CRH Bundle

How Did the CRH Company Build a Global Empire?

From its humble beginnings, the CRH SWOT Analysis reveals a fascinating journey. Established in 1970 as an Irish company, CRH, originally Cement Roadstone Holdings, has transformed into a global leader. This evolution showcases a remarkable ability to adapt and thrive within the dynamic building materials sector. The CRH history is a testament to strategic vision and relentless expansion.

This brief history of CRH plc will explore the key milestones that shaped its growth. Discover how this Irish company became a dominant force in the construction industry, impacting global infrastructure. We'll examine CRH's early years, its growth strategy, and the acquisitions that fueled its expansion, offering insights into its current market capitalization and global presence.

What is the CRH Founding Story?

The CRH company, a global leader in building materials, has a fascinating founding story. Understanding the CRH history provides valuable insights into its evolution and success. The company's origins are rooted in a strategic merger that laid the groundwork for its future expansion and dominance in the construction industry.

The story begins on March 31, 1970, when Cement Ltd. and Roadstone Ltd. joined forces. This merger created what we know today as CRH. This pivotal moment was driven by a vision to build a stronger, more diversified entity capable of competing on a larger scale. The merger was a strategic move to combine the strengths of both companies.

The original business model focused on integrating the production and distribution of essential building materials. This approach allowed CRH to offer comprehensive solutions to the construction industry. Their initial product offerings included cement, aggregates, and asphalt. The merger was an all-share deal, demonstrating a shared commitment to the new venture. From the outset, CRH had a vision beyond Ireland, recognizing the need for international diversification. This early ambition set the stage for CRH's global leadership.

CRH's founding in 1970 marked the beginning of its journey in the building materials sector.

- Merger of Cement Ltd. and Roadstone Ltd.: This strategic move combined the strengths of two established Irish companies.

- Vision for Growth: The merger was driven by a shared vision to create a more robust and diversified entity.

- Initial Business Model: Focused on integrating the production and distribution of essential building materials.

- Early International Ambition: Recognizing the need for diversification beyond Ireland.

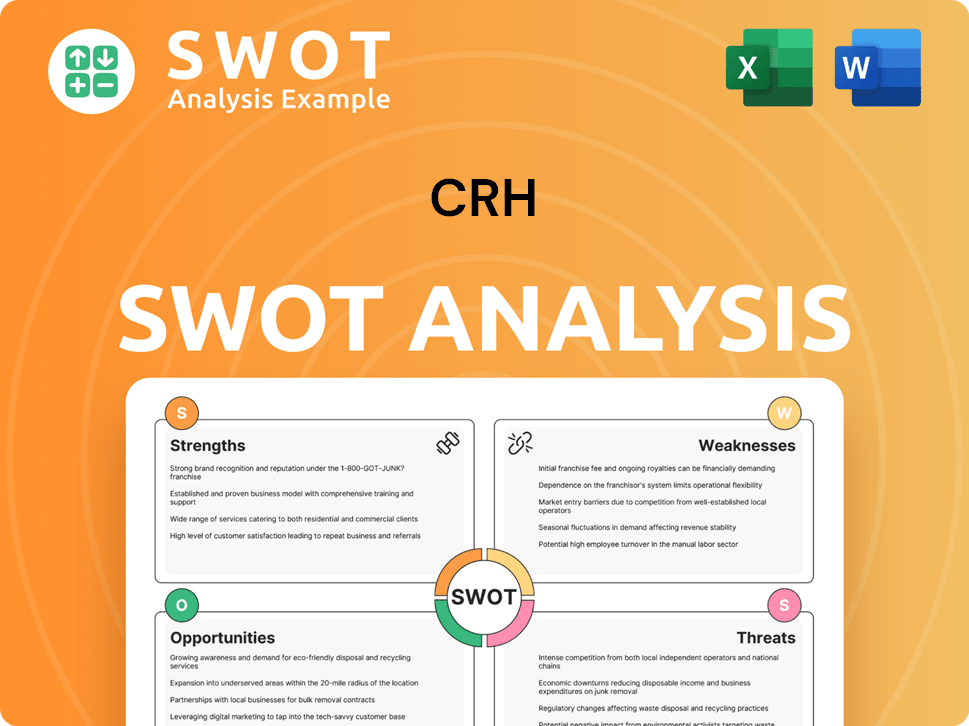

CRH SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of CRH?

