CleanSpark Bundle

Can CleanSpark Continue Its Bitcoin Mining Dominance?

CleanSpark, Inc. (Nasdaq: CLSK) has rapidly emerged as a key player in the Bitcoin mining sector, but what does the future hold for this innovative company? Founded in 2014, CleanSpark initially focused on pioneering energy solutions, but has since made a strategic pivot. Today, they operate multiple mining facilities across the U.S., holding approximately 5% of the market share.

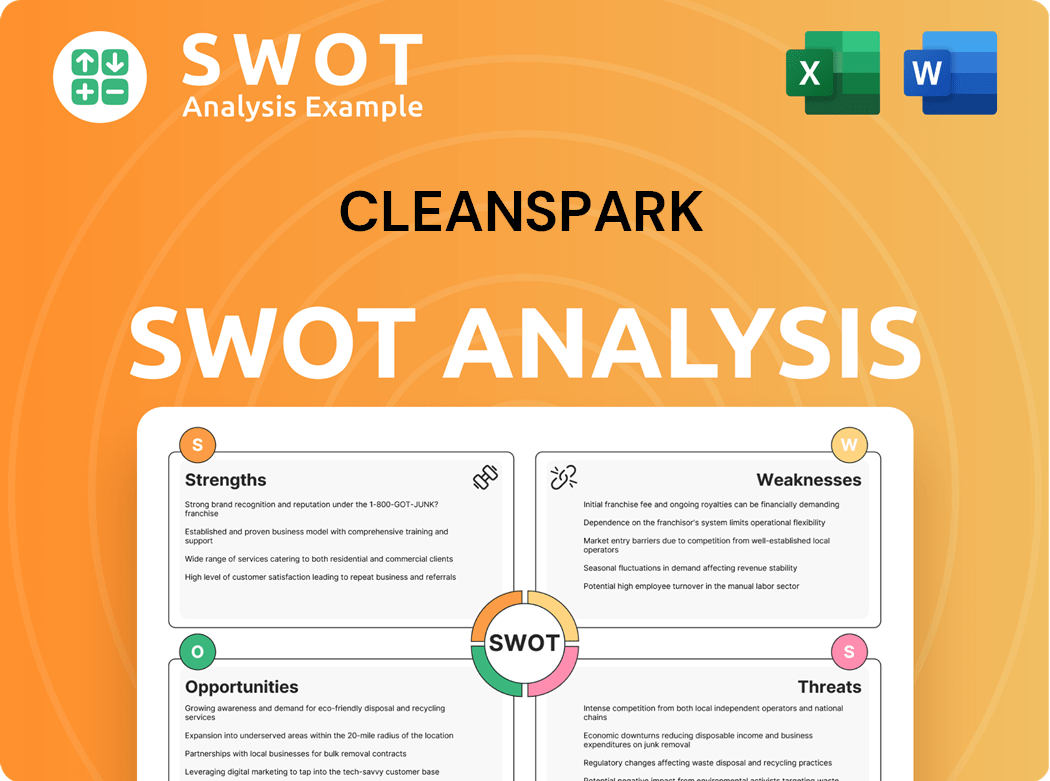

CleanSpark's impressive journey from energy solutions to a leading Bitcoin miner is a testament to its adaptability and strategic vision. The company's CleanSpark SWOT Analysis reveals key insights into its strengths, weaknesses, opportunities, and threats, providing a comprehensive overview of its position in the market. With a market capitalization of $2.4 billion as of May 2025, understanding CleanSpark's growth strategy and future prospects is crucial for investors and analysts alike, especially when considering the company's investment potential and long-term strategy in the volatile digital asset landscape. The company's focus on increasing its hashrate, improving energy efficiency, and disciplined capital management will be key drivers of its future success, as it navigates the dynamic cryptocurrency market and explores various growth opportunities.

How Is CleanSpark Expanding Its Reach?

CleanSpark is aggressively expanding its Bitcoin mining operations, focusing on boosting its mining capacity and diversifying its geographical presence. This CleanSpark growth strategy includes entering new markets within the United States, such as Tennessee and Wyoming. The company aims to replicate its successful community-oriented approach, similar to its operations in Georgia, as part of its CleanSpark future prospects.

