CleanSpark Bundle

How Does CleanSpark Stack Up in the Bitcoin Mining Arena?

CleanSpark has emerged as a major player in the Bitcoin mining and energy solutions sector, but who are its rivals, and how does it compete? Founded in 2014, CleanSpark's journey from energy management to large-scale Bitcoin mining is a fascinating case study in strategic adaptation. This analysis dives deep into the CleanSpark SWOT Analysis, providing a comprehensive look at its competitive landscape.

This exploration of the CleanSpark competitive landscape will dissect its market positioning, key CleanSpark competitors, and unique advantages. We'll analyze the company's growth strategy, its financial performance compared to rivals, and its use of renewable energy, offering critical insights for investors and analysts. Understanding the challenges and opportunities within the Bitcoin mining space is crucial, and this analysis provides a detailed CleanSpark market analysis.

Where Does CleanSpark’ Stand in the Current Market?

CleanSpark has established itself as a significant player in the North American Bitcoin mining sector. As of early 2025, it consistently ranks among the top publicly traded Bitcoin miners, measured by hash rate and operational efficiency. This strong market position is a key element of the CleanSpark competitive landscape.

The company focuses primarily on Bitcoin mining, optimizing its operations through expertise in energy management. CleanSpark's geographic footprint is mainly in the United States, with major mining facilities in states like Georgia and Mississippi. The company's customer base includes institutional and individual investors interested in Bitcoin mining operations and the wider cryptocurrency ecosystem. CleanSpark has transitioned from a broader energy solutions provider to a specialized Bitcoin miner, emphasizing sustainable and efficient practices.

Financially, CleanSpark has demonstrated robust performance, with substantial investments in expanding its mining infrastructure. This financial strength and strategic expansion highlight its strong market standing compared to many smaller, less capitalized industry players. For more information on the company's structure, you can read about the Owners & Shareholders of CleanSpark.

As of March 2025, CleanSpark reported a hash rate of 17.0 EH/s. CleanSpark plans to expand to 20 EH/s by mid-2025. This positions CleanSpark among the largest Bitcoin mining operators globally, significantly impacting its market share analysis.

CleanSpark's main operations are in the United States, with facilities in Georgia and Mississippi. The company's focus on the US market allows for strategic advantages in terms of energy resources and regulatory environments. This focus is a key aspect of its growth strategy and competitive positioning.

In early 2024, CleanSpark announced a $140 million investment in its Dalton, Georgia campus. This investment underscores the company's financial strength and its commitment to expanding its mining capacity. This is a key factor in its competitive advantages in the Bitcoin space.

CleanSpark primarily targets institutional and individual investors interested in Bitcoin mining. The company has shifted from a broader energy solutions provider to a specialized Bitcoin miner. This strategic focus helps CleanSpark stay ahead of its competitors.

CleanSpark's competitive landscape is defined by its substantial hash rate and strategic investments. The company's expansion plans and financial performance are critical factors in its market share analysis. The company's use of renewable energy versus competitors is also a key factor.

- Hash Rate: 17.0 EH/s as of March 2025.

- Expansion: Targeting 20 EH/s by mid-2025.

- Investment: $140 million invested in the Dalton, Georgia campus in early 2024.

- Focus: Primarily on Bitcoin mining, with a shift towards sustainable practices.

