Celestica Bundle

How Does Celestica Thrive in the Tech World?

Celestica, a major player in electronics manufacturing services (EMS), is making waves with its impressive financial results. With a significant revenue of $2.55 billion in Q4 2024 and a 21% annual growth, the Celestica SWOT Analysis reveals the company's strengths. This growth highlights Celestica's critical role in supporting leading tech brands across multiple sectors.

This in-depth exploration will uncover the core of Celestica company operations, from its diverse services to its strategic positioning within the EMS provider landscape. We'll examine how Celestica's global footprint and focus on high-growth areas like AI contribute to its ongoing success. Understanding Celestica's manufacturing process and supply chain solutions is key to grasping its impact on the tech industry and its future outlook.

What Are the Key Operations Driving Celestica’s Success?

The Celestica company excels in providing end-to-end product lifecycle solutions. These solutions span from the initial design phase to full-scale production and after-market services. As an Electronics manufacturing services (EMS provider), Celestica focuses on high-reliability markets.

Celestica's core operations are multifaceted, encompassing advanced manufacturing, comprehensive supply chain solutions, after-market services, and joint design and engineering. They serve a diverse customer base across sectors such as aerospace and defense, industrial, healthtech, and communications. The company's emphasis on customer customization, quality assurance, and speed to market is central to its value proposition.

Celestica's global supply chain network is a key enabler, supported by strategic partnerships and distribution networks. This network allows for agile and adaptive solutions. For example, Celestica has partnered with World Wide Technology (WWT) to enhance supply chain solutions and services, leveraging their combined expertise in product lifecycle management, engineering, and logistics.

Celestica's advanced manufacturing solutions include printed circuit board assembly, system assembly, and testing services. These services ensure high-quality and reliable products for various industries. Their manufacturing processes are designed to meet stringent industry standards and customer-specific requirements.

Celestica offers comprehensive supply chain solutions, including procurement, logistics, and inventory management. Their supply chain solutions are designed to optimize efficiency and reduce costs. They leverage their global network and strategic partnerships to provide flexible and responsive supply chain services.

After-market services include repair, refurbishment, and lifecycle management. These services extend the lifespan of products and reduce environmental impact. Celestica's after-market services are crucial for maintaining product performance and customer satisfaction.

Celestica provides joint design and engineering services to support customers in product development. These services include design for manufacturability, prototyping, and testing. This collaborative approach helps customers bring innovative products to market quickly.

Celestica's ability to provide integrated hardware platform solutions (HPS) is a key differentiator. This capability helps customers balance performance, power efficiency, and space as technologies evolve. They focus on cutting-edge solutions, particularly in AI/machine learning and data center connectivity.

- Integrated hardware platform solutions for networking, storage, and computing.

- Focus on AI/ML and data center connectivity solutions.

- Global supply chain network with strategic partnerships.

- Commitment to customer customization and quality assurance.

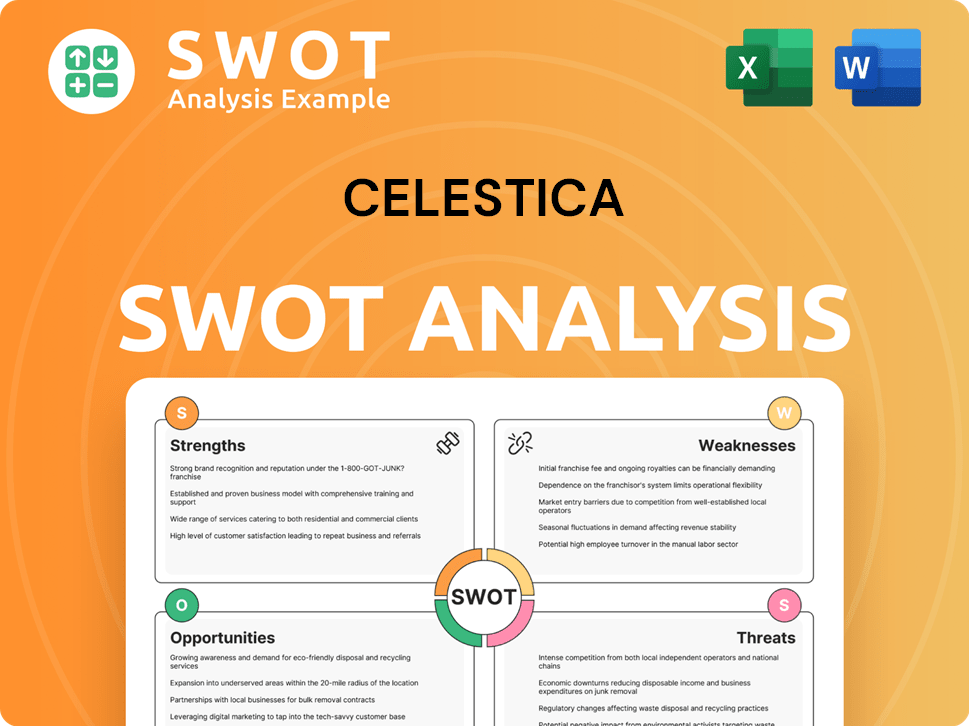

Celestica SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Celestica Make Money?

