DexCom Bundle

Can DexCom Maintain Its Edge in the CGM Arena?

DexCom has fundamentally altered diabetes management with its continuous glucose monitoring (CGM) systems, offering a lifeline to millions. Its journey from a visionary startup to a market leader showcases a commitment to innovation and patient-centric solutions. But in the dynamic world of DexCom SWOT Analysis, understanding the competitive landscape is crucial for investors and strategists alike.

This analysis delves into the DexCom competitive landscape, examining its key rivals and the overall CGM market dynamics. We'll explore DexCom competitors, dissecting their strengths and weaknesses to provide a comprehensive DexCom market analysis. Furthermore, the evaluation will include a look at the DexCom G7 competitive advantages and how the company's strategic decisions influence its future growth potential within the diabetes technology sector.

Where Does DexCom’ Stand in the Current Market?

DexCom holds a strong position in the continuous glucose monitoring (CGM) industry. The company competes primarily with Abbott Laboratories, collectively dominating the global CGM market. DexCom focuses on providing advanced CGM technology, prioritizing accuracy and user experience.

DexCom's main product lines include the G6 and G7 CGM systems. These systems offer real-time glucose data to compatible devices, providing alerts and warnings. The company serves a broad customer base, including individuals with Type 1 and Type 2 diabetes, as well as healthcare providers. Marketing Strategy of DexCom has played a significant role in its market positioning.

Geographically, DexCom has a strong presence in North America, Europe, and select international markets. They are continually expanding their global footprint. The company’s strategic focus allows it to maintain strong pricing power and foster brand loyalty.

DexCom and Abbott Laboratories are the primary competitors in the CGM market. While specific market share figures fluctuate, they collectively control a significant portion of the global market. This duopoly highlights the competitive landscape within the diabetes technology sector.

DexCom's product portfolio includes the G6 and G7 CGM systems. These systems offer advanced features like real-time glucose monitoring and customizable alerts. The company invests heavily in research and development to maintain its competitive edge and introduce innovative products.

DexCom demonstrates robust financial health, with projected revenue between $1.030 billion and $1.050 billion for the first quarter of 2025. This represents a growth of 24-27% compared to the first quarter of 2024. The company’s consistent revenue growth underscores its leadership in the diabetes technology sector.

DexCom has a substantial presence in North America, Europe, and select international markets. The company is actively expanding its global footprint, with opportunities for further penetration in emerging economies. They also aim to reach a broader segment of the Type 2 diabetes population.

The CGM market is highly competitive, with DexCom and Abbott as key players. DexCom's focus on innovation and user experience helps it maintain a strong market position. The company’s financial performance and growth trajectory are indicative of its success in the diabetes technology sector.

- Market Share: DexCom and Abbott collectively dominate the global CGM market.

- Product Innovation: Continuous investment in R&D drives new product releases and enhancements.

- Financial Health: Strong revenue growth and profitability reflect market leadership.

- Geographic Expansion: Strategic focus on expanding global presence and market penetration.