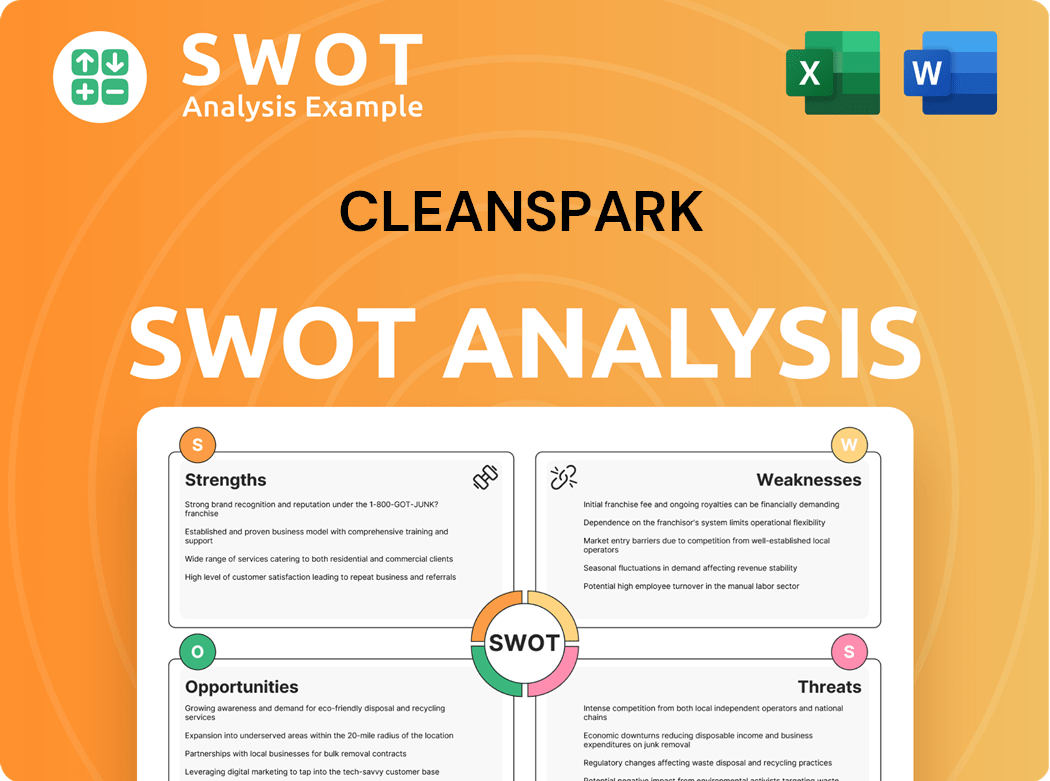

CleanSpark SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CleanSpark?

The CleanSpark competitive landscape is primarily shaped by its rivals in the Bitcoin mining sector. These competitors vie for market share, hash rate dominance, and operational efficiency. Analyzing these factors is crucial for understanding CleanSpark's position and potential growth.

CleanSpark's market analysis reveals a dynamic environment where established players and emerging entities constantly reshape the competitive dynamics. The company's success depends on its ability to navigate this landscape, adapt to technological advancements, and maintain a competitive edge.

The competitive landscape for CleanSpark is complex, including direct and indirect competition. The company faces intense pressure from other Bitcoin mining companies and broader investment opportunities. Staying ahead requires strategic decisions and operational excellence.

The most significant direct competitors for CleanSpark are other publicly traded Bitcoin mining companies. These companies compete directly in the Bitcoin mining market, striving for hash rate, efficiency, and operational scale.

Marathon Digital Holdings is a major competitor, known for its large-scale operations and significant investment in mining rigs. As of May 2024, Marathon had a hash rate of approximately 27.7 EH/s.

Riot Platforms is another key competitor, recognized for its vertically integrated operations and strategic infrastructure investments. Riot's self-mining hash rate was about 15.1 EH/s as of April 2024.

Hut 8 Corp. is a significant competitor, particularly after its merger with US Data Mining Group, Inc. (USBTC). This merger has broadened Hut 8's operations. In May 2024, Hut 8's self-mining capacity was approximately 7.5 EH/s.

CleanSpark faces challenges from its competitors through various means, including operational scale and efficiency. Companies like Marathon and Riot compete on hash rate and rapid deployment of new miners. All three companies strive for lower energy costs per Bitcoin mined.

Indirect competition includes smaller, private mining operations and the broader cryptocurrency investment landscape. Investors can choose to directly purchase Bitcoin instead of investing in mining companies. Emerging players, often backed by venture capital, aim to disrupt the market.

Several factors influence the competitive landscape. These include hash rate, energy efficiency, and access to capital. These factors impact CleanSpark's ability to compete effectively.

- Hash Rate: The computational power used to mine Bitcoin. Higher hash rates increase the probability of mining blocks.

- Energy Efficiency: The cost of electricity is a significant factor. Lower energy costs translate into higher profitability.

- Infrastructure: The ability to scale operations and deploy new mining rigs.

- Access to Capital: Funding for purchasing mining equipment and expanding operations.

- Strategic Partnerships: Alliances that enhance access to resources, technology, or markets.

