CleanSpark Bundle

How Does CleanSpark Thrive in the Bitcoin Mining Realm?

CleanSpark, a leading technology innovator, is revolutionizing the Bitcoin mining landscape with its focus on renewable energy and sustainable practices. The company's impressive growth, evidenced by its expanding operational hash rate, highlights its significant influence in the digital asset sector. With a strategic commitment to energy efficiency, CleanSpark is not just mining Bitcoin; it's redefining how it's done.

CleanSpark company's commitment to CleanSpark SWOT Analysis and sustainable energy solutions positions it uniquely in the competitive Bitcoin mining market. Its strategic acquisitions and technological advancements in energy management are key to understanding its operational model and financial success. Delving into CleanSpark's business model reveals how it leverages renewable energy and innovative technology to drive profitability and minimize its environmental impact.

What Are the Key Operations Driving CleanSpark’s Success?

The core operations of the CleanSpark company are centered around the mining of Bitcoin, emphasizing efficiency and sustainability. This involves the deployment of advanced software and hardware to optimize the performance and energy consumption of its Bitcoin mining fleet. The company’s value proposition lies in its ability to provide a reliable supply of newly minted Bitcoin while minimizing its environmental impact.

CleanSpark's business model is built on acquiring and developing mining facilities, procuring high-efficiency Bitcoin miners, and continuously optimizing energy usage. The company focuses on vertical integration where possible, managing aspects from facility design to miner deployment and maintenance. This approach allows for greater control over operational costs and efficiency.

CleanSpark creates value for individuals and institutions interested in Bitcoin by directly contributing to the supply of the cryptocurrency. Its focus on renewable energy and sustainable practices provides a competitive advantage and appeals to environmentally conscious investors. The company's operational strategies are designed to improve Bitcoin mining profitability while adhering to sustainable practices.

Operational processes include acquiring and developing mining facilities, procuring and deploying Bitcoin miners, and optimizing energy usage. CleanSpark has expanded its infrastructure, acquiring facilities in Georgia and Mississippi. The company focuses on vertical integration, managing aspects from facility design to miner deployment and maintenance.

CleanSpark emphasizes energy efficiency and sustainability in its Bitcoin mining operations. The company aims to use a high percentage of low-carbon energy sources. This approach reduces operational costs and appeals to environmentally conscious investors. This commitment is a key aspect of CleanSpark's growth strategy.

CleanSpark's core capabilities translate into customer benefits through a more reliable and responsibly mined supply of Bitcoin. This contributes to the overall stability and public perception of the cryptocurrency. The company's focus on sustainability and efficiency enhances its value proposition.

CleanSpark's competitive advantages include its emphasis on energy efficiency and sustainability. This focus potentially reduces operational costs and attracts environmentally conscious investors. The company's strategic partnerships and operational efficiencies further enhance its competitive position.

CleanSpark's operational strategy includes expanding its mining capacity and improving energy efficiency. The company is focused on increasing its hashrate and reducing its carbon footprint. CleanSpark's commitment to sustainable energy sources is a key differentiator in the Bitcoin mining industry.

- Focus on renewable energy sources to reduce environmental impact.

- Strategic facility acquisitions to scale mining operations.

- Continuous optimization of energy usage through advanced software and hardware.

- Partnerships with energy providers to secure competitive electricity rates.

