Constellation Brands Bundle

Who Really Controls Constellation Brands?

Understanding who owns a company is crucial for investors and strategists alike. A shift in ownership can signal significant changes in a company's direction and potential for growth. This exploration dives into the ownership structure of Constellation Brands, a beverage alcohol giant, to uncover the key players shaping its future.

From its roots as Canandaigua Industries to its current status as a Fortune 500 company, Constellation Brands SWOT Analysis reveals a fascinating journey of evolution. This analysis of Constellation Brands ownership will examine the key players, from early founders to institutional investors, and their impact on the company's strategic decisions. Discover the dynamics behind Constellation Brands shareholders and their influence on this leading producer of iconic brands like Corona and Modelo. Understanding Who owns Constellation Brands is key to understanding its future.

Who Founded Constellation Brands?

The story of Constellation Brands began in 1945, when Marvin Sands, at the young age of 22, founded Canandaigua Industries in Canandaigua, New York. Initially, the company focused on selling bulk wine to bottlers, marking the start of what would become a major player in the beverage industry. Sands started the business with a modest investment, setting the stage for its future growth.

In its early years, the company made significant strides, including the acquisition of Mother Vineyard Wine Company in 1948 and the opening of Richards Wine Cellars in 1951. A notable early product was Richard's Wild Irish Rose, named after Marvin's son. By 1972, the company was incorporated as Canandaigua Wine Company, Inc., and went public in 1973 on the New York Stock Exchange.

The Sands family maintained significant control over the company for many years. Richard Sands became president in 1986, and Robert Sands joined the business the same year, eventually becoming CEO. The family's influence ensured that Constellation Brands remained a 'controlled company' under NYSE rules until November 2022, reflecting the family's enduring impact on the company's ownership structure.

The early ownership of Constellation Brands was heavily influenced by its founder, Marvin Sands, and his family. The company's initial capital was a modest $2,000, but it quickly grew, selling approximately 200,000 gallons of wine in its first year and generating $150,000 in gross sales. The Sands family's involvement extended through multiple generations, with Richard and Robert Sands playing key roles in leadership.

- Marvin Sands founded the company in 1945.

- Richard Sands became president in 1986.

- Robert Sands served as CEO from 2007 to 2019.

- The Sands family maintained significant control for decades.

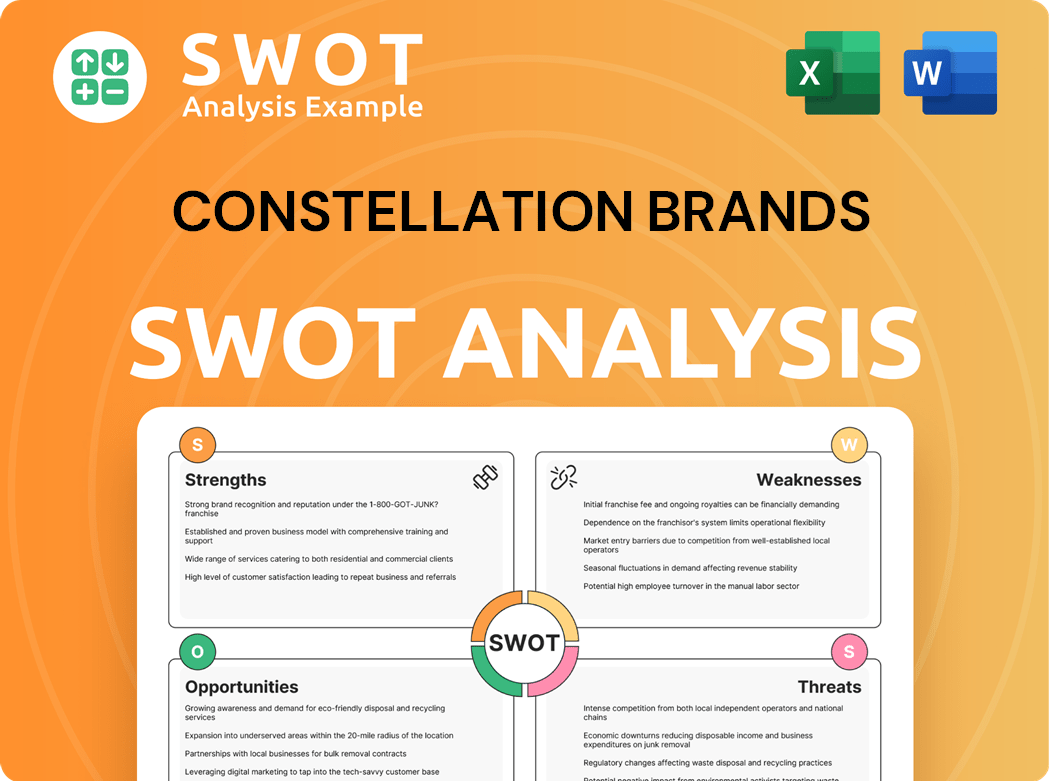

Constellation Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Constellation Brands’s Ownership Changed Over Time?

