DexCom Bundle

Can DexCom Continue to Lead in Diabetes Management?

DexCom, Inc. (Nasdaq: DXCM) has reshaped diabetes care with its continuous glucose monitoring (CGM) systems, empowering millions worldwide. Founded in 1999, the company's commitment to real-time glucose data has driven it to the forefront of the industry. With the recent launch of the Dexcom G7 and the Stelo, DexCom is poised for continued growth.

DexCom's DexCom SWOT Analysis reveals a dynamic landscape, with its growth strategy focused on expanding its market share and leveraging its innovative CGM technology. The company's future prospects are bright, driven by its commitment to innovation in diabetes care and strategic partnerships. This DexCom company analysis will delve into the specifics of its revenue growth forecast and the competitive landscape, offering insights into its long-term investment potential.

How Is DexCom Expanding Its Reach?

The growth strategy of DexCom focuses on expanding its market reach, introducing new products, and exploring innovative business models. A key element involves targeting new customer segments, particularly the large population of individuals with Type 2 diabetes, including those not using insulin. This strategic focus is critical for the company's long-term success and market share.

DexCom's future prospects are closely tied to its ability to broaden its customer base and enhance its product offerings. The company aims to increase coverage for Type 2 diabetes patients who do not use insulin. The company’s expansion initiatives aim to increase its market share by offering advanced diabetes management solutions and expanding its global presence.

DexCom's company analysis reveals a strong commitment to innovation and strategic growth. The company's focus on expanding coverage and launching new products positions it well for future growth. Owners & Shareholders of DexCom can benefit from understanding these expansion initiatives.

DexCom is actively working to expand its coverage in the U.S. As of January 2025, the company secured broader coverage with two of the three largest pharmacy benefit managers (PBMs). This expanded coverage includes all diabetes patients, adding over 5 million covered lives.

The company plans to extend its coverage to an additional 20 million Type 2 non-insulin users throughout 2025. This expansion is a key part of DexCom's growth strategy.

DexCom launched Stelo, its first over-the-counter glucose biosensor in the U.S. in 2024. Stelo has experienced strong initial demand across various populations, including those with Type 2 diabetes, prediabetes, and those focused on health and wellness.

The company is also advancing its Dexcom G7 platform. They received FDA clearance for a 15-day G7 system shortly after Q1 2025, with a launch expected in the second half of 2025. This longer-lasting sensor could improve user convenience and enhance the company's competitive position.

International expansion is a significant driver for DexCom's growth. In 2024, DexCom secured reimbursement for Dexcom ONE+ in France for people with Type 2 diabetes on basal insulin. This has significantly expanded access in that market.

For 2025, DexCom plans launches in Australia, Belgium, Canada, Israel, Italy, Switzerland, and the Nordics. These launches are part of the international expansion strategy.

DexCom continues to advance pump connectivity. They are integrating Dexcom G7 with Insulet's Omnipod 5 Automated Insulin Delivery System and Tandem Diabetes Care's Mobi insulin pump with Control-IQ technology.

This connectivity enhances the user experience and provides more comprehensive diabetes management solutions. These partnerships are important for DexCom's innovation in diabetes care.

DexCom's expansion initiatives include broadening market access, launching new products, and exploring new business models. The company is focused on entering new customer segments, particularly the Type 2 diabetes population.

- Expanded coverage in the U.S. with major PBMs.

- Launch of Stelo as an over-the-counter glucose biosensor.

- Advancement of the Dexcom G7 platform with a 15-day system.

- International expansion with launches planned in multiple countries.

- Continued pump connectivity integrations.