The early growth and expansion of the CRH company were characterized by a strategic focus on international diversification and enhancing its product portfolio. Following its formation, the CRH group quickly sought growth opportunities beyond its initial market. This involved strategic acquisitions and a focus on becoming a leading player in the building materials sector.

In 1973, the CRH company expanded internationally by acquiring Van Neerbos in the Netherlands, a concrete products and builders' merchanting business. This marked its first significant international acquisition. This move set the stage for future growth by acquiring established regional players in the construction industry.

The late 1970s and early 1980s saw CRH entering the United States, a crucial market for long-term growth. The acquisition of Amasco in 1978, involved in asphalt and aggregates, provided a strong foothold in North America. The North American market eventually became CRH's largest revenue generator.

Throughout the 1980s and 1990s, CRH continued its acquisition-led growth strategy, expanding into new geographical markets across Europe and North America. Key acquisitions included significant players in Germany, Spain, and the UK. This strategy enabled the company to adapt to varying market conditions.

By the turn of the millennium, CRH had transformed from an Irish company into a truly international building materials group. The company's growth was driven by its ability to integrate acquired businesses effectively. As of 2024, CRH operates in 30 countries, with a significant presence across multiple continents.

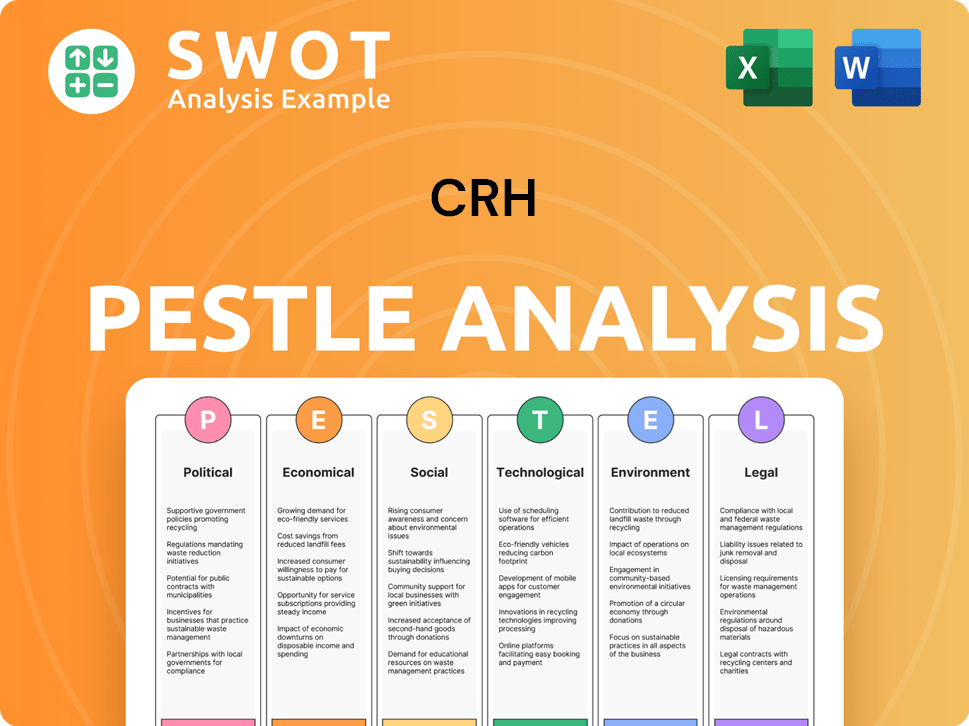

CRH PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in CRH history?

The CRH company has achieved several significant milestones throughout its history, demonstrating its growth and strategic evolution. A key moment was its listing on the New York Stock Exchange in September 2023, which enhanced its global reach and access to capital markets, reflecting its increasing importance in the construction industry.

| Year | Milestone |

|---|---|

| 1970 | Founded in Ireland through the merger of two Irish companies, creating a foundation in the building materials sector. |

| 1980s | Expanded through strategic acquisitions, growing its presence in the Irish and UK markets. |

| 1990s | Expanded into the United States, becoming a major player in the North American construction market. |

| 2000s | Continued global expansion, including acquisitions in Europe and Asia, solidifying its position as a global leader. |

| 2023 | Listed on the New York Stock Exchange, underscoring its global reach and enhanced access to capital markets. |

Innovation is a core element of the CRH history, particularly in the area of sustainable building materials. The company is committed to reducing carbon emissions, aiming to cut its absolute carbon emissions by 25% by 2030 and achieve net-zero emissions by 2050. This commitment is driving the development of lower-carbon cement and concrete technologies.

