Celestica Bundle

Who Really Owns Celestica?

Ever wondered who pulls the strings at a global electronics manufacturing giant like Celestica? Understanding the Celestica SWOT Analysis is key, but knowing its ownership structure is the first step. From its IBM roots to its current standing, Celestica's ownership story is a fascinating journey of corporate evolution. This exploration dives deep into the Celestica company and its ownership.

The Celestica ownership landscape is a dynamic reflection of its strategic shifts and market positioning. Examining the Celestica shareholders, Celestica investors, and the influence of Celestica executives provides critical insights. By tracing the evolution of Who owns Celestica, we can better understand the company's past, present, and potential future, including details on Celestica stock ownership details and Celestica institutional ownership breakdown.

Who Founded Celestica?

The journey of understanding Celestica's growth strategy begins with its founders and early ownership structure. Initially conceived as a subsidiary, the company's evolution involved key shifts in ownership that shaped its trajectory. This chapter delves into the foundational ownership dynamics that set the stage for Celestica's growth.

Celestica, a prominent player in the electronics manufacturing services sector, was initially established as a wholly-owned subsidiary. This initial structure provided a foundation for what would become a globally recognized company. The early days were marked by internal growth and the development of operational strategies.

Eugene Polistuk, an IBM Canada employee and University of Toronto engineering graduate, played a pivotal role in the formation and early development of Celestica. His influence was crucial in establishing the company's operational independence and fostering its growth. The early focus was on building a strong foundation for future expansion.

Celestica was incorporated in January 1994 as a wholly-owned subsidiary of IBM Canada. This initial setup provided a stable base for operations.

Eugene Polistuk, an IBM Canada employee, was instrumental in the company's formation and early development. He was pivotal in setting the stage for its operational independence.

Celestica was given its own marketing staff and financial control, allowing for cost management, innovation, and employee motivation.

In 1996, Onex Corporation acquired Celestica from IBM for $550 million. This acquisition marked a significant shift towards independent ownership.

The acquisition by Onex also involved Celestica's management, solidifying the shift towards independent ownership and setting the stage for its global expansion.

The acquisition by Onex Corporation and management established the early ownership structure that would precede its public listing.

Understanding the evolution of Celestica ownership is key to grasping its corporate journey. The initial structure as an IBM subsidiary evolved significantly with the Onex acquisition. The company's early ownership structure was pivotal for its strategic direction and growth. Key aspects of the ownership structure include:

- Initial ownership was held by IBM as a wholly-owned subsidiary.

- The acquisition by Onex Corporation in 1996 for $550 million was a major ownership change.

- Management was also involved in the Onex acquisition, highlighting the shift towards independent ownership.

- The early ownership structure set the stage for Celestica's public listing.

- Specific equity splits for founders at inception aren't publicly detailed beyond the initial IBM subsidiary status.

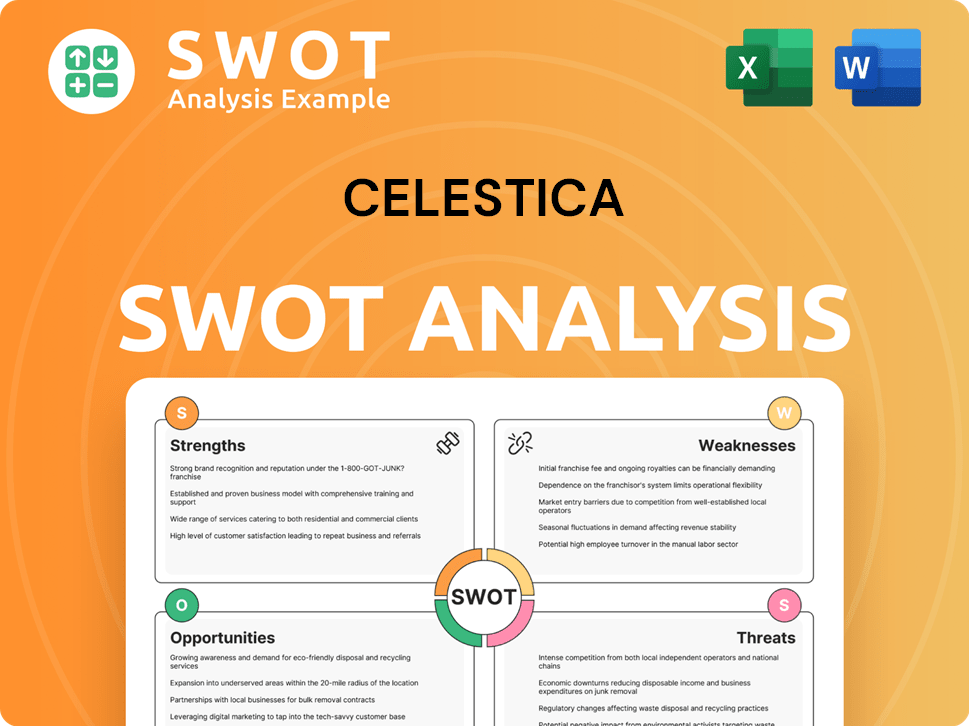

Celestica SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Celestica’s Ownership Changed Over Time?

