CRRC Bundle

How Does CRRC Conquer the Global Railway Industry?

CRRC Corporation Limited, a dominant force in the global railway industry, achieved record-breaking financial results in 2024. With operating revenue soaring to RMB 246.457 billion and net profit hitting RMB 12.388 billion, CRRC's performance highlights its robust operational model. This success underscores the company's critical role as a leading manufacturer of high-end rail transit equipment and system solutions.

Delving into CRRC SWOT Analysis is key to understanding this Chinese rail giant's strategic prowess. From its comprehensive rolling stock offerings, including high-speed trainsets and urban mass transit vehicles, to its global presence, CRRC's operations are a testament to its engineering and market dominance. This exploration will provide a detailed look at the CRRC company, its manufacturing process, and its impact on the railway industry, alongside its future projects and plans.

What Are the Key Operations Driving CRRC’s Success?

The CRRC company operates through a vertically integrated business model, covering research and development, design, manufacturing, refurbishment, sales, leasing, and technical services. This comprehensive approach allows for stringent quality control and fosters continuous innovation. The company's core offerings include railway locomotives, multiple units (MUs), and urban rail transit vehicles, serving a broad customer base that includes railway and urban rail transportation operators.

The value proposition of CRRC operations lies in delivering reliable, high-performance, and increasingly intelligent and green transportation solutions. This is achieved through meticulous management of operational processes, from sourcing raw materials to sophisticated manufacturing and assembly. Strategic partnerships and an extensive distribution network support its global operations, ensuring that CRRC remains competitive in the railway industry.

In 2024, the company made significant technological advancements, including the debut of the CR450 EMU prototype and the introduction of new energy locomotives. These innovations highlight CRRC's commitment to sustainability and technological leadership. The company's global presence spans 116 countries and regions, demonstrating its widespread impact and market reach. For more insights into the company's strategic growth, consider reading the article on Growth Strategy of CRRC.

CRRC's operational excellence is driven by its comprehensive approach to the railway industry. This includes a strong focus on technology and a commitment to sustainability. The company's manufacturing processes and supply chain are designed to support its global operations effectively.

- Vertical Integration: Ensures control over the entire production process.

- Technological Innovation: Focus on new energy locomotives and advanced prototypes.

- Global Presence: Operates in 116 countries and regions.

- Strategic Partnerships: Collaborations to minimize costs and enhance development.

CRRC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CRRC Make Money?

The CRRC company, a leading rolling stock manufacturer, employs a diversified monetization strategy. This approach combines substantial revenue from product sales with ongoing income from after-sales services. This dual strategy supports the company's financial health and market competitiveness.

CRRC operations generate revenue primarily through the sale of railway locomotives, MUs, urban rail transit vehicles, and other rail equipment. Additionally, the company leverages services like maintenance, refurbishment, leasing, and technical consulting to ensure customer loyalty and stable income streams. These services are crucial for long-term financial stability.

CRRC's total operating revenue for 2024 reached RMB 246.457 billion, marking a 5.21% year-on-year increase. The company also focuses on innovative business models such as 'Product+' and 'System+' to boost growth and international expansion across the entire industry chain.

In 2024, revenue from rail equipment reached RMB 110.461 billion, a 12.5% increase year-on-year. This segment remains a core revenue driver for the company.

Emerging industries, including clean energy equipment, significantly contribute to revenue. Revenue from these sectors rose to RMB 86.375 billion, up 7.13% in 2024.

The company's gross profit margin increased by 0.84 percentage points in 2024. This improvement reflects enhanced operational efficiency and strategic financial management.

Total new orders for 2024 reached approximately RMB 322.2 billion, including RMB 47.2 billion in international orders. This indicates strong market demand and global expansion.

For the first quarter ended March 31, 2025, CRRC reported sales and revenue of CNY 48.671 billion. This showcases consistent performance.

CRRC generates substantial revenue from services like maintenance, refurbishment, and technical consulting, ensuring customer loyalty and consistent income streams.

CRRC's revenue streams are diversified, focusing on both product sales and after-sales services. This approach supports sustainable growth and market leadership in the railway industry.

