CRH Bundle

Who Really Owns CRH?

Delving into the CRH SWOT Analysis reveals a global building materials giant, but who truly steers this massive ship? Understanding the CRH ownership structure is key to unlocking its strategic moves and future potential. From its Dublin headquarters to the New York Stock Exchange, CRH's journey offers a fascinating case study in corporate evolution.

This exploration of CRH ownership will uncover the key players behind this industry leader. We'll examine the evolution of CRH plc, from its roots to its present-day market capitalization, and identify the major shareholders influencing its decisions. Discover how to invest in CRH and gain insights into CRH stock, its financial performance, and the individuals who shape its destiny, including the CEO and the CRH executive team.

Who Founded CRH?

The story of CRH's beginnings centers on a strategic merger, not a traditional startup. CRH, a major player in the building materials industry, emerged in 1970 from the union of Cement Limited and Roadstone Limited, two well-established Irish companies. This consolidation aimed to create a stronger entity within the Irish market.

Tracing the precise founders and initial ownership details of the pre-merger companies proves challenging due to limited public historical records. The merger itself was the defining moment, bringing together existing shareholders rather than introducing new founders in the conventional sense. Therefore, pinpointing the original equity splits or early investors in the newly formed CRH is difficult.

The focus of CRH immediately after its formation was on integrating the operations of Cement Limited and Roadstone Limited. This integration was aimed at building a more efficient and dominant presence in the Irish building materials market. Details regarding early ownership disputes or buyouts from this formative period are not readily available in the company's public historical narrative. The core vision, reflected in the merger, was to establish a robust, unified entity capable of driving growth and efficiency in the sector.

The early ownership of CRH, or CRH ownership, primarily involved the shareholders of the two merged entities, Cement Limited and Roadstone Limited. Publicly available information doesn't specify early backers or angel investors. The strategic focus was on integrating operations to become a dominant force in the Irish building materials market. If you're interested in understanding the competitive environment, you might find insights in the Competitors Landscape of CRH.

- The merger of Cement Limited and Roadstone Limited formed CRH in 1970.

- Specific details on initial equity splits and early investors are not readily available.

- The primary goal was to integrate operations and dominate the Irish market.

- Focus on the integration of operations to create a more efficient and dominant player.

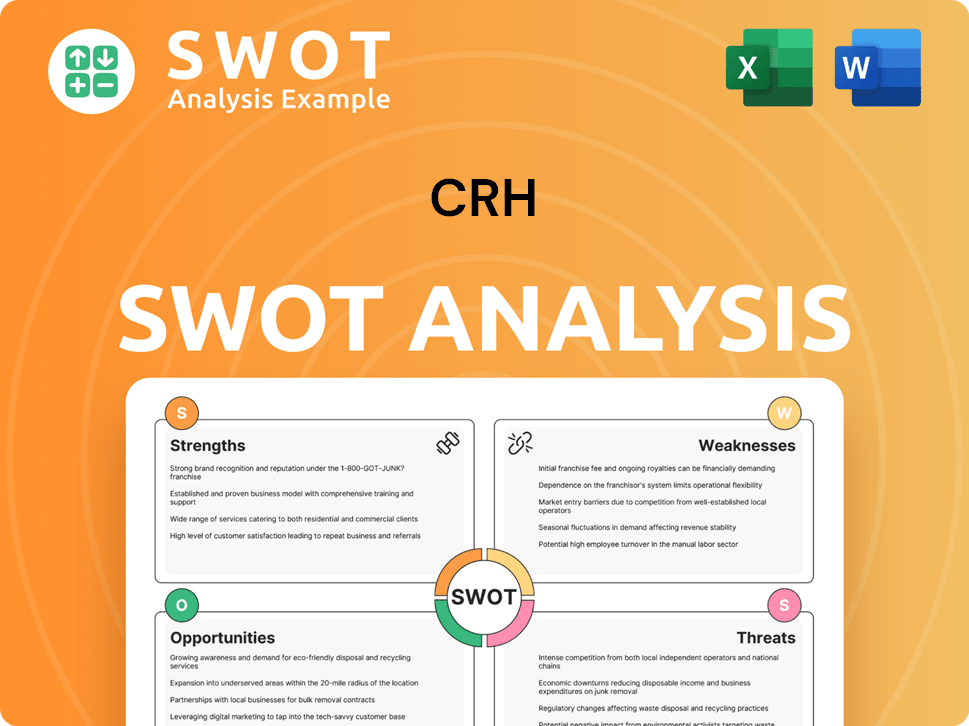

CRH SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has CRH’s Ownership Changed Over Time?

