CRRC Bundle

Who Really Owns CRRC?

Unraveling the ownership of China Railway Rolling Stock Corporation (CRRC) is key to understanding its global dominance in rail transport. Formed from a strategic merger, CRRC has become the world's largest rolling stock manufacturer. This deep dive explores the intricate ownership structure that shapes CRRC's strategies and influences its vast operations.

CRRC's story began with a significant consolidation, creating a powerhouse in the railway industry. As a prominent Chinese state-owned enterprise, CRRC's operations, from its CRRC SWOT Analysis to its global projects, are deeply intertwined with government strategies. Understanding who controls CRRC, its parent company, and its subsidiaries is crucial for anyone looking to navigate the complexities of the rail transport market and the broader implications of Chinese state-backed enterprises.

Who Founded CRRC?

The story of CRRC's ownership begins not with individual founders, but with a strategic merger orchestrated by the Chinese government. This entity, now known as China Railway Rolling Stock Corporation (CRRC), emerged from the consolidation of two major state-owned rolling stock manufacturers: China North Rolling Stock Corporation (CNR) and China South Rolling Stock Corporation (CSR).

Both CNR and CSR were already substantial Chinese state-owned enterprises (SOEs) before the merger. They had been separated from the former Ministry of Railways in 2000. The formation of CRRC, therefore, reflects the Chinese state's direct control over its rail industry.

In 2015, when CRRC was formed, it was primarily owned by China CRRC Corporation Limited, a wholly state-owned enterprise under the supervision of the State-owned Assets Supervision and Administration Commission (SASAC) of the State Council. This structure meant that the Chinese government held the ultimate control and a significant majority of shares. There were no individual founders in the traditional Western sense, but rather a combination of assets and operations from two large state-controlled entities.

CRRC's creation was a result of a merger between CNR and CSR, both previously under the control of the Chinese government.

The initial ownership structure of CRRC was firmly rooted in the Chinese state, with the government holding the majority of shares.

The merger aimed to enhance competitiveness, reduce internal competition, and facilitate international expansion.

Unlike typical companies, CRRC did not have individual founders with specific equity splits; it was a consolidation of state assets.

The merger was part of a broader national strategy to establish a global leader in rail transportation technology.

Early agreements focused on regulatory approvals and the seamless integration of two large state-controlled entities.

The merger of CNR and CSR aimed to create a stronger entity for international expansion and reduce internal competition within the Chinese rail industry. This strategic move was designed to enhance the global competitiveness of Chinese rolling stock manufacturers. The Brief History of CRRC illustrates the company's evolution and its role in the Chinese government's industrial policy. As of 2024, CRRC continues to be a dominant player in the global rail market, with the Chinese government maintaining significant control over its operations and strategic direction. In 2024, CRRC's revenue reached approximately $33.7 billion USD, reflecting its substantial market presence and the ongoing support from the Chinese government.

Understanding the origins of CRRC's ownership structure is crucial for assessing its market position and strategic direction.

- CRRC's ownership is primarily controlled by the Chinese government through the State-owned Assets Supervision and Administration Commission (SASAC).

- The merger of CNR and CSR in 2015 formed CRRC, creating a globally competitive rolling stock manufacturer.

- The strategic intent was to enhance competitiveness, reduce internal competition, and facilitate international expansion.

- CRRC's early agreements focused on regulatory approvals and the integration of state-controlled entities.

- The vision was to establish a world leader in rail transportation technology and manufacturing.

CRRC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has CRRC’s Ownership Changed Over Time?

The evolution of CRRC's ownership is marked by its foundation as a state-controlled entity with a substantial public float. Formed in 2015 through the merger of CNR and CSR, CRRC Corporation Limited became a publicly listed company. Its shares are traded on the Shanghai Stock Exchange (SSE: 601766) and the Hong Kong Stock Exchange (HKEX: 1766). This structure reflects a blend of state control and market participation, typical of many Chinese state-owned enterprises.

