CBIZ Bundle

Can CBIZ Continue Its Ascent in the Financial Services Arena?

CBIZ, a leading provider of financial, insurance, and advisory services, is making waves with its strategic moves. The recent acquisition of Marcum LLP, a landmark deal in November 2024, is set to redefine its market position. This bold move signals a pivotal moment for CBIZ, promising significant growth and a strengthened presence in the competitive landscape.

This CBIZ SWOT Analysis will explore the CBIZ growth strategy, examining how strategic acquisitions and technological integration are shaping its future. We'll dissect CBIZ's financial outlook, including future revenue projections, and analyze the competitive landscape to understand its potential. Furthermore, this CBIZ company analysis will provide insights into CBIZ's market share and trends, assessing its long-term growth strategy and the opportunities and challenges it faces in the financial services sector, making it a compelling investment consideration.

How Is CBIZ Expanding Its Reach?

CBIZ is actively pursuing an expansion strategy focused on strategic acquisitions and organic growth. This approach aims to strengthen its market position and diversify its service offerings. The company's commitment to growth is evident through its recent acquisitions and ongoing initiatives. This strategy is designed to enhance CBIZ's marketing strategy and overall market presence.

The company's expansion efforts are driven by a desire to access new customer bases, diversify revenue streams, and stay ahead of industry changes. CBIZ's growth strategy combines strategic acquisitions with internal growth drivers. The company maintains a healthy pipeline of M&A opportunities, focusing on integration and sustained growth.

CBIZ's geographical diversity, with operations in over 160 locations across 22 major markets, provides a geographically diverse client base. This helps insulate the company from downturns in specific industries or regions, contributing to its long-term growth strategy. The company's strategic initiatives and goals are centered on sustainable growth and market leadership.

CBIZ's expansion plans include strategic acquisitions to enhance its service offerings and market presence. The acquisition of Marcum LLP, completed on November 1, 2024, significantly boosted its presence in the financial services sector. This acquisition is a key part of CBIZ's business strategy and execution.

Alongside acquisitions, CBIZ focuses on organic growth through various initiatives. These include net new business, pricing adjustments, and cross-serving existing clients. Producer development also plays a vital role in driving internal growth. This approach is part of CBIZ's long-term growth strategy.

CBIZ aims to expand into high-growth industries and broaden its service offerings. The acquisition of CompuData, Inc., in March 2024, exemplifies this by expanding its technology services. This expansion is crucial for CBIZ's future prospects in the financial services sector.

CBIZ operates across more than 160 locations in 22 major markets nationwide. This geographical diversity helps mitigate risks associated with industry-specific or regional economic downturns. This diversification supports CBIZ's market share and trends.

CBIZ's expansion strategy involves both acquisitions and organic growth, aiming to enhance its market position and service offerings. The acquisition of Marcum LLP is a significant step in this direction, with the combined entity expected to have over 10,000 team members and more than 135,000 clients. CBIZ's financial outlook and forecasts are positive due to these strategic moves.

- Acquisition of Marcum LLP completed on November 1, 2024.

- Five strategic acquisitions completed in 2024, including CompuData, Inc.

- Operations in over 160 locations across 22 major markets.

- Focus on integration, cultural alignment, and sustained growth in M&A activities.