The company is actively acquiring and developing infrastructure to support its expansion. This includes purchasing existing facilities and constructing new data centers. These initiatives are designed to capitalize on competitive energy prices and diversify revenue streams. The goal is to achieve significant hashrate growth and secure a strong position in the Bitcoin mining industry, as part of the overall CleanSpark company strategy.

These moves are part of a broader strategy to increase its Bitcoin mining capabilities and broaden its operational scope. The focus is on securing competitive energy markets and diversifying revenue streams, which is crucial for long-term growth.

In September 2024, CleanSpark acquired seven Bitcoin mining facilities in Knoxville, Tennessee, for $27.5 million, adding 85 MW of capacity and an anticipated 5 EH/s to its hashrate. The acquisition of GRIID Infrastructure Inc. in October 2024 is expected to increase CleanSpark's mining capacity in Tennessee to over 400 MW. Construction of two immersion-cooled data centers totaling 75 MW is underway in Cheyenne, Wyoming, projected to add approximately 5 EH/s.

CleanSpark aims to achieve a hashrate of 50 EH/s by mid-2025 and has secured infrastructure to support growth beyond 60 EH/s. As of May 2025, the company's month-end operating hashrate reached 45.6 EH/s, a 7.5% sequential increase. The total contracted power capacity stands at 987 MW. These targets show the company's commitment to significant growth in its Bitcoin mining operations.

CleanSpark's strategy includes pre-purchasing mining equipment at low prices to quickly capitalize on infrastructure acquisitions and fill acquired data center space. The company’s Bitcoin treasury has also significantly expanded, doubling year-over-year to 12,502 BTC as of May 2025, all self-mined without equity financing since November 2024. This approach demonstrates a proactive and financially sound strategy.

Two new mining sites near Clinton, Mississippi, were nearing completion in late 2024, projected to add around 1 EH/s. These new sites are part of CleanSpark's broader strategy to increase its operational footprint and mining capacity. The focus on multiple sites helps to diversify risk and ensure consistent growth.

CleanSpark is executing a robust expansion plan to increase its Bitcoin mining capacity and market presence. This strategy involves strategic acquisitions and the development of new mining sites across the United States. The company's focus on efficient operations and strategic acquisitions is key to its growth.

- Acquisition of mining facilities in Tennessee and Wyoming.

- Targeting a hashrate of 50 EH/s by mid-2025.

- Significant growth in Bitcoin holdings through self-mining.

- Strategic pre-purchasing of mining equipment.

For more information on the company's core values and mission, read this article: Mission, Vision & Core Values of CleanSpark.

CleanSpark SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CleanSpark Invest in Innovation?

The core of the CleanSpark growth strategy lies in its commitment to technological innovation, particularly within its Bitcoin mining operations. This focus allows the company to enhance efficiency and sustainability, which are critical for long-term success. The company's approach emphasizes a vertically integrated business model, providing greater control over operational performance and cost management.

CleanSpark's future prospects are closely tied to its ability to optimize its Bitcoin mining operations. The company's strategic investments in advanced hardware and software, along with its focus on renewable energy integration, position it well to capitalize on the growing demand for sustainable Bitcoin mining solutions. This approach is critical for maintaining a competitive edge in a rapidly evolving market.

The company's infrastructure-first and vertically integrated model is a key element of its strategy, allowing it to own and operate its facilities, deploy its own hardware, and secure energy contracts. This approach enables greater control over operational performance and cost management, which is essential for maximizing profitability in the competitive Bitcoin mining landscape.

CleanSpark continuously improves its fleet efficiency, a crucial metric in Bitcoin mining. The company's focus on optimizing its fleet efficiency is a key driver of its operational performance and profitability.

CleanSpark utilizes advanced software and hardware for energy management, aiming to improve energy efficiency and sustainability within the Bitcoin mining industry. The company is committed to reducing its environmental impact through the use of renewable energy sources.

CleanSpark's microgrids integrate renewable energy sources like solar and battery storage to provide reliable and sustainable power. This integration is a key component of the company's sustainability initiatives and its ability to participate in demand response programs.

New facilities are designed to participate in demand response programs, reinforcing CleanSpark's commitment to energy efficiency and grid sustainability. This participation further enhances the company's operational efficiency and supports its sustainability goals.

While focusing on Bitcoin mining, CleanSpark also emphasizes research and development to stay at the forefront of technological innovation in the clean energy sector. This commitment allows the company to explore new opportunities and maintain a competitive edge.

