Enovis Bundle

How did Enovis, a leading medical device company, become the orthopedic powerhouse it is today?

Embark on a journey through the Enovis SWOT Analysis, a company that has redefined orthopedic solutions. From its inception as Colfax Corporation in 1995, Enovis's story is one of strategic evolution and unwavering dedication to improving patient outcomes. Discover the pivotal moments that shaped this medical device company into a global leader.

This exploration into the Enovis company timeline will uncover the significant acquisitions and innovative strategies that propelled its growth. Delving into the brief history of DJO Global, now Enovis, reveals a transformation from a diversified industrial manufacturer to a focused innovator in musculoskeletal health. Understand how Enovis's commitment to orthopedic devices has solidified its market position and shaped its future.

What is the Enovis Founding Story?

The story of Enovis, a prominent player in the medical device industry, begins with the founding of Colfax Corporation in 1995 by Steven and Mitchell Rales. Their initial strategy was to build a global enterprise through strategic acquisitions, setting the stage for the company's future involvement in healthcare.

A critical element in Enovis's history is the acquisition of DJO Global by Colfax in 2019, which significantly expanded its presence in the orthopedic and rehabilitation markets. This acquisition was a key step in Colfax's strategic shift towards healthcare, eventually leading to the creation of Enovis.

The roots of Enovis's orthopedic focus can be traced back to 1978 with the founding of DonJoy by Mark Nordquist and Ken Reed. DonJoy's early innovations, such as the rigid knee brace introduced in 1980, aligned with the emerging field of sports medicine and helped establish a strong market position. This history is essential to understanding the evolution of the Enovis company and its focus on orthopedic solutions.

Enovis's journey began with Colfax Corporation's establishment in 1995, followed by the acquisition of DJO Global, which was a pivotal moment for the company. The acquisition of DJO Global by Colfax in 2019 was a strategic move that expanded its presence in the orthopedic and rehabilitation markets.

- Colfax Corporation was founded in 1995 by Steven and Mitchell Rales.

- DonJoy was founded in 1978 by Mark Nordquist and Ken Reed.

- The introduction of a rigid knee brace in 1980 by DonJoy was a significant innovation.

- The acquisition of DJO Global by Colfax in 2019 was a key strategic move.

DonJoy's origins in 1978 laid the groundwork for Enovis's future specialization in orthopedic devices. The company's early success, including approximately $100 million in annual revenues by the late 1990s, highlights its early market dominance. This early success set the stage for its integration into the larger entity that would become Enovis. Understanding the Target Market of Enovis is crucial for appreciating its market position.