The primary ownership structure of CRRC involves China CRRC Group Co., Ltd., a wholly state-owned enterprise under the direct supervision of the State-owned Assets Supervision and Administration Commission (SASAC) of the State Council. This ensures the Chinese government maintains a controlling interest. As of December 31, 2023, China CRRC Group Co., Ltd. held approximately 50.86% of CRRC Corporation Limited's total shares. This significant stake allows the Chinese government, through SASAC, to exert considerable influence over CRRC's strategic direction, major investments, and key appointments. The remaining shares are publicly traded, attracting various institutional investors, mutual funds, and individual shareholders.

| Ownership Structure Aspect | Details | Impact |

|---|---|---|

| Parent Company | China CRRC Group Co., Ltd. (Wholly state-owned) | Ensures alignment with national industrial policies. |

| Government Control | SASAC oversight | Influences strategic direction, investments, and appointments. |

| Public Float | Shares traded on SSE and HKEX | Attracts diverse investors; subject to market dynamics. |

The Chinese government's substantial ownership in CRRC, a major rolling stock manufacturer, directly affects the company's strategy. This often aligns with national industrial policies and global infrastructure initiatives, such as the Belt and Road Initiative. The state's influence is evident in CRRC's strategic focus on international market expansion and technological innovation. This ownership structure ensures that CRRC's operations support broader national economic and strategic objectives.

CRRC's ownership is predominantly controlled by the Chinese government through China CRRC Group Co., Ltd.

- The state's controlling stake ensures alignment with national policies.

- Publicly traded shares attract a diverse range of investors.

- The government's influence shapes CRRC's strategic direction.

- CRRC's focus on international expansion is influenced by state ownership.

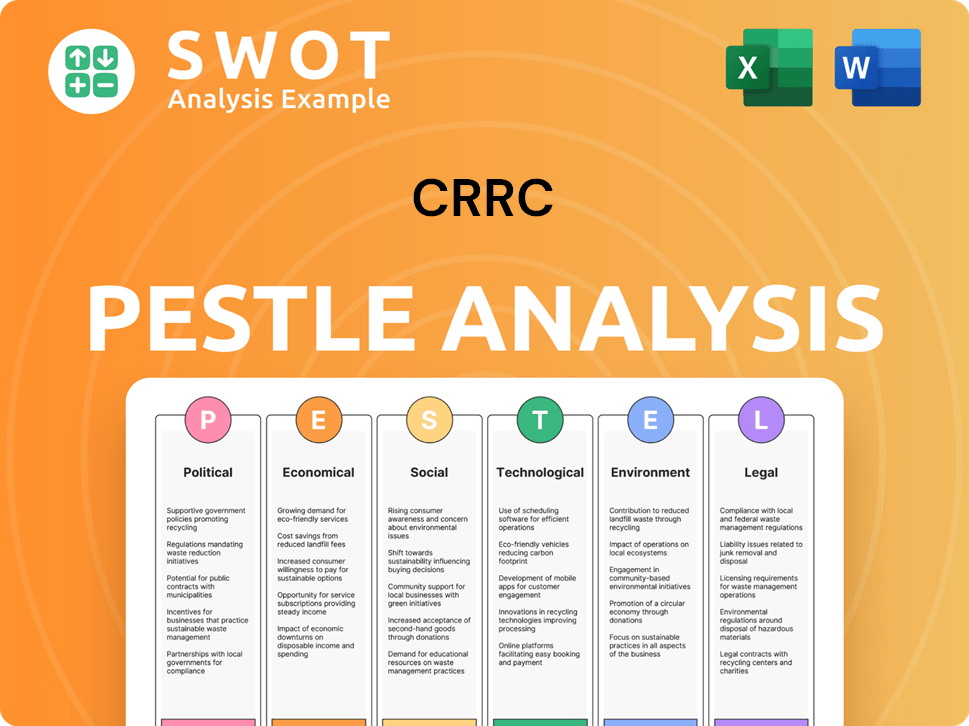

CRRC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on CRRC’s Board?

The Board of Directors of China Railway Rolling Stock Corporation (CRRC), as of early 2024, is structured to reflect its status as a Chinese state-owned enterprise. The board typically includes a mix of executive directors, who are also senior management within CRRC, non-executive directors representing the interests of the major state-owned shareholder, China CRRC Group Co., Ltd., and independent non-executive directors. This composition ensures alignment with national industrial policies and provides external oversight.