The ownership structure of Constellation Brands, a prominent player in the beverage alcohol industry, has evolved significantly since its inception. Initially, the company operated as Canandaigua Wine Company, Inc., going public in 1973. Over time, it strategically expanded its portfolio through acquisitions, leading to a name change in 2000 to Constellation Brands, Inc., reflecting its broader scope. A pivotal moment occurred in November 2022, when the company eliminated its dual-class share structure, converting all shares into a single class of voting common stock.

This reclassification, which involved a $1.5 billion payment to the Sands family for their Class B stock, was a strategic move to enhance the company's governance and align it more closely with standard public company practices. This change significantly reduced the Sands family's voting power, transforming the company's operational dynamics.

| Key Events | Year | Impact on Ownership |

|---|---|---|

| Initial Public Offering | 1973 | Transitioned from private to public ownership. |

| Name Change to Constellation Brands, Inc. | 2000 | Reflected expanded business scope through acquisitions. |

| Reclassification of Shares | 2022 | Eliminated dual-class structure; reduced Sands family voting power. |

As of March 2025, institutional investors are the dominant shareholders of Constellation Brands. Their holdings increased from 83.40% to 85.37%. Mutual funds also increased their holdings from 140.75% to 145.66% during the same period. Key institutional investors include Vanguard Group Inc., Capital World Investors, and BlackRock, Inc. Individual insiders, including the Sands family, held about 0.17% of the shares in March 2025. Despite the dilution of direct voting power, Richard Sands and Robert Sands remain on the Board as non-executive directors. For further details on the company's financial performance, consider reading about the Revenue Streams & Business Model of Constellation Brands.

The ownership of Constellation Brands has shifted towards institutional investors, reflecting a move towards a more traditional public company structure.

- Institutional investors hold the majority of the shares.

- The Sands family retains influence through board positions and significant ownership.

- The single-class share structure enhances corporate governance.

- The company's focus is on shareholder value.

