Celestica Bundle

How Did Celestica Become a Global Tech Powerhouse?

Ever wondered how a Celestica SWOT Analysis can reveal the secrets of a leading EMS provider? From its humble beginnings as an IBM subsidiary in 1994, this Toronto based company has transformed the electronics manufacturing landscape. This article dives into the Celestica history, exploring its fascinating journey and strategic evolution.

Celestica's story is one of remarkable growth and adaptation within the competitive EMS provider industry. The Celestica company, initially focused on electronics manufacturing, strategically expanded its services through organic growth and acquisitions. Its impressive financial performance, including a strong Q1 2025 report, underscores its robust market position and future outlook, particularly in high-growth areas like AI servers. This detailed exploration of Celestica company background will provide valuable insights.

What is the Celestica Founding Story?

The story of the Celestica company begins in 1994, but its roots trace back much further. This Toronto-based company emerged from the manufacturing arm of IBM Canada, marking the start of its journey as an independent EMS provider.

The vision to spin off from IBM came from Eugene Polistuk, who led IBM Canada's Toronto manufacturing unit. He saw the growing trend of companies outsourcing their electronics manufacturing and the potential for a dedicated entity to capitalize on this shift. This led to the formal incorporation of Celestica in January 1994.

Celestica's early years were marked by strategic initiatives and rapid growth, setting the stage for its future in the electronics manufacturing services industry. The company's early success demonstrates the importance of recognizing market trends and adapting quickly.

Celestica's founding in January 1994 marked its formal independence from IBM. Eugene Polistuk, the head of IBM Canada's Toronto manufacturing unit, is credited with spearheading the company's formation. He recognized the potential in the expanding EMS provider market.

- Celestica's initial focus was on securing non-IBM OEM customers.

- An early strategy included a 5% wage cut combined with a profit-sharing program.

- Within its first year, Celestica gained approximately 40 non-IBM OEM customers.

- In 1996, Celestica was sold to Onex Corporation, further distancing it from IBM.

The early strategy focused on attracting non-IBM customers. This was successful, as the contribution of non-IBM sales increased significantly within the first year. This early focus on securing external clients was a key factor in the company's initial growth. For more information on how Celestica has approached its market, see the Marketing Strategy of Celestica.

Celestica's early years also involved innovative employee incentives. A profit-sharing program was implemented to motivate employees. This approach reflects an early focus on performance and employee engagement. The sale to Onex Corporation in 1996 further solidified Celestica's independence and its ability to attract a broader client base.

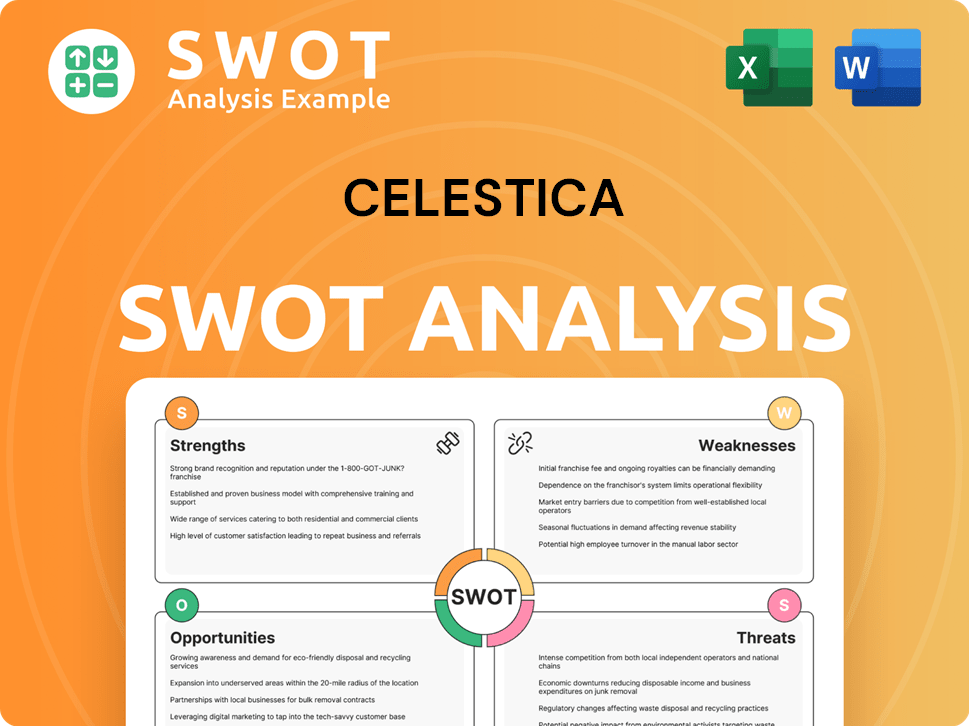

Celestica SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Celestica?

Following its 1994 independence, the Celestica company, a Toronto based company, experienced rapid expansion. This growth was fueled by strategic acquisitions and a shift from primarily serving IBM to becoming a global EMS provider. This period marked the beginning of Celestica's early years and its transformation into a major player in electronics manufacturing.

In January 1997, Celestica entered the European market by acquiring Design to Distribution (D2D). This acquisition was a significant step in expanding its global footprint. This move was followed by further acquisitions, solidifying its presence in Europe.

In 1997, Celestica acquired Hewlett-Packard's printed-circuit board assembly plant and system-assembly operation. These acquisitions expanded Celestica's manufacturing capabilities. Ascent Power Technology was also acquired during this period.

Celestica established a manufacturing presence in Mexico in 1998 through the acquisition of Lucent's facility. Further expansion in Europe occurred with the acquisition of Madge Networks' Dublin operation. The acquisition of International Manufacturing Services (IMS) extended its reach into Asia.

The aggressive acquisition strategy and organic growth led to significant expansion. By 1998, Celestica had grown to 38 locations across 17 countries. Celestica completed the largest EMS initial public offering (IPO) in history, raising US$414 million.

By the end of its first year of independence, Celestica's revenues reached $3.2 billion, a substantial increase. Major strategic agreements, such as the US$10 billion manufacturing agreement with Lucent in 2001, were secured. For more insights, explore the Target Market of Celestica.

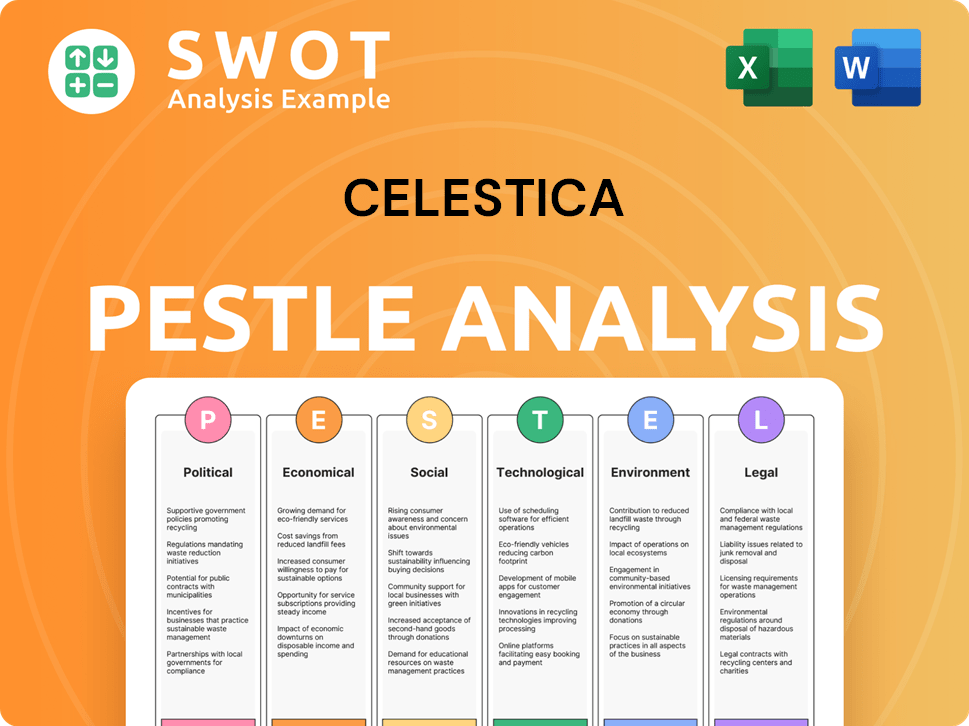

Celestica PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Celestica history?

The Celestica company has a rich history marked by significant achievements in the electronics manufacturing services (EMS) sector. From its early days as a Toronto-based company, it has evolved into a global player, consistently adapting to market changes and technological advancements.

| Year | Milestone |

|---|---|

| Early Years | Establishment of Customer Gateway Centres to streamline new product introduction. |

| Early Years | Early adoption of globalization with operations in China, Thailand, and Eastern Europe. |

| 2004 | Acquisition of Manufacturers' Services Limited (MSL), expanding its customer base and service offerings. |

| Q1 2025 | Hardware Platform Solutions (HPS) division saw a 99% revenue surge compared to Q1 2024. |

| 2026 (expected) | Ramp-up of production for a new HPS Full Rack AI System program with a leading Digital Native Company. |

| Q1 2025 | Increased adjusted operating margin, reaching 7.1%, its highest ever. |

Celestica's commitment to innovation is evident in its strategic initiatives and technological advancements. The company has focused on key areas such as AI, cloud computing, and advanced networking to stay ahead in the competitive EMS provider landscape.

These centers facilitated design prototyping, significantly speeding up the new product introduction process for clients.

Early establishment of manufacturing facilities and operations in emerging markets like China and Eastern Europe.

Development of expertise in advanced manufacturing processes, including lead-free soldering, to meet industry standards.

Focus on AI, cloud computing, and advanced networking to drive innovation and growth.

Significant revenue growth in its Hardware Platform Solutions (HPS) division, part of the Connectivity & Cloud Solutions (CCS) segment.

Securing new programs, including a second 1.6 Terabyte switching program with a hyperscaler and a new HPS Full Rack AI System program.

Despite its successes,

The dot-com crash in April 2001 led to the layoff of approximately 10% of its workforce, or 3,000 employees.

Mounting losses led to the retirement of CEO Eugene Polistuk in January 2004, with Stephen Delaney taking over as interim CEO.

The Advanced Technology Solutions (ATS) segment experienced a 5% revenue decline in Q3 2024, attributed to sector-specific headwinds.

The company has opted not to renew certain margin-dilutive programs in its Aerospace & Defense business for 2025.

Navigating economic downturns and industry-specific challenges has been a constant factor.

The EMS industry is highly competitive, requiring continuous innovation and adaptation to maintain market share.

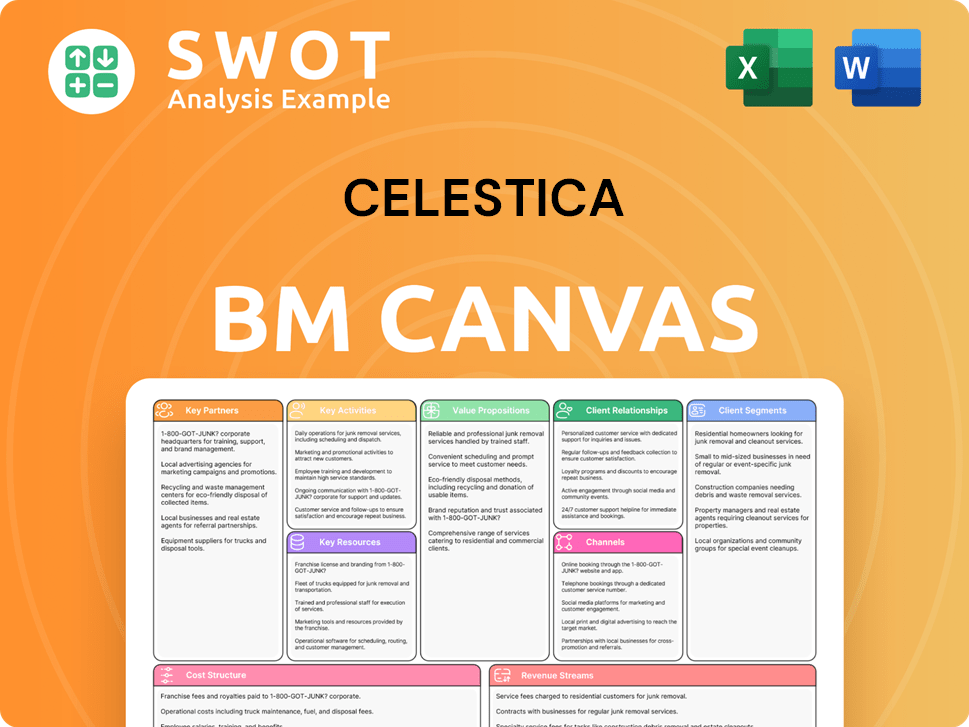

Celestica Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Celestica?

The journey of the Celestica company began in 1917 as the manufacturing division of IBM Canada. Over the years, it evolved through various acquisitions and strategic moves, becoming a leading Electronics manufacturing (EMS provider) with a strong presence in the tech industry. The Toronto based company has consistently adapted to market changes, expanded its global footprint, and invested in innovative solutions to meet the evolving needs of its clients.

| Year | Key Event |

|---|---|

| 1917 | Established as the manufacturing arm of IBM Canada. |

| 1986 | Eugene Polistuk becomes head of IBM Canada's Toronto manufacturing unit. |

| 1994 | Celestica Inc. is incorporated as a subsidiary of IBM Canada, with its headquarters in Toronto. |

| 1996 | Celestica is acquired by Onex Corporation. |

| 1997 | Acquires Design to Distribution (D2D) Limited, expanding into Europe. |

| 1998 | Completes the largest EMS IPO in history, raising US$414 million, and acquires International Manufacturing Services (IMS), expanding into Asia. |

| 2001 | Announces a five-year, US$10 billion strategic manufacturing agreement with Lucent and acquires Omni Industries Limited for $475M. |

| 2004 | Eugene Polistuk retires as CEO, and Stephen Delaney is appointed. |

| 2012 | Darren Myers is appointed Executive Vice President and Chief Financial Officer. |

| 2015 | Robert Mionis is appointed President and CEO. |

| 2021 | Acquires PCI, an electronic manufacturing services provider, for $306M. |

| October 2024 | Launches the DS4100, its latest 800G Switch optimized for AI/ML Data Center Workloads. |

| Q3 2024 | Reports revenue of $2.50 billion, a 22% increase year-over-year. |

| Q4 2024 | Reports revenue of $2.55 billion, a 19% increase compared to Q4 2023. |

| Q1 2025 | Reports revenue of $2.65 billion, a 20% increase compared to Q1 2024, with adjusted EPS of $1.20. |

Celestica is positioned for continued growth, driven by demand from hyperscalers and AI adoption.

The company has raised its full-year 2025 revenue outlook to $10.85 billion, reflecting a 12.5% year-over-year growth.

Anticipates a 7.2% adjusted operating margin and $5.00 adjusted EPS.

Connectivity & Cloud Solutions (CCS) segment is expected to see high-teens percentage revenue growth in 2025.

This growth is fueled by AI/ML compute programs and strong demand for data center hardware.

The company is focused on expanding its Hardware Platform Solutions (HPS) portfolio and services offerings.

Celestica is investing in its global network to support customer demand.

The long-term strategy involves a shift towards higher-value businesses and enhancing capabilities.

Focus on engineering and operational excellence is a key part of the company’s strategy.

Analysts predict strong top-line growth through 2026.

Free cash flow generation is expected to reach approximately $271.5 million in fiscal 2025.

Free cash flow generation is expected to reach approximately $538.6 million in fiscal 2026.

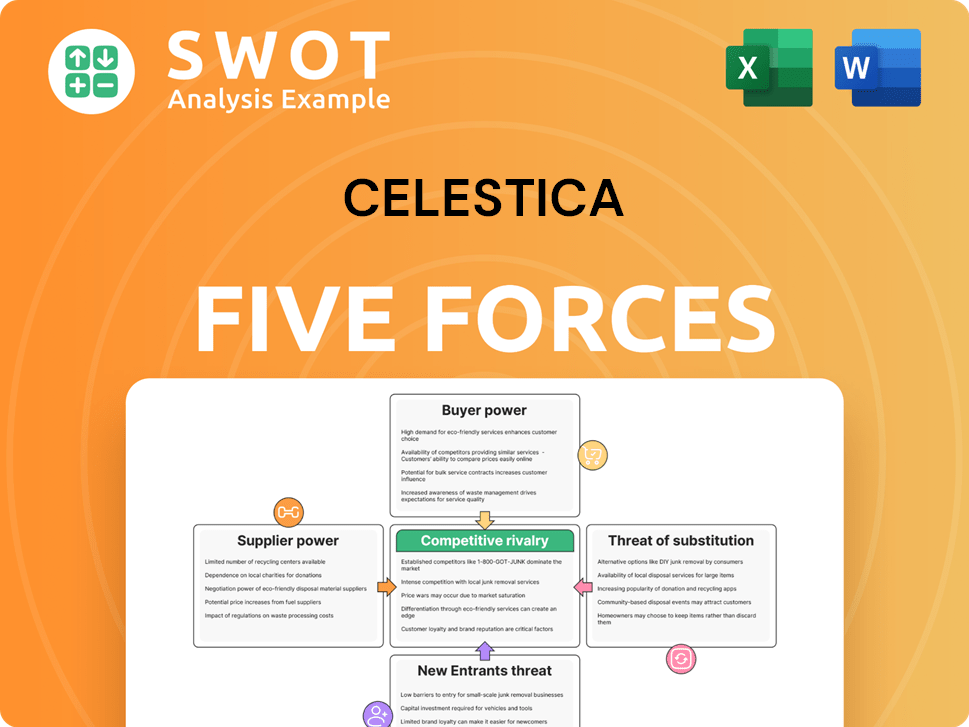

Celestica Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Celestica Company?

- What is Growth Strategy and Future Prospects of Celestica Company?

- How Does Celestica Company Work?

- What is Sales and Marketing Strategy of Celestica Company?

- What is Brief History of Celestica Company?

- Who Owns Celestica Company?

- What is Customer Demographics and Target Market of Celestica Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.