DexCom Bundle

How has DexCom Transformed Diabetes Management?

DexCom, Inc. has fundamentally changed diabetes management with its innovative continuous glucose monitoring (CGM) systems. From its inception in 1999 in San Diego, California, DexCom aimed to provide a more continuous and accurate method for monitoring glucose levels, moving beyond traditional fingerstick tests. This DexCom SWOT Analysis can provide deeper insights into its strategic position.

The introduction of the STS in 2006 was a crucial step, paving the way for advancements in CGM technology. Today, DexCom is a leader in the diabetes care technology industry, with substantial revenue and a growing customer base. Understanding the brief history of DexCom provides valuable context to its impact on diabetes care and its future plans.

What is the DexCom Founding Story?

The story of the DexCom company begins in 1999 in San Diego, California. A team of visionaries, including Scott Glenn, John Burd, Lauren Otsuki, Ellen Preston, and Bret Megargel, came together with a shared goal. Their aim was to revolutionize diabetes management.

John Burd and Scott K. Glenn are particularly recognized as key figures in the company's founding. They saw a significant problem in how diabetes was managed, specifically the limitations of traditional fingerstick testing. These tests only provided a snapshot of glucose levels, making it difficult for individuals to understand trends and effectively manage their condition. Their solution was to develop continuous glucose monitoring (CGM) systems.

While specific details about initial funding rounds are not readily available, Dexcom went public in 2005. The company listed on the Nasdaq Global Select Market under the ticker symbol DXCM. The initial public offering and subsequent funding rounds provided the necessary capital to advance their technology and expand their operations. The team's diverse expertise and the unmet need for better diabetes management tools created a strong foundation for Dexcom's establishment. You can read more about the Growth Strategy of DexCom.

The founding of DexCom was driven by a clear vision to improve diabetes management through continuous glucose monitoring.

- Founded in 1999 in San Diego, California.

- Key founders include John Burd and Scott K. Glenn.

- Identified limitations of fingerstick testing.

- Vision: Develop continuous glucose monitoring (CGM) systems.

- Went public in 2005, listed on the Nasdaq.

- Raised a total of $52.7 million across eight rounds.

- Latest funding round was a Post IPO in April 2020, which raised $1.05 billion.

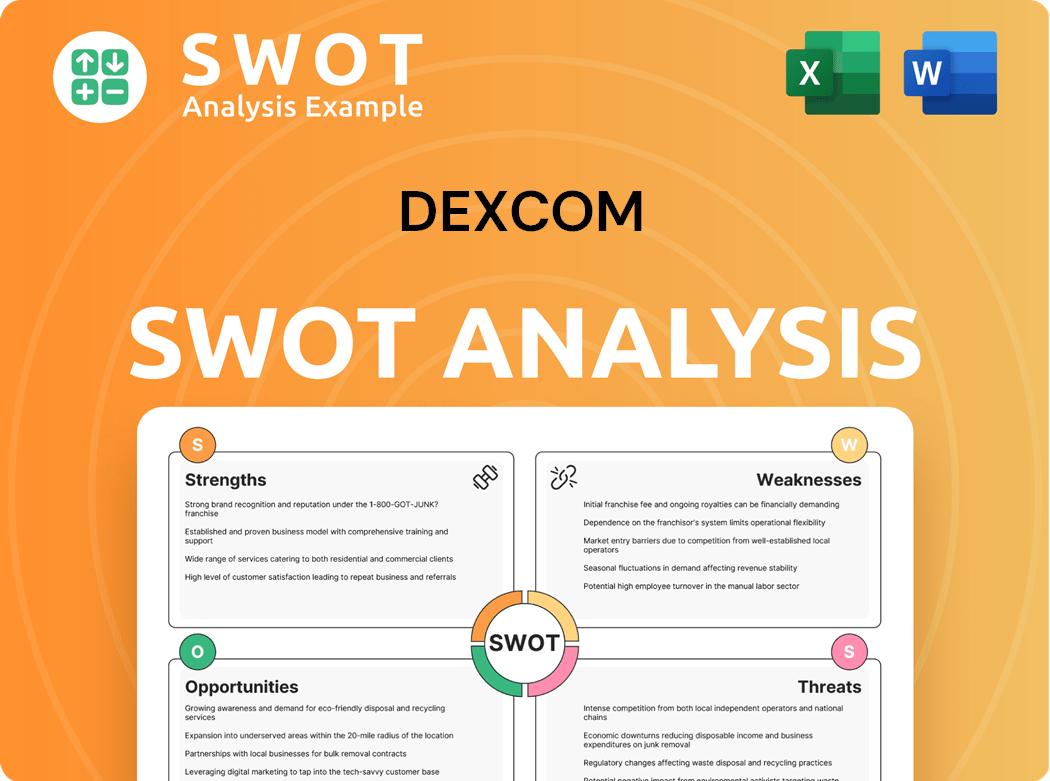

DexCom SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of DexCom?

