CRRC Bundle

Can CRRC Continue Its Dominance in the Global Rail Industry?

Born from a strategic merger, CRRC Corporation Limited swiftly became the world's largest rolling stock manufacturer, reshaping the CRRC SWOT Analysis. This Chinese giant, with roots in various railway equipment manufacturers, aimed to be a national champion in advanced railway technology. Today, CRRC boasts a significant share of the high-speed rail market and a global presence spanning six continents, but what's next?

This in-depth analysis of the CRRC company delves into its growth strategy, exploring its expansion plans globally and assessing its future prospects within the dynamic Chinese rail industry and beyond. We'll examine CRRC's market share analysis, financial performance review, and strategic partnerships, while also considering the challenges and opportunities it faces in the competitive landscape. Furthermore, we'll explore CRRC's commitment to sustainable transportation initiatives and its long term growth potential within the future of rail transport, providing valuable insights for investors and industry professionals alike.

How Is CRRC Expanding Its Reach?

The focus of CRRC's expansion initiatives centers on strengthening its global market presence, broadening its product offerings, and exploring innovative service models. This strategic approach is crucial for enhancing the company's CRRC growth strategy and solidifying its position in the competitive Chinese rail industry and the global high-speed rail market.

Geographically, CRRC is targeting emerging markets in Southeast Asia, Africa, and Latin America, where significant demand exists for new railway infrastructure and urban transit solutions. This expansion is supported by strategic partnerships and collaborations aimed at enhancing local presence and integrating into regional supply chains. These initiatives are key to understanding the CRRC future prospects.

In terms of product expansion, CRRC is investing in next-generation urban mass transit vehicles, including autonomous rail rapid transit (ART) systems and hydrogen-powered trams, to meet the growing demand for sustainable and efficient urban mobility. The company is also actively exploring new business models beyond traditional manufacturing, such as providing comprehensive lifecycle services, to create recurring revenue streams and strengthen customer relationships. For more insights, consider reading about the Owners & Shareholders of CRRC.

CRRC is focusing on emerging markets in Southeast Asia, Africa, and Latin America. These regions offer significant opportunities for new railway infrastructure and urban transit systems. The company's expansion plans globally are driven by the need to tap into these growing markets and increase its market share.

CRRC is investing in next-generation urban mass transit vehicles, including autonomous rail rapid transit (ART) systems and hydrogen-powered trams. This diversification strategy aims to address the growing demand for sustainable and efficient urban mobility solutions. The company's new product development is a key aspect of its long term growth potential.

CRRC is pursuing strategic partnerships and collaborations to enhance its local presence and integrate into regional supply chains. These partnerships include joint ventures for local manufacturing and technology transfer agreements. This approach helps overcome trade barriers and tailor solutions to specific market needs.

The company is exploring new business models beyond traditional manufacturing, such as providing comprehensive lifecycle services. These services include maintenance, refurbishment, and digital solutions for railway operations. This shift aims to create recurring revenue streams and strengthen customer relationships.

CRRC's expansion strategy involves several key initiatives to ensure sustained growth and market leadership. These initiatives are designed to capitalize on emerging market opportunities and technological advancements. Understanding these initiatives is crucial for a comprehensive CRRC company analysis.

- Focus on emerging markets in Southeast Asia, Africa, and Latin America for infrastructure projects.

- Investment in next-generation urban mass transit vehicles like ART and hydrogen-powered trams.

- Strategic partnerships and collaborations for local manufacturing and technology transfer.

- Development of comprehensive lifecycle services to generate recurring revenue.

CRRC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CRRC Invest in Innovation?

Innovation and technology are central to the CRRC growth strategy, driving its expansion and shaping its CRRC future prospects. The company's commitment to research and development (R&D) is a key element, with substantial investments consistently made to advance its technological capabilities. This focus allows it to stay competitive in the Chinese rail industry and the global high-speed rail market.

CRRC company analysis reveals a strong emphasis on in-house development and strategic collaborations. This approach accelerates innovation and ensures the company remains at the forefront of the rolling stock manufacturer sector. The company leverages digital transformation and sustainable transportation solutions to enhance its market position.

