Constellation Brands Bundle

How Does Constellation Brands Dominate the Beverage Alcohol Market?

Constellation Brands stands as a titan in the beverage alcohol industry, but how does it maintain its leading position? Its strategic focus on premium segments, especially with brands like Corona and Modelo, showcases a keen understanding of consumer preferences. This Constellation Brands SWOT Analysis delves into the competitive landscape to uncover the secrets behind its sustained success.

This company analysis will explore Constellation Brands' competitive advantages, dissecting its business strategy and market position within the context of evolving industry trends. We'll examine its key competitors, market share dynamics, and recent acquisitions to understand its financial performance and future outlook. Understanding the Constellation Brands competitive environment is crucial for investors and strategists alike.

Where Does Constellation Brands’ Stand in the Current Market?

Constellation Brands holds a strong market position in the U.S. beverage alcohol industry. The company is a leader, particularly in the imported beer category. Its success is largely due to its popular Mexican import brands.

As of early 2024, the company has a significant share of the U.S. beer market. The company's beer division consistently delivers strong financial results. In the third quarter of fiscal year 2024, net sales increased by 11% to $2.1 billion.

Constellation Brands also has a presence in the wine and spirits markets. However, its focus is on premium and high-end offerings. The company has strategically divested some of its lower-end wine brands. This move aims to concentrate on premiumization, which should lead to higher margins and stronger brand equity.

Constellation Brands has a significant market share in the U.S. beer market. Its portfolio includes successful brands like Corona Extra and Modelo Especial. Modelo Especial has seen remarkable growth, even surpassing Bud Light in dollar sales for certain periods.

The company is focused on premium and high-end offerings in wine and spirits. This involves divesting lower-end brands and investing in premium brands. This strategy aims to increase margins and brand value.

Constellation Brands primarily focuses on the United States. The U.S. represents the vast majority of its sales and operational footprint. This focus allows for targeted marketing and distribution strategies.

The company's financial health is strong, with robust cash flow. This financial stability enables investments in marketing, innovation, and strategic acquisitions. The Growth Strategy of Constellation Brands has been key to its success.

Constellation Brands has a strong market position in the U.S. beverage alcohol industry. Its focus on premiumization and successful beer brands drives its financial performance. The company's strategic decisions have positioned it for continued growth.

- Dominant position in the imported beer market.

- Strategic shift towards premium brands.

- Strong financial performance and cash flow generation.

- Focus on the U.S. market.

