CleanSpark Bundle

How Did CleanSpark Go From Energy Solutions to Bitcoin Mining Powerhouse?

CleanSpark, a company synonymous with innovation in the Bitcoin mining and energy sectors, has an intriguing past. Founded with a vision to revolutionize energy management, it quickly adapted to the evolving landscape of digital assets. Its journey offers a compelling narrative of strategic pivots and technological advancements.

CleanSpark's CleanSpark SWOT Analysis reveals a company that has strategically navigated the complexities of both renewable energy and the cryptocurrency market. From its early projects focused on modular energy solutions, CleanSpark has demonstrated remarkable growth, transforming into a key player in Bitcoin mining. This brief history of CleanSpark Bitcoin mining will delve into the key milestones that have shaped its trajectory, examining its current operations and future plans within the dynamic world of Bitcoin mining and renewable energy.

What is the CleanSpark Founding Story?

The story of CleanSpark, a company now synonymous with Bitcoin mining and renewable energy, began on December 16, 2014. This marked the official CleanSpark's founding date, initiated by Matthew A. Schultz, who became the first CEO, and Bryan K. Ezell. Their combined expertise in technology and business formed the foundation upon which the company would grow.

The initial vision for CleanSpark was driven by the need for more efficient and resilient energy infrastructure. The founders recognized the growing demand for energy and concerns about grid stability. They aimed to create energy systems that were modular, sustainable, and capable of operating independently or collaboratively, setting the stage for CleanSpark's early projects.

CleanSpark started with a focus on microgrid solutions. They offered products and services designed to optimize energy usage and ensure power reliability. Their initial offering included software and hardware solutions for energy management, focusing on distributed energy resources.

- CleanSpark aimed to simplify complex energy systems for a broader market.

- Initial funding came from seed rounds and private placements.

- The founders' expertise in software, hardware, and energy markets was key.

- The cultural context of renewable energy and energy independence influenced the company.

The company's early strategy centered on providing microgrid solutions. The first product was a suite of software and hardware solutions focused on distributed energy resources. A key aspect of their early approach was the emphasis on creating 'plug-and-play' energy solutions. Initial funding came from seed rounds and private placements. The founding team's expertise in software and hardware development, combined with their understanding of energy markets, was crucial. The increasing awareness of renewable energy and energy independence also influenced the company's creation. For more insights, see the Competitors Landscape of CleanSpark.