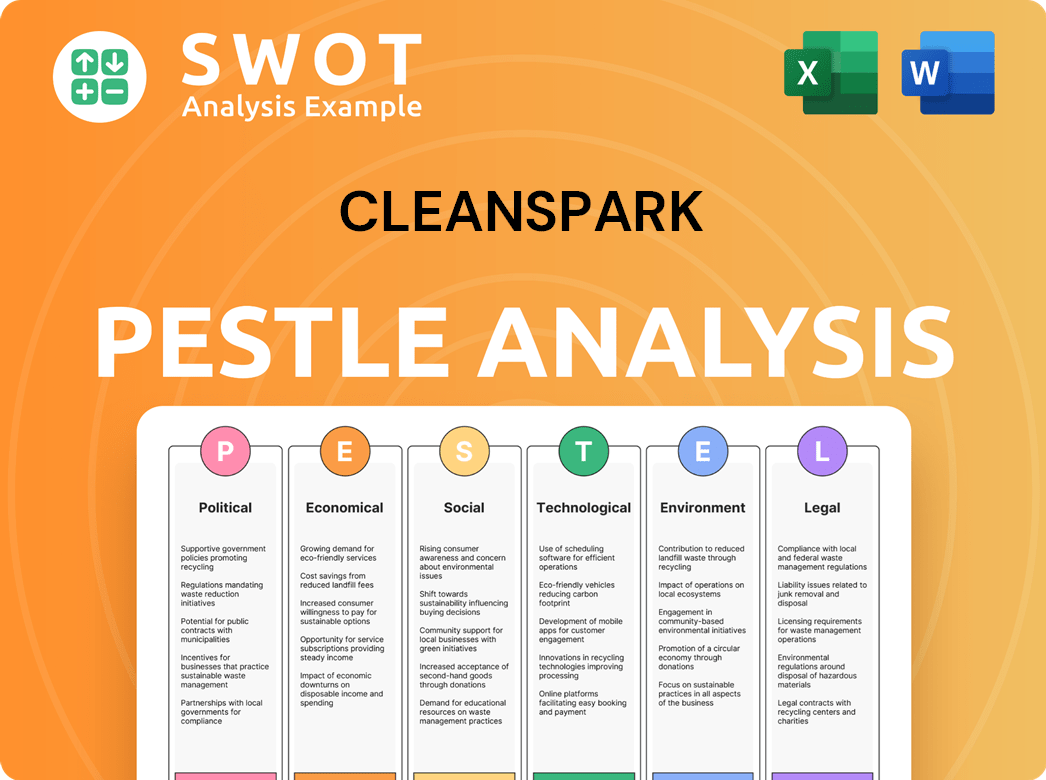

CleanSpark PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CleanSpark a Competitive Edge Over Its Rivals?

The Brief History of CleanSpark reveals a company that has strategically positioned itself within the dynamic CleanSpark competitive landscape. CleanSpark's journey from an energy solutions provider to a significant player in Bitcoin mining is marked by key milestones and strategic shifts. These moves have been pivotal in establishing its competitive edge in a rapidly evolving market.

CleanSpark's success hinges on a combination of technological innovation, strategic acquisitions, and a commitment to sustainable practices. This approach has allowed the company to enhance operational efficiency and reduce costs. The company's ability to adapt and scale its operations is crucial in the face of increasing competition from other Bitcoin mining companies.

The company's focus on operational efficiency and strategic infrastructure development is a cornerstone of its competitive strategy. CleanSpark's commitment to sustainable mining practices further differentiates it from competitors, aligning with growing environmental concerns and potentially offering long-term cost advantages. This focus helps in the CleanSpark market analysis.

CleanSpark's proprietary energy management software and expertise are key differentiators. This technological advantage allows for optimized energy consumption and cost control. This results in lower operational expenses per Bitcoin mined, enhancing resilience during price volatility.

The company's strategic acquisitions and rapid deployment of efficient mining hardware are significant. CleanSpark invests in the latest generation of Application-Specific Integrated Circuit (ASIC) miners. This proactive approach to fleet upgrades significantly enhances its hash rate per unit of energy.

CleanSpark emphasizes sustainability by utilizing renewable energy sources. This focus aligns with environmental concerns and offers potential long-term cost benefits. The company's strong balance sheet and access to capital enable rapid expansion and infrastructure development.

CleanSpark's robust financial position allows for rapid expansion. The company's ability to secure capital and acquire new sites and power agreements is crucial. This financial strength supports its growth strategy and competitive positioning within the Bitcoin mining space.

CleanSpark distinguishes itself through operational efficiency, strategic infrastructure, and sustainable mining practices. These advantages are pivotal in the competitive landscape. CleanSpark's focus on these areas provides a strong foundation for future growth and resilience in the Bitcoin mining market.

- Technological Edge: Proprietary energy management software optimizes energy consumption.

- Strategic Hardware: Rapid deployment of the latest ASIC miners enhances efficiency.

- Sustainability Focus: Utilization of renewable energy sources for long-term cost advantages.

- Financial Stability: Strong balance sheet supports rapid expansion and infrastructure development.