Focus on developing and implementing sustainable building materials to reduce the environmental impact of construction projects.

Targeting a 25% reduction in absolute carbon emissions by 2030 and net-zero emissions by 2050, demonstrating a proactive approach to environmental sustainability.

Investing in and developing low-carbon cement and concrete technologies to reduce the carbon footprint of its products.

Implementing digital solutions across its operations to improve efficiency, optimize processes, and enhance decision-making.

Focusing on circular economy principles, including waste reduction, material reuse, and recycling, to minimize environmental impact.

Continuously improving operational efficiency through process optimization, technology adoption, and supply chain management.

The CRH group has faced various challenges, including economic downturns and intense competition in the building materials and construction industry. The global financial crisis of 2008-2009 significantly impacted construction demand worldwide. The company has adapted by optimizing its operations and focusing on markets with growth potential.

Navigating the impact of economic recessions and fluctuations in construction demand, requiring strategic adjustments to maintain performance.

Managing the volatility of commodity prices, which can significantly affect production costs and profitability within the construction industry.

Facing intense competition from both large multinational corporations and smaller regional players, requiring continuous innovation and efficiency.

Operating in a highly fragmented global market, necessitating a decentralized operating model to effectively respond to regional needs and opportunities.

Addressing supply chain disruptions, including raw material shortages and logistical challenges, to ensure a consistent supply of building materials.

Adapting to evolving regulations and environmental standards, particularly those related to carbon emissions and sustainable building practices.

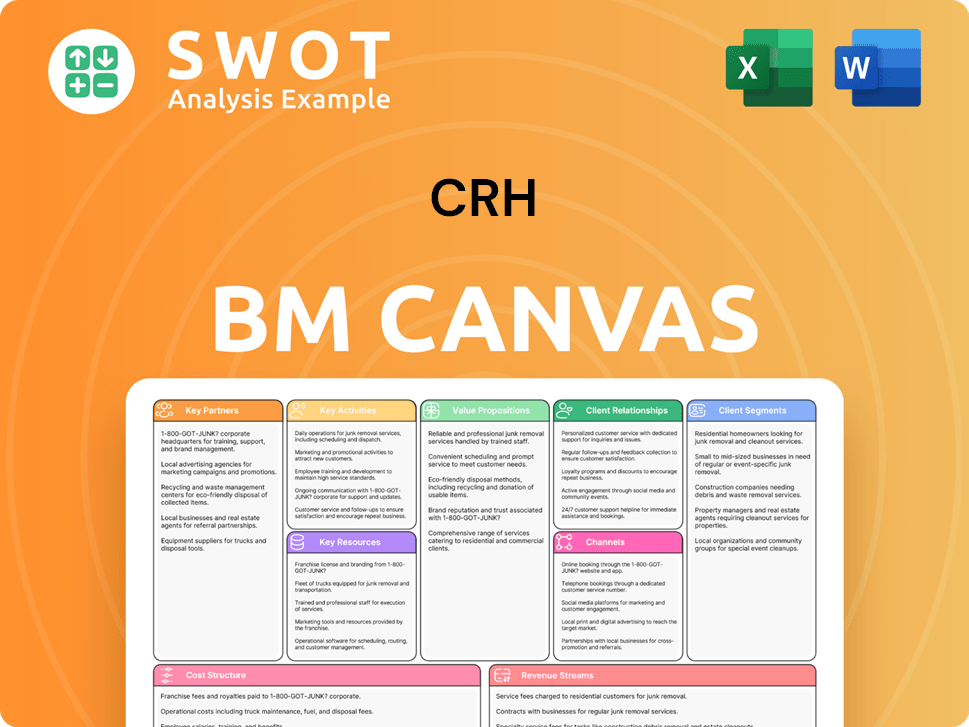

CRH Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for CRH?

