CRRC Bundle

How Does CRRC Dominate the Global Rail Industry?

The global rolling stock market is a dynamic arena, and at its heart lies CRRC, a company reshaping the benchmarks of transportation. Born from a strategic merger, CRRC has rapidly ascended to become the world's largest rolling stock manufacturer. Understanding the CRRC SWOT Analysis is crucial for navigating this complex landscape.

This deep dive into the CRRC competitive landscape will illuminate its strategies and challenges. We'll explore the CRRC market analysis, identifying key CRRC competitors and dissecting CRRC's competitive advantages within the Chinese rail industry and beyond. Examining CRRC's global expansion strategy and its impact on the rail industry will provide valuable insights into its future growth prospects.

Where Does CRRC’ Stand in the Current Market?

The company currently holds a dominant market position within the global rolling stock manufacturing industry. As of 2024, the company is recognized as the world's largest rolling stock manufacturer by revenue, significantly outpacing its international competitors. The company's primary product lines encompass a comprehensive range of railway vehicles, including high-speed trainsets, passenger coaches, freight wagons, railway locomotives, and urban mass transit vehicles like metros and trams.

The company's geographic presence is extensive, with a strong foothold in its domestic Chinese market, which is the largest railway market globally, and a growing international presence across Asia, Africa, Europe, North America, and South America. The company serves a diverse range of customer segments, including national railway operators, urban transit authorities, and industrial clients requiring specialized rolling stock. Understanding the Growth Strategy of CRRC can provide additional insights into its market approach.

Over time, the company has strategically shifted its positioning, particularly by emphasizing its high-speed rail technology and expanding its international project portfolio. This has allowed the company to move beyond being primarily a domestic supplier to a significant global player, often competing for and winning large-scale, high-value contracts. For instance, in the first three quarters of 2023, the company reported operating revenue of approximately 147.4 billion yuan (around 20.3 billion USD), showcasing its substantial financial health compared to industry averages.

The company consistently leads the global rolling stock market. While precise 2024-2025 figures are still emerging, historical data indicates a substantial lead, often exceeding 50% of the global railway equipment market. This dominance is supported by significant revenue figures, underscoring its financial strength and market influence.

The company offers a comprehensive range of railway vehicles, including high-speed trains, passenger coaches, freight wagons, locomotives, and urban transit vehicles. It serves a diverse customer base, including national railway operators, urban transit authorities, and industrial clients. This broad portfolio and customer reach contribute to its market position.

The company has a strong presence in its domestic Chinese market and is expanding internationally. Its global footprint spans Asia, Africa, Europe, North America, and South America. This widespread presence enables the company to tap into diverse markets and customer needs.

The company's financial scale is unparalleled in the industry, with robust revenue figures. The company has strategically emphasized high-speed rail technology and expanded its international project portfolio. This strategic shift has transformed the company into a significant global player.

The company's competitive advantages include its cost-effectiveness, comprehensive technological solutions, and strong presence in emerging markets. It faces challenges in mature markets due to established local players and regulatory complexities. The company continues to make inroads through strategic partnerships and targeted bids.

- Dominant market share in the global rolling stock industry.

- Strong financial performance, reflected in substantial operating revenue.

- Extensive product portfolio catering to diverse customer segments.

- Strategic focus on high-speed rail and international expansion.

- Growing presence in emerging markets and strategic partnerships.

CRRC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CRRC?

The CRRC competitive landscape is characterized by intense rivalry in the global rolling stock market. Several major players vie for market share, particularly in high-speed rail and urban transit systems. This competition drives innovation and influences pricing strategies within the Chinese rail industry and beyond.

Understanding the key CRRC competitors is crucial for analyzing the company's strategic positioning and future prospects. These competitors employ various strategies, including technological advancements, extensive service networks, and cost-effectiveness, to gain an edge in the rolling stock market. The dynamics of this competition are constantly evolving, influenced by mergers, acquisitions, and technological disruptions.