The early years of the [Company Name] were marked by significant advancements in DexCom history and expansion. The company focused on introducing innovative products to improve CGM capabilities. These initial steps were crucial in establishing [Company Name]'s presence in the market and setting the stage for future innovations in diabetes management.

In 2004, [Company Name] introduced its first sensor as part of a short-term sensor program. This was followed by the FDA approval and launch of the Dexcom STS Continuous Glucose Monitoring System in March 2006, which provided up to 288 glucose measurements daily. The Dexcom Seven Continuous Glucose Monitoring System, approved in May 2007, improved accuracy and extended wear time.

During this period, [Company Name] formed key strategic alliances. In 2008, agreements were announced with Insulet Corporation and Animas Corporation. A development agreement was also made with Edwards Lifesciences for a continuous glucose monitor for intensive care units. In 2015, [Company Name] entered a non-exclusive agreement with Tandem Diabetes Care, Inc.

The initial public offering in April 2005 on the NASDAQ Stock Market under DXCM significantly fueled expansion. In 2024, [Company Name]'s worldwide user base grew by approximately 25%, reaching between 2.8 and 2.9 million users globally. The company added over 50,000 new physicians to its prescriber base in 2024, broadening its presence in primary care.

In 2024, [Company Name] reported a total revenue growth of 11%, reaching $4.033 billion. This financial performance reflects the company's continued growth and impact in the CGM market, demonstrating its commitment to innovation and patient care.

DexCom PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in DexCom history?

The DexCom company has achieved numerous significant milestones since its inception, marking its journey in the field of Continuous Glucose Monitoring (CGM). From its initial FDA approvals to recent advancements, the company's history reflects a commitment to innovation and improving diabetes management.

| Year | Milestone |

|---|---|

| 2006 | FDA approval of the first DexCom continuous glucose monitoring system, the STS. |

| 2007 | Introduction of the DexCom Seven, extending sensor use to seven days. |

| 2009 | Launch of the DexCom Seven Plus, enhancing accuracy and convenience. |

| 2012 | Introduction of the DexCom G4 Platinum, with improved range and display. |

| 2016 | International launch of the DexCom G5 Mobile system, the first mobile CGM system with Android and iOS compatibility. |

| 2018 | FDA clearance for the DexCom G6, an integrated CGM system eliminating fingerstick calibrations. |

| December 2022 | FDA approval of the DexCom G7, offering a smaller wearable and improved accuracy. |

| February 2023 | DexCom launched the G7. |

| 2024 | DexCom received FDA approval for the over-the-counter (OTC) continuous glucose monitor, the Stelo device, and launched with generative AI integration. |

| 2024 | DexCom secured reimbursement for DexCom ONE+ in France for people with type 2 diabetes on basal insulin. |

DexCom has consistently pushed the boundaries of CGM technology. The introduction of mobile CGM systems, like the G5 Mobile, revolutionized how users could access and share their glucose data. The G6 and G7 further simplified diabetes management by eliminating the need for fingerstick calibrations and offering enhanced features.

The DexCom G5 Mobile was the world's first mobile CGM system with both Android and iOS compatibility, enabling real-time data sharing via smartphones. This innovation allowed for greater convenience and accessibility for users managing their diabetes.

The DexCom G6 and G7 systems eliminated the need for fingerstick calibrations, simplifying diabetes management. These systems provided more accurate and convenient glucose monitoring, improving the user experience.

DexCom's Stelo device, approved in 2024, marked a significant step by becoming the first over-the-counter CGM. This innovation broadened access to CGM technology for individuals with type 2 diabetes not on insulin.

The launch of Stelo with generative AI integration in December 2024, provided personalized insights. This integration enhanced the user experience by offering customized data analysis and recommendations.

