DexCom Bundle

How Does DexCom Revolutionize Diabetes Management?

DexCom is transforming diabetes management with its cutting-edge Continuous Glucose Monitor (CGM) systems. Imagine a world where real-time blood sugar monitoring replaces finger pricks, offering unprecedented convenience and insights. This innovative approach enhances the lives of millions. Dive in to explore how DexCom is leading the charge in medical technology.

The DexCom SWOT Analysis highlights the company's strong position in the market, driven by its innovative CGM technology, including the Dexcom G6, and strategic partnerships. Understanding the operational mechanics of DexCom is crucial for anyone looking to invest in the diabetes care market or simply understand how this technology works. This in-depth analysis will provide valuable insights into DexCom's operations, revenue streams, and strategic moves.

What Are the Key Operations Driving DexCom’s Success?

The core operations of DexCom revolve around designing, developing, and selling continuous glucose monitoring (CGM) systems. These systems, like the Dexcom G6 and G7, are primarily for individuals with diabetes. The technology provides real-time glucose data, helping users manage their condition more effectively.

DexCom's value proposition centers on improving diabetes management through accurate and user-friendly CGM technology. This includes fewer fingersticks, real-time alerts, and data-driven insights. The company's operations span research and development, manufacturing, supply chain management, and sales, all geared towards delivering innovative diabetes solutions.

The company's CGM systems consist of a sensor inserted under the skin, a transmitter, and a display device. This setup offers continuous monitoring, empowering users to make informed decisions about their health. DexCom also partners with other companies to integrate its data into broader diabetes management ecosystems.

DexCom invests heavily in research and development to enhance sensor accuracy, minimize device size, and improve the user experience. This includes exploring new materials and technologies to provide more reliable and comfortable CGM solutions. The focus is on continuous improvement and innovation in CGM technology.

Manufacturing involves precision engineering and rigorous quality control to produce the sensors and transmitters. DexCom's global supply chain ensures the timely procurement of raw materials. This global network supports the production and distribution of CGM systems worldwide.

Sales channels include direct sales teams, distributors, and online platforms. This multi-channel approach ensures that CGM systems are accessible to a wide range of users. DexCom also partners with healthcare providers and pharmacies for broader market reach.

Customer service is a critical component, providing technical support and training to users. This support helps users maximize the benefits of their CGM systems. The company is committed to ensuring customer satisfaction and effective diabetes management.

DexCom's success is driven by its commitment to accuracy and user-friendliness in its CGM technology. This, combined with a robust ecosystem of compatible devices and software, sets it apart from traditional blood glucose meters and some competitors. The focus is on providing a seamless and informative experience for users managing their diabetes.

- Accuracy: DexCom strives for high accuracy in its glucose readings, which is crucial for effective diabetes management.

- User-Friendliness: The systems are designed to be easy to use, with features like simple sensor insertion and intuitive data display.

- Real-Time Data: Continuous monitoring provides real-time glucose data, allowing for immediate adjustments to diet, exercise, and medication.

- Integration: DexCom integrates its data with insulin pumps and digital health platforms for comprehensive diabetes management.

The global CGM market is experiencing significant growth. In 2024, the market was valued at approximately $7.5 billion, and it's projected to reach over $12 billion by 2028. This growth is fueled by the increasing prevalence of diabetes and the growing adoption of CGM technology. The Competitors Landscape of DexCom shows the competitive environment. DexCom's revenue for 2024 was around $3.6 billion, reflecting its strong market position and the demand for its products like the Dexcom G6 and the newer G7 CGM systems.

