CBIZ Bundle

How Does CBIZ Thrive in the Business World?

CBIZ, Inc. stands as a leading national professional services advisor, helping middle-market businesses navigate complex financial and operational challenges. Following its historic acquisition of Marcum LLP in November 2024, CBIZ is poised to become a top-tier accounting firm. This strategic move significantly reshapes the competitive landscape, making it crucial to understand how CBIZ operates.

This comprehensive analysis will uncover the inner workings of the CBIZ SWOT Analysis, examining its core CBIZ services, business model, and strategic initiatives. We'll explore how CBIZ solutions are structured, its recent expansions, and its competitive advantages within the financial services industry. Understanding how CBIZ company operates is essential for anyone looking to make informed decisions in today’s dynamic market.

What Are the Key Operations Driving CBIZ’s Success?

The CBIZ company creates and delivers value by providing a wide array of professional business services. These services are tailored to the needs of middle-market businesses and organizations. Its core offerings are delivered through three main groups: Financial Services, Benefits and Insurance Services, and National Practices.

The CBIZ company focuses on a client-centric approach, emphasizing long-term relationships and personalized services. They leverage a vast network of over 160 locations and over 10,000 team members. This extensive geographical presence helps to insulate the company from downturns in specific industries or regions.

A key differentiator for CBIZ is its deep industry knowledge and expertise across various sectors. This specialization allows CBIZ to provide tailored CBIZ solutions and actionable insights. These help clients manage growth, maximize profitability, and adapt to evolving business environments.

This group includes accounting, tax compliance, and advisory services. It also offers specialized services like transaction and risk advisory, litigation support, and valuation. This segment is crucial, contributing significantly to the company's overall revenue.

This group provides brokerage and consulting for group health benefits, property and casualty insurance, and retirement plan advisory. It also offers investment services. Additionally, CBIZ services include human capital management solutions, such as payroll and HR consulting, and executive recruitment.

The National Practices group focuses on managed networking and hardware services. It also provides healthcare consulting. These services help CBIZ offer a comprehensive suite of solutions.

CBIZ has made strategic acquisitions to enhance its service breadth and expertise. For example, the non-attest business of Marcum LLP. These acquisitions help solidify its position in the middle market.

CBIZ differentiates itself through industry specialization and a broad service portfolio. This allows the company to provide tailored solutions. These solutions help clients manage growth and adapt to changing business environments.

- Extensive network of over 160 locations.

- Over 10,000 team members.

- Deep industry knowledge across various sectors.

- Client-centric approach with a focus on long-term relationships.

