Danaher Bundle

Can Danaher Maintain Its Growth Trajectory?

Danaher Corporation, a science and technology powerhouse, has consistently demonstrated a remarkable ability to adapt and thrive. Its strategic shift towards life sciences and diagnostics, highlighted by the significant acquisition of Pall Corporation, underscores its commitment to high-growth sectors. This article delves into Danaher's Danaher SWOT Analysis, examining its growth strategy and future prospects within a dynamic global landscape.

From its humble beginnings, Danaher has transformed into a global leader, and this transformation offers valuable insights into its business model and market position. This comprehensive Danaher company analysis will explore the drivers behind its impressive financial performance, including its strategic acquisitions and relentless focus on innovation. We will also examine Danaher's long-term growth potential, considering its expansion into emerging markets and its ability to navigate industry changes.

How Is Danaher Expanding Its Reach?

The core of the Danaher growth strategy involves a disciplined approach to mergers and acquisitions (M&A). This strategy targets companies with strong market positions and high-growth potential within its key segments. This is complemented by organic growth, driven by new product development and market penetration. The company's focus on strategic M&A, particularly in attractive end-markets within life sciences and diagnostics, aims to access new customers and diversify revenue streams.

Danaher's business model is built on identifying and integrating high-potential businesses. The company consistently pursues bolt-on acquisitions to expand its product pipelines and technological capabilities. This approach has allowed it to build a diverse portfolio of businesses, each contributing to its overall growth. The company's market position is strengthened through these strategic moves, allowing it to maintain a competitive edge.

Danaher's financial performance is closely tied to its ability to execute its growth strategy. The company's focus on recurring revenue streams through consumables and services further enhances its stability and growth prospects. This focus, combined with strategic acquisitions and international expansion, positions Danaher for sustained long-term growth. For an overview of the competitive landscape, consider exploring the Competitors Landscape of Danaher.

Danaher actively uses acquisitions to fuel its growth. The company seeks out businesses that complement its existing portfolio and offer strong growth potential. This approach allows Danaher to enter new markets and expand its product offerings. In 2023, Danaher completed the acquisition of Abcam plc, a leading global supplier of protein research tools, for approximately $5.7 billion.

Danaher emphasizes international expansion, particularly in emerging markets. This strategy capitalizes on growing demand for healthcare and scientific solutions globally. The company aims to increase its presence in regions with high growth potential. This expansion is a key driver of Danaher's future prospects.

Danaher invests in new product development and innovation to drive organic growth. The company focuses on creating cutting-edge solutions that meet the evolving needs of its customers. This includes investments in research and development (R&D) to maintain a competitive edge in the market. Innovation is critical to Danaher's long-term growth potential.

Danaher's focus on recurring revenue streams, such as consumables and services, enhances its financial stability. These revenue streams provide a consistent source of income, which helps to mitigate the impact of economic fluctuations. This focus supports Danaher's revenue growth drivers and long-term growth potential.

Danaher's expansion strategy involves strategic acquisitions, international growth, and a focus on recurring revenue. The company's 2024 outlook includes continued strategic M&A in life sciences and diagnostics. This approach supports Danaher's competitive advantages and disadvantages.

- Strategic M&A: Danaher continues to acquire companies to expand its product portfolio and market reach.

- International Expansion: The company is focusing on emerging markets to capitalize on growing demand.

- Recurring Revenue: Danaher emphasizes consumables and services to ensure stable revenue streams.

- Innovation: Danaher invests in R&D to drive organic growth.