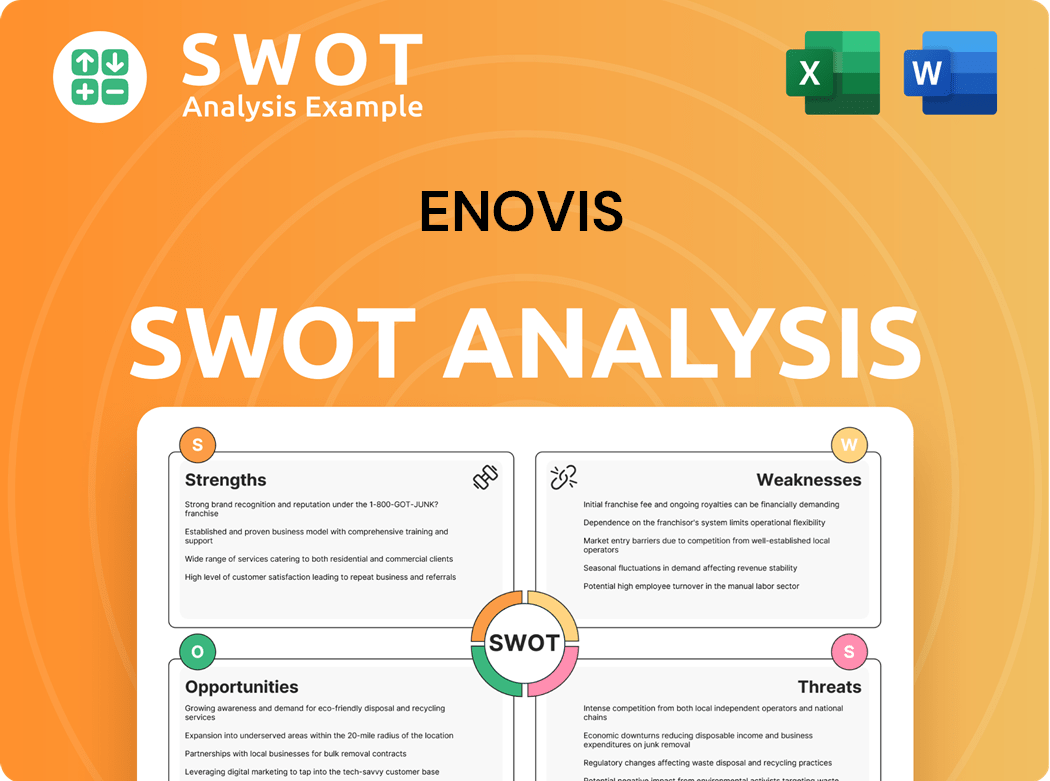

Enovis SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Enovis?

The early growth of the Enovis company, formerly known as Colfax Corporation, was marked by strategic acquisitions and a shift in focus. This

In August 1997, Colfax acquired approximately 93% of IMO Industries, Inc. This acquisition, with $469 million in annual revenue, was a key step in Colfax's early expansion. Following this, the company divested certain IMO units, which helped narrow its strategic focus.

Between 2012 and 2019, Colfax completed over two dozen acquisitions to build out its industrial businesses. These acquisitions were part of a broader strategy to diversify and strengthen its market presence. The company's focus was to grow its industrial segment through strategic purchases.

The acquisition of

Following the acquisition of DJO Global, Colfax divested its industrial businesses, Colfax Fluid Handling and Howden. In 2022, Colfax separated from ESAB and rebranded as Enovis Corporation. This signaled a dedicated focus on medical technology and orthopedic devices.

In June 2023, Enovis acquired Novastep, a developer of foot and ankle solutions. This acquisition strengthened Enovis's position in the bunion segment and expanded its international presence. The January 2024 acquisition of LimaCorporate S.p.A. for approximately $846.4 million (€800 million) established Enovis's reconstructive segment as a nearly $1 billion revenue business.

The acquisitions of Novastep and LimaCorporate S.p.A. highlight Enovis's strategy of expanding its product offerings and market reach. The LimaCorporate acquisition brought 3D-printed Trabecular Titanium into the Enovis portfolio, focusing on the fast-growing extremities markets. These moves underscore Enovis's commitment to growth and innovation in the medical technology sector.

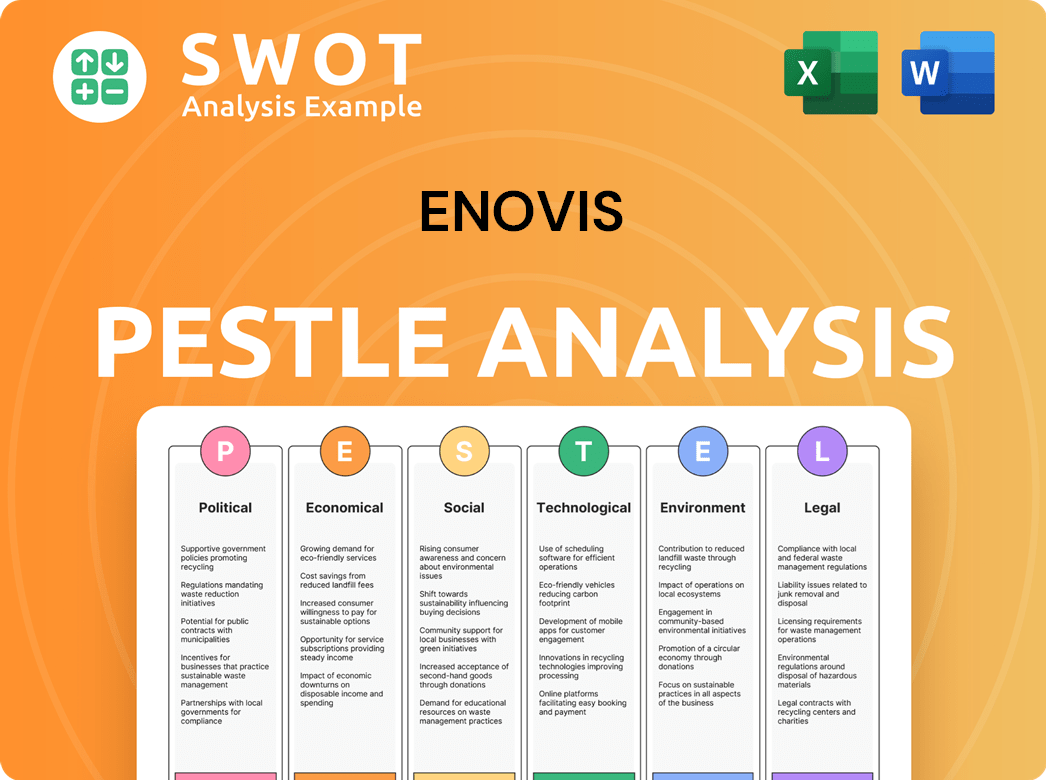

Enovis PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Enovis history?