- Sales of railway locomotives, MUs, and urban rail transit vehicles.

- Revenue from maintenance, refurbishment, and leasing services.

- Technical consulting and support services.

- Strategic initiatives such as 'Product+' and 'System+' business models.

- Focus on international orders to expand global presence.

For a deeper dive into CRRC's strategic growth, consider reading the Growth Strategy of CRRC.

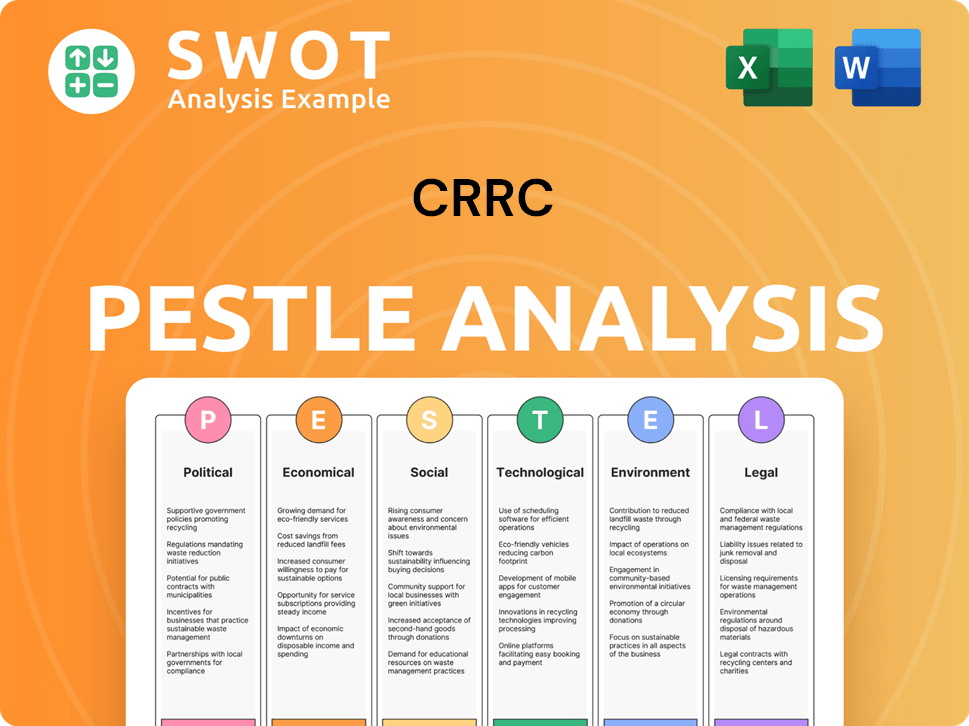

CRRC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped CRRC’s Business Model?

The CRRC company has achieved significant milestones, shaping its operations and financial performance. In 2024, the company launched the global debut of the CR450 EMU prototype, introduced new energy locomotives, and successfully trialed a hydrogen-powered urban train. These achievements highlight its commitment to innovation and technological advancement within the railway industry.

Strategic moves include expansion into emerging business sectors and nurturing future-oriented industries to consolidate high-quality development. The company signed agreements worth approximately 54.7 billion yuan between December 2024 and May 2025 for various urban rail transit vehicles and energy equipment. A notable market entry involves plans to open a factory in Brazil, with potential investments reaching $1 billion, alongside securing contracts for metro trains.

CRRC operations face market risks, product quality risks, exchange rate risks, and overseas operating risks. The company addresses these challenges by strengthening risk control and adhering to compliance-oriented operations. Its competitive advantages stem from its brand strength, technology leadership, and economies of scale.

The CRRC company achieved several key milestones in 2024, including the debut of the CR450 EMU prototype and the introduction of new energy locomotives. It also successfully trialed a hydrogen-powered urban train, showcasing its commitment to innovation. These advancements support its role in technological progress and industrial transformation.

Strategic moves include expansion into emerging business sectors and nurturing future-oriented industries. High-value contracts were signed, with agreements totaling approximately 54.7 billion yuan between December 2024 and May 2025. Plans to open a factory in Brazil, with potential investments of $1 billion, demonstrate its global expansion strategy.

