CRH Bundle

Can CRH Maintain Its Dominance in the Dynamic Building Materials Market?

The construction materials industry is undergoing a significant transformation, driven by sustainability, technological advancements, and evolving construction practices. As a global leader, CRH plc has strategically positioned itself at the forefront. This article provides a deep dive into the CRH SWOT Analysis, examining its competitive landscape and strategic responses to industry trends.

Understanding the CRH competitive landscape is crucial for investors and industry professionals alike. This CRH market analysis will dissect the company's strategies, identify its key CRH competitors, and evaluate its competitive advantages within the building materials market. We'll explore CRH's global presence and market position, offering insights into its financial performance and strategic outlook, including CRH's recent acquisitions and their impact on the sector.

Where Does CRH’ Stand in the Current Market?

CRH holds a leading position in the global building materials industry. It is the largest building materials company in North America, with a significant presence worldwide. CRH's extensive portfolio includes essential products like cement, aggregates, and asphalt, crucial for construction and infrastructure projects.

The company's market leadership is supported by its broad geographic footprint, with operations in 28 countries, mainly in North America and Europe. This allows CRH to serve a diverse customer base across public infrastructure, commercial construction, and residential markets. A detailed Target Market of CRH analysis reveals the company's strategic focus.

CRH has strategically focused on North America, which represented approximately 77% of its EBITDA in 2023. This focus allows CRH to capitalize on strong infrastructure spending and a positive construction outlook in the region. The company's decentralized operating model further enhances its market responsiveness, enabling local businesses to tailor solutions to specific market needs.

CRH's market position is strengthened by its diverse product range and extensive geographic reach. The company's ability to supply essential materials like cement and aggregates positions it well in both developed and emerging markets. This broad presence helps mitigate risks associated with regional economic fluctuations.

In 2023, CRH reported strong financial results, with sales revenue increasing by 7% and EBITDA increasing by 13%, reaching $34.9 billion and $6.2 billion, respectively. This financial health supports its market position and allows for strategic investments and acquisitions. These figures highlight CRH's strong competitive advantage.

CRH's emphasis on North America has been a key strategic move, allowing it to benefit from robust infrastructure spending and a positive construction outlook in the region. This focus enables CRH to concentrate resources and tailor its strategies to the specific needs of the North American market. This is a key element of CRH's competitive landscape.

The decentralized operating model enhances CRH's market responsiveness, enabling local businesses to tailor solutions to specific market needs. This approach allows for greater flexibility and adaptability to local market conditions, which strengthens CRH's competitive position. The company's ability to adapt is a key aspect of its market analysis.

CRH's competitive edge comes from its vast product portfolio, geographic diversity, and strong financial performance. These advantages allow CRH to maintain a leading position in the construction materials industry.

- Extensive Product Portfolio: Cement, aggregates, asphalt, and ready-mixed concrete.

- Geographic Diversity: Operations across 28 countries, primarily in North America and Europe.

- Strong Financial Performance: Sales revenue increased by 7% and EBITDA by 13% in 2023.

- Strategic Focus: Emphasis on North America, which accounted for approximately 77% of its EBITDA in 2023.

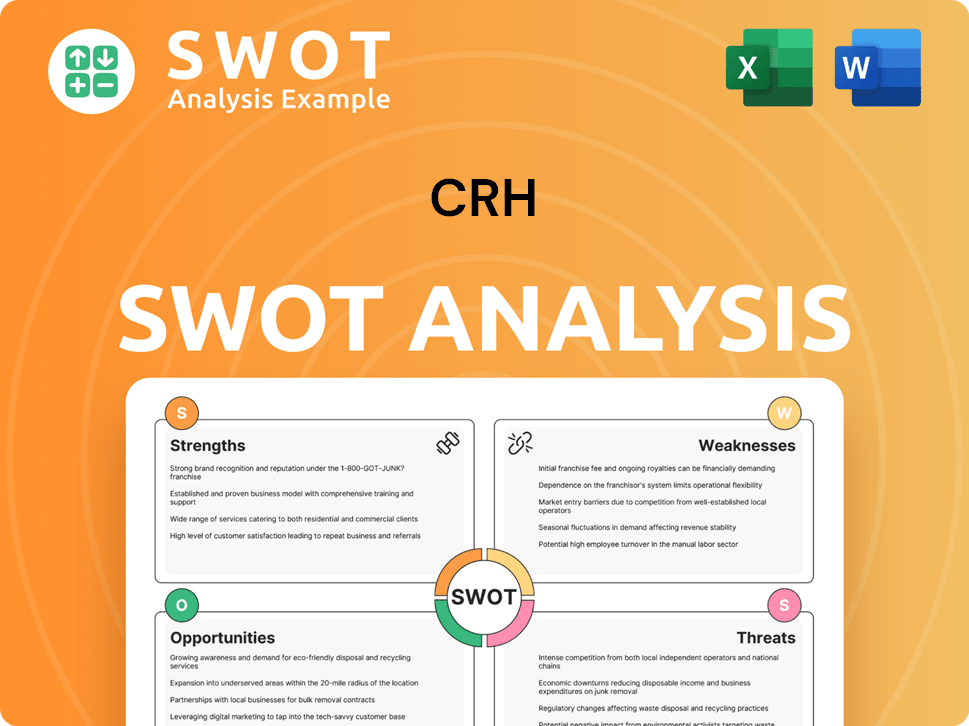

CRH SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CRH?