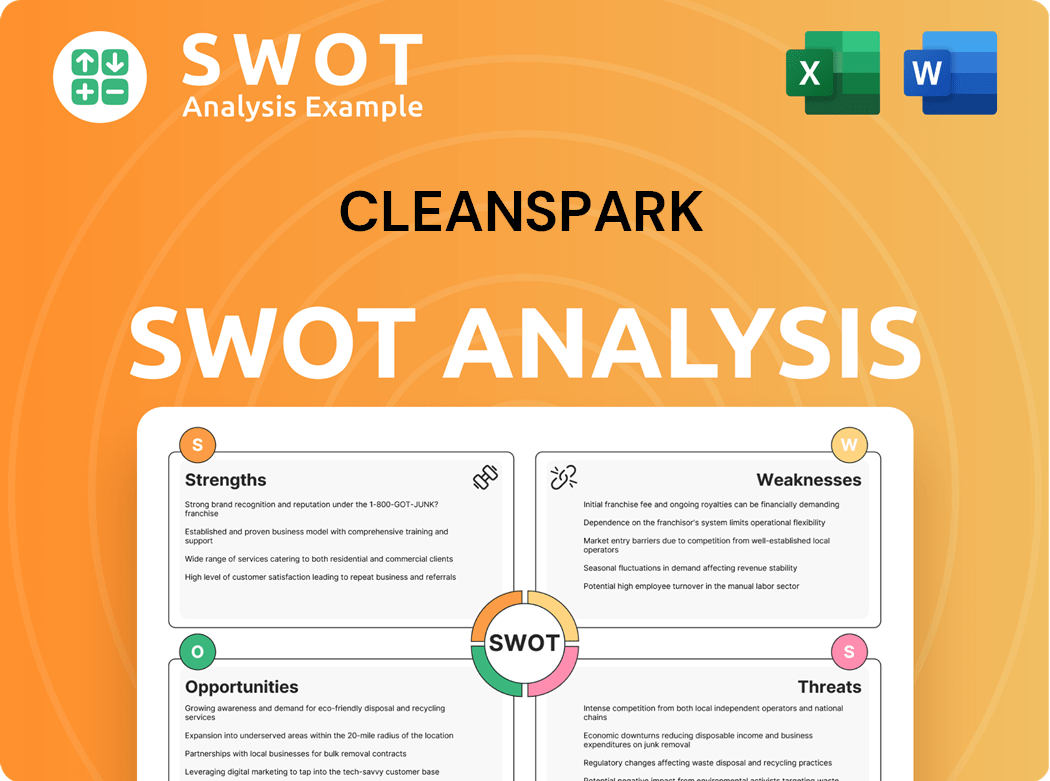

CleanSpark SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CleanSpark Make Money?

The primary revenue stream for the CleanSpark company is derived from its Bitcoin mining operations. This involves earning revenue by successfully mining new Bitcoin blocks. The company's financial performance is closely linked to the price of Bitcoin and its operational hash rate.

CleanSpark's business model focuses on maximizing Bitcoin mined while minimizing operational costs, particularly energy consumption. This is achieved through strategic acquisitions of mining facilities, the deployment of efficient mining hardware, and optimization of energy usage via its software solutions. For example, in January 2024, CleanSpark reported mining 721 Bitcoin, a 50% increase year-over-year.

The company's strategy includes expanding its operational hash rate to secure a larger portion of block rewards. Any future diversification into energy management solutions or other blockchain-related services could represent new revenue streams. To learn more about the CleanSpark business and its mission, check out the Growth Strategy of CleanSpark.

The core of CleanSpark's revenue generation centers on Bitcoin mining, with a strong emphasis on operational efficiency and strategic expansion. The company aims to increase its share of the global hash rate, which is crucial for securing a larger portion of block rewards. The following points highlight the key aspects of their strategy:

- Bitcoin Mining: The primary source of revenue comes from mining new Bitcoin blocks and receiving block rewards.

- Operational Efficiency: CleanSpark focuses on minimizing operational costs, especially energy consumption, to maximize profitability.

- Hash Rate Expansion: Increasing the operational hash rate is a key strategy to secure a larger share of block rewards. The company aims to increase its share of the global hash rate.

- Strategic Acquisitions: CleanSpark strategically acquires mining facilities to grow its operations.

- Efficient Hardware: Deployment of efficient mining hardware is crucial for maximizing Bitcoin production.

