CBIZ Bundle

How Does CBIZ Stack Up in the Business Services Arena?

In the complex world of professional services, understanding the CBIZ SWOT Analysis is crucial. CBIZ, a major player, offers a wide array of solutions from financial advisory to human capital management. But how does CBIZ truly measure up against its rivals, and what are the key factors driving its success?

This deep dive into the CBIZ competitive landscape will explore its market position and the dynamics of the CBIZ industry. We'll dissect CBIZ's business services, analyze its financial performance, and identify its key competitors. This CBIZ market analysis will provide actionable insights for investors, analysts, and business strategists alike, offering a comprehensive view of CBIZ's strengths, weaknesses, opportunities, and threats.

Where Does CBIZ’ Stand in the Current Market?

CBIZ holds a strong market position within the professional business services sector, especially for small and mid-sized businesses (SMBs) and larger enterprises. The company is consistently ranked among the top accounting, tax, and advisory firms in the United States. Its service offerings are diverse, encompassing accounting and tax services, financial advisory, risk advisory, and human capital management.

The company's primary customer base includes privately held companies, non-profit organizations, and public entities across various industries like healthcare, manufacturing, and financial services. CBIZ has strategically shifted its focus to offer more integrated, value-added advisory services, reflecting a broader industry trend. This shift has also included a greater emphasis on technology-driven service delivery.

CBIZ's financial health is robust, with total revenue of approximately $1.5 billion for the fiscal year 2023. This strong financial performance underscores its stable market position, particularly in the Midwest and Northeast regions. An in-depth CBIZ market analysis reveals consistent revenue growth and profitability, highlighting the company's resilience and strategic positioning within the CBIZ industry.

CBIZ offers a wide array of services, including accounting and tax, financial advisory, risk advisory, and human capital management. These diverse offerings cater to a broad client base, providing comprehensive solutions. The company's ability to integrate these services differentiates it within the CBIZ competitive landscape.

CBIZ maintains a significant national presence across the United States, with offices in major metropolitan areas. This widespread presence allows CBIZ to serve a diverse client base effectively. Strong presence in key regions contributes to the company's overall market strength and CBIZ market share analysis.

CBIZ reported approximately $1.5 billion in revenue for fiscal year 2023, demonstrating solid financial performance. The company's focus on integrated advisory services and technology-driven delivery has enhanced its market position. This strategic approach has allowed CBIZ to maintain consistent revenue growth and profitability.

- CBIZ business services are designed to meet the evolving needs of its clients.

- The company's strategic shift towards integrated advisory services has been successful.

- Technology-driven service delivery is a key component of CBIZ's growth strategy.

- Consistent revenue growth and profitability underscore its stable market position.

