Celestica Bundle

How Does Celestica Stack Up in the Electronics Manufacturing Arena?

Celestica, a leading electronics manufacturing services (EMS) provider, has carved a significant niche in an industry constantly reshaped by innovation. Born from IBM's manufacturing roots, Celestica now offers comprehensive design, manufacturing, and supply chain solutions. Its strategic shift towards high-growth areas like AI/ML compute has fueled impressive recent financial performance, making understanding its competitive position crucial.

To truly understand Celestica's position, we must delve into its Celestica SWOT Analysis and the broader Celestica competitive landscape. This analysis will explore Celestica's key competitors, assess its market share, and examine its business strategy. We'll also explore the company's financial performance, recent acquisitions, and future outlook within the dynamic Celestica industry, providing valuable insights for investors and industry watchers alike.

Where Does Celestica’ Stand in the Current Market?

Celestica is a key player in the electronics manufacturing services (EMS) sector, providing comprehensive, end-to-end product lifecycle solutions. The company's core operations encompass design, manufacturing, hardware platform solutions (HPS), and supply chain management. This allows Celestica to serve a diverse customer base across various industries, including aerospace and defense, healthcare, industrial, communications, and capital equipment.

Celestica's value proposition centers on its ability to offer integrated solutions, supporting its clients from initial design through to manufacturing and supply chain management. This comprehensive approach helps original equipment manufacturers (OEMs), cloud service providers, and business enterprises streamline their operations, reduce costs, and improve time-to-market. As highlighted in a Brief History of Celestica, the company has consistently adapted to industry changes, reinforcing its market position.

As of Q1 2025, Celestica held a market share of 2.93% within the technology sector for the trailing 12 months ending Q1 2025. Although smaller compared to industry leaders, this share reflects Celestica's focused strategy and strong presence in its target markets. This position allows Celestica to compete effectively in specific segments of the electronics manufacturing services industry.

Celestica maintains a significant global presence, with 44 operating sites across 16 countries. The company's operations span North America, Europe, and Asia. Approximately 70% of Celestica's revenue in 2024 was generated in Asia, highlighting the importance of its presence in this region for its overall business strategy.

Celestica is strategically shifting towards higher-growth and higher-margin end markets, particularly data centers supporting AI. This is evident in the significant growth of its Connectivity & Cloud Solutions (CCS) segment. The Hardware Platform Solutions (HPS) revenue within CCS approximately doubled in Q1 2025 compared to Q1 2024, reaching about $1 billion. This strategic shift is a key element of Celestica's growth strategy.

Celestica's financial health is robust, with a trailing 12-month revenue of $10.1 billion as of March 31, 2025. The company's adjusted operating margin in Q1 2025 was 7.1%, compared to 5.9% in Q1 2024, reflecting improved profitability. As of June 3, 2025, Celestica had a market capitalization of $14 billion, indicating strong investor confidence.

The Celestica competitive landscape includes major players in the electronics manufacturing services (EMS) industry. Key Celestica competitors include Foxconn, which holds a dominant market share, as well as other companies that offer similar services. Analyzing the Celestica market analysis reveals a focus on specific segments, allowing it to compete effectively.

- Celestica's market share, while smaller than industry giants, demonstrates a strong presence in its target segments.

- The company's strategic shift towards higher-growth markets, such as data centers supporting AI, is a key driver of its future growth.

- Celestica's financial performance, including revenue and operating margins, indicates a healthy and improving financial position.

- The company's global presence and diverse customer base across various industries contribute to its competitive advantages.