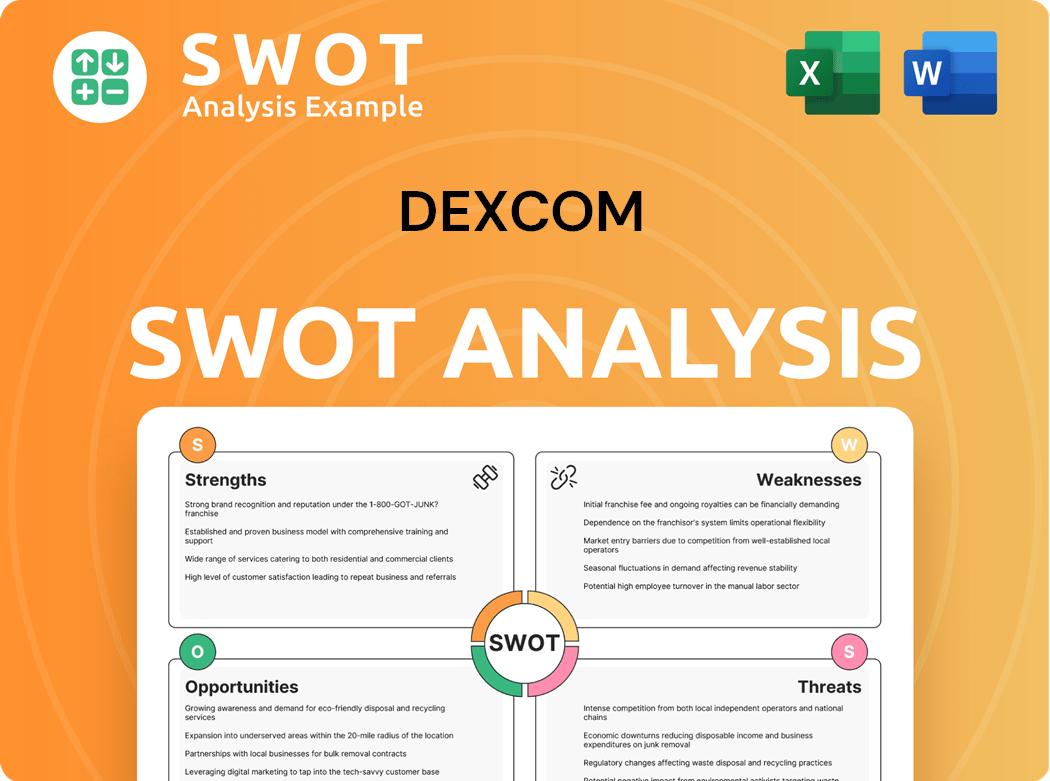

DexCom SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does DexCom Invest in Innovation?

The innovation and technology strategy of DexCom is central to its growth, focusing on continuous improvements in its continuous glucose monitoring (CGM) systems. This strategy involves significant investments in research and development (R&D) to enhance existing products and explore new opportunities in biosensing technology. The company's commitment to technological advancement is evident in its product pipeline and strategic partnerships.

DexCom's approach to innovation is multifaceted, encompassing product enhancements, integration of cutting-edge technologies, and strategic collaborations. These efforts aim to improve user experience, expand market reach, and maintain a competitive edge in the diabetes management market. The company's focus on innovation is also reflected in its efforts to obtain regulatory approvals for new products and features.

DexCom's dedication to technological advancement is a key driver in its Mission, Vision & Core Values of DexCom. The company's growth strategy is closely tied to its ability to innovate and bring new technologies to market, which is crucial for maintaining and expanding its market share in the competitive CGM landscape.

The Dexcom G7 platform represents a significant advancement in CGM technology. It features a smaller on-body wearable, a quicker warm-up time, and improved sensor accuracy, enhancing the user experience.

DexCom is working towards transitioning all its sensors to a 15-day platform, similar to its Stelo product. This move aims to provide users with extended sensor use and convenience.

In 2024, DexCom launched a new feature allowing the G7 to connect directly to the Apple Watch in the U.S. This integration simplifies glucose monitoring for users.

DexCom integrated generative AI with its sensors, becoming the first CGM manufacturer to do so with Stelo in December 2024. This AI analyzes health data to provide personalized recommendations.

DexCom partnered with Oura to enable data flow between their glucose biosensors and the Oura Ring and App. This integration allows users to track glucose levels and understand the impact of behaviors on metabolic health.

The company is developing its next-generation sensor, anticipated to be 50% smaller than the G7, with more powerful electronics and multi-analyte probes. This indicates a continuous commitment to innovation.

DexCom's strategy is centered on continuous innovation and the integration of advanced technologies to enhance its CGM systems and expand its market presence. These initiatives are designed to improve user experience and provide more comprehensive diabetes management solutions.

- Product Enhancements: Focus on improving sensor accuracy, reducing size, and extending sensor life.

- AI Integration: Leveraging AI to provide personalized health insights and recommendations.

- Strategic Partnerships: Collaborating with other health technology companies to expand data integration and user benefits.

- Regulatory Approvals: Actively pursuing regulatory approvals for new products and features to ensure market access.

- R&D Investments: Continuing to invest in research and development to drive future innovations in biosensing technology.

DexCom PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is DexCom’s Growth Forecast?

The financial outlook for Dexcom in 2025 points to continued growth, driven by increasing adoption of its Continuous Glucose Monitoring (CGM) technology and global expansion efforts. The company's strategic initiatives, including the introduction of new products and expansion into international markets, are expected to fuel revenue growth. This positive trajectory reflects Dexcom's strong position in the diabetes management market and its commitment to innovation.

Dexcom's financial performance in 2024 set a strong foundation for future growth. The company's focus on innovation and market expansion is expected to drive continued revenue increases. Investors and stakeholders are closely watching Dexcom's progress as it aims to solidify its market share and enhance its product offerings to meet the evolving needs of diabetes patients worldwide.

