Danaher Bundle

How did Danaher transform from a real estate venture to a global science and technology powerhouse?

Embark on a journey through the compelling Danaher SWOT Analysis to uncover the remarkable evolution of the Danaher Company. From its roots in the early 1980s, conceived by the Rales brothers, to its current status as a leader in life sciences and diagnostics, Danaher's story is one of strategic vision and relentless pursuit of excellence. Discover how this transformation was fueled by the Danaher Business System (DBS) and a series of impactful acquisitions.

This brief history of Danaher Corporation reveals a company that has consistently adapted and innovated. The company's journey, marked by strategic Danaher acquisitions and a focus on its core business segments, showcases its commitment to long-term growth. Understanding the Danaher history provides crucial insights into its growth strategy and its significant impact on the scientific industry, including its involvement in diagnostics and environmental solutions. By examining Danaher's business model, we can better appreciate its sustained financial performance.

What is the Danaher Founding Story?

The story of the Danaher Company begins in 1969, but its true transformation started in the 1980s. Initially, it was a real estate investment trust called DMG, Inc. This entity went through a series of changes before becoming the Danaher Corporation we know today.

In 1984, the Rales brothers, Steven and Mitchell, took control. They renamed the company Danaher, drawing inspiration from Danaher Creek in Montana. This marked the start of a new chapter focused on manufacturing and strategic acquisitions, setting the stage for its future growth.

The brief history of Danaher Corporation is marked by a swift transition into manufacturing. This shift was driven by the vision of the Rales brothers. Their approach, influenced by Japanese lean manufacturing, emphasized continuous improvement and customer satisfaction.

In 1984, Steven M. Rales, at age 33, became the CEO and chairman, steering the company towards industrial manufacturing.

- The initial focus was on acquiring companies to enter the manufacturing sector.

- Within two years, Danaher acquired 12 companies, demonstrating an aggressive growth strategy.

- The company quickly achieved Fortune 500 status.

The early Danaher acquisitions included Mohawk Rubber Company, entering tire manufacturing, and Master Shield Inc., expanding into vinyl building products. This rapid expansion was a key part of the company's strategy. The swift pace of acquisitions and the company's name, reflecting a 'swift flowing' nature, defined its early years.

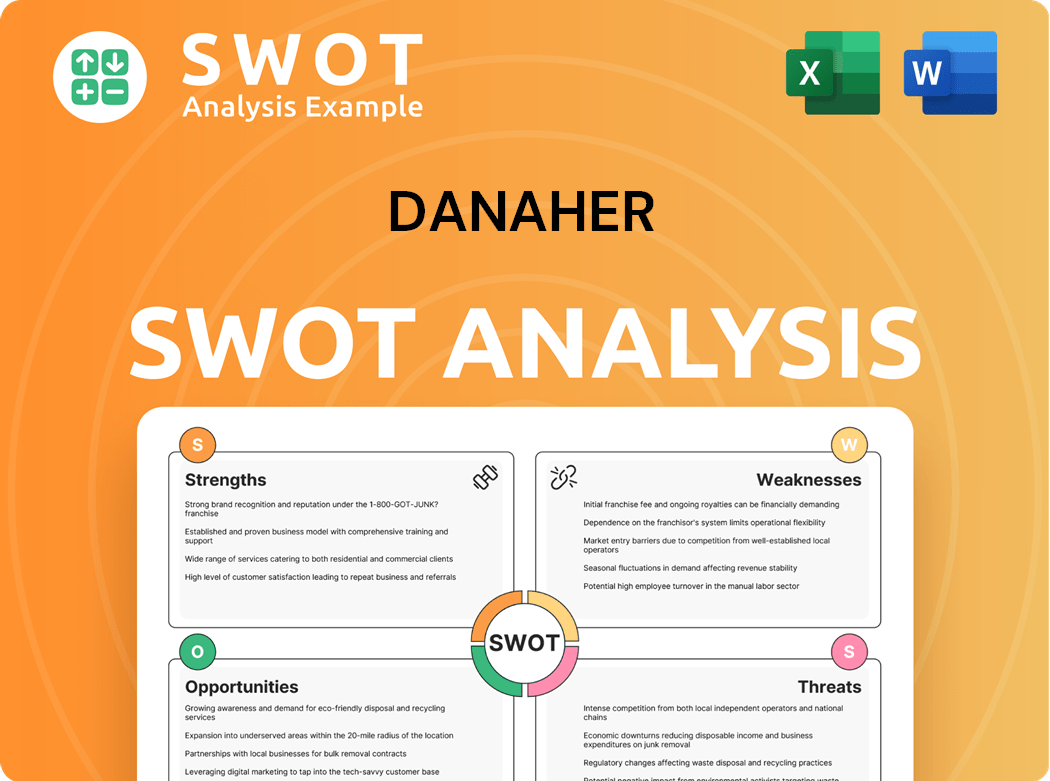

Danaher SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Danaher?