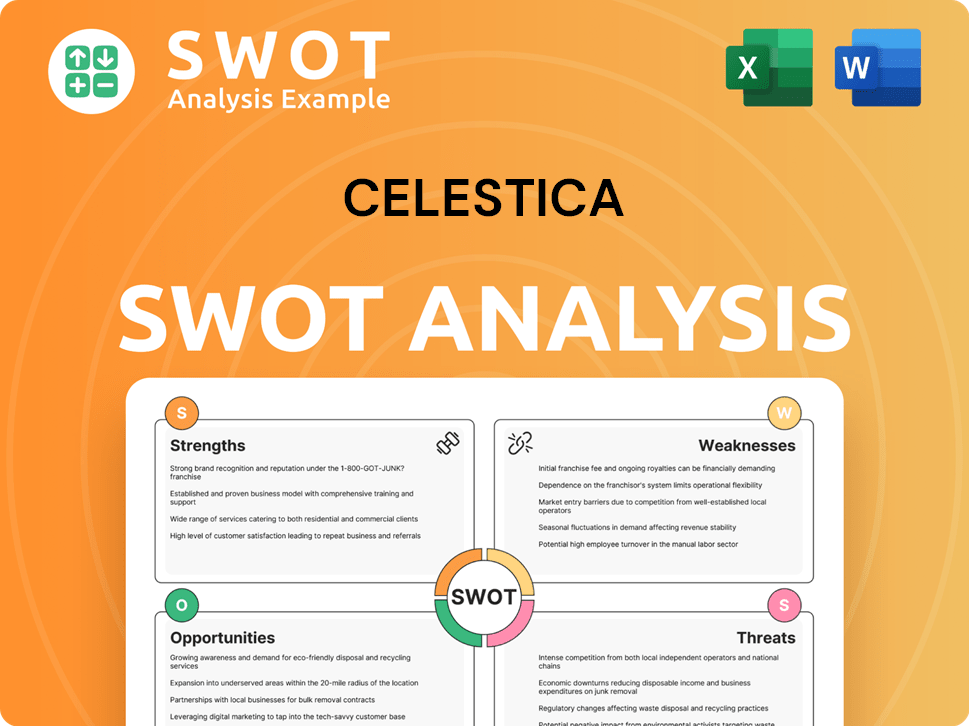

Celestica SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Celestica?

The Revenue Streams & Business Model of Celestica are significantly influenced by the competitive dynamics within the electronics manufacturing services (EMS) industry. Understanding the Celestica competitive landscape is crucial for assessing its financial performance and strategic positioning. This involves a detailed Celestica market analysis to identify key players and their respective strengths.

Celestica's ability to compete effectively depends on factors such as pricing, quality, geographical reach, and the scope of services offered. The company's business strategy must continually adapt to the evolving demands of the market. This dynamic environment requires constant innovation and a proactive approach to address Celestica supply chain challenges.

Celestica operates in a highly competitive electronics manufacturing services (EMS) industry, facing significant direct and indirect competition. Its most prominent direct competitors include Foxconn Technology Group (Hon Hai Precision Industry Co., Ltd.), Flex Ltd., Jabil Inc., and Sanmina Corporation. These companies compete across various factors such as price, quality, geographical reach, and breadth of services.

Foxconn is a dominant force in the EMS sector, holding a substantial market share. As of Q1 2025, Foxconn's market share was approximately 72.00%. The company offers a wide array of manufacturing services, making it a major challenger to Celestica.

Flex Ltd. is a significant player in the EMS industry. It provides comprehensive design, manufacturing, and supply chain solutions across diverse industries. Flex competes directly with Celestica in offering end-to-end services.

Jabil Inc. is another key competitor, known for its innovative solutions. Jabil focuses on sectors like healthcare, automotive, and consumer electronics, with an emphasis on sustainability. This focus allows Jabil to compete effectively with Celestica.

Sanmina Corporation focuses on the communications, defense, and aerospace industries. Sanmina's specialized focus allows it to compete effectively in these niche markets, presenting a challenge to Celestica's diversification efforts.

Plexus Corp. provides design and manufacturing solutions, particularly in healthcare, aerospace, and defense. Plexus competes with Celestica in these specialized sectors, offering similar services.

Beyond direct EMS providers, Celestica faces competition from companies in the broader 'electronic equipment' industry. These include NXP Semiconductors, L3Harris Technologies, Vertiv, Nokia Oyj, Telefonaktiebolaget LM Ericsson, Ubiquiti, STMicroelectronics, ASE Technology, Hubbell, and GlobalFoundries. These companies compete for various aspects of the electronics supply chain, indirectly impacting Celestica.