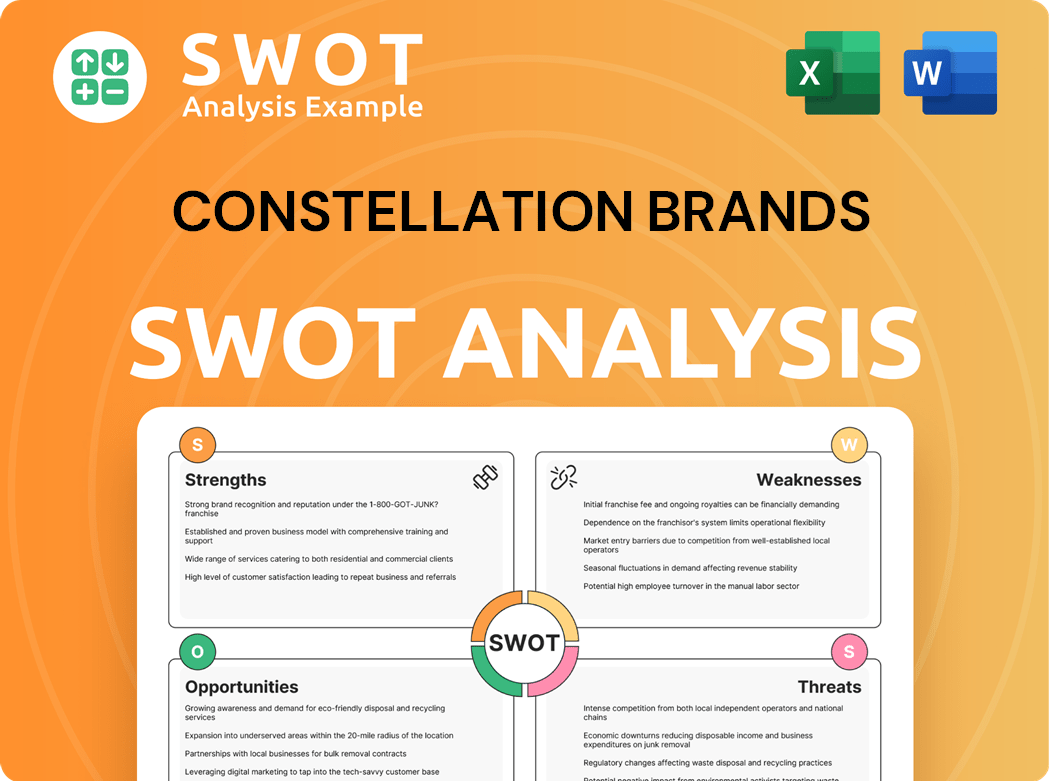

Constellation Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Constellation Brands?

The competitive landscape for Constellation Brands is complex, encompassing direct and indirect rivals across its beer, wine, and spirits segments. A thorough company analysis reveals a dynamic market where market share is fiercely contested. Understanding the competitive environment is crucial for assessing Constellation Brands' market position analysis and future outlook.

Constellation Brands' business strategy must navigate the challenges posed by both established giants and emerging players. Analyzing industry trends and the brand portfolio of competitors is essential for strategic decision-making. This analysis helps in identifying Constellation Brands competitive advantages and potential areas for growth.

In the U.S. beer market, Constellation Brands faces strong competition. Its primary direct competitors include Anheuser-Busch InBev (ABI) and Molson Coors Beverage Company. ABI, with its vast portfolio of mainstream and craft beers, presents a significant challenge. Molson Coors also directly competes for market share with brands like Coors Light and Miller Lite. These companies often engage in intense promotional activities.

ABI is a major competitor, boasting a large portfolio of mainstream and craft beers. Its extensive distribution network and marketing power are significant advantages. The company's brands include Budweiser, Bud Light, and Michelob Ultra, directly competing with Constellation Brands' beer offerings.

Molson Coors competes directly with Constellation Brands in the beer market, particularly with brands like Coors Light and Miller Lite. The company focuses on maintaining its market share and engaging in promotional activities. Molson Coors' success depends on its ability to adapt to changing consumer preferences.

Constellation Brands also faces competition from a growing number of craft breweries and regional players. These smaller entities cater to increasingly fragmented consumer preferences. They often focus on product innovation and direct-to-consumer sales to gain market share.

Treasury Wine Estates is a major competitor in the wine sector, with a diverse portfolio of brands. The company challenges Constellation Brands through product innovation and direct-to-consumer sales. Their strategies include vineyard ownership and targeted marketing campaigns.

E. & J. Gallo Winery is a significant competitor in the wine sector, with a broad range of products. They compete through product innovation, vineyard ownership, and direct-to-consumer sales. Gallo's extensive distribution network and brand recognition pose a challenge.

Diageo, a global conglomerate, competes in the spirits category with brands like Johnnie Walker and Smirnoff. Their extensive brand portfolios and marketing budgets enable them to compete effectively. Diageo leverages its global reach to capture market share.

In the wine sector, Constellation Brands competes with large global wine companies like Treasury Wine Estates and E. & J. Gallo Winery, as well as numerous smaller, independent wineries. These competitors challenge through product innovation and direct-to-consumer sales strategies. In the spirits category, the competition includes global conglomerates such as Diageo, Pernod Ricard, and Beam Suntory. These companies leverage their extensive brand portfolios and global reach. Emerging players, particularly in the craft spirits movement, also represent a growing threat, offering unique and artisanal products. The impact of mergers and alliances further intensifies the competitive dynamics.

The spirits category features global conglomerates and emerging players. These companies compete for consumer attention and market share. The craft spirits movement adds another layer of competition, offering unique products.

- Diageo: (Johnnie Walker, Smirnoff) Utilizes a large brand portfolio and global reach.