In 2024, DexCom secured reimbursement for DexCom ONE+ in France. This expansion significantly increased access to CGM technology for individuals with type 2 diabetes on basal insulin in that market.

The DexCom G7, approved by the FDA in December 2022, was launched in February 2023. This latest generation offers a smaller on-body wearable, shorter warm-up time, and improved accuracy.

Despite its achievements, DexCom has faced challenges, including fluctuations in market share and regulatory hurdles. The company has responded by expanding its sales force and investing in manufacturing capabilities to meet growing demand. For more insights into the competitive landscape, you can refer to Competitors Landscape of DexCom.

In July 2024, DexCom's stock experienced a decline following its second-quarter earnings report, due in part to revenue falling below expectations. This was partly attributed to a sales force realignment and a loss of market share among durable medical equipment distributors.

In response to market challenges, DexCom expanded its sales force by 40% and brought new manufacturing lines online in Malaysia and the U.S. to meet demand. These actions were aimed at strengthening its market position and ensuring product availability.

DexCom received an FDA warning letter in 2024 related to observations from inspections of its San Diego and Mesa facilities. The company has initiated corrective actions to address the issues raised by the FDA.

The launch of Stelo, while innovative, presented challenges, including the need for effective sales force training and market education to ensure successful adoption. DexCom is actively working to overcome these hurdles.

DexCom has invested in expanding its manufacturing capacity, including new lines in Malaysia and the U.S., to mitigate supply chain risks and meet increasing demand. These expansions are crucial for supporting its growth.

The CGM market is competitive, with DexCom facing rivals that continually introduce new products and technologies. DexCom must continuously innovate and adapt to maintain its market share.