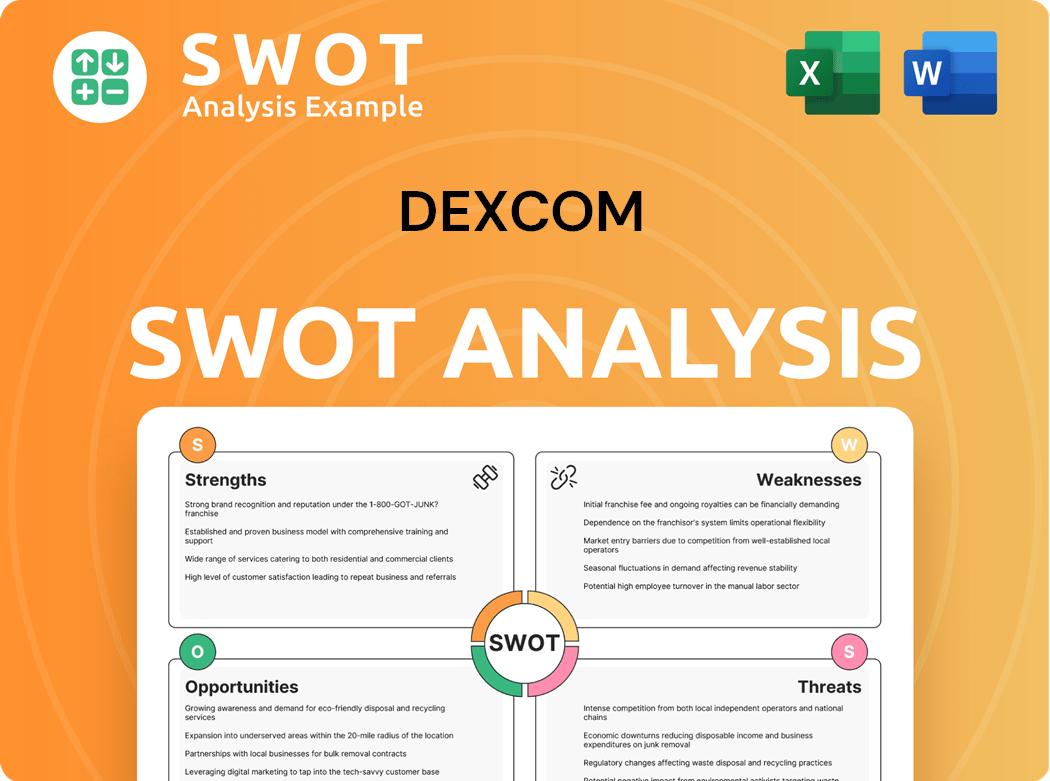

DexCom SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does DexCom Make Money?

The primary revenue streams for Dexcom stem from the sale of its Continuous Glucose Monitor (CGM) systems. These systems include disposable sensors, reusable transmitters, and display devices. The recurring need for sensor replacements forms the core of their revenue model.

Dexcom's monetization strategy heavily relies on a razor-and-blade model, encouraging continuous purchases. The initial purchase of a transmitter and receiver (or a compatible smart device) leads to the ongoing need for sensors, driving recurring revenue. The company also employs a tiered pricing strategy catering to various markets and payer types.

Strategic partnerships and expansion into new patient demographics are key growth drivers. Integrations with insulin pumps and automated insulin delivery systems boost demand. Additionally, focusing on type 2 diabetes patients, particularly those not on intensive insulin therapy, presents a significant opportunity for market penetration and revenue growth.

The cornerstone of Dexcom's financial success lies in the recurring revenue generated by its CGM systems, particularly the sensors. The company's approach involves a multi-faceted strategy to maximize revenue and expand its market reach. Here's a breakdown:

- Recurring Revenue from Sensors: Sensors, which need regular replacement (typically every 10-14 days), are the primary revenue driver.

- Razor-and-Blade Model: The initial purchase of transmitters and receivers leads to ongoing sensor purchases.

- Tiered Pricing: Different pricing structures are in place for various markets and payer types, such as commercial insurance and Medicare.

- Strategic Partnerships: Integrations with insulin pumps and automated insulin delivery systems indirectly boost demand for CGM products.

- Market Expansion: Targeting type 2 diabetes patients, especially those not on intensive insulin therapy, is a key growth area.

In fiscal year 2023, Dexcom reported total revenue of $3.62 billion, a 24% increase from 2022, driven by new patient additions and increased utilization of its G7 CGM system. The Marketing Strategy of DexCom has played a crucial role in this growth. While specific percentage breakdowns for 2024-2025 are still emerging, the trend of sensor sales dominating revenue is expected to continue due to their recurring nature. The company's ability to innovate and expand its market presence will be critical for sustained financial performance.

DexCom PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped DexCom’s Business Model?

The journey of DexCom has been marked by significant milestones and strategic maneuvers, solidifying its leadership in the Continuous Glucose Monitor (CGM) market. A pivotal moment was the 2018 launch of the Dexcom G6, the first integrated CGM (iCGM) system approved by the FDA, eliminating the need for fingerstick calibrations and enhancing user convenience. This breakthrough significantly boosted market adoption. The subsequent launch of the Dexcom G7 in late 2022 and its continued rollout into 2024 represents another key strategic move, offering a smaller, all-in-one sensor with a faster warm-up time, further enhancing the user experience and expanding its competitive edge.