The competitive landscape is constantly evolving due to technological advancements and market shifts. Celestica's ability to secure new programs, such as those for AI-optimized systems and 1.6 Terabyte switches in the hyperscaler market, indicates a fierce contest for high-growth opportunities. New and emerging players, particularly those focused on specialized AI hardware and digital native companies, are also disrupting the traditional landscape, requiring Celestica to continuously innovate and diversify its customer base.

- Celestica's growth strategies must include adapting to new technologies and market trends.

- Celestica should focus on customer base analysis to understand and meet the evolving needs of clients.

- Celestica needs to consider recent acquisitions and mergers within the industry to stay competitive.

- The Celestica future outlook depends on its ability to navigate these challenges and capitalize on emerging opportunities.

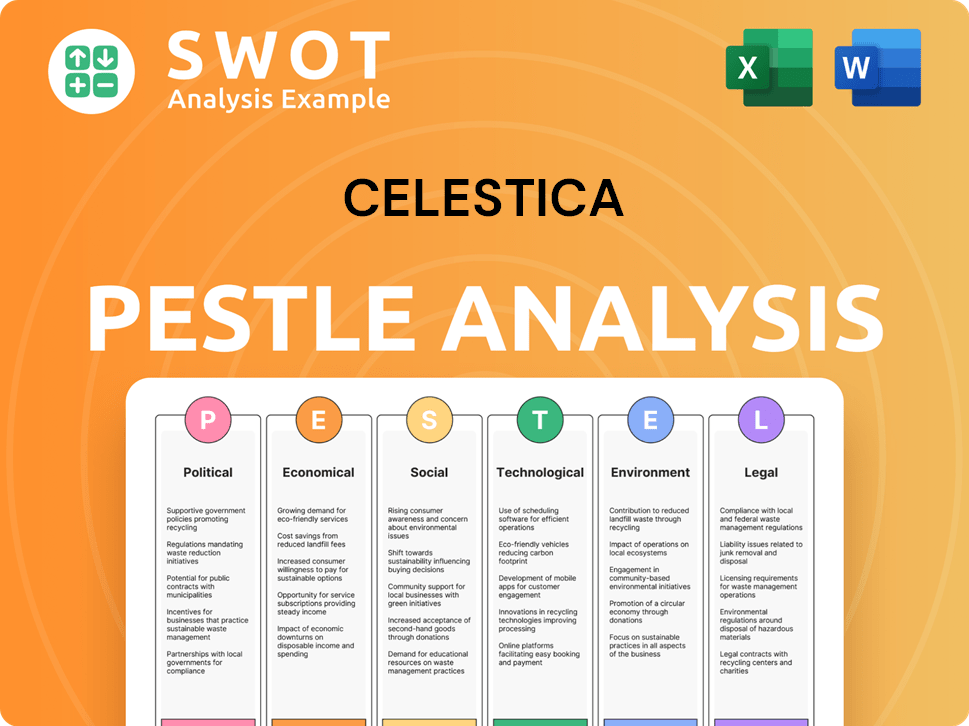

Celestica PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Celestica a Competitive Edge Over Its Rivals?

Understanding the Celestica competitive landscape involves recognizing its core strengths. The company distinguishes itself through comprehensive end-to-end product lifecycle solutions, a global presence, deep technological expertise, and robust supply chain management. This integrated approach allows Celestica to serve a diverse customer base across various high-reliability industries.

Celestica's operational efficiency is a key factor in its financial performance. With operations spanning North America, Europe, and Asia, the company can provide localized support and adapt quickly to market changes. Its strategic partnerships with over 500 suppliers across multiple regions ensure robust supply chain capabilities, which is critical in today's dynamic market.

The company's focus on higher-growth, higher-margin markets, particularly data centers supporting AI, reinforces its competitive edge. Investments in advanced technologies, such as AI/ML servers and advanced liquid cooling systems, have led to new program wins. Celestica's commitment to quality, enhanced by advanced statistical engineering techniques, further strengthens its position in the Celestica industry.

Celestica offers comprehensive services, including design, manufacturing, and supply chain management. This integrated approach simplifies the process for customers. It allows Celestica to serve various industries, including healthcare and aerospace.

With a presence in North America, Europe, and Asia, Celestica provides localized support. This global network is supported by strategic supplier relationships. It allows for quick adaptation to market changes.