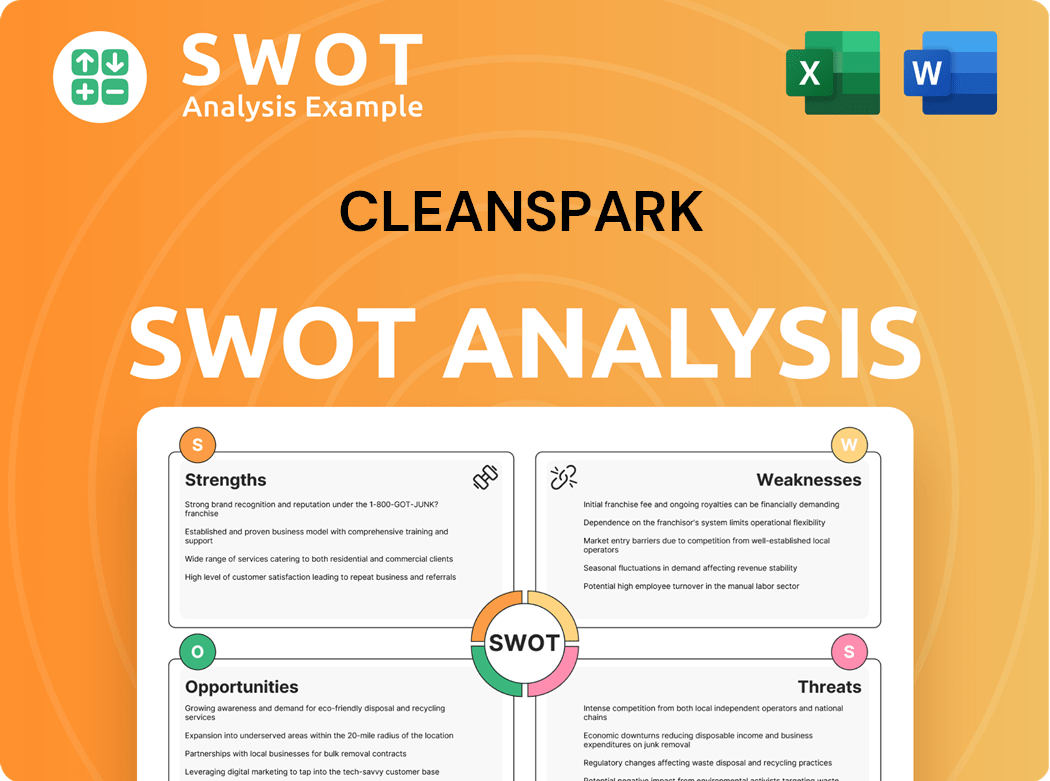

CleanSpark SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of CleanSpark?

The early growth and expansion of CleanSpark, a CleanSpark company, marked a significant transition from its initial focus on modular energy solutions to a strategic pivot towards Bitcoin mining. This shift was driven by the recognition of the potential within the cryptocurrency sector and the application of its energy management expertise. This chapter explores the key milestones and strategies that defined this crucial phase in CleanSpark's history.

Initially, CleanSpark concentrated on developing its mPulse software, designed for microgrid control and energy optimization. Early projects included integrated energy solutions for commercial and industrial clients. The goal was to provide energy resilience and cost savings. The early team expansion focused on engineering and sales personnel to support the development and deployment of these early offerings.

Around 2020, CleanSpark entered the Bitcoin mining sector. This strategic shift was driven by the recognition of Bitcoin mining's significant energy consumption and the opportunity to apply CleanSpark's energy management expertise to improve efficiency and sustainability. The company started acquiring Bitcoin mining infrastructure and rapidly scaled its operations.

Major capital raises, including public offerings and private placements, fueled this expansion into Bitcoin mining. In December 2023, CleanSpark announced its intent to acquire four new Bitcoin mining facilities for $18.3 million, adding 3.8 EH/s to its operations. This expansion included securing new locations in Georgia and other states, diversifying its geographical footprint.

The market reception to this strategic shift was largely positive, as investors recognized the potential for CleanSpark to become a leading, energy-efficient Bitcoin miner. This period saw significant growth in its mining hash rate and Bitcoin production, demonstrating the effectiveness of its strategic pivot and aggressive expansion efforts. As of March 2024, the company's self-mining capacity reached 17.0 EH/s, highlighting its rapid scaling.

