Danaher Bundle

How Does Danaher Dominate Its Competitive Arena?

Danaher Corporation, a titan in the science and technology realm, continually evolves through strategic acquisitions and a sharp focus on innovation. Its recent moves, like investing in bioprocessing technologies, signal its commitment to high-growth, high-margin segments. Founded in 1984, Danaher's journey from a manufacturing base to a diversified technology leader is a testament to its adaptability.

This exploration delves into the Danaher SWOT Analysis, examining its competitive landscape and dissecting its key business segments. We'll analyze Danaher's market share analysis, identify its main competitors, and assess its competitive advantages within the Danaher industry. Understanding Danaher's business strategy, including its acquisition strategy, is crucial for grasping its financial performance compared to rivals.

Where Does Danaher’ Stand in the Current Market?

Danaher Corporation's market position is robust, built on strong leadership across its diverse segments. The company excels in specialized niches, holding significant positions in areas like immunoassay and clinical microbiology within its Diagnostics segment. Its Life Sciences segment is a key player in bioprocessing technologies, crucial for pharmaceutical and biotechnology research and manufacturing. The Environmental & Applied Solutions segment provides essential products and services for water quality and product identification.

Danaher's global presence serves a wide array of customers, including hospitals, research institutions, industrial facilities, and municipal water systems. The company's strategic moves have focused on higher-growth, higher-margin businesses, often involving divesting less strategic industrial assets. This transformation is supported by a strong emphasis on digital transformation, enhancing data analytics and connectivity for its diagnostic and scientific instruments.

Financially, Danaher consistently demonstrates strong performance, driven by its proprietary Danaher Business System (DBS), which fosters operational excellence. As of early 2025, its financial health remains strong, supported by consistent revenue growth and profitability. The company's strong position is particularly evident in North America and Europe, with an increasing focus on expanding in emerging markets, especially within the Asia-Pacific region, for its life sciences and diagnostics portfolios. For a deeper dive into the company's origins, consider reading about the Brief History of Danaher.

Danaher's market share varies across its segments. In the diagnostics market, it holds a significant position, particularly in immunoassay and clinical microbiology. The company's Life Sciences segment also commands a strong market share in bioprocessing technologies. These strong positions contribute to the overall Danaher competitive landscape.

Danaher operates through key segments: Diagnostics, Life Sciences, and Environmental & Applied Solutions. The Diagnostics segment offers clinical chemistry, immunoassay, and molecular diagnostics. Life Sciences provides bioprocessing and analytical tools. Environmental & Applied Solutions focuses on water quality and product identification. Understanding these segments is crucial for a thorough Danaher market analysis.

Danaher's competitive advantages include its focus on high-growth, high-margin businesses and the Danaher Business System (DBS). DBS drives operational excellence and continuous improvement. The company's strategic acquisitions also bolster its market position. These factors contribute to Danaher's strong financial performance compared to rivals.

Danaher's growth strategy involves expanding its footprint in emerging markets, particularly in the Asia-Pacific region. The company also focuses on digital transformation within its offerings to enhance data analytics and connectivity. Strategic acquisitions further support its growth. This strategy is key to understanding Danaher's business strategy.

Danaher has demonstrated consistent revenue growth and profitability. The company's strong financial health is supported by its focus on operational excellence and strategic acquisitions. In recent years, Danaher's revenue has shown steady increases, reflecting its robust market position and effective business strategy.

- Revenue growth is a key indicator of Danaher's success.

- Profitability remains strong due to the Danaher Business System.

- Strategic acquisitions have contributed to financial performance.

- Danaher's financial performance is a key factor in its competitive landscape.

