Constellation Brands Bundle

Uncorking Success: How Does Constellation Brands Thrive?

Constellation Brands, a powerhouse in the alcoholic beverage company arena, consistently captivates investors and industry watchers alike. With a portfolio brimming with household names like Corona and Modelo, the company's financial performance is a compelling story. Its strategic focus on premium offerings has fueled impressive growth, making it a fascinating case study for anyone interested in the beer industry, wine and spirits, and overall market dynamics.

This exploration delves into the Constellation Brands SWOT Analysis, examining its core Constellation Brands business model and operations to understand its impressive financial performance. We'll unpack how this alcoholic beverage company generates revenue, its distribution network, and its strategic approach to maintaining its leadership position. Understanding Constellation Brands' success offers valuable insights for investors considering Constellation Brands stock analysis and those interested in the future outlook of the beverage industry.

What Are the Key Operations Driving Constellation Brands’s Success?

Constellation Brands is a leading alcoholic beverage company that creates value through the production and marketing of premium beer, wine, and spirits. Their core operations are centered around a diverse portfolio of brands, including popular Mexican beer labels like Corona and Modelo Especial, as well as a variety of wine and spirits such as Robert Mondavi Winery and Casa Noble Tequila. The company's success is built on a strategy of 'premiumization,' focusing on high-end products to cater to consumers seeking quality beverages.

The company's business model revolves around a complex interplay of manufacturing, sourcing, and distribution. Constellation Brands invests heavily in its supply chain, leveraging technology and data analytics to optimize demand forecasting and inventory management. Their extensive distribution network ensures products reach consumers efficiently across key markets, including the U.S., Mexico, and Italy. Strategic partnerships and technology integration further streamline these operations, contributing to their market reach and brand recognition.

Constellation Brands' value proposition is centered on providing a diverse selection of high-quality, well-recognized brands. This approach allows the company to differentiate itself in the market. They focus on adapting to evolving consumer preferences through product innovation, which enhances customer benefits. The company's strong brand equity and extensive reach contribute to its overall market success.

Constellation Brands' core products include a variety of premium beer, wine, and spirits. Their beer portfolio is highlighted by Mexican beer brands like Corona and Modelo Especial, which are exclusively distributed in the U.S. The wine and spirits segment features brands such as Robert Mondavi Winery and Casa Noble Tequila, catering to diverse consumer tastes.

The operational processes involve manufacturing, sourcing, and extensive distribution networks. They use AI-driven analytics for demand forecasting and inventory management. The company has a strong distribution network across key markets, including the U.S. and Mexico. Strategic partnerships and technology integration streamline these operations.

Constellation Brands offers a diverse selection of high-quality, well-recognized brands. This approach helps differentiate them in the market. They continually adapt to evolving consumer preferences through product innovation. Their strong brand equity and extensive reach contribute to their overall market success.

Constellation Brands primarily targets consumers seeking premium beverages. Their focus on 'premiumization' ensures they cater to a specific segment of the market. The company's marketing strategy is designed to reach these consumers effectively. For more details on their target market, see Target Market of Constellation Brands.

Constellation Brands employs several key strategies to maintain its competitive edge. These include a strong focus on premium products and adapting to consumer preferences. They use advanced technology to optimize their supply chain and distribution networks.

- Emphasis on premium brands like Corona and Modelo.

- Use of AI for demand forecasting and inventory management.

- Extensive distribution networks in key markets.

- Strategic partnerships to streamline operations.