The Celestica company has seen significant shifts in its ownership structure since its Initial Public Offering (IPO) on June 29, 1998. At the IPO, shares were initially priced at US$17.50 each, with the price adjusting to US$8.75 post-split. The company began with a dual-class share structure, where Onex Corporation held the multiple voting shares (MVS), giving them substantial control for over two decades.

A key development occurred in March 2023 when Onex Corporation announced plans to convert its MVS into subordinate voting shares (SVS) on a one-for-one basis. This conversion, expected to be completed within six months, aimed to simplify Celestica's voting structure. This change meant that Onex would no longer be the controlling shareholder, transforming the company into a widely held entity.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | June 29, 1998 | Public offering of shares; creation of dual-class share structure. |

| Onex Corporation Announces Share Conversion | March 2023 | Planned conversion of multiple voting shares to subordinate voting shares, reducing Onex's control. |

| Institutional Ownership as of May 2025 | May 2025 | Institutional ownership at 67.38%, indicating strong investor confidence. |

As of May 2025, institutional investors hold a significant portion of Celestica's shares, accounting for 67.38% of the total. Major institutional investors include FMR LLC, holding 8,978,515 shares as of March 31, 2025, Whale Rock Capital Management LLC with 6,866,214 shares as of March 31, 2025, and Vanguard Group Inc. holding 4,514,605 shares as of March 31, 2025. The top 25 shareholders collectively own 44% of the shares, which helps to reduce concentration risks. Celestica's financial performance in fiscal year 2024, with revenues of $9.65 billion and net earnings of $428.0 million, further influences its strategic direction and governance.

Celestica's ownership structure has evolved significantly since its IPO, with a shift from a controlling shareholder to a widely held model. The conversion of Onex's shares and the high level of institutional ownership highlight the company's transition.

- Institutional ownership stands at 67.38% as of May 2025.

- Onex Corporation planned to convert its multiple voting shares.

- Revenue reached $9.65 billion in fiscal year 2024.

- The Connectivity & Cloud Solutions (CCS) segment contributed 67% of total revenue.

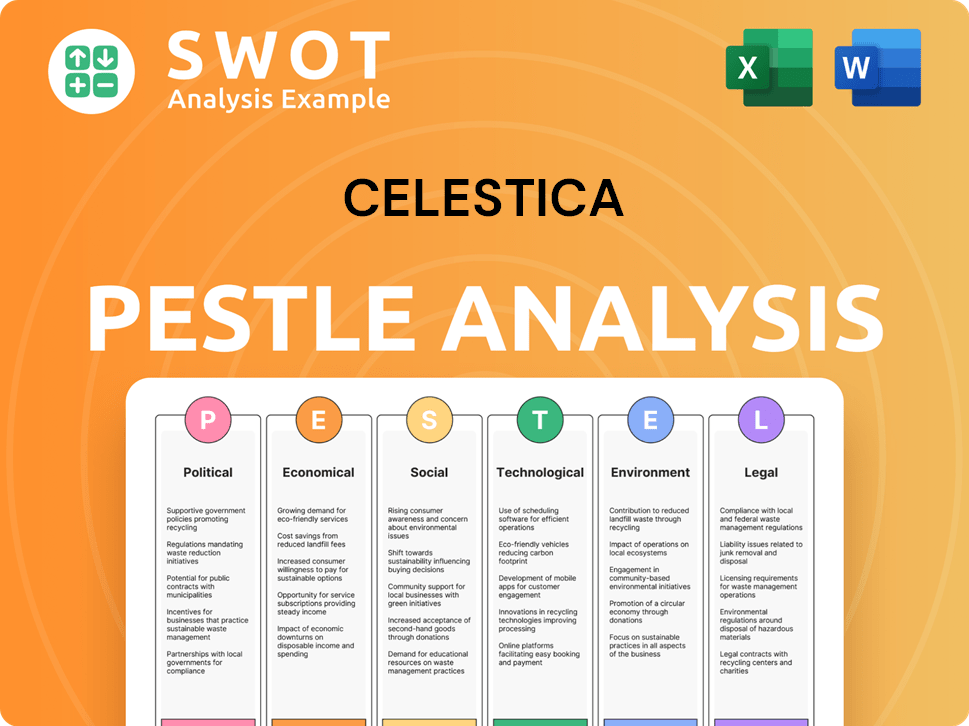

Celestica PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Celestica’s Board?

