CBIZ Bundle

Who Really Owns CBIZ?

Unraveling the CBIZ ownership structure is key to understanding its strategic moves and future potential. From its 1996 inception as Century Business Services, Inc., to its current status as a leading financial services provider, CBIZ's journey is a testament to strategic evolution. Knowing who controls CBIZ is critical for investors and stakeholders alike.

CBIZ, now a publicly traded company on the NYSE under the ticker 'CBZ', has seen significant shifts in its ownership since its initial public offering. This analysis explores the CBIZ SWOT Analysis, key CBIZ shareholders, and the influence of CBIZ executives. We'll examine the CBIZ ownership structure, including major institutional investors, insider holdings, and the impact on CBIZ stock and overall company strategy, providing insights into who truly owns and influences the direction of this prominent firm. Understanding the CBIZ company profile is essential for anyone interested in the financial services sector.

Who Founded CBIZ?

The story of CBIZ, originally known as Century Business Services, Inc., began in 1996. It was founded with the aim of consolidating various professional services to cater to the needs of small and middle-market businesses. The company's origins are rooted in Stout Environmental, Inc., established in 1987.

CBIZ's evolution involved several strategic shifts and acquisitions. Stout Environmental, Inc. was acquired by Republic Industries in 1992. Later, in 1995, Republic Industries spun off Republic Environmental Systems, which then merged with Century Surety Company. This led to the formation of International Alliance Services, Inc. (IASI) in October 1996. IASI subsequently divested its environmental services and rebranded as Century Business Services, Inc. (CBIZ) in December 1997, marking its listing on the NYSE.

The initial financial backing for CBIZ involved significant investment and investor confidence, although specific figures are not readily available. Michael G. DeGroote played a pivotal role in the founding and early development of CBIZ. He pioneered the concept of a national, comprehensive outsourced business services provider for small and middle-market businesses. As of May 2025, DeGroote remains a significant CBIZ shareholder.

CBIZ was founded to offer a wide range of professional services.

The focus was on providing these services to small and middle-market businesses.

Michael G. DeGroote is a key figure in CBIZ's early history.

He spearheaded the idea of a national business services provider.

The company evolved through acquisitions and mergers.

This included the acquisition of accounting firms and service providers.

CBIZ's inception involved substantial financial backing.

This support was crucial for its early growth and acquisitions.

CBIZ expanded rapidly through acquisitions.

This strategy helped build its national footprint.

DeGroote remains a significant shareholder.

His stake reflects his early involvement and ongoing commitment.

Understanding the Target Market of CBIZ is crucial when considering the company's ownership and history. As of May 2025, Michael G. DeGroote remains the largest individual shareholder of CBIZ, holding 15.43 million shares, which represents 28.37% of the company. The initial ownership structure and specific equity splits of other early investors are not publicly detailed. The aggressive acquisition phase between 1997 and 1999, which involved acquiring numerous accounting firms and business service providers, rapidly expanded its national footprint and service offerings. This rapid expansion phase was crucial for establishing CBIZ's presence in the market and broadening its service portfolio.

CBIZ was founded in 1996 with a vision to consolidate professional services.

Michael G. DeGroote was a key founder and remains a major shareholder.

The company grew through strategic acquisitions.

- CBIZ's early development involved significant financial backing.

- The company's initial strategy focused on acquiring accounting firms and business service providers.

- DeGroote's substantial shareholding highlights his enduring influence on the company.

- Understanding the history of CBIZ is essential for investors.

