CRRC Bundle

How did CRRC transform the global rail landscape?

The evolution of the global railway industry is intricately linked to the story of CRRC, a company that has rapidly ascended to become a dominant force. Its formation, a pivotal moment, reshaped the Chinese rail industry and set the stage for international expansion. From its origins as a merger of domestic giants, CRRC's journey is a compelling case study in strategic consolidation and technological innovation.

Delving into the CRRC SWOT Analysis reveals the strategic decisions that propelled CRRC from a domestic rolling stock manufacturer to a global leader. Understanding the CRRC history is crucial for anyone interested in the Chinese rail industry and the future of railway vehicle production. This exploration will uncover the key milestones, major acquisitions, and technological advancements that have defined CRRC's remarkable trajectory, offering insights into its impact on the railway industry worldwide.

What is the CRRC Founding Story?

The CRRC company, a major player in the global railway industry, has a fascinating history. Its formation was a strategic move by the Chinese government to create a dominant force in the rolling stock manufacturer market. This consolidation aimed to streamline operations and boost competitiveness on a global scale.

The story of CRRC begins with the merger of China CNR Corporation Limited and CSR Corporation Limited. This merger, completed on June 1, 2015, marked a pivotal moment in the Chinese rail industry. The goal was to unify resources and expertise, setting the stage for CRRC's rapid growth and international expansion.

CRRC's establishment was driven by the need to consolidate the competitive landscape in the Chinese railway vehicle production sector. The primary objective was to eliminate internal competition and create a unified national champion capable of competing globally.

- The merger aimed to integrate research and development, manufacturing, and intellectual property.

- CRRC's initial business model focused on designing, manufacturing, and selling a wide range of railway vehicles.

- The company also provided maintenance and upgrade services.

The merger of China CNR and CSR was a complex undertaking. It involved integrating two large state-owned enterprises, each with its own corporate culture and operational structures. The leadership of the respective companies, along with the overseeing Chinese government bodies, played a crucial role in this process. The expertise of the founding teams, drawing from decades of experience in the Chinese railway industry, was essential for navigating the integration and setting the foundation for CRRC's future global ambitions.

Initial funding for CRRC came from the combined assets and capital of the two merged entities. This large-scale consolidation of state-owned assets provided a strong financial base. The company's name, CRRC, or China Railway Rolling Stock Corporation, clearly reflects its core business and national identity.

In its early years, CRRC focused on establishing a strong domestic presence while simultaneously expanding its international footprint. The company leveraged its technological advancements and manufacturing capabilities to secure contracts worldwide. This expansion was supported by significant investments in research and development, aimed at enhancing its product portfolio and maintaining a competitive edge in the global market. By 2024, CRRC had a presence in over 100 countries, with its products and services contributing significantly to the railway infrastructure of numerous nations.

CRRC's early success can be attributed to several factors. The company's ability to offer a comprehensive range of railway vehicles, from high-speed trains to urban mass transit systems, was a key advantage. Furthermore, its commitment to technological innovation and its strong government backing provided a solid foundation for growth. The company's focus on quality and reliability helped it gain the trust of customers worldwide.

CRRC's impact on the railway industry has been significant. The company has not only become a major player in the global market but has also driven technological advancements in railway vehicle production. Its high-speed trains have set new standards for speed and efficiency, while its urban mass transit solutions have helped alleviate congestion in major cities. CRRC's manufacturing locations, strategically located across China and around the world, have enabled it to meet the growing demand for its products and services.

CRRC's financial performance has been robust, reflecting its strong market position and operational efficiency. In 2024, the company reported revenues of over $30 billion, demonstrating its continued growth and profitability. This financial success has allowed CRRC to invest in further research and development, expand its manufacturing capacity, and pursue strategic acquisitions to strengthen its market position.

CRRC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of CRRC?

The CRRC history began with its formation in June 2015, marking a pivotal moment in the Chinese rail industry. This new entity quickly focused on growth and expansion, capitalizing on the combined strengths of its predecessors. The company's early years were marked by strategic moves to consolidate its domestic market leadership and aggressively pursue international opportunities, establishing itself as a leading rolling stock manufacturer.

In its initial phase, CRRC company prioritized optimizing its extensive manufacturing footprint across China. This involved integrating diverse production lines for high-speed trains, locomotives, and urban transit vehicles. A key early product launch was the new generation of Fuxing high-speed trains, which became a flagship product for China's railway network. The company's focus on railway vehicle production was evident in its efforts to streamline operations and enhance efficiency within the domestic market.

