Danaher Bundle

How Does Danaher Thrive in a Complex World?

Danaher Corporation, a global powerhouse in science and technology, consistently delivers impressive results. Its strategic focus on acquiring and developing leading businesses has solidified its position across vital sectors. With a diverse portfolio spanning life sciences, diagnostics, and environmental solutions, Danaher addresses critical needs worldwide.

Danaher's success is built on a robust Danaher SWOT Analysis, a strong business model, and a keen ability to innovate. Understanding the Danaher business model, including its strategic acquisitions and operational framework, is crucial for anyone looking to understand its enduring market leadership. This exploration will delve into the company's core business segments, financial performance, and future strategies, offering actionable insights for investors and industry watchers alike. The company's history and structure are also key to understanding its success.

What Are the Key Operations Driving Danaher’s Success?

Danaher Corporation creates value through its diversified portfolio, mainly organized into three segments: Biotechnology, Life Sciences, and Diagnostics. These segments offer various products, services, and platforms designed to meet specific customer needs. The company's operational excellence is driven by the Danaher Business System (DBS), which emphasizes continuous improvement in quality, delivery, cost, and innovation.

The Biotechnology segment focuses on bioprocessing technologies, providing essential tools for biologics research, development, and production. The Life Sciences segment offers a wide range of instruments and consumables used in academic research, drug discovery, and clinical diagnostics. The Diagnostics segment provides analytical instruments, reagents, and consumables for hospitals and laboratories, assisting in disease diagnosis and monitoring.

Operational processes involve sophisticated manufacturing, rigorous research and development, and global logistics. Strategic partnerships and acquisitions are integral to its strategy, allowing for expansion of technological capabilities and market presence. Recent acquisitions, such as Abcam, have strengthened its position in life sciences research tools. This integrated approach, coupled with a focus on high-value, recurring revenue streams, allows Danaher to offer unique and effective solutions.

Danaher's structure is built around three primary segments: Biotechnology, Life Sciences, and Diagnostics. Each segment targets specific markets with specialized products and services. This diversified approach allows Danaher to serve a broad range of customers in the life sciences and healthcare industries.

The DBS is a core component of Danaher's operational strategy, driving continuous improvement. It focuses on enhancing quality, delivery, cost, and innovation across all business units. This system fosters a culture of operational excellence, enabling efficient production and rapid product development.

Danaher's acquisition strategy is a key driver of its growth and expansion. The company strategically acquires businesses to enhance its technological capabilities and market presence. These acquisitions often complement existing segments, allowing for increased market share and innovation.

Danaher provides unique and effective solutions to its customers, leading to significant benefits. These benefits include accelerated scientific discovery, improved diagnostic accuracy, and enhanced environmental protection. The company's focus on high-value, recurring revenue streams supports a strong financial performance.

In 2024, Danaher reported strong financial results, with revenue growth driven by both organic growth and strategic acquisitions. The company's commitment to the DBS and its disciplined capital allocation strategy have contributed to its success. For instance, the Diagnostics segment saw significant growth due to increased demand for diagnostic tools and services. To understand the company's target audience, you can read more about the Target Market of Danaher.

- Danaher's revenue for 2024 is projected to be over $30 billion.

- The company's operating margin remains strong, reflecting efficient operations.

- Strategic acquisitions, such as the recent purchase of Abcam, have expanded Danaher's market reach.

- Danaher's commitment to innovation continues to drive product development and market leadership.