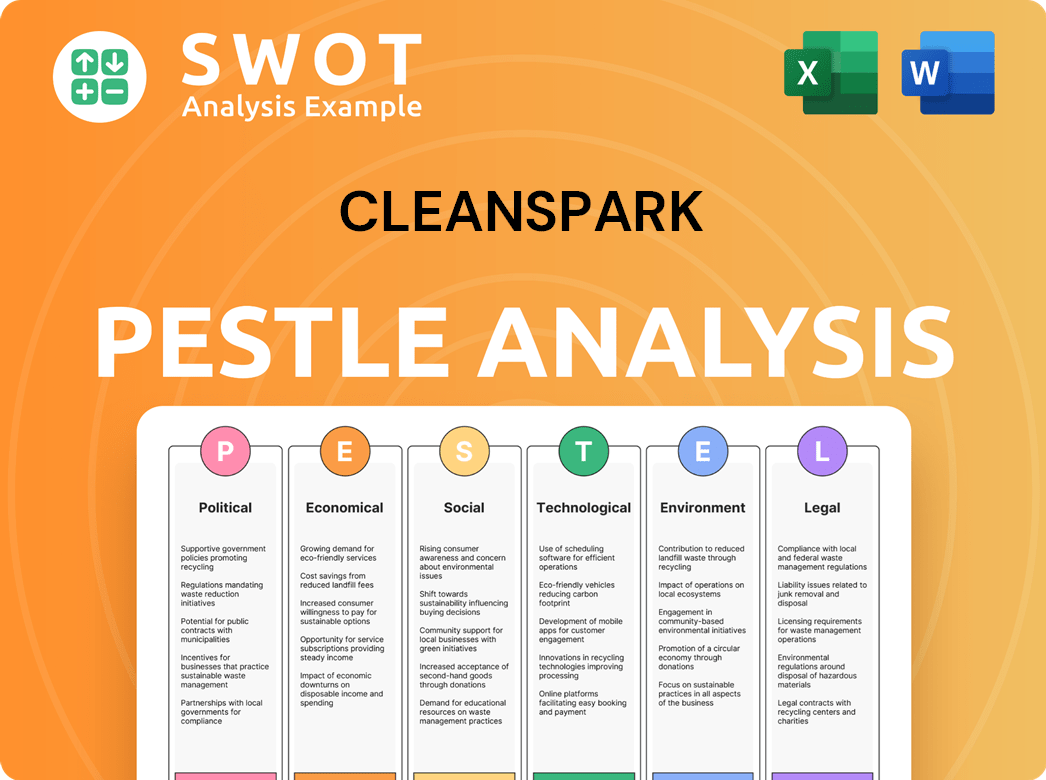

CleanSpark PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in CleanSpark history?

The CleanSpark company's journey has been marked by significant achievements, strategic pivots, and consistent growth in the competitive landscape of Bitcoin mining. From its early projects to its current operations, CleanSpark's history reflects a commitment to innovation and sustainable practices within the cryptocurrency sector. The company has consistently expanded its mining capacity, reaching a self-mining hash rate of 17.0 EH/s as of March 2024, demonstrating rapid development milestones.

| Year | Milestone |

|---|---|

| 2023 | Announced intent to acquire four new Bitcoin mining facilities for $18.3 million, adding 3.8 EH/s to its operations. |

| 2024 | Reached a self-mining hash rate of 17.0 EH/s as of March. |

| 2024 (Mid-Year) | Projected self-mining capacity to exceed 20 EH/s. |

One of CleanSpark's groundbreaking innovations is the integration of its energy management software with Bitcoin mining operations. This allows for greater efficiency and demand response capabilities, positioning the company as a leader in sustainable Bitcoin mining. The company's focus on owning and operating its facilities allows for greater control over energy costs and operational efficiency.

CleanSpark has integrated its energy management software with Bitcoin mining, enhancing efficiency and demand response.

The company is positioned as a leader in sustainable Bitcoin mining, a crucial differentiator in an energy-intensive industry.

CleanSpark has strategically acquired new mining facilities to expand its operational capacity.

CleanSpark has faced challenges inherent in the volatile cryptocurrency market, including fluctuating energy prices and the need for continuous technological upgrades. Product-market fit struggles were evident during its initial phase as an energy solutions provider, leading to the pivotal decision to pivot towards Bitcoin mining. Competitive pressure from other large-scale Bitcoin miners is an ongoing challenge.

CleanSpark faces risks associated with Bitcoin price fluctuations, impacting profitability.

Navigating fluctuating energy prices is a significant challenge for CleanSpark.

Competition from other large-scale Bitcoin miners presents an ongoing challenge.

The need for continuous technological upgrades to maintain efficiency is an ongoing challenge.