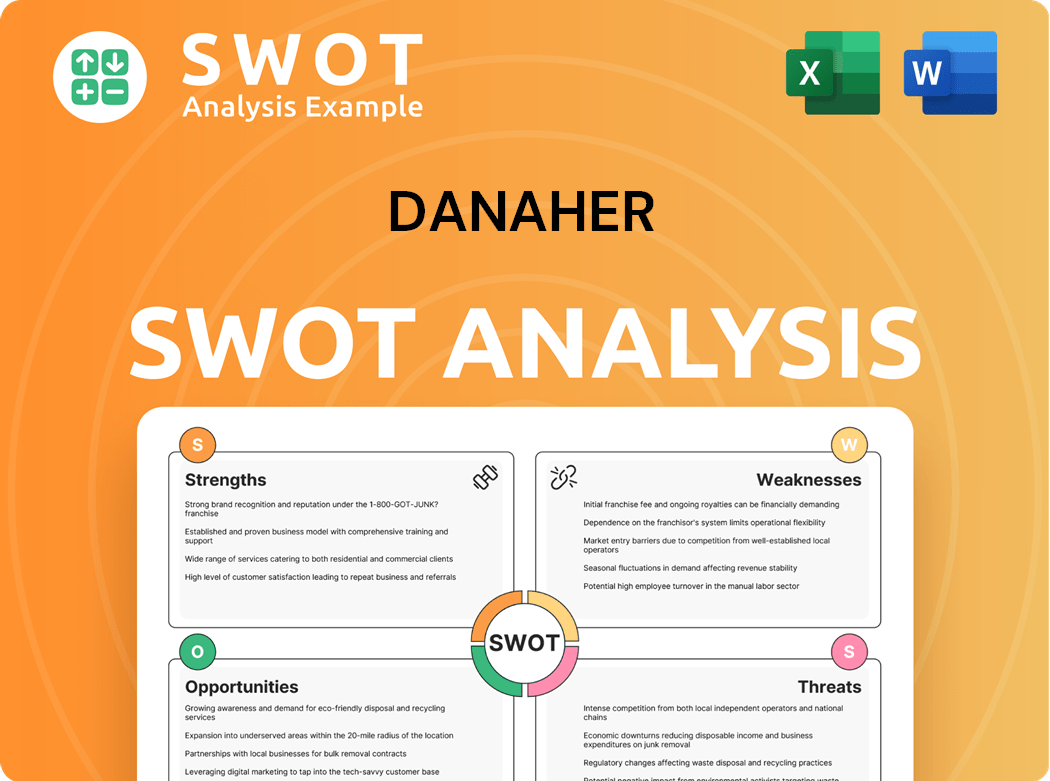

Danaher SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Danaher?

The Danaher competitive landscape is complex, with its diverse business segments facing a wide array of rivals. Understanding Danaher's competitors is crucial for investors and analysts to assess its market position and growth potential. Analyzing the Danaher market analysis reveals the competitive pressures and opportunities across its various sectors.

Danaher's success hinges on its ability to navigate a competitive environment characterized by both established industry giants and emerging players. The company's strategic focus on innovation, acquisitions, and operational excellence is continuously tested by the actions of its rivals. The competitive dynamics influence Danaher's business strategy and its ability to generate Danaher revenue.

To gain a deeper understanding of Danaher's financial performance and strategic positioning, consider reading Revenue Streams & Business Model of Danaher.

In the Diagnostics segment, Danaher competes with major players like Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, and Hologic. These companies offer a range of diagnostic solutions, including immunoassay and molecular diagnostics.

Roche is a global leader in diagnostics, providing a comprehensive test menu and a large installed base. They compete directly with Danaher in areas like immunoassay and molecular diagnostics.

Abbott offers a broad portfolio including diagnostics, medical devices, and nutrition. Their integrated solutions and strong global presence make them a significant competitor to Danaher.

Siemens Healthineers is a major player in medical imaging and laboratory diagnostics. They often compete with Danaher by offering comprehensive hospital solutions.

Hologic specializes in women's health and diagnostics, providing focused competition in specific testing areas, which impacts Danaher's market share.