The early growth of the Danaher Company was marked by an aggressive acquisition strategy and the implementation of its operational framework, the Danaher Business System (DBS). This approach quickly propelled the company into the manufacturing sector. The Danaher history showcases a consistent focus on strategic acquisitions and operational efficiency, which has been a key driver of its success.

Within two years of its 1984 founding, Danaher Corporation acquired 12 companies. By 1986, the company achieved Fortune 500 status. Revenue rose from $300 million in 1984 to $456 million by 1986, highlighting the rapid growth through acquisitions like Qualitrol in 1986.

The late 1980s saw the formalization of the Danaher Business System (DBS), inspired by Kaizen principles. DBS became a critical driver of growth and efficiency across Danaher and its operating companies. By 1991, sales revenues had climbed to $1 billion, reflecting the impact of DBS.

The 1990s saw Danaher transform into a leading global multi-industrial business. Strategic mergers and acquisitions, along with DBS-driven improvements, were key. The company also expanded geographically, acquiring Normond/CMS in 1991, and entered the high-growth healthcare market in 2004.

Danaher's entry into healthcare began in 2004 with the acquisition of Radiometer. Further expansion included SCIEX in 2010 and Beckman Coulter Diagnostics in 2011. Subsequent acquisitions like Pall Corporation for $13.8 billion in 2015, Cepheid for $4 billion in 2016, and Phenomenex for $700 million in 2016, solidified its presence in bioprocessing, molecular diagnostics, and life sciences. You can learn more about their approach in this Marketing Strategy of Danaher article.

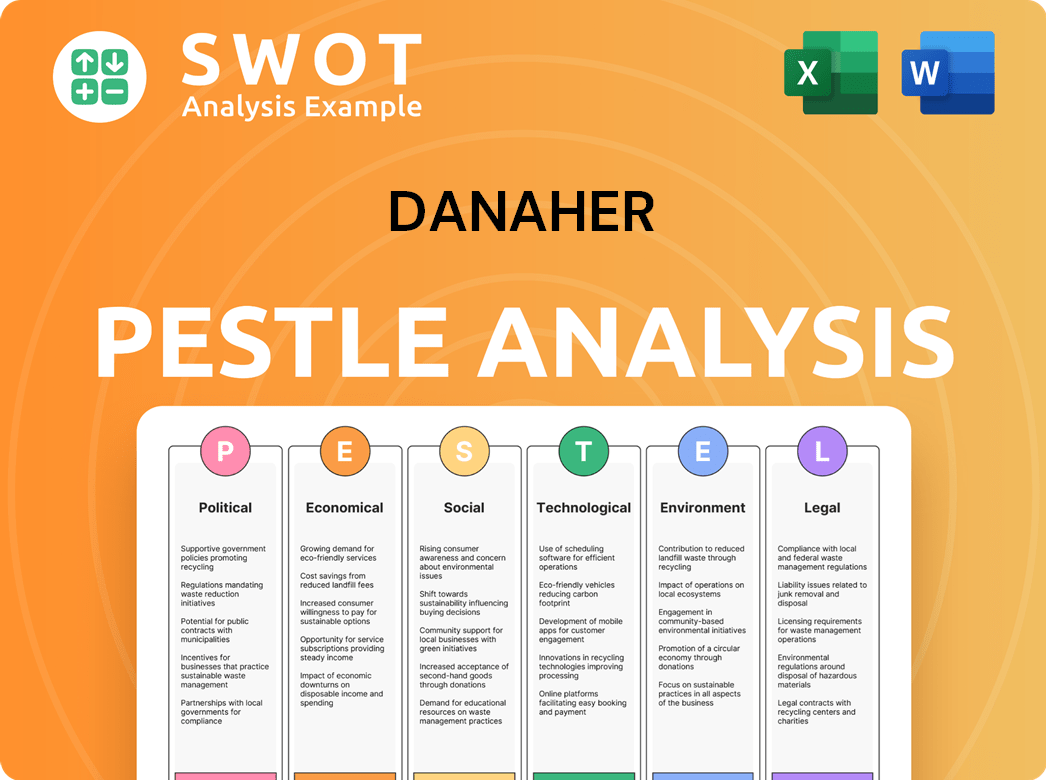

Danaher PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Danaher history?