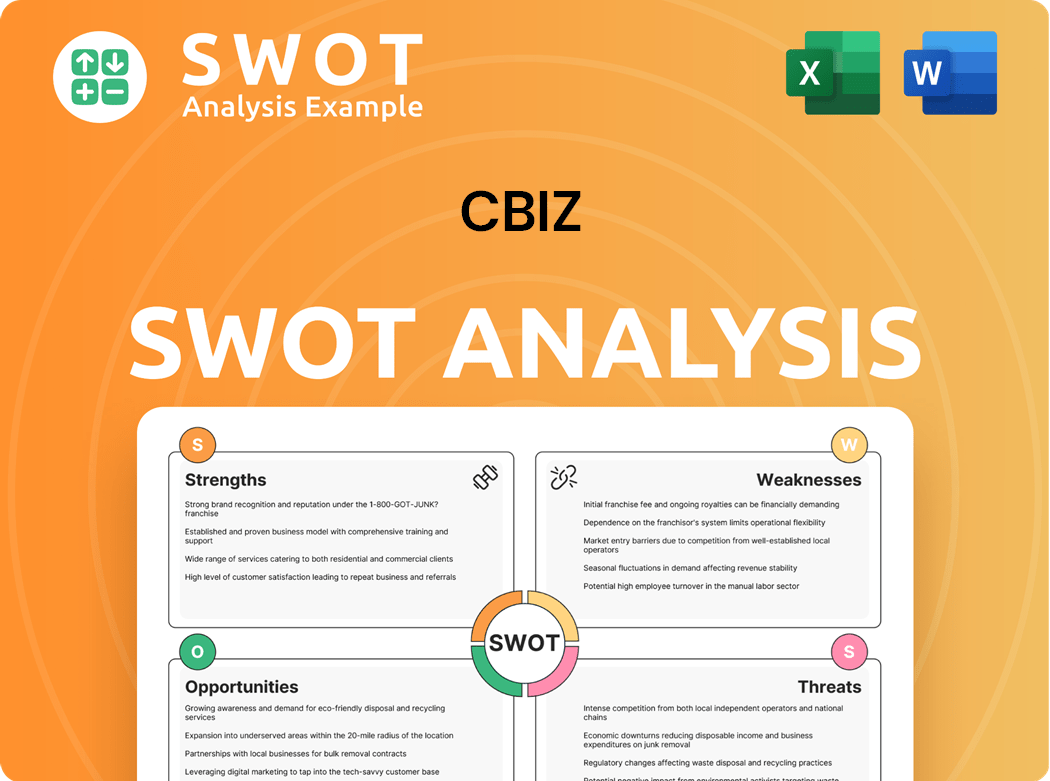

CBIZ SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CBIZ?

The CBIZ competitive landscape is complex, encompassing a wide array of firms vying for market share across various service lines. This analysis explores the key players challenging CBIZ in accounting, tax, advisory, employee benefits, and human capital management. Understanding these CBIZ competitors is crucial for assessing its strategic positioning and potential for growth. A thorough CBIZ market analysis reveals the dynamics of the industry and the competitive pressures the company faces.

CBIZ operates within a dynamic CBIZ industry, where competition is fierce and market conditions are constantly evolving. The company's CBIZ business services are subject to continuous scrutiny from both established and emerging competitors. This competitive environment impacts CBIZ financial performance, influencing its ability to secure and retain clients, and ultimately, its profitability.

The 'Big Four' firms, including Deloitte, EY, PwC, and KPMG, are competitors, especially for specialized advisory services. National firms like RSM US LLP, BDO USA LLP, Grant Thornton LLP, and CliftonLarsonAllen (CLA) also provide similar services to mid-market companies.

Large insurance brokers and consulting firms such as Marsh McLennan Agency (MMA), Gallagher, and Aon compete in this space. Payroll and HR technology providers like ADP and Paychex also present significant challenges.

Smaller, niche advisory firms and independent consultants offer specialized services, posing indirect competition. Emerging players leveraging AI and automation in accounting and HR represent a growing threat.

Mergers and acquisitions continue to reshape the competitive landscape, impacting market share and service capabilities. Technology and innovation are key drivers of competition, particularly in HR and payroll services.

Key competitive factors include brand recognition, service breadth, technological innovation, and pricing. Client relationships and industry expertise are also crucial for success.

CBIZ and its competitors have varying geographic footprints, with some firms having a national or global presence. Local market conditions and regional expertise can influence competitive dynamics.

The CBIZ competitive landscape is shaped by various factors, including the size and scope of competitors, the services offered, and the geographic reach of each firm. For example, the 'Big Four' firms often target larger clients, while national and regional firms focus on mid-market companies, where CBIZ also concentrates its efforts. Understanding the competitive advantages of each player is essential for CBIZ to maintain and enhance its market position. For a deeper dive into the company's strategies, consider reading about the Growth Strategy of CBIZ.

CBIZ's competitive advantages include its comprehensive service offerings and focus on the mid-market. Disadvantages may include competition from larger firms with greater resources.

- CBIZ Market Share Analysis: CBIZ holds a significant share in the mid-market segment.

