CRH Bundle

Can CRH Continue Its Ascent in the Building Materials Industry?

CRH, a global titan in building materials, has strategically positioned itself for enduring success, but what does the future hold? The company's recent redomiciliation to the U.S. in 2023 signals a bold move to capitalize on the world's largest market and enhance financial flexibility. This strategic shift is just one facet of CRH's evolving CRH SWOT Analysis, which is critical for understanding its growth trajectory.

This exploration into CRH's growth strategy will examine its strategic initiatives and expansion plans, especially in North America, providing a comprehensive CRH company analysis. We'll dissect the CRH financial performance and assess its long term growth potential within the dynamic construction materials market. Analyzing the CRH future prospects involves understanding its competitive landscape, including the impact of inflation, and its digital transformation strategy, offering insights into potential CRH investment opportunities and the company's sustainability strategy.

How Is CRH Expanding Its Reach?

The growth strategy of CRH is built on a foundation of strategic acquisitions, organic growth, and targeted market expansion. This approach is particularly focused on North America. The company's ability to integrate new businesses effectively, thanks to its decentralized operating model, is a key factor in its success.

A significant portion of CRH's expansion strategy involves bolt-on acquisitions. These acquisitions help to enhance product offerings and broaden geographical reach. In 2023, CRH completed 22 bolt-on acquisitions, representing a total consideration of roughly $800 million, which strengthened its market positions.

CRH's strategic initiatives are heavily influenced by the North American market. This is driven by the promising long-term demand for infrastructure and construction projects. The company's operations in North America accounted for approximately 75% of its EBITDA in 2023, highlighting the region's importance to its growth trajectory. For more details on the company's structure, you can read about Owners & Shareholders of CRH.

CRH frequently uses bolt-on acquisitions to expand its market presence and product offerings. These acquisitions are a core part of CRH's strategy, allowing for the integration of new businesses. This approach has been effective in enhancing both the company's geographical reach and its product range.

North America is a key focus area for CRH's expansion plans, driven by strong demand in infrastructure and construction. The region represents a significant portion of the company's financial performance. This strategic focus is expected to continue, capitalizing on the region's growth potential.

CRH is actively pursuing opportunities in renewable energy and green infrastructure projects. This aligns with global sustainability trends and helps diversify its revenue streams. Investments in sustainable products, like lower-carbon cement, support evolving customer needs and regulatory requirements.

The company aims to benefit from increased government spending on infrastructure. CRH is positioned to capitalize on the growing demand for sustainable building solutions. This includes offering products that meet environmental standards and supporting infrastructure development.

CRH's expansion strategy includes a strong emphasis on acquisitions, particularly in North America. The company is also focused on sustainable building solutions and renewable energy projects. These initiatives are designed to capitalize on infrastructure spending and evolving market demands.

- Strategic Acquisitions: Bolt-on acquisitions to enhance market position and product offerings.

- North American Market: Significant investment and focus due to strong demand and growth potential.

- Sustainability: Investments in lower-carbon products and green infrastructure projects.

- Government Spending: Capitalizing on increased spending on infrastructure projects.