The global rolling stock market is estimated to be worth billions of dollars, with significant growth projected in the coming years, especially in emerging markets. For instance, the high-speed rail market alone is expected to reach substantial figures by 2030, presenting lucrative opportunities for companies like CRRC and its competitors. Recent data indicates that the demand for sustainable and efficient transportation solutions is increasing, which is influencing the CRRC strategy and its competitors' strategies.

Siemens Mobility, a division of Siemens AG, is a major direct competitor to CRRC. It is known for its innovative rolling stock, rail infrastructure, and intelligent mobility solutions. Siemens Mobility competes with CRRC in various segments, including high-speed trains, regional trains, and urban transit systems.

Alstom, a French multinational, is a significant competitor with a broad portfolio. Following its acquisition of Bombardier Transportation, Alstom expanded its global reach. It directly challenges CRRC in various segments, including metro systems and regional trains, leveraging its established presence.

Hitachi Rail, part of the Japanese Hitachi Group, is a key competitor, expanding its global presence. It offers a range of rolling stock and signaling solutions, competing with CRRC on technological sophistication and reliability, particularly in high-speed and commuter rail projects.

Indirect competition comes from local manufacturers in various countries. These manufacturers may offer more localized solutions or benefit from government support. This localized competition adds another layer of complexity to the CRRC market analysis.

Emerging players, particularly those focusing on niche technologies like hydrogen-powered trains or advanced signaling systems, could disrupt the traditional competitive landscape. Their current scale does not rival CRRC's, but they represent potential future challenges.

Mergers and alliances, such as Alstom's acquisition of Bombardier Transportation, significantly reshape the competitive dynamics. These consolidations lead to fewer but larger global players, intensifying the competition for market share.

The competitive landscape is further shaped by regional variations and specific project requirements. For example, in Europe, stringent safety standards and a focus on sustainability influence procurement decisions, impacting CRRC's market share in Europe. In contrast, developing economies often prioritize cost-effectiveness and rapid project execution, which can be a CRRC's competitive advantages. The ongoing technological advancements, such as the development of autonomous trains and digital signaling systems, are also key factors. For more insights, consider reading a detailed analysis of the company's performance in this Rolling Stock Market report.

The competition among CRRC and its rivals is based on several key factors:

- Technology: Siemens and Alstom often compete on advanced technology and customized solutions.

- Cost-Effectiveness: CRRC often competes on cost-effectiveness, particularly in developing economies.

- Service Networks: Rivals counter with long-standing safety records and extensive service networks.

- Regional Standards: Adherence to specific regional standards is crucial for winning contracts.

- Project Execution: Rapid project execution is a key factor, especially in large infrastructure projects.