The Danaher Company has a rich history, marked by strategic moves and significant growth. Its journey is characterized by key acquisitions and the implementation of the Danaher Business System, driving its evolution and expansion across various sectors.

| Year | Milestone |

|---|---|

| 2004 | Entry into healthcare with the acquisition of Radiometer, marking the beginning of its diagnostics business. |

| 2010 | Strengthened its life sciences portfolio with the acquisition of SCIEX. |

| 2011 | Expanded its diagnostics capabilities through the acquisition of Beckman Coulter. |

| 2015 | Acquired Pall Corporation for $13.8 billion, establishing a strong presence in bioprocessing. |

| 2016 | Acquired Cepheid for $4 billion, boosting its molecular diagnostics capabilities, and Phenomenex for $700 million. |

| 2016 | Spun off its industrial businesses, creating Fortive. |

| 2019 | Spun off its dental businesses, creating Envista Holdings Corporation. |

| 2020 | Acquired GE Biopharma (now Cytiva) for $21.4 billion, significantly expanding its biopharmaceutical tools. |

| 2022 | Spun off its environmental and applied solutions group, now called Veralto. |

| 2023 | Acquired Abcam plc for approximately $5.7 billion, expanding its Life Sciences segment. |

A pivotal innovation in the

The DBS, implemented in 1988, is a core innovation that drives continuous improvement and operational excellence.

Danaher's growth strategy includes strategic acquisitions, such as Radiometer, SCIEX, Beckman Coulter, Pall Corporation, and Cytiva, to expand its market presence and product offerings.

Danaher's focus on life sciences and diagnostics, with acquisitions like Abcam in 2023, highlights its commitment to these high-growth sectors.

Danaher invests in new product development, such as in Alzheimer's disease detection and cell therapy, to address market needs and challenges.

The

Danaher faces challenges from market downturns, impacting its financial performance, as seen in the 18.16% reduction in net profit in 2024.

Danaher encounters competitive threats, requiring strategic responses such as product innovation and market expansion to maintain its position.

Increased pricing pressure, particularly in markets like China, has affected Danaher's diagnostics business and overall profitability.

To sharpen its focus, Danaher has strategically spun off industrial and dental businesses, creating Fortive and Envista Holdings Corporation.

Danaher Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Danaher?

The Danaher Company, formerly DMG, Inc., has a rich history marked by strategic shifts and acquisitions, evolving from a real estate investment trust to a global leader in life sciences and diagnostics. This transformation reflects its commitment to continuous improvement and innovation, driving its expansion and impact across various sectors.

| Year | Key Event |

|---|---|

| 1969 | Origins as DMG, Inc., a Massachusetts real estate investment trust. |

| 1984 | Steven and Mitchell Rales take over, reincorporating the company as Danaher Corporation, and initiating a rapid acquisition strategy. |

| 1986 | Achieves Fortune 500 status and acquires 12 companies, with revenues reaching $456 million. |

| 1988 | Danaher Business System (DBS) is developed, formalizing continuous improvement principles. |

| 1991 | Sales revenues reach $1 billion; Danaher becomes the sole source for mechanics' hand tools for Sears, Roebuck & Co. |

| 2004 | Strategic entry into healthcare with the acquisition of Radiometer, its first diagnostics business. |

| 2007 | Acquires Tektronix, Inc. for US$2.85 billion. |

| 2010 | Gains a foothold in life sciences with the acquisition of SCIEX. |

| 2011 | Expands diagnostics portfolio with the acquisition of Beckman Coulter Diagnostics. |

| 2015 | Acquires Pall Corporation for $13.8 billion, strengthening its bioprocessing capabilities. |

| 2016 | Spins off industrial businesses into Fortive; acquires Cepheid and Phenomenex. |

| 2019 | Spins off dental businesses into Envista Holdings Corporation. |

| 2020 | Acquires GE Biopharma (now Cytiva) for $21.4 billion, enhancing biopharmaceutical development and manufacturing. |

| 2022 | Spins off environmental and applied solutions group into Veralto. |

| 2023 (Dec) | Acquires Abcam plc for approximately $5.7 billion, expanding Life Sciences segment. |

| 2024 | Reports full year revenue of $23.9 billion and launches two new Centers of Innovation in Diagnostics. |

| 2025 (Q1) | Reports revenue of $5.7 billion, with non-GAAP core revenue flat year-over-year. |