In the Life Sciences segment, Danaher faces competition from Thermo Fisher Scientific, Agilent Technologies, and Sartorius. These companies offer products and services for research and bioprocessing.

Danaher's competitive landscape is shaped by companies with varying strengths and strategies. Analyzing these competitors helps in understanding Danaher's market position and potential challenges.

- Thermo Fisher Scientific: Offers a wide range of products and services for research and diagnostics, competing on scale and comprehensive solutions. In 2024, Thermo Fisher's revenue was approximately $42.5 billion, reflecting its strong market presence.

- Agilent Technologies: Focuses on analytical instrumentation and diagnostics, competing with its expertise in specific scientific applications. Agilent's revenue in 2024 was around $6.8 billion.

- Sartorius: A key player in bioprocessing, providing equipment and services for the biopharmaceutical industry, often competing on specialized technologies and customer relationships. Sartorius reported sales of approximately €3.4 billion in 2024.

- Emerging Players: The rise of smaller, specialized companies in areas like gene therapy and personalized medicine poses a potential disruption to traditional markets. These companies often introduce novel technologies that challenge established players like Danaher.

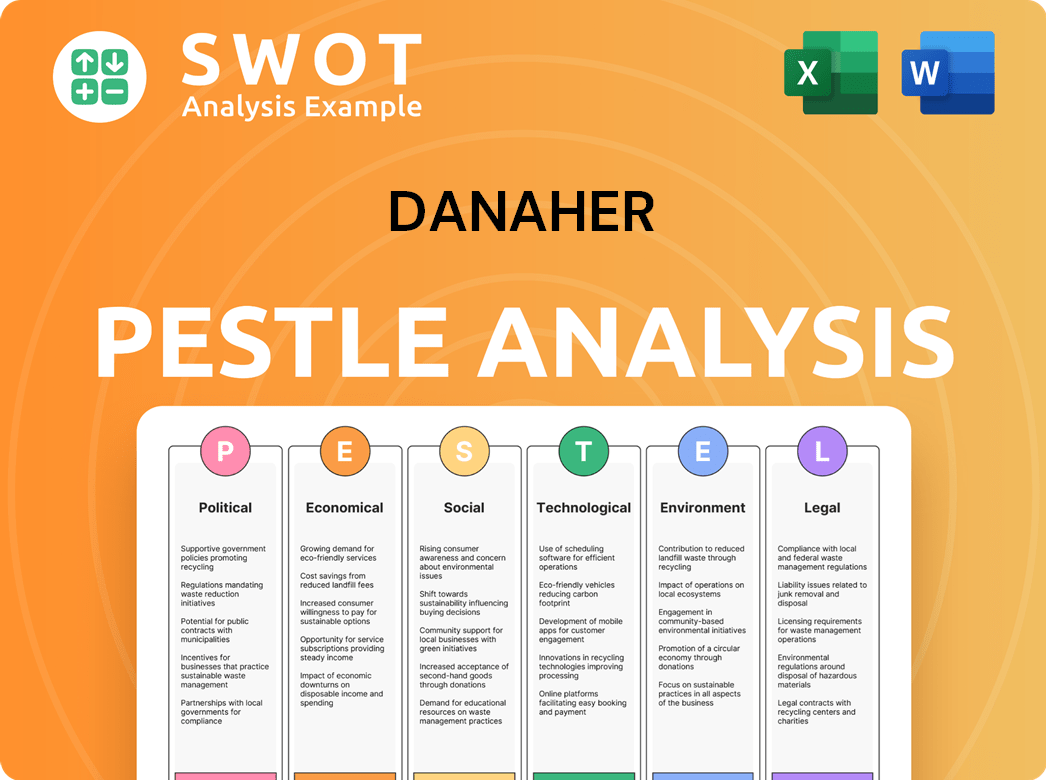

Danaher PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Danaher a Competitive Edge Over Its Rivals?