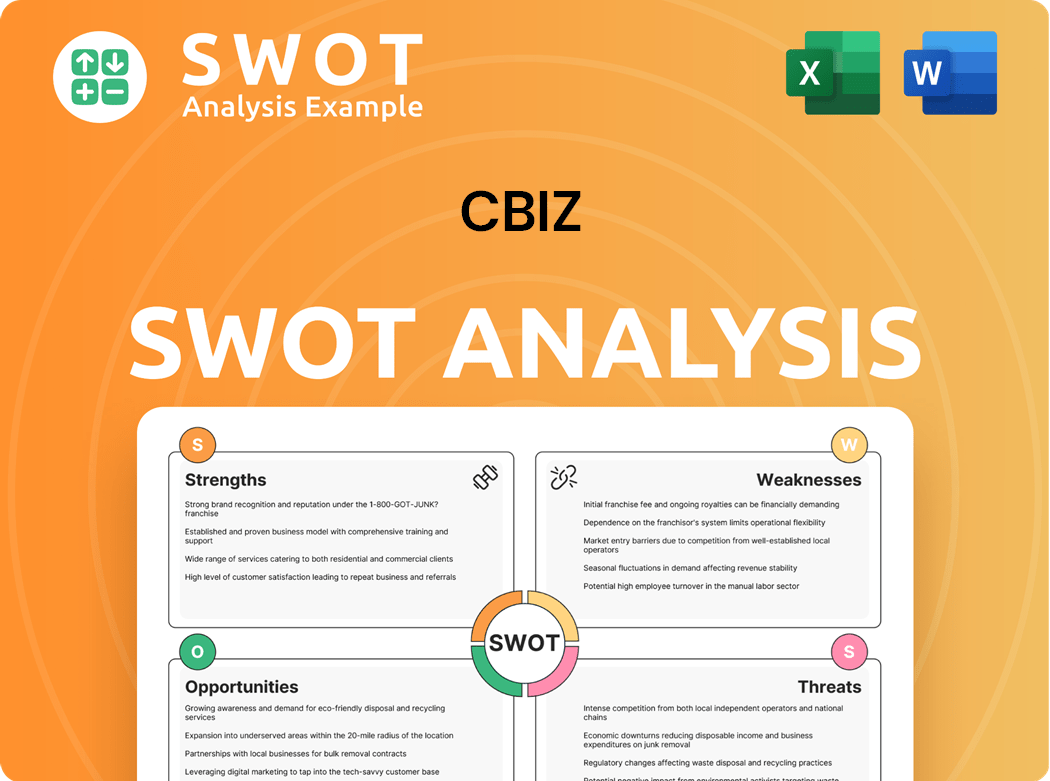

CBIZ SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CBIZ Make Money?

The CBIZ company generates revenue through its comprehensive professional business services, which are divided into different segments. The company's revenue streams are diverse, covering financial services, benefits and insurance, and national practices, ensuring a broad market reach. The CBIZ business model focuses on providing integrated solutions to clients, maximizing revenue per client.

In 2024, CBIZ reported total revenue of $1,813.5 million, reflecting a 14.0% increase compared to 2023. This growth was significantly influenced by the acquisition of Marcum LLP, which closed on November 1, 2024. For the first quarter of 2025, the company's total revenue reached $838.0 million, a substantial increase of 69.5% compared to the same period in 2024.

The Financial Services practice group was the largest contributor to total revenue in 2024, accounting for 75.1%. The Benefits and Insurance Services segment contributed 22.1% of total revenue in 2024. Looking ahead, CBIZ anticipates full-year 2025 revenue to be between $2.8 billion and $2.95 billion.

The company's monetization strategies include direct fees for accounting, tax, and advisory services, as well as commissions and consulting fees for employee benefits and insurance offerings. CBIZ services are monetized through a combination of fees and commissions, depending on the service provided. Bundled services and cross-selling are also key strategies, allowing the company to offer integrated solutions.

- Financial Services: Revenue is generated through fees for accounting, tax, and advisory services.

- Benefits and Insurance Services: Income is derived from commissions and consulting fees.

- Integrated Solutions: Bundling services and cross-selling to maximize revenue per client.

- Market Position: Marketing Strategy of CBIZ is key to maintaining its market share and industry position.