CleanSpark's leadership in the industry was highlighted by its participation in the Bitcoin 2025 conference, where discussions on strategic trends in mining, energy, and digital asset management took place. This participation underscores the company's commitment to innovation and industry leadership.

CleanSpark's technological strategy focuses on improving fleet efficiency, integrating renewable energy, and participating in demand response programs. These initiatives are designed to enhance operational performance and sustainability, which are critical for long-term success.

- Fleet Efficiency: The company improved fleet efficiency from 18 joules per terahash in December to less than 17 joules per terahash by April 2025. As of May 2025, the average fleet efficiency was 16.71 J/Th.

- Renewable Energy Integration: CleanSpark integrates renewable energy sources, such as solar and battery storage, to provide reliable and sustainable power.

- Demand Response Programs: New facilities are designed to participate in demand response programs, reinforcing the company's commitment to energy efficiency and grid sustainability.

- Research and Development: CleanSpark emphasizes research and development to stay at the forefront of technological innovation in the clean energy sector.

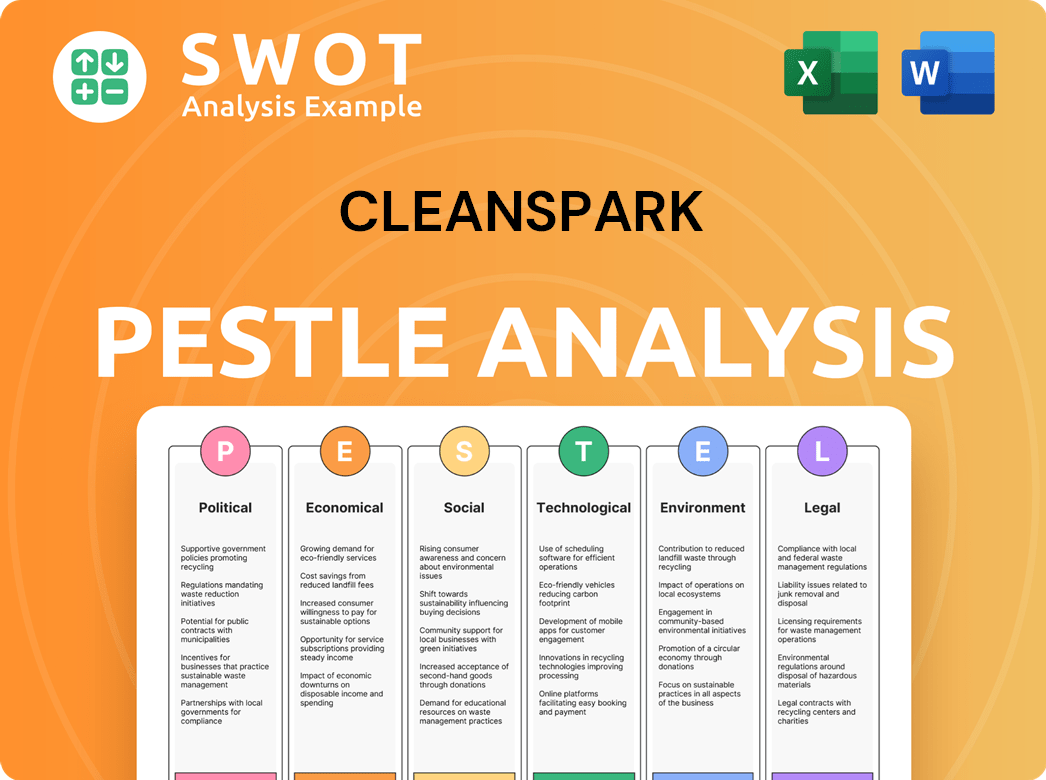

CleanSpark PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is CleanSpark’s Growth Forecast?

The financial performance of CleanSpark demonstrates substantial growth, particularly in revenue. The company's strategic investments and disciplined capital management have been key factors in its recent successes. Understanding the financial outlook is crucial for assessing the overall Revenue Streams & Business Model of CleanSpark and its potential for future growth.

For the fiscal year ending September 30, 2024, CleanSpark reported impressive revenue figures. This growth, however, was coupled with strategic financial decisions that impacted net income. Analyzing these factors provides a comprehensive view of the company's financial health and future prospects.