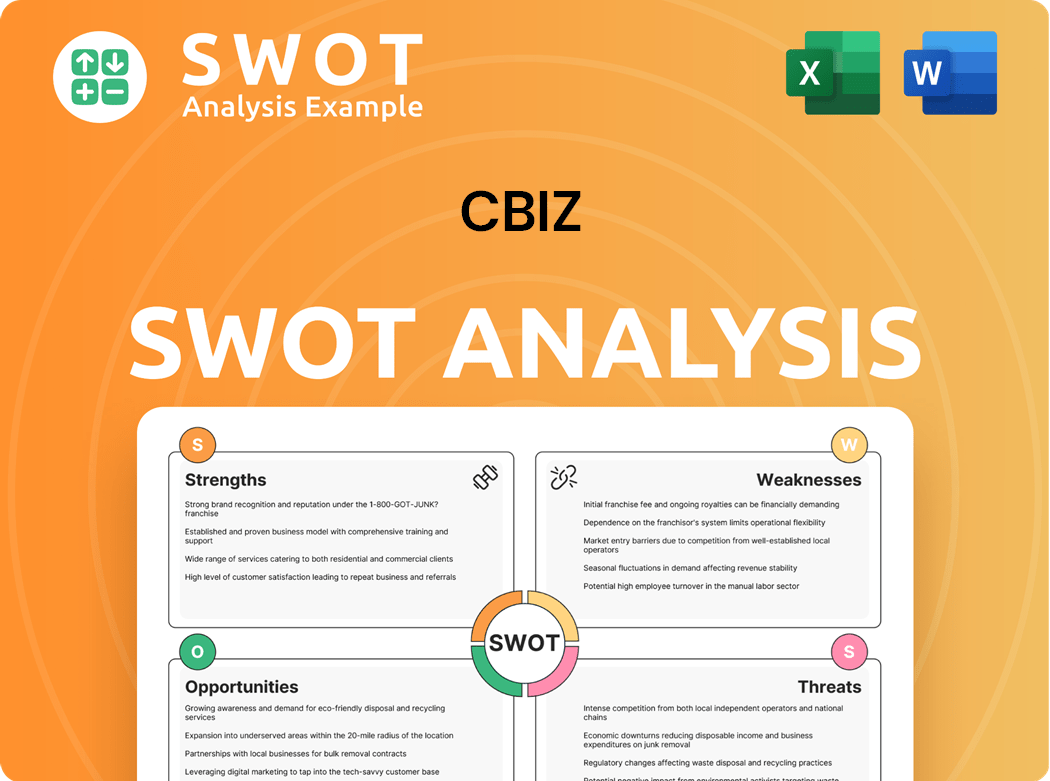

CBIZ SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has CBIZ’s Ownership Changed Over Time?

The ownership of CBIZ, Inc. is characterized by a dispersed structure, typical for a publicly traded company. The company's stock trades on the New York Stock Exchange (NYSE) under the ticker symbol 'CBZ' since 1997. As of December 31, 2024, there were approximately 2,430 holders of CBIZ common stock based on record ownership.

A major event impacting CBIZ's ownership and strategic direction was the acquisition of Marcum LLP in July 2024, which closed in November 2024. This transaction was the largest in CBIZ's history, expanding its services and expertise. The acquisition contributed 6.8% to CBIZ's full-year 2024 revenue growth of 14% and significantly expanded its Financial Services segment.

| Ownership Category | Percentage of Shares (Early 2025) | Shareholders (June 11, 2025) |

|---|---|---|

| Institutional Investors | Approximately 81.89% - 87.44% | 544 |

| Insider Ownership | Approximately 4.95% - 4.89% | N/A |

| Retail Investors | Smaller portion | N/A |

Institutional investors hold a significant majority of CBIZ's stock. As of June 11, 2025, CBIZ had 544 institutional owners and shareholders, holding a total of 56,720,123 shares. Major institutional shareholders include Vanguard Group Inc. (8.55%), BlackRock, Inc. (6.56%), and Morgan Stanley (5.74%). Insider ownership is approximately 4.95% to 4.89% as of early 2025. Michael G. Degroote remains the largest individual shareholder, owning 15.43 million shares, which represents 28.37% of the company. Retail investors hold a smaller portion of the company's stock.

CBIZ's ownership is primarily held by institutional investors, followed by insiders and retail investors. The company's stock is publicly traded on the NYSE.

- Institutional investors hold a significant majority of the shares.

- Insider ownership includes shares held by executives and board members.

- Retail investors hold a smaller portion of the stock.

- The acquisition of Marcum LLP in November 2024 was a key event.