Celestica invests in cutting-edge technologies like AI/ML servers and advanced cooling systems. These investments drive new program wins. The company's focus is on higher-growth markets, such as data centers.

Celestica has a robust supply chain with over 500 suppliers. This ensures flexibility and reliability. The company's supply chain management is a key competitive advantage.

Celestica's competitive advantages are crucial for its success in the electronics manufacturing services sector. The company's ability to offer comprehensive solutions, coupled with its global reach and technological prowess, positions it well to capitalize on market opportunities. Understanding the Celestica market analysis reveals that these strengths are essential for maintaining and expanding its market share. For more insights into the company's strategic direction, consider exploring the Target Market of Celestica.

Celestica's competitive advantages include end-to-end solutions, a global presence, and technological expertise. These factors contribute to the company's success. The company's strong supply chain management is also a key differentiator.

- Comprehensive Solutions: Offers a wide range of services from design to manufacturing.

- Global Presence: Operations in North America, Europe, and Asia.

- Technology Expertise: Investments in AI/ML servers and advanced cooling systems.

- Supply Chain Management: Robust network with over 500 suppliers.

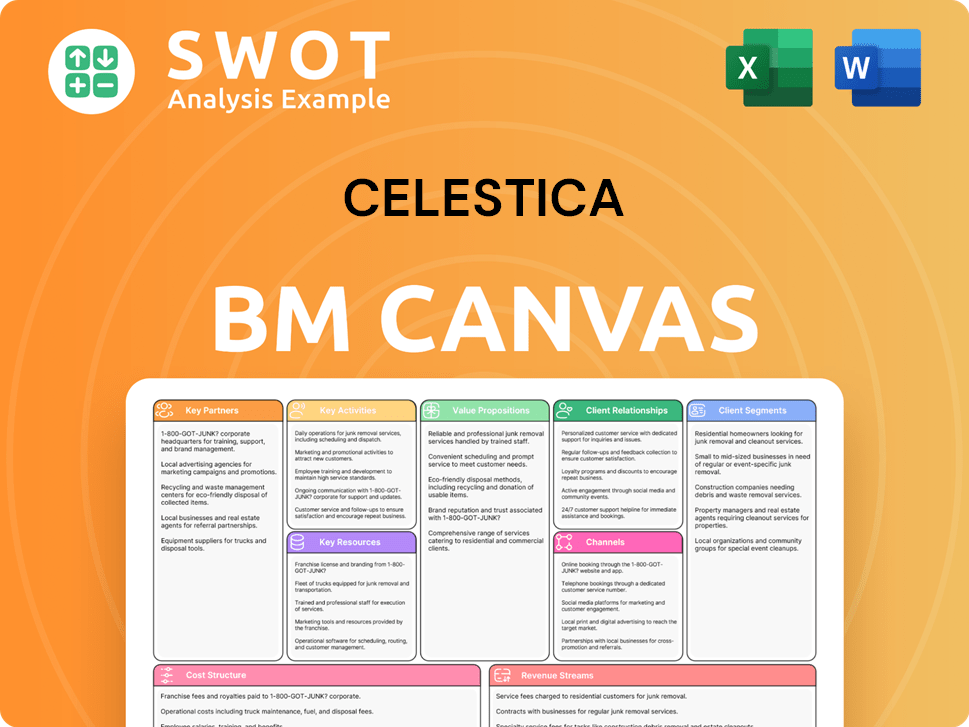

Celestica Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Celestica’s Competitive Landscape?

The electronics manufacturing services (EMS) sector is experiencing significant shifts, primarily driven by advancements in artificial intelligence (AI), the growing demand for high-performance computing, and the evolution of cloud infrastructure. These trends shape the Growth Strategy of Celestica, presenting both opportunities and challenges. A key aspect is the increasing demand from hyperscalers for data center hardware, especially for AI applications, which is a major growth driver.

Celestica's competitive landscape is influenced by its customer base and the broader economic climate. Customer concentration risk remains a factor, with a significant portion of revenue coming from a few major clients. Global economic uncertainties and supply chain vulnerabilities add to the complexity of the industry. Despite these challenges, the company is positioning itself to capitalize on emerging technologies and expand its service offerings.

