Enovis Bundle

How Does Enovis Thrive in the Orthopedic Market?

Since its 2022 spin-off, Enovis company has quickly become a major player in medical technology, focusing on innovative orthopedic solutions. But what exactly does this company do, and how has it achieved such impressive growth? This analysis dives deep into the core of Enovis SWOT Analysis to uncover its operational strategies and financial successes.

Enovis's impressive financial performance, including an 8% increase in net sales in Q1 2025, highlights its robust business model. Understanding How Enovis works is crucial for anyone looking to invest in or learn more about the medical technology sector. This exploration will dissect Enovis's revenue streams, strategic initiatives, and market position, offering a clear view of its potential.

What Are the Key Operations Driving Enovis’s Success?

The Enovis company is a medical technology firm that designs, manufactures, and distributes products and services. Its main focus is on orthopedic solutions and medical devices. The company's core aim is to improve patient outcomes and enhance healthcare provider efficiency.

The Enovis company operates globally, offering solutions for a wide range of musculoskeletal conditions. It serves a diverse customer base, including hospitals, clinics, and individual patients. The company's operations are structured to ensure high-quality standards and cost-effectiveness.

The company's business model includes product innovation, manufacturing, and service delivery. Enovis invests heavily in research and development to create advanced medical technologies. They also focus on maintaining control over the supply chain and manufacturing processes.

Enovis products are divided into Prevention & Recovery (P&R) and Reconstructive (Recon) segments. P&R includes bracing, soft goods, and therapy products. Recon focuses on joint implants and surgical solutions.

The company uses a vertically integrated model, encompassing product innovation, manufacturing, and service delivery. They emphasize R&D to create cutting-edge medical technologies. They also utilize long-term partnerships with healthcare providers.

Notable brands within the Enovis portfolio include Aircast, DonJoy, Chattanooga, and Compex. These brands contribute significantly to the company's market presence. They are well-recognized in the medical community.

In recent financial reports, Enovis revenue has shown steady growth, reflecting strong demand for its products. The company's financial performance is closely tied to its ability to innovate and maintain market share. Investors often analyze the Enovis stock performance.

The value proposition of Enovis lies in its ability to provide innovative medical solutions that improve patient outcomes. The company's focus on both prevention and recovery, alongside reconstructive products, positions it as a comprehensive provider in the orthopedic market. Understanding the Competitors Landscape of Enovis is important for investors.

- Focus on innovation and R&D to create cutting-edge medical technologies.

- Vertically integrated business model to ensure quality and cost efficiency.

- Strong partnerships with healthcare providers to drive recurring revenue.

- Diverse product portfolio catering to various musculoskeletal conditions.

