CleanSpark Bundle

Who Really Owns CleanSpark?

Understanding a company's ownership structure is crucial for any savvy investor or business strategist. CleanSpark, a rapidly evolving technology company at the forefront of Bitcoin mining and energy solutions, presents a compelling case study in ownership dynamics. The evolution of CleanSpark SWOT Analysis showcases how its ownership has shaped its strategic direction and market performance.

This analysis of CleanSpark ownership will examine the key players behind the company's success, from its initial founders to its current major shareholders. We'll explore how the shifts in CleanSpark investors and institutional ownership have influenced its trajectory within the dynamic Bitcoin mining landscape. Furthermore, we'll delve into the CleanSpark CEO's role and how the company's financials are impacted by its ownership structure, providing insights for those interested in CleanSpark stock and its future.

Who Founded CleanSpark?

The story of CleanSpark, Inc. began in 2014 in Nevada, with roots stretching back to its founding on October 15, 1987, by S. Matthew Schultz and Bryan Huber. The company, headquartered in Henderson, Nevada, started with a small team focused on innovative energy solutions. Understanding the early ownership structure of CleanSpark is key to understanding its evolution.

The initial funding for CleanSpark, like many startups, likely came from a mix of private investments, angel investors, and early-stage venture capital. While specific details on the exact initial capital and funding sources aren't extensively detailed in public records, this approach is typical for companies in their early stages. The founders' vision played a crucial role in shaping the company's direction.

S. Matthew Schultz, a co-founder, served as the executive chairman and former CEO of CleanSpark. Zachary K. Bradford is also a co-founder and has been the CEO and President since October 2019. The early focus of the company evolved, eventually strategically shifting towards Bitcoin mining, reflecting the adaptability of the leadership.

CleanSpark was founded by S. Matthew Schultz and Bryan Huber.

Zachary K. Bradford is the current CEO and President.

The company is headquartered in Henderson, Nevada.

Initial funding likely came from private investments, angel investors, and early-stage venture capital.

CleanSpark's focus later shifted to Bitcoin mining.

The CleanSpark stock symbol is CLSK.

Understanding the evolution of CleanSpark's target market is essential for investors. The company's

CleanSpark ownership

structure has evolved since its founding. Details onCleanSpark investors

and major shareholders can be found through SEC filings and financial reports. AnalyzingCleanSpark stock

performance requires looking at historical data andCleanSpark financials

. For those interested in how to invest inCleanSpark company

, information on theCleanSpark stock price history

andCleanSpark stock forecast

is available. TheCleanSpark CEO

andCleanSpark leadership team

play key roles. Further insights intoCleanSpark market capitalization

,CleanSpark institutional ownership

, andCleanSpark insider ownership

can be found in company filings. Keep up with theCleanSpark latest news

andCleanSpark earnings report

to stay informed. Also, considerCleanSpark company profile

andCleanSpark competitors

for a comprehensive overview.- The company's focus has shifted from energy solutions to Bitcoin mining.

- The current CEO is Zachary K. Bradford.

- The company is headquartered in Henderson, Nevada.

- Early funding came from a mix of private and venture sources.

