation services, broadening its revenue streams and client base.

Beyond accounting, CBIZ broadened its CBIZ services to include employee benefits, insurance, and valuation. This diversification helped to expand its client base and revenue streams. This expansion was a key part of the CBIZ company timeline.

In the 2000s, CBIZ focused on integrating acquired firms and expanding service lines. This included employee benefits, valuation, and risk advisory services. The 2010s saw strategic divestitures to focus on core growth areas. The company continued acquiring firms that complemented its existing offerings. This period also saw expansion into technology and advisory services.

In 2024, CBIZ completed five strategic CBIZ acquisitions, including Erickson, Brown & Kloster LLC, and CompuData, Inc. The most significant was the acquisition of Marcum LLP on November 1, 2024, valued at approximately $2.3 billion. This acquisition is projected to contribute to an expected combined annualized revenue of approximately $2.8 billion. For the full year ended December 31, 2024, CBIZ reported total revenue of $1.81 billion, a 14.0% increase over 2023, with a 6.8% increase attributed to the Marcum transaction. For more information on the company's ownership, you can read about Owners & Shareholders of CBIZ.

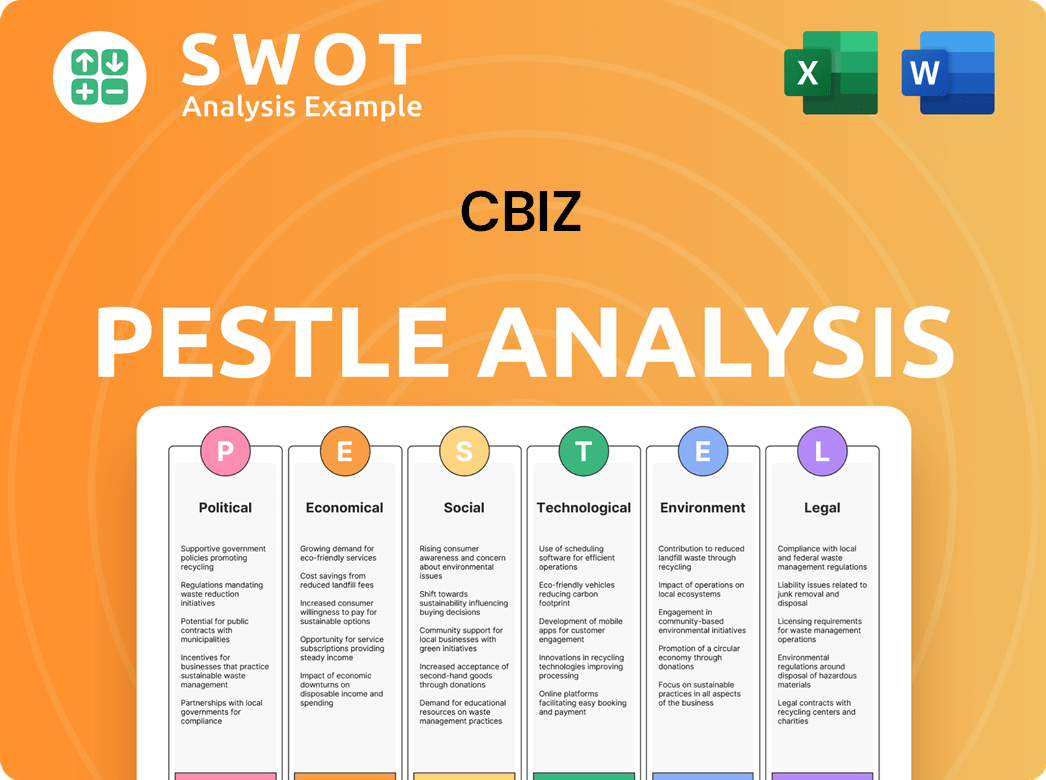

CBIZ PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in CBIZ history?

The CBIZ company has a rich history marked by significant milestones, including strategic acquisitions and expansions. A key aspect of its growth has been its focus on providing comprehensive professional services.

| Year | Milestone |

|---|---|

| 2024 | Acquired Marcum LLP, becoming the seventh-largest accounting firm in the U.S. |

| 2025 | Launched a comprehensive tariff solution to assist businesses with evolving trade pressures. |

| 2025 | Appointed new national industry leaders to address market trends and client needs. |

Innovation at CBIZ is evident through its expansion beyond traditional accounting. The company has invested in areas like employee benefits, valuation, and technology advisory services.

CBIZ has expanded its service offerings to include employee benefits, valuation, and risk advisory services.

The company focuses on digital transformation and data analytics to offer more sophisticated advisory services.

In May 2025, CBIZ launched a comprehensive tariff solution to help businesses navigate trade pressures.

Despite its successes, CBIZ faces challenges common to the professional services industry. These include competition and the complexities of integrating acquired firms.

CBIZ competes with national firms, regional players, and smaller specialized practices.

Economic downturns can reduce demand for CBIZ's services, particularly in areas like transaction advisory and valuation.