- Pernod Ricard: (Absolut, Jameson) Competes with extensive marketing and brand recognition.

- Beam Suntory: (Jim Beam, Maker's Mark) Leverages brand strength and global distribution.

- Craft Spirits: Emerging players offering unique, artisanal products.

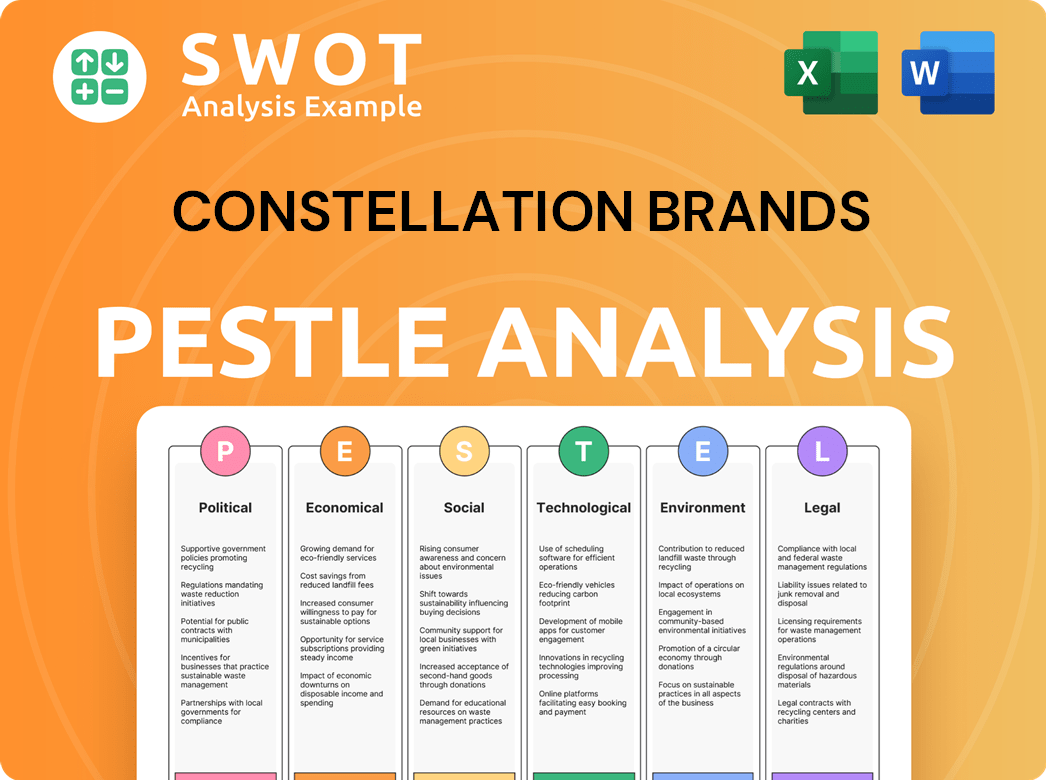

Constellation Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Constellation Brands a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Constellation Brands requires a deep dive into its core strengths. The company has cultivated a robust portfolio of premium brands, particularly in the beer segment, which provides a significant competitive advantage. Its strategic focus on high-growth segments and efficient distribution networks further solidifies its market position. A comprehensive company analysis reveals how these factors contribute to its sustained success.

Key milestones for Constellation Brands include strategic acquisitions and divestitures that have shaped its portfolio. These moves have been instrumental in optimizing profitability and focusing on premium offerings. The company's ability to adapt to industry trends and consumer preferences has been crucial in maintaining its competitive edge. Recent acquisitions and growth strategies have enhanced its market presence.

The company's business strategy centers on premiumization and brand building. This approach allows it to command higher prices and margins. Its extensive distribution network ensures widespread availability of its products, providing a significant barrier to entry for new competitors. The company's financial performance is a testament to its effective strategies.

Constellation Brands boasts a portfolio of premium brands, most notably its Mexican import beers like Corona Extra and Modelo Especial. These brands have strong consumer loyalty and consistent demand. This premium positioning allows the company to maintain higher margins and a strong market share.