Celestica's revenue streams are primarily driven by its comprehensive electronics manufacturing services. As an EMS provider, the company offers design and manufacturing, supply chain solutions, and after-market services. This diversified approach allows Celestica to cater to a wide range of customer needs and market demands.

The company operates through two main segments: Advanced Technology Solutions (ATS) and Connectivity & Cloud Solutions (CCS). These segments reflect Celestica's focus on high-growth areas within the technology sector. This strategic alignment supports its revenue generation and market positioning.

Celestica's monetization strategies leverage its expertise in advanced manufacturing and strategic collaborations. The company focuses on providing value-added services throughout the product lifecycle. This approach enhances customer relationships and drives sustainable revenue growth.

In 2024, Celestica reported total revenue of $9.646 billion, marking a 21% increase from the previous year. The fourth quarter of 2024 saw revenue reach $2.55 billion, a 19% year-over-year increase. The first quarter of 2025 showed continued growth, with revenue reaching $2.65 billion, a 20% increase from Q1 2024. This growth is fueled by strong demand in key segments.

- The CCS segment was a significant driver, with its revenue increasing 30% in Q4 2024 and 28% in Q1 2025.

- The ATS segment remained relatively stable in Q4 2024 but showed growth in Q1 2025.

- Hardware Platform Solutions revenue increased significantly, growing 99% to approximately $1 billion in Q1 2025.

- Geographically, approximately 70% of Celestica's revenue in 2024 was generated in Asia.

- The Communications sub-segment within CCS showed an impressive 87% year-over-year growth in Q1 2025, reflecting strong demand for data center hardware.

For more insights into the competitive landscape, consider exploring the Competitors Landscape of Celestica.

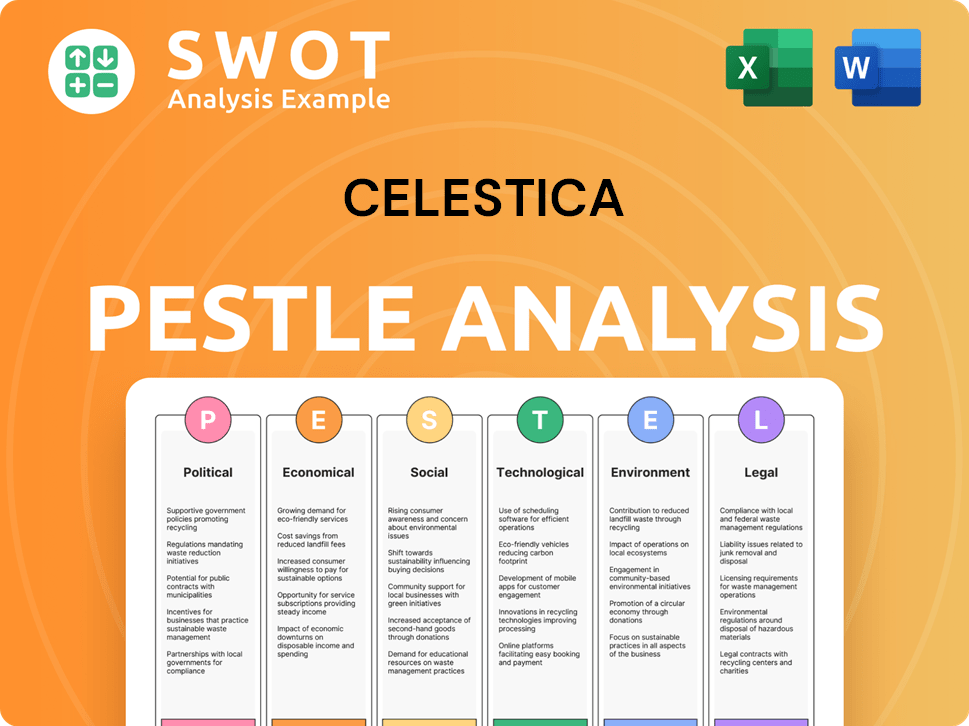

Celestica PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Celestica’s Business Model?

Celestica, a prominent player in the electronics manufacturing services (EMS) sector, has consistently demonstrated its ability to adapt and thrive. Recent milestones and strategic moves highlight the company's focus on innovation and expansion. The company's performance in 2024 reflects this, with significant revenue and earnings growth. This positions Celestica as a key player in the rapidly evolving tech landscape.