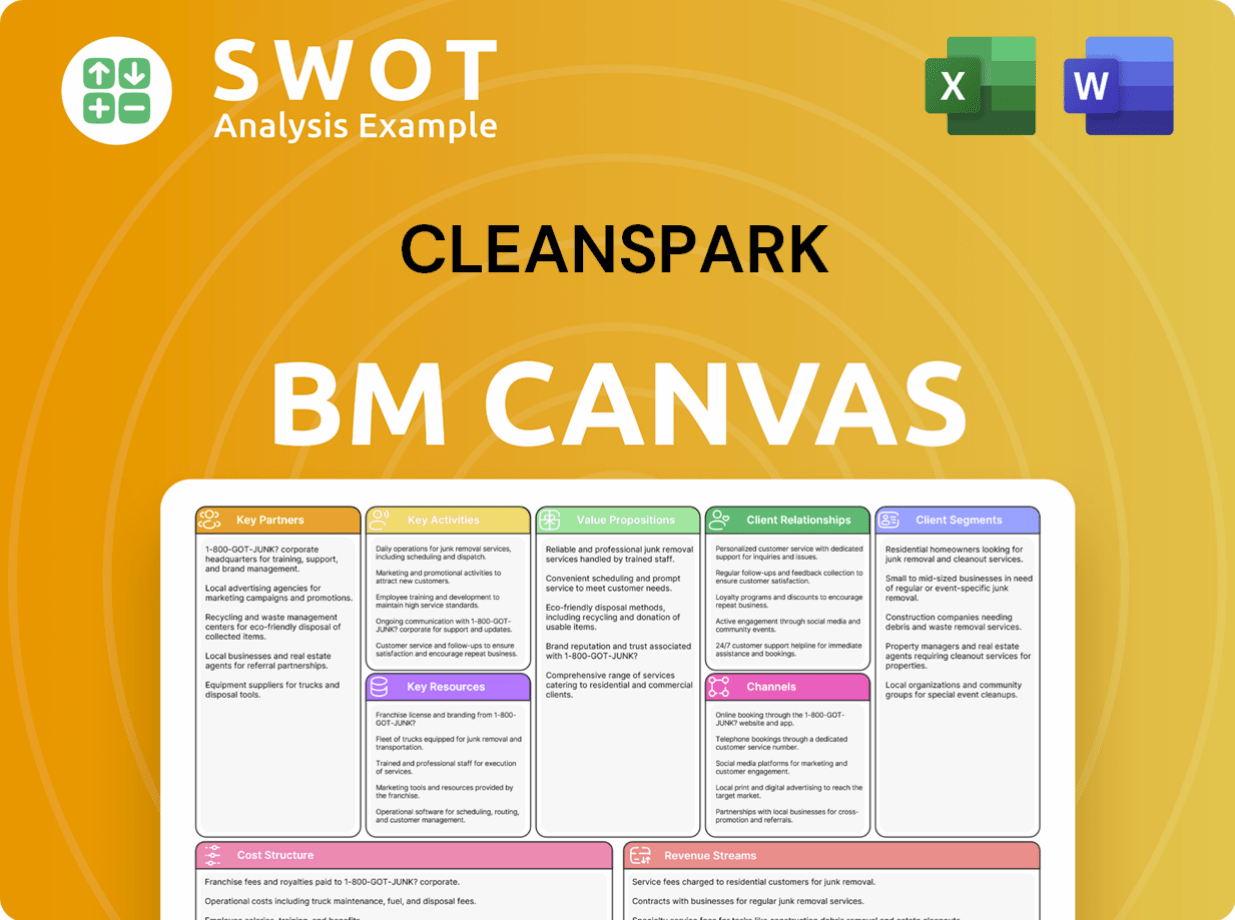

CleanSpark Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CleanSpark’s Competitive Landscape?

The CleanSpark competitive landscape is significantly influenced by industry trends, future challenges, and opportunities within the Bitcoin mining sector. This analysis examines the key factors shaping the company's position, the risks it faces, and the outlook for its future growth. A thorough CleanSpark market analysis reveals the dynamic nature of the Bitcoin mining industry, which is constantly evolving due to technological advancements, regulatory changes, and the volatility of Bitcoin's price.

CleanSpark competitors operate within a complex ecosystem, navigating through technological upgrades, regulatory pressures, and the inherent price volatility of Bitcoin. The company's strategic decisions, including its focus on sustainable practices and infrastructure investments, are critical to its ability to maintain a competitive edge and capitalize on emerging opportunities. Understanding these elements is crucial for assessing CleanSpark's stock performance and its overall potential within the Bitcoin mining market.

Technological advancements are rapidly increasing the efficiency of Bitcoin mining, with newer ASICs offering higher hash rates per watt. Regulatory scrutiny regarding energy consumption and environmental impact is increasing globally. Bitcoin's price volatility continues to directly affect the profitability of mining operations, requiring robust financial management.