Dexcom's 2025 financial forecast indicates robust revenue growth and strategic financial management. The company's ability to maintain profitability while investing in innovation highlights its commitment to long-term value creation. For a look back at the company's journey, you can explore the Brief History of DexCom.

Dexcom's total revenue for 2024 was $4.033 billion, marking an 11% increase compared to 2023. The company anticipates total revenue of $4.60 billion for fiscal year 2025, representing an approximate 14% growth over 2024. This growth is supported by increasing CGM adoption and awareness, the launch of Stelo, and international expansion.

The Stelo over-the-counter device is projected to contribute approximately 2-3% to the 2025 revenue growth. This new product introduction is a key component of Dexcom's strategy to expand its market reach and offer more accessible diabetes management solutions.

The non-GAAP gross profit margin for Q1 2025 decreased to 57.5% from 61.8% in Q1 2024. The fiscal year 2025 guidance for non-GAAP gross profit margin has been adjusted downward to approximately 62%, a decrease from the previous guidance of 64-65%. This adjustment is primarily due to higher costs related to supply dynamics, increased freight expenses, and inflationary pressures.

Dexcom has maintained its non-GAAP operating margin guidance at approximately 21% and its adjusted EBITDA margin guidance at around 30% for 2025. The company's GAAP operating income for Q1 2025 was $133.7 million, which is 12.9% of revenue, demonstrating its ability to manage profitability despite margin pressures.

Dexcom's strong financial position is further supported by its substantial cash reserves and strategic capital allocation. The company's investment in share repurchases indicates confidence in its future prospects.

- As of December 31, 2024, Dexcom held $2.58 billion in cash, cash equivalents, and marketable securities.

- In Q1 2025, Dexcom initiated a $750 million share repurchase program, reflecting confidence in its market position and growth potential.

- The company's focus on innovation and market expansion positions it well for continued success in the CGM market.

- Dexcom's strategic financial management is crucial for sustaining its long-term growth trajectory.