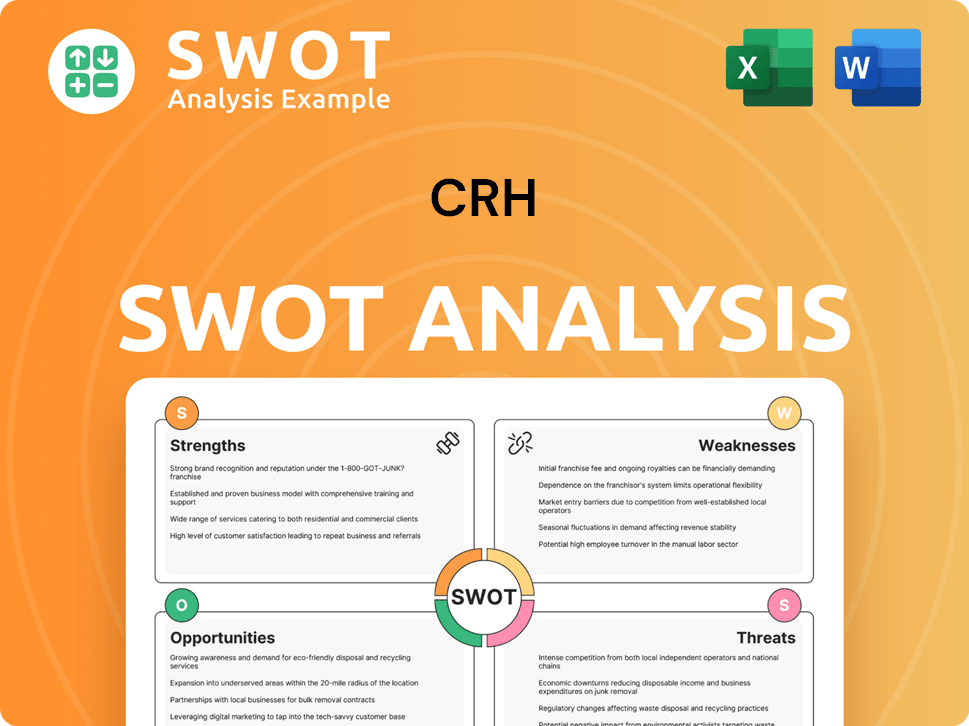

CRH SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CRH Invest in Innovation?

The company's approach to innovation and technology is central to its CRH growth strategy, focusing on digital transformation, advanced materials, and sustainable solutions. This strategy aims to improve operational efficiency, create new products, and reduce environmental impact. Innovation is a key driver for maintaining a competitive edge within the Construction materials market.

CRH invests significantly in research and development (R&D) to create innovative products and optimize existing ones. This includes developing lower-carbon products and solutions, such as advanced cement and concrete technologies, which are crucial for meeting the growing demand for sustainable construction practices. These efforts also contribute to the company's CRH future prospects and long-term growth potential.

Digitalization plays a crucial role in CRH's strategy, with initiatives aimed at improving supply chain management, optimizing production processes, and enhancing customer experience through data analytics and automation. The company explores cutting-edge technologies like AI and IoT to improve operational performance and decision-making. These technology investments support CRH’s strategic initiatives and enhance overall CRH financial performance.

CRH is actively implementing digital technologies across its operations. This includes using data analytics to improve decision-making and supply chain management. The goal is to enhance efficiency and customer experience.

The company focuses on developing innovative building materials. These materials are designed to be more durable, sustainable, and efficient. This drives the CRH company analysis and market competitiveness.

CRH prioritizes sustainability in its product development and operational practices. This includes the development of lower-carbon products and the use of renewable energy. This emphasis supports CRH ESG performance.

CRH invests heavily in research and development. These investments are focused on creating new products and optimizing existing ones. This is a key part of their CRH strategic initiatives 2024.

The company is exploring the use of AI and IoT technologies. These technologies aim to improve operational performance and decision-making processes. This contributes to CRH long term growth potential.

CRH is developing circular economy solutions within the building materials sector. This involves recycling construction and demolition waste. This supports CRH sustainability strategy.

CRH's innovation strategy is deeply integrated with sustainability initiatives, including investments in renewable energy sources and the development of circular economy solutions. These efforts are crucial for meeting environmental standards and enhancing market leadership within the Building materials industry.

- Lower-Carbon Products: Development of innovative cement and concrete technologies to reduce carbon emissions.

- Digitalization: Implementing data analytics and automation to improve supply chain management and optimize production.

- Renewable Energy: Investing in renewable energy sources to power operations.

- Circular Economy: Developing solutions for recycling construction and demolition waste.

- AI and IoT: Exploring the use of AI and IoT to enhance operational performance.