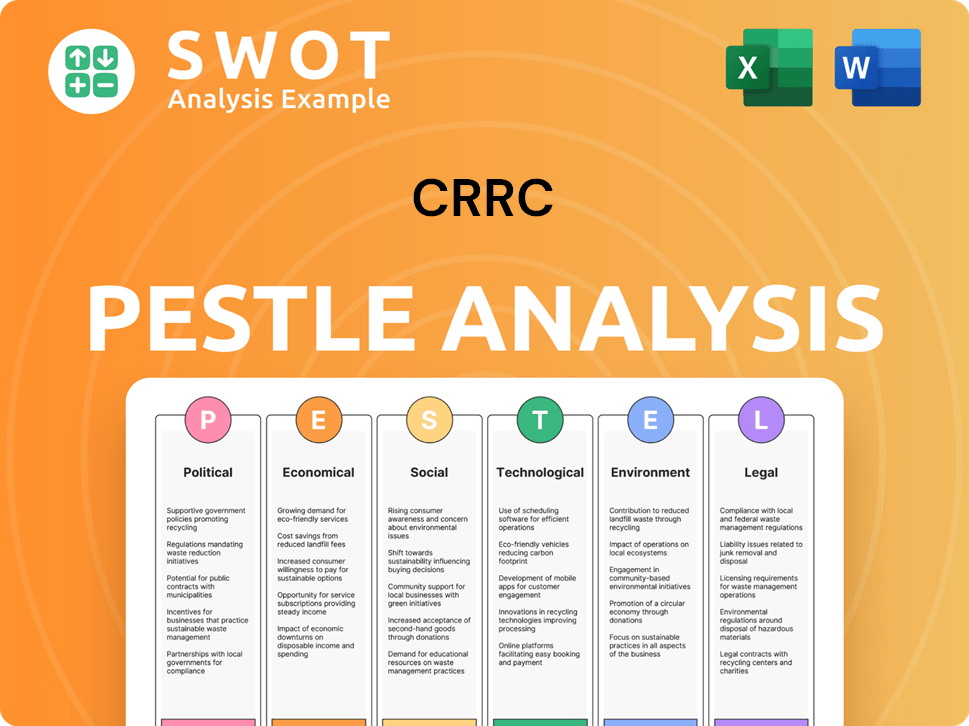

CRRC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CRRC a Competitive Edge Over Its Rivals?

The competitive advantages of CRRC are substantial, stemming from its scale, technological prowess, and strategic global presence. A comprehensive CRRC market analysis reveals that the company has built a strong foundation for sustained success. Its ability to offer cost-effective solutions through economies of scale is a key differentiator, particularly in large-volume orders. This is supported by a robust supply chain within China, providing efficient access to raw materials and components, which is a major advantage in the Chinese rail industry.

Government support and investment in research and development, especially in high-speed rail technology, have significantly boosted CRRC's capabilities. This backing has enabled the development of proprietary technologies and intellectual property in critical areas such as high-speed train design and intelligent control systems. CRRC's comprehensive product portfolio, which includes everything from high-speed trains to urban transit vehicles and maintenance services, simplifies procurement for clients. The company's extensive experience in building and maintaining China's vast railway network serves as a strong credential in global tenders, which is a critical aspect of its CRRC's global expansion strategy.

While brand equity outside of China is still developing compared to some Western counterparts, CRRC is actively building its global brand through successful project deliveries and localized operations. Its ability to adapt solutions to diverse geographic and operational requirements, coupled with competitive financing packages, further enhances its appeal in international markets. These advantages have evolved from primarily being a domestic supplier to a global contender, with the company increasingly focusing on technological innovation and localized partnerships to sustain its edge. For a deeper understanding of the company's origins and development, consider reading a Brief History of CRRC.

CRRC benefits significantly from its immense scale, enabling cost-effective production and competitive pricing. This advantage is particularly crucial in securing large-volume orders, allowing the company to offer more attractive terms to clients. The scale also supports a robust supply chain, ensuring efficient access to raw materials and components. This is a key element in its CRRC competitive landscape.

CRRC's technological capabilities are a cornerstone of its competitive edge, especially in high-speed rail. Investments in research and development have led to proprietary technologies and intellectual property. This includes advancements in high-speed train design, traction systems, and intelligent control systems, positioning CRRC as a leader in this segment. This is a major factor in CRRC's technological advancements.

The company offers a 'one-stop shop' solution, covering everything from high-speed trains to urban transit vehicles and maintenance services. This broad portfolio simplifies procurement for clients, ensuring compatibility across different railway components. This comprehensive approach reduces the need for multiple suppliers, streamlining project management and reducing overall costs. This is a key aspect of CRRC's product portfolio overview.

CRRC is actively building its global brand through successful project deliveries and localized operations. It adapts solutions to diverse geographic and operational requirements, enhancing its appeal in international markets. Competitive financing packages further support its global expansion. This focus is essential for CRRC's future growth prospects.

CRRC's competitive advantages are multifaceted, including economies of scale, technological expertise, and strategic global outreach. These strengths are critical in a competitive market, allowing CRRC to maintain its leadership position. The company's ability to innovate and adapt to changing market demands is also a key factor in its success.