Navigating the evolving regulatory landscapes and securing access to affordable and reliable energy are key challenges. Increased competition from well-capitalized rivals puts pressure on operational efficiency. Maintaining operational efficiency as the Bitcoin network difficulty rises is also a significant hurdle.

Growing institutional adoption of Bitcoin and increasing demand for decentralized finance could drive sustained interest in mining infrastructure. CleanSpark's focus on sustainable mining practices positions it well to capitalize on the demand for 'green' Bitcoin. Expanding into new markets with favorable energy policies and developing innovative solutions for waste heat recovery and renewable energy integration present further opportunities.

CleanSpark's strategy of acquiring operational sites and investing in energy-efficient infrastructure supports its competitive standing. The company aims to further solidify its position and explore diversification into related energy services or high-performance computing. This approach is critical for long-term success within the dynamic Bitcoin mining sector.

The CleanSpark competitive landscape includes both established and emerging Bitcoin mining companies. These companies are constantly striving to increase their hash rate capacity, reduce energy costs, and comply with environmental regulations. The competition also extends to securing favorable energy contracts and accessing the latest mining hardware.

- Capital Investment: The ability to raise and deploy capital quickly is crucial for purchasing new mining equipment and expanding operations.

- Operational Efficiency: Minimizing energy consumption and maximizing hash rate per unit of power is vital for profitability.

- Regulatory Compliance: Navigating the varying regulatory environments across different jurisdictions is essential.

- Strategic Partnerships: Collaborations with energy providers and technology suppliers can provide competitive advantages.

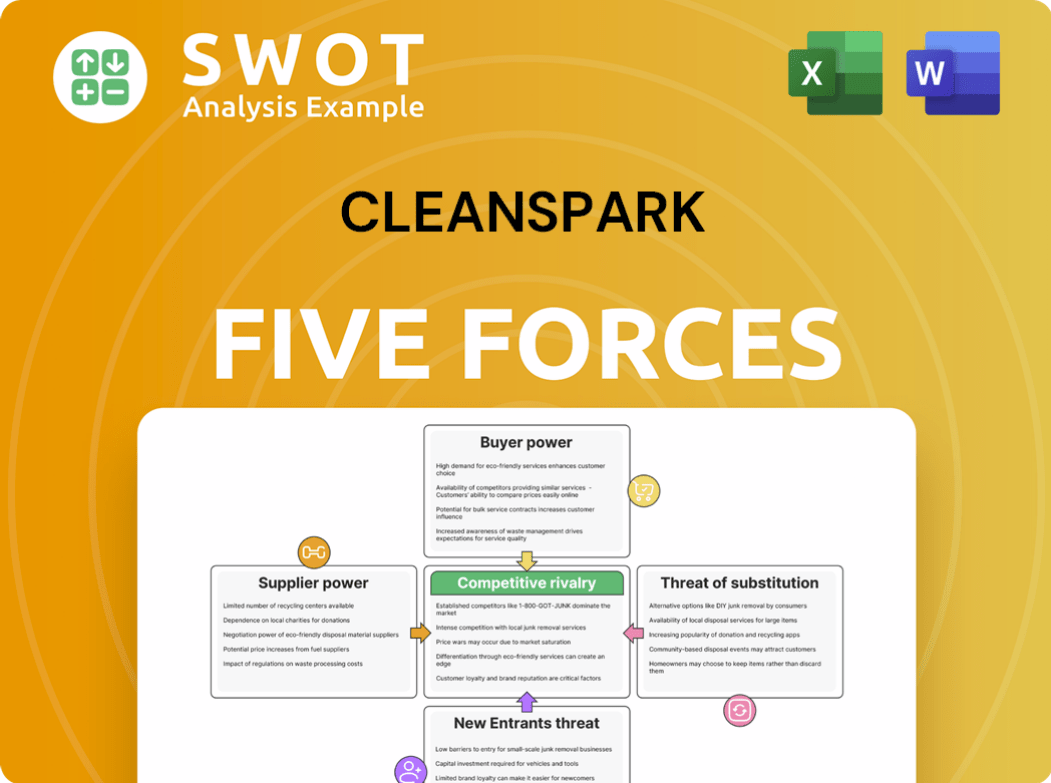

CleanSpark Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CleanSpark Company?

- What is Growth Strategy and Future Prospects of CleanSpark Company?

- How Does CleanSpark Company Work?

- What is Sales and Marketing Strategy of CleanSpark Company?

- What is Brief History of CleanSpark Company?

- Who Owns CleanSpark Company?

- What is Customer Demographics and Target Market of CleanSpark Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.