The company's investments in R&D represent a significant portion of its revenue, focusing on high-speed rail, intelligent railway systems, and new energy vehicles. These efforts are crucial for maintaining its competitive edge and capitalizing on market opportunities. For a deeper dive into the company's financial structure and revenue streams, consider reading Revenue Streams & Business Model of CRRC.

CRRC has been at the forefront of high-speed train development, particularly with its Fuxing series. These trains incorporate advanced propulsion, control systems, and passenger comfort features. They are capable of reaching speeds up to 350 km/h, showcasing the company's technological prowess.

CRRC is heavily invested in digital transformation, using AI, IoT, big data analytics, and 5G. These technologies improve operational efficiency, enable predictive maintenance, and optimize manufacturing processes. Smart railway solutions enhance traffic management and safety.

CRRC is committed to sustainable transportation. In 2024, the company showcased breakthroughs in hydrogen-powered light rail vehicles. This demonstrates its dedication to reducing emissions and promoting eco-friendly transportation options, which contributes to its long-term growth.

CRRC holds numerous patents in railway technology and has received industry accolades. These recognitions solidify its leadership in the global rolling stock sector. The company's innovative contributions are key to its market position.

New products and technical capabilities directly contribute to growth objectives. They open new market segments and provide competitive advantages. CRRC's innovations help it maintain a strong position in the face of increasing competition.

CRRC engages in strategic partnerships to enhance its technological capabilities and market reach. These collaborations are crucial for expanding its global presence and accessing new technologies. These partnerships are key to its long-term growth potential.

CRRC's technological advancements have a significant impact on its financial performance and market position. These innovations drive efficiency, reduce costs, and enhance the company's ability to compete in the global rail market. The company's focus on R&D is reflected in its financial results, with increasing revenues and market share attributed to its technological edge.

- High-Speed Rail: Development of advanced high-speed trains, such as the Fuxing series, which operate at speeds up to 350 km/h, enhancing passenger experience and operational efficiency.

- Intelligent Railway Systems: Implementation of AI, IoT, and big data analytics to optimize traffic management, improve safety, and reduce energy consumption, leading to cost savings and increased operational effectiveness.

- New Energy Vehicles: Development of hydrogen-powered light rail vehicles and other sustainable transportation solutions, positioning the company at the forefront of eco-friendly rail transport and opening new market segments.

- Digital Transformation: Integration of digital technologies to enhance manufacturing processes, enabling predictive maintenance, and improving overall operational efficiency, which reduces downtime and increases productivity.

- Strategic Partnerships: Collaborations with technology providers and research institutions to accelerate innovation and expand market reach, fostering knowledge sharing and access to new technologies.