For the full year 2025, Danaher anticipates non-GAAP core revenue to increase by approximately 3% year-over-year. The company's strategic focus on high-growth life sciences and diagnostics markets is expected to drive future expansion.

Danaher has initiated full-year adjusted diluted net earnings per common share guidance in the range of $7.60 to $7.75 for 2025. Analysts project revenue around $24.41 billion and EPS around $7.70 for fiscal year 2025.

Danaher aims for higher long-term growth, expanded margins, and stronger cash flow through its focused portfolio. Strategic initiatives include ongoing investments in new product development, particularly in areas like Alzheimer's disease detection and cell therapy, and market expansion in key regions like China.

The company expects its life sciences business to experience high single-digit growth and its diagnostics business to grow in the mid-single digits in the long run after a challenging 2025. Forecasts for 2026 project approximately $25.98 billion in revenue and $8.57 in EPS.

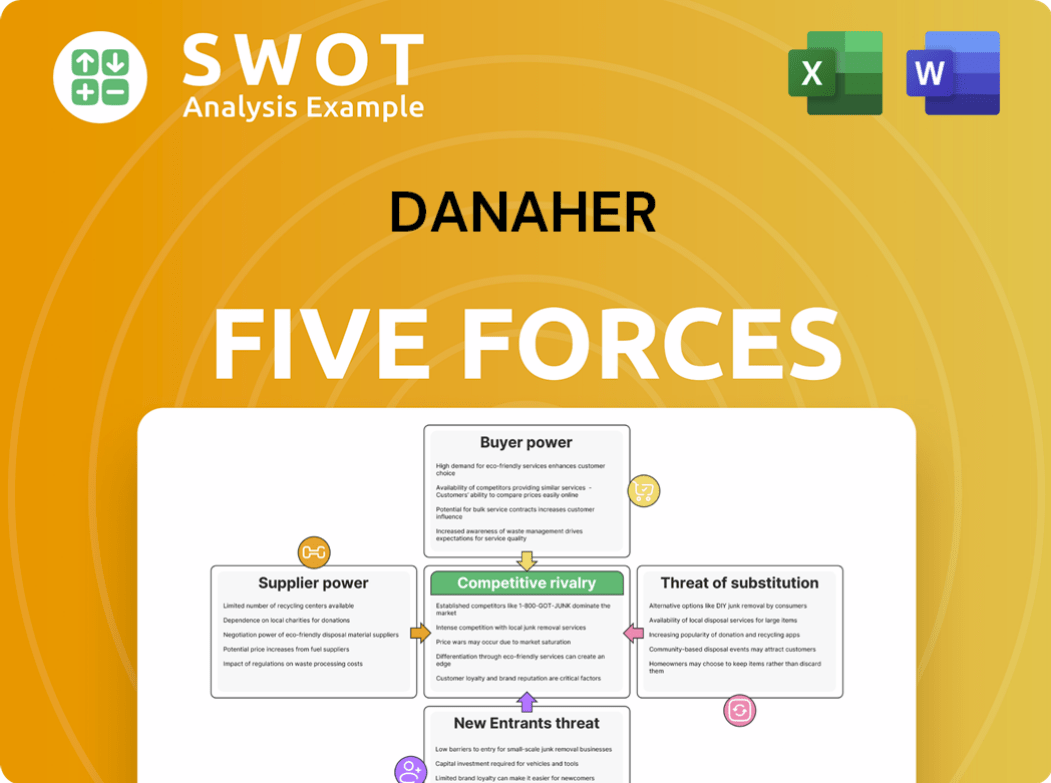

Danaher Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Danaher Company?

- What is Growth Strategy and Future Prospects of Danaher Company?

- How Does Danaher Company Work?

- What is Sales and Marketing Strategy of Danaher Company?

- What is Brief History of Danaher Company?

- Who Owns Danaher Company?

- What is Customer Demographics and Target Market of Danaher Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.