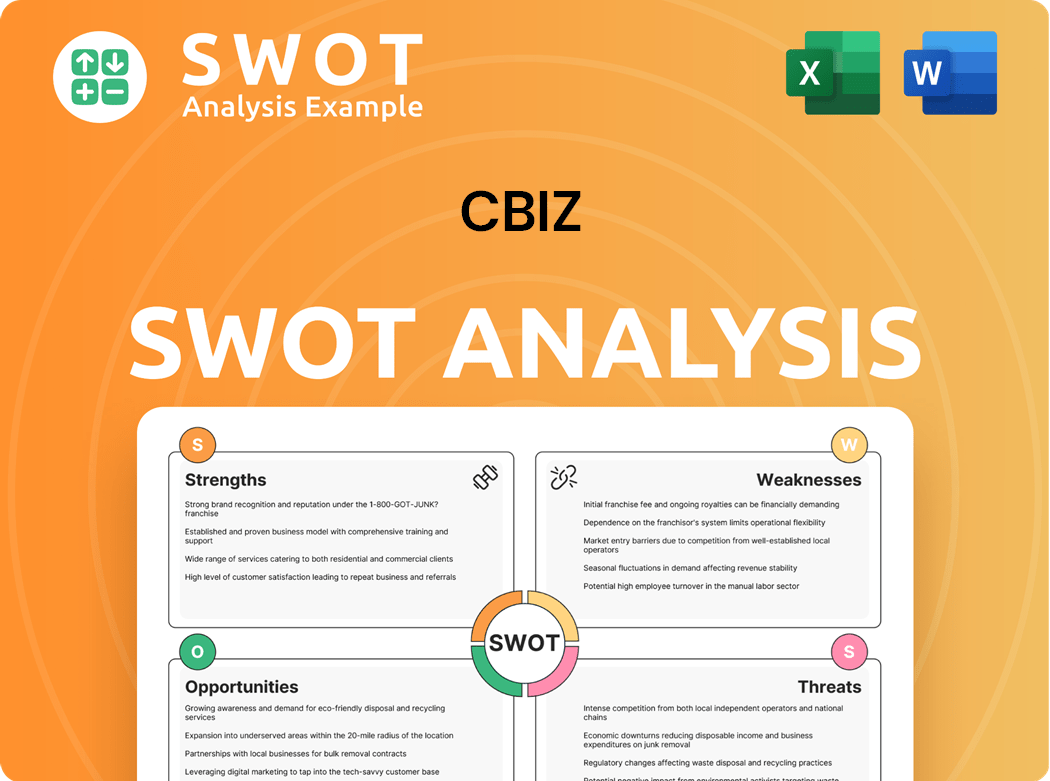

CBIZ SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CBIZ Invest in Innovation?

The company is employing a robust innovation and technology strategy to foster sustained growth and enhance its service offerings. This approach is a crucial element in its overall business strategy, aiming to improve client experiences and achieve operational efficiencies. The company is actively working on data-driven decision-making, collaboration, and cost reduction.

A core component of the company's strategy involves digital transformation, which is essential in today's market. This focus is particularly relevant, given the evolving needs of clients and the increasing importance of technology in the professional services sector. The company's approach is strategic and forward-thinking.

The company's strategic initiatives and goals are centered on leveraging technology to improve its market position. This involves a multi-faceted approach that includes adopting new technologies and streamlining existing processes. The company aims to stay ahead of industry trends.

While many professional services firms lag in digital transformation, the company is making significant strides. According to recent data, approximately 62% of the company's accounting firms report that their digital transformation is in progress.

The company launched CBIZ D@taNEXUS in July 2024. This suite of data analytics and automation services is designed to transform complex information into actionable insights for businesses.

The D@taNEXUS platform helps mid-market companies manage vast amounts of operational and financial data. It normalizes and standardizes reports across various systems, including financial, CRM, production, and personnel management platforms.

The company plans to expand D@taNEXUS's reach to multinational clients by 2025. This expansion is anticipated to meet the increasing business demand for advanced data analytics solutions.

The company acknowledges the significant impact of artificial intelligence (AI) on the industry. Approximately 77% of professional services workers expect AI to enhance operational efficiencies.

The company is addressing the risks associated with AI adoption, such as bias and data privacy. It emphasizes the importance of inventorying all software and applications used by employees.

The company's technology team focuses on sourcing solutions that enhance efficiency and unlock new capabilities, working within budget constraints. Their digital transformation framework includes developing roadmaps, aligning data and processes, securing environments, selecting application platforms, installing data analytics, and adopting emergent technologies.