The EMS industry is currently influenced by AI, high-performance computing, and cloud infrastructure. Hyperscaler demand for data center hardware, particularly for AI, is a major growth driver. Sustainable manufacturing and green technology solutions are also gaining importance.

Intense competition from major players like Foxconn, Flex, and Jabil poses a challenge. Customer concentration risk, with a significant portion of revenue from top clients, is a concern. Global economic uncertainties and supply chain vulnerabilities also create ongoing threats.

Expanding service offerings in emerging technologies presents growth opportunities. Strategic acquisitions can enhance competitive positioning. Increased demand for sustainable manufacturing and green technology solutions offers a growth avenue.

Celestica's revised 2025 revenue target is $10.85 billion. The anticipated non-GAAP adjusted EPS is $5.00. The company focuses on high-growth, high-margin markets and leverages strong operational execution.

Celestica's strategy includes expanding services in emerging technologies and pursuing strategic acquisitions. The company is investing in engineering and supply chain solutions to meet evolving customer needs. The market analysis reveals a focus on high-growth markets and leveraging operational strengths.

- The top 10 customers accounted for 73% of total revenue in 2024, highlighting customer concentration risk.

- Celestica is exploring opportunities with digital native companies to diversify its customer base.

- Production of AI-optimized full racks and 1.6 Terabyte switches is expected to ramp up in 2026.

- Strategic partnerships, such as with Groq for AI server rack manufacturing, are key.

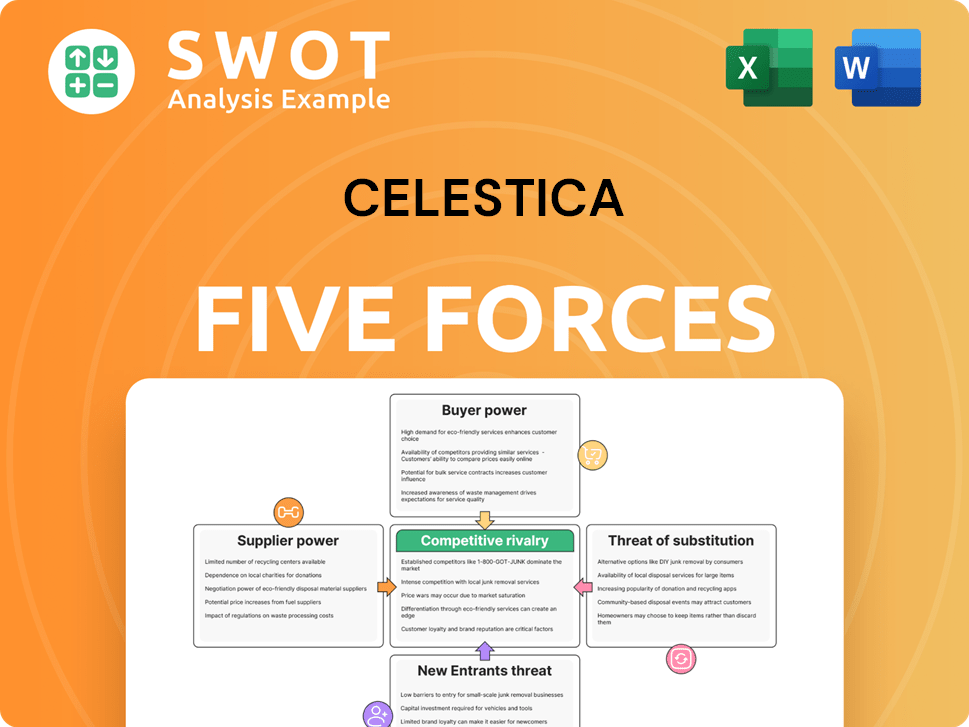

Celestica Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Celestica Company?

- What is Growth Strategy and Future Prospects of Celestica Company?

- How Does Celestica Company Work?

- What is Sales and Marketing Strategy of Celestica Company?

- What is Brief History of Celestica Company?

- Who Owns Celestica Company?

- What is Customer Demographics and Target Market of Celestica Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.