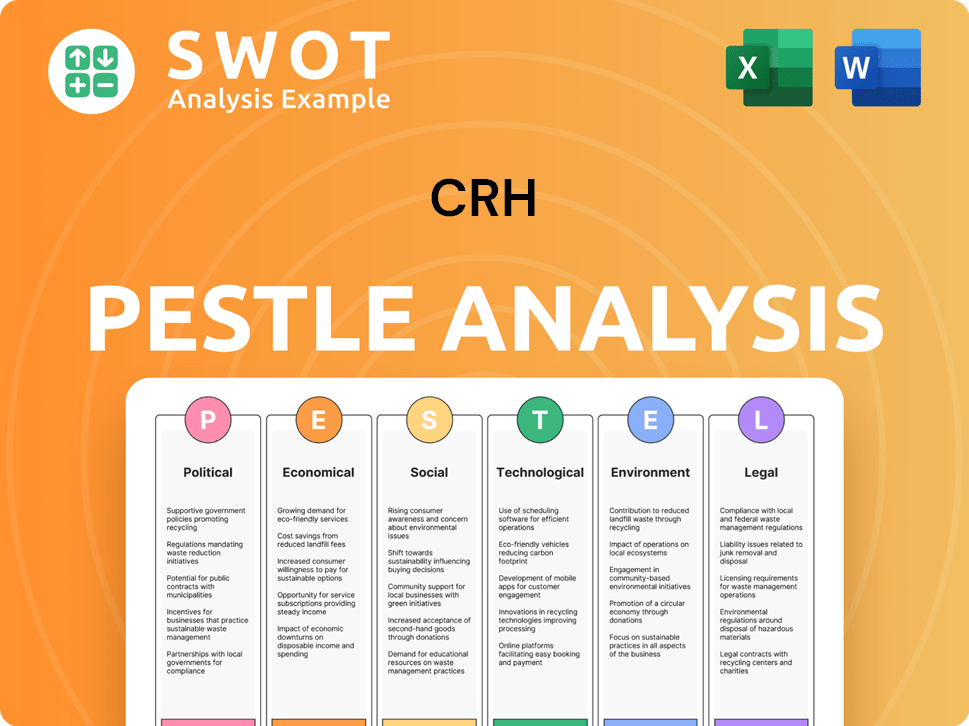

CRH PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is CRH’s Growth Forecast?

The financial outlook for CRH reflects a strong trajectory, underpinned by a strategic focus on key markets and disciplined capital allocation. The company's performance in 2023 showcased robust financial health, with record EBITDA and significant growth in adjusted earnings per share. This positive momentum is expected to continue, driven by resilient demand and strategic initiatives.

CRH's financial strategy emphasizes sustainable returns to shareholders through dividends and share buybacks, alongside strategic investments in high-growth areas. The company's strong balance sheet and investment-grade credit ratings further support its ability to fund future growth initiatives. This approach is designed to create long-term value for investors while navigating the dynamic construction materials market.

CRH anticipates continued growth, driven by resilient demand in key markets, particularly in North America, and the benefits of the U.S. Infrastructure Investment and Jobs Act. Analysts' forecasts generally project continued revenue growth and stable profit margins, supported by CRH's operational efficiencies and strategic acquisitions. The company's focus on operational excellence and strategic investments positions it well for future success in the building materials industry. For more insights into the company's performance, you can refer to a detailed CRH company analysis.

In 2023, CRH achieved a record EBITDA of $6.2 billion, a 13% increase compared to 2022. Adjusted earnings per share rose by 26% to $4.76. This strong financial performance highlights the company's operational efficiency and strategic focus.

CRH generated approximately $4.3 billion in free cash flow in 2023. This robust cash generation provides significant financial flexibility for ongoing investments, strategic acquisitions, and shareholder returns. This supports CRH's long term growth potential.

CRH's strategic focus on North America is a key driver of its growth. The company benefits from resilient demand and the U.S. Infrastructure Investment and Jobs Act. This strategic alignment positions CRH to capitalize on favorable market conditions and expansion plans in North America.

CRH emphasizes sustainable returns to shareholders through dividends and share buybacks. Strategic investments in high-growth areas are also a priority. This balanced approach aims to create long-term value and support CRH's investment opportunities.