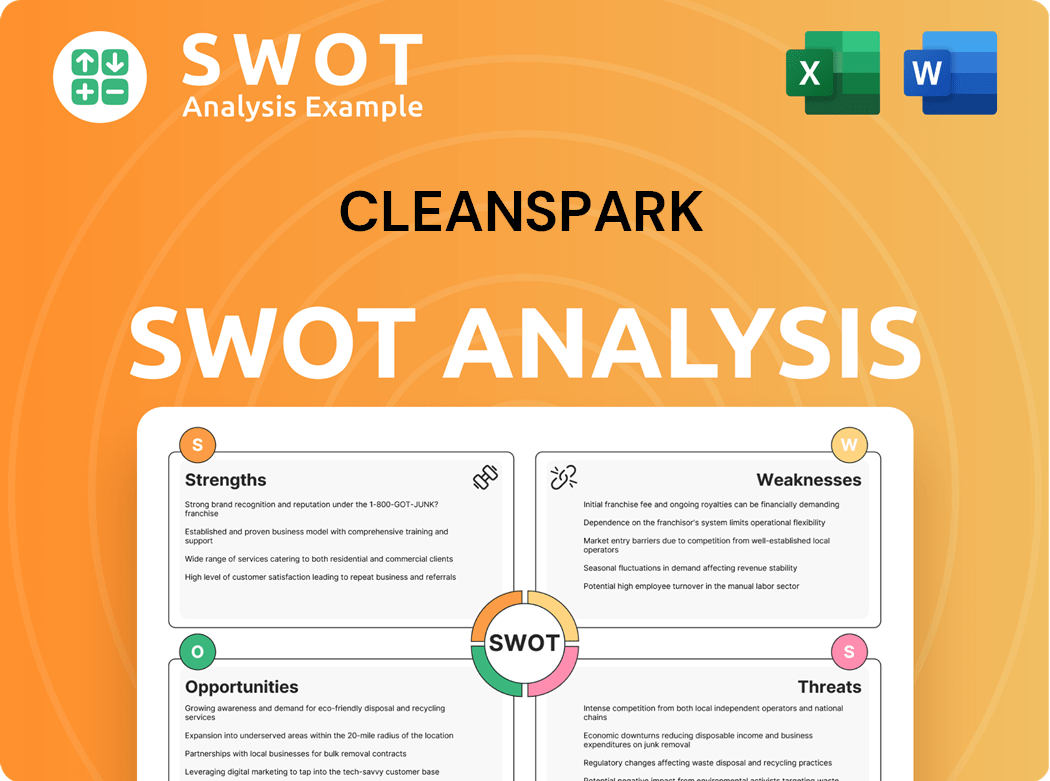

CleanSpark SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has CleanSpark’s Ownership Changed Over Time?

The ownership structure of CleanSpark, Inc. reflects a blend of public shareholders, institutional investors, and company insiders. The company went public on January 29, 2016, marking a significant milestone in its evolution. CleanSpark's common stock began trading on the Nasdaq Capital Market under the symbol 'CLSK' on January 24, 2020, further shaping its ownership landscape. These key events have influenced the distribution of shares and the composition of its investor base.

As of June 10, 2025, CleanSpark's market capitalization stood at $2.85 billion, with approximately 281 million shares outstanding. This valuation underscores the company's growth and the interest from various investor groups. Institutional investors and insiders hold a significant portion of the company's stock, indicating their confidence in the company's long-term prospects. The company's financial strategies, including the $650 million zero-coupon convertible notes offering in December 2024 and the $200 million Bitcoin-backed credit facility from Coinbase Prime in April 2025, have also impacted its ownership structure and financial stability.

| Ownership Category | Percentage (June 11, 2025) | Shares Held |

|---|---|---|

| Institutional Investors | 60% | 215,413,102 |

| Insiders | 3.41% | Not Specified |

| Public Companies and Individual Investors | 53.91% | Not Specified |

Institutional investors are a key part of CleanSpark's marketing strategy. As of June 11, 2025, institutional investors hold a substantial 60% ownership stake, demonstrating their significant influence on the company's direction. Major institutional shareholders include BlackRock, Inc., Vanguard Group Inc, and State Street Corp. Insiders, such as Zachary Bradford and S. Matthew Schultz, also maintain notable stakes, further aligning their interests with the company's performance. The company's ability to attract and retain institutional investors is crucial for its financial health and future growth. CleanSpark's market capitalization is currently at $2.85 billion.

Institutional investors hold a dominant position in CleanSpark ownership, with a 60% stake as of June 11, 2025. Insiders and public shareholders also play important roles in the company's ownership structure.

- CleanSpark's stock symbol is CLSK.