The story of Enovis, and its predecessors, is marked by significant milestones in the medical device industry, particularly in orthopedic solutions. These achievements reflect a commitment to innovation and strategic expansion, shaping the company's trajectory over the years.

| Year | Milestone |

|---|---|

| 1980 | DonJoy, a predecessor of Enovis, revolutionized knee bracing with the introduction of a rigid, ready-to-wear knee brace. |

| 2024 | Enovis showcased its newly integrated portfolio, including products from the LimaCorporate acquisition, demonstrating its commitment to continuous product innovation. |

| 2025 | Enovis continues to focus on clinically differentiated solutions and strategic initiatives to navigate challenges and drive growth. |

The ARVIS Augmented Reality System provides real-time surgical guidance for precise implant alignment. This innovation enhances the accuracy and efficiency of surgical procedures, improving patient outcomes.

The EMPOWR 3D Knee is the first and only dual-pivot total knee on the market replicating natural motion. This design aims to provide a more natural and functional experience for patients.

The EMPOWR blade stem is designed for improved fit and efficiency in surgical procedures. This innovation contributes to better surgical outcomes and streamlined processes.

The DynaNail Helix is used for sustained dynamic compression in subtalar fusion. It provides a reliable solution for this specific orthopedic procedure.

In Q4 2024, Enovis reported a net loss from continuing operations of $827 million, partly due to a substantial goodwill impairment charge and increased interest expenses. In Q1 2025, the net loss from continuing operations was $56 million.

Enovis is navigating the impact of tariffs, anticipating a $40 million tariff exposure, which they aim to mitigate to $20 million through strategies like diversifying sourcing and manufacturing. The company is actively working to minimize these financial impacts.

The company's stock has seen a dip, trading near 52-week lows, with a forward P/E ratio of 8.68, which may indicate potential undervaluation by the market. Despite these challenges, Enovis maintains a robust revenue growth rate of 8.20%.

Enovis is addressing these challenges through strategic initiatives like the Enovis Growth Excellence (EGX) program. This program contributed to a 300 basis point improvement in adjusted gross margin to 61.7% in Q1 2025.