- Developing roadmaps to guide technology implementation.

- Aligning data and processes to ensure seamless integration.

- Securing environments to protect sensitive information.

- Selecting application platforms that meet specific needs.

- Installing data analytics tools for data-driven insights.

- Adopting emergent technologies to stay competitive.

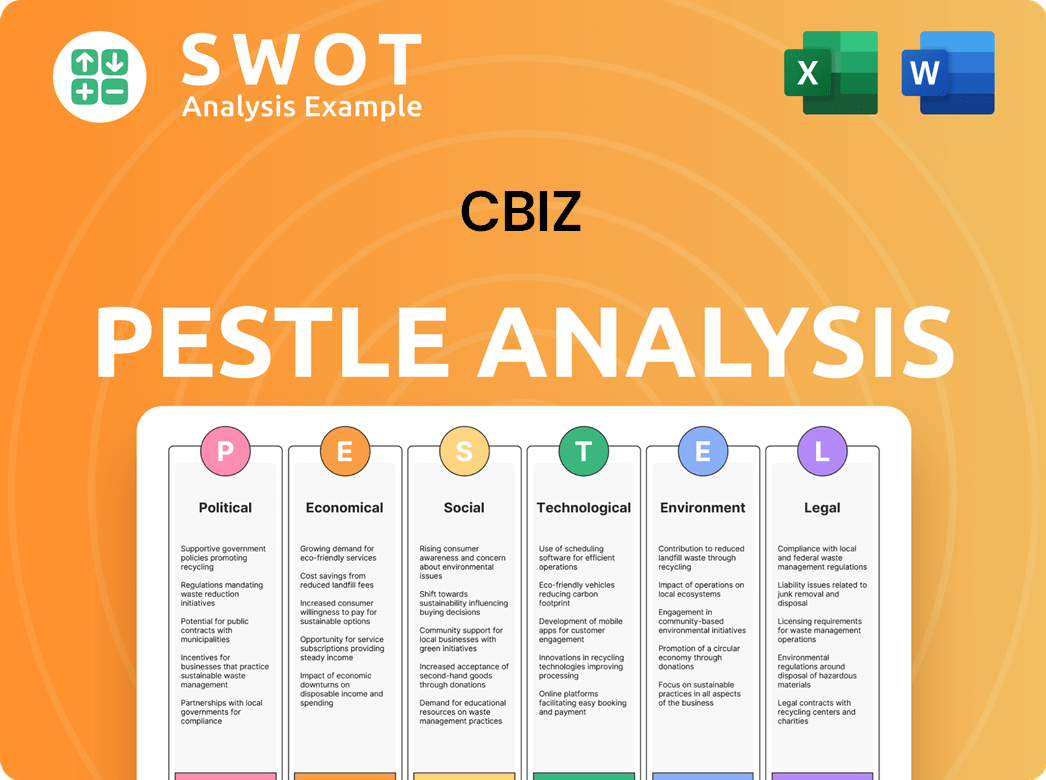

CBIZ PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is CBIZ’s Growth Forecast?

The financial outlook for CBIZ in 2025 indicates a trajectory of continued growth, although with some adjustments to revenue expectations. The company's strategic initiatives, including acquisitions and operational efficiencies, are designed to bolster its CBIZ growth strategy and enhance its market position. This approach is crucial for navigating the evolving financial services landscape and achieving its CBIZ future prospects.

CBIZ's robust financial performance in the first quarter of 2025 sets a positive tone for the year. The company's ability to adapt to economic uncertainties while maintaining strong profitability demonstrates its resilience and strategic acumen. Understanding the CBIZ company analysis is key to appreciating its potential for sustained expansion and value creation.

For a deeper dive into how CBIZ generates revenue, you can explore Revenue Streams & Business Model of CBIZ.