- The company's market capitalization is $2.85 billion as of June 10, 2025.

- Zachary K. Bradford and S. Matthew Schultz are key insiders.

- The company went public on January 29, 2016.

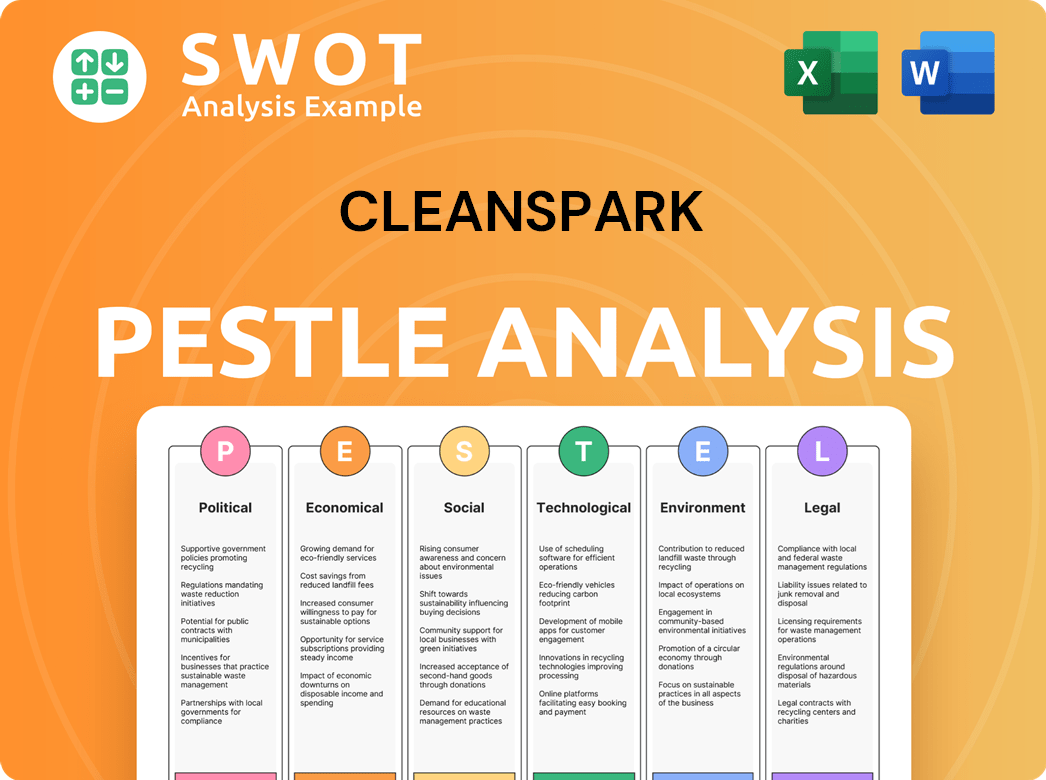

CleanSpark PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on CleanSpark’s Board?

The current board of directors at the [Company Name] is instrumental in guiding the company's strategic direction. The board is composed of several key individuals, each bringing unique expertise. The members include S. Matthew Schultz, who serves as Executive Chairman and Director, and Zachary K. Bradford, holding the positions of Chief Executive Officer, President, and Director. Other directors include Roger P. Beynon, Amanda Cavaleri, Larry McNeill, and Dr. Thomas L. Wood. This team of leaders oversees the company's operations and ensures alignment with shareholder interests.