- CBIZ SWOT Analysis: Strengths include a broad service portfolio; weaknesses may involve higher pricing compared to some competitors.

- CBIZ Key Competitors 2024: RSM US LLP, BDO USA LLP, and Grant Thornton LLP remain key rivals.

- CBIZ Revenue Comparison: CBIZ's revenue growth is often compared to national accounting firms. In 2024, CBIZ reported revenues of approximately $1.4 billion.

- CBIZ vs. Top Accounting Firms: CBIZ competes with larger firms in specific advisory areas.

- CBIZ Service Offerings Comparison: CBIZ offers a wide range of services, including accounting, tax, and HR solutions.

- CBIZ Growth Strategies: Acquisitions and organic growth initiatives are key strategies.

- CBIZ Acquisition History: CBIZ has a history of strategic acquisitions to expand its service offerings.

- CBIZ Financial Advisory Services Competitors: Deloitte and PwC are major players in financial advisory.

- CBIZ Insurance Services Competitors: Marsh McLennan Agency (MMA) and Gallagher are significant competitors.

- CBIZ Human Capital Management Competitors: ADP and Paychex are key competitors in this area.

- CBIZ Client Base Analysis: CBIZ primarily serves mid-market companies.

- CBIZ Geographic Presence: CBIZ has a strong presence across the United States.

- CBIZ Recent Financial Results: CBIZ has shown consistent revenue growth.

- CBIZ Competitive Advantages: A broad service portfolio and focus on mid-market clients.

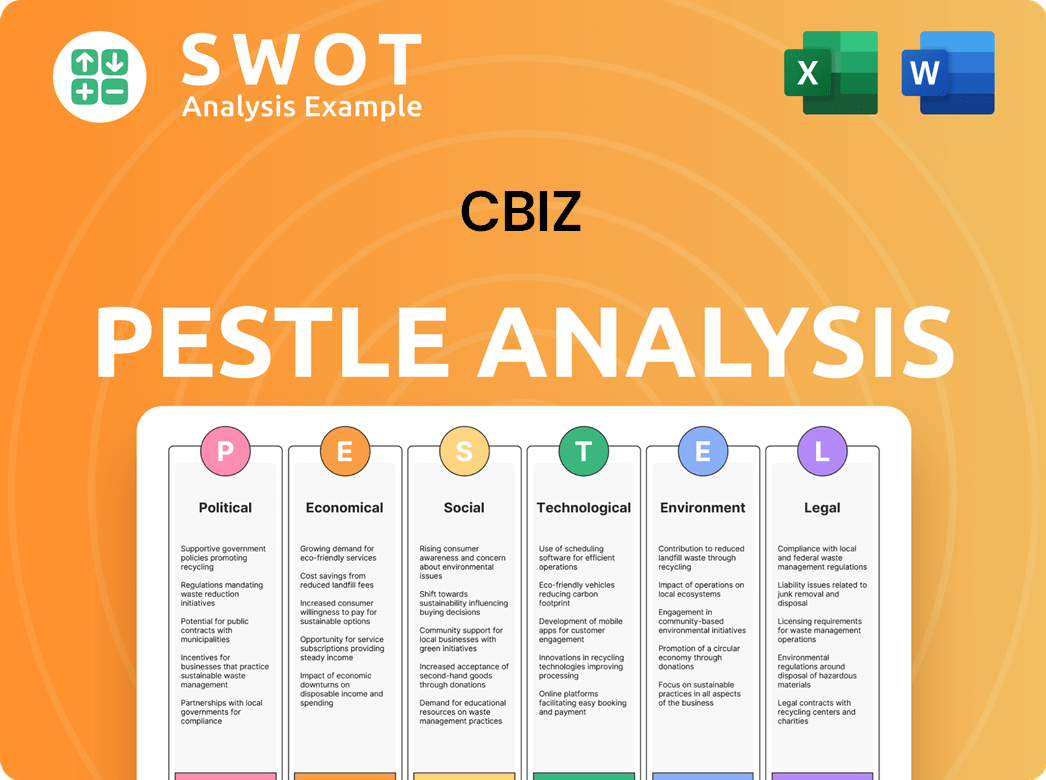

CBIZ PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CBIZ a Competitive Edge Over Its Rivals?