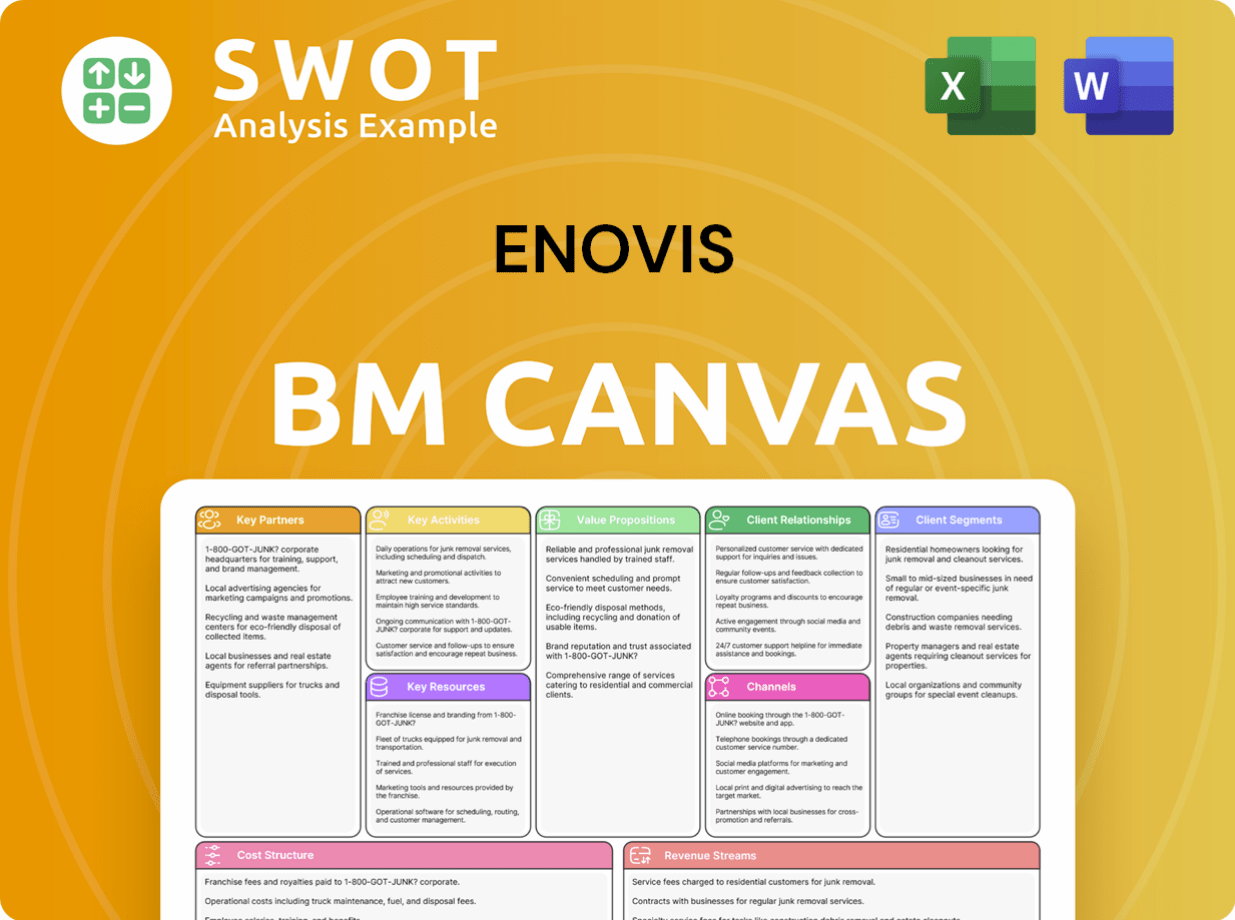

Enovis Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Enovis?

The Enovis company's journey reflects a strategic evolution within the medical technology sector, marked by significant acquisitions and transformations. The company's roots trace back to 1978 with the founding of DonJoy, a precursor to the current entity. The company's trajectory has been shaped by key acquisitions and strategic shifts, positioning it as a significant player in the orthopedic solutions market. For more insights into the company's guiding principles, explore the mission, vision, and core values of Enovis.

| Year | Key Event |

|---|---|

| 1978 | DonJoy, a precursor to Enovis, is founded in Carlsbad, California. |

| 1995 | Colfax Corporation, from which Enovis emerged, is founded. |

| 1997 | Colfax begins its growth through acquisition with the purchase of IMO Industries, Inc. |

| 2001 | DJ Orthopedics (formerly DonJoy) goes public. |

| 2007 | Blackstone Group acquires DJO, renaming it DJO Global. |

| 2008 | Colfax goes public with an initial public offering. |

| 2019 | Colfax Corporation acquires DJO Global, establishing its medical technology platform. |

| 2022 | Colfax separates from ESAB and rebrands as Enovis Corporation, focusing solely on medical technology. |

| June 2023 | Enovis acquires Novastep, expanding its foot and ankle solutions portfolio. |

| January 2024 | Enovis completes the acquisition of LimaCorporate S.p.A., significantly boosting its reconstructive business. |

| Q1 2025 | Enovis reports $559 million in sales, up 8% compared to Q1 2024, with adjusted EBITDA reaching $99 million. |

| May 2025 | Damien McDonald is appointed as the new CEO, succeeding Matt Trerotola. |

For 2025, Enovis projects revenue between $2.22 and $2.25 billion, reflecting a 6-6.5% organic revenue growth. The company anticipates adjusted EBITDA to be in the range of $385-$395 million, and full-year adjusted earnings per share are expected to be $2.95-$3.10. These forecasts highlight the company's continued growth trajectory.

Enovis is focused on strategic investments and new product launches to drive above-market growth. The company is working to mitigate a projected $40 million tariff exposure, aiming to reduce it to $20 million through diversification. This proactive approach supports sustainable growth and profitability.

The company's strategic focus on clinically differentiated solutions and expansion into new markets, including digital health technologies, positions it for continued growth. This approach aligns with the evolving demands of the medical device market and enhances its competitive edge.

Analysts remain optimistic about Enovis, with an average target price of $56.50, suggesting a potential upside of 90.56% from current levels. This positive outlook underscores the company's strong growth prospects and its ability to deliver value to investors.

Enovis Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Enovis Company?

- What is Growth Strategy and Future Prospects of Enovis Company?

- How Does Enovis Company Work?

- What is Sales and Marketing Strategy of Enovis Company?

- What is Brief History of Enovis Company?

- Who Owns Enovis Company?

- What is Customer Demographics and Target Market of Enovis Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.