Constellation Brands Bundle

How did Constellation Brands become a beverage giant?

Embark on a journey through the Constellation Brands SWOT Analysis and uncover the fascinating story of an alcohol beverage company that transformed from a small wine producer into a global powerhouse. From its humble beginnings in 1945, this Company history reveals strategic acquisitions and a relentless pursuit of market dominance. Discover how this remarkable Constellation Brands corporate timeline shaped the beverage industry.

The Brief history of Constellation Brands is a testament to its adaptability and foresight. The company's strategic moves, including the pivotal acquisition of Grupo Modelo's U.S. beer business, significantly broadened its portfolio and solidified its position in the market. Today, Constellation Brands continues to evolve, focusing on premium products and maintaining its status as a leader in the wine and spirits and beer brands industries. This evolution underscores its impact on the alcohol industry.

What is the Constellation Brands Founding Story?

The story of Constellation Brands, a leading alcohol beverage company, began in 1945. Founded by Marvin Sands, the company's origins are rooted in Canandaigua, New York. This marked the start of what would become a significant player in the wine and spirits and beer brands industries.

Marvin Sands, at the young age of 21, launched Canandaigua Industries. This venture was initiated after his family acquired a sauerkraut factory that was converted into a winery. His father, Mack Sands, had prior experience in the wine business, having opened the Car-Cal Winery in North Carolina. The company's early focus was on producing and selling bulk wine to East Coast companies for bottling.

In its inaugural year, the company achieved sales of roughly 200,000 gallons of wine, generating gross sales of $150,000. The initial investment was modest, with Marvin Sands starting the business with only $2,000. The company's early years set the stage for its future growth and expansion, illustrating the ambition and strategic vision of its founder.

Constellation Brands quickly evolved beyond its initial business model. Marvin Sands aimed to produce and sell wine under his own brand names. This shift was a crucial early decision.

- In 1948, the Car-Cal operation was closed, and wine production was consolidated at the Canandaigua facility.

- That same year, Sands made his first strategic acquisition, purchasing the Mother Vineyard Wine Company in North Carolina.

- This acquisition marked the beginning of a long history of strategic purchases to expand market presence.

- These early moves established the foundation for Constellation Brands' growth and its impact on the alcohol industry.

The early acquisitions and strategic shifts demonstrate the company's proactive approach to growth. The company's ability to quickly adapt and expand its operations laid the groundwork for its future success. To learn more about the company's target audience, you can read about the target market of Constellation Brands.

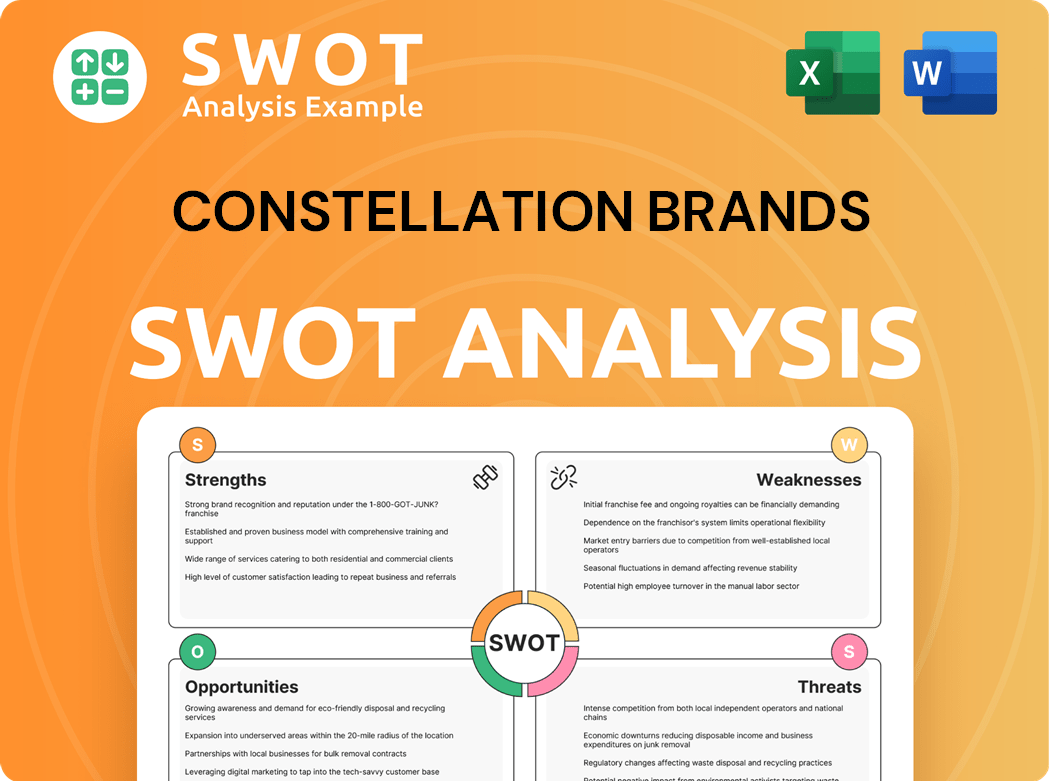

Constellation Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Constellation Brands?

