EVERTEC Bundle

How has EVERTEC Transformed Payments in Latin America?

EVERTEC's story is a compelling narrative of innovation and expansion in the financial technology sector, specifically within the Caribbean and Latin American markets. Founded with the ambitious goal of revolutionizing financial transactions, EVERTEC SWOT Analysis reveals a dynamic journey. The company's evolution reflects a strategic adaptation to the ever-changing demands of its diverse customer base.

From its origins in Puerto Rico, the EVERTEC company has grown to become a major player, offering a wide range of EVERTEC services, including merchant acquiring and payment processing. This article delves into the EVERTEC history, exploring its key milestones, strategic moves, and the EVERTEC acquisitions that have shaped its current market position. Understanding the trajectory of EVERTEC provides valuable insights for investors and industry observers alike.

What is the EVERTEC Founding Story?

The story of EVERTEC begins with its roots in Popular, Inc., a major financial institution based in Puerto Rico. The company's origins are closely tied to its role as a payment processing unit within Popular, Inc., even before it became an independent entity. This initial phase was all about building a strong technological foundation for payment processing and business solutions, mainly serving Popular, Inc.'s large customer base.

The primary goal was to streamline and improve the technology used for handling payments and providing business solutions. This internal focus allowed EVERTEC to perfect its services and build a solid technological base. This early focus helped the company prepare for its future as a significant player in the financial technology sector.

EVERTEC identified a need for efficient, secure, and integrated payment processing services in the Caribbean and Latin American markets. As more financial transactions moved online, there was a clear demand for a specialized entity to handle these complex operations.

- EVERTEC's initial business model focused on providing a complete range of payment processing services, including transaction acquiring, processing, and management.

- It also offered various business solutions to help clients optimize their financial operations.

- The initial funding came from Popular, Inc., providing a stable base for development and expansion.

- The financial sector and growing digital economy in Puerto Rico provided a good environment for EVERTEC to grow into a major fintech player in the region.

The Marketing Strategy of EVERTEC has been key to its growth. EVERTEC's early focus on providing payment processing services was a direct response to the increasing digitization of financial transactions. The company aimed to offer secure and integrated solutions to meet the growing demand in the Caribbean and Latin American markets. This strategic move allowed EVERTEC to establish itself as a reliable provider in the fintech space. EVERTEC's commitment to innovation and its ability to adapt to market changes have been critical to its success.

In 2024, EVERTEC continued to expand its services and market reach. The company's focus on providing comprehensive payment solutions and business services has positioned it well in the evolving fintech landscape. The company has consistently demonstrated its ability to adapt to market changes and maintain a strong financial performance. EVERTEC's ability to innovate and meet the needs of its clients has been a key driver of its success. As of the latest reports, EVERTEC's financial performance reflects its strategic growth initiatives and its ability to capitalize on opportunities in the payment processing industry.