CBIZ reported a substantial revenue increase of 69.5% in Q1 2025, reaching $838.0 million. This significant growth reflects the success of its CBIZ business model and strategic acquisitions. The increase from $494.3 million in Q1 2024 highlights the company's strong financial momentum.

Net income for Q1 2025 was $122.8 million, or $1.91 per diluted share, a significant increase. This is a notable improvement from $76.9 million, or $1.53 per diluted share, in Q1 2024. This demonstrates the company's enhanced profitability and operational efficiency.

Adjusted EBITDA for Q1 2025 surged by 100.0% to $237.6 million. This substantial growth in EBITDA underscores the company's strong operational performance. This increase is a testament to the effectiveness of CBIZ's strategic initiatives.

For the full year 2025, CBIZ revised its revenue outlook to a range of $2.8 billion to $2.95 billion. This adjustment reflects the impact of economic uncertainties. The initial projection was $2.90 billion to $2.95 billion.

Despite the revenue adjustment, CBIZ maintained its adjusted EBITDA guidance. The company expects adjusted EBITDA to be within a range of $450 million to $456 million for 2025. This demonstrates the company's confidence in its operational efficiency.

CBIZ forecasts GAAP fully diluted earnings per share to be between $1.97 and $2.02 for 2025. Adjusted fully diluted earnings per share are expected to be within a range of $3.60 to $3.65. These forecasts highlight the company's strong earnings potential.

The acquisition of Marcum LLP, completed in November 2024, is a significant factor in CBIZ's financial performance. It is estimated to have a 10% accretive impact on adjusted EPS in 2025. This acquisition strengthens CBIZ's market position.

CBIZ's financial strategy includes reducing leverage to 2-2.5x by the end of 2026. The company is also exploring share repurchases. This strategy aims to improve financial flexibility and shareholder value.

CBIZ plans to continue strategic acquisitions to enhance its market presence and service offerings. This approach is part of its long-term CBIZ growth strategy. These acquisitions will drive future growth.

As of December 31, 2024, CBIZ had an outstanding indebtedness of $1.421 billion under its credit facilities. The company had $556 million of unused borrowing capacity. This capacity is expected to cover 2025 cash requirements and strategic initiatives.

