CRH Bundle

How Does the CRH Company Thrive?

CRH, a titan in the building materials sector, isn't just constructing buildings; it's building a legacy of financial success. With impressive 2024 revenues of $35.6 billion and an 11th consecutive year of margin expansion, the CRH SWOT Analysis reveals the strategic prowess behind its enduring influence. This analysis explores the core of CRH's operations, revealing how this global leader maintains its competitive edge.

Delving into the CRH business model is essential for understanding its dominance in the construction industry. From cement to ready-mixed concrete, CRH's diverse product portfolio supports critical infrastructure projects worldwide. Its substantial market capitalization, approximately £53.81 billion as of February 2025, and a positive outlook for 2025, further demonstrate the strength of CRH operations and its potential for investors looking at CRH stock.

What Are the Key Operations Driving CRH’s Success?

The CRH company creates value by providing integrated solutions across the construction value chain. This approach combines essential materials, building products, and construction services. The company caters to diverse customer segments including transportation, infrastructure, and non-residential construction projects.

CRH's operational processes are extensive, encompassing manufacturing, sourcing, technology, logistics, sales, and customer service. A decentralized structure empowers local businesses to meet specific market needs. This strategy, along with a focus on commercial management and operational efficiencies, has been key to its performance.

CRH's supply chain is supported by a global network of manufacturing and production sites. Its capabilities and expertise make it a valuable partner for large-scale projects. The integrated offering allows CRH to build relationships higher up in the decision-making process, becoming a preferred supplier. This strategy supports the transition to a more sustainable built environment.

CRH's core operations involve manufacturing and supplying building materials, products, and services. These include aggregates, cement, and value-added products. The company also offers construction services to support various projects.

The value proposition of CRH lies in its integrated solutions strategy. By combining materials, products, and services, CRH offers complete solutions. This approach allows the company to build strong customer relationships and support sustainable construction practices.

CRH's operational efficiency is supported by significant investments in information and operational technology. The company's decentralized structure enables local businesses to cater to specific market needs, contributing to its success. CRH's focus on customer-connected solutions allows it to provide innovative solutions.

- Manufacturing Network: CRH operates with a global network of 3,100 manufacturing sites across 28 countries.

- Margin Expansion: CRH achieved its 11th consecutive year of margin expansion in 2024.

- Customer Segments: CRH serves a broad range of customers in transportation, infrastructure, and non-residential construction.

- Integrated Offering: CRH's integrated approach allows it to build relationships higher up in the decision-making process.

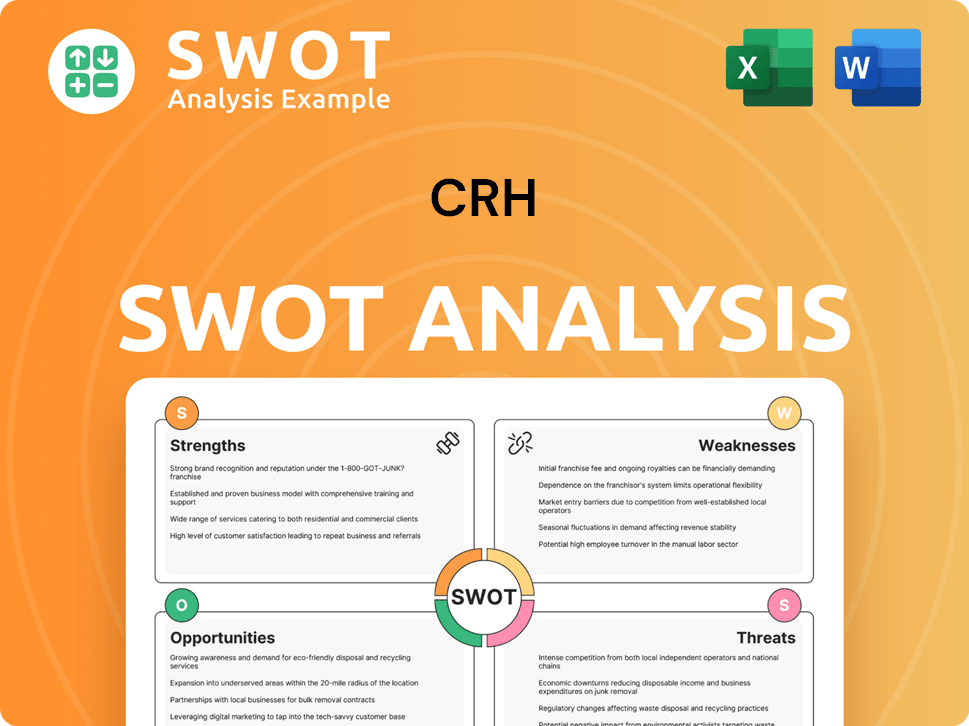

CRH SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CRH Make Money?