CRRC benefits from its brand strength as a global leader in high-end rail transit equipment. Its technology leadership, demonstrated by continuous innovation, and economies of scale through extensive manufacturing capabilities provide a competitive advantage. Robust government support and favorable policies in China further stimulate industry demand.

Operational and market challenges include market risks, product quality risks, and exchange rate risks. CRRC addresses these by strengthening risk control and adhering to compliance-oriented operations. The company continues to adapt to new trends by focusing on digitalization, high-end development, and internationalization.

CRRC is a leading rolling stock manufacturer, with a significant presence in the Chinese rail market and globally. The company's financial performance is influenced by government support and global demand for rail transit equipment. For more insights into the CRRC's target market, see Target Market of CRRC.

- CRRC has a substantial market share worldwide.

- The company is expanding its global presence through strategic investments and partnerships.

- CRRC's manufacturing process is highly efficient, supporting its economies of scale.

- The company continues to invest in technological advancements to maintain its competitive edge.

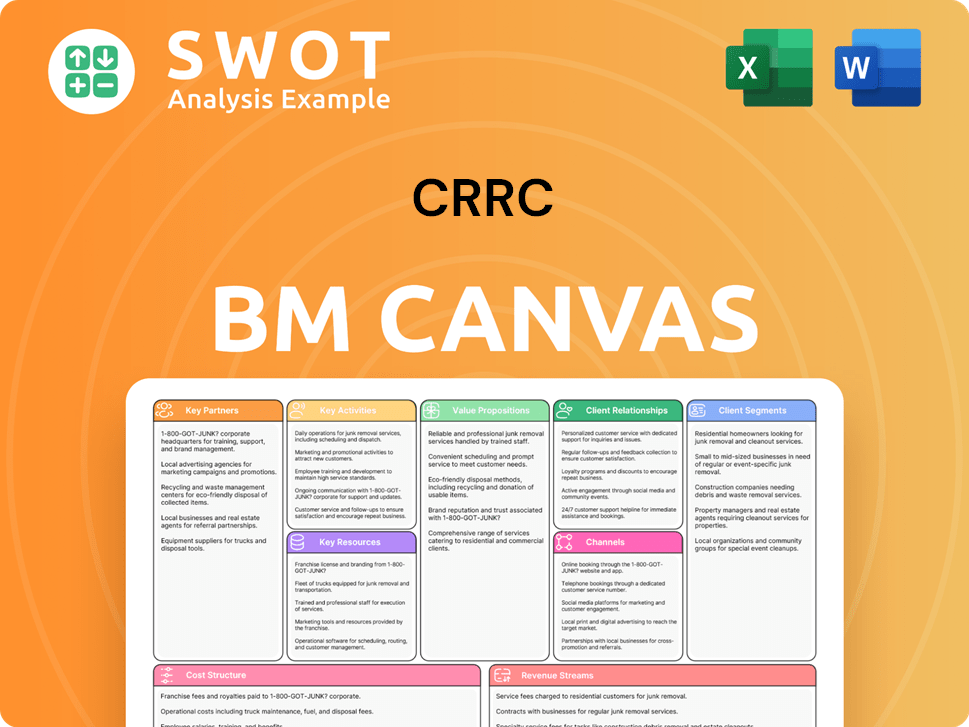

CRRC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is CRRC Positioning Itself for Continued Success?

The CRRC company, a leading player in the global railway industry, holds a significant position in the market for high-end rail transit equipment and system solutions. With a vast network of over 100 overseas subsidiaries and offices, the company's reach extends to 116 countries and regions worldwide. This extensive global presence underscores its importance in the Chinese rail sector and its impact on the railway industry.

CRRC operations face several risks, including strategic, market, and product quality risks. Heavy reliance on state support introduces policy risks, while technological disruptions and new competitors pose ongoing challenges. Despite these hurdles, the company is committed to sustainable growth and innovation.

As a rolling stock manufacturer, CRRC competes with global leaders like Alstom and Siemens Mobility. Its consistent revenue growth and strategic expansions highlight its strong competitive standing. CRRC fosters customer loyalty by offering comprehensive services, including maintenance and refurbishment, ensuring long-term support for its products.