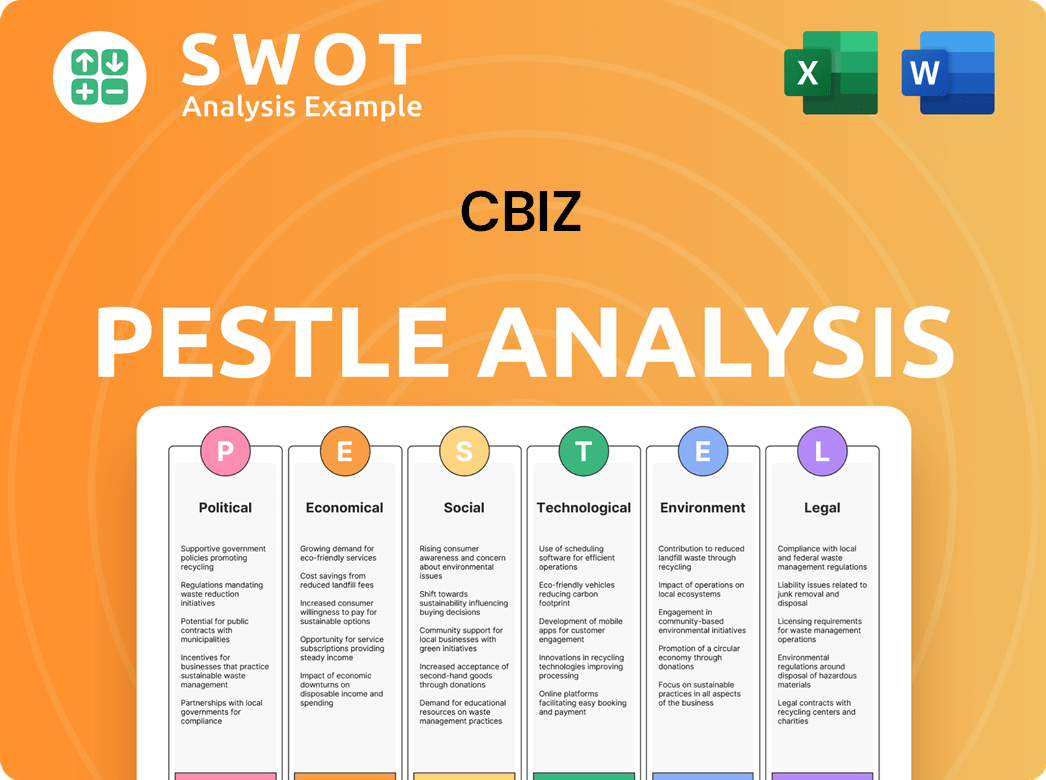

CBIZ PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on CBIZ’s Board?

CBIZ, Inc. is overseen by a Board of Directors, which guides the company's strategic direction. The company's structure includes authorized capital stock of 250 million shares of common stock, with no preferred stock. CBIZ shareholders are entitled to one vote for each share they own on all matters subject to a stockholder vote. The election of directors does not involve cumulative voting, meaning the majority of outstanding common stock can elect the directors whose terms are expiring.

Company executives and board members hold insider shares, representing approximately 4.95% to 4.89% of the stock. Key insiders include Michael P Kouzelos, Ware H Grove, Chris Spurio, Sherrill W Hudson, Benaree Pratt Wiley, and Joseph S Dimartino. CBIZ CPAs, operating in an alternative practice structure with CBIZ, Inc., has a nine-member Board of Directors, with no board members holding senior officer positions at CBIZ, Inc.

| Board Member | Title | Notes |

|---|---|---|

| Michael P Kouzelos | Insider | Owns CBIZ stock |

| Ware H Grove | Insider | Owns CBIZ stock |

| Chris Spurio | Insider | Owns CBIZ stock |

The voting structure follows a one-share-one-vote principle for common stock. There are no indications of dual-class shares or special voting rights. Proxy advisory firms influence corporate governance policies through their recommendations, with recent discussions highlighting concerns about political influence on these firms' policies. For more insights, you can explore the Marketing Strategy of CBIZ.

Understanding CBIZ ownership structure is key to assessing its governance. The company is governed by a Board of Directors and operates under a one-share-one-vote system. This structure ensures that voting power is directly proportional to share ownership, providing a clear picture of who owns CBIZ.

- CBIZ is a public company.

- CBIZ executives and board members hold insider shares.

- CBIZ has a nine-member Board of Directors.

- The voting structure is one-share-one-vote.