The CRH competitive landscape is characterized by intense rivalry in the global building materials market. Several multinational corporations and regional players compete for market share. Understanding these competitors is crucial for assessing CRH's market position and strategic initiatives.

The building materials market is subject to continuous change, influenced by mergers, acquisitions, and the emergence of new technologies. CRH must navigate these dynamics to maintain its competitive edge. This analysis will explore the key competitors, their strategies, and their impact on CRH's performance.

CRH faces a diverse range of competitors, from global giants to local specialists. These companies compete on various fronts, including product offerings, geographic presence, and pricing strategies. The following sections provide a detailed look at the key players in the CRH competitive landscape.

Holcim is a major global competitor, particularly in cement, aggregates, and ready-mixed concrete. It often challenges CRH in Europe and North America. In 2023, Holcim reported net sales of CHF 27.0 billion.

Heidelberg Materials is another significant global player with a strong presence in cement and aggregates. It competes with CRH across numerous regions. The company's revenue for 2023 was approximately €21.1 billion.

Cemex is a prominent competitor, especially in the Americas and parts of Europe, focusing on cement and ready-mixed concrete. Cemex's net sales for 2023 reached $15.7 billion.

Numerous regional and local companies also compete with CRH. These competitors often have strong market shares within their specific geographies. These companies can challenge CRH through localized supply chains and competitive pricing.

Vertical integration strategies, where construction companies produce their own materials, indirectly compete with CRH. This can impact CRH's market share. This trend continues to reshape the competitive dynamics.

Consolidation through mergers and acquisitions continuously reshapes the competitive dynamics. The acquisition of smaller players by major competitors can lead to increased market concentration and intensified rivalry. The building materials market is dynamic.

The CRH competitive landscape is shaped by several key factors. These include the scale of operations, product breadth, and distribution networks. The building materials market is also influenced by regional and local companies.

- Scale and Global Presence: Large multinational companies leverage their extensive operations and global reach.

- Product Breadth: Offering a wide range of products, from cement to aggregates, is crucial for market share.

- Distribution Networks: Efficient distribution systems are essential for reaching customers and ensuring timely delivery.

- Pricing Strategies: Competitive pricing is a key factor, especially in markets with numerous local competitors.

- Sustainability Initiatives: The growing focus on sustainable building materials influences the competitive environment.

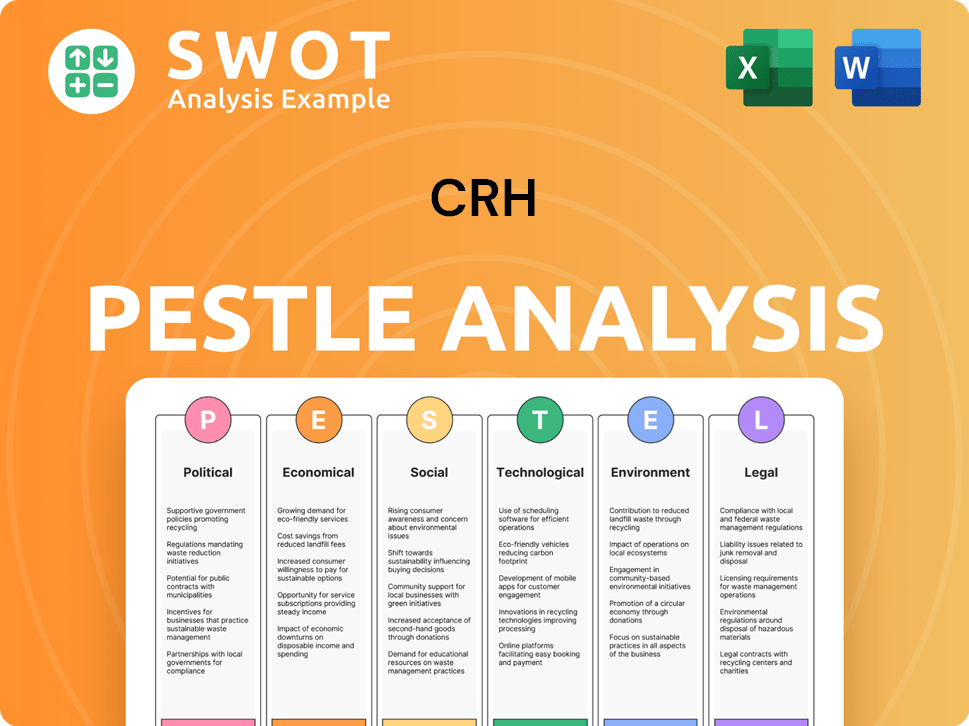

CRH PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CRH a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of the company involves assessing its strengths and how it positions itself within the construction materials industry. The company's robust financial performance, driven by strategic acquisitions and operational efficiencies, is a key factor. It has consistently demonstrated its ability to adapt and thrive in a dynamic market, making it a significant player in the building materials market.