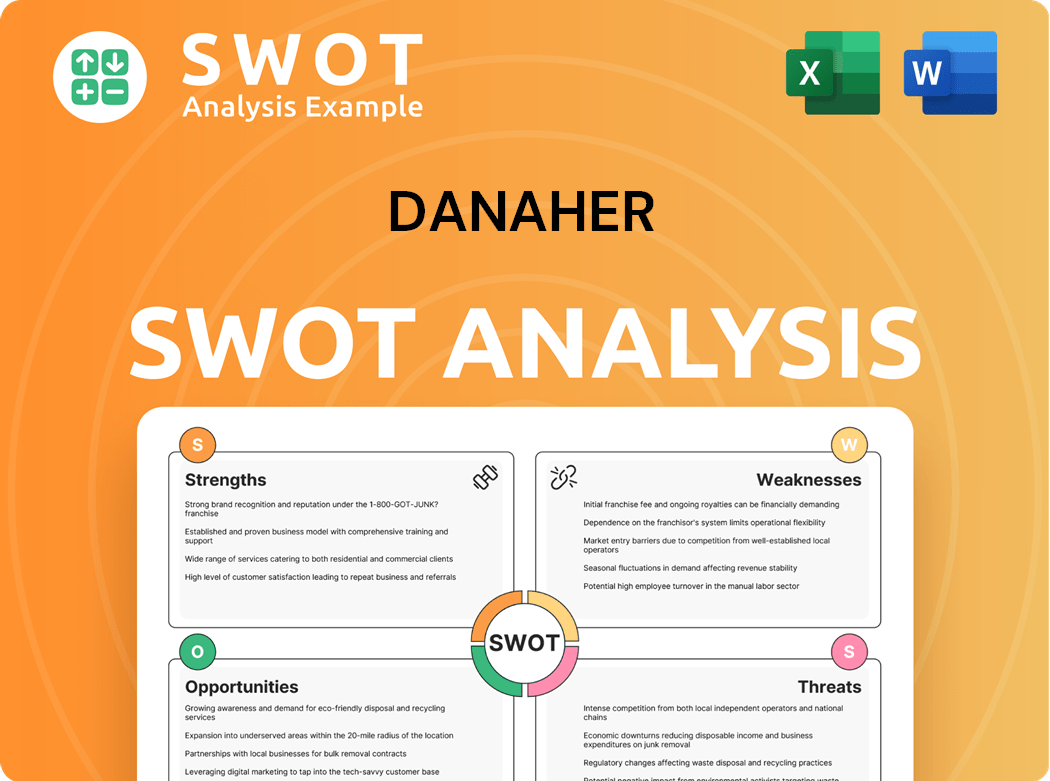

Danaher SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Danaher Invest in Innovation?

Danaher's innovation and technology strategy is a core component of its overall Danaher growth strategy, driving sustained expansion across its diverse business segments. The company consistently invests heavily in research and development (R&D) to stay at the forefront of technological advancements in healthcare, life sciences, and environmental solutions. This commitment to innovation is crucial for maintaining a strong Danaher market position and capitalizing on emerging opportunities.

A key aspect of Danaher's approach is its decentralized structure, which empowers its operating companies to foster in-house development and strategic collaborations. This allows each business unit to focus on its specific market needs and customer preferences, ensuring that innovation efforts are directly aligned with market demands. This strategy enables Danaher to quickly adapt to industry changes and maintain a competitive edge.

Danaher's commitment to digital transformation and the integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) into its products and services are also central to its innovation strategy. These technologies enhance diagnostic accuracy, improve operational efficiency, and enable the development of next-generation solutions. For a deeper understanding of Danaher's strategic approach, consider reading about the Target Market of Danaher.

Danaher's Biotechnology segment, including Pall and Cytiva, leads in developing advanced bioprocessing technologies. These technologies are critical for vaccine and gene therapy production, supporting the growing demand for innovative healthcare solutions.

Diagnostics platforms increasingly incorporate AI and ML to improve diagnostic accuracy and efficiency. These advancements enable more precise and faster results, benefiting both healthcare providers and patients.

Continued investment in next-generation sequencing technologies is a key focus for Danaher. These technologies are essential for advancing precision medicine and improving patient outcomes.

Danaher is developing advanced cell and gene therapy solutions to address critical healthcare challenges. These solutions are expected to contribute significantly to long-term growth.

The company's Environmental & Applied Solutions segment focuses on developing environmentally friendly solutions. This focus positions Danaher for growth in increasingly regulated markets.

Danaher's commitment to innovation is evident in its robust patent portfolio and consistent introduction of new products. This ensures that Danaher remains at the forefront of its industry.

Danaher's innovation strategy includes significant R&D investments and strategic collaborations to drive growth. The company's focus on digital transformation and the integration of AI and ML are crucial for enhancing its product offerings and operational efficiency. These investments are designed to support the Danaher future prospects and maintain its competitive advantage. Here are some of the key areas of investment:

- R&D Spending: Danaher consistently allocates a substantial portion of its revenue to R&D. In recent years, this has been a key driver of innovation.

- Digital Transformation: Investments in digital technologies, including AI and ML, are ongoing across all segments.

- Strategic Partnerships: Collaborations with other companies and research institutions are common to accelerate innovation and expand market reach.

- Product Development: Continuous introduction of new products and platforms to meet evolving customer needs.

- Sustainability: Developing environmentally friendly solutions to meet the growing demand for sustainable products.