The CRH company's journey, from its origins to its current global stature, showcases a history marked by strategic growth and adaptability. The CRH group's evolution reflects significant milestones, including early international expansions and major acquisitions that solidified its position in the construction industry. The CRH history is a prime example of how strategic decisions can shape a company's trajectory.

| Year | Key Event |

|---|---|

| 1970 | Formation of Cement Roadstone Holdings (CRH) through the merger of Cement Ltd. and Roadstone Ltd. |

| 1973 | First international expansion with the acquisition of Van Neerbos in the Netherlands. |

| 1978 | Entry into the North American market with the acquisition of Amasco. |

| 1980s-1990s | Continued expansion across Europe and North America through numerous acquisitions. |

| 2000s | Significant growth in emerging markets and further consolidation in core regions. |

| 2015 | Major acquisition of assets from LafargeHolcim in North America, solidifying its market leadership. |

| 2020 | Celebrated 50 years of operations, reflecting on its journey from a regional player to a global leader. |

| September 2023 | Primary listing moved to the New York Stock Exchange (NYSE), underscoring its focus on the North American market. |

| February 2024 | Reported strong financial results for 2023, with sales of $34.9 billion and an adjusted EBITDA of $6.2 billion. |

| May 2024 | Announced a new $300 million share buyback program, demonstrating confidence in future performance. |

CRH is committed to sustainable building solutions, aiming for a 25% reduction in absolute carbon emissions by 2030 and net-zero by 2050. This commitment reflects a broader trend in the construction industry towards environmentally responsible practices. The company's focus on sustainability is a key element of its long-term strategy. These initiatives are driven by both regulatory pressures and market demands.

CRH is exploring opportunities in digitalization and advanced manufacturing to improve operational efficiency and product innovation. These advancements are designed to enhance competitiveness and drive growth. This includes implementing new technologies across its operations. Digital transformation is essential for the future of the building materials sector.

With its primary listing on the NYSE, CRH is strategically positioned to capitalize on infrastructure spending in North America. Demand for building materials remains robust in this key region. This focus is supported by favorable market fundamentals and government investments. The company is well-placed to benefit from ongoing infrastructure projects.

Analysts predict continued growth for CRH, driven by strong market fundamentals and its commitment to sustainability and operational excellence. The recent financial results, including $34.9 billion in sales and an adjusted EBITDA of $6.2 billion in February 2024, demonstrate the company's strong performance. For more insights, you can also explore the Competitors Landscape of CRH.

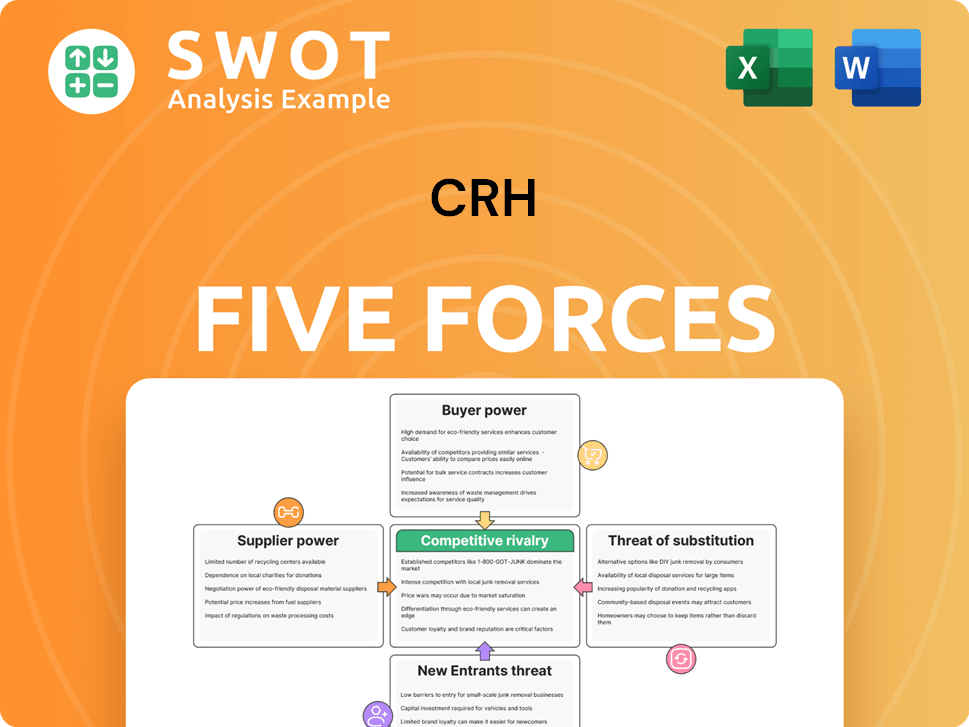

CRH Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of CRH Company?

- What is Growth Strategy and Future Prospects of CRH Company?

- How Does CRH Company Work?

- What is Sales and Marketing Strategy of CRH Company?

- What is Brief History of CRH Company?

- Who Owns CRH Company?

- What is Customer Demographics and Target Market of CRH Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.