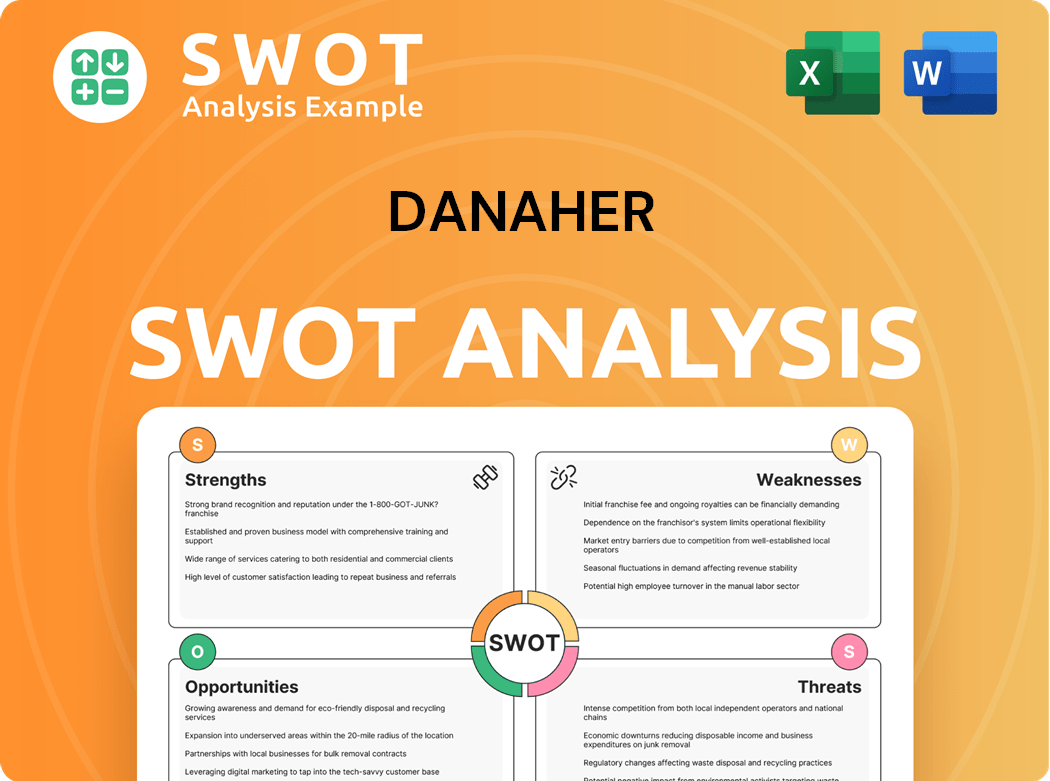

Danaher SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Danaher Make Money?

The Danaher Corporation generates revenue primarily through selling its specialized products, consumables, and services across its Biotechnology, Life Sciences, and Diagnostics segments. The company's business model is centered on providing high-value, differentiated solutions. This approach allows Danaher to command premium pricing and maintain strong profitability.

Product sales, including instruments, reagents, and other consumables, constitute the largest portion of its revenue. Danaher also leverages service contracts, software licenses, and aftermarket support to monetize its offerings. This strategy ensures a recurring revenue stream, particularly from the continuous sales of proprietary reagents and consumables.

In 2023, Danaher reported total revenues of approximately $23.9 billion. The company's financial performance reflects its ability to generate significant revenue through both product sales and recurring service contracts. Danaher's focus on high-value solutions and a strong global presence contribute to its financial success.

The core of Danaher's revenue generation lies in its product sales, which include specialized instruments, reagents, and consumables. The company employs a 'razor-and-blade' model, where the initial sale of an instrument leads to ongoing sales of proprietary consumables. This strategy ensures a steady stream of revenue. Furthermore, Danaher uses its extensive installed base to cross-sell and up-sell new products and services, maximizing customer lifetime value.

- Product Sales: Instruments, reagents, and consumables are the primary revenue drivers.

- Service Contracts: Ongoing maintenance and support generate recurring revenue.

- Software Licenses: Software solutions contribute to the revenue stream.

- Aftermarket Support: Additional services and consumables enhance revenue.