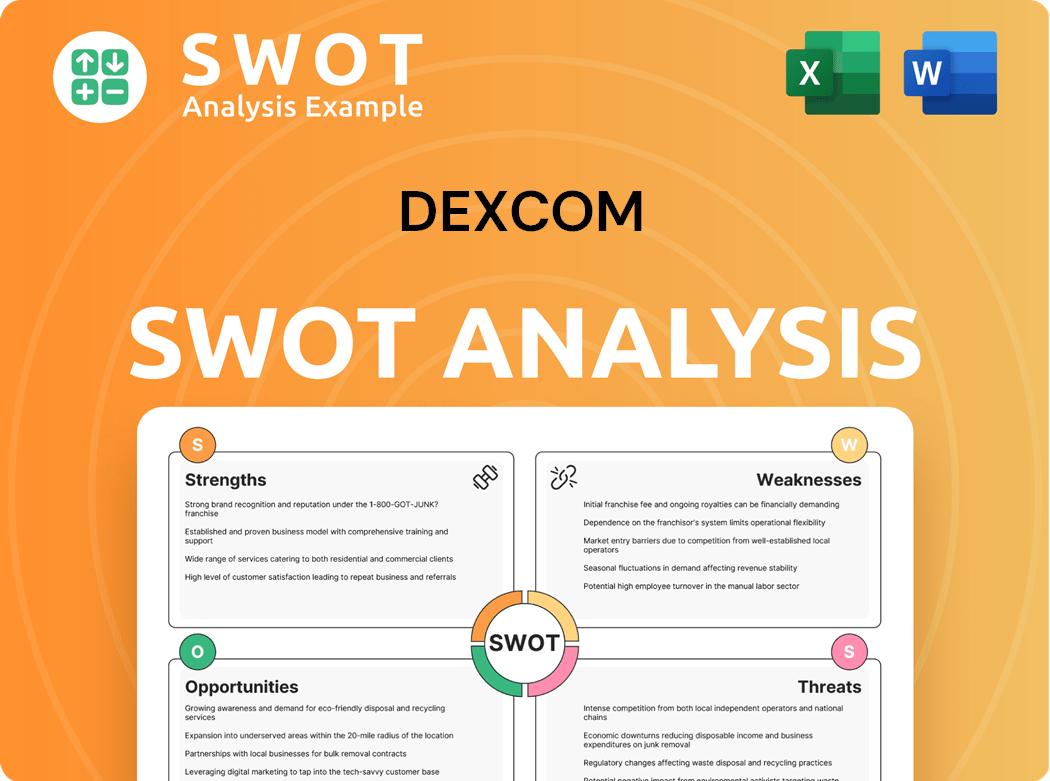

DexCom SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging DexCom?

The DexCom competitive landscape is primarily shaped by the continuous glucose monitoring (CGM) market, where it competes with several key players. The company's success is heavily influenced by its ability to innovate, secure regulatory approvals, and effectively navigate the complex healthcare market. Understanding the competitive dynamics is crucial for assessing its market position and future growth prospects.

DexCom's market analysis reveals a landscape dominated by a few major competitors, with a mix of established companies and emerging players. The company's strategies, including product development, pricing, and distribution, are constantly challenged by these competitors. The CGM market is dynamic, with technological advancements and evolving consumer preferences constantly reshaping the competitive environment.

DexCom competitors include both direct and indirect rivals, each employing different strategies to gain market share. The competitive landscape is not static, with mergers, acquisitions, and strategic alliances further influencing the market dynamics. The company's financial performance and market share are directly impacted by these competitive pressures.

Abbott is a major direct competitor, primarily through its FreeStyle Libre system. This system uses a 'flash' glucose monitoring approach, requiring users to scan a sensor for readings. The competition between the two companies is intense, especially regarding pricing, technological advancements, and regulatory approvals.

Medtronic offers integrated insulin pump and CGM systems, such as the MiniMed series. This approach combines insulin delivery with glucose monitoring, appealing to users seeking a comprehensive diabetes management solution. Medtronic's strength lies in its integrated solutions.

Senseonics provides the Eversense implantable CGM system. This system differentiates itself with a long-term implantable sensor, offering convenience for some users. Senseonics is a smaller player but provides a unique offering in the market.

Indirect competition comes from traditional blood glucose meter manufacturers. However, the trend is shifting towards CGM due to its superior data insights and convenience. This shift poses a challenge to these manufacturers as CGM technology gains wider adoption.

Emerging players and smaller startups are entering the competitive landscape. These companies often focus on niche solutions or leverage new technologies like non-invasive glucose monitoring. These entrants could disrupt the market.

The competitive dynamics are influenced by mergers, acquisitions, and strategic alliances. Companies seek to consolidate positions or gain access to new technologies and markets. These activities reshape the competitive landscape.

Several factors drive competition in the CGM market. These include technological innovation, pricing strategies, regulatory approvals, and market access. The ability to differentiate products and establish strong distribution networks is critical.

- Technological Advancements: Continuous innovation in sensor technology, data analytics, and user interfaces.

- Pricing and Reimbursement: Competitive pricing strategies and securing favorable reimbursement from insurance providers.

- Regulatory Approvals: Obtaining approvals for new products and expanded indications from regulatory bodies like the FDA.

- Market Access and Distribution: Establishing strong distribution channels and partnerships with healthcare providers.

- Product Differentiation: Offering unique features, improved accuracy, and enhanced user experience.

DexCom PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives DexCom a Competitive Edge Over Its Rivals?

The competitive advantages of DexCom are rooted in its technological prowess, brand strength, and focus on user experience. The company's continuous glucose monitoring (CGM) systems, such as the G6 and G7, offer real-time data, providing immediate insights into glucose levels without the need for fingerstick calibrations. This technological edge is supported by extensive research and development, leading to a portfolio of patents that create barriers to entry for potential competitors. A deep dive into the Growth Strategy of DexCom reveals how these advantages are leveraged.