Early CRRC's international expansion included securing contracts for urban transit vehicles in the United States and Australia. For instance, CRRC Sifang America, established in 2017, received significant orders for metro cars in Chicago and Los Angeles. These early international ventures built upon the export successes of the predecessor companies. The company's global strategy was to leverage its domestic strength to gain a foothold in key international markets.

Geographical expansion was a primary focus, with CRRC company origins including the establishment of overseas subsidiaries and manufacturing facilities to localize production. This involved investments in countries along the Belt and Road Initiative. The company also pursued key acquisitions and mergers to enhance its technological capabilities and market reach. Major capital raises were primarily through its listings on the Shanghai and Hong Kong stock exchanges, funding ambitious R&D and global expansion plans.

The market reception to CRRC as a unified entity was largely positive, presenting a single, strong player to international clients. Growth efforts were shaped by a strategic shift towards higher-value products and services, including intelligent rail systems and comprehensive maintenance solutions. Pivotal decisions included significant investments in R&D to develop cutting-edge technologies like maglev trains and hydrogen-powered locomotives. For more insights into their core values, consider reading about the Mission, Vision & Core Values of CRRC.

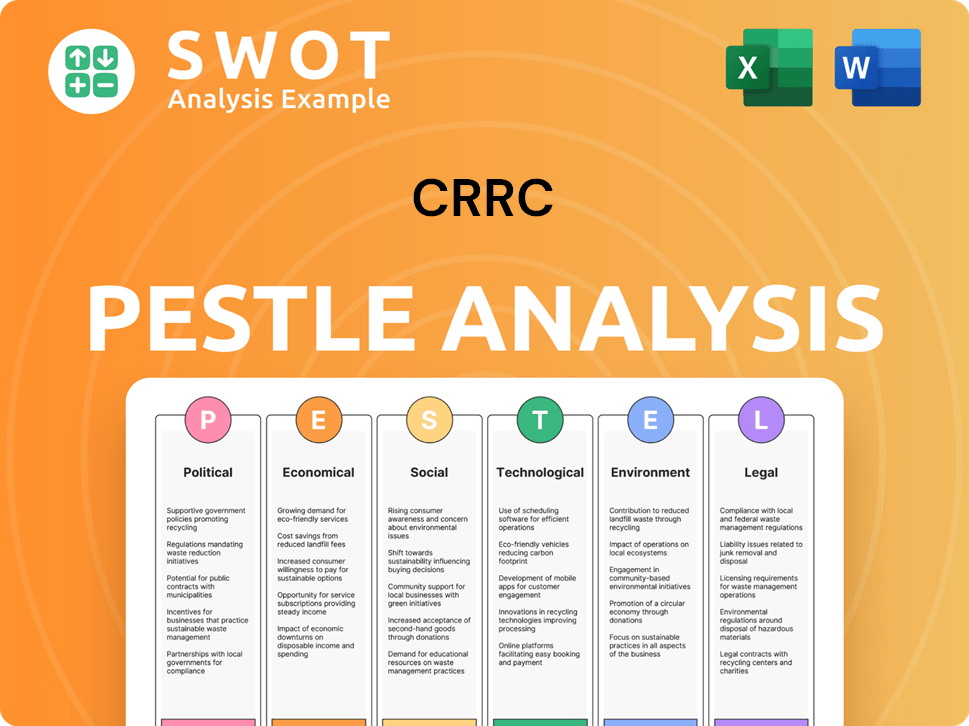

CRRC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in CRRC history?

Since its formation in 2015, the CRRC company has achieved several significant milestones, becoming a major player in the global railway vehicle production market. These achievements highlight its growth and impact on the Chinese rail industry.

| Year | Milestone |

|---|---|

| 2015 | Formation of China Railway Rolling Stock Corporation (CRRC) through the merger of CSR and CNR. |

| 2017 | Launch of the Fuxing Hao series of high-speed trains, marking a significant advancement in rail technology. |

| Ongoing | Securing numerous patents related to high-speed rail, maglev technology, and intelligent railway systems. |

| Ongoing | Establishing major partnerships globally, including collaborations on metro projects and technical exchanges. |

| Ongoing | Consistently ranking among the top global enterprises in terms of revenue and market share in the rolling stock industry. |

CRRC has consistently pushed the boundaries of railway vehicle production through various innovations. These advancements have solidified its position in the Chinese rail industry and beyond.

Development and deployment of the Fuxing Hao series, with speeds up to 350 km/h (217 mph) on commercial lines. These trains incorporate advanced intelligent systems.

CRRC has been at the forefront of maglev technology, contributing to the development of high-speed maglev systems.