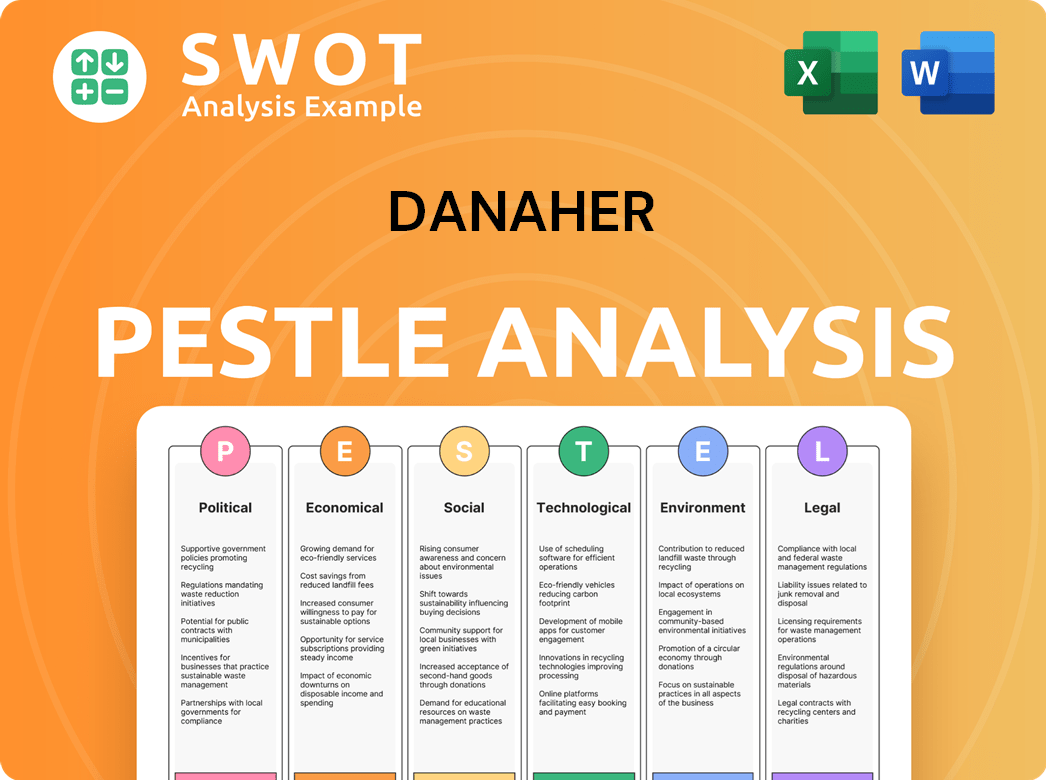

Danaher PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Danaher’s Business Model?

The evolution of Danaher Corporation has been marked by strategic acquisitions and operational refinements, establishing it as a leader in the life sciences and diagnostics sectors. Its consistent approach to mergers and acquisitions has been a cornerstone of its growth strategy. This has allowed Danaher to expand its portfolio and enter new markets, driving both revenue and shareholder value.

A significant strategic move was the spin-off of its industrial businesses into Fortive Corporation in 2016. This strategic realignment enabled Danaher to concentrate on its core areas: life sciences, diagnostics, and environmental and applied solutions. More recently, the acquisition of Abcam in late 2023 for approximately $5.7 billion further strengthened its position in the life sciences research tools market, enhancing its offerings in antibodies and reagents.

The Danaher business model is characterized by disciplined capital allocation, operational excellence, and a focus on long-term value creation. The company's ability to integrate acquired businesses effectively and leverage the Danaher Business System (DBS) has been crucial to its success. This system promotes continuous improvement and operational efficiency, enabling the company to adapt to market changes and maintain a competitive edge.

Key milestones for Danaher include the strategic spin-off of Fortive Corporation in 2016, allowing a sharper focus on life sciences and diagnostics. The acquisition of Cepheid in 2016 for about $4 billion expanded its diagnostics capabilities. The Abcam acquisition in late 2023 for approximately $5.7 billion further bolstered its life sciences portfolio.

Strategic moves involve a disciplined approach to mergers and acquisitions, focusing on high-growth, innovative markets. The company consistently integrates acquired businesses using the Danaher Business System (DBS) for operational efficiency. Investment in R&D and technology leadership ensures a continuous pipeline of innovative products.

Danaher's competitive advantages include a strong brand portfolio, technology leadership, and economies of scale. The 'ecosystem effects' of its integrated solutions enhance its competitive moat. Continuous adaptation to market trends, such as personalized medicine, ensures sustained relevance and profitability. You can learn more about Danaher's growth strategy by reading Growth Strategy of Danaher.

Danaher has a history of strategic acquisitions to expand its market presence and product offerings. Recent acquisitions include Abcam, which was announced in 2023. These acquisitions are strategically aligned with the company's focus on life sciences and diagnostics.

The Danaher Business System (DBS) is central to Danaher's operational excellence, enabling rapid responses to challenges like supply chain disruptions. DBS focuses on continuous improvement, waste reduction, and customer satisfaction. The company invests heavily in R&D, with expenditures consistently exceeding $1 billion annually, driving innovation and product development.

- The DBS helps identify and solve bottlenecks quickly.

- It optimizes inventory management and maintains production continuity.

- R&D investments support a pipeline of new products.

- This approach enhances market competitiveness.

Danaher Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Danaher Positioning Itself for Continued Success?

The Danaher Corporation holds a prominent position in its core markets, particularly in biotechnology, diagnostics, and water quality, showcasing strong market share and customer loyalty. Its global presence spans over 160 countries, serving a diverse customer base. The company's competitive advantage is bolstered by a strong portfolio of well-regarded brands and a consistent stream of innovations. Understanding the Marketing Strategy of Danaher provides further insights into its market approach.

Despite its robust standing, Danaher faces several risks, including regulatory changes in healthcare and environmental sectors, intense competition, and economic downturns. Supply chain vulnerabilities, though mitigated by the Danaher Business System (DBS), remain a potential concern. The company's future hinges on strategic initiatives aimed at sustained revenue growth, focusing on high-growth, high-margin businesses within life sciences and diagnostics.