DexCom has fostered strong brand loyalty through consistent product performance, reliability, and continuous software updates. Its integration capabilities with other diabetes management tools, such as insulin pumps and digital health platforms, further solidify its position in the diabetes care ecosystem. Strategic partnerships with insulin pump manufacturers and healthcare providers expand its reach and ensure its technology is seamlessly integrated into treatment protocols. The company's ability to maintain its lead depends on its continued innovation and ability to respond to evolving patient needs.

The sustainability of DexCom's competitive advantages is tied to ongoing investment in intellectual property and maintaining a superior user experience. The company faces a dynamic competitive landscape, with rivals continually investing in R&D to close technological gaps. Therefore, DexCom's ability to maintain its lead will depend on its continued innovation, rapid product iteration, and ability to anticipate and respond to evolving patient needs and technological advancements. The company's financial performance in 2024 reflects its strong market position. For instance, DexCom reported revenue of $3.6 billion in 2023, a growth of approximately 24% year-over-year. The company's market capitalization is around $40 billion as of April 2024, demonstrating investor confidence in its long-term prospects.

DexCom's CGM systems offer real-time data and eliminate the need for fingerstick calibrations. This technological lead is protected by a robust portfolio of patents. The G7 system, for example, has been praised for its improved accuracy and ease of use.

DexCom has cultivated strong brand loyalty through consistent product performance and software updates. The company focuses on user-friendly designs and seamless integration with other diabetes management tools. Customer satisfaction scores are consistently high, reflecting the company's commitment to user needs.

Partnerships with insulin pump manufacturers and healthcare providers expand DexCom's market reach. These collaborations ensure that DexCom's technology is integrated into treatment protocols. These partnerships are crucial for driving adoption and maintaining market share.

DexCom invests heavily in research and development to maintain its technological edge. The company continuously iterates on its products, introducing new features and improvements. Ongoing innovation is essential to stay ahead of competitors in the CGM market.

DexCom's competitive edge stems from several key factors. These include its technological leadership in the CGM market, strong brand recognition, and strategic partnerships. The company's focus on user experience and continuous innovation further strengthens its position.

- Real-time data delivery and accuracy.

- Strong brand reputation and customer loyalty.

- Strategic partnerships with key industry players.

- Continuous investment in research and development.