CRH's growth strategy centers on expanding its presence in North America and leveraging its strong financial position. The company is focused on strategic acquisitions and operational efficiencies to drive revenue growth.

Analysts generally project continued revenue growth for CRH, supported by market demand and strategic initiatives. The company's revenue forecast is positively influenced by its strong market position and operational excellence.

CRH is managing the impact of inflation through pricing strategies and operational efficiencies. The company's ability to adapt to market dynamics is crucial. This helps maintain stable profit margins.

Key strategic initiatives for 2024 include further expansion in North America and optimizing operational performance. CRH is focused on enhancing its market share and improving its competitive landscape analysis.

While specific stock price predictions vary, analysts generally hold a positive outlook, reflecting the company's strong financial performance. The stock price is influenced by factors such as market conditions and CRH's strategic initiatives.

CRH continues to pursue strategic acquisitions and mergers to expand its market presence and product offerings. These activities are a key component of its growth strategy. This contributes to its long term growth potential.

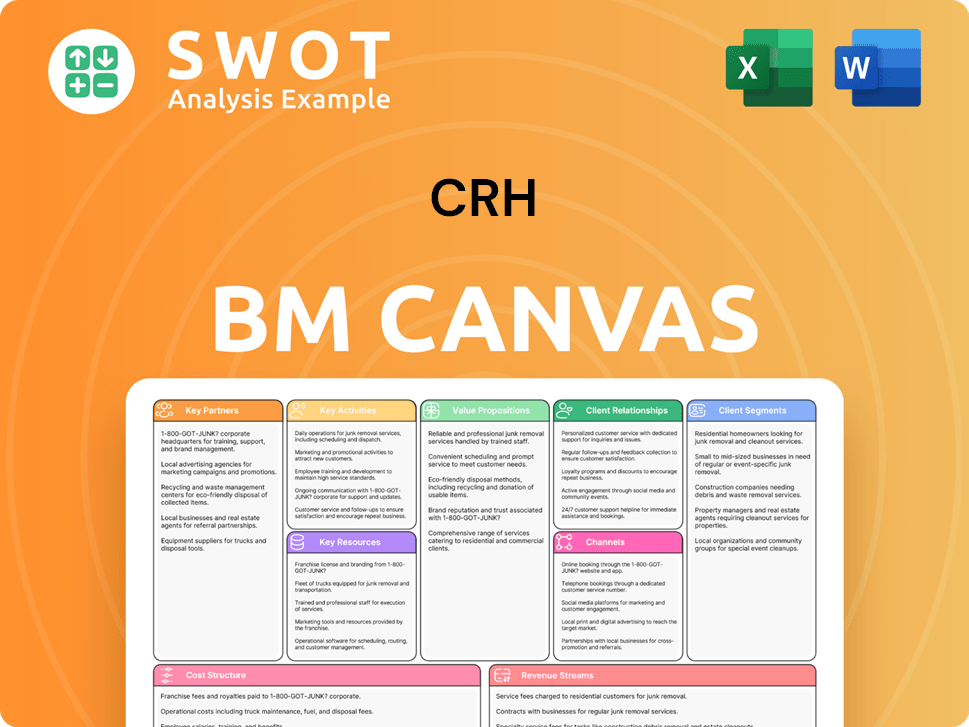

CRH Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow CRH’s Growth?

Assessing potential risks and obstacles is crucial when evaluating the CRH growth strategy. The CRH company analysis reveals that several factors could impact its future prospects. Understanding these challenges is essential for investors and stakeholders.

The building materials industry is highly competitive, with numerous players vying for market share. Economic downturns and shifts in government spending can significantly affect demand for CRH's products. Additionally, regulatory changes and supply chain issues pose ongoing challenges.

CRH's strategic initiatives in 2024 are influenced by various external factors. Geopolitical instability and trade tensions further complicate international operations. The company's ability to navigate these risks will be critical to its long-term success.

The construction materials market is intensely competitive, with both established firms and new entrants. This competition can squeeze profit margins and require continuous innovation. CRH faces rivals across various regions and product segments.