The early growth of Constellation Brands, initially known as Canandaigua Industries, marked a significant expansion beyond its initial bulk wine sales. This period was characterized by strategic brand introductions and acquisitions that broadened its market presence. Key decisions, such as the introduction of Richard's Wild Irish Rose, fueled rapid growth and set the stage for its future development as a major player in the alcohol beverage company industry.

In 1954, the launch of Richard's Wild Irish Rose, a key brand, propelled the company's growth. This was achieved through a unique franchising system, utilizing bottling across five U.S. locations. This approach allowed for rapid expansion with minimal capital investment. This strategy helped the company establish a strong foothold in the market.

The company was officially incorporated as Canandaigua Wine Company, Inc. in 1972. A year later, in 1973, it went public, marking a significant step in its corporate timeline. This move provided access to capital for further expansion and acquisitions. The initial public offering helped in raising funds for future growth.

In 1974, the acquisition of Bisceglia Brothers Winery in California provided access to the West Coast varietal wine market. The company launched its own champagne brand, J. Roget, in 1979, which quickly gained success. These acquisitions and product launches were crucial for diversifying the company's portfolio.

The 1980s saw the company venture into the wine cooler market with the Sun Country brand in 1984, leading to revenue increases. Leadership transitions also occurred, with Richard Sands becoming president in 1986. This period was marked by strategic diversification and leadership changes.

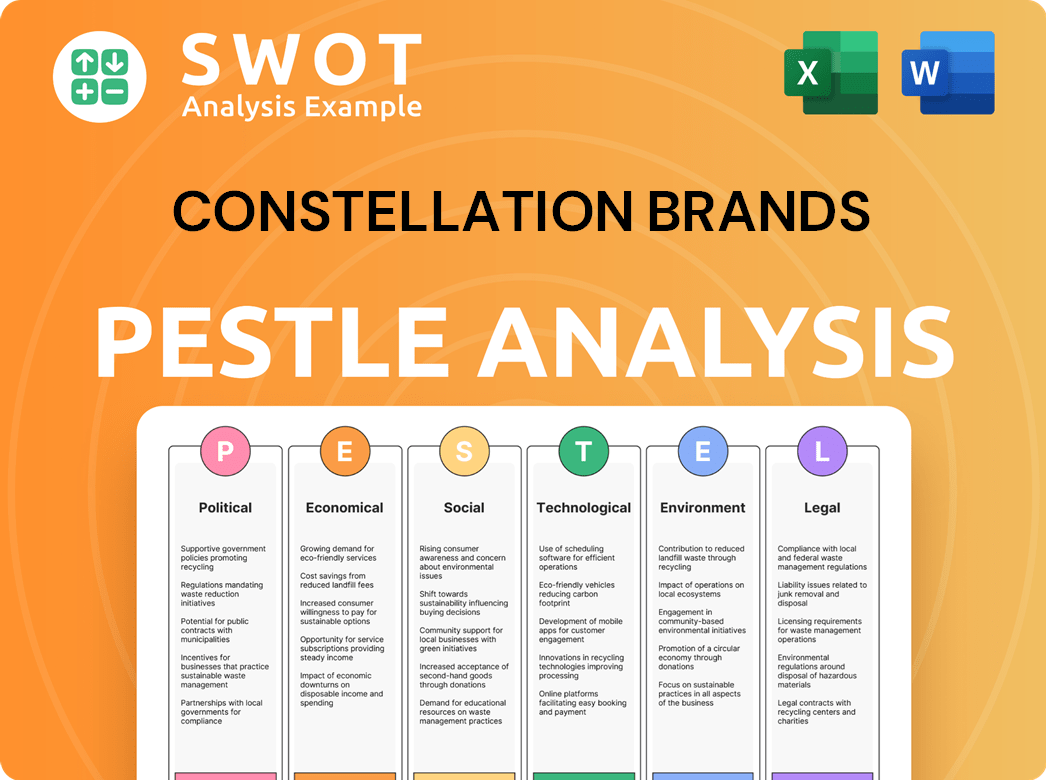

Constellation Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Constellation Brands history?