The board of directors at the Celestica company oversees the company's governance. Details about current board members and their representation of major shareholders are usually found in the company's annual proxy statements. The planned conversion of Onex Corporation's multiple voting shares (MVS) to subordinate voting shares (SVS) will significantly change the voting structure.

Historically, Celestica has had a dual-class share structure since its 1998 IPO. MVS, mainly held by Onex Corporation, had 25 votes per share, while SVS had one vote per share. This gave Onex significant control. However, the conversion of all MVS into SVS on a one-for-one basis will eliminate the dual-class structure. This change will make Celestica a widely-held company, spreading voting power among shareholders and implementing a one-share-one-vote system.

| Board Member | Title | Notes |

|---|---|---|

| Craig Muhlhauser | Chair of the Board | |

| Robert M. Brown | Director | |

| Anthony J. Munk | Director |

This simplified voting structure is a natural evolution, as stated by Bobby Le Blanc, president of Onex. The change means the protection from unsolicited takeover bids provided by the dual-class structure will no longer exist. This could make Celestica more susceptible to takeovers or tender offers. Shareholders will vote together as a single class, with each SVS carrying one vote. As of February 28, 2025, Celestica is transitioning to U.S. Generally Accepted Accounting Principles (GAAP) for its financial reporting, which should increase transparency for global investors. The company also focuses on shareholder engagement, seeking feedback on executive compensation, succession planning, and board composition. For more on the company's strategic direction, see the Growth Strategy of Celestica.

Celestica's ownership structure is evolving, moving from a dual-class to a single-class share system. This shift impacts voting power and potential for takeovers. Understanding the changes in Celestica ownership is crucial for investors.

- The conversion of shares will give more voting power to a broader shareholder base.

- The company is transitioning to GAAP for enhanced financial reporting.

- Shareholder engagement is a priority for the company.

- The change could make Celestica more vulnerable to takeovers.

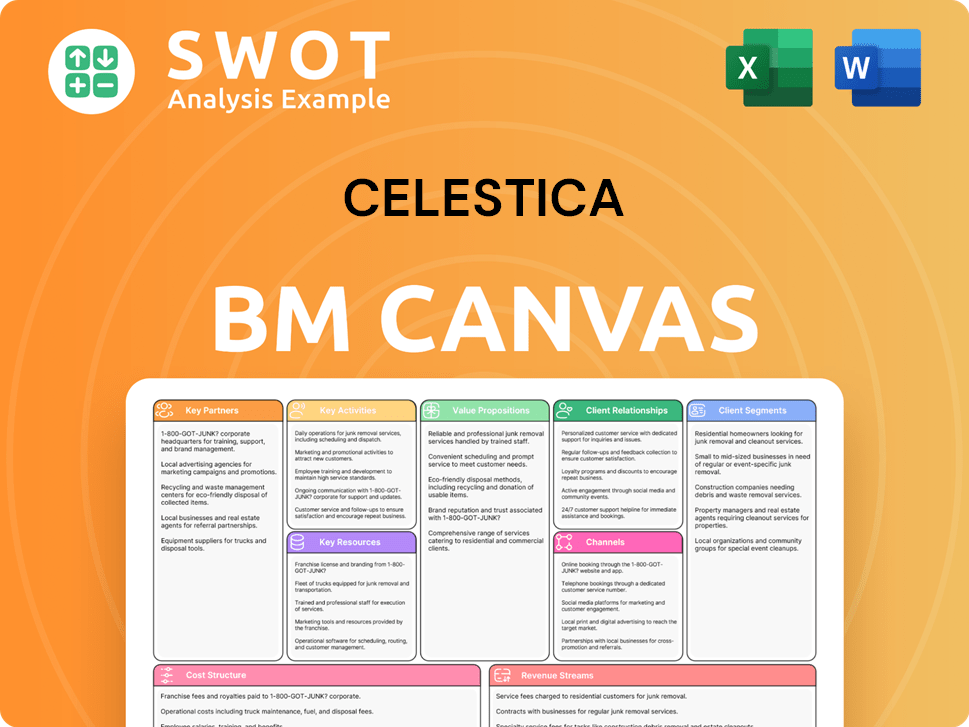

Celestica Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Celestica’s Ownership Landscape?