The company's three-tier distribution system in the United States is a significant competitive advantage. This network ensures widespread product availability across various retail channels. This extensive reach provides a barrier to entry for new competitors and supports effective market penetration.

Constellation Brands strategically focuses on high-growth segments within the beverage alcohol industry. This includes premium beer, wine, and spirits. This focus allows the company to capitalize on evolving consumer preferences and market trends, driving revenue growth.

The company benefits from economies of scale in production and procurement, leading to cost efficiencies. Its disciplined portfolio management and strong marketing capabilities further reinforce its market position. These operational efficiencies contribute to its overall profitability and competitive edge.

The competitive advantages of Constellation Brands are multifaceted, stemming from its brand portfolio, distribution capabilities, and strategic focus. Its premium brand portfolio allows it to command higher prices, while its distribution network ensures broad market reach. These advantages are crucial in the competitive environment.

- Premium Brand Portfolio: The company's focus on premium brands, especially Mexican import beers, drives strong consumer demand and higher margins.

- Extensive Distribution Network: The three-tier distribution system ensures widespread product availability, providing a significant barrier to entry.

- Strategic Agility: Divesting lower-performing assets and focusing on premiumization optimizes the portfolio for profitability and growth.

- Economies of Scale: Production and procurement efficiencies contribute to cost savings and enhanced profitability.

To delve deeper into the company's consumer base, consider exploring the Target Market of Constellation Brands. The competitive landscape for Constellation Brands is dynamic, with industry trends and market share constantly evolving. Understanding its business model and key competitors is essential for a comprehensive company analysis. The company's financial performance reflects the effectiveness of its strategies.