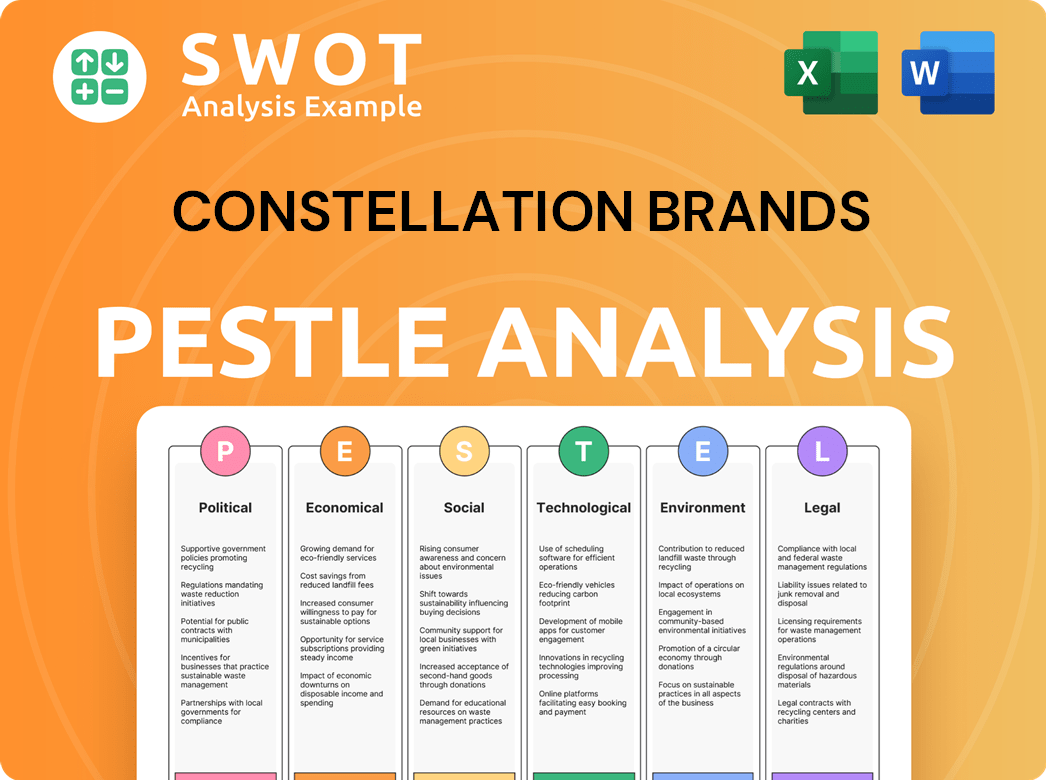

Constellation Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Constellation Brands’s Board?

The Board of Directors at Constellation Brands plays a key role in the company's governance. As of May 2024, the Board comprised thirteen members. The company has been actively refreshing its Board composition, adding seven independent directors in the past five years. This includes an independent Board Chair, appointed effective March 1, 2024. This structure aims to enhance accountability and align with best practices.

The Board operates with a single class of voting common stock (Class A Stock), where each share carries one vote. This change followed the elimination of the prior 'high-vote/low-vote' voting structure in November 2022. The founding Sands family previously held a majority of the voting power. Richard Sands and Robert Sands, members of the founding family, continue to serve on the Board. Their influence on voting power is now aligned with their proportionate shareholdings, which are below 20% following the reclassification.

| Board Committee | Responsibilities | Composition |

|---|---|---|

| Audit | Oversees financial reporting and internal controls. | Composed entirely of independent directors. |

| Corporate Governance, Nominating, and Responsibility | Identifies and recommends director nominees and advises on corporate governance practices. | Composed entirely of independent directors. |

| Human Resources | Oversees executive compensation and talent management. | Composed entirely of independent directors. |

In July 2023, the Board appointed two new independent directors, William Giles and Luca Zaramella, following a Cooperation Agreement with Elliott Management. Christopher J. Baldwin was elected as independent Board Chair effective March 1, 2024. A class action lawsuit was filed in April 2025 by shareholders alleging 'false and misleading statements' regarding the wine and spirits division's sales performance between April 2024 and January 2025. The lawsuit seeks damages and a revised corporate governance structure. Understanding the Target Market of Constellation Brands can provide further insights into the company's strategic direction.

The Board of Directors at Constellation Brands has evolved to increase accountability. The company has moved to a single class of voting stock, impacting the voting power of the founding family. Recent developments include new independent directors and a shareholder lawsuit.

- The Board consists of thirteen members as of May 2024.

- The Sands family's voting power is now proportionate to their shareholdings.

- Shareholders are seeking greater influence over company policies.

- The company's focus is on enhancing governance and aligning with best practices.