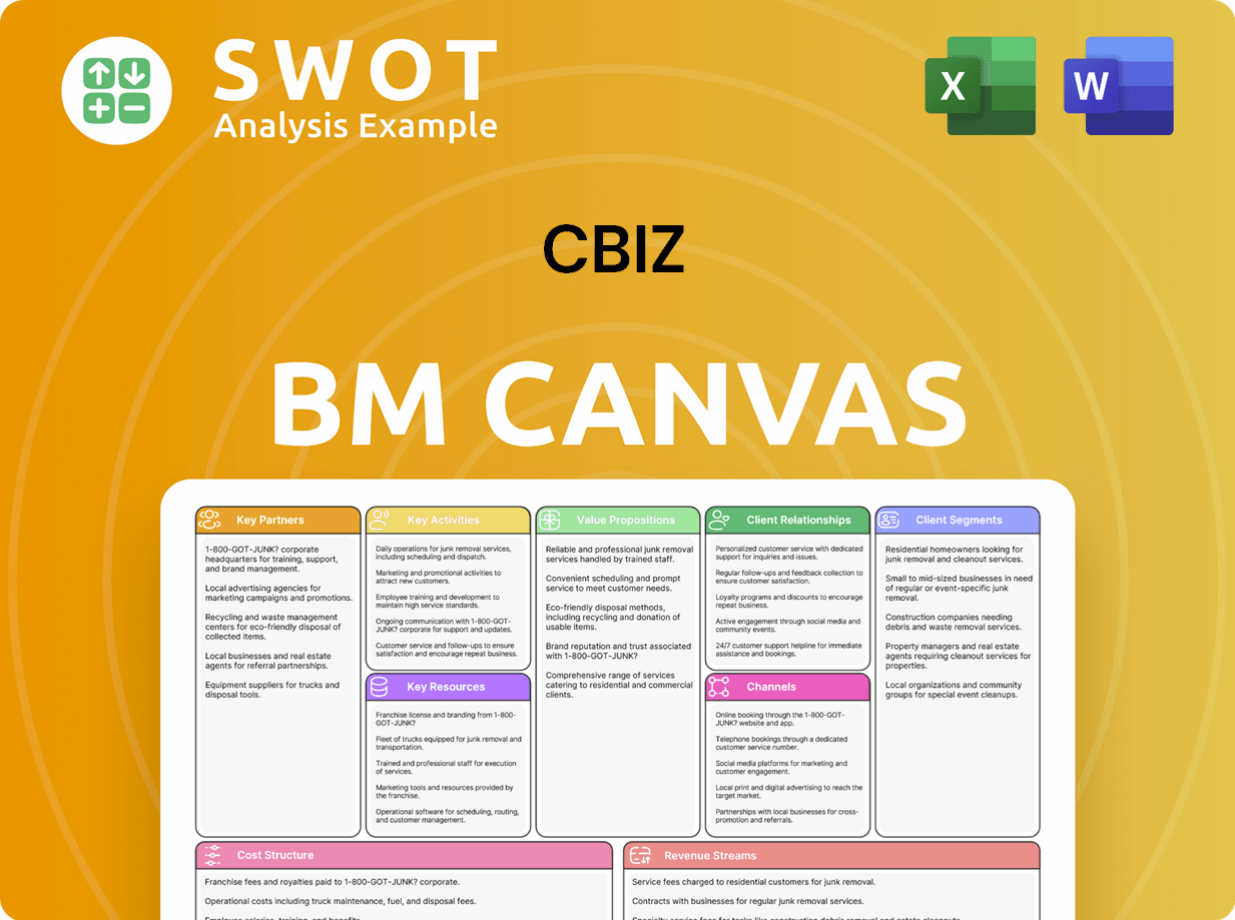

CBIZ Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow CBIZ’s Growth?

Understanding the potential risks and obstacles is crucial for a comprehensive CBIZ company analysis. Several factors could impede the firm's ambitious CBIZ growth strategy and influence its CBIZ future prospects. These challenges range from economic uncertainties to competitive pressures and the ever-evolving technological landscape.

One of the primary concerns is the unpredictable economic environment, which can significantly impact the demand for project-based and discretionary advisory services. The professional services industry, in which CBIZ operates, is highly competitive. Attracting and retaining top talent is another critical challenge, especially in specialized areas such as cloud services and AI. These factors collectively shape the CBIZ business model and its ability to maintain and expand its market position.

Technological advancements and regulatory changes also present both opportunities and risks. The rapid adoption of AI, for example, while offering potential efficiency gains, also elevates cybersecurity threats. Moreover, compliance with new laws regarding data privacy and AI usage adds another layer of complexity. Addressing these challenges is vital for ensuring the long-term success of CBIZ and realizing its CBIZ financial performance goals.

The current economic and geopolitical climate presents significant challenges. This uncertainty directly impacts non-recurring service lines. Limited visibility in forecasting client demand for project-based services poses a revenue risk, particularly in 2025.

The professional business services industry is highly fragmented and intensely competitive. CBIZ competes with global, national, and local firms across various service areas. This competitive landscape requires constant adaptation and strategic positioning.

Attracting and retaining top talent is a critical challenge. Competition for specialized professionals, especially those skilled in cloud services and AI, is fierce. A 2024 survey ranked the failure to attract or retain top talent as a top risk.

Rapid adoption of new technologies, like AI, presents both opportunities and risks. While AI can boost operational efficiencies, it also increases the scope and scale of cyberattacks. Cybersecurity threats are a major concern.

Cyberattacks, such as ransomware, pose a significant risk. The manufacturing industry, for example, faces an average loss of $353,000 per incident. Future incidents could lead to loss of business, litigation, and reputational damage.