The evolution of CRH's ownership structure has been shaped significantly since its inception in 1970. A pivotal moment was its initial public offering (IPO), which transitioned the company from private to public ownership. Subsequent shifts in major shareholding have further defined its ownership landscape. The company's listing on the New York Stock Exchange (NYSE) in September 2023, with its primary listing, marked a strategic move to broaden its investor base and increase liquidity. This transition followed its previous listings on the London Stock Exchange and Euronext Dublin.

CRH's shift to public trading has made it a key player in the construction materials sector, attracting a diverse range of investors. The company's history and evolution are detailed in Growth Strategy of CRH.

| Key Event | Impact on Ownership | Date |

|---|---|---|

| Initial Public Offering (IPO) | Transition from private to public ownership, opening up shares to a wider investor base. | Early years following formation in 1970 |

| Listing on London Stock Exchange and Euronext Dublin | Provided access to European investors and increased trading volume. | Historically, before September 2023 |

| Primary Listing on the New York Stock Exchange (NYSE) | Attracted North American investors, potentially altering the geographic distribution of shareholders and increasing liquidity. | September 2023 |

As of early 2024, the major stakeholders in CRH (CRH plc) are predominantly institutional investors. These include large asset management firms, mutual funds, and index funds. Vanguard Group Inc. held approximately 9.38% of CRH plc as of December 31, 2023, while BlackRock Inc. held around 6.5% as of the same date. Other significant institutional holders include Capital Research Global Investors and Norges Bank Investment Management. Individual insider ownership, including shares held by the executive management and board of directors, represents a smaller percentage of the total outstanding shares.

CRH's ownership structure is largely dominated by institutional investors, reflecting its status as a major publicly traded company. The shift to the NYSE as its primary listing is expected to further attract North American investors.

- Institutional investors hold the majority of CRH shares.

- The NYSE listing aims to increase investor access and liquidity.

- Changes in shareholding influence company strategy and governance.

- Individual insider ownership is a smaller percentage.

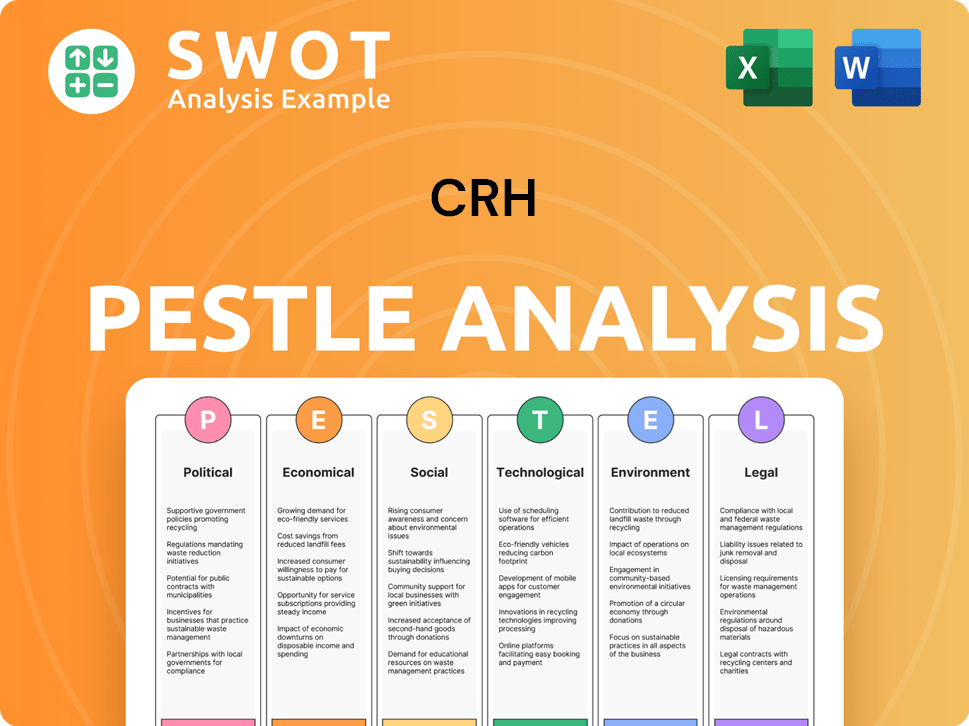

CRH PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on CRH’s Board?

The current board of directors of CRH reflects a commitment to strong corporate governance, comprising a mix of independent non-executive directors and executive directors. As of April 2025, the board includes individuals with extensive experience across various industries, ensuring diverse perspectives in strategic decision-making. Albert Manifold serves as the Chief Executive, and Jim Mintern as the Chief Financial Officer, representing the executive leadership on the board. Caroline Dowling serves as the Chair of the Board.