In fiscal Q1 2025, CleanSpark continued its growth trajectory, showing strong revenue increases and profitability. The company's ability to manage costs and maintain a robust financial position is essential for sustaining its expansion plans and achieving long-term goals. The following financial data provides a detailed look at the company's performance.

For the fiscal year ended September 30, 2024, CleanSpark reported annual revenues of $378.9 million. This represents a 125% increase from the $168.4 million reported in the prior fiscal year. This substantial growth highlights the company's strong performance and expansion in the market.

Despite the revenue growth, CleanSpark recorded a net loss of $145.8 million for FY2024. This was primarily due to non-cash factors, such as mark-to-market adjustments on Bitcoin holdings and impairment of older miners. Adjusted EBITDA for FY2024 significantly increased to $245.8 million from $25.0 million in the previous fiscal year.

In fiscal Q1 2025 (ended December 31, 2024), CleanSpark reported quarterly revenues of $162.3 million, a 120% increase year-over-year. Net income for Q1 2025 was $246.8 million, or $0.85 per basic share, a substantial improvement from $25.9 million in the prior year.

Adjusted EBITDA for Q1 2025 reached $321.6 million. The marginal cost per Bitcoin mined decreased to approximately $34,000 at owned facilities during this quarter. This demonstrates efficient operations and cost management within the company.

For fiscal Q2 2025 (ended March 31, 2025), CleanSpark reported revenues of $181.7 million, a 62.5% increase year-over-year. The company reported a net loss of ($138.8 million) or ($0.49) per basic share for Q2 2025, compared to a net income in the same prior year period, primarily due to Bitcoin price adjustments.

Adjusted EBITDA for Q2 2025 was ($57.8 million). As of April 30, 2025, CleanSpark's Bitcoin holdings exceeded 12,100 coins. This significant holding reflects the company’s investment strategy and its confidence in the future of Bitcoin.

CleanSpark's strong financial position is further supported by its robust liquidity and strategic financial partnerships. These factors contribute to the company's ability to pursue its CleanSpark growth strategy and capitalize on CleanSpark's growth opportunities.

CleanSpark ended Q1 2025 with $1.2 billion in total liquidity and nearly $2.8 billion in assets. This strong financial foundation provides the company with the flexibility to invest in future growth and manage its operations effectively.

The company expanded its line of credit with Coinbase to $200 million, supporting growth without equity dilution since November 2024. This strategic financial move allows CleanSpark to fund its expansion plans efficiently.

CleanSpark's disciplined capital management and focus on self-mined Bitcoin contribute to its strong balance sheet. This approach helps to mitigate risks and ensures the company's financial stability, supporting its CleanSpark stock performance.

The company's focus on self-mined Bitcoin is a key component of its financial strategy. This approach provides a direct revenue stream and allows CleanSpark to benefit from the appreciation of Bitcoin, enhancing its CleanSpark investment potential.

Strategic partnerships, such as the expanded line of credit with Coinbase, play a crucial role in supporting CleanSpark's growth. These partnerships provide access to capital and resources, enabling the company to execute its CleanSpark's expansion plans.

Analyzing CleanSpark's financial data and strategic initiatives provides insights into its future prospects. The company's ability to manage costs, secure funding, and capitalize on market opportunities will be critical for achieving its long-term goals and enhancing its CleanSpark's market capitalization.