The competitive landscape for Danaher is shaped by its unique operational model and strategic focus on high-growth, specialized markets. Danaher's success is significantly influenced by its ability to integrate acquired businesses effectively, a key element of its growth strategy. This approach allows it to quickly improve the performance of new acquisitions, leveraging its Danaher Business System (DBS) to drive operational efficiencies and realize synergies, which is a critical factor in its market share analysis.

Danaher's competitive advantages are deeply rooted in its proprietary Danaher Business System (DBS). DBS is a comprehensive management philosophy that drives operational excellence, innovation, and talent development. This system enables Danaher to consistently integrate acquired businesses effectively, rapidly improving their performance and realizing synergies. The company's focus on innovation and strategic partnerships further strengthens its position in the market, allowing it to extend its reach and deepen its market penetration.

Danaher's strategic moves, including acquisitions and partnerships, are designed to bolster its market position and expand its product offerings. A recent article, Growth Strategy of Danaher, highlights the company's approach to achieving sustainable growth through strategic initiatives. These moves are crucial in maintaining its competitive edge in the diagnostics and life sciences sectors. Danaher's ability to identify and integrate promising businesses is a key driver of its revenue growth and overall financial performance.

DBS is a core competitive advantage, fostering continuous improvement and operational excellence. It enables efficient integration of acquisitions and drives profitability. This system is key to Danaher's ability to outperform its competitors in terms of operational efficiency.

Danaher possesses a strong portfolio of patented instruments, reagents, and software. These technologies provide a significant barrier to entry for competitors. This advantage is particularly evident in its life sciences and diagnostics segments.

Danaher's brand reputation, built over decades, fosters deep customer loyalty. This is especially true in critical healthcare and industrial applications. The company's commitment to quality and reliability reinforces its market position.

Danaher benefits from cost efficiencies in manufacturing and procurement. Its vast global distribution networks ensure widespread product availability. These factors contribute to its ability to compete effectively.

Danaher's competitive advantages include its operational efficiency, innovative products, and global reach. These strengths enable it to maintain a strong position in the Danaher industry and drive consistent revenue growth. The company's ability to adapt and innovate is crucial for its long-term success.

- Danaher's main competitors 2024 include companies like Roche, Siemens Healthineers, and Thermo Fisher Scientific.

- The company's focus on strategic acquisitions and its ability to integrate new businesses efficiently are key drivers of its growth.

- Danaher's revenue in 2024 is expected to continue growing, driven by its strong market position and strategic initiatives.

- Danaher's competitive environment in life sciences is dynamic, with constant innovation and competition.

Danaher Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Danaher’s Competitive Landscape?

The competitive landscape for Danaher is influenced by industry trends, future challenges, and growth opportunities. The company's position is shaped by technological advancements, regulatory changes, and evolving global healthcare demands. Understanding these factors is crucial for assessing Danaher's strategic direction and its ability to maintain a competitive edge in the market.

Danaher faces challenges such as supply chain complexities and cost pressures, but also benefits from opportunities in emerging markets and product innovations. Strategic moves like acquisitions and partnerships are vital for expanding its capabilities and market reach. This analysis provides insights into Danaher's competitive environment, helping stakeholders make informed decisions.

Technological advancements drive innovation in diagnostics and life sciences, creating new avenues for products. Regulatory changes, such as stricter guidelines for medical devices, influence market dynamics. The increasing adoption of precision medicine and personalized diagnostics creates demand for advanced instruments.

Managing global supply chains and navigating geopolitical uncertainties are significant hurdles. Adapting to cost pressures in healthcare systems worldwide is essential. The rise of new market entrants in digital health could disrupt traditional business models.

Expanding healthcare infrastructure in emerging markets offers substantial growth. Product innovations, especially in cell and gene therapy manufacturing, drive expansion. Strategic partnerships and targeted acquisitions are essential for market reach and technological advancements.

Danaher focuses on high-growth, high-margin segments, leveraging the Danaher Business System. The company aims to drive efficiency and innovation for resilience in a dynamic market. Recent acquisitions and partnerships have been key to expanding its portfolio and market share.