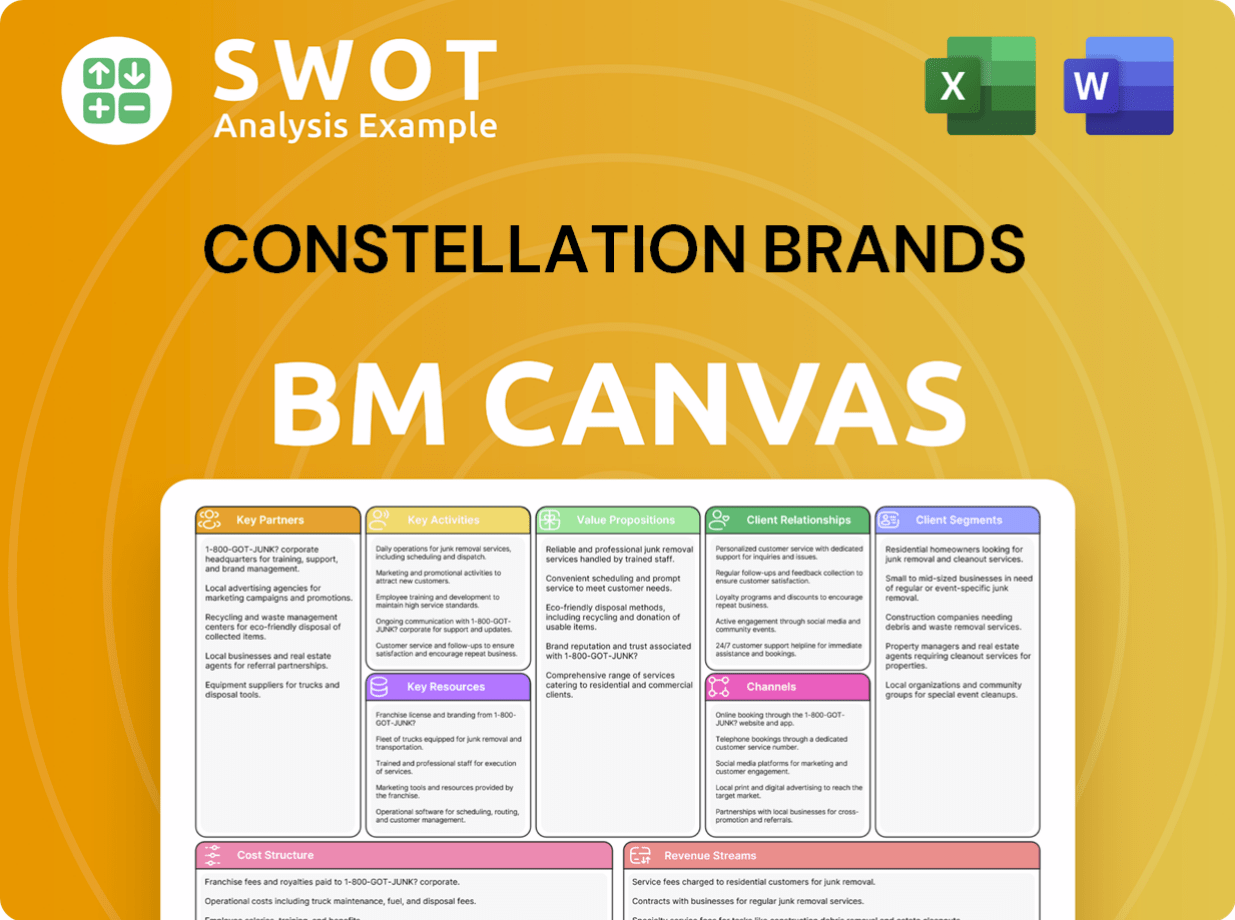

Constellation Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Constellation Brands’s Competitive Landscape?

The beverage alcohol industry presents a dynamic competitive landscape, with evolving industry trends, challenges, and opportunities for companies like Constellation Brands. Understanding these factors is crucial for assessing the company's future prospects and strategic positioning. This analysis will delve into the key industry trends, potential challenges, and growth opportunities that shape the competitive environment for Constellation Brands.

Analyzing the Owners & Shareholders of Constellation Brands helps to understand the company's long-term strategy and commitment to the industry. The company's ability to navigate these complexities will determine its future success in the market. This includes adapting to changing consumer preferences, technological advancements, and economic conditions.

The beverage alcohol industry is experiencing significant shifts. Premiumization remains a key driver, with consumers increasingly seeking higher-quality products. E-commerce and direct-to-consumer sales are growing, requiring companies to adapt their distribution and marketing strategies. Sustainability and health-conscious choices, such as low-calorie options, are also gaining traction.

Constellation Brands faces challenges including intense competition from both established and emerging brands. Shifting consumer preferences, especially among younger demographics, could impact demand. Global economic shifts and supply chain disruptions also pose risks. Regulatory changes, such as evolving alcohol taxation, can affect profitability and market access.

Significant growth opportunities exist in emerging international markets and through expansion in premium spirits. Innovation in product development, such as new flavors and sustainable packaging, offers avenues for growth. Strategic partnerships and acquisitions can unlock new revenue streams. The company's investment in cannabis-infused beverages represents a diversification opportunity.

Constellation Brands focuses on brand building, market penetration, and disciplined capital allocation. The company aims to strengthen its competitive position by leveraging its strong brand portfolio and adapting to changing market dynamics. These strategies are designed to ensure long-term resilience and capitalize on evolving industry trends.

Constellation Brands' ability to maintain its market share and profitability depends on several factors. These include effectively managing its brand portfolio, navigating regulatory changes, and adapting to consumer preferences. The company's financial performance, including revenue and profit margins, will be critical in assessing its success.

- Market Share: Monitor the company's market share in key segments (beer, wine, and spirits) against its competitors.

- Financial Performance: Analyze revenue growth, profit margins, and return on invested capital (ROIC).

- Strategic Initiatives: Evaluate the success of new product launches, acquisitions, and international expansion efforts.

- Competitive Landscape: Understand the strategies of key competitors and their impact on Constellation Brands.

Constellation Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Constellation Brands Company?

- What is Growth Strategy and Future Prospects of Constellation Brands Company?

- How Does Constellation Brands Company Work?

- What is Sales and Marketing Strategy of Constellation Brands Company?

- What is Brief History of Constellation Brands Company?

- Who Owns Constellation Brands Company?

- What is Customer Demographics and Target Market of Constellation Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.