Understanding the CBIZ competitive landscape involves recognizing its core strengths. The company distinguishes itself through an integrated service model, a broad national presence, and a client-focused approach. This strategic positioning allows it to offer a comprehensive suite of services, creating a 'one-stop shop' for clients and fostering deeper, more enduring relationships. This approach is crucial when evaluating CBIZ competitors and their market strategies.

A significant advantage for CBIZ is its extensive national footprint, which enables it to serve multi-location clients effectively. This broad geographic reach, combined with its strong brand equity built over decades, enhances trust and recognition among potential clients. Furthermore, CBIZ benefits from economies of scale, allowing it to invest in technology and talent, which smaller firms may find challenging. For a detailed look at the company's origins, consider reading the Brief History of CBIZ.

The company's commitment to attracting and retaining top talent, coupled with a culture that prioritizes client service and technical expertise, contributes significantly to its competitive edge. CBIZ's ability to cross-sell services across its various divisions further strengthens client relationships and increases revenue per client. These competitive advantages are largely sustainable due to the integrated model and national scale, although they face threats from aggressive pricing by larger competitors and the constant need for technological innovation.

CBIZ offers a wide array of services under one umbrella, including accounting, tax, employee benefits, and human capital management. This integrated approach simplifies business operations for clients. This contrasts with many competitors who may specialize in fewer areas, potentially leading to a more fragmented service experience.

With offices across the United States, CBIZ can serve clients across multiple locations. This extensive geographic reach is a significant advantage, especially for businesses with a national footprint. It allows for consistent service delivery and local market expertise.

CBIZ prioritizes building strong relationships with its clients, focusing on understanding and meeting their specific needs. This client-focused approach fosters loyalty and long-term partnerships. This emphasis on client relationships is a key differentiator in the CBIZ industry.

CBIZ's size allows it to invest in technology, training, and specialized talent. This scale advantage enables the company to offer more comprehensive and sophisticated services than smaller firms. It is a critical factor in the CBIZ market analysis.

CBIZ's competitive advantages are multifaceted, stemming from its integrated service offerings, national footprint, and client-focused business model. These factors contribute to strong client retention and the ability to attract new business. Understanding these advantages is crucial for assessing the company's long-term prospects and its position within the CBIZ business services sector.

- Integrated Services: Offering a wide range of services under one roof simplifies client management.

- National Footprint: Provides the ability to serve clients across multiple locations with consistent service.

- Strong Brand Equity: Enhances trust and recognition among prospective clients.

- Economies of Scale: Enables investment in technology and talent, improving service quality.