Implementation of advanced intelligent systems in trains and railway infrastructure to improve efficiency and safety. CRRC has invested heavily in the digitalization of rail networks.

CRRC is actively developing and testing hydrogen-powered trains as part of its commitment to sustainable transportation. In 2024, CRRC unveiled a new generation of hydrogen fuel cell hybrid locomotives.

Research and development in autonomous rail systems to enhance operational efficiency and safety. These systems are designed to reduce human error and optimize train movements.

CRRC has formed partnerships worldwide, including collaborations on metro projects and technical exchanges with international rail companies. These partnerships facilitate knowledge sharing and market expansion.

Despite its successes, CRRC has faced various challenges that have impacted its operations and expansion. Addressing these issues is crucial for its continued growth and market leadership.

Global economic slowdowns and geopolitical tensions have affected CRRC's international expansion efforts. These factors can lead to reduced demand and increased trade barriers.

Competition from established European and Japanese manufacturers, as well as emerging players, necessitates continuous innovation and cost efficiency. This requires CRRC to invest heavily in R&D.

Product failures or technical issues in some projects have required swift remedial actions and quality control enhancements. Addressing these issues is critical for maintaining customer trust.

Managing the vast scale of operations, integrating diverse corporate cultures, and fostering innovation across its numerous subsidiaries present ongoing organizational challenges. These require effective leadership and strategic planning.

Disruptions in the supply chain, particularly during the COVID-19 pandemic, have impacted production and delivery schedules. Building resilient supply chains is crucial for mitigating these risks.

Increasing trade barriers and protectionist measures in various countries have hindered CRRC's international expansion. Localization of production and services is a key strategy to overcome these challenges.

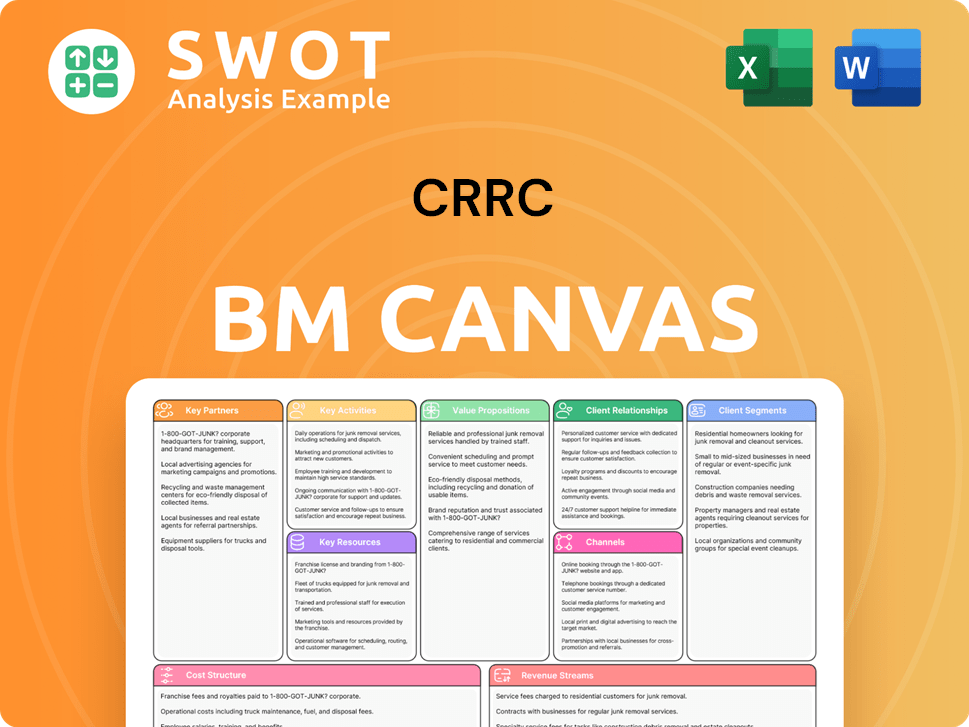

CRRC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for CRRC?