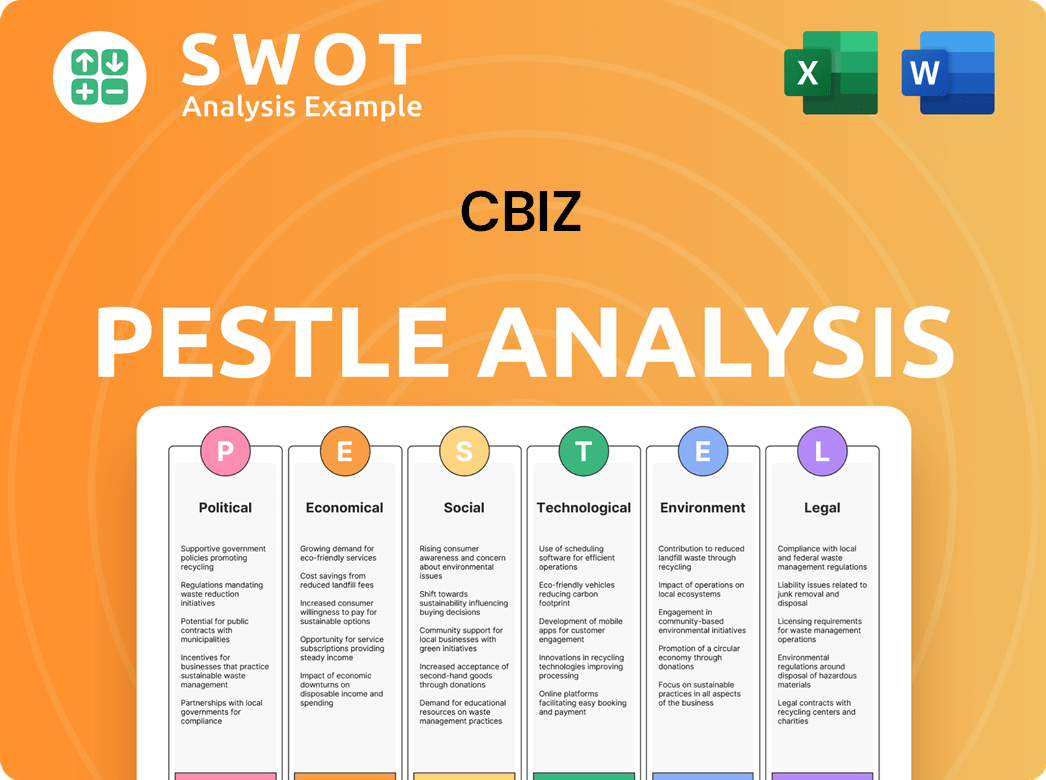

CBIZ PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped CBIZ’s Business Model?

Understanding how the CBIZ company operates involves examining its key milestones, strategic initiatives, and competitive advantages. The company has consistently demonstrated strategic growth, with significant developments shaping its operational and financial performance. These elements are crucial for understanding its position within the professional services sector and its approach to providing comprehensive business solutions.

A pivotal event was the acquisition of the non-attest business of Marcum LLP, finalized on November 1, 2024. This transaction, valued at $2.3 billion, significantly expanded the scope of CBIZ's services and market presence. This strategic move positioned CBIZ as the largest professional services provider of its kind in the U.S., and the seventh-largest accounting firm by revenue. The acquisition is projected to boost adjusted earnings per share (EPS) in 2025 by approximately 10%.

In 2024, CBIZ completed five strategic acquisitions, including CompuData, Inc., and Educational & Institutional Insurance Administrators, Inc. These acquisitions further strengthened its market presence and broadened its service offerings. These moves reflect CBIZ's commitment to strategic expansion and enhancing its capabilities to meet the evolving needs of its clients. The company's ability to adapt and grow through acquisitions is a key aspect of its business model.

The acquisition of Marcum LLP's non-attest business in late 2024 was a landmark achievement, significantly increasing CBIZ's market share. The company has also completed several other strategic acquisitions to broaden its service offerings. These acquisitions have been instrumental in expanding CBIZ's capabilities and reach within the professional services industry.

CBIZ focuses on strategic acquisitions to enhance its market presence and service offerings. Technology integration and operational efficiencies are also key priorities. These strategies are designed to improve client experiences and streamline operations.

CBIZ offers comprehensive services, catering to a broad client base. Its national footprint and deep industry knowledge provide a strong competitive advantage. The company's client-centric approach fosters long-term relationships.

CBIZ provides a wide array of services, including accounting, tax, and consulting. The company offers specialized solutions in areas such as human capital management and employee benefits. These diverse offerings allow CBIZ to meet the varied needs of its clients.

CBIZ's competitive advantages are rooted in its comprehensive service offerings and national footprint. These factors enable the company to serve a diverse clientele and maintain a strong market position. The company's focus on digital transformation also enhances its competitive edge.

- Comprehensive Service Offerings: Catering to a broad client base.

- National Footprint: Operating across 22 major markets with over 160 locations.

- Industry Expertise: Deep knowledge and client-centric approach.

- Digital Transformation: Leveraging technology for improved client experiences.