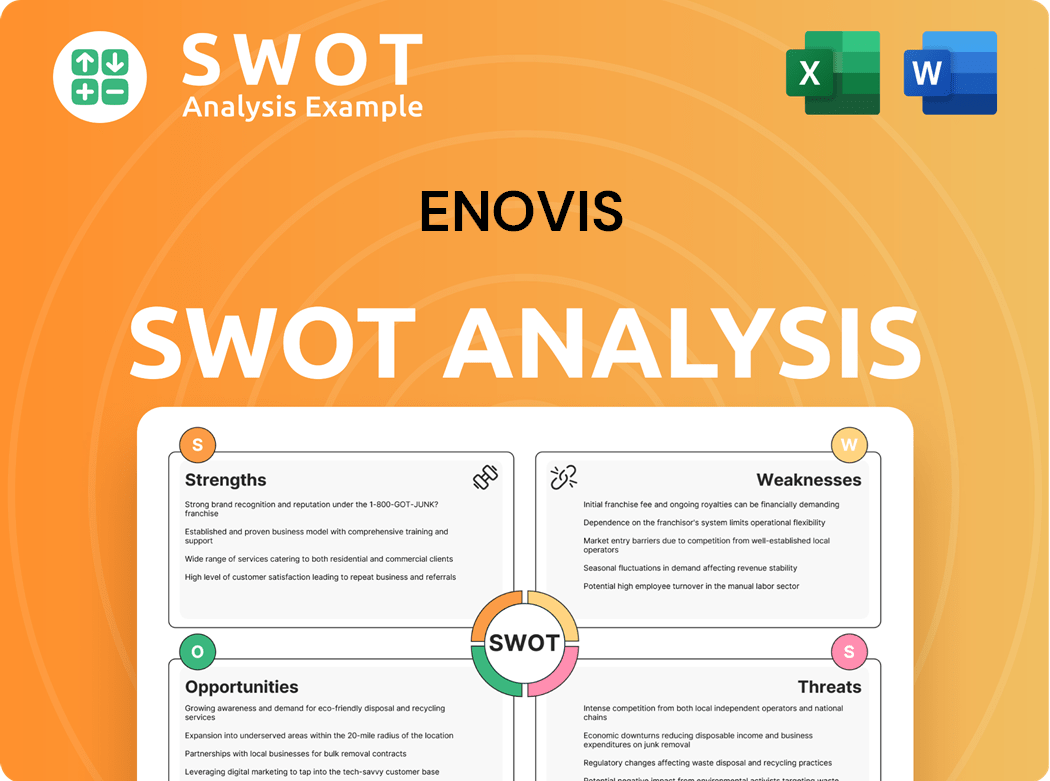

Enovis SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Enovis Make Money?

The Enovis company generates revenue primarily through the design, development, manufacturing, and distribution of medical technology products, with a focus on orthopedic solutions. Its revenue streams are mainly derived from the sale of bracing and supports, surgical implants, and rehabilitation technologies. This strategic focus allows Enovis to capture a significant portion of the market for orthopedic solutions.

For the full year 2024, Enovis reported net sales of $2.1 billion, reflecting a substantial increase in revenue. This growth highlights the company's strong market position and effective sales strategies. The company's financial performance underscores its ability to capitalize on market opportunities and drive revenue growth.

In the first quarter of 2025, Enovis reported net sales of $559 million, showing continued growth in its core business segments. The company anticipates full-year 2025 revenue to be in the range of $2.22 billion to $2.25 billion, indicating sustained financial health and strategic planning.

The company employs several monetization strategies to maximize revenue. These strategies include value-based pricing, reflecting the clinical benefits and cost-effectiveness of its products, and premium pricing for innovative technologies. Enovis is also exploring opportunities in digital health and telemedicine, which could offer new revenue streams and enhance its value proposition. For further insights into Enovis's strategic direction, consider reading this article: Growth Strategy of Enovis.

- Value-Based Pricing: This strategy emphasizes the clinical benefits and cost-effectiveness of products.

- Premium Pricing: Applied to innovative or proprietary technologies.

- Digital Health and Telemedicine: Exploring new revenue streams and enhancing value.

- Geographic Diversification: Approximately 41% of net sales in 2024 came from outside the U.S., with Europe as a principal market.

- Strategic Acquisitions: Acquisitions like LimaCorporate are expected to improve financial performance and margins in future years.