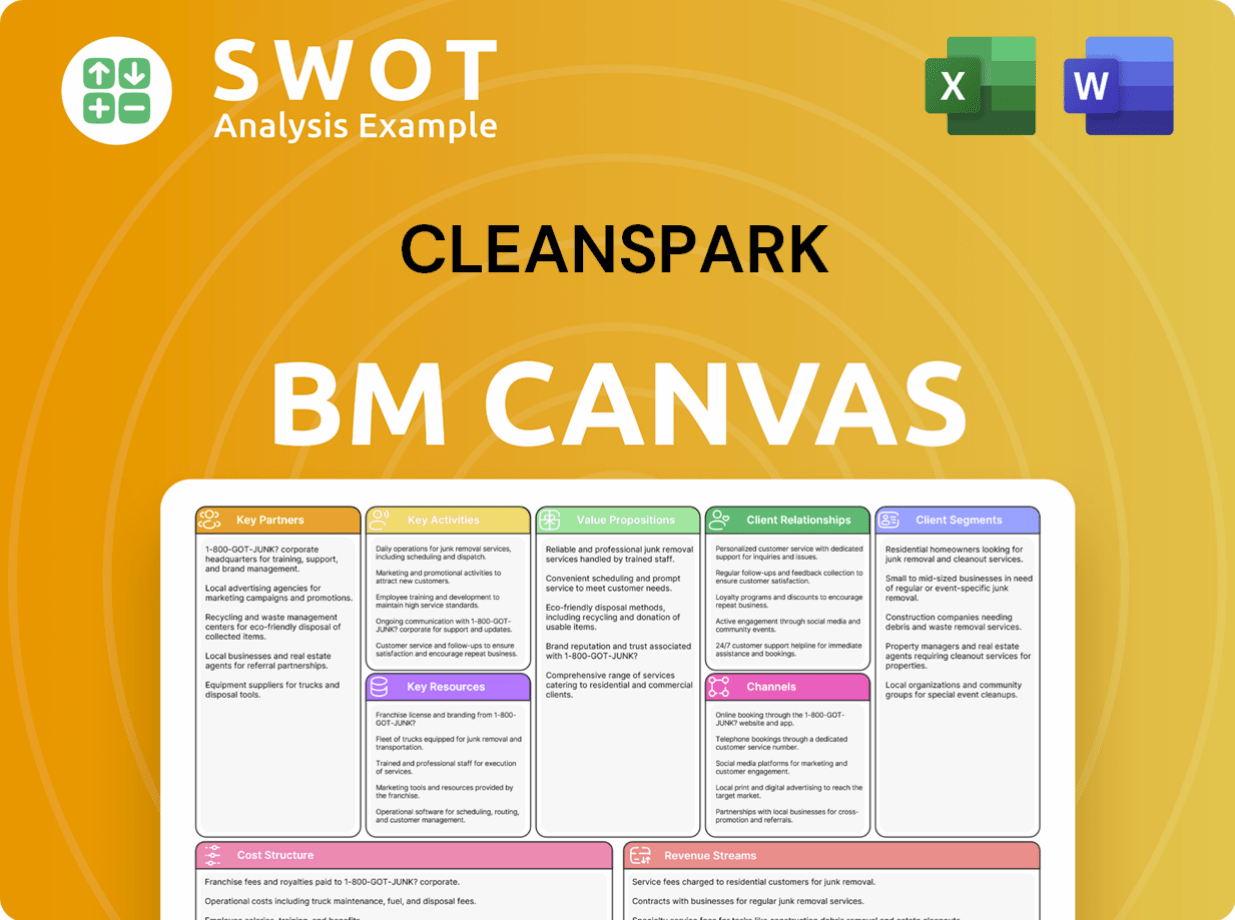

CleanSpark Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for CleanSpark?

The CleanSpark history is marked by strategic shifts and substantial growth, particularly in the Bitcoin mining sector. From its founding to its current operations, the CleanSpark company has evolved significantly. Its journey includes early projects in microgrid and energy management solutions, followed by a strategic pivot towards Bitcoin mining. The company has rapidly scaled its hash rate through infrastructure acquisitions and a focus on energy efficiency. For more information on the Owners & Shareholders of CleanSpark, you can delve deeper into the company's structure.

| Year | Key Event |

|---|---|

| December 16, 2014 | CleanSpark is founded. |

| 2016-2019 | Focused on developing and deploying microgrid and energy management solutions. |

| Early 2020 | Strategic pivot towards Bitcoin mining operations. |

| Late 2020 - 2021 | Acquisition of initial Bitcoin mining infrastructure and rapid scaling of hash rate. |

| 2022 | Continued expansion of mining capacity and focus on energy efficiency. |

| March 2023 | Announces a self-mining hash rate of 6.7 EH/s. |

| July 2023 | Reports a self-mining hash rate of 9.0 EH/s. |

| October 2023 | Achieves a self-mining hash rate of 10.0 EH/s. |

| December 2023 | Announces intent to acquire four new Bitcoin mining facilities for $18.3 million, adding 3.8 EH/s. |

| March 2024 | Self-mining hash rate reaches 17.0 EH/s. |

| Mid-2024 | Projected self-mining capacity to exceed 20 EH/s due to recent acquisitions. |

CleanSpark's future is centered on expanding its Bitcoin mining operations. The company aims to increase its hash rate by acquiring more mining facilities. Targets include reaching over 20 EH/s by mid-2024 and potentially higher in the near future. This growth is vital for maintaining a competitive edge in the cryptocurrency market.