S. Matthew Schultz, a co-founder, and Zachary K. Bradford, also a co-founder, CEO, and president, play significant roles in the company's leadership. Amanda Cavaleri, who is also the CEO of a Wyoming-based company and chairs the Bitcoin Today Coalition's board of directors, adds additional expertise. The board's composition reflects a blend of experience in executive leadership, financial management, and industry-specific knowledge, which is crucial for navigating the complexities of the market and driving sustainable growth. Understanding the Growth Strategy of CleanSpark is essential for investors.

| Board Member | Title | Key Role |

|---|---|---|

| S. Matthew Schultz | Executive Chairman and Director | Co-founder; Provides strategic oversight. |

| Zachary K. Bradford | CEO, President, and Director | Co-founder; Leads day-to-day operations and strategic initiatives. |

| Roger P. Beynon | Director | Provides guidance and oversight. |

| Amanda Cavaleri | Director | Brings expertise in mining and industry leadership. |

| Larry McNeill | Director | Provides guidance and oversight. |

| Dr. Thomas L. Wood | Director | Provides guidance and oversight. |

The voting structure for [Company Name] is straightforward, with a one-share-one-vote system for common stock. This means that each share of common stock held entitles the holder to one vote on all matters presented to shareholders, including the election of directors. The company's stockholders do not have cumulative voting rights in the election of directors, which implies that the holders of a majority of the shares can elect all directors. The board of directors has the authority to amend the Bylaws, though shareholders also hold this power, requiring a two-thirds affirmative vote for such actions. This structure ensures that the CleanSpark ownership is clearly defined, affecting how CleanSpark investors and CleanSpark stock are managed.

The voting structure at [Company Name] is designed to provide clarity and fairness to all shareholders. This structure ensures that each share has an equal say in company decisions, including the election of directors.

- One-share-one-vote system for common stock.

- No cumulative voting rights.

- Board can amend bylaws, but shareholders can also.

- Two-thirds vote required for shareholder-led bylaw changes.