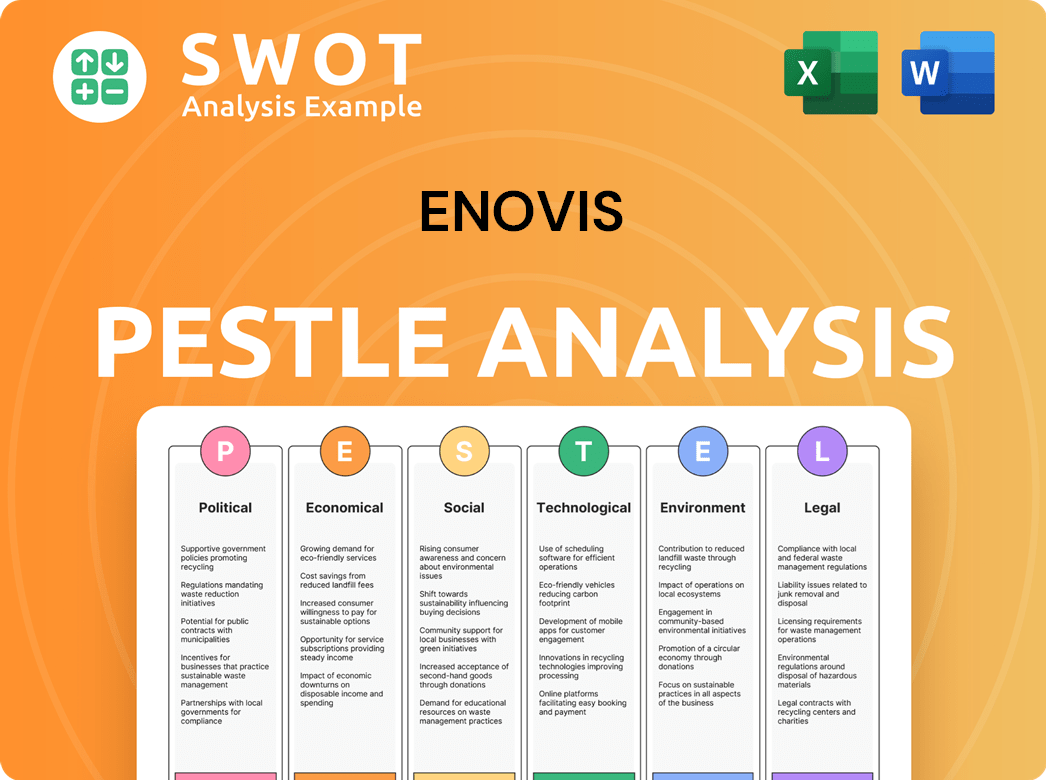

Enovis PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Enovis’s Business Model?

The Brief History of Enovis reveals a company shaped by strategic decisions and market adaptations. A significant turning point for the Enovis company was its spin-off from Colfax Corporation in 2022, which enabled a dedicated focus on medical technology. This strategic shift allowed Enovis to concentrate on innovation and respond more effectively to the evolving needs of the healthcare market.

One of the most impactful strategic moves for Enovis was the acquisition of LimaCorporate S.p.A. in January 2024. This acquisition, valued at $865.6 million, substantially broadened Enovis's reconstructive product offerings. This move strengthened its position in the global orthopedic reconstruction market. The acquisition is expected to drive future growth and enhance the company's market presence.

Enovis's focus on innovation and strategic acquisitions, such as the LimaCorporate deal, demonstrates its commitment to expanding its product portfolio and market reach. These actions are designed to improve its competitive edge and provide value to its stakeholders. The company's strategic direction is centered on sustainable growth and leadership in the medical technology sector.

Spin-off from Colfax Corporation in 2022, marking a dedicated focus on medical technology. This strategic move allowed Enovis to concentrate on innovation and respond more effectively to market needs. The company's structure was streamlined, allowing for more agile decision-making.

The acquisition of LimaCorporate S.p.A. in January 2024, for $865.6 million, significantly expanded Enovis's reconstructive product offerings. This strategic acquisition enhanced its standing in the global orthopedic reconstruction market. This move is expected to drive future growth.

Enovis's competitive advantage lies in its focus on innovation, strategic acquisitions, and a broad product portfolio. The company's ability to quickly adapt to market changes and its commitment to providing high-quality medical devices. These factors contribute to its strong market position.

Enovis's financial performance is influenced by its strategic initiatives and market dynamics. The company's revenue and profitability are impacted by factors such as product sales, acquisitions, and market demand. The financial results reflect the company's growth trajectory.

Enovis has strategically expanded its market presence through acquisitions and a focus on innovation. The acquisition of LimaCorporate in January 2024 is a prime example of this strategy. Enovis continues to seek opportunities to enhance its product offerings and market share.

- Acquisition of LimaCorporate in January 2024 for $865.6 million.

- Focus on expanding reconstructive product offerings.

- Enhancement of its position in the global orthopedic market.

- Strategic moves to drive future growth and improve market presence.