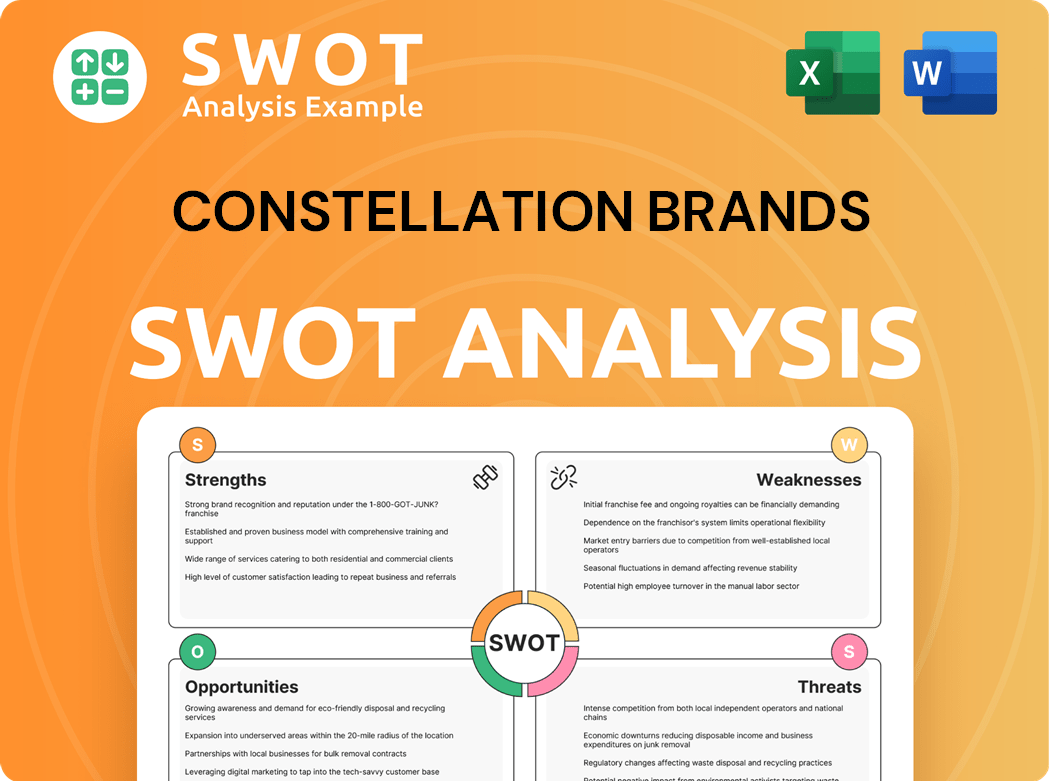

Constellation Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Constellation Brands Make Money?

Constellation Brands, an alcoholic beverage company, primarily generates its revenue through the sale of beer, wine, and spirits. The company's financial performance is heavily influenced by its beer segment, which consistently contributes the largest portion of its total revenue. Understanding the revenue streams and monetization strategies is crucial for a comprehensive Constellation Brands business model analysis.

The company's operations are structured to maximize profitability across different product categories. Constellation Brands employs various strategies, including premiumization and strategic portfolio transformations, to drive revenue growth and improve margins. This approach is essential for investors and analysts assessing Constellation Brands stock analysis and its long-term viability.

Constellation Brands focuses on optimizing its product mix and distribution network to enhance financial outcomes. By analyzing its revenue breakdown and understanding its market position, stakeholders can gain insights into the company's ability to navigate the competitive landscape and capitalize on emerging trends within the beer industry and the broader alcoholic beverage market.

Constellation Brands' revenue streams are primarily derived from its beer, wine, and spirits sales. The beer segment is the strongest performer, with beer sales improving by 6% year-over-year to reach $2.27 billion in the first quarter of fiscal year 2025 (ending May 31, 2024). For the full fiscal year 2025, the company anticipates beer net sales growth of 6% to 8%, and operating income growth of 11% to 12%. This segment accounts for over 80% of total sales. In contrast, the Wine and Spirits segment faced headwinds, with a 7% decline in sales to $389 million in the first quarter of fiscal year 2025. The company expects organic net sales for Wine and Spirits to decline by 5% to 8% for fiscal year 2025.

- Beer Segment: The primary revenue driver, showing consistent growth.

- Wine and Spirits Segment: Facing challenges due to changing consumer preferences.