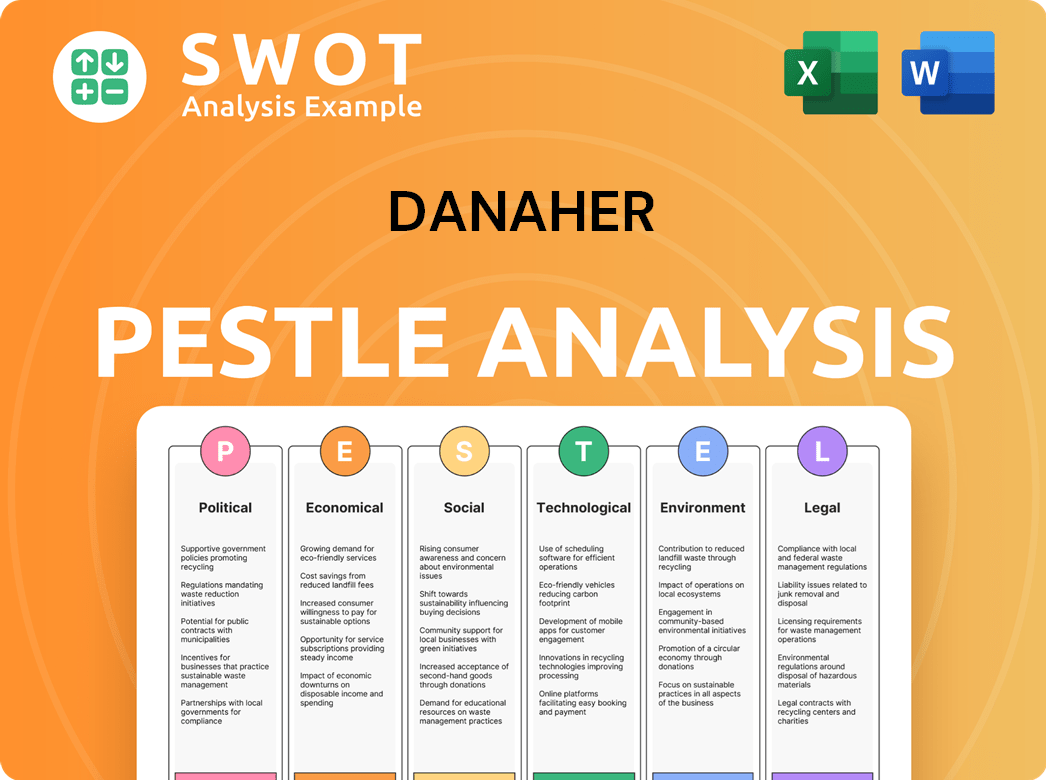

Danaher PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Danaher’s Growth Forecast?

The financial outlook for Danaher reflects a strategy focused on consistent growth, supported by strong market positions and disciplined capital allocation. The company's ability to generate robust free cash flow is a key element, enabling strategic acquisitions, investments in research and development, and the return of capital to shareholders. This approach is central to understanding Danaher's financial performance and future prospects.

For 2024, Danaher anticipates base business core revenue growth in the low single-digit percentage range. This projection considers a more normalized demand environment following the elevated demand experienced during the pandemic. Danaher's commitment to operational efficiency and high-value solutions is expected to maintain healthy profit margins. A detailed analysis of Danaher's mission can further illuminate the company's strategic direction and financial goals.

Danaher's balance sheet remains strong, providing flexibility for future growth initiatives. Analysts generally project continued steady growth for Danaher, driven by its diversified portfolio and its ability to capitalize on long-term trends in healthcare and scientific research. The company's financial performance is a key indicator of its success in executing its growth strategy.

Danaher's revenue growth is driven by its diversified portfolio and strategic acquisitions. In the first quarter of 2024, the company's gross profit margin was 59.4%. This demonstrates its strong profitability and ability to generate revenue across various market segments. The company’s financial performance is a key indicator of its ability to execute its growth strategy.

Danaher aims to maintain healthy profit margins through operational efficiency and a focus on high-value solutions. The company's strong free cash flow generation enables it to fund strategic acquisitions, R&D investments, and return capital to shareholders. Danaher's ability to manage costs and improve efficiency is crucial for its financial performance.

Danaher Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Danaher’s Growth?

Even with a robust Danaher growth strategy and strong market standing, the company faces potential risks. These challenges span various areas, from market competition to regulatory changes, which could impact its operations and future prospects. Understanding these obstacles is crucial for a comprehensive Danaher company analysis.

Intense competition, particularly in the healthcare and life sciences sectors, poses a significant threat. The rapid pace of technological advancements and the need for continuous innovation also create challenges. Additionally, managing acquisitions and maintaining a unified corporate culture can be complex.

Supply chain disruptions and regulatory changes also present risks. The company must navigate these challenges to sustain its Danaher future prospects. Adapting to new technologies and ensuring efficient integration of acquired businesses are key.