The company's strategic initiatives, including partnerships and facility expansions, are designed to capitalize on emerging opportunities in high-growth areas like AI/ML and data center solutions. These moves underscore Celestica's commitment to staying ahead of market trends and meeting the evolving needs of its customers. Celestica's focus is on providing comprehensive supply chain solutions.

Celestica's competitive edge is built on a foundation of comprehensive services, global reach, and technological innovation. Its ability to offer end-to-end solutions, coupled with a strong global presence, allows it to serve a diverse customer base effectively. Furthermore, Celestica's investments in advanced technologies and strategic partnerships are enhancing its margins and driving long-term growth. For more insights into Celestica's strategic direction, see the Growth Strategy of Celestica.

Celestica secured two 1.6 Terabyte (1.6T) data center switch programs with hyperscaler customers by the end of 2024, and a third 1.6T program win in early 2025. In 2024, the company's revenue grew by 21%, with non-GAAP adjusted EPS increasing by 58% year-over-year. The transition to U.S. GAAP reporting in Q4 2024 enhanced transparency.

Celestica invested in capacity expansion at facilities in Thailand, Malaysia, and Richardson, U.S., to support growth in AI/ML and Hardware Platform Solutions (HPS) programs. A key strategic move was the partnership with Groq, Inc. to manufacture AI server racks, with initial programs expected to ramp in early 2025. These moves underscore Celestica's commitment to staying ahead of market trends.

Celestica offers end-to-end product lifecycle solutions, positioning it as a one-stop shop for electronics manufacturing services. Its global presence spans over 10 countries with more than 20 facilities, enabling worldwide service. The launch of the 800GbE switch (DS5000) in 2023, optimized for AI/ML and data center connectivity, demonstrates its commitment to innovation.

In 2024, Celestica achieved a 21% increase in revenue. The non-GAAP adjusted EPS saw a significant rise of 58% year-over-year. These financial results highlight Celestica's strong performance and ability to drive growth in the competitive EMS market. Celestica's financial performance is a testament to its strategic initiatives.

Celestica's comprehensive service offerings, global reach, and technological innovation provide a significant competitive edge. Its focus on high-performance networking solutions and strategic partnerships are enhancing margins. The company's commitment to innovation is evident in its continuous investment in advanced technologies.

- End-to-end product lifecycle solutions.

- Extensive global presence.

- Continuous investment in advanced technologies.

- Strategic partnerships.

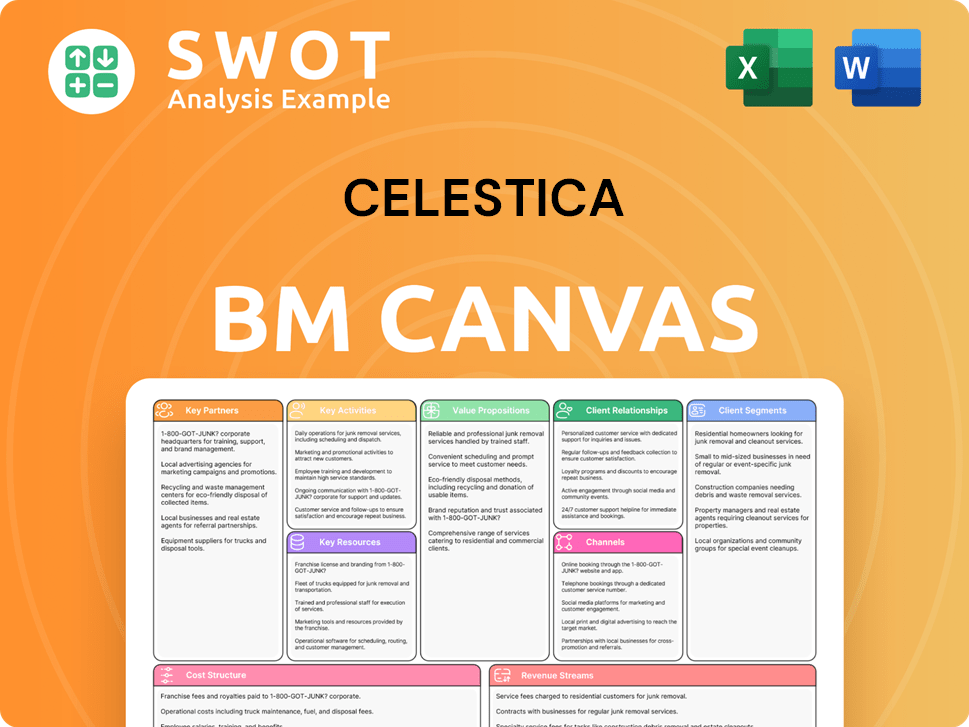

Celestica Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Celestica Positioning Itself for Continued Success?