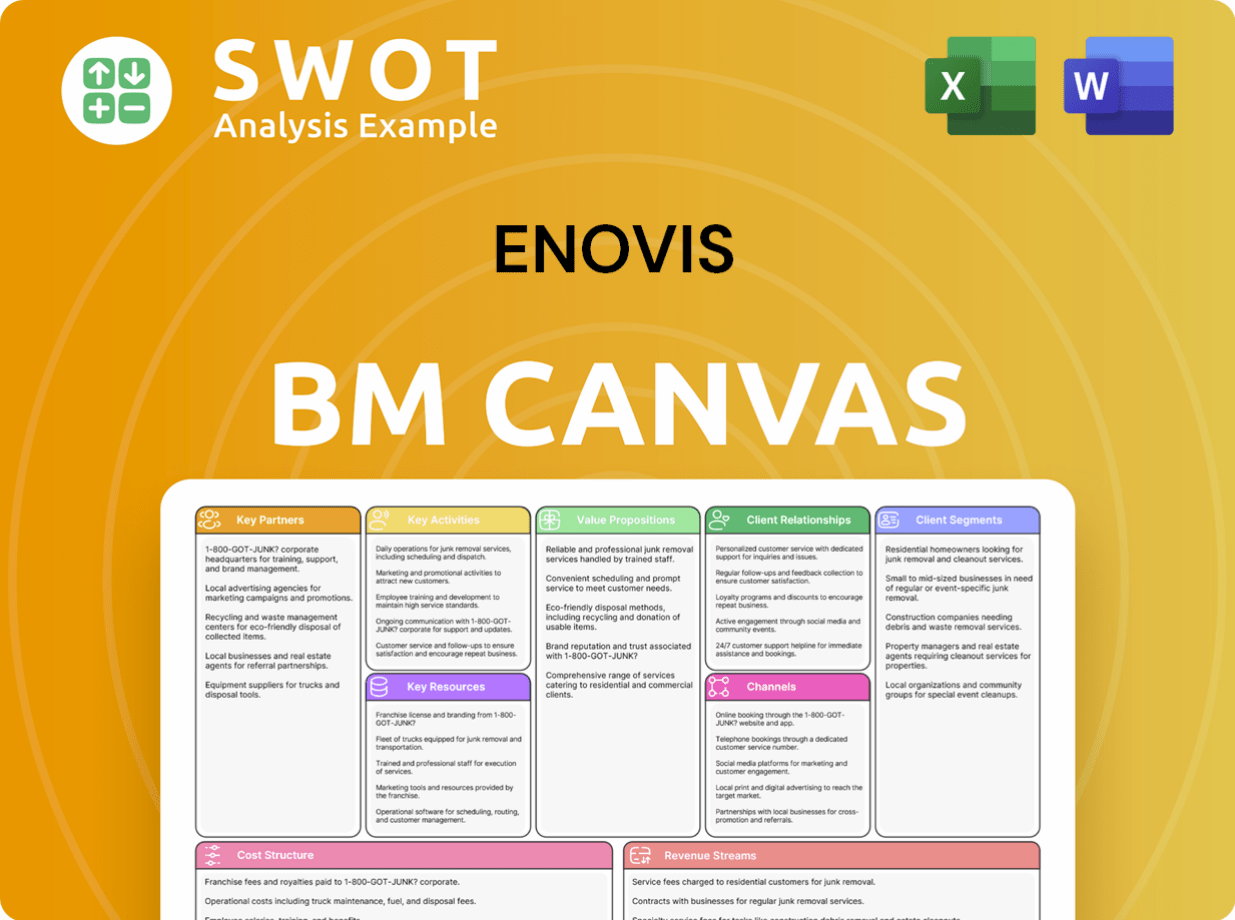

Enovis Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Enovis Positioning Itself for Continued Success?

Understanding the industry position, potential risks, and future outlook of the Enovis company is crucial for investors and stakeholders. The company operates in the medical technology sector, focusing on reconstructive products and pain management solutions. Recent financial results and strategic initiatives offer insights into its current standing and future prospects. The company's performance is influenced by market dynamics, competitive pressures, and its ability to innovate and adapt.

The Enovis company's strategy involves organic growth and acquisitions. The company completed asset and business acquisitions in 2024, expanding its product offerings. These moves are designed to bolster its market position and create opportunities for cross-selling. The company aims to leverage its existing infrastructure and distribution networks to drive revenue growth and improve profitability. The company's financial performance, including its revenue and margins, is a key indicator of its success.

The Enovis company has a strong market position due to its diversified product portfolio and established brands. The company focuses on innovation and R&D, leading to new product launches. The company's strategy includes both organic growth and strategic acquisitions to expand its market reach and product offerings.

The company faces operational and market challenges, including tariff impacts. For 2025, the company anticipates a $40 million tariff exposure, which it plans to mitigate. The company is also exposed to market competition and regulatory changes. The ability to manage these risks is critical for sustained growth.