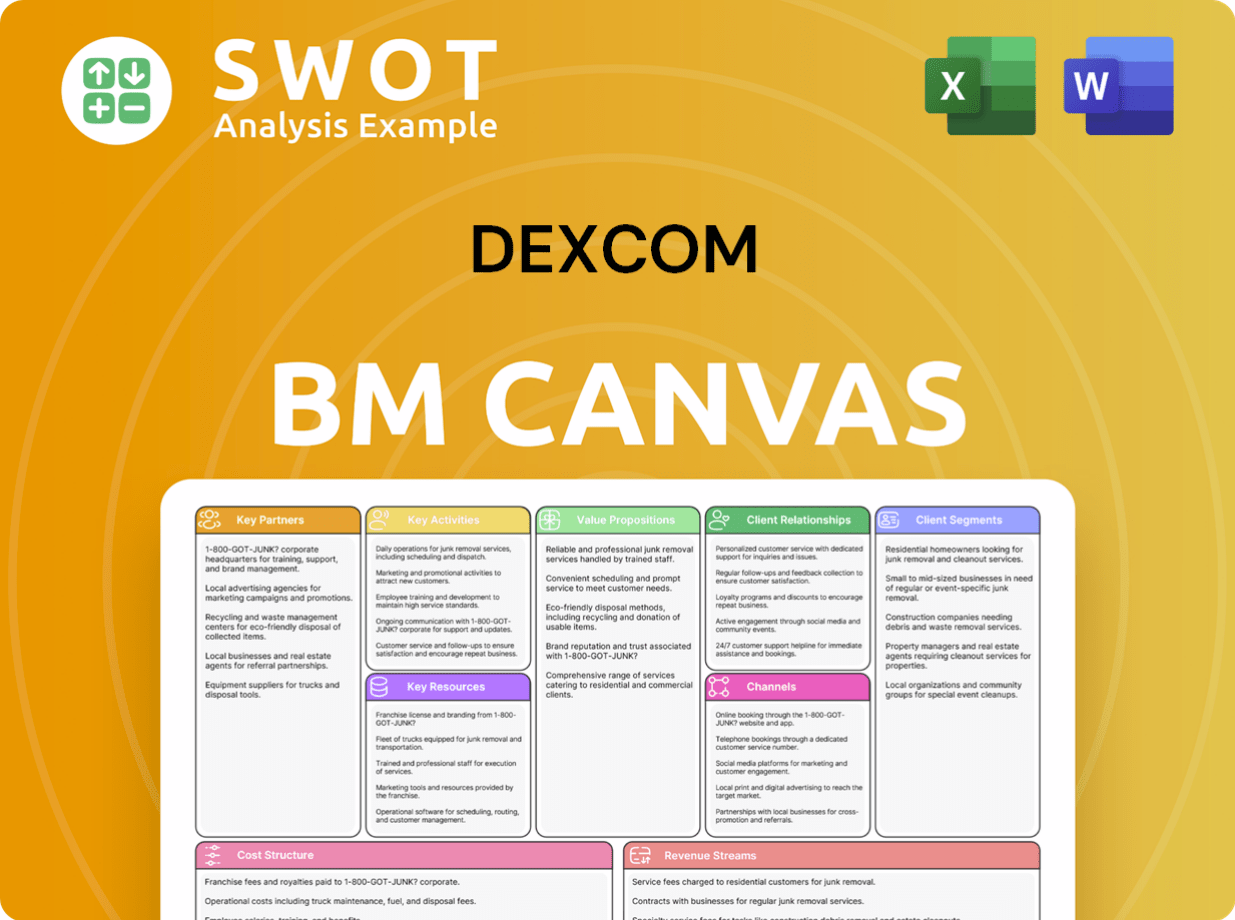

DexCom Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping DexCom’s Competitive Landscape?

The continuous glucose monitoring (CGM) industry is dynamic, shaped by rapid technological advancements, evolving regulatory landscapes, and the rising global prevalence of diabetes. This environment presents both significant opportunities and considerable challenges for companies like DexCom. A thorough DexCom competitive landscape analysis is crucial to understanding its position and future prospects within the CGM market.

DexCom's market analysis reveals a competitive environment, with key players like Abbott and Medtronic vying for market share. The company's ability to innovate, adapt to regulatory changes, and expand its global footprint will be critical to its long-term success. Understanding the competitive dynamics, including DexCom competitors, is essential for investors and stakeholders.

Technological advancements are driving the development of smaller, more accurate, and less intrusive sensors. Data analytics and AI integration are enhancing predictive insights. Regulatory changes, especially in reimbursement policies, are expanding CGM's accessibility. Consumer preferences are shifting towards convenient, real-time, and integrated health solutions.

Intensifying competition from Abbott and Medtronic, which are also innovating rapidly. The potential for new market entrants, particularly those developing non-invasive glucose monitoring technologies, could disrupt the traditional CGM market. Regulatory hurdles in new geographic markets and the need for ongoing clinical validation for expanded indications also pose challenges.

Significant growth opportunities in emerging markets, where diabetes prevalence is rising. Increased CGM adoption among Type 2 diabetes patients, especially those not on insulin, represents a large untapped market. Further product innovations, such as extended wear sensors and enhanced connectivity, offer avenues for growth. Strategic partnerships can unlock new revenue streams.

DexCom must continue investing in R&D, expanding its global footprint, and adapting to changing healthcare paradigms. The company aims to maintain its leadership through innovation and strategic market penetration. The DexCom competitive landscape is constantly evolving, requiring agility and foresight.

DexCom faces a competitive landscape dominated by Abbott and Medtronic, with each company vying for market share through product innovation and strategic initiatives. The DexCom market analysis indicates a need for continuous innovation to stay ahead. Understanding DexCom's competitors and their strategies is crucial for evaluating its future potential.

- DexCom G7 competitive advantages include improved accuracy and ease of use.

- DexCom is investing heavily in R&D to maintain its competitive edge.

- Strategic partnerships and global expansion are key growth strategies.

- The company's financial performance and DexCom financial performance analysis are closely tied to its ability to execute these strategies. Learn more about the Revenue Streams & Business Model of DexCom.

DexCom Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DexCom Company?

- What is Growth Strategy and Future Prospects of DexCom Company?

- How Does DexCom Company Work?

- What is Sales and Marketing Strategy of DexCom Company?

- What is Brief History of DexCom Company?

- Who Owns DexCom Company?

- What is Customer Demographics and Target Market of DexCom Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.