The CRH company generates revenue primarily through the sale of building materials and solutions. This includes a wide range of products essential for the construction industry. Understanding the revenue streams and monetization strategies of CRH is crucial for investors and stakeholders.

In 2024, CRH reported total revenues of $35.6 billion, demonstrating its significant market presence. The company's performance in the first quarter of 2025 showed continued growth, with revenues reaching $6.8 billion, a 3% increase compared to Q1 2024. This growth highlights the effectiveness of its strategies in a dynamic market.

The CRH business model focuses on customer-connected solutions. This approach integrates materials, products, and services to better serve customer needs and encourage repeat business. This strategy allows for comprehensive offerings, potentially including bundled services or solutions that enhance value and profitability.

The primary revenue source for CRH is the sale of building materials. These include cement, aggregates, asphalt, and ready-mixed concrete. Value-added products also contribute to the revenue stream.

The customer-connected solutions approach is a key monetization strategy. Commercial excellence measures and operational efficiencies also play a vital role in financial performance. Strategic acquisitions and divestitures further influence revenue.

Approximately 75% of CRH's profits come from North America. This strong presence in higher-growth markets, particularly those with supportive government infrastructure spending, is a key driver of revenue.

In 2024, CRH completed 40 acquisitions for a total consideration of $5.0 billion, expanding its reach and product offerings. The largest was a $2.1 billion acquisition of cement and ready-mixed concrete assets in Texas.

In 2024, CRH realized $1.4 billion from divestitures, primarily from European lime operations. This strategic portfolio management supports overall value creation and revenue optimization.

The company's focus on commercial excellence measures and operational efficiencies has consistently contributed to its financial performance and margin expansion. This focus is important for the CRH operations.

Several factors significantly influence CRH's revenue streams and overall financial success. These include geographic concentration, strategic acquisitions and divestitures, and the company's customer-connected solutions approach. For more insights, consider reading about the Target Market of CRH.

- Geographic Footprint: North America accounts for a significant portion of profits.

- Strategic M&A: Acquisitions and divestitures actively shape the revenue base.

- Customer-Connected Solutions: This approach aims to drive repeat business.

- Operational Efficiencies: Commercial excellence measures support margin expansion.

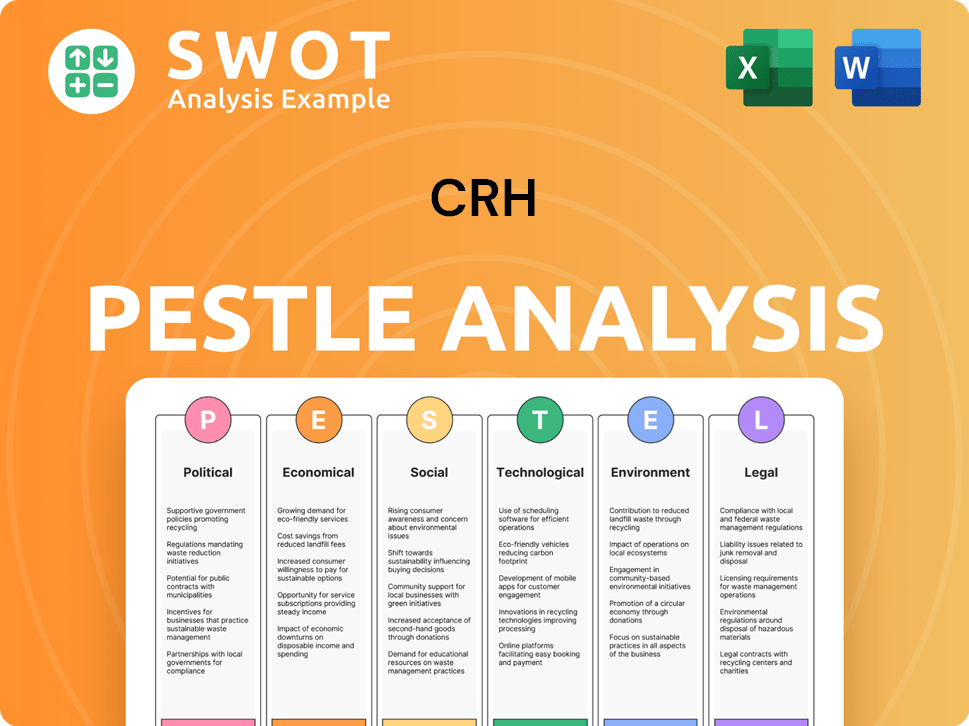

CRH PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped CRH’s Business Model?