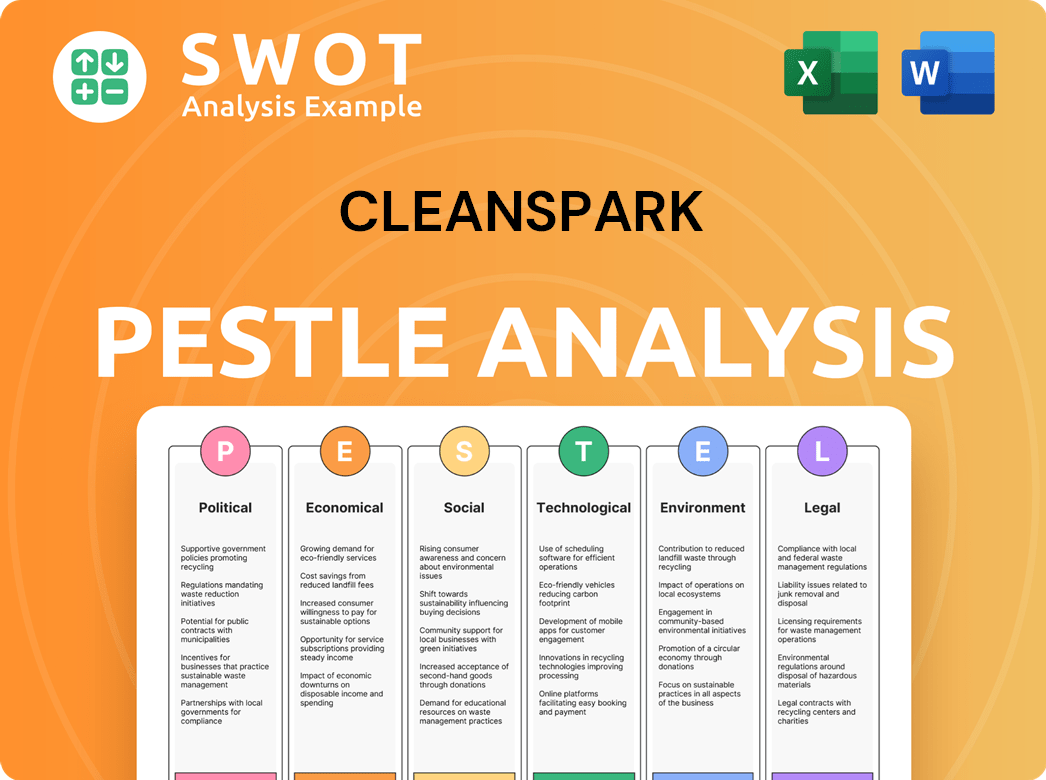

CleanSpark PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped CleanSpark’s Business Model?

The following outlines the key milestones, strategic moves, and competitive advantages of the CleanSpark company. CleanSpark has strategically expanded its Bitcoin mining capacity through significant acquisitions and operational enhancements. This approach has enabled the company to increase its Bitcoin production and revenue potential. CleanSpark's focus on operational efficiency and sustainable practices further strengthens its position in the market.

CleanSpark's strategic initiatives are centered on scaling its mining operations while maintaining a competitive cost structure. This includes investing in the latest generation of mining hardware and exploring opportunities for further vertical integration. The company's ability to secure and operate large-scale mining facilities with a focus on low-carbon energy sources provides a distinct edge in an increasingly environmentally conscious market. For a broader perspective, you can also explore the Competitors Landscape of CleanSpark.

CleanSpark's commitment to sustainable mining practices and its focus on operational efficiency are key differentiators. The company continues to adapt to new trends and technology shifts, ensuring its long-term competitiveness. This is crucial in an industry marked by volatility and increasing competition. The company's recent acquisitions demonstrate its commitment to growth and its ability to execute its strategic vision.

CleanSpark acquired four new Bitcoin mining facilities in Mississippi in April 2024, adding 60 MW of capacity. Early in 2024, the company acquired a 20 MW campus in Sandersville, Georgia, which was expected to add 2.4 EH/s to its operational hash rate. These expansions significantly boosted its infrastructure and Bitcoin production capabilities.

A crucial strategic move has been the consistent expansion of Bitcoin mining capacity through strategic acquisitions. CleanSpark focuses on efficiency and cost control by continually upgrading its mining fleet with more efficient hardware. The company is also exploring opportunities for further vertical integration to enhance its operations.

CleanSpark's strong operational efficiency and significant scale provide a competitive advantage. Its commitment to sustainable mining practices, including the use of renewable energy sources, is a key differentiator. The company's ability to secure and operate large-scale mining facilities with a focus on low-carbon energy sources provides a distinct edge in an increasingly environmentally conscious market.

CleanSpark focuses on securing and operating large-scale mining facilities. The company prioritizes low-carbon energy sources to enhance its sustainability profile. Ongoing strategic initiatives center on scaling mining operations and maintaining a competitive cost structure.

CleanSpark is committed to sustainable mining practices, leveraging renewable energy sources to reduce its environmental impact. This approach aligns with the growing demand for environmentally responsible Bitcoin mining. The company's focus on sustainability enhances its brand reputation and long-term viability.

- Focus on low-carbon energy sources.

- Investing in the latest generation of mining hardware.

- Optimizing energy consumption.

- Exploring opportunities for further vertical integration.