- Overall Strategy: Focused on premiumization and strategic portfolio adjustments.

- Financial Outlook: Positive for beer, with expectations of a decline in wine and spirits.

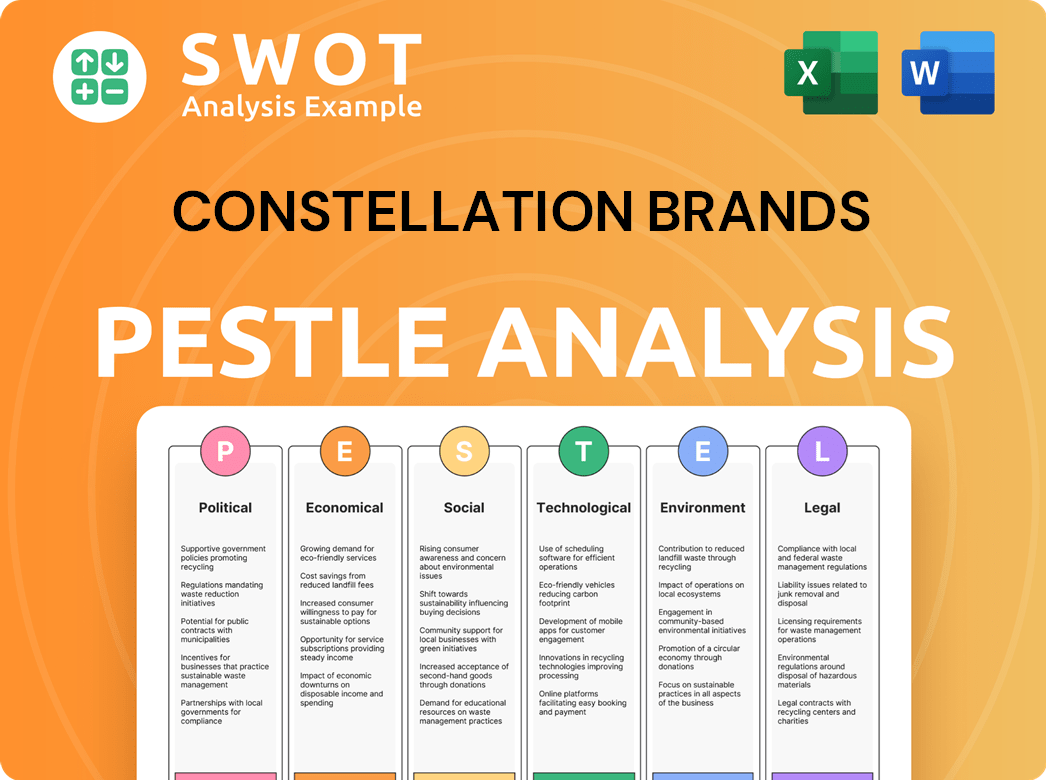

Constellation Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Constellation Brands’s Business Model?

Constellation Brands, a prominent player in the alcoholic beverage industry, has strategically navigated the market through key milestones, strategic moves, and a focus on maintaining its competitive edge. The company's operations are heavily influenced by its investments and responses to market dynamics, particularly within the beer, wine, and spirits sectors. Understanding these elements is crucial for grasping how the Owners & Shareholders of Constellation Brands manage and grow their business.

The company's financial performance and strategic direction are significantly shaped by its investments in its high-end Mexican beer portfolio. Constellation Brands has consistently adapted to changing consumer preferences and economic conditions, implementing operational adjustments and exploring strategic alternatives to optimize its portfolio and financial outcomes. These actions are critical to its long-term success.

Constellation Brands' competitive advantages stem from its strong brand recognition, a diverse product portfolio, and a robust distribution network. The company’s ability to adapt, innovate, and respond to market changes is also essential. These factors contribute to its resilience and success in the competitive alcoholic beverage market.