Celestica, a prominent player in the electronics manufacturing services (EMS) industry, holds a strong position in the global market. It competes with major EMS providers like Foxconn and Flex. The company's focus on high-growth areas such as AI, cloud computing, and advanced networking is a key factor in its market strength. As of May 2025, institutional ownership stood at 67.38%, indicating significant investor confidence in Celestica's operations.

Despite its strong market position, Celestica faces risks, including customer and segment concentration. Operational challenges, such as inventory management and supply chain constraints, can also impact its performance. Moreover, geopolitical events and currency fluctuations can affect operations and financial results. For instance, currency fluctuations impacted revenue by approximately $10 million in Q4 2024.

Celestica is a leading EMS provider, competing with major players in the global market. Its focus on high-growth areas like AI and cloud computing strengthens its position. The company's strong institutional ownership reflects investor confidence.

Customer and segment concentration pose risks to Celestica. Operational challenges, including supply chain issues and currency fluctuations, can also impact performance. Geopolitical events and trade policy changes add further uncertainty.

Celestica's future outlook is positive, driven by demand in its Connectivity & Cloud Solutions (CCS) segment. The company anticipates a 12% year-over-year revenue growth in 2025. Strategic initiatives include diversifying its customer base and achieving a $350 million free cash flow target.

Celestica has raised its full-year 2025 revenue outlook to $10.85 billion. The company projects non-GAAP adjusted EPS of $5.00 for 2025. These targets reflect Celestica's growth and focus on profitability.

Celestica is actively exploring opportunities to diversify its customer base and expand its market presence. This includes targeting digital native companies and sovereign governments. The company's commitment to innovation and operational excellence supports its long-term goals.

- Exploring opportunities with digital native companies.

- Targeting specialized AI cloud providers.

- Focusing on sovereign governments.

- Aiming for a $350 million free cash flow target for 2025.

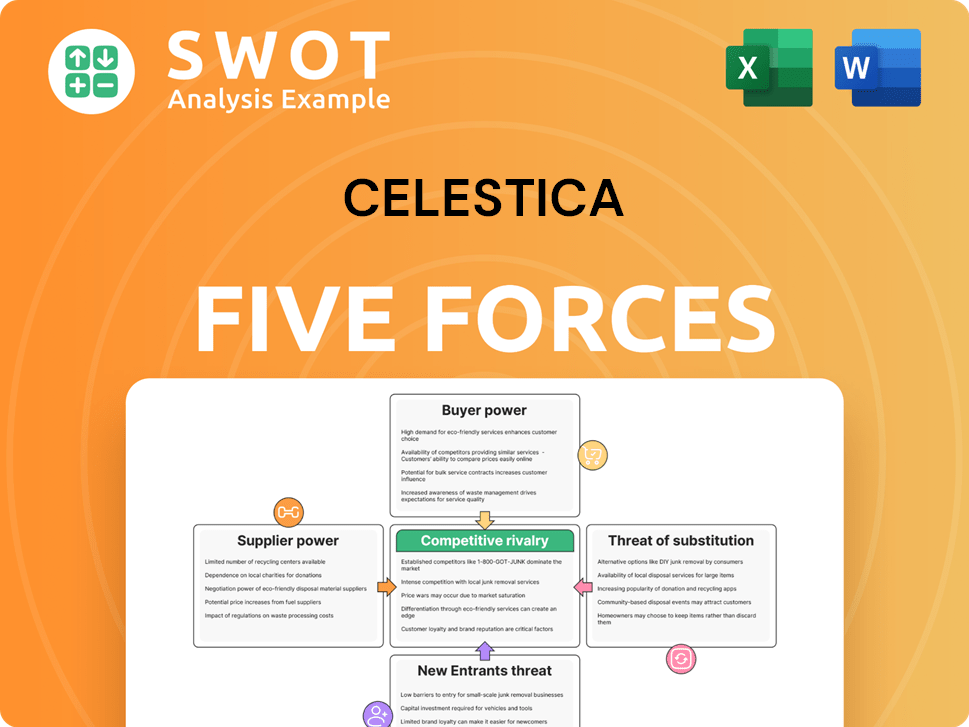

Celestica Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Celestica Company?

- What is Competitive Landscape of Celestica Company?

- What is Growth Strategy and Future Prospects of Celestica Company?

- What is Sales and Marketing Strategy of Celestica Company?

- What is Brief History of Celestica Company?

- Who Owns Celestica Company?

- What is Customer Demographics and Target Market of Celestica Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.