Danaher's competitive landscape is dynamic, shaped by industry trends, challenges, and opportunities. The company's success depends on its ability to adapt to technological advancements and regulatory changes. Strategic decisions, such as acquisitions and innovation, are crucial for maintaining market leadership. For a deeper dive into the company's performance, you can read about the Danaher's financial performance compared to rivals.

- Market Analysis: Danaher's competitive position in the diagnostics market is strong, driven by innovation and strategic acquisitions.

- Financial Performance: In 2023, Danaher reported revenues of approximately $31.4 billion, reflecting solid growth.

- Strategic Focus: Danaher's growth strategy includes expanding in emerging markets and focusing on high-growth segments.

- Competitive Advantages: Danaher's strengths include its diversified portfolio, strong brand reputation, and effective business system.

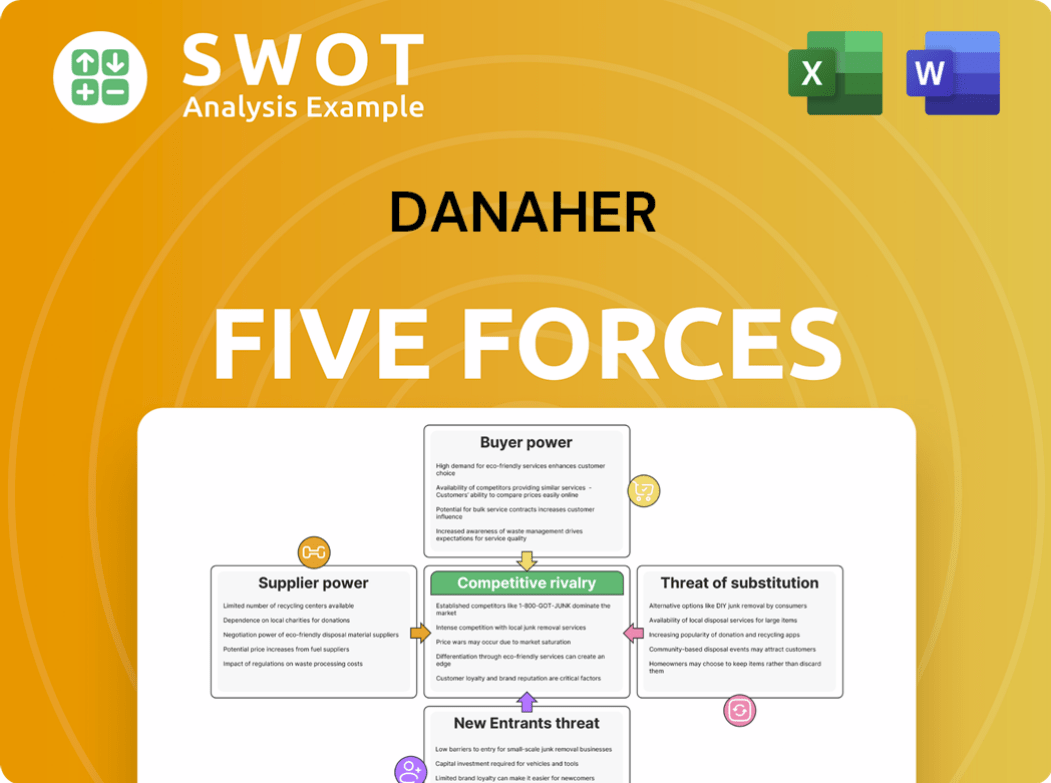

Danaher Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Danaher Company?

- What is Growth Strategy and Future Prospects of Danaher Company?

- How Does Danaher Company Work?

- What is Sales and Marketing Strategy of Danaher Company?

- What is Brief History of Danaher Company?

- Who Owns Danaher Company?

- What is Customer Demographics and Target Market of Danaher Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.