The company's competitive advantages are multifaceted, stemming from its global scale, integrated operations, and strategic focus. Its extensive global presence, particularly in North America and Europe, allows it to leverage economies of scale. This enables it to achieve cost efficiencies and offer comprehensive solutions for large-scale infrastructure projects. The company's commitment to innovation, particularly in sustainable building solutions, further differentiates it.

A deep dive into the company's strategies reveals a focus on value-added solutions and operational excellence. Its decentralized business model empowers local teams to respond to specific market demands, fostering strong regional relationships. This adaptability, combined with a commitment to sustainability, positions it well for future growth. For a deeper understanding of their growth strategies, consider exploring the Growth Strategy of CRH.

The company's size and global presence are significant competitive advantages. This allows for economies of scale in procurement, production, and distribution. The company benefits from extensive quarry reserves and a vast distribution network, ensuring reliable supply and efficient delivery.

The integrated business model, encompassing aggregates, asphalt, cement, and ready-mixed concrete, provides a seamless supply chain. This integration enhances operational efficiency and allows for better quality control. This model enables the company to offer comprehensive solutions for large-scale infrastructure projects.

The decentralized operating structure empowers local management teams to respond swiftly to specific market demands. This fosters strong regional relationships and market responsiveness. Local expertise, combined with global best practices, allows the company to adapt its offerings to diverse environments.

The company's commitment to innovation, particularly in sustainable building solutions, differentiates it. This aligns with increasing industry and regulatory emphasis on environmental performance. This focus on sustainability provides a competitive edge in a market increasingly focused on green building practices.

The company's competitive advantages are rooted in its scale, integrated operations, and strategic focus. These advantages contribute to its strong financial performance and market position. The company's ability to adapt to market changes and its commitment to sustainability further enhance its competitive edge.

- Global Presence: Operates across multiple countries, allowing for diversification and economies of scale.

- Integrated Operations: Offers a comprehensive range of products and services, enhancing efficiency and customer solutions.

- Decentralized Model: Empowers local teams to respond to market demands, fostering agility.

- Sustainability Focus: Invests in low-carbon solutions, aligning with industry trends.

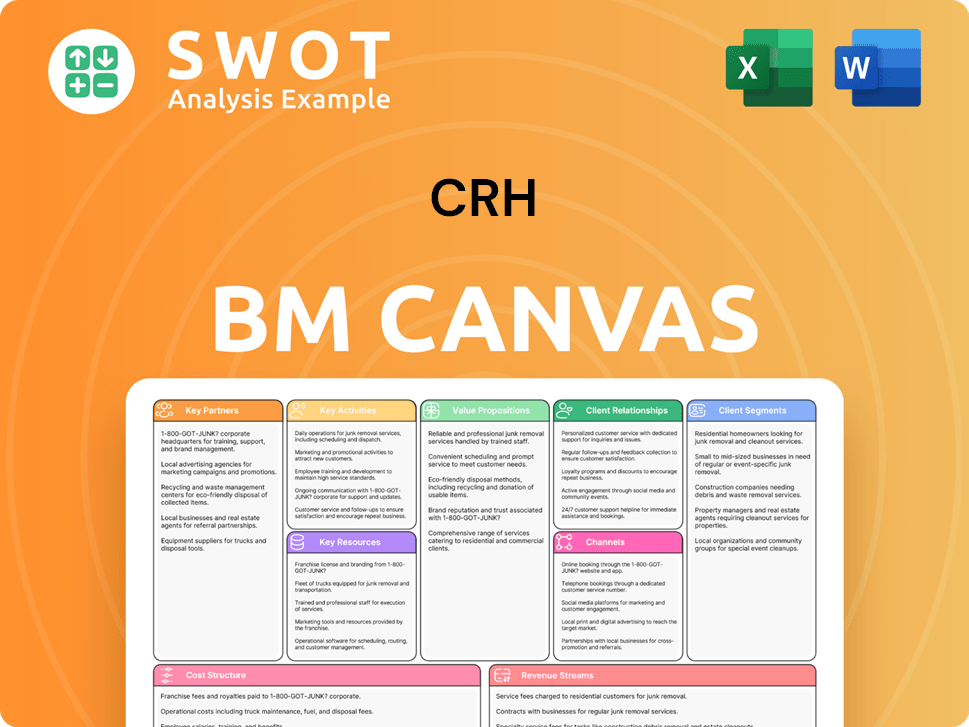

CRH Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CRH’s Competitive Landscape?