- Economies of scale and cost-effective production.

- Technological leadership in high-speed rail and related systems.

- Comprehensive product portfolio offering 'one-stop shop' solutions.

- Strategic global expansion and localized operations.

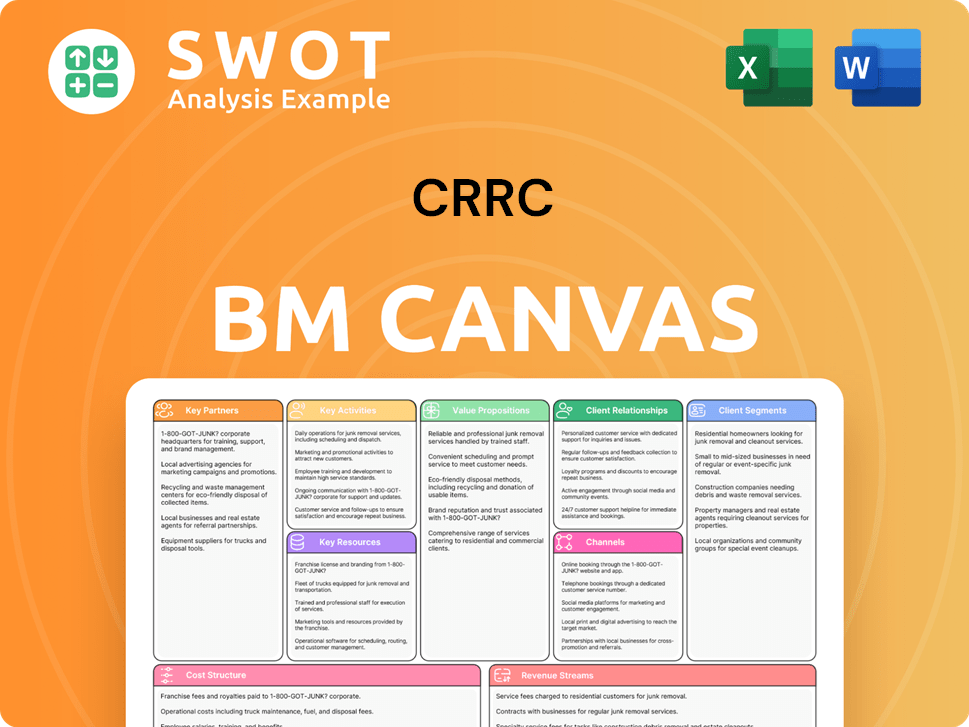

CRRC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CRRC’s Competitive Landscape?

The global rolling stock industry is experiencing significant shifts, primarily driven by the push for sustainable transportation, digitalization, and the expansion of urban mass transit. This dynamic environment presents both opportunities and challenges for major players like CRRC. Understanding the CRRC competitive landscape is crucial for investors and industry analysts alike, given the company's substantial influence in the Chinese rail industry and its global ambitions.

The company's strategy is heavily influenced by these trends, which include the growing need for electric and hydrogen-powered trains to reduce carbon emissions. Digitalization, encompassing intelligent maintenance systems and autonomous train operation, is also transforming the sector. Rapid urbanization is further fueling demand for new metro lines and regional rail networks. Assessing the CRRC market analysis requires a close look at how the company navigates these evolving industry dynamics and the competitive pressures from its rivals.

The rolling stock market is witnessing a surge in demand for sustainable transportation solutions, including electric, hydrogen, and hybrid trains. Digitalization is transforming operational efficiency and safety through intelligent maintenance systems and autonomous train operation. Urbanization continues to drive the need for new metro lines and regional rail networks.

Adapting to stringent environmental regulations and diverse technical standards across international markets is a key challenge, requiring significant R&D investment. Geopolitical tensions and protectionist policies in some Western markets could limit market access and intensify competition. Maintaining cost advantages while enhancing technological sophistication is crucial.