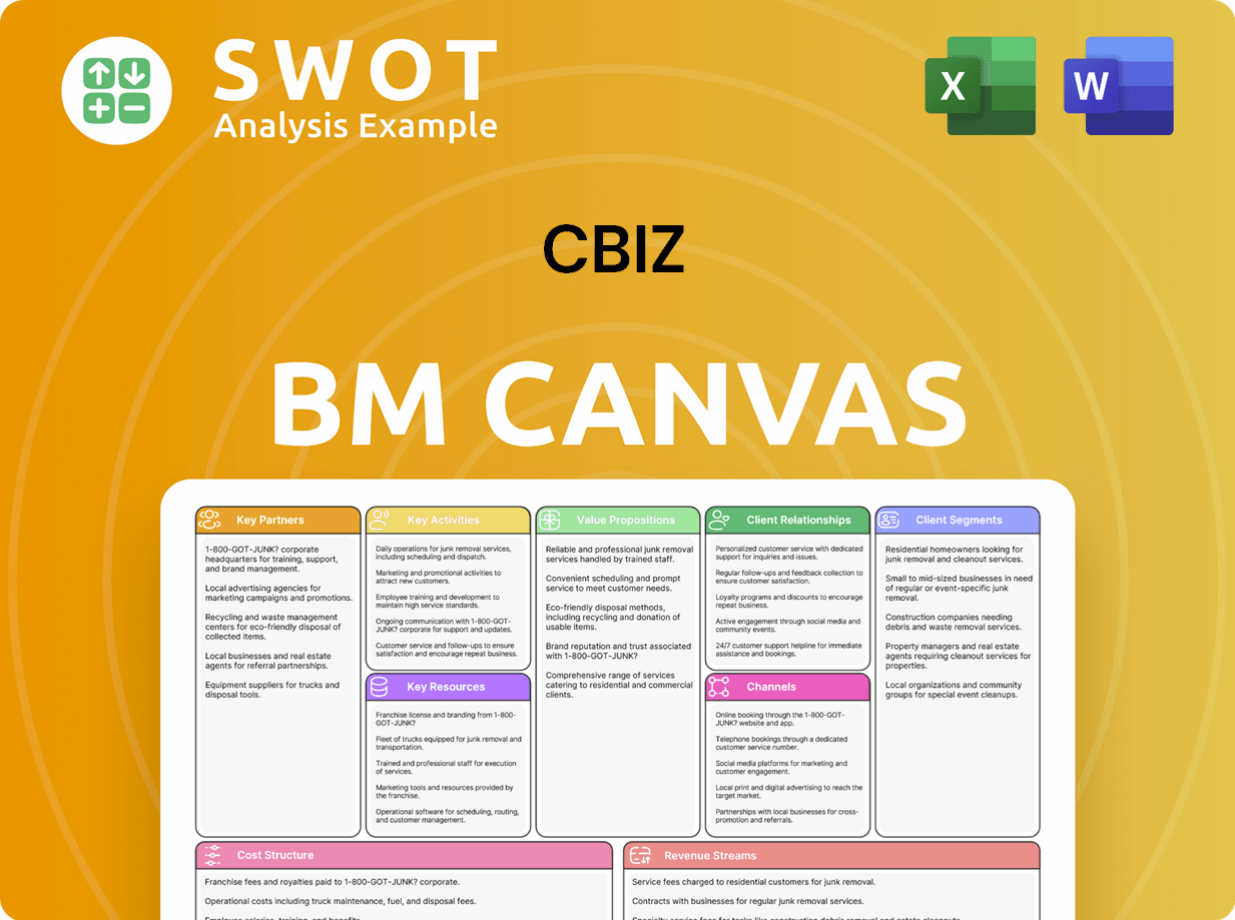

CBIZ Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CBIZ’s Competitive Landscape?

The professional business services industry is experiencing significant shifts, influencing the CBIZ competitive landscape. Technological advancements, evolving regulations, and changing client preferences are reshaping how services are delivered. This dynamic environment presents both challenges and opportunities for CBIZ as it navigates the future.

Understanding the CBIZ industry trends is crucial for assessing its future outlook. The company's ability to adapt to technological changes, regulatory shifts, and evolving client demands will be critical to its success. This analysis explores the key trends, potential disruptions, and growth opportunities for CBIZ.

Technological advancements, particularly in AI and automation, are transforming service delivery. Regulatory changes, including evolving tax laws and data privacy regulations, continuously create new compliance challenges. Clients increasingly seek proactive, technology-enabled, and value-added advisory services.

The rise of specialized fintech and HR tech startups could disrupt traditional service providers. Increased competition from larger consulting firms and aggressive pricing strategies pose threats. Attracting and retaining skilled professionals in a competitive talent market remains a challenge.

Increasing complexity in business operations and regulations drives demand for specialized advisory services. The growing demand for outsourced human capital management services presents a significant opportunity. Strategic partnerships with technology providers can enable expansion into new markets.