Operational challenges, including supply chain disruptions during the global pandemic, were navigated through strategic inventory management and diversified sourcing. Regulatory hurdles, especially in expanding reimbursement and market access in new geographies, are ongoing, with the company actively engaging with regulatory bodies worldwide. DexCom's competitive advantages are multifaceted. Its technological leadership, particularly in sensor accuracy and reliability, is a core differentiator. The strong brand recognition and established trust among patients and healthcare providers create a significant barrier to entry for competitors.

DexCom's extensive ecosystem of compatible devices and software, including integrations with leading insulin pumps, fosters customer loyalty and provides a comprehensive diabetes management solution. DexCom continues to adapt to new trends by investing heavily in R&D for future generations of CGM technology, exploring non-invasive glucose monitoring solutions, and expanding its focus to a broader population of people with type 2 diabetes, thereby sustaining its business model against evolving competitive threats.

The launch of the Dexcom G6 in 2018 was a game-changer, being the first iCGM approved by the FDA. This allowed for non-adjunctive dosing decisions. The subsequent launch of the Dexcom G7 in late 2022 and its continued rollout into 2024 offered advanced features.

Strategic inventory management and diversified sourcing helped navigate supply chain disruptions. DexCom actively engages with regulatory bodies to expand market access. Investing in R&D for future CGM technology is a key strategy.

Technological leadership, particularly in sensor accuracy and reliability, is a core differentiator. Strong brand recognition and trust create a barrier to entry. The extensive ecosystem of compatible devices enhances customer loyalty.

DexCom is expanding its focus to a broader population of people with type 2 diabetes. This strategic move is crucial for sustaining its business model. The company is also exploring non-invasive glucose monitoring solutions.

DexCom's competitive advantages include technological leadership in CGM technology, strong brand recognition, and an extensive ecosystem. The company's focus on innovation and market expansion, including exploring non-invasive glucose monitoring, positions it well for future growth. The company's commitment to research and development is evident in its continuous improvement of its products, such as the Dexcom G6 and G7, and its efforts to enhance the user experience. For more insights, see the Growth Strategy of DexCom.

- Technological superiority in sensor accuracy and reliability.

- Strong brand recognition and trust among patients and healthcare providers.

- Extensive ecosystem of compatible devices and software integrations.

- Continuous investment in R&D for future generations of CGM technology.