The Company history of Constellation Brands is marked by strategic acquisitions and a focus on premium beverage brands, evolving from its early days to become a major player in the global alcohol beverage company market.

| Year | Milestone |

|---|---|

| 2004 | Acquired Robert Mondavi Corporation, strengthening its position in the premium wine segment. |

| 2013 | Acquired Grupo Modelo's U.S. beer business, including Corona and Modelo Especial, transforming the company into the largest beer import company in the U.S. |

| 2017 | Invested in Canopy Growth Corporation, entering the cannabis industry. |

| 2022 | Acquired high-quality wine brands like Lingua Franca and Sea Smoke, continuing its premiumization strategy. |

| 2025 (April) | Agreed to divest primarily mainstream wine brands like Woodbridge and Meiomi to The Wine Group. |

Constellation Brands has consistently pursued innovation through acquisitions and strategic shifts in its product portfolio. The company's investment in Canopy Growth Corporation in 2017 was a move to capitalize on the emerging cannabis market, though it faced significant challenges.

The acquisition of Grupo Modelo's U.S. beer business in 2013 significantly expanded Constellation Brands' beer portfolio, making it the largest beer import company in the U.S. and increasing its market share.

In 2017, Constellation Brands invested in Canopy Growth Corporation, marking an early entry into the cannabis industry and aiming to diversify its business interests beyond alcoholic beverages.

The company's consistent focus on premiumization, particularly in wine and spirits, through acquisitions of high-end brands like Lingua Franca and Sea Smoke, reflects a strategic shift towards higher-margin products.

The agreement in April 2025 to divest mainstream wine brands demonstrates a commitment to focus on higher-growth, higher-margin brands, streamlining the product portfolio.

Despite its successes, Constellation Brands has faced challenges, particularly in its wine and spirits division. In September 2024, the company issued a profit warning, anticipating significant impairment charges due to macroeconomic headwinds, and in April 2025, a class-action lawsuit was filed alleging misleading sales performance reporting.

The wine and spirits division has faced ongoing challenges, including a profit warning in September 2024 due to macroeconomic factors, leading to significant impairment charges and impacting financial performance.

Initial investments in the cannabis industry through Canopy Growth Corporation resulted in significant write-downs and losses, impacting overall profitability.

A class-action lawsuit filed in April 2025 alleges that the company misled investors about its wine and spirits sales performance between April 2024 and January 2025, adding to the company's legal and financial burdens.