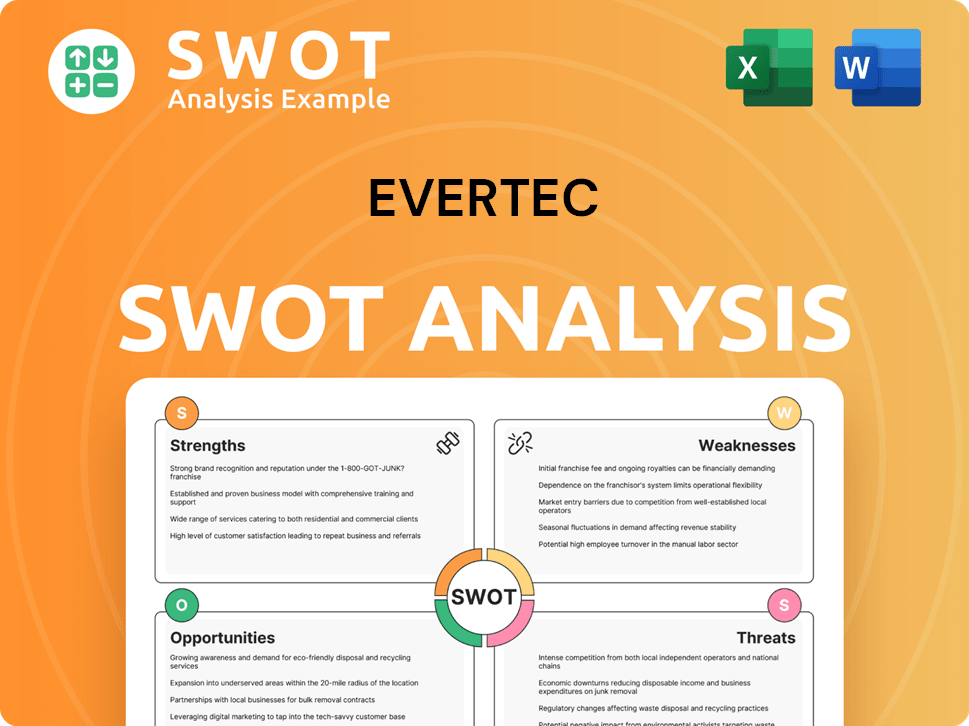

EVERTEC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of EVERTEC?

The early years of the EVERTEC company were focused on establishing a strong foundation as a technology provider within Popular, Inc. This involved refining payment processing platforms and expanding service offerings to meet the needs of its primary client. As the company matured, it broadened its services to other financial institutions and businesses, leveraging the experience gained from its initial operations. Early growth was characterized by strategic expansion of technological capabilities and the development of a robust infrastructure.

A pivotal moment in EVERTEC's history was its spin-off from Popular, Inc. and subsequent IPO in 2013, which marked its transition into an independent, publicly traded entity. This move allowed EVERTEC to pursue a more aggressive growth strategy, expanding its client base and entering new geographical markets. The IPO provided the company with capital to invest in expansion and innovation.

Key developments included broadening merchant acquiring services, enhancing payment processing solutions, and introducing new business solutions. Expansion into new markets, such as Mexico, Costa Rica, and the Dominican Republic, was driven by strategic acquisitions and partnerships. For example, in 2024, EVERTEC announced a strategic partnership with a major financial institution in Latin America, solidifying its regional presence.

This period also saw significant investments in technology upgrades and talent acquisition to support its growing operations and maintain its competitive edge. These investments were crucial for enhancing its service offerings and adapting to the evolving demands of the market. The company focused on innovation to stay ahead of competitors and meet the needs of its clients.

The company's growth strategy involved both organic expansion and strategic acquisitions to increase its market share. Understanding EVERTEC's Business Model provides insights into its revenue streams and operational strategies. This approach allowed EVERTEC to diversify its services and strengthen its position in the payment processing industry.