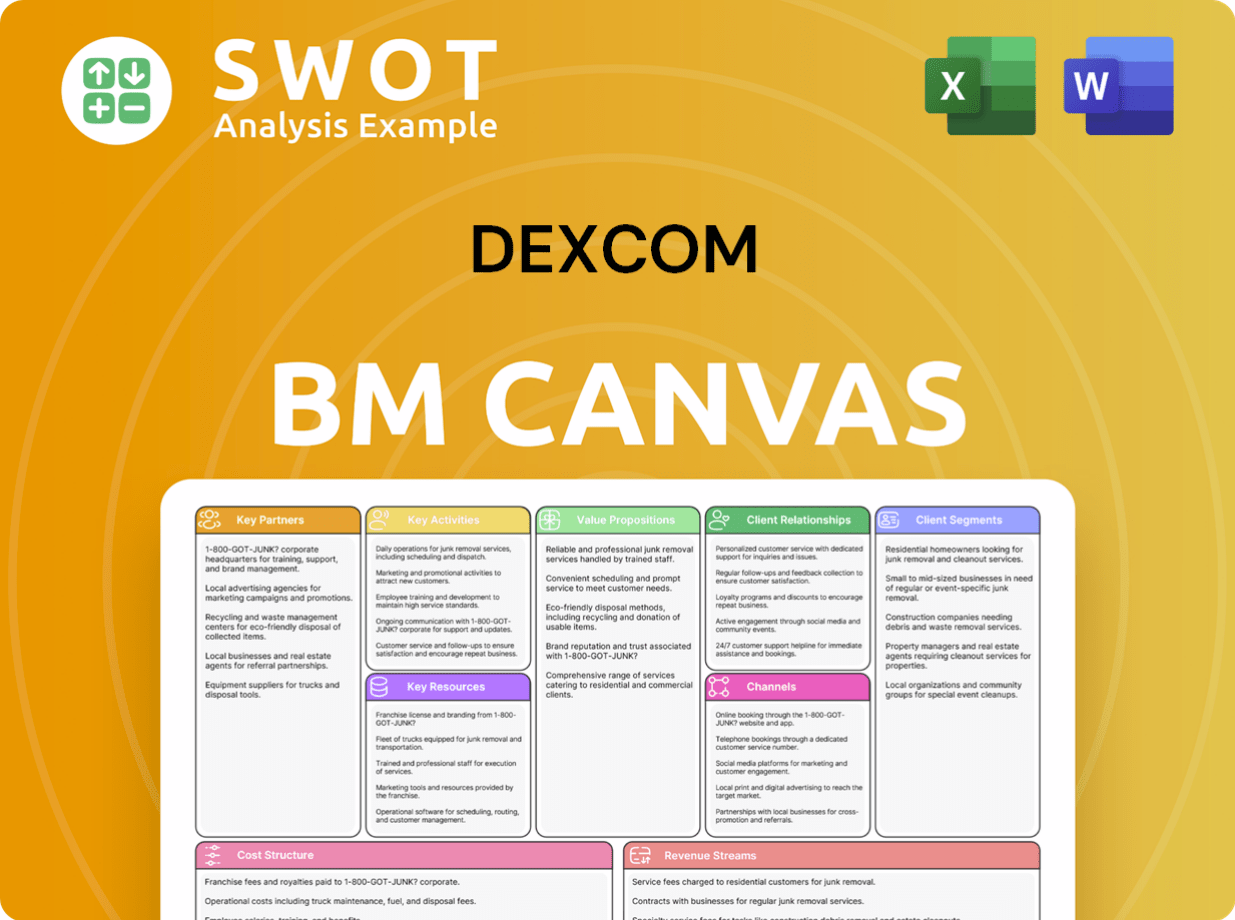

DexCom Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for DexCom?

The DexCom journey began in 1999 in San Diego, California, with the mission to revolutionize diabetes management through continuous glucose monitoring (CGM) technology. Over the years, the company has achieved significant milestones, from initial product launches to strategic partnerships and technological advancements, shaping the landscape of diabetes care. This evolution reflects DexCom's commitment to innovation and its impact on improving the lives of individuals with diabetes.

| Year | Key Event |

|---|---|

| 1999 | Dexcom was founded in San Diego, California. |

| 2004 | The company created its short-term sensor program. |

| 2005 | Dexcom announced its IPO on NASDAQ under the ticker DXCM. |

| March 2006 | Dexcom launched the STS Continuous Glucose Monitoring System after FDA approval. |

| May 2007 | The Dexcom Seven Continuous Glucose Monitoring System received FDA approval. |

| February 2009 | The Dexcom Seven Plus Continuous Glucose Monitor received FDA approval. |

| 2012 | The Dexcom G4 Platinum system was launched in the US and internationally. |

| 2015 | Dexcom entered a non-exclusive agreement with Tandem Diabetes Care, Inc. for G5 and G6 integration into insulin pumps. |

| 2016 | The Dexcom G5 Mobile CGM System was launched internationally, compatible with Android and iOS. |

| March 2018 | The Dexcom G6 CGM System received market authorization from the FDA. |

| April 2020 | Dexcom became a component of the Nasdaq-100. |

| December 2022 | Dexcom G7 received FDA clearance. |

| February 2023 | Dexcom G7 was officially launched. |

| 2024 | Dexcom launched Stelo, the first over-the-counter glucose biosensor in the U.S., and integrated generative AI with its sensors. |

| November 2024 | Dexcom announced a strategic partnership with ŌURA, including a $75 million investment, to integrate glucose data with Oura Ring biometrics. |

| April 2025 | Dexcom G7 15 Day CGM system received FDA clearance for adults 18 and older. |

Dexcom is preparing to launch its 15-day G7 system in the second half of 2025, which received FDA clearance in April 2025. This new system is expected to be the longest-lasting and most accurate sensor available. The company is also working on ensuring compatibility of the G7 15 Day with automated insulin delivery systems.

For fiscal year 2025, Dexcom anticipates total revenue of $4.60 billion, representing approximately 14% growth over 2024. The company expects a non-GAAP gross profit margin of roughly 64% to 65% and a non-GAAP operating margin of around 21% for 2025. These projections indicate continued financial strength and expansion.

Dexcom's strategic focus includes expanding its offerings to people with pre-diabetes and exploring opportunities within the broader metabolic health landscape. The company's partnership with ŌURA and the launch of Stelo are examples of its commitment to innovation and broadening its market reach. These initiatives support Dexcom's commitment to empowering individuals to take control of their health.

CEO Kevin Sayer has expressed that 2025 is 'shaping up to be a good year' for Dexcom, highlighting ongoing advancements and global expansion. This positive outlook underscores the company's confidence in its future and its continued impact on diabetes management. The company's vision remains focused on empowering individuals through innovative glucose monitoring technology.

DexCom Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of DexCom Company?

- What is Growth Strategy and Future Prospects of DexCom Company?

- How Does DexCom Company Work?

- What is Sales and Marketing Strategy of DexCom Company?

- What is Brief History of DexCom Company?

- Who Owns DexCom Company?

- What is Customer Demographics and Target Market of DexCom Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.