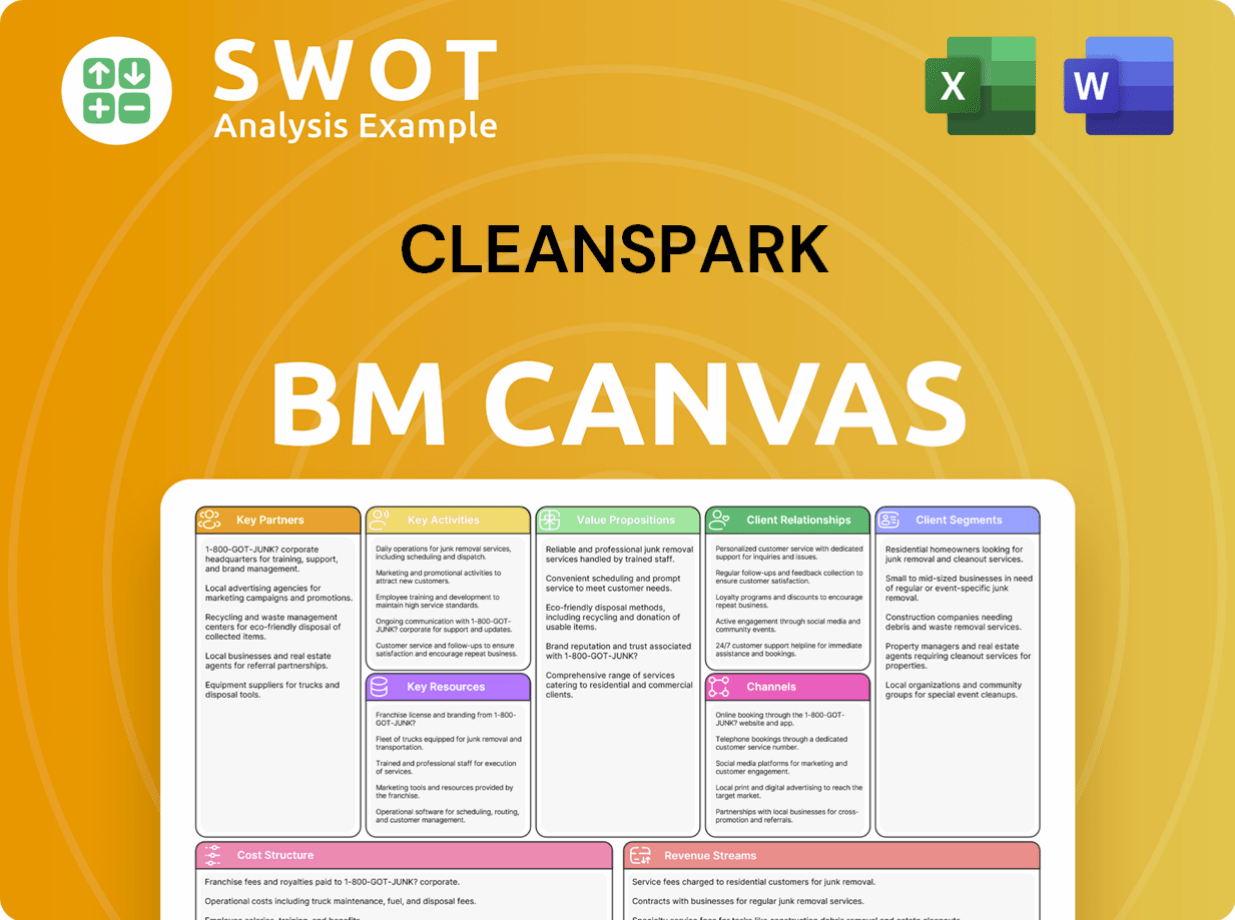

CleanSpark Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is CleanSpark Positioning Itself for Continued Success?

The CleanSpark company holds a prominent position within the Bitcoin mining industry, recognized as a top publicly traded Bitcoin miner based on operational hash rate. As of January 2024, the company's operational hash rate reached 10.6 EH/s, with a target of 16 EH/s by mid-2024, demonstrating its significant presence in the market. The firm's market share is growing through strategic acquisitions and organic expansion, reflecting its commitment to growth in the sector.

Key risks for the CleanSpark business include Bitcoin's volatile price, which directly impacts revenue and profitability. Regulatory changes concerning energy consumption and environmental impact could also create challenges. Competition may intensify with new entrants or technological advancements. Furthermore, fluctuations in energy prices represent a significant operational risk.

The CleanSpark company is a major player in the Bitcoin mining industry, consistently ranking among the top publicly traded miners. Its expanding market share is a result of strategic acquisitions and organic growth. The company focuses on increasing its operational hash rate to maintain its competitive edge.