The presence of independent directors is crucial for maintaining corporate governance standards, especially for a company listed on international exchanges. Their role involves scrutiny of the company's operations, ensuring transparency, and protecting the interests of minority shareholders. The board's decisions, particularly those related to capital allocation, major projects, and international expansion, are heavily influenced by directives from its ultimate state ownership. The Marketing Strategy of CRRC is also influenced by these factors.

| Board Member Category | Role | Typical Representation |

|---|---|---|

| Executive Directors | Senior Management | Executives within CRRC |

| Non-Executive Directors | Representing Shareholder Interests | China CRRC Group Co., Ltd. |

| Independent Non-Executive Directors | External Oversight | Independent professionals |

The voting structure of CRRC is primarily based on a one-share-one-vote principle for its publicly traded shares. However, the significant majority stake held by China CRRC Group Co., Ltd. grants the Chinese government substantial control over major corporate decisions. Resolutions, whether requiring simple or special majorities, are largely determined by the state's vote. The company is subject to regulatory scrutiny and shareholder engagement, particularly from institutional investors, despite being a state-controlled enterprise.

CRRC's ownership structure gives the Chinese government significant control over its operations. This control is primarily exerted through China CRRC Group Co., Ltd., which holds a majority stake. This structure influences strategic decisions, including capital allocation and international expansion.

- State-owned enterprise.

- Majority stake held by China CRRC Group Co., Ltd.

- Influenced by national industrial policies.

- Subject to regulatory scrutiny.

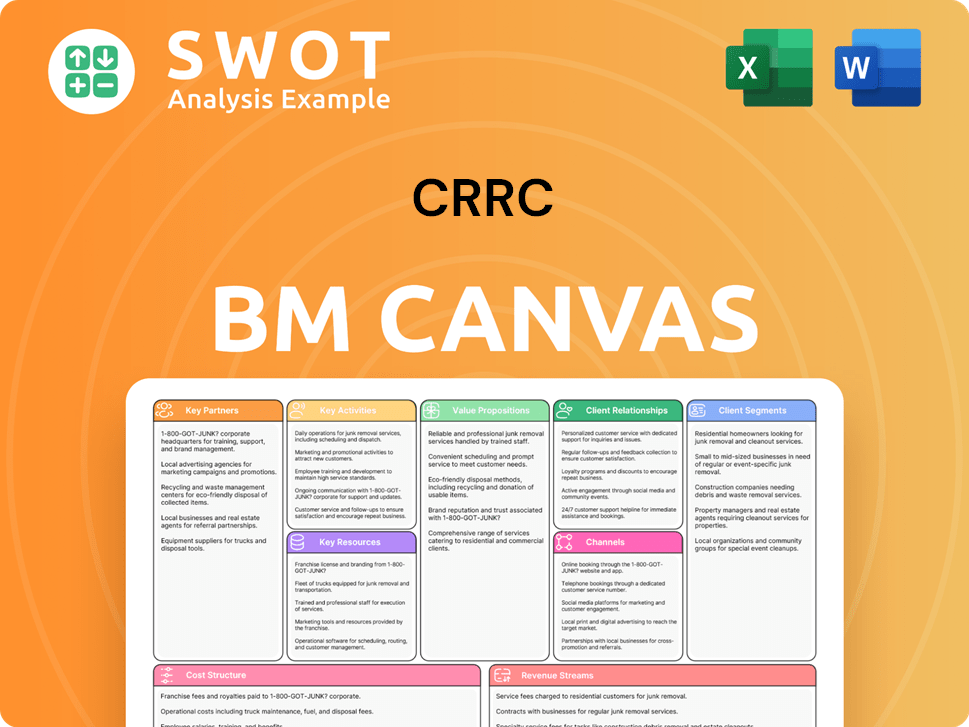

CRRC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped CRRC’s Ownership Landscape?

Over the past few years, the ownership structure of China Railway Rolling Stock Corporation (CRRC) has largely remained stable, with China CRRC Group Co., Ltd., its state-owned parent, maintaining a dominant stake. While the core ownership by the state has not significantly changed, CRRC has continued to utilize capital market activities, such as bond issuances, to finance its operations and research and development efforts. For example, in 2023, CRRC actively pursued international market expansion, often involving strategic partnerships, which, however, did not alter the fundamental ownership structure.