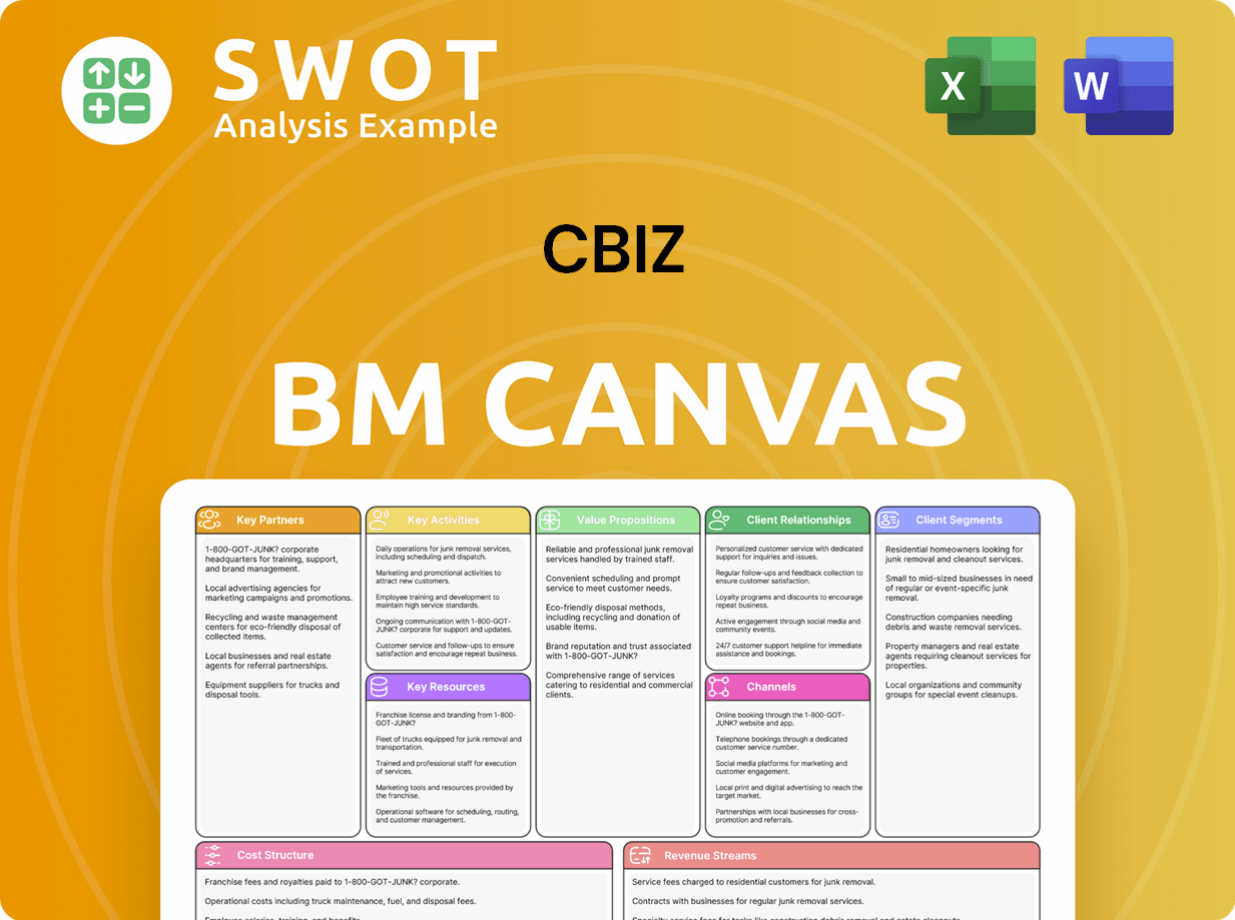

CBIZ Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is CBIZ Positioning Itself for Continued Success?

The professional services industry sees CBIZ holding a strong market position, particularly after strategic expansions. Following the acquisition of Marcum LLP in November 2024, the CBIZ company is now positioned as the seventh-largest accounting firm in the United States. This expansion has significantly bolstered its presence in the market.

Despite a solid industry standing, the CBIZ faces several key risks, including economic uncertainties and integration costs. The company's future outlook centers on sustained growth and strategic initiatives, aiming to strengthen its market presence and expand service offerings.

Post-acquisition, CBIZ is the seventh-largest accounting firm in the U.S. The company serves over 135,000 clients across more than 25 industries. This broad client base and diversified exposure highlight its strong market position.