The primary risk for CleanSpark is the volatile price of Bitcoin, which directly affects its financial performance. Regulatory changes and increased competition also pose challenges. Fluctuations in energy prices are a significant operational risk, impacting the company's profitability.

The future of CleanSpark hinges on the broader adoption of Bitcoin and its ability to maintain operational efficiency. The company plans to scale its high-efficiency Bitcoin mining operations. Its success depends on navigating regulatory and market uncertainties.

The company's operational strategies include expanding its mining fleet and optimizing energy efficiency. The focus is on sustainable growth and maximizing shareholder value. The firm explores new energy solutions to enhance its competitive advantage.

The company's strategic initiatives are focused on expanding its mining fleet, improving energy efficiency, and potentially exploring new energy solutions. The leadership consistently emphasizes sustainable growth and maximizing shareholder value through efficient Bitcoin production. The future outlook for CleanSpark depends on Bitcoin's broader adoption and the company's ability to maintain operational efficiency and a competitive cost structure while managing market uncertainties. For more details, see the article about Owners & Shareholders of CleanSpark.

The company's success is tied to its ability to navigate the volatile Bitcoin market and regulatory changes. Maintaining operational efficiency and a competitive cost structure are crucial. The company's future prospects depend on its ability to adapt to market dynamics.

- Expansion of mining fleet.

- Optimization of energy efficiency.

- Exploration of new energy solutions.

- Sustainable growth and shareholder value.

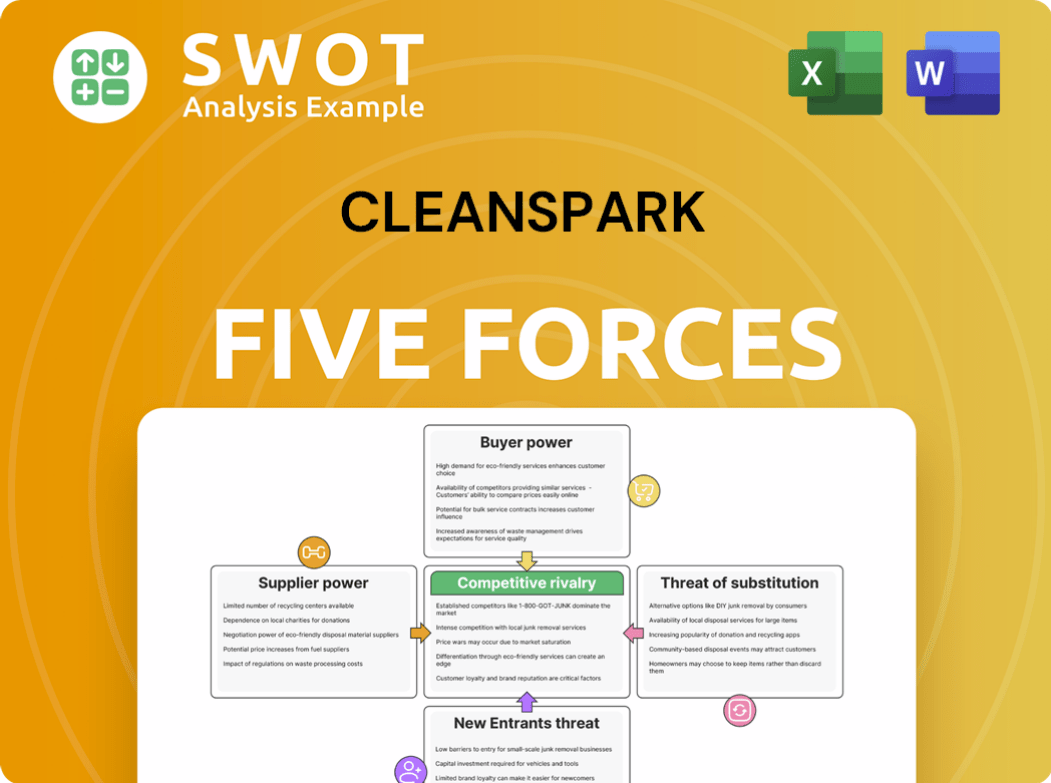

CleanSpark Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CleanSpark Company?

- What is Competitive Landscape of CleanSpark Company?

- What is Growth Strategy and Future Prospects of CleanSpark Company?

- What is Sales and Marketing Strategy of CleanSpark Company?

- What is Brief History of CleanSpark Company?

- Who Owns CleanSpark Company?

- What is Customer Demographics and Target Market of CleanSpark Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.