The CRH competitive landscape is currently shaped by significant industry trends, presenting both challenges and opportunities. The building materials market is undergoing transformations driven by sustainability demands, technological advancements, and economic factors. Understanding these dynamics is crucial for assessing CRH's market analysis and its strategic positioning.

CRH's company profile reveals a global presence, with a strong focus on North America, making it a key player in the construction materials industry. The company faces risks from fluctuating costs, economic downturns, and geopolitical instability. However, its strategic initiatives and focus on value-added products position it for future growth. The Marketing Strategy of CRH article provides more insights into their approach.

The primary trend is the increasing demand for sustainable construction materials and practices. This includes low-carbon cement and recycled aggregates. Regulatory changes are also influencing production methods and product offerings.

Challenges include fluctuating raw material and energy costs. Economic slowdowns affecting construction demand and geopolitical instability disrupting supply chains are also significant concerns. These factors can impact profitability.

Opportunities exist in emerging markets with growing infrastructure needs. The retrofitting and renovation sector in developed economies also offer significant potential. CRH's strong presence in North America provides a solid growth platform.

CRH's focus on value-added products and solutions, coupled with strategic acquisitions, enhances its market reach. Ongoing commitment to operational excellence, sustainability, and strategic capital allocation are crucial for maintaining a competitive edge.

Technological advancements, such as digitalization and advanced analytics, are transforming operations. However, these require capital investment and skilled labor. Geopolitical instability and trade policies could disrupt supply chains. CRH's market share analysis 2024 will reflect these influences.

- Sustainability Initiatives: CRH's investments in sustainable solutions, like ECOPact low-carbon concrete, are key.

- Market Expansion: Strategic acquisitions and a focus on value-added products are crucial.

- Operational Efficiency: Leveraging technology to optimize supply chains and enhance customer service is essential.

- Geographic Focus: North America, with its infrastructure plans, provides a significant growth platform.

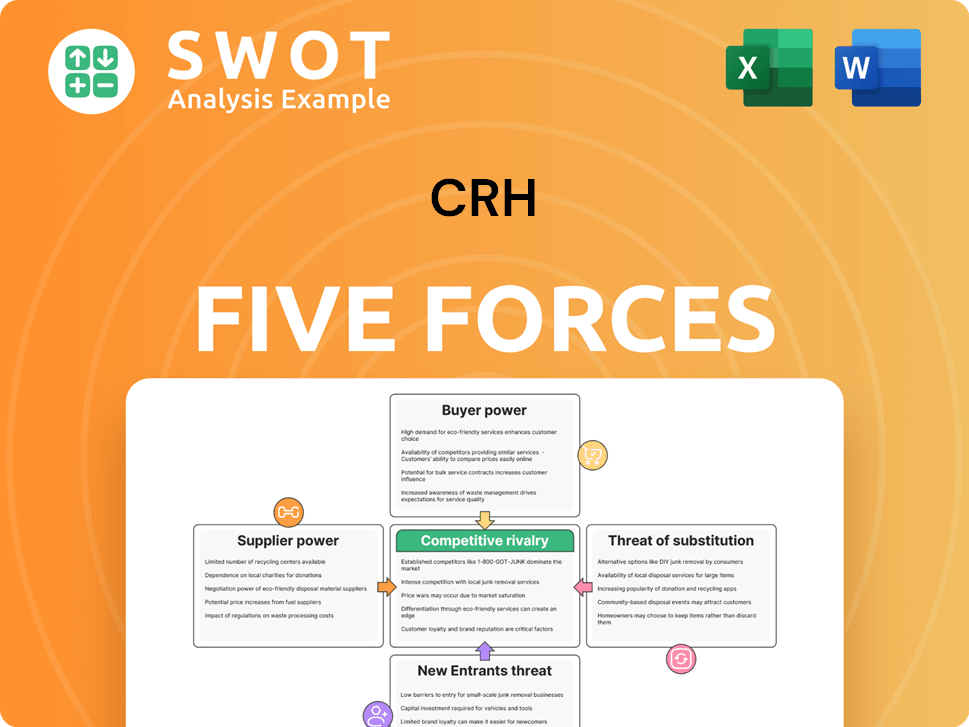

CRH Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CRH Company?

- What is Growth Strategy and Future Prospects of CRH Company?

- How Does CRH Company Work?

- What is Sales and Marketing Strategy of CRH Company?

- What is Brief History of CRH Company?

- Who Owns CRH Company?

- What is Customer Demographics and Target Market of CRH Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.