CleanSpark is committed to integrating renewable energy sources. This aligns with the industry's move towards sustainability. The company's efforts to use green energy are expected to enhance its operational efficiency. They are also looking to lower their environmental impact.

The CleanSpark company focuses on disciplined growth and operational excellence. This involves strategic acquisitions to boost hash rate. The company is focused on maximizing shareholder value. These initiatives are designed to solidify their position as a leading, low-cost Bitcoin miner.

Analysts often highlight CleanSpark's strong operational efficiency. Strategic acquisitions are key drivers for future growth. The company's forward-looking approach is tied to optimizing energy utilization. This is especially relevant in the expanding world of digital assets.

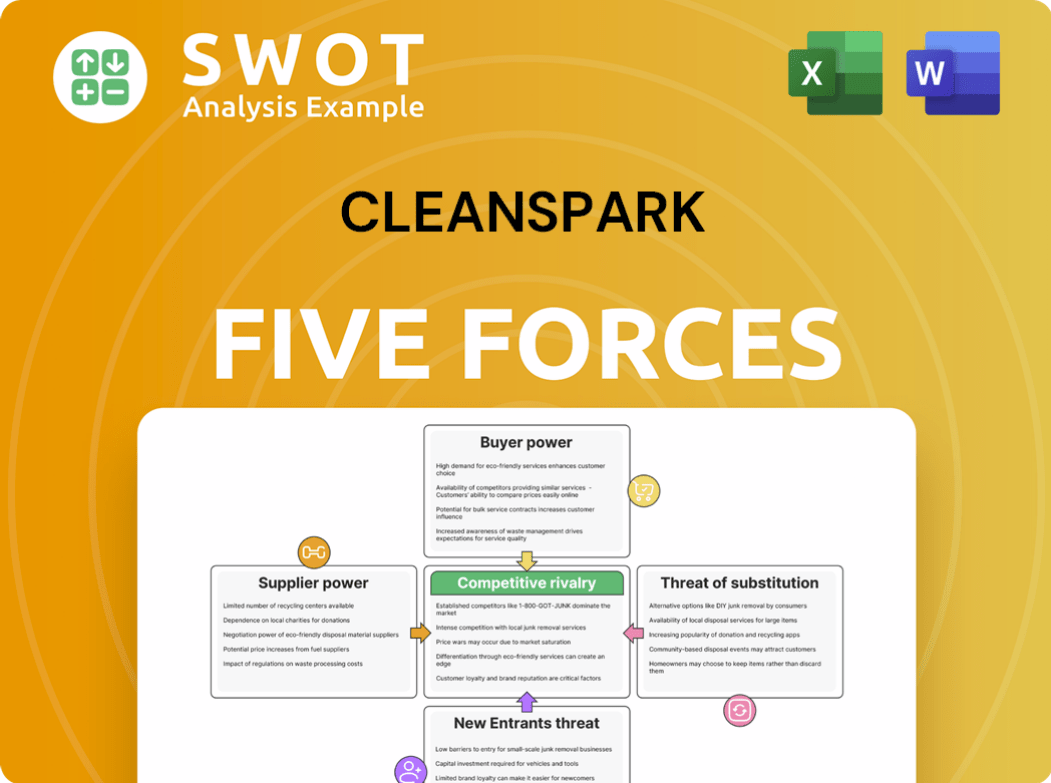

CleanSpark Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of CleanSpark Company?

- What is Growth Strategy and Future Prospects of CleanSpark Company?

- How Does CleanSpark Company Work?

- What is Sales and Marketing Strategy of CleanSpark Company?

- What is Brief History of CleanSpark Company?

- Who Owns CleanSpark Company?

- What is Customer Demographics and Target Market of CleanSpark Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.