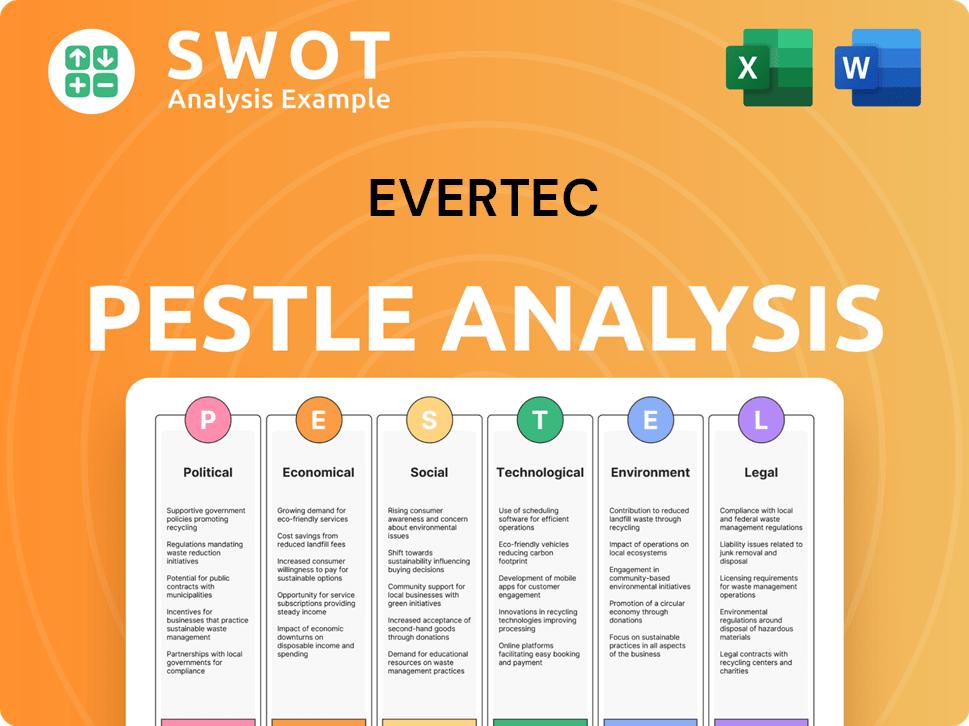

EVERTEC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in EVERTEC history?

The EVERTEC company has a rich history, marked by significant milestones that have shaped its evolution in the payment processing industry. From its origins to its current standing, EVERTEC's history reflects strategic growth and adaptability. The company's journey includes pivotal moments that have solidified its position as a key player in the fintech sector.

| Year | Milestone |

|---|---|

| 2013 | Successful spin-off from Popular, Inc. and IPO, establishing EVERTEC as an independent entity. |

| 2015 | Expansion of services and infrastructure, including significant investments in data centers and technology upgrades. |

| 2017 | Strategic acquisitions to broaden service offerings and expand market reach in Latin America and the Caribbean. |

| 2020 | Enhanced digital payment solutions to meet the increasing demand for online transactions during the pandemic. |

| 2023 | Launch of an AI-powered fraud detection system, enhancing security for clients. |

| 2024 | Continued diversification into business solutions, demonstrating adaptability to market changes. |

EVERTEC has consistently been at the forefront of innovation in the payment processing sector. The company’s focus on technological advancements has allowed it to meet the evolving needs of its clients and stay ahead of the competition. Growth Strategy of EVERTEC has been a key driver in its success, particularly in adapting to the dynamic fintech landscape.

EVERTEC has developed and implemented real-time payment systems, enabling faster and more efficient transactions. These systems have enhanced the speed and convenience of financial transactions for both merchants and consumers.

The company has invested heavily in advanced cybersecurity measures to protect sensitive financial data. These measures include encryption, fraud detection, and other security protocols to safeguard transactions.

In 2023, EVERTEC launched an AI-powered fraud detection system. This system has significantly reduced fraudulent transactions, improving security for its clients.

EVERTEC has expanded its mobile payment solutions, catering to the growing demand for mobile transactions. These solutions provide convenience and flexibility for consumers and businesses alike.

EVERTEC has integrated data analytics to provide valuable insights to its clients, helping them make informed decisions. This includes transaction data analysis and customer behavior analysis.

The company has developed loyalty programs to enhance customer engagement and retention for its clients. These programs offer rewards and incentives to customers.

Despite its successes, EVERTEC has faced various challenges. These include intense competition within the fintech industry and the need to adapt to diverse regulatory landscapes across its markets. Economic downturns in key markets have also presented obstacles, impacting transaction volumes and client spending.

The fintech industry is highly competitive, requiring EVERTEC to constantly innovate and improve its services. This includes competition from both established players and emerging fintech companies.

EVERTEC must navigate complex and diverse regulatory environments across different countries. This requires significant resources and expertise to ensure compliance.

Economic downturns in key markets can significantly impact transaction volumes and client spending. This requires strategic planning and adaptability to mitigate financial risks.

Rapid technological advancements require continuous investