Celestica Bundle

Can Celestica Maintain its Momentum in the Competitive EMS Market?

Celestica, a key player in the electronics manufacturing services (EMS) sector, has rapidly evolved since its inception, transforming from an IBM subsidiary into a global powerhouse. With a strategic focus on design, manufacturing, and supply chain solutions, Celestica has carved out a significant Celestica SWOT Analysis market position. This analysis delves into the company's ambitious growth strategy and future prospects.

Celestica's impressive financial performance, particularly in its Connectivity & Cloud Solutions segment, signals a pivotal shift, driving the need for a thorough Celestica company analysis. This analysis will explore the key drivers behind Celestica's revenue growth, its strategic acquisitions, and the potential impact of technological advancements. Understanding Celestica's response to market challenges and its long-term growth potential is critical for investors and business strategists alike.

How Is Celestica Expanding Its Reach?

Celestica's expansion initiatives are primarily focused on strengthening its position in key markets and diversifying its customer and product portfolios. This strategy is particularly evident within its Hardware Platform Solutions (HPS) business and service offerings. The company aims for consistent organic growth in its Advanced Technology Solutions (ATS) segment, targeting an average of 10% annually over the long term, complemented by strategic acquisitions to enhance its capabilities.

A significant focus of Celestica's growth strategy is the Connectivity & Cloud Solutions (CCS) segment. This is driven by the increasing demand for data center hardware from hyperscalers and investments in Artificial Intelligence (AI). Celestica is actively pursuing opportunities in this area, aiming to capitalize on the growing market for AI-related technologies and data center infrastructure. The company's strategic moves are designed to ensure it remains competitive and adaptable to the evolving demands of the electronics manufacturing services (EMS) industry.

Celestica's strategic acquisitions and partnerships are essential for its expansion. These initiatives are aimed at broadening its capabilities and entering new markets. By focusing on both organic growth and targeted acquisitions, Celestica aims to maintain its competitive edge and capitalize on emerging opportunities within the electronics manufacturing sector.

Celestica is expanding its presence in the Connectivity & Cloud Solutions (CCS) segment. This expansion is driven by the increasing demand for data center hardware, particularly from hyperscalers. The company's focus on CCS is a key element of its growth strategy, aligning with market trends and customer needs. This focus is crucial for Celestica's future prospects.

The company is targeting an average of 10% annual organic growth in its Advanced Technology Solutions (ATS) segment. This segment is a key area of focus for Celestica's expansion efforts. The ATS segment's growth is supported by strategic acquisitions aimed at broadening the company's capabilities and market reach. This growth is essential for Celestica's financial performance.

Celestica is investing in its global network to support customer demand in key regions. These investments are focused on expanding capacity and capabilities in facilities located in Thailand, Malaysia, and Richardson, U.S. These investments are designed to support growth in AI/Machine Learning (AI/ML) and HPS programs. Celestica's global presence is a key factor in its competitive landscape analysis.

The company is working to diversify its customer concentration beyond traditional clients. This includes securing new programs with leading digital native companies. Celestica's customer base and key clients are a critical factor in its long-term growth potential. The company's ability to diversify its customer base is essential for its future prospects.

Celestica's expansion initiatives include securing new data center switch programs and AI system programs. The company has secured multiple 1.6 Terabyte (1.6T) data center switch programs with hyperscaler customers, with production expected to ramp up in 2026. The company has also won new HPS Full Rack AI System programs with leading digital native companies, including Groq, which are anticipated to begin ramping in early 2025 or 2026.

- Securing multiple 1.6 Terabyte (1.6T) data center switch programs with hyperscaler customers.

- Winning new HPS Full Rack AI System programs with leading digital native companies like Groq.

- Investing in global network infrastructure to support customer demand in key regions.

- Focusing on the Connectivity & Cloud Solutions (CCS) segment to capitalize on data center hardware demand.

Geographically, Celestica continues to invest in its global network to support customer demand in key regions. Investments have been made to expand capacity and capabilities at facilities in Thailand, Malaysia, and Richardson, U.S., specifically to support growth in AI/Machine Learning (AI/ML) and HPS programs. The company's strategic focus on these areas is critical for its long-term growth potential and maintaining its Competitors Landscape of Celestica.

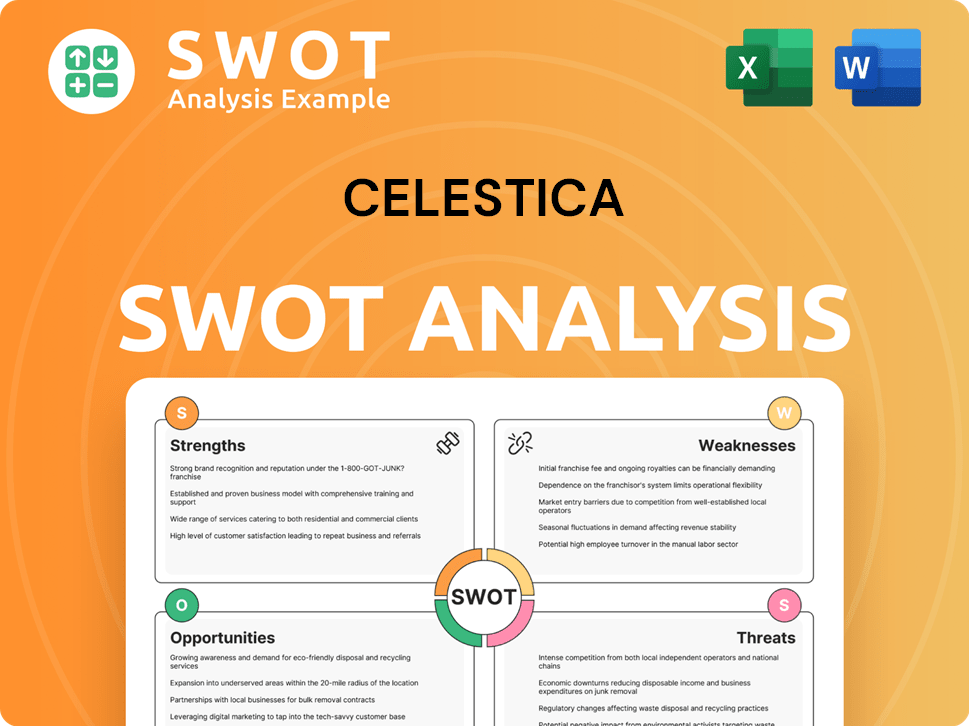

Celestica SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Celestica Invest in Innovation?

The company's innovation and technology strategy is a key driver for its sustained growth. Through strategic investments in research and development, in-house development, and collaborations, Celestica aims to evolve its revenue portfolio. This involves increasing its focus on higher-value businesses, including its Hardware Platform Solutions (HPS) portfolio and services offerings.

A significant aspect of the company's technology strategy involves cutting-edge technologies, particularly in AI and high-performance computing. This focus allows the company to capitalize on the rising demand for Connectivity & Cloud Solutions (CCS), driven by hyperscaler and AI-related investments. This strategic direction is crucial for maintaining a strong market position.

The company's commitment to innovation is also evident in its development of new products, such as the DS4100, its latest 800G switch optimized for AI/ML data center workloads, launched in October 2024. This ongoing investment in technology and product development is a core component of the company's growth strategy.

Celestica invests strategically in R&D, in-house development, and collaborations to drive innovation. These investments support the company's goal of expanding into higher-value businesses and enhancing its engineering capabilities.

The company is actively engaged with cutting-edge technologies, particularly in AI and high-performance computing. This includes securing new AI program awards and supporting customers with AI-optimized networking solutions.

Celestica is committed to developing new products, such as the DS4100, its latest 800G switch optimized for AI/ML data center workloads. This commitment to innovation is a key element of its growth strategy.

Offering extensive Circular Services to enable customers to extend product life and quality through sustainable IT Asset Management and Disposition. This demonstrates a commitment to sustainability and supports the company's long-term growth potential.

The company is focused on several key technology initiatives to drive growth and maintain a competitive edge. These initiatives include investments in AI, high-performance computing, and new product development. These efforts are crucial for the company's

- AI and High-Performance Computing: Securing new AI program awards, including 1.6 Terabyte switching programs.

- New Product Development: Launch of the DS4100, an 800G switch optimized for AI/ML data center workloads.

- Circular Services: Offering sustainable IT Asset Management and Disposition to extend product life.

- Capacity Expansion: Investments to expand capacity and capabilities at its facilities to support growth in AI/ML and HPS programs.

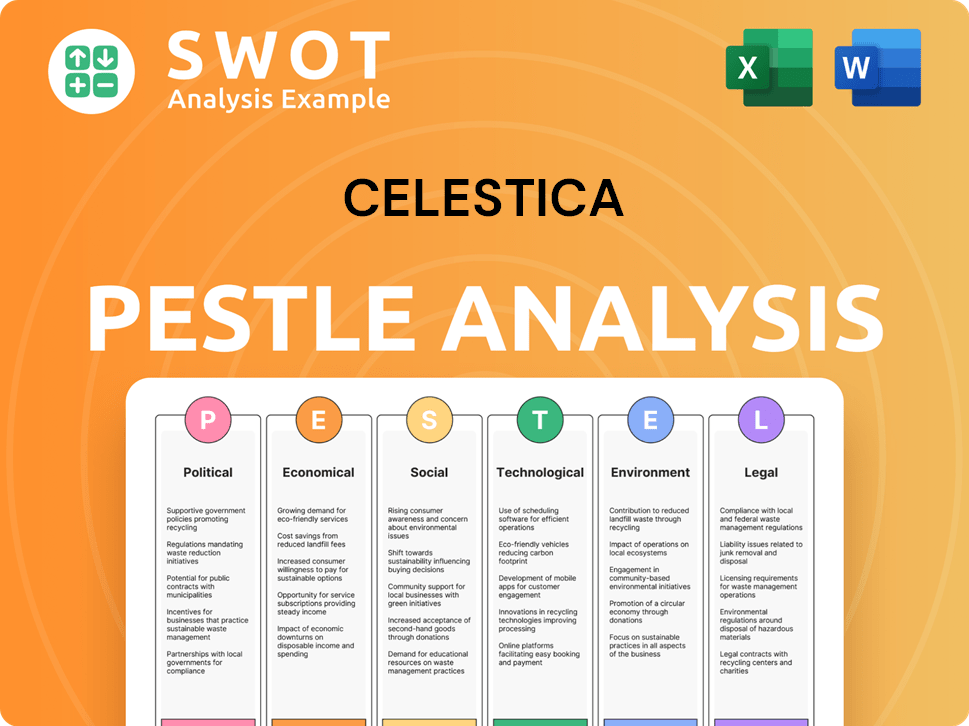

Celestica PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Celestica’s Growth Forecast?

The financial outlook for Celestica is positive, driven by strong performance and strategic growth initiatives. The company's focus on the Connectivity & Cloud Solutions (CCS) segment has been a key driver of its success, with significant revenue increases and margin improvements. A comprehensive Celestica company analysis reveals a strong commitment to innovation and market expansion.

Celestica's financial performance in 2024 and its projections for 2025 highlight its robust growth trajectory. The company's ability to adapt to market demands and leverage its core competencies positions it well for continued success in the electronics manufacturing services (EMS) industry. This positive outlook is supported by strategic investments and a focus on operational efficiency.

For the full year 2024, Celestica achieved record results with $9.65 billion in revenues, a 21% increase compared to 2023, and a non-GAAP adjusted EPS of $3.88, a 58% increase year-over-year. The company's adjusted operating margin improved by 100 basis points in 2024.

Celestica anticipates revenue to reach $10.85 billion in 2025, an increase from its prior outlook of $10.7 billion. This reflects confidence in the company's ability to capitalize on market opportunities and drive further growth. This forecast is a key indicator of Celestica's future prospects.

The non-GAAP adjusted EPS for 2025 is expected to be $5.00, up from the previous outlook of $4.75. This upward revision demonstrates the company's improved profitability and operational efficiency. This positive trend is a key component of Celestica's financial performance.

The adjusted operating margin is projected to be 7.2% for 2025, an increase from the previous outlook of 6.9%. This improvement reflects Celestica's focus on cost management and margin expansion. This is a key factor in Celestica's market position.

In Q1 2025, Celestica reported revenue of $2.65 billion, a 20% increase compared to Q1 2024. The CCS segment revenue increased 28% to $1.84 billion, with a segment margin of 8.0%. Hardware Platform Solutions (HPS) revenue notably increased 99% to approximately $1 billion in Q1 2025, contributing 39% of total company revenue.

Celestica generated $94 million in free cash flow for Q1 2025. S&P Global Ratings projects Celestica to generate approximately $271.5 million of adjusted free cash flow in fiscal 2025 and $538.6 million in fiscal 2026, primarily from earnings growth. The company's net debt stood at $584 million in Q1 2025, with a gross debt-to-EBITDA leverage ratio of 1.1 turns.

- Celestica's strong free cash flow generation supports its financial flexibility.

- The company's debt levels are manageable, reflecting prudent financial management.

- These financial metrics contribute to Celestica's long-term growth potential.

- Celestica's strategic acquisitions and partnerships further enhance its financial outlook.

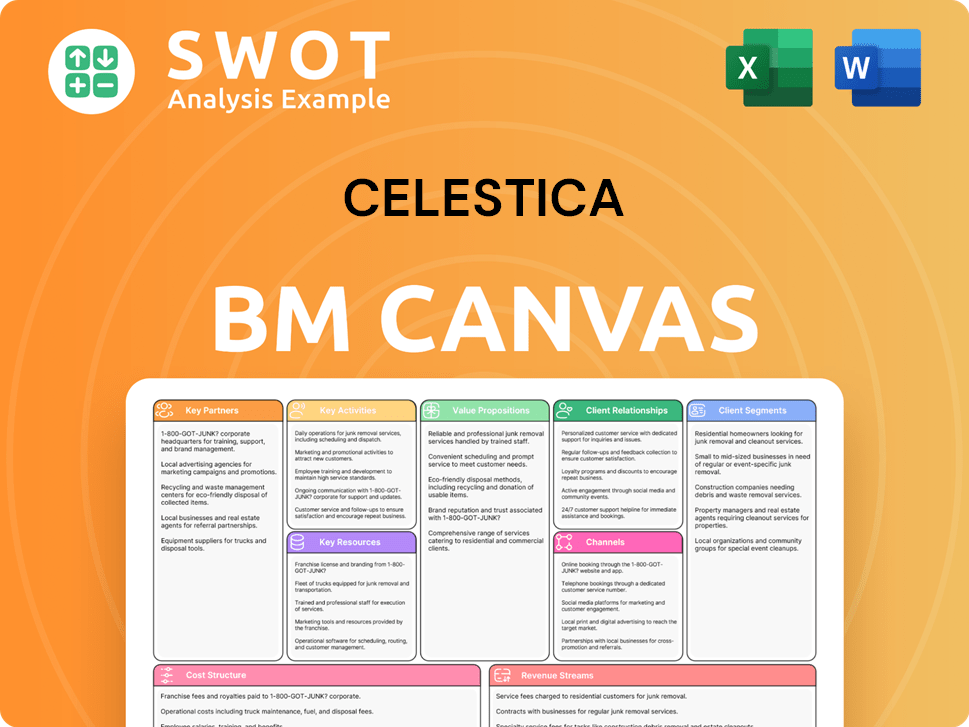

Celestica Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Celestica’s Growth?

Analyzing the potential risks and obstacles is critical for understanding the Celestica growth strategy and its future prospects. Several factors could impede the company's progress, from customer concentration to economic downturns. A thorough Celestica company analysis must consider these challenges to provide a comprehensive view.

Celestica's reliance on a few key customers presents a significant risk. Broader market and economic conditions, including interest rate fluctuations, also pose threats. Furthermore, supply chain disruptions and technological advancements add to the complexity Celestica faces in the competitive Electronics manufacturing services (EMS) industry.

The company's ability to navigate these challenges will significantly impact its financial performance and long-term success. Understanding these risks is essential for investors and stakeholders evaluating Celestica's market position and future potential.

In 2024, the top 10 customers accounted for 73% of Celestica's total revenue, highlighting a significant customer concentration risk. Two customers in the CCS segment contributed 28% and 11% respectively to total revenue. A downturn or shift in business from these key customers could materially affect earnings, impacting the Celestica growth strategy.

Broader market and economic trends significantly influence Celestica's performance. High interest rates can lead to delayed investments and cost-cutting measures by businesses. The cyclical nature and volatility of certain businesses, along with changing revenue mix and margins, also present challenges for Celestica’s future prospects.

Supply chain vulnerabilities remain a concern, particularly given the geopolitical environment. Disruptions in the availability and price fluctuations of raw materials could impact Celestica’s operations. Operational challenges such as inventory management and materials constraints also pose risks to the company's Celestica market position.

Technological disruption necessitates continuous investment in research and development to keep pace with advancements. Celestica must navigate increasing legal, tax, and regulatory complexity, including emerging regulations concerning AI/ML technology. This requires a proactive approach to ensure its Celestica company analysis remains competitive.

Expanding operations and integrating acquisitions can lead to higher costs and operational inefficiencies. Addressing these challenges is crucial for maintaining profitability and efficiency. Celestica's ability to manage these issues will affect its Celestica financial performance and overall success.

Celestica addresses these risks through diversification, risk management frameworks, and strategic planning. The company is diversifying its customer base by exploring opportunities with digital native companies, including specialized AI cloud providers. For more insights into Celestica’s journey, consider reading a Brief History of Celestica.

Celestica is actively working to diversify its customer base to reduce its dependence on a few key clients. This includes targeting digital native companies and specialized AI cloud providers. Such diversification is crucial for mitigating the customer concentration risk and ensuring sustained growth, which is a key aspect of the Celestica growth strategy.

While the ATS segment is expected to remain flat in 2025, demand growth in certain areas is anticipated. This growth may be offset by the non-renewal of margin-dilutive programs in the Aerospace & Defense segment. Analyzing these segment-specific dynamics is essential for understanding the company’s overall Celestica future prospects.

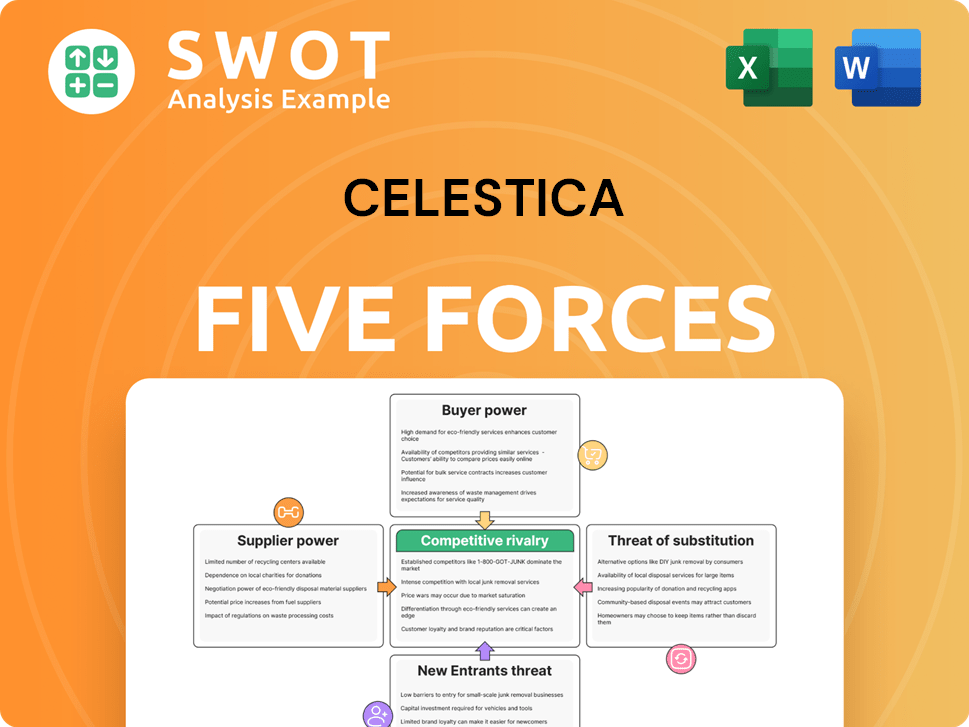

Celestica Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Celestica Company?

- What is Competitive Landscape of Celestica Company?

- How Does Celestica Company Work?

- What is Sales and Marketing Strategy of Celestica Company?

- What is Brief History of Celestica Company?

- Who Owns Celestica Company?

- What is Customer Demographics and Target Market of Celestica Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.