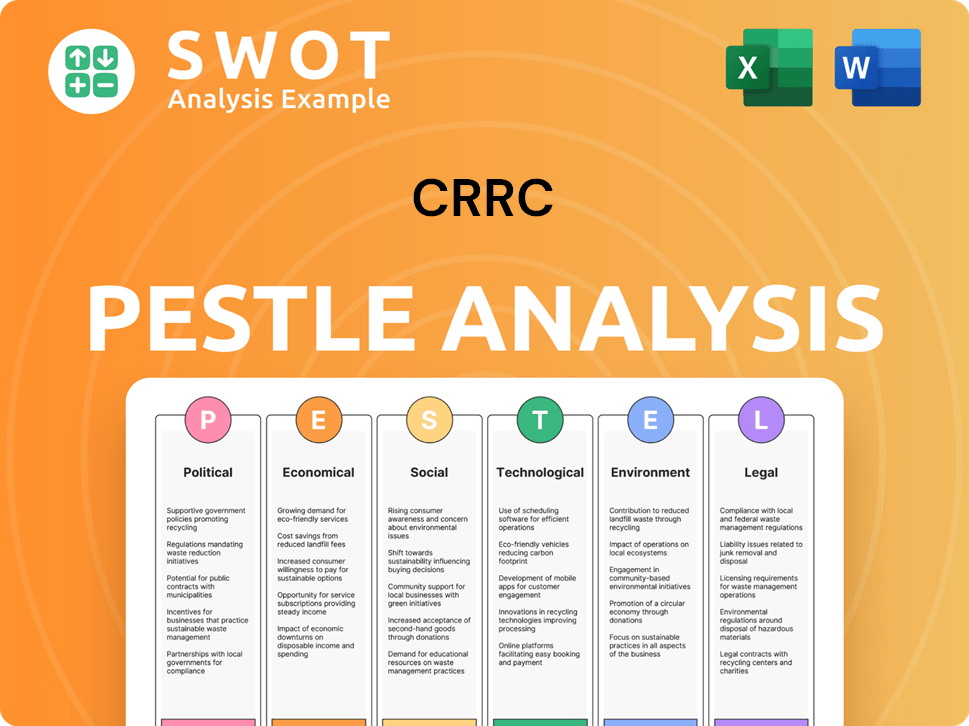

CRRC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is CRRC’s Growth Forecast?

The financial outlook for CRRC, a major rolling stock manufacturer, is shaped by its strong position in the Chinese rail industry and strategic global initiatives. The company's ability to capitalize on infrastructure development, both domestically and internationally, is key to its future financial performance. This includes leveraging opportunities within the high-speed rail market and expanding its presence in key global markets.

CRRC's financial health is supported by its robust market share and technological advancements. The company's focus on sustainable transportation initiatives and new product development is expected to drive growth. Furthermore, strategic partnerships and government support play a crucial role in its long-term growth potential.

For the first three quarters of 2024, CRRC reported a total revenue of approximately RMB 113.8 billion. This indicates a stable performance, demonstrating the company's resilience in a dynamic market. The company aims to maintain healthy profit margins by optimizing production efficiencies and expanding into higher-value service offerings.

CRRC holds a significant market share in the Chinese rail industry, dominating the rolling stock manufacturer sector. This strong domestic position provides a solid foundation for its international expansion plans. The company's market share is a key indicator of its competitive landscape and ability to secure large-scale projects.

The financial performance of CRRC is closely monitored, with analysts projecting stable to moderate growth. The company's revenue for the first three quarters of 2024, at approximately RMB 113.8 billion, reflects its ability to navigate market fluctuations. Investment in R&D and international projects are key drivers.

CRRC's expansion plans globally are centered around the Belt and Road Initiative and strategic partnerships. The company is actively pursuing international market entry strategies to increase its global footprint. These initiatives are crucial for long-term growth and diversification of revenue streams.

New product development is a core element of CRRC's growth strategy, focusing on technological advancements in rail transport. The company invests heavily in R&D to enhance its product offerings and maintain a competitive edge. This includes innovations in high-speed rail and sustainable transportation solutions.

CRRC's financial ambitions are closely tied to national infrastructure development plans within China and its successful execution of Belt and Road Initiative projects abroad. For more insights into CRRC's target market, see Target Market of CRRC. The company's strong balance sheet and access to capital markets position it well to fund future growth, including potential mergers and acquisitions that align with its strategic objectives.

The competitive landscape of CRRC includes both domestic and international players in the rolling stock manufacturer sector. The company differentiates itself through technological prowess and scale. Navigating this landscape is critical for maintaining market share and securing new projects.

CRRC is committed to sustainable transportation initiatives, aligning with global trends towards greener solutions. This includes developing energy-efficient trains and promoting rail transport as an environmentally friendly alternative. These initiatives enhance the company's long-term growth potential.

CRRC's impact on global rail is significant, influencing technological standards and market dynamics. The company's projects and innovations contribute to the modernization of rail systems worldwide. This global influence enhances its brand recognition.

CRRC presents investment opportunities due to its strong market position and growth potential. The company's financial performance and strategic initiatives make it an attractive option for investors. Analyzing its financial data is important for assessing these opportunities.

Technological advancements are central to CRRC's growth, including innovations in high-speed rail and smart train technologies. The company's investment in R&D supports its competitive advantage. These advancements are key to its future prospects.

Strategic partnerships are crucial for CRRC's expansion, especially in international markets. These collaborations help in accessing new markets and sharing technological expertise. The company leverages these partnerships to drive growth.