Danaher's industry position is characterized by leadership in several key segments. It benefits from a diversified portfolio and a global footprint. The company's success is partly attributable to its ability to consistently innovate and adapt to changing market demands. Danaher’s strategic acquisitions have also played a significant role in strengthening its market position.

The company faces risks such as regulatory changes, particularly in healthcare. Competition from both established and emerging players is also a significant challenge. Economic downturns and shifts in government funding could also affect Danaher's performance. Supply chain issues, while managed, remain a potential concern.

Danaher is focused on expanding its revenue streams through strategic initiatives. It prioritizes high-growth, high-margin businesses within its life sciences and diagnostics portfolios. The company is leveraging AI and automation to improve its offerings. Leadership is committed to driving long-term shareholder value.

In the most recent fiscal year, Danaher reported revenues of approximately $31.4 billion. The company’s operating margin has consistently been strong, reflecting efficient operations. Its stock performance has shown consistent growth, indicating investor confidence. The company continues to invest significantly in R&D to drive innovation.

Danaher is strategically positioned to capitalize on global trends, including an aging population and increased demand for biologics. The company is actively pursuing strategic acquisitions to bolster its portfolio and expand its market reach. The Danaher Business System (DBS) continues to be a key driver of operational efficiency and value creation.

- Focus on high-growth, high-margin businesses.

- Leveraging artificial intelligence and automation.

- Strategic acquisitions and disciplined capital allocation.

- Continued application of the Danaher Business System (DBS).

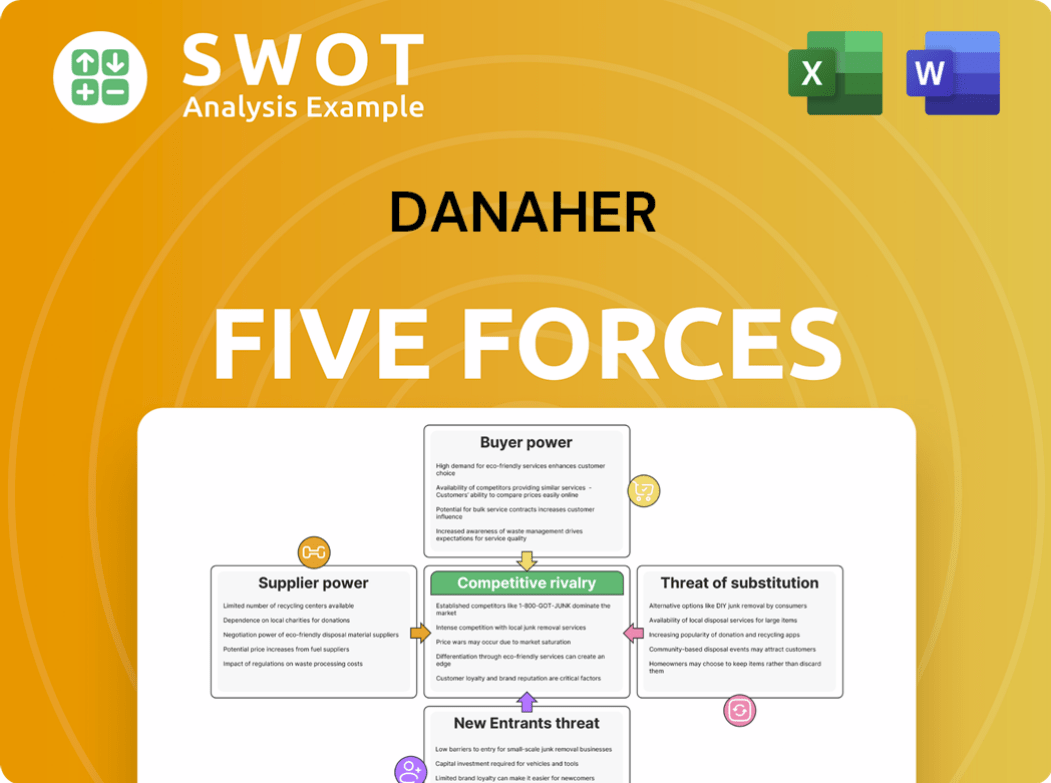

Danaher Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Danaher Company?

- What is Competitive Landscape of Danaher Company?

- What is Growth Strategy and Future Prospects of Danaher Company?

- What is Sales and Marketing Strategy of Danaher Company?

- What is Brief History of Danaher Company?

- Who Owns Danaher Company?

- What is Customer Demographics and Target Market of Danaher Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.