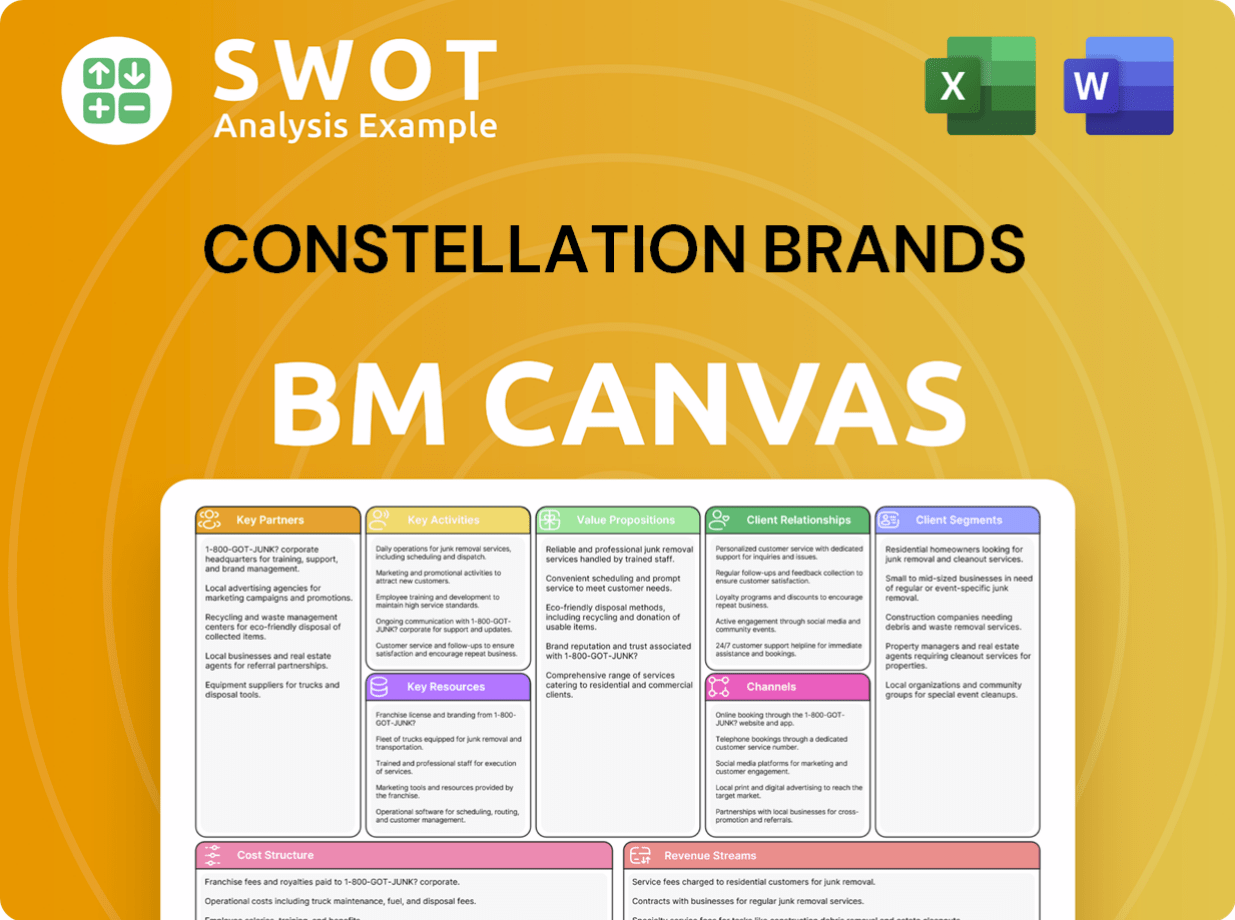

Constellation Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Constellation Brands?

The Company history of Constellation Brands is marked by strategic acquisitions and a focus on evolving market trends within the alcohol beverage company sector. Founded in 1945 by Marvin Sands as Canandaigua Industries, the company initially specialized in bulk wine sales before expanding its portfolio through brand introductions and acquisitions. Over the years, it has transformed from a regional wine producer to a global leader in the beverage alcohol industry, with significant moves in the beer, wine, and spirits markets.

| Year | Key Event |

|---|---|

| 1945 | Marvin Sands founds Canandaigua Industries in Canandaigua, New York, beginning with bulk wine sales. |

| 1954 | Introduction of the Richard's Wild Irish Rose brand boosts the company's growth. |

| 1972 | The company incorporates as Canandaigua Wine Company, Inc. |

| 1973 | Canandaigua Wine Company, Inc. goes public. |

| 1984 | Enters the wine cooler market with the Sun Country brand. |

| 1993 | Acquires Barton Inc. and Vintners International, expanding into spirits and wine. |

| 1997 | The company changes its name to Canandaigua Brands, Inc. |

| 2000 | The company changes its name to Constellation Brands, Inc., reflecting a broader portfolio. |

| 2004 | Acquires Robert Mondavi Corporation, strengthening its position in premium wine. |

| 2013 | Acquires Grupo Modelo's U.S. beer business, including Corona and Modelo. |

| 2017 | Begins investing in medical and recreational cannabis through Canopy Growth. |

| 2022 (November) | Shifts away from family control with reclassification of Class B stock, prioritizing shareholder value. |

| 2024 (April 11) | Reports fiscal year and fourth quarter 2024 financial results and fiscal year 2025 outlook. |

| 2025 (April 9) | Reports fiscal year and fourth quarter 2025 financial results. |

| 2025 (April 9) | Announces agreement to divest mainstream wine brands to The Wine Group. |

| 2025 (July 1) | Scheduled to report first quarter fiscal 2026 financial results. |

The company is strategically focusing on higher-growth, higher-margin brands, particularly within its wine and spirits division. This involves divesting mainstream brands to streamline the portfolio and enhance profitability.

The Beer Business is expected to continue driving strong growth, with projected net sales growth of between 6% and 8% for fiscal year 2025. This segment remains a key driver of overall financial performance.

Ongoing challenges in the Wine and Spirits Business are leading to strategic repositioning. Net sales and operating income are anticipated to decline by between 4% and 6%, and 16% and 18%, respectively, for fiscal year 2025.

The company has announced a new three-year share repurchase authorization of $4 billion, underscoring its commitment to delivering shareholder value and confidence in its financial outlook.

Constellation Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Constellation Brands Company?

- What is Growth Strategy and Future Prospects of Constellation Brands Company?

- How Does Constellation Brands Company Work?

- What is Sales and Marketing Strategy of Constellation Brands Company?

- What is Brief History of Constellation Brands Company?

- Who Owns Constellation Brands Company?

- What is Customer Demographics and Target Market of Constellation Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.