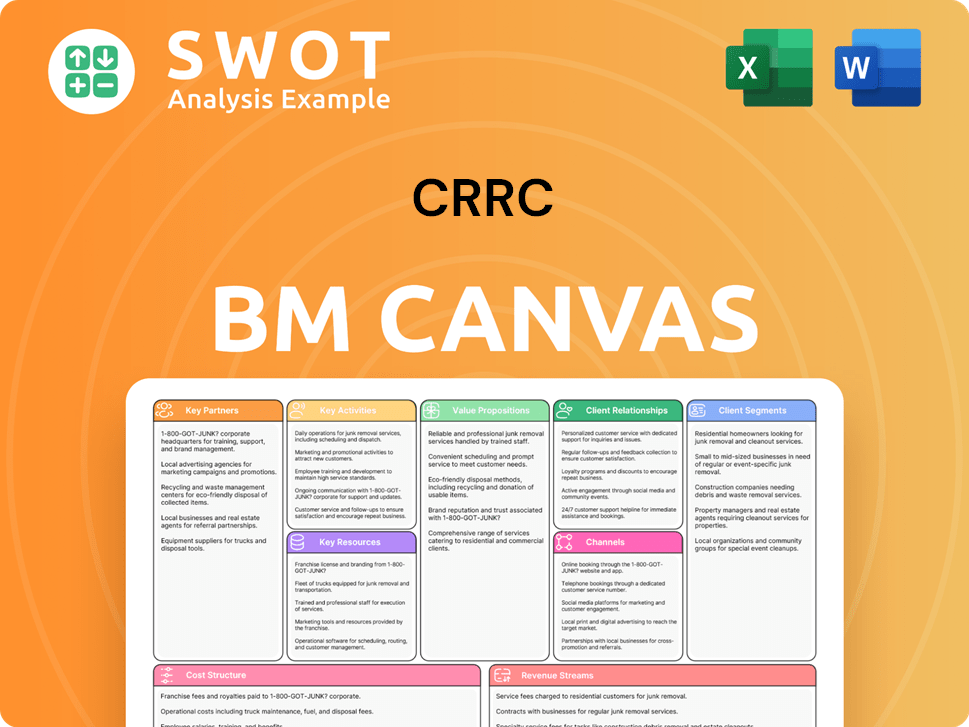

CRRC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow CRRC’s Growth?

The path to growth for the company faces several significant challenges. Competition from established European and Japanese manufacturers remains fierce, particularly in the high-speed rail market. Navigating regulatory changes and geopolitical tensions adds further complexity to their expansion plans globally.

Supply chain disruptions and fluctuations in commodity prices can impact production schedules and costs, presenting operational hurdles. Furthermore, the rapid pace of technological advancements requires continuous innovation to avoid falling behind competitors in the Chinese rail industry and beyond.

Internal resource constraints, such as securing highly skilled talent, could also impede expansion. The company's ability to adapt to emerging risks, including cybersecurity threats, will be crucial for its long-term growth potential. Addressing these challenges is essential for sustaining its position as a leading rolling stock manufacturer.

Intense competition from global players like Siemens and Alstom, especially in high-speed rail, poses a constant threat. These competitors often have established market presence and advanced technologies. The company must continuously innovate and offer competitive pricing to maintain and grow its market share analysis.

Changes in trade policies, such as increasing protectionism, can limit market access. Geopolitical tensions and trade disputes can disrupt international operations and impact project timelines. Navigating these complex environments requires strong government support and strategic partnerships.

Reliance on global supply chains exposes the company to disruptions from events such as pandemics, natural disasters, and geopolitical instability. Fluctuations in commodity prices, particularly for steel and other raw materials, can affect production costs and profitability. Diversifying suppliers and building resilient supply chains are crucial.

Rapid technological advancements in rail transport, including areas like autonomous trains and advanced signaling systems, require continuous investment in research and development. Failure to keep pace with competitors could result in a loss of market share. Focusing on CRRC technological advancements is vital.