Over the past few years, recent developments have significantly reshaped the ownership landscape of the Celestica company. The fiscal year 2024 marked a high point, with a 21% year-over-year increase in revenue, reaching $9.65 billion, and a 58% increase in non-GAAP adjusted EPS. This positive trend continued into Q1 2025, with revenue at $2.65 billion, a 20% increase compared to Q1 2024, and adjusted EPS of $1.20. The company has also revised its full-year 2025 revenue outlook to $10.85 billion and anticipates non-GAAP adjusted EPS of $5.00.

A key change in Celestica ownership was the planned conversion of Onex Corporation's multiple voting shares to subordinate voting shares, eliminating the dual-class share structure. This transition, expected around September 2023, transformed Celestica into a widely-held company, removing Onex as the controlling shareholder. As of January 2024, Onex Corp reported owning zero shares, reflecting a complete shift in its stake. The company's strategic focus on AI, cloud computing, and advanced networking, along with partnerships like the one with Groq for AI and machine learning servers, positions it to capitalize on secular data center growth trends. For more insights into the company's strategic positioning, consider reading about the Target Market of Celestica.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Revenue (USD billions) | $2.21 | $2.65 |

| Adjusted EPS | $1.00 | $1.20 |

| Institutional Ownership (May 2025) | 67.38% | 67.38% |

Furthermore, Celestica has actively engaged in share buyback programs, demonstrating confidence in its financial health. In October 2024, the company announced a new Normal Course Issuer Bid (NCIB) to repurchase up to 8,609,693 common shares by October 31, 2025. In Q1 2025, 0.6 million common shares were repurchased for cancellation, totaling $75.0 million. Institutional ownership remains high, at 67.38% as of May 2025, while some analysts express caution regarding the sustainability of AI-driven demand.

Onex Corporation reduced its stake to zero, removing its controlling shareholder status.

Emphasis on AI, cloud computing, and advanced networking to capitalize on data center growth.

Ongoing share repurchase programs to optimize capital structure and signal confidence.

High institutional ownership, with major investors consistently increasing their stakes.

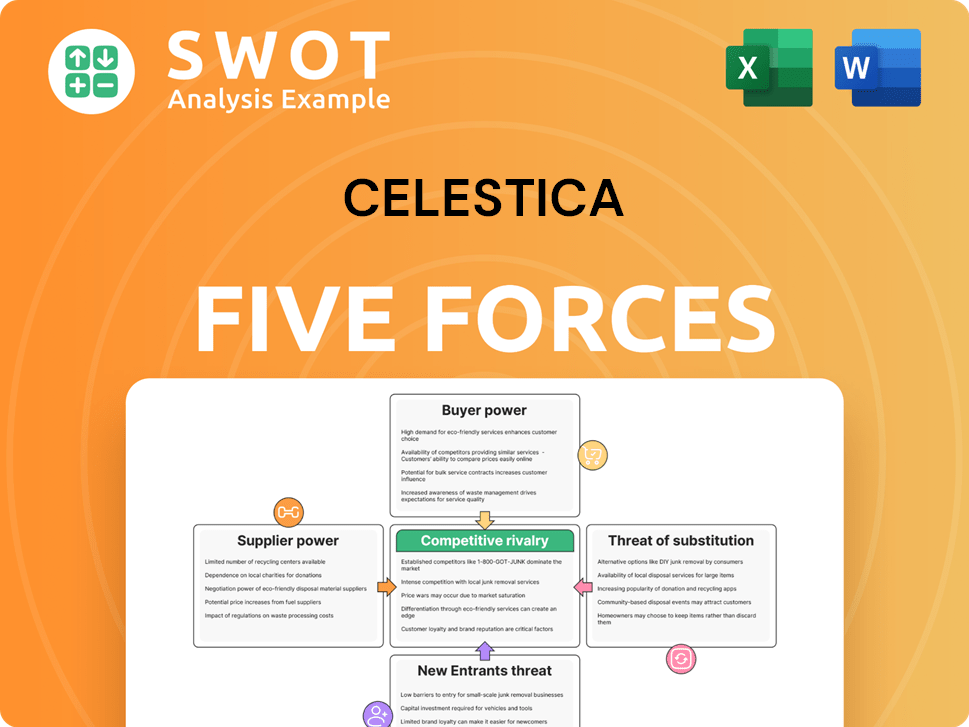

Celestica Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Celestica Company?

- What is Competitive Landscape of Celestica Company?

- What is Growth Strategy and Future Prospects of Celestica Company?

- How Does Celestica Company Work?

- What is Sales and Marketing Strategy of Celestica Company?

- What is Brief History of Celestica Company?

- What is Customer Demographics and Target Market of Celestica Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.