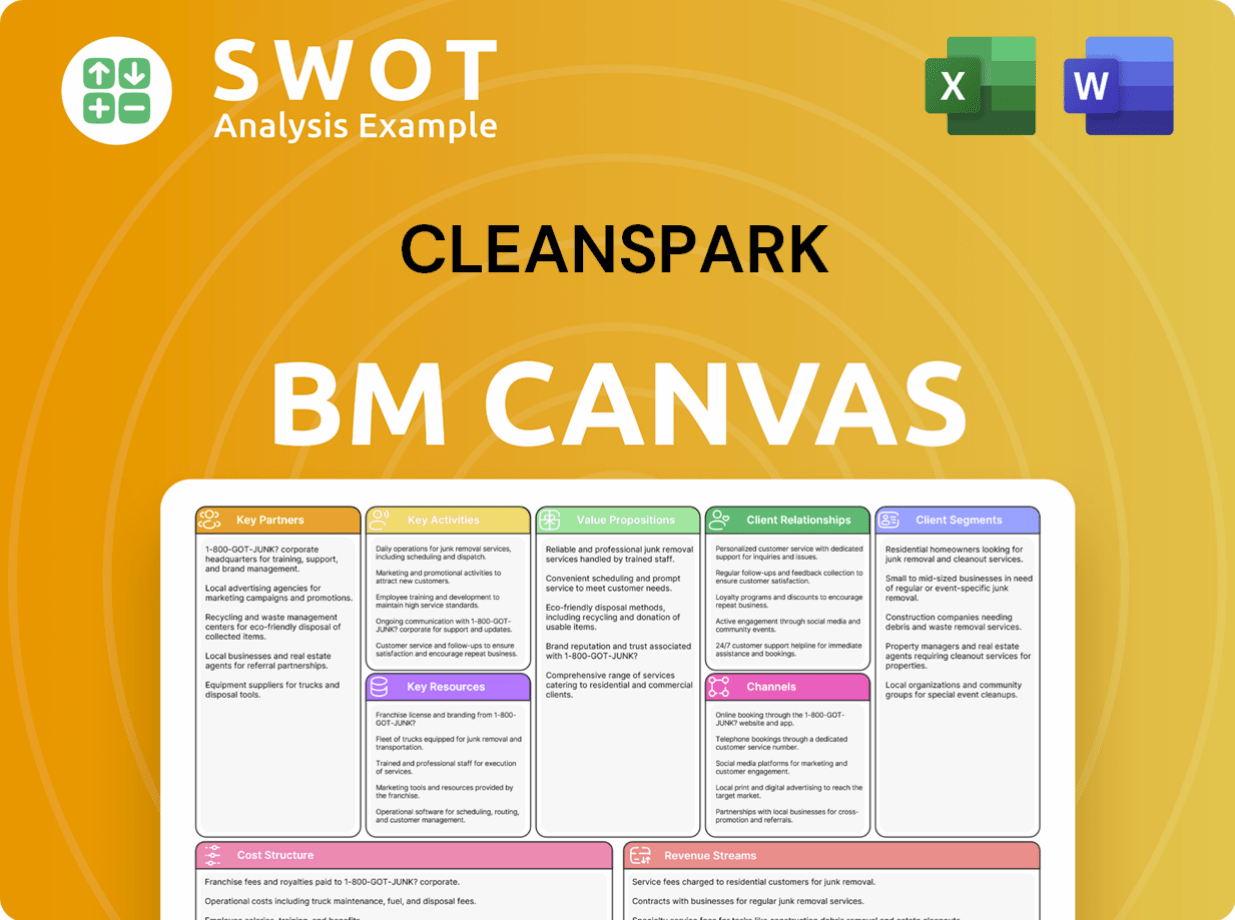

CleanSpark Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow CleanSpark’s Growth?

The growth trajectory of CleanSpark is subject to various risks and obstacles. The cryptocurrency mining industry is inherently volatile, and CleanSpark's success hinges on navigating these challenges effectively. Understanding these potential pitfalls is crucial for assessing the company's future prospects and investment potential.

CleanSpark's operations face significant competition from established players in the Bitcoin mining sector. Regulatory changes and market dynamics can significantly impact the company. Furthermore, the price of Bitcoin and energy costs are critical factors directly influencing CleanSpark's financial performance, as highlighted in a detailed analysis of CleanSpark's target market.

Supply chain disruptions, technological advancements, and Bitcoin price volatility are key areas of concern. These factors can affect expansion timelines, require continuous investment in research and development, and directly impact revenues and profitability, respectively. Managing these risks is essential for achieving sustainable growth.

CleanSpark competes with major players like Marathon Digital Holdings and Riot Blockchain, Inc. Competition involves securing new miners, obtaining low-cost electricity, and accessing reliable power sources. This competitive landscape impacts CleanSpark's ability to expand and maintain profitability.

The Bitcoin mining industry is largely unregulated, but increased scrutiny is anticipated. Changes to state government tax incentives, or failure to meet their conditions, could significantly impact CleanSpark's financial health. The company's reliance on utility rate structures and government incentive programs also poses risks.