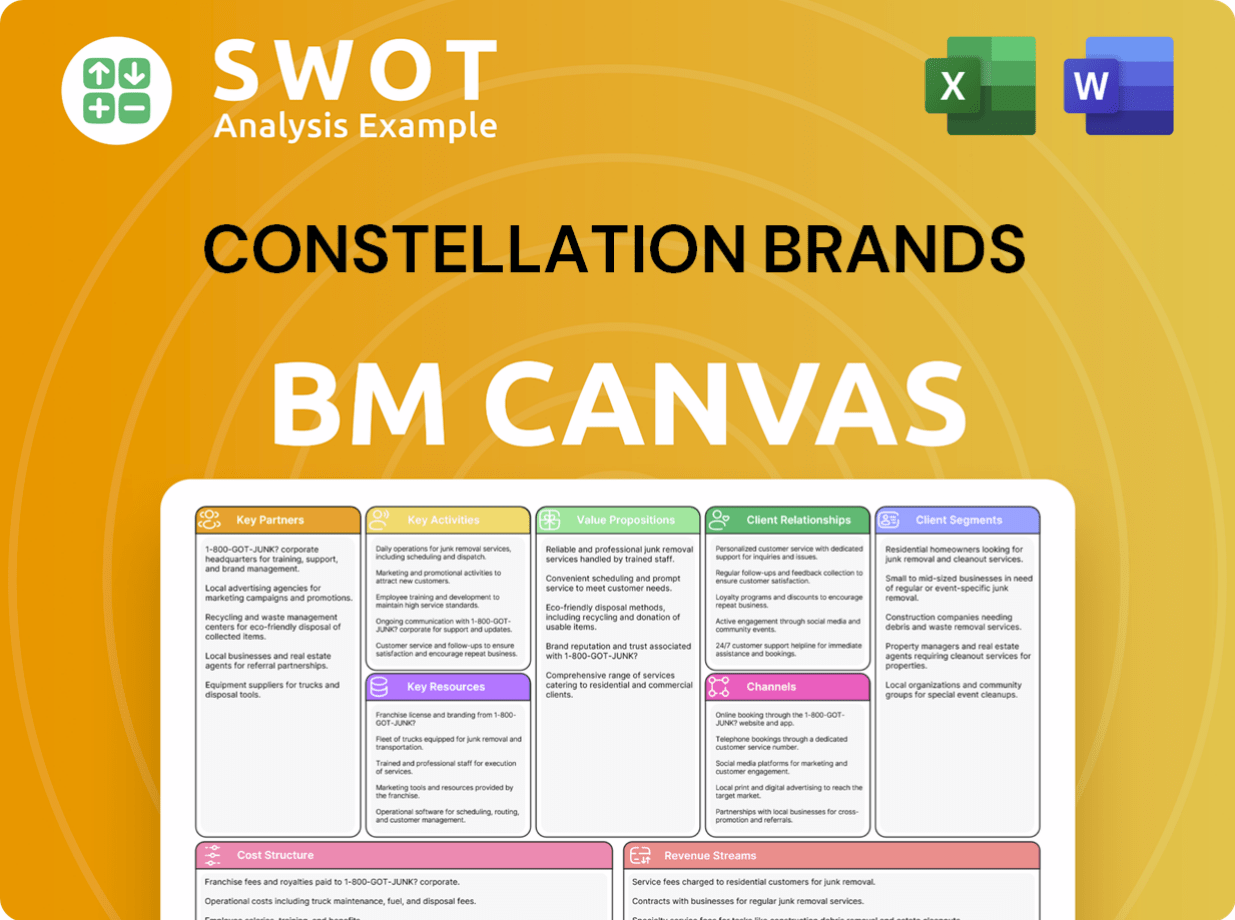

Constellation Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Constellation Brands’s Ownership Landscape?

Over the last few years, Constellation Brands has made significant changes to its ownership and strategic direction. A key move was eliminating the dual-class share structure in November 2022. This change, which cost the Sands family $1.5 billion for their Class B stock, has improved the company's corporate governance and made it more attractive to a broader range of investors. This shift is part of a broader strategy to focus on premium offerings.

In April 2025, the company announced an agreement with The Wine Group to divest brands, including Woodbridge and Meiomi. This strategic shift is expected to generate over $200 million in net annualized cost savings by fiscal year 2028 through organizational restructuring. These actions show a clear effort to streamline operations and concentrate on higher-value products. Recent insider trading data indicates sales by key executives and Sands family trusts, which is part of a broader trend of insider sells.

| Metric | Details | As of March 2025 |

|---|---|---|

| Institutional Ownership | Percentage of shares held by institutional investors | 85.37% |

| Mutual Fund Ownership | Percentage of shares held by mutual funds | 145.66% |

| Insider Sales | Number of insider sells over the past year | 20 |

The evolving ownership structure of Constellation Brands reflects broader industry trends. The increased institutional ownership, reaching 85.37% as of March 2025, highlights the growing influence of large institutional investors. This trend, combined with strategic portfolio adjustments and a focus on premiumization, positions the company for sustained long-term value creation. For more insights, you can explore the Marketing Strategy of Constellation Brands.

Elimination of dual-class share structure, enhancing corporate governance and attracting a wider investor base. The Sands family received $1.5 billion for their Class B stock. This change simplified the capital structure.

Divestiture of mainstream wine brands to concentrate on higher-margin, premium offerings. This move is expected to generate over $200 million in net annualized cost savings by fiscal year 2028. This strategic focus is on premiumization.

Increase in institutional ownership to 85.37% as of March 2025. Insider sales by key executives and Sands family trusts. This indicates a shift in ownership dynamics.

Focus on premiumization across beer, wine, and spirits aligns with evolving consumer preferences. The company is positioned for sustained long-term value creation. This strategic direction is key.

Constellation Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Constellation Brands Company?

- What is Competitive Landscape of Constellation Brands Company?

- What is Growth Strategy and Future Prospects of Constellation Brands Company?

- How Does Constellation Brands Company Work?

- What is Sales and Marketing Strategy of Constellation Brands Company?

- What is Brief History of Constellation Brands Company?

- What is Customer Demographics and Target Market of Constellation Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.