The CRH company has established itself as a leading player in the building materials industry, marked by significant milestones and strategic initiatives. These actions have shaped its operational framework and financial outcomes. A key aspect of its evolution has been the transformation into a major building materials manufacturer, achieved through a combination of strategic acquisitions and disposals over the past decade. This approach has been central to its growth trajectory.

The CRH business model involves a customer-connected solutions strategy, which has been a key factor in its resilience and growth. This strategy, along with significant investments in acquisitions, has helped offset operational and market challenges, such as adverse weather conditions in various regions. The company's ability to consistently deliver on this strategy underscores its adaptability and commitment to customer needs.

In 2024, the company invested $5.0 billion in 40 value-accretive acquisitions, a substantial increase from $0.7 billion in 2023. This included a $2.1 billion acquisition of cement and ready-mixed concrete assets in Texas and a majority stake in Adbri Ltd, a market leader in cement and aggregates in Australia, for $0.8 billion. These moves highlight the company's aggressive growth strategy and its focus on expanding its market presence.

The company's journey includes significant acquisitions and strategic shifts that have solidified its position in the construction industry. These milestones reflect a proactive approach to market dynamics and operational excellence. Recent acquisitions, like those in Texas and Australia, are prime examples of its growth strategy.

A primary strategic move has been the expansion through acquisitions and disposals, transforming it into a leading building materials manufacturer. The company's focus on customer-connected solutions and its ability to adapt to market changes have been crucial. These strategic moves have enabled it to maintain a competitive edge.

The company's competitive advantages are multifaceted, including unmatched scale, differentiated strategies, and technological leadership. Its integrated offerings allow it to build strong customer relationships. The company's financial strength, with €3.1 billion in cash, supports future growth initiatives.

The company is actively involved in sustainability through initiatives like CRH Ventures, which launched a Sustainable Building Materials Accelerator in October 2024. This accelerator supports startups focused on reducing emissions, waste, and improving energy efficiency in construction. These initiatives demonstrate a commitment to sustainable practices.

The company's competitive edge comes from its scale, differentiated strategies, and technological leadership. The company's brand strength, technology leadership, and economies of scale are evident in its operations. The company's integrated approach allows it to build stronger customer relationships and become a preferred supplier.

- Operates 7 dedicated innovation centers across North America and Europe.

- Holds 243 active patents in construction materials technology.

- Maintains a robust balance sheet with €3.1 billion in cash and undrawn committed facilities.

- Adapts to new trends through initiatives like CRH Ventures.

The company's consistent focus on strategic acquisitions, operational efficiencies, and customer-centric solutions has positioned it favorably within the construction industry. For more details on the company's growth strategy, you can read Growth Strategy of CRH.

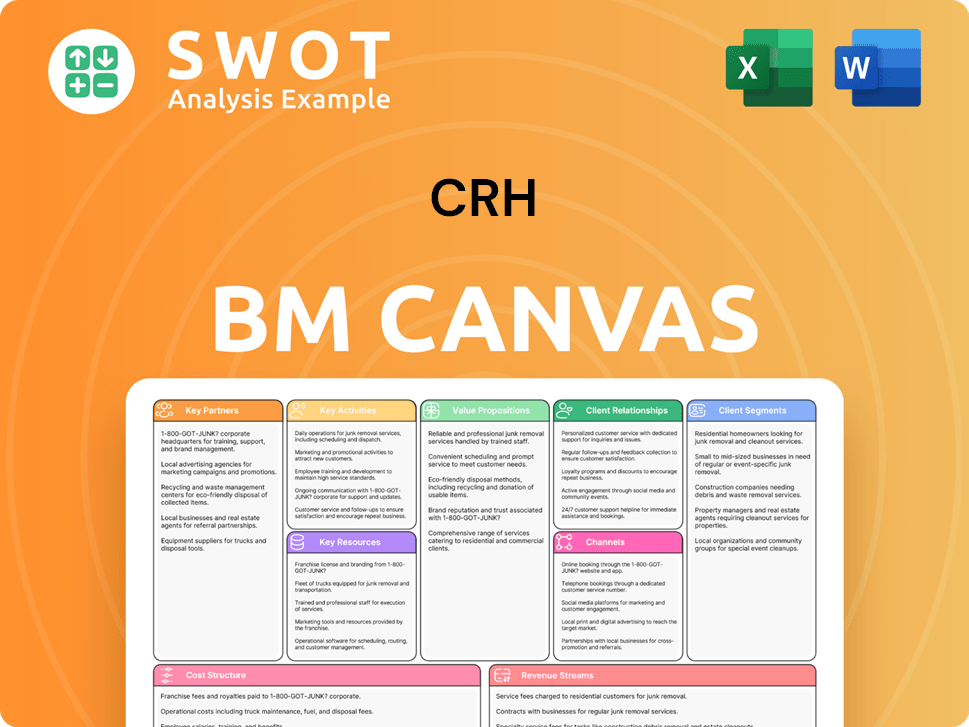

CRH Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is CRH Positioning Itself for Continued Success?