CBIZ is focused on continued investment in technology, strategic acquisitions, and fostering a culture of continuous learning. These strategies aim to meet the evolving needs of its diverse client base and maintain a strong CBIZ competitive landscape position. The company is adapting its approach to maintain its position in the market.

CBIZ's competitive position is evolving towards a technology-enabled, advisory-focused model. To stay resilient, the company is deploying strategies focused on technology, strategic acquisitions, and innovation. For more insights, consider reading Owners & Shareholders of CBIZ.

- CBIZ's focus on technology includes investments in AI and data analytics to automate processes.

- Strategic acquisitions help expand capabilities and geographic reach, increasing the company's market presence.

- Fostering a culture of continuous learning ensures the workforce can adapt to the changing industry demands.

- The company aims to enhance its service offerings to meet the evolving needs of its clients.

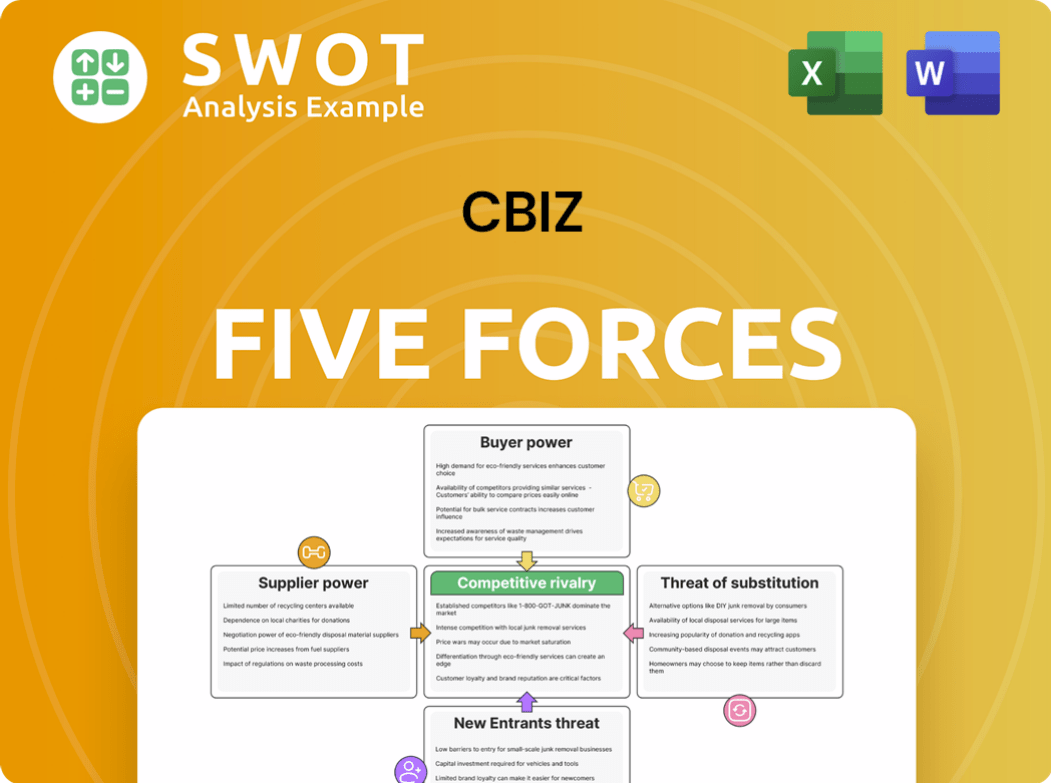

CBIZ Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CBIZ Company?

- What is Growth Strategy and Future Prospects of CBIZ Company?

- How Does CBIZ Company Work?

- What is Sales and Marketing Strategy of CBIZ Company?

- What is Brief History of CBIZ Company?

- Who Owns CBIZ Company?

- What is Customer Demographics and Target Market of CBIZ Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.