Industry trends indicate a continued focus on consolidation within Chinese state-owned enterprises, aiming to create stronger, globally competitive entities. For CRRC, this means a sustained emphasis on technological innovation, particularly in areas like high-speed rail and new energy rail vehicles. Institutional ownership of CRRC shares can fluctuate based on market sentiment and investment strategies. Large institutional funds consistently show interest in CRRC as a major player in a critical infrastructure sector. The Growth Strategy of CRRC highlights the company's continued efforts to support national development goals.

Public statements from CRRC and analysts consistently highlight the company's role in supporting national development goals, including the 'Belt and Road Initiative,' which often translates into state-backed support for its international projects. There have been no major public announcements regarding a potential privatization or significant shift in the state's controlling stake, suggesting the current ownership structure is stable and aligned with the Chinese government's long-term strategic objectives for the rail industry. The focus remains on enhancing its global competitiveness and technological leadership in rolling stock manufacturing.

CRRC's ownership has remained largely consistent, with the state-owned parent company maintaining a dominant stake. Capital market activities, like bond issuances, are used to fund operations and R&D. International expansion efforts, including partnerships, have not significantly altered the core ownership structure.

Consolidation within Chinese state-owned enterprises is a key industry trend. CRRC focuses on technological innovation, especially in high-speed rail. Institutional ownership can fluctuate, with large funds showing consistent interest due to CRRC's role in infrastructure.

CRRC supports national development goals, including the 'Belt and Road Initiative.' There have been no announcements of privatization or changes in the state's controlling stake. The focus is on global competitiveness and technological leadership in rolling stock manufacturing.

CRRC has been involved in capital market activities to fund its operations. These include potential secondary offerings or bond issuances. Such activities are common for large state-owned enterprises.

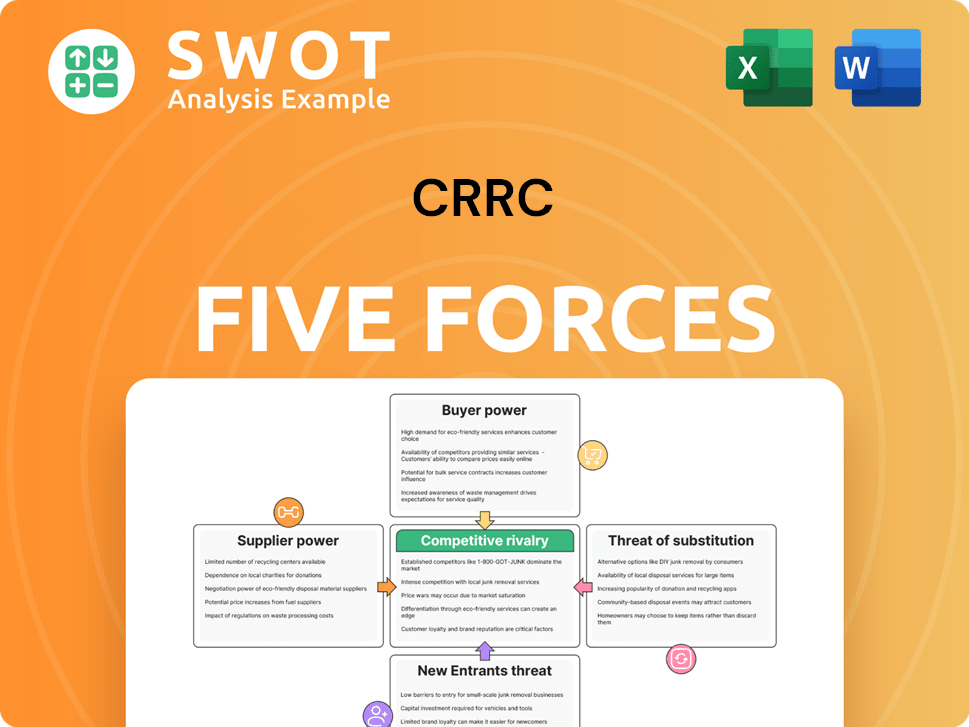

CRRC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CRRC Company?

- What is Competitive Landscape of CRRC Company?

- What is Growth Strategy and Future Prospects of CRRC Company?

- How Does CRRC Company Work?

- What is Sales and Marketing Strategy of CRRC Company?

- What is Brief History of CRRC Company?

- What is Customer Demographics and Target Market of CRRC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.