Acquiring and delivering new mining equipment can affect expansion timelines. Delays in the supply chain can hinder CleanSpark's ability to scale its operations. Efficient supply chain management is therefore critical for sustained growth and meeting strategic objectives.

Continuous investment in research and development is crucial to maintain a competitive edge. Rapid technological advancements require CleanSpark to adapt and innovate. Staying ahead of the curve is essential for long-term success in the Bitcoin mining sector.

Bitcoin price fluctuations directly impact revenues and profitability. A net loss in Q2 2025 was primarily attributed to a Bitcoin price mark-to-market adjustment. This volatility underscores the inherent risks associated with CleanSpark's business model.

Rising energy costs pose a considerable challenge, potentially eroding profit margins. CleanSpark has experienced higher average power prices in recent quarters. Managing energy costs is crucial for maintaining profitability and achieving sustainable growth.

CleanSpark's focus on non-dilutive financing and an infrastructure-first strategy aim to mitigate these risks. These strategies are designed to provide financial stability and support the company's expansion plans. This approach is intended to help the company navigate the challenges inherent in the Bitcoin mining industry.

In Q2 2025, the company reported a net loss primarily due to Bitcoin price adjustments. Rising energy costs have also put pressure on profitability. These factors highlight the importance of effective risk management and strategic planning for CleanSpark's financial success.

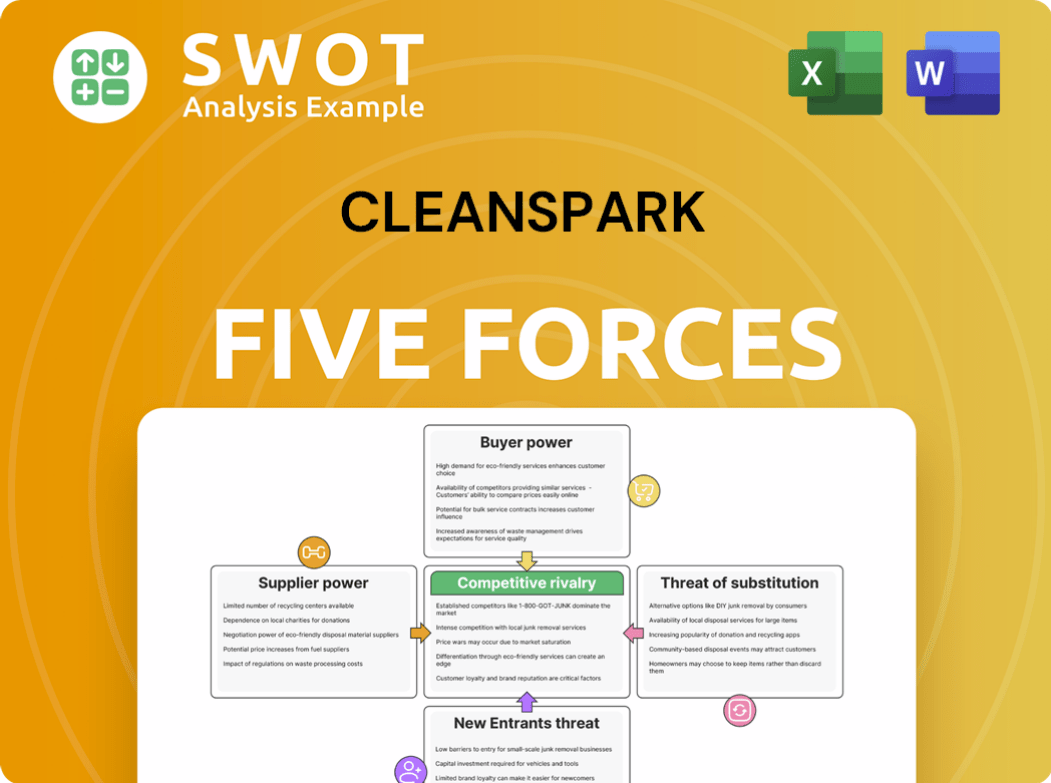

CleanSpark Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CleanSpark Company?

- What is Competitive Landscape of CleanSpark Company?

- How Does CleanSpark Company Work?

- What is Sales and Marketing Strategy of CleanSpark Company?

- What is Brief History of CleanSpark Company?

- Who Owns CleanSpark Company?

- What is Customer Demographics and Target Market of CleanSpark Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.