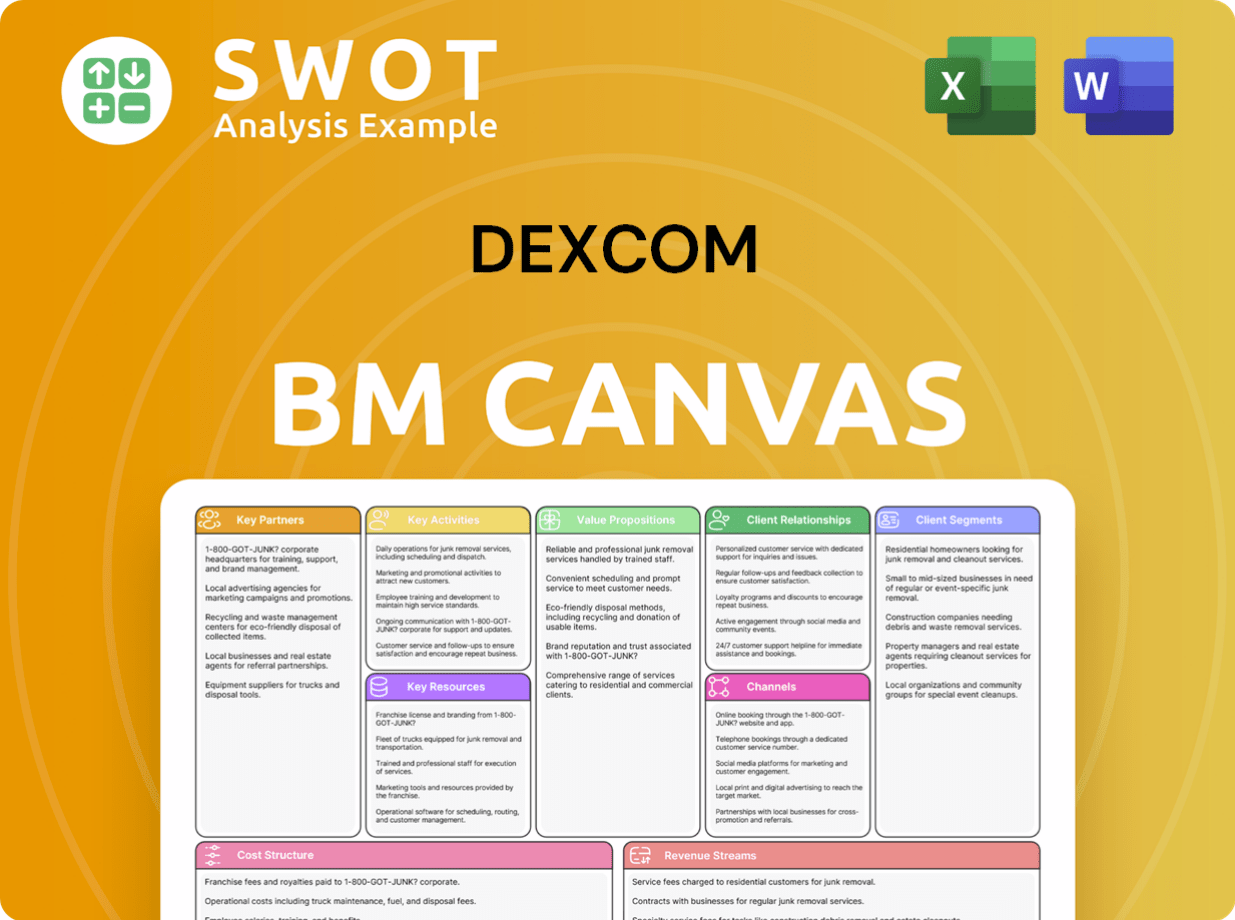

DexCom Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is DexCom Positioning Itself for Continued Success?

Dexcom holds a prominent position within the continuous glucose monitoring (CGM) sector, sharing dominance with Abbott Laboratories. The company has a substantial market share, driven by its advanced and user-friendly CGM systems. Strong brand loyalty is evident among users who rely on real-time data for effective diabetes management. Dexcom's global presence is significant, with products available in numerous countries, and it continues to expand internationally.

Despite its strong market position, Dexcom faces various risks. Regulatory changes, particularly concerning reimbursement policies and product approvals, could affect its operations and revenue. Competition from new entrants with innovative technologies or aggressive pricing strategies poses a constant threat. Technological disruption from alternative glucose monitoring methods is a long-term consideration. Changes in consumer preferences or healthcare provider adoption patterns could also impact demand for its products. To learn more about the company's target market, read this article: Target Market of DexCom.

Dexcom is a leader in the CGM market, competing with Abbott. It has a significant market share due to its advanced technology and user-friendly systems. Its products are available globally, and the company continues to expand its international reach.

Dexcom faces risks from regulatory changes, competition, and technological disruptions. Changes in reimbursement policies and new competitors could impact revenue. Shifts in consumer preferences and healthcare adoption also pose challenges.

Dexcom is focused on continued innovation and market expansion. This includes investment in R&D for future CGM generations and expanding into the type 2 diabetes market. The company aims to enhance user experience and broaden access to CGM technology.

Dexcom is investing in research and development for the next generation of CGM systems. The company is targeting the large type 2 diabetes market. Leadership emphasizes innovation, user experience, and global access to CGM technology.

Dexcom's future success depends on innovation, regulatory navigation, and market penetration. The company must adapt to changes in the CGM market and meet evolving patient needs. Effective strategies are crucial to sustain growth and profitability.

- Innovation: Continuous development of smaller, more accurate CGM systems.

- Market Expansion: Targeting the type 2 diabetes market, which represents a significant growth opportunity.

- Regulatory Compliance: Navigating the regulatory landscape to ensure product approvals and reimbursement.

- Competitive Advantage: Differentiating through technology, user experience, and strategic partnerships.

DexCom Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DexCom Company?

- What is Competitive Landscape of DexCom Company?

- What is Growth Strategy and Future Prospects of DexCom Company?

- What is Sales and Marketing Strategy of DexCom Company?

- What is Brief History of DexCom Company?

- Who Owns DexCom Company?

- What is Customer Demographics and Target Market of DexCom Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.