A significant milestone is the ongoing investment in its Mexican beer portfolio. The company plans to invest $3 billion between fiscal years 2025 and 2028 to expand capacity in Mexico. This builds on the $900 million invested in fiscal year 2024 to expand brewery capacity.

Strategic moves include focusing on operational and commercial execution initiatives within its wine and spirits business. The company is also considering divesting its entire wine portfolio. Additionally, Constellation Brands is implementing a restructuring program to achieve over $200 million in savings by fiscal year 2028.

Constellation Brands' competitive edge is rooted in its strong brand recognition, diverse portfolio, and robust distribution network. The company benefits from economies of scale and the recession-resistant nature of alcoholic beverages. They are also focusing on consumer-led innovation and enhanced data mining capabilities.

The company's investment in Mexican beer capacity expansion is a key financial commitment. The restructuring program aims for over $200 million in savings by fiscal year 2028. These financial strategies are crucial for the company's future performance and are part of the Constellation Brands business model.

Constellation Brands faces challenges such as macroeconomic headwinds, including rising unemployment and shifting consumer behaviors, which have impacted demand. The company is responding to these challenges by focusing on operational improvements and exploring strategic alternatives for its wine and spirits segment.

- Focus on premium beer brands like Corona and Modelo Especial, which hold leading market positions.

- Aggressive advertising and enhanced data mining to improve market responsiveness.

- Potential risks from tariffs on Mexican imports, which could impact earnings.

- Adapting to consumer preferences through innovation and strategic portfolio adjustments.