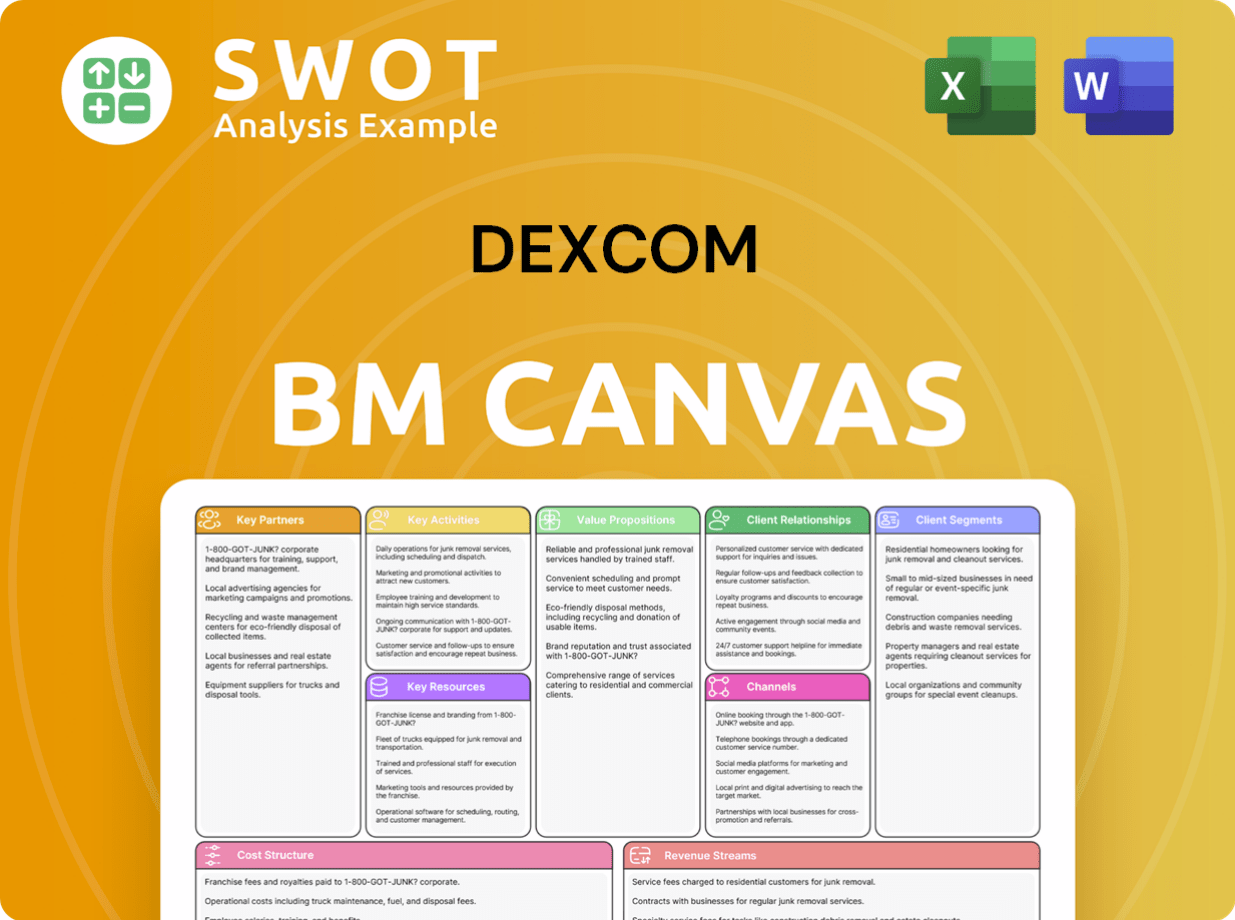

DexCom Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow DexCom’s Growth?

The path forward for DexCom, while promising, is fraught with potential risks and obstacles that could impact its DexCom growth strategy and DexCom future prospects. Several factors could impede the company's ability to maintain its current trajectory, including intense competition and regulatory hurdles. Understanding these challenges is crucial for any comprehensive DexCom company analysis.

Market dynamics and technological advancements present significant threats. The continuous glucose monitoring (CGM) market is highly competitive, and potential disruptions from innovative diabetes treatments loom. Moreover, the company faces internal challenges, such as supply chain vulnerabilities and leadership transitions, which could further complicate its operations.

The company's ability to navigate these risks will be critical to its long-term success. Investors and stakeholders should carefully consider these factors when evaluating the DexCom long-term investment potential.

Dexcom faces stiff competition in the CGM market from rivals like Abbott and Medtronic. The lack of significant switching costs for end-users could make it harder to retain customers if more user-friendly competitive products emerge. Rising competition in the Type 1 diabetes market, particularly from pump-integrated CGM systems, also adds pressure.

Regulatory changes and compliance are continuous concerns. In March 2025, the company received a warning letter from the FDA due to shortcomings in manufacturing processes and quality management systems at its San Diego and Mesa, Arizona facilities. Stringent quality control is essential to avoid further issues.

Supply chain vulnerabilities have impacted production and margins. A one-time supply disruption in Q1 2025 led to a gross margin shortfall and a lowered gross margin forecast for the full year. Persistent supply chain issues could hinder the company's ability to meet demand and maintain profitability.

Technological disruption is a long-term risk. Advancements in diabetes treatment, such as the creation and implantation of beta cells, could render CGMs less relevant. The company also faces notable rebate pressure in the U.S. market, impacting revenue growth despite strong demand.

Internal resource constraints, such as a leadership transition in the U.S. commercial team, could introduce risks to execution. These transitions can disrupt operations and potentially affect the company's ability to execute its strategic initiatives effectively. Maintaining stability during such changes is crucial.

Rebate pressure in the U.S. market is negatively impacting revenue growth, despite strong demand for its products. This pressure can affect the company's financial performance and its ability to maintain profitability. The company must address these challenges to sustain its growth trajectory.

The CGM market is dominated by a few key players, including Abbott and Medtronic. These competitors continuously innovate, putting pressure on Dexcom's DexCom market share. The intensity of competition requires Dexcom to invest heavily in research and development to maintain its competitive edge. For a deeper dive into the company's business model, consider reading about the Revenue Streams & Business Model of DexCom.

Regulatory compliance is an ongoing concern. The FDA's warning letter in March 2025 highlights the importance of maintaining high manufacturing standards. Any failure to adhere to regulatory requirements can lead to production delays, financial penalties, and damage to the company's reputation. The company's response to these challenges is crucial.

Supply chain disruptions can significantly impact Dexcom's ability to meet demand, affecting both revenue and profitability. The Q1 2025 supply disruption serves as a reminder of the importance of a robust and resilient supply chain. Managing these risks is essential for sustained DexCom revenue growth forecast.

The rapid pace of technological innovation in diabetes care poses a long-term risk. The development of alternative treatments, such as beta cell implantation, could potentially reduce the demand for CGMs. Dexcom must continue to innovate and adapt to stay ahead of these potential disruptions. This includes focusing on DexCom CGM technology and its continuous improvement.

DexCom Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DexCom Company?

- What is Competitive Landscape of DexCom Company?

- How Does DexCom Company Work?

- What is Sales and Marketing Strategy of DexCom Company?

- What is Brief History of DexCom Company?

- Who Owns DexCom Company?

- What is Customer Demographics and Target Market of DexCom Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.