The board also includes several independent non-executive directors, such as Martin Bates, Lisa Hook, and Frank O'Keeffe, among others, who bring external expertise and oversight. These independent directors typically do not represent specific major shareholders, but rather provide impartial guidance and challenge to management. Understanding the Brief History of CRH can provide further context to the evolution of its leadership structure.

| Director | Position | Notes |

|---|---|---|

| Albert Manifold | Chief Executive | Executive Director |

| Jim Mintern | Chief Financial Officer | Executive Director |

| Caroline Dowling | Chair | Non-Executive Director |

| Martin Bates | Non-Executive Director | Independent |

| Lisa Hook | Non-Executive Director | Independent |

| Frank O'Keeffe | Non-Executive Director | Independent |

CRH operates under a one-share-one-vote structure, ensuring proportional voting power based on shareholding. Major institutional shareholders, such as Vanguard and BlackRock, hold significant voting power due to their large stakes. There are no indications of dual-class shares or special voting rights. This structure promotes equitable representation among shareholders. The company's governance framework emphasizes transparency and accountability to its broad base of shareholders, particularly following its primary listing on the New York Stock Exchange.

CRH's governance structure is designed to ensure fair representation and transparency for all shareholders. The one-share-one-vote system means voting power is directly proportional to share ownership. This approach is crucial for understanding who owns CRH and how decisions are made.

- The board includes a mix of executive and independent directors.

- Major shareholders like Vanguard and BlackRock have significant influence.

- CRH's structure promotes equitable representation.

- The company emphasizes transparency and accountability.

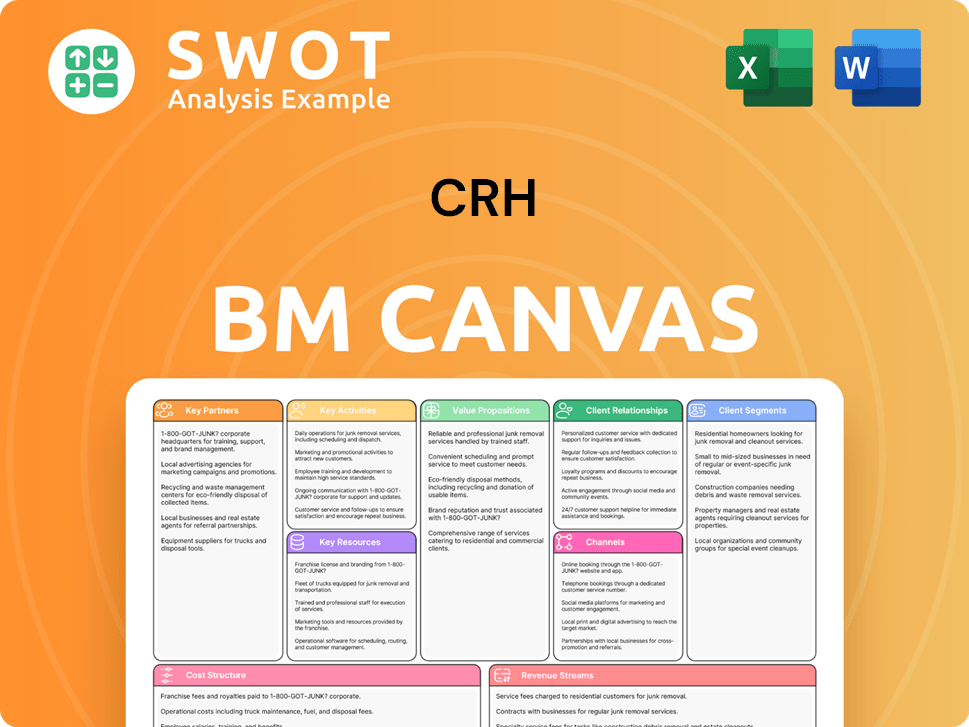

CRH Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped CRH’s Ownership Landscape?

In the past few years, the ownership profile of CRH has seen significant shifts. The most notable change was the move of its primary stock market listing to the New York Stock Exchange (NYSE) in September 2023. This strategic decision aimed to enhance CRH’s access to North American capital markets, improve share liquidity, and increase exposure to a broader investor base, especially US-based institutional investors. This transition is expected to lead to a higher concentration of North American institutional ownership over time. The company's focus remains on leveraging its NYSE listing to attract further investment and strengthen its position as a global leader in building materials.