Securing and retaining highly skilled engineers, project managers, and international business professionals can be a challenge. Competition for talent is fierce, and the company must offer competitive compensation and career development opportunities. Effective talent management is crucial for CRRC expansion plans globally.

Increasingly sophisticated cyberattacks pose a risk to the company's digital infrastructure and operational systems. Protecting sensitive data and ensuring the secure operation of its products and services requires robust cybersecurity measures. Investing in cybersecurity is essential for CRRC future prospects.

The company employs several strategies to mitigate risks. Diversifying its customer base across different regions reduces reliance on any single market. Developing a robust risk management framework helps anticipate and respond to potential challenges. Strategic partnerships and joint ventures can provide access to new markets and technologies. For more insights, you can read about the Mission, Vision & Core Values of CRRC.

Managing complex international projects, especially in regions with political instability, presents operational challenges. Fluctuations in currency exchange rates can impact profitability. Ensuring compliance with diverse regulatory requirements across different countries adds complexity. Efficient project management and strong financial controls are essential.

Economic downturns in key markets can reduce demand for rolling stock and related services. Changes in interest rates can affect the cost of financing projects. The company’s financial performance review is crucial for assessing its ability to navigate these risks. Maintaining a strong balance sheet and effective financial planning are essential.

Despite these risks, there are opportunities for the company to strengthen its position. Investing in new product development, such as sustainable transportation initiatives, can create a competitive advantage. Strategic partnerships can facilitate market entry and technology transfer. Focusing on innovation and operational efficiency is key to long term growth potential.

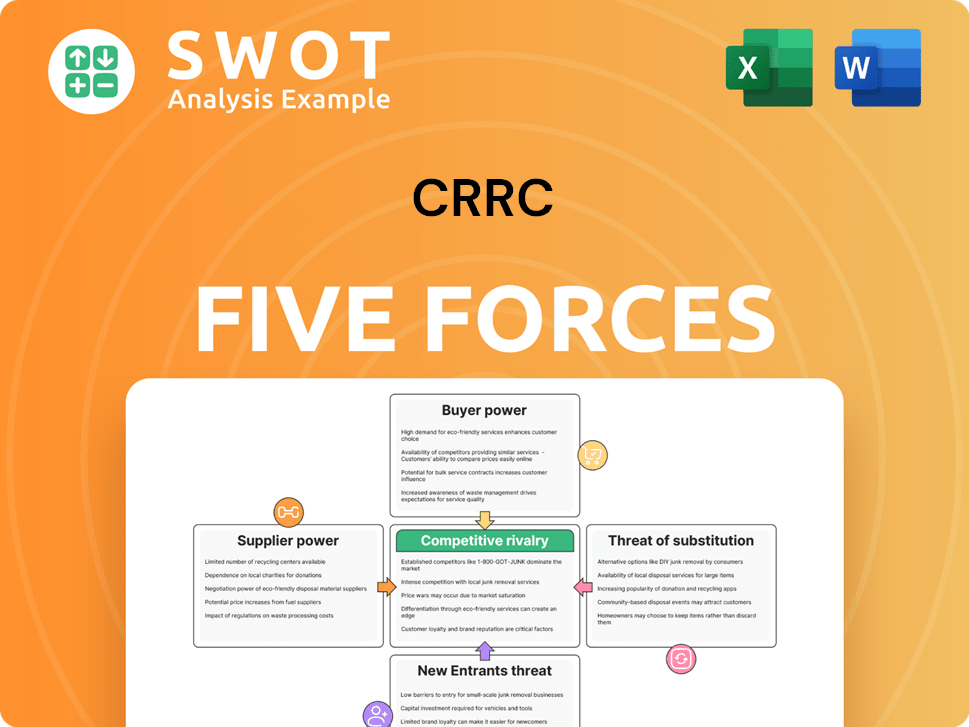

CRRC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CRRC Company?

- What is Competitive Landscape of CRRC Company?

- How Does CRRC Company Work?

- What is Sales and Marketing Strategy of CRRC Company?

- What is Brief History of CRRC Company?

- Who Owns CRRC Company?

- What is Customer Demographics and Target Market of CRRC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.