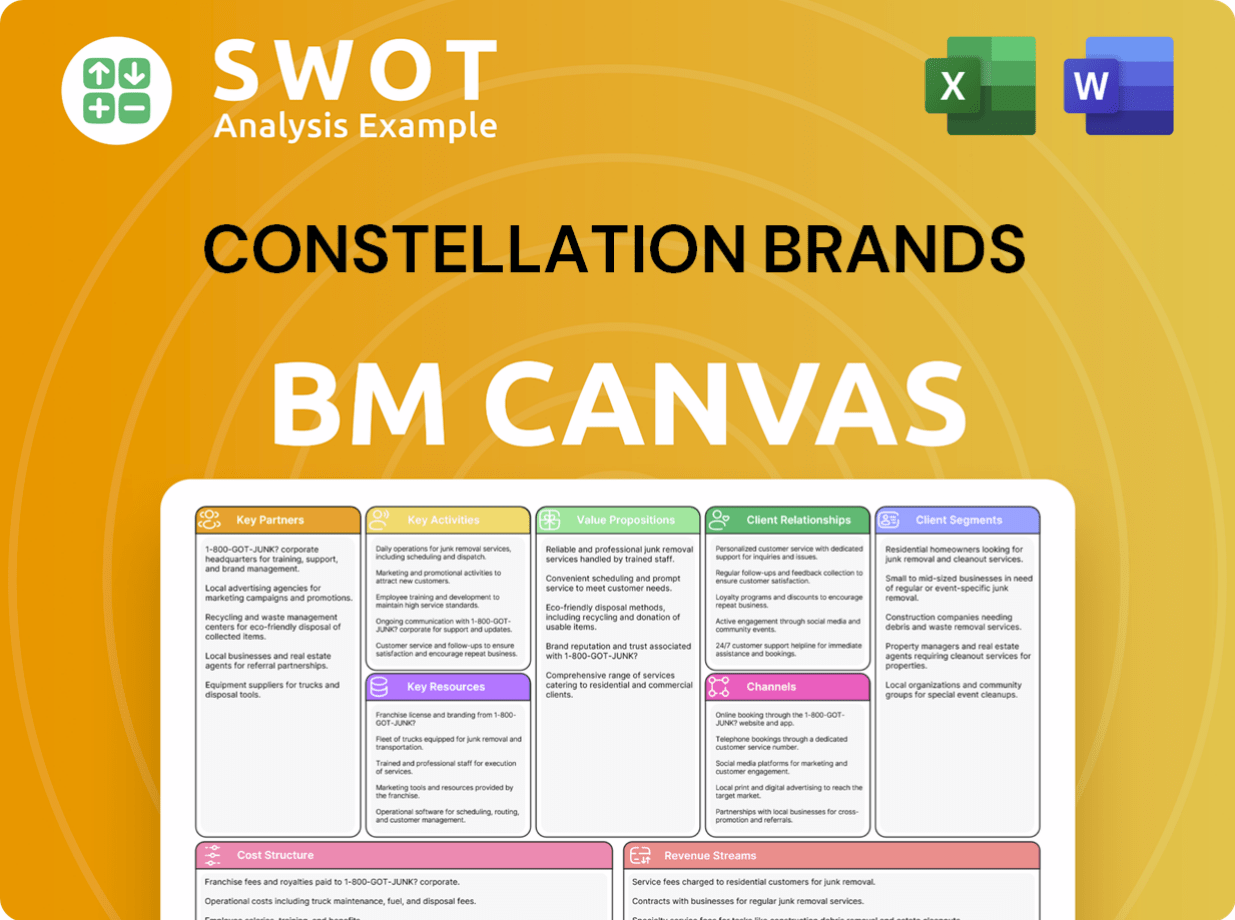

Constellation Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Constellation Brands Positioning Itself for Continued Success?

Constellation Brands is a leading player in the alcoholic beverage company sector, particularly known for its strong position in the U.S. beer market. The company's success is significantly tied to its portfolio of imported beers, especially Mexican brands. The company's operations span across several countries, including Mexico, New Zealand, and Italy, reflecting its global presence in the beer industry.

Despite its strong market presence, Constellation Brands faces considerable challenges. Macroeconomic factors and shifts in consumer behavior pose risks, particularly affecting its wine and spirits segment. Potential tariffs on Mexican imports and ongoing legal issues also create uncertainty. For a deeper understanding, consider exploring the Brief History of Constellation Brands.

Constellation Brands holds a significant market position, especially in the U.S. high-end beer market. Its Mexican beer imports account for approximately 86% of its sales in that segment. Modelo Especial's rise to the top-selling beer in the U.S. in 2023 demonstrates its strong consumer loyalty and market share.

The company faces risks from macroeconomic conditions, including potential rising unemployment and changing consumer preferences. Potential tariffs on Mexican imports could significantly impact earnings. Investor lawsuits regarding financial statements in the wine and spirits division also pose a risk.

Constellation Brands focuses on consumer-led innovation and aggressive advertising to maintain brand leadership. Strategic initiatives include continued investment in its Beer Business, with projected net sales growth of 6% to 8% for fiscal year 2025. The company anticipates comparable EPS growth of $13.60 to $13.80 for fiscal year 2025.

The company is enhancing data mining and improving SKU efficiency. It aims to sustain growth through strategic acquisitions and investments in non-alcoholic beverages. Operational and commercial execution initiatives are underway to improve the performance of the Wine and Spirits segment.

Constellation Brands' performance is influenced by its beer business, which is projected to grow. The company's focus on premiumization and strategic acquisitions are key to its future. The company is navigating challenges in its wine and spirits segment through operational improvements.

- Projected net sales growth for the Beer Business: 6% to 8% for fiscal year 2025.

- Comparable EPS growth expected: $13.60 to $13.80 for fiscal year 2025.

- Focus on consumer-led innovation and advertising to maintain brand leadership.

- Strategic initiatives include data mining, SKU efficiency, and portfolio adjustments.

Constellation Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Constellation Brands Company?

- What is Competitive Landscape of Constellation Brands Company?

- What is Growth Strategy and Future Prospects of Constellation Brands Company?

- What is Sales and Marketing Strategy of Constellation Brands Company?

- What is Brief History of Constellation Brands Company?

- Who Owns Constellation Brands Company?

- What is Customer Demographics and Target Market of Constellation Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.