The company is optimistic about its future, as indicated by its strong first-quarter 2025 results. The company anticipates continued growth through its strategic initiatives and market opportunities. The company's focus on innovation and operational efficiency positions it well for long-term success.

The Enovis company reported strong first-quarter 2025 results, with revenues and margins exceeding expectations. The company's financial performance is a key indicator of its success. The company's ability to manage costs and drive revenue growth will be crucial for future financial results.

The Enovis company's competitive advantages include a strong focus on innovation, a solid brand reputation, and a broad international footprint. The company's diversified product portfolio and commitment to continuous improvement further solidify its market position. The company's vertically integrated business model helps control its supply chain.

- Innovation and R&D: Driving new product launches and staying ahead of market trends.

- Brand Reputation: Known for quality and reliability, fostering customer trust.

- International Footprint: Operating globally, expanding market reach.

- Product Portfolio: Including established brands, such as DonJoy and Aircast.

- Vertical Integration: Controlling supply chain and manufacturing for efficiency.

The Enovis company's ability to navigate market challenges and capitalize on growth opportunities will determine its long-term success. The company's strategic initiatives, including acquisitions and product innovation, are designed to enhance its market position. Understanding the company's competitive advantages and financial performance is crucial for assessing its future prospects. For more insights, you can explore the Growth Strategy of Enovis.

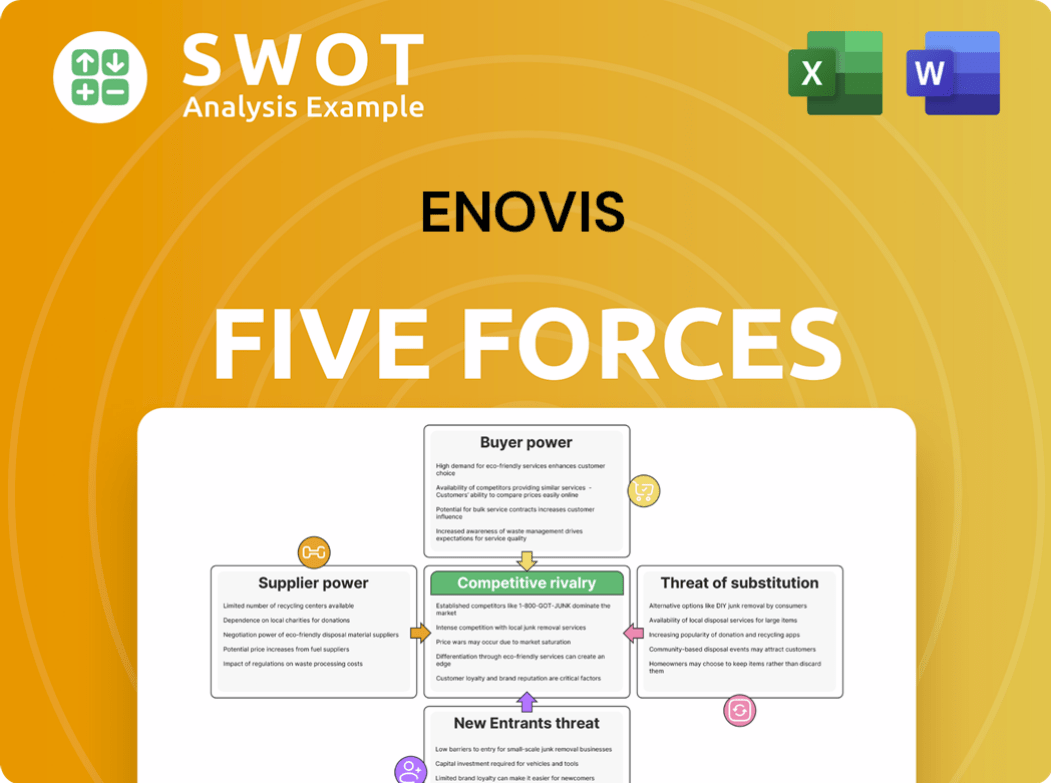

Enovis Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Enovis Company?

- What is Competitive Landscape of Enovis Company?

- What is Growth Strategy and Future Prospects of Enovis Company?

- What is Sales and Marketing Strategy of Enovis Company?

- What is Brief History of Enovis Company?

- Who Owns Enovis Company?

- What is Customer Demographics and Target Market of Enovis Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.