Governments continually introduce new laws around data privacy, AI usage, and climate impact. These regulatory changes require constant adaptation and investment in compliance. Supply chain vulnerabilities have also re-emerged.

CBIZ emphasizes proactive risk management to mitigate these challenges. This includes regular risk assessments, diversification of revenue streams, and investment in technology. Workforce training is also a key component of their strategy.

Supply chain vulnerabilities, including raw material shortages and increased logistics costs, have re-emerged. These issues require careful monitoring and strategic planning. Supply chain transparency is also crucial.

CBIZ's strategic initiatives and goals must address these potential risks. The company's ability to adapt and innovate will be crucial for its long-term growth. This includes focusing on its CBIZ market position.

Understanding these risks is vital for investors assessing CBIZ stock performance and investment potential. For a deeper dive into CBIZ's ideal clients, consider exploring the Target Market of CBIZ.

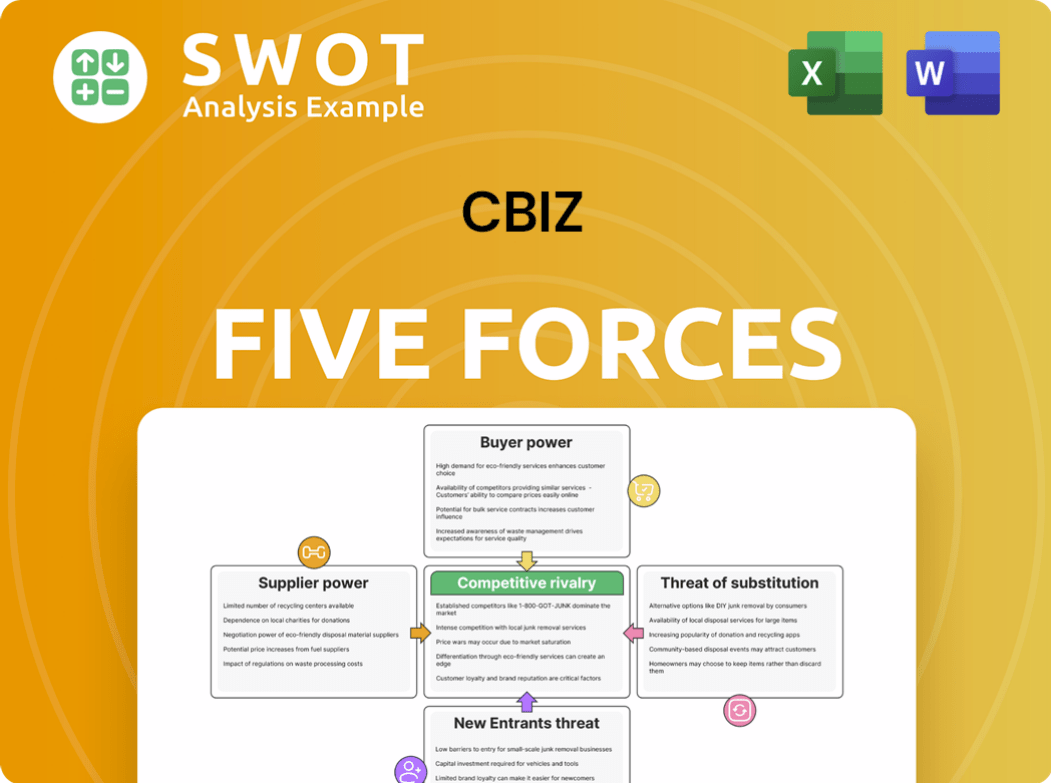

CBIZ Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CBIZ Company?

- What is Competitive Landscape of CBIZ Company?

- How Does CBIZ Company Work?

- What is Sales and Marketing Strategy of CBIZ Company?

- What is Brief History of CBIZ Company?

- Who Owns CBIZ Company?

- What is Customer Demographics and Target Market of CBIZ Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.