Fluctuations in construction activity, driven by economic cycles and interest rate changes, can significantly impact demand. A slowdown in construction can lead to decreased sales and lower profitability. Government spending policies also play a crucial role.

Regulatory changes, particularly those related to environmental protection and carbon emissions, pose risks and opportunities. Stricter regulations could increase operational costs or necessitate investments in new technologies. CRH must adapt to these changes.

Supply chain disruptions, including raw material shortages and transportation issues, can affect production and distribution. These vulnerabilities can lead to increased costs and delays. CRH needs robust supply chain management.

Geopolitical instability and trade tensions can complicate international operations, affecting market access and increasing costs. These factors can create uncertainty and impact CRH's global strategy. Navigating these challenges is vital.

Emerging risks include extreme weather events and the challenge of attracting and retaining skilled labor. These factors can disrupt operations and increase costs. CRH must proactively address these new challenges. For more details, see Marketing Strategy of CRH.

CRH addresses these risks through diversification across geographies and product lines. A robust risk management framework is essential. The company also focuses on operational efficiency and cost control to mitigate market volatility.

CRH's strong performance in 2023, despite inflationary pressures, demonstrated its ability to manage cost increases. Effective pricing and operational leverage were key. The company's ability to adapt is crucial for continued success.

Operational efficiency and cost control are vital for mitigating the impact of market volatility. CRH continuously seeks ways to improve its processes. This includes streamlining operations and reducing expenses to maintain profitability.

The increasing frequency of extreme weather events poses a growing threat to operations and supply chains. Attracting and retaining skilled labor is also a significant challenge. CRH must adapt to these evolving issues.

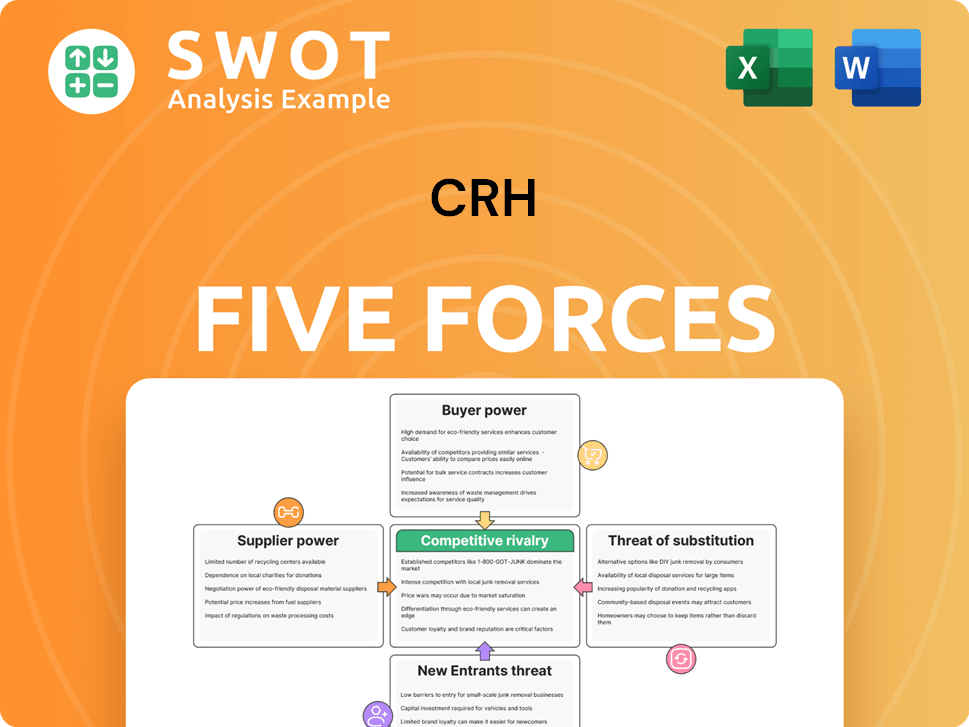

CRH Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.