While there haven't been major public events like large share buybacks or secondary offerings directly impacting the overall ownership structure, CRH consistently uses capital allocation strategies, including share repurchases, to return value to shareholders. For example, in 2024, CRH continued its share buyback program, demonstrating ongoing efforts to optimize its capital structure. Mergers and acquisitions are a core part of CRH's growth strategy; these typically involve asset or company acquisitions rather than direct changes to the top-level ownership structure. However, they can indirectly influence investor perceptions and the overall value of the company's shares. The company's financial performance and market capitalization are key indicators of its stability, and they are closely watched by investors and analysts.

| Metric | Value (2024) | Notes |

|---|---|---|

| Market Capitalization | Approximately $50 billion | As of recent market data. |

| Share Buyback Program | Ongoing | Part of the company's capital allocation strategy. |

| Institutional Ownership | Increasing | Driven by the NYSE listing and ESG factors. |

Industry trends, such as increased institutional ownership and the rise of ESG investing, are influencing CRH. Large institutional investors are increasingly integrating ESG factors into their investment decisions, encouraging companies like CRH to enhance their sustainability reporting and practices. Founder dilution is a natural progression for mature, publicly traded companies like CRH, where original founder stakes become negligible over decades of public trading and capital raises. There have been no public statements by the company or analysts about planned succession at the CEO level directly linked to ownership changes, nor any discussions of potential privatization. The focus remains on leveraging its NYSE listing to attract further investment and reinforce its position as a global leader in building materials.

CRH is a publicly traded company, and its ownership is primarily held by institutional investors. The company's stock is listed on the NYSE, which has increased its visibility to North American investors.

The move to the NYSE has improved liquidity and attracted more institutional investors. This strategic shift aims to increase the company's exposure to a broader investor base.

ESG factors are increasingly influencing investment decisions. CRH is enhancing its sustainability practices to meet the demands of ESG-focused investors.

The company's focus is on leveraging its NYSE listing to attract further investment and strengthen its position as a global leader in building materials. Share buybacks will continue.

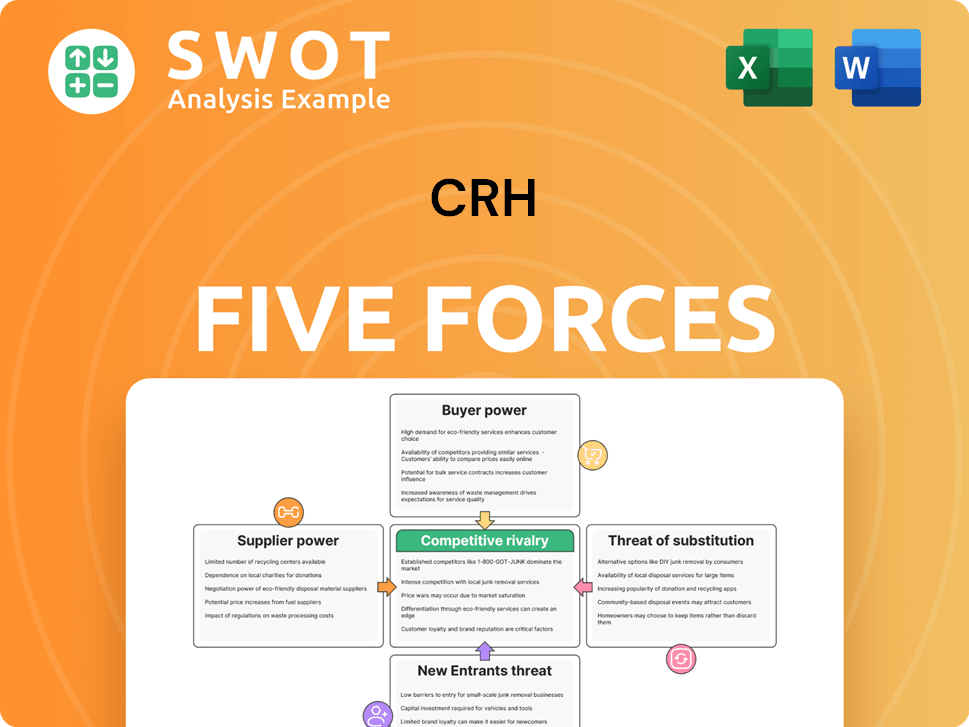

CRH Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CRH Company?

- What is Competitive Landscape of CRH Company?

- What is Growth Strategy and Future Prospects of CRH Company?

- How Does CRH Company Work?

- What is Sales and Marketing Strategy of CRH Company?

- What is Brief History of CRH Company?

- What is Customer Demographics and Target Market of CRH Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.