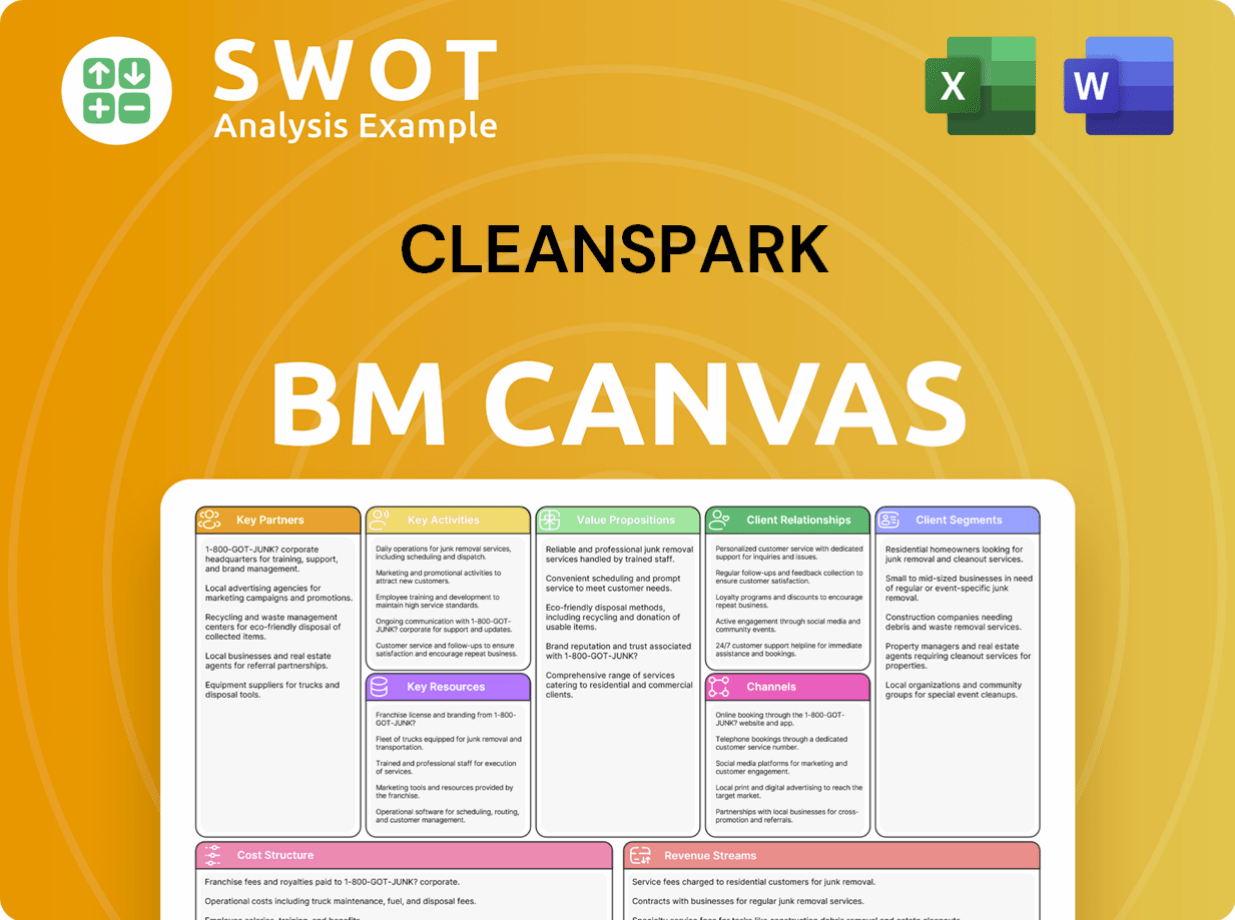

CleanSpark Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped CleanSpark’s Ownership Landscape?

Over the past few years, the focus on Bitcoin mining operations and financial strengthening has been a key aspect of the Growth Strategy of CleanSpark. As of April 30, 2025, the company's operating hashrate stood at 42.4 EH/s, with 204,770 miners hashing, representing approximately 4.9% of the global Bitcoin network hashrate. The company is aiming to reach 50 EH/s by the first half of calendar year 2025.

Financially, the company reported significant growth, with revenues of $162.3 million for the first quarter of fiscal year 2025 (ended December 31, 2024), a 120% increase from the prior year. The second quarter of fiscal year 2025 (ended March 31, 2025) showed a 62.5% year-over-year increase in revenue to $181.7 million. The Bitcoin treasury expanded to over 12,500 BTC as of May 31, 2025. CleanSpark also secured an additional 72 megawatts of contracted power, bringing its total to 987 megawatts.

| Metric | Value | Date |

|---|---|---|

| Operating Hashrate | 42.4 EH/s | April 30, 2025 |

| Miners Hashing | 204,770 | April 30, 2025 |

| Bitcoin Treasury | Over 12,500 BTC | May 31, 2025 |

| Contracted Power | 987 Megawatts | May 31, 2025 |

In terms of ownership trends for CleanSpark ownership, institutional ownership remains high, indicating sensitivity to their trading actions. While institutional investors' holdings remained largely unchanged in May 2025, mutual funds showed a slight increase. Insiders have slightly decreased their holdings. The recent addition to the S&P SmallCap 600 has increased visibility among CleanSpark investors, potentially impacting CleanSpark stock performance.

The CEO leads the company's strategic direction, focusing on expanding Bitcoin mining operations and energy solutions. The leadership team plays a crucial role in driving growth and managing financial performance.

The company has reported strong financial results, with significant revenue growth and a substantial increase in net income. The robust financial performance supports the company's expansion plans and strategic initiatives.

Institutional investors hold a significant portion of CleanSpark's stock, influencing its price. Their trading activities can impact the stock's performance, making it crucial to monitor their holdings.

Insider ownership provides insights into the confidence of the leadership team in the company's future. Changes in insider holdings can signal potential shifts in the company's direction.

CleanSpark Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CleanSpark Company?

- What is Competitive Landscape of CleanSpark Company?

- What is Growth Strategy and Future Prospects of CleanSpark Company?

- How Does CleanSpark Company Work?

- What is Sales and Marketing Strategy of CleanSpark Company?

- What is Brief History of CleanSpark Company?

- What is Customer Demographics and Target Market of CleanSpark Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.