The global push for decarbonization presents a massive market for electric and hydrogen-powered solutions. The Belt and Road Initiative continues to open doors for railway infrastructure projects in developing economies. Further opportunities lie in expanding service and maintenance businesses, which offer higher margins and recurring revenue streams.

CRRC's strategy focuses on technological leadership in sustainable and intelligent rail solutions, alongside expanding its global footprint, particularly in emerging markets. The company is investing in advanced manufacturing and forming strategic partnerships to overcome market entry barriers. The company is also focused on improving its CRRC competitive advantages.

CRRC's future hinges on its ability to navigate complex international regulations and geopolitical risks while capitalizing on the growing demand for sustainable rail solutions. The company must continue to invest in R&D to meet evolving technical standards and maintain its competitive edge in the Rolling stock market.

- Market Expansion: CRRC's global expansion strategy involves targeting emerging markets and leveraging initiatives like the Belt and Road.

- Technological Advancement: Investments in digitalization, sustainable propulsion systems, and advanced manufacturing are critical.

- Competitive Dynamics: The company faces competition from established players and emerging niche technology providers. Understanding CRRC competitors is key. For more insights, read about Owners & Shareholders of CRRC.

- Financial Performance: The company's CRRC financial performance analysis is crucial.

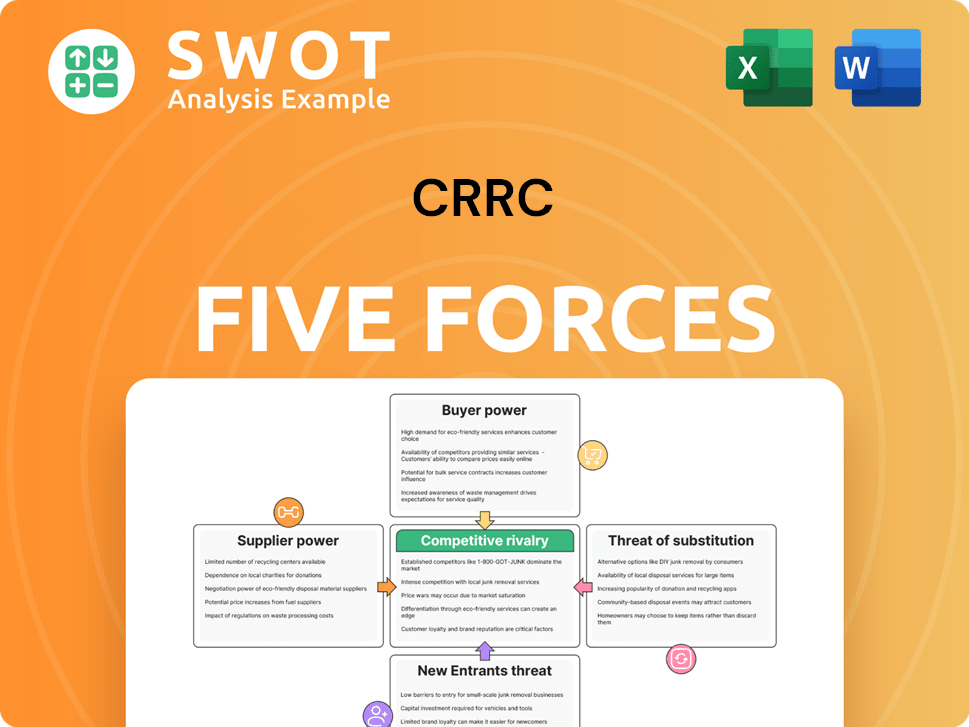

CRRC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CRRC Company?

- What is Growth Strategy and Future Prospects of CRRC Company?

- How Does CRRC Company Work?

- What is Sales and Marketing Strategy of CRRC Company?

- What is Brief History of CRRC Company?

- Who Owns CRRC Company?

- What is Customer Demographics and Target Market of CRRC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.