The CRH company holds a leading position in the global building materials sector, operating across 29 countries. It is a major player in North America and Europe, and the largest roadbuilder in North America. This strong market presence allows the company to capitalize on increased infrastructure spending and construction demands.

However, the CRH business model faces risks related to macroeconomic factors like infrastructure spending, housing starts, and interest rates. Supply chain issues and regulatory changes also present challenges. The construction industry's competitiveness necessitates constant innovation and operational efficiency to maintain its strong market position. The company's diverse portfolio, geographic reach, and operational efficiency are critical for long-term success.

The CRH company is a global leader in building materials, with significant market share in North America and Europe. Its extensive operations across 29 countries provide a broad base for revenue generation. As the largest roadbuilder in North America, it's well-positioned to benefit from infrastructure investments.

Key risks include macroeconomic factors such as fluctuations in infrastructure spending and interest rates, which directly impact demand. Supply chain disruptions and regulatory changes also pose potential challenges. Competition from multinational and regional players requires continuous innovation and efficiency improvements.

The outlook for 2025 is positive, with net income projected to be between $3.7 billion and $4.1 billion. Adjusted EBITDA is expected to range from $7.3 billion to $7.7 billion. This positive outlook is supported by strong demand in key markets and ongoing strategic initiatives.

The company focuses on customer-connected solutions, disciplined portfolio management, and investment in growth capital expenditure. They are also committed to providing innovative solutions that support a more sustainable built environment. These strategies are designed to drive profitable growth.

The company's financial guidance for 2025 indicates strong performance, reflecting confidence in its strategic initiatives and market position. The forecast anticipates sustained growth driven by key market demand.

- Net income is projected to be between $3.7 billion and $4.1 billion.

- Adjusted EBITDA is expected to be between $7.3 billion and $7.7 billion.

- The company plans to continue its customer-connected solutions strategy.

- Investments in growth capital expenditure will continue.

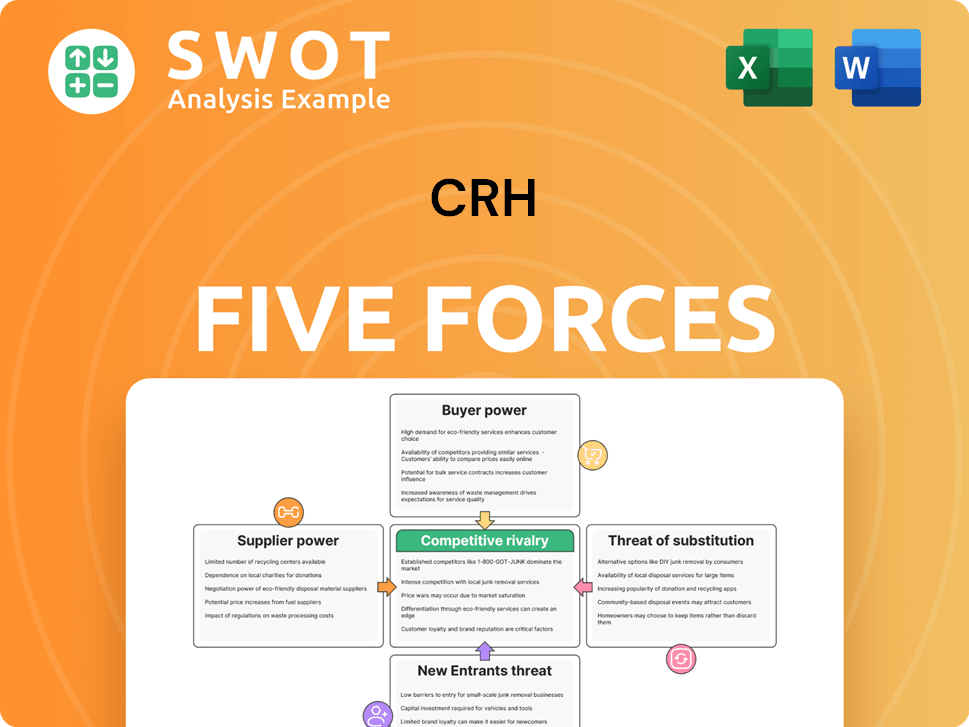

CRH Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CRH Company?

- What is Competitive Landscape of CRH Company?

- What is Growth Strategy and Future Prospects of CRH Company?

- What is Sales and Marketing Strategy of CRH Company?

- What is Brief History of CRH Company?

- Who Owns CRH Company?

- What is Customer Demographics and Target Market of CRH Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.