Key risks include strategic and market risks, alongside product quality and exchange rate fluctuations. The company is also exposed to policy risks due to its dependence on state support. The evolving transportation sector presents ongoing challenges from new competitors and technological advancements. For more insights into the competitive landscape, consider reading Competitors Landscape of CRRC.

CRRC is focused on high-quality development, aiming to strengthen its core rail transit business through green, intelligent, and high-end transformation. The company plans to expand globally with Chinese solutions. Strategic initiatives include accelerating growth in strategic emerging industries, building a 'dual-track, dual-cluster' model, and fostering new quality productive forces.

For 2025, CRRC's financial strategy emphasizes value creation, innovation leadership, and reform empowerment. The goal is to lay a solid foundation for the 15th Five-Year Plan. By 2030, CRRC aims to become a world-class enterprise known for its excellent products, brand recognition, leadership in innovation, and modern governance.

CRRC is focusing on several key areas to ensure future growth and competitiveness. These initiatives are designed to enhance its market position and drive innovation in the railway industry.

- Prioritizing green, intelligent, and high-end transformation of its core rail transit business.

- Expanding globally with Chinese solutions and increasing its international market share.

- Accelerating the growth of strategic emerging industries to diversify its portfolio.

- Building a 'dual-track, dual-cluster' model focusing on rail transit equipment and clean energy equipment.

- Fostering new quality productive forces through sustained R&D investment and technological advancements.

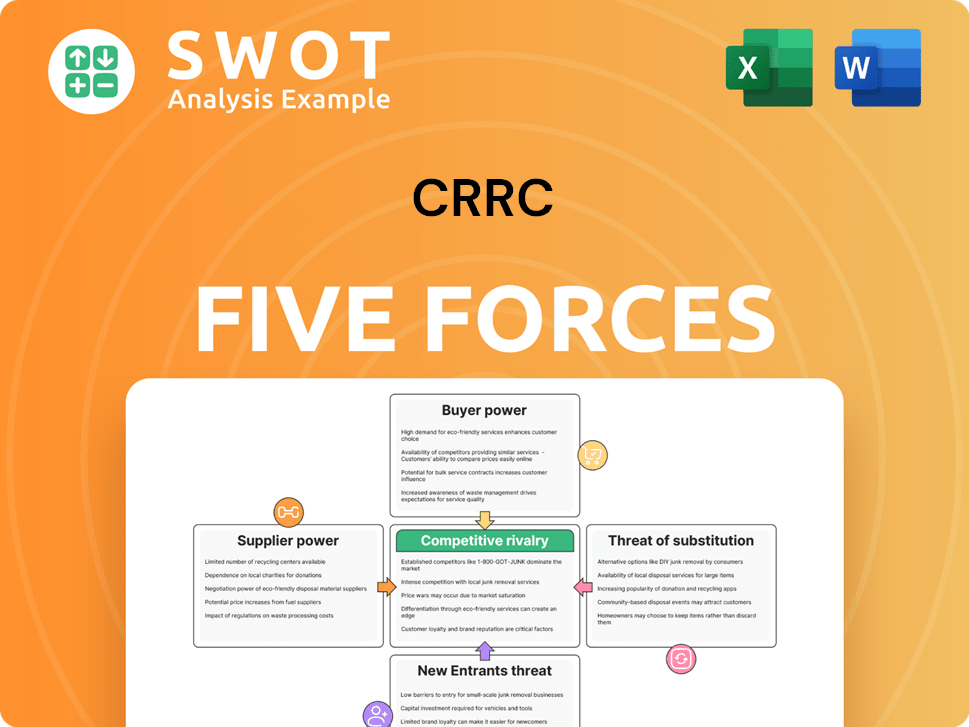

CRRC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CRRC Company?

- What is Competitive Landscape of CRRC Company?

- What is Growth Strategy and Future Prospects of CRRC Company?

- What is Sales and Marketing Strategy of CRRC Company?

- What is Brief History of CRRC Company?

- Who Owns CRRC Company?

- What is Customer Demographics and Target Market of CRRC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.