Economic and geopolitical uncertainties can impact non-recurring service lines. Integration costs related to the Marcum acquisition are estimated at approximately $75 million for 2025. Competition from larger firms like Deloitte and PwC also poses a challenge.

The company expects total revenue for 2025 to be within a range of $2.8 billion to $2.95 billion. Management projects adjusted diluted earnings per share to be within a range of $3.60 to $3.65 for 2025. Strategic acquisitions and share repurchases are planned.

Focus on strategic acquisitions to strengthen market presence and expand service offerings. The company aims to reduce leverage to 2-2.5x by the end of 2026. Long-term annual growth goals include 8-10% for revenue and 1.5x-2x for earnings growth.

The CBIZ business model is built on a foundation of diverse service offerings and strategic expansion. This approach is detailed in the Growth Strategy of CBIZ article.

- Strong market position with significant client base.

- Focus on strategic acquisitions and operational efficiencies.

- Financial targets for 2025 include revenue and earnings per share projections.

- Ongoing initiatives include technology integration to enhance service delivery.

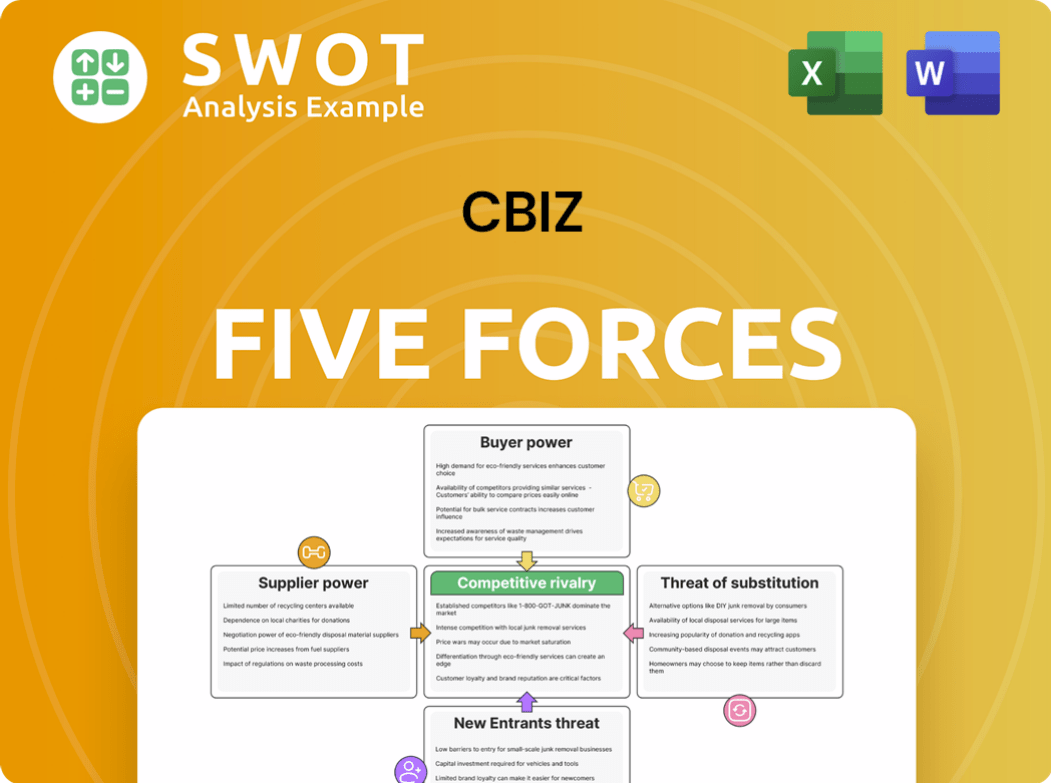

CBIZ Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CBIZ Company?

- What is Competitive Landscape of CBIZ Company?

- What is Growth Strategy and Future Prospects of CBIZ Company?

- What is Sales and Marketing Strategy of CBIZ Company?

- What is Brief History of CBIZ Company?

- Who Owns CBIZ Company?

- What is Customer Demographics and Target Market of CBIZ Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.