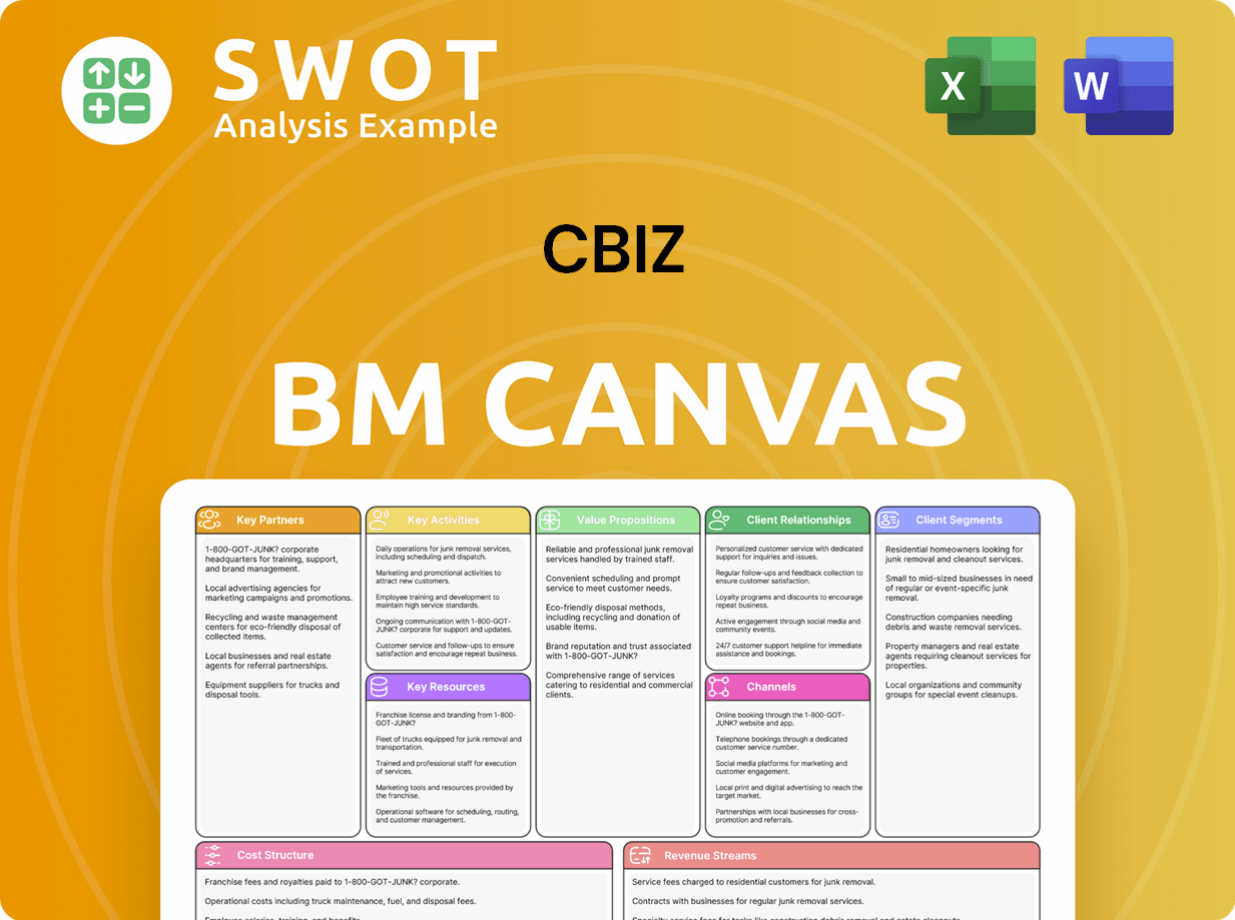

CBIZ Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped CBIZ’s Ownership Landscape?

Recent developments significantly shape the CBIZ ownership landscape. The acquisition of Marcum LLP in 2024 was a pivotal event, marking the largest transaction in CBIZ's history. This strategic move expanded its Financial Services segment, bolstering its market position and contributing to substantial revenue growth. The Marcum acquisition notably contributed 33.2% to CBIZ's fourth-quarter 2024 revenue growth and 6.8% to its full-year 2024 revenue growth of 14%.

Ownership trends indicate a strong institutional presence. Approximately 81.89% to 87.44% of CBIZ stock is held by institutions as of early 2025, reflecting market confidence. Insider ownership constitutes a smaller portion, around 4.89% to 4.95%, while retail ownership remains a minor component. These factors help determine the CBIZ ownership structure. The company's financial performance in early 2025 also reflects these developments, with CBIZ reporting a 69.5% increase in total revenue for Q1 2025, largely driven by the Marcum acquisition.