The market is highly competitive, with both established companies and new entrants constantly vying for market share. Competitors invest heavily in R&D and innovation, which can erode Danaher's market position. This requires continuous adaptation and strategic investments to stay ahead.

Changes in regulations, especially in healthcare and life sciences, can affect product development, approval processes, and market access. Compliance with these regulations often requires significant investment. Any non-compliance could lead to penalties or delays.

Global disruptions can impact production and delivery. The COVID-19 pandemic highlighted the vulnerability of supply chains. Diversifying suppliers and improving logistics are essential strategies to mitigate these risks.

Rapid technological advancements necessitate continuous R&D investments. Shifts in diagnostic technologies or bioprocessing methodologies could render existing products obsolete. Staying at the forefront of innovation is critical.

Managing the integration of numerous acquisitions and maintaining a cohesive corporate culture across a diverse portfolio can be difficult. Successfully integrating new businesses and leveraging synergies is essential for sustained growth. This can be a challenge for Danaher's acquisition strategy and its impact.

Economic downturns can impact demand for certain products and services. Healthcare spending may be affected during economic slowdowns. Diversification across segments and geographic regions can help to mitigate these risks.

Danaher mitigates these risks through diversification across its segments, a robust risk management framework, and continuous scenario planning. The company's focus on the Danaher Business System (DBS) helps drive operational excellence and adaptability. To delve deeper into the company's strategic approach, consider reading about the Marketing Strategy of Danaher.

In recent financial reports, Danaher's financial performance has shown resilience, but future growth depends on navigating these risks. The company's ability to innovate and adapt to market changes will be crucial. Strategic investments and operational efficiency are key to achieving long-term growth. In 2024, the company reported revenues of approximately $32.3 billion.

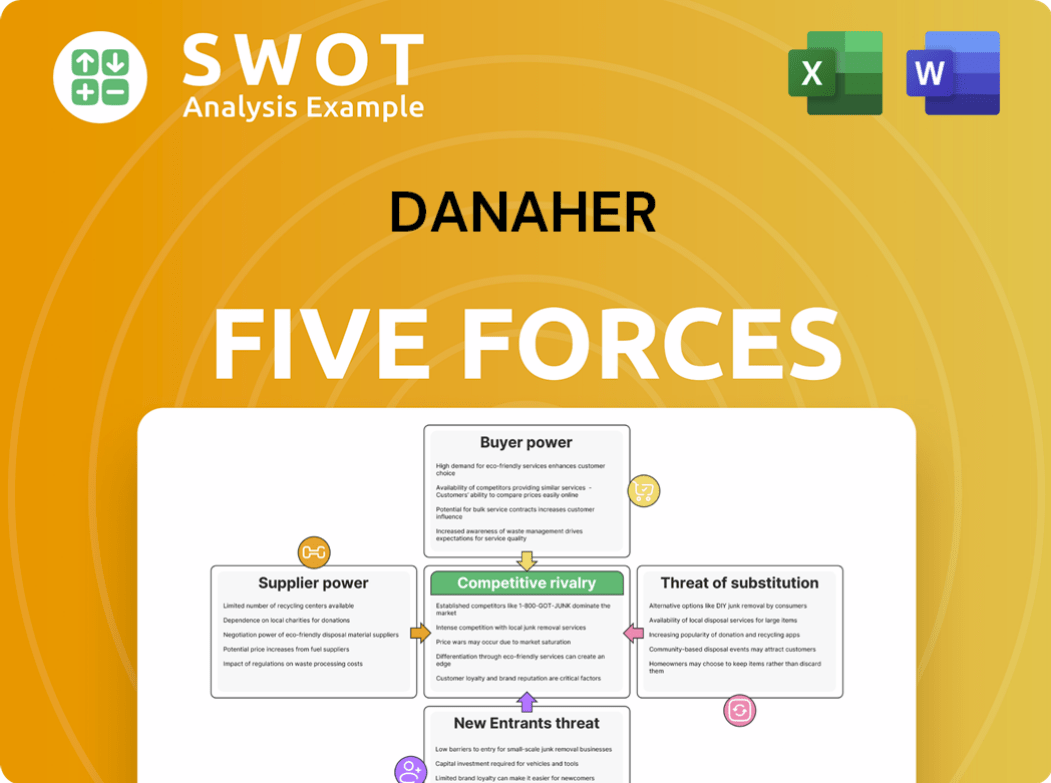

Danaher Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Danaher Company?

- What is Competitive Landscape of Danaher Company?

- How Does Danaher Company Work?

- What is Sales and Marketing Strategy of Danaher Company?

- What is Brief History of Danaher Company?

- Who Owns Danaher Company?

- What is Customer Demographics and Target Market of Danaher Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.