The CRRC history, officially beginning in 2015, reflects decades of development in the Chinese rail industry. The CRRC company has rapidly evolved into a global leader in railway vehicle production, marked by significant milestones and strategic initiatives.

| Year | Key Event |

|---|---|

| June 1, 2015 | CRRC Corporation Limited was officially established through the merger of China CNR Corporation and CSR Corporation. |

| 2016 | CRRC secured major international contracts for metro cars in the United States and Australia. |

| 2017 | The Fuxing Hao high-speed train series, developed by CRRC, began commercial operation in China, setting new benchmarks for speed and technology. |

| 2018 | CRRC expanded its global footprint with new manufacturing facilities and R&D centers in various countries. |

| 2019 | The company continued to advance maglev technology, showcasing prototypes capable of extremely high speeds. |

| 2020 | Despite global economic challenges, CRRC maintained strong performance, focusing on domestic market resilience and technological upgrades. |

| 2021 | CRRC began exploring new energy solutions for rail, including hydrogen fuel cell technology. |

| 2022 | Further advancements in intelligent train systems and autonomous operation capabilities were reported. |

| March 22, 2024 | CRRC released its 2023 annual report, showing operating revenue of RMB 234.336 billion and net profit attributable to shareholders of RMB 11.792 billion. |

| April 2024 | CRRC unveiled a new generation of hydrogen fuel cell hybrid locomotives, demonstrating its commitment to sustainable rail transport. |

| May 2024 | CRRC Qingdao Sifang Co., Ltd. delivered the first batch of high-speed electric multiple units (EMUs) for Indonesia's Jakarta-Bandung High-Speed Railway. |

| November 2024 | CRRC signed new agreements for rolling stock supply and maintenance in Central Asia, expanding its presence in emerging markets. |

CRRC aims to increase its market share globally, especially in Europe, North America, and emerging economies. This includes expanding local manufacturing, service, and R&D capabilities. The company is focused on better serving regional demands through localized operations.

Innovation roadmaps are centered on intelligent rail systems, including autonomous trains, predictive maintenance, and advanced signaling technologies. CRRC is investing in technologies to improve efficiency and safety. These advancements are crucial for the future of rail transport.

CRRC is committed to developing sustainable and environmentally friendly rail solutions, with a strong emphasis on new energy sources like hydrogen and advanced battery technologies for rolling stock. This is in response to the growing demand for green transportation.

The increasing global demand for high-speed rail and urban mass transit will provide continued growth opportunities. Analysts predict that CRRC will continue to dominate the global rolling stock market. The company is well-positioned to lead the industry.

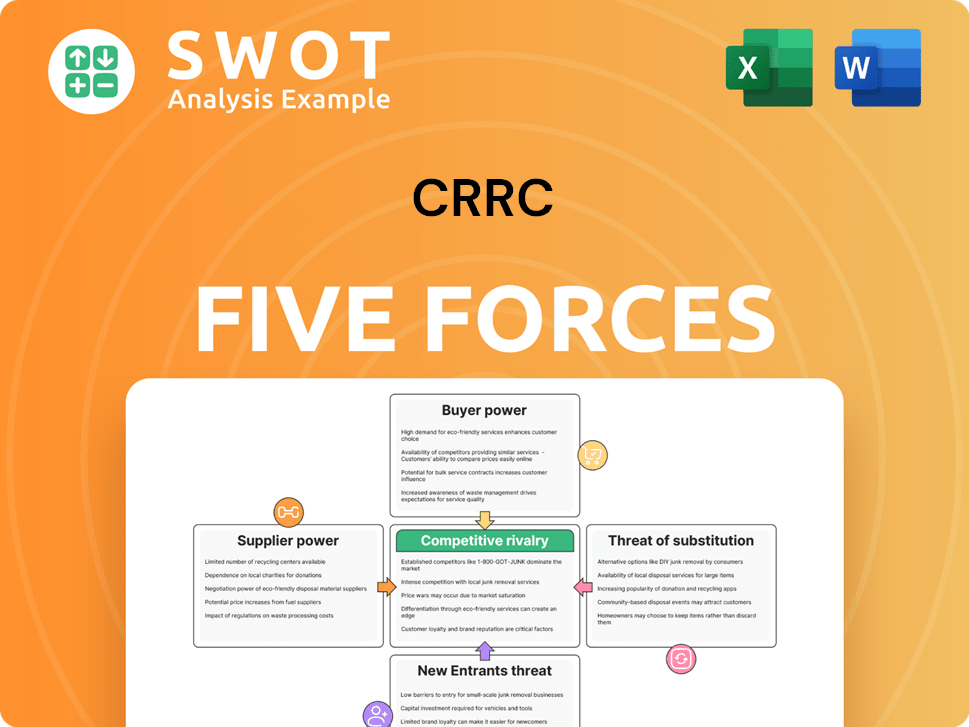

CRRC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of CRRC Company?

- What is Growth Strategy and Future Prospects of CRRC Company?

- How Does CRRC Company Work?

- What is Sales and Marketing Strategy of CRRC Company?

- What is Brief History of CRRC Company?

- Who Owns CRRC Company?

- What is Customer Demographics and Target Market of CRRC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.