Integrating acquired firms, especially large ones like Marcum, presents complexities and risks.

The seasonal nature of its accounting and tax business, particularly in the fourth quarter, poses challenges.

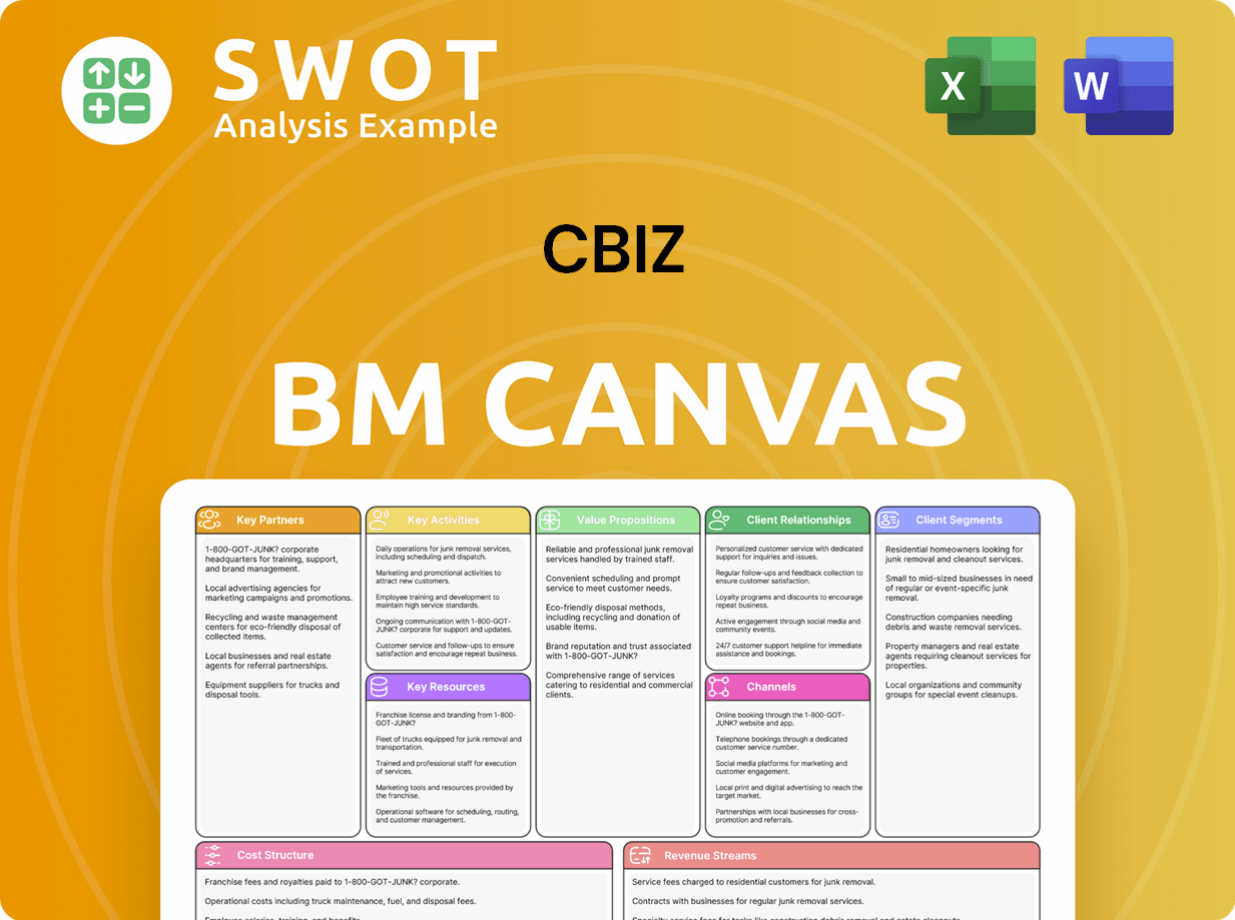

CBIZ Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for CBIZ?

The CBIZ history began in 1987 with the formation of Stout Environmental, Inc., evolving into Century Business Services, Inc. in 1996. Through aggressive acquisitions, CBIZ rapidly expanded its services, listing on the NYSE in 1997. The company officially became CBIZ, Inc. in 2005 and has continued to grow, notably with the acquisition of Marcum LLP in late 2024, significantly boosting its market position and financial performance. CBIZ has consistently adapted and expanded its offerings, solidifying its presence in the professional services sector.