The leadership team remains consistent, with Jerry Grisko as President and CEO and Ware Grove as CFO. Insider trading activity in late 2024 included sales by CFO Ware H Grove and a purchase by Director Rodney A Young. Further insight into the CBIZ company and its strategic direction can be found in the Growth Strategy of CBIZ article.

| Metric | Details | Data |

|---|---|---|

| Institutional Ownership | Percentage of stock held by institutions | Approximately 81.89% to 87.44% (early 2025) |

| Insider Ownership | Percentage of stock held by insiders | Around 4.89% to 4.95% |

| Q1 2025 Revenue Growth | Increase in total revenue | 69.5% |

| 2025 Revenue Forecast | Projected revenue for the full year | Between $2.90 billion and $2.95 billion |

CBIZ is a publicly traded company. Key ownership groups include institutional investors, with a smaller percentage held by insiders.

The Marcum LLP acquisition in 2024 significantly impacted CBIZ's financial performance and market position. This acquisition was the largest in CBIZ's history.

Jerry Grisko and Ware Grove continue to lead CBIZ. The company forecasts strong revenue for 2025, driven by strategic acquisitions.

Recent insider trading activity showed sales by the CFO and a purchase by a director, reflecting the current CBIZ stock trends.

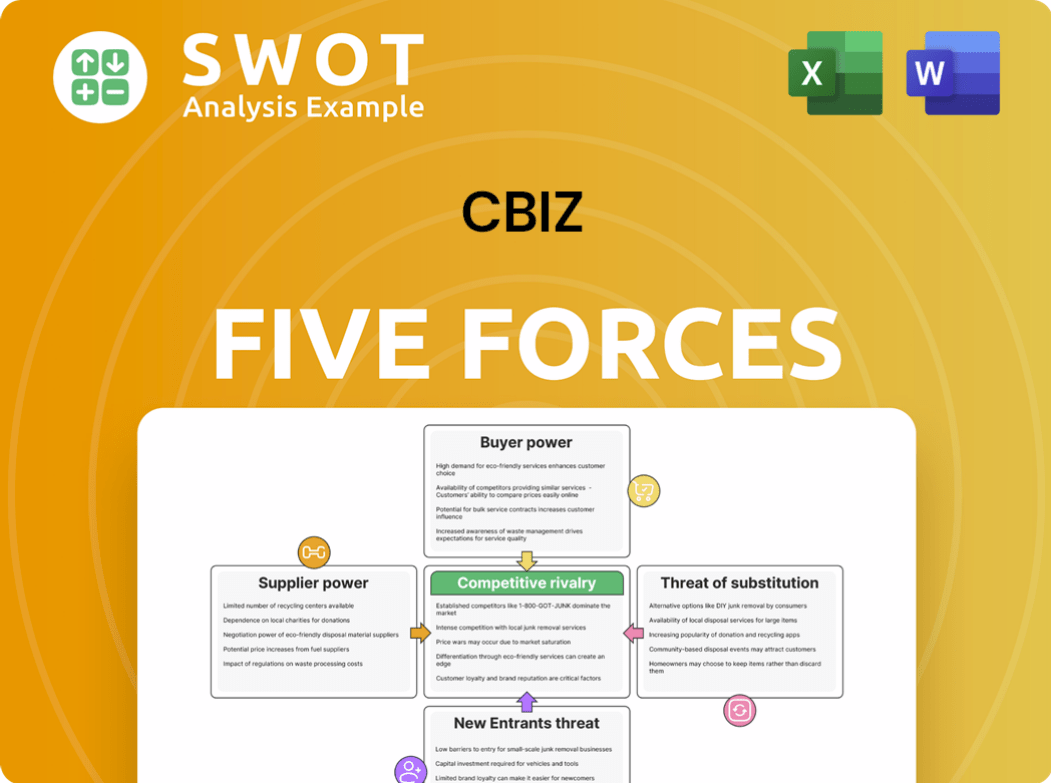

CBIZ Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CBIZ Company?

- What is Competitive Landscape of CBIZ Company?

- What is Growth Strategy and Future Prospects of CBIZ Company?

- How Does CBIZ Company Work?

- What is Sales and Marketing Strategy of CBIZ Company?

- What is Brief History of CBIZ Company?

- What is Customer Demographics and Target Market of CBIZ Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.