| Year | Key Event |

|---|---|

| 1987 | Stout Environmental, Inc., the earliest predecessor to CBIZ, is formed. |

| 1996 | CBIZ is established as Century Business Services, Inc. in Cleveland, Ohio, with a vision to consolidate professional services. |

| 1997-1999 | CBIZ undergoes an aggressive acquisition phase, rapidly expanding its national footprint and service offerings. |

| 1997 | The company's common stock begins trading on the New York Stock Exchange under the symbol 'CBZ'. |

| 2005 | Century Business Services, Inc. officially changes its name to CBIZ, Inc. |

| November 1, 2024 | CBIZ completes the acquisition of Marcum LLP, the largest acquisition in the company's history, valued at approximately $2.3 billion. |

| December 31, 2024 | CBIZ reports full-year revenue of $1.81 billion, a 14.0% increase over 2023. |

| February 1, 2025 | CBIZ appoints six new national industry leaders, reinforcing its commitment to industry specialization, following the Marcum integration. |

| February 26, 2025 | CBIZ announces its fourth-quarter and full-year 2024 results, highlighting the positive impact of the Marcum acquisition. |

| March 2025 | CBIZ acquires CompuData, Inc., a managed IT services provider. |

| April 24, 2025 | CBIZ reports first-quarter 2025 results, with total revenue of $838.0 million, a 69.5% increase from Q1 2024, largely driven by the Marcum acquisition. |

| May 13, 2025 | CBIZ launches a comprehensive tariff solution to help businesses navigate evolving trade pressures. |

| May 20, 2025 | CBIZ releases a report highlighting rising healthcare costs, including the impact of GLP-1 drugs. |

CBIZ projects total revenue to be within a range of $2.8 billion to $2.95 billion for the full year 2025, reflecting an optimistic outlook driven by recent acquisitions and organic growth strategies. The company aims to continue its growth trajectory through strategic initiatives.

For 2025, GAAP fully diluted earnings per share are projected between $1.97 and $2.02, while adjusted fully diluted earnings per share are expected to range from $3.60 to $3.65, indicating strong financial health and strategic planning. The company anticipates continued profitability.

CBIZ plans to focus on strategic CBIZ acquisitions to strengthen its market presence and expand service offerings, with a healthy pipeline of M&A opportunities for 2025. Revenue growth in 2025 is largely expected to be organic as the company focuses on integration activities, particularly with the Marcum acquisition.

CBIZ's long-term annual growth goals are 8-10% for revenue and 1.5x-2x for earnings growth, reflecting confidence in its business model. This forward-looking approach remains consistent with its founding vision of being a premier provider of comprehensive professional services to the middle market.

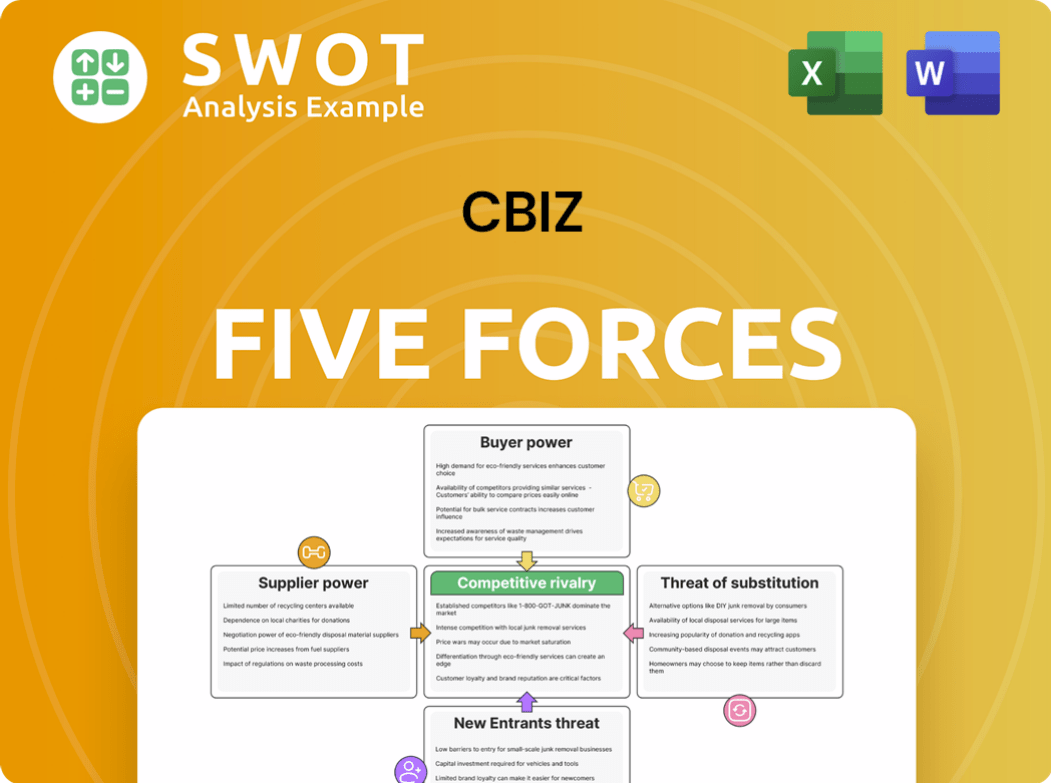

CBIZ Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of CBIZ Company?

- What is Growth Strategy and Future Prospects of CBIZ Company?

- How Does CBIZ Company Work?

- What is Sales and Marketing Strategy of CBIZ Company?

- What is Brief History of CBIZ Company?

- Who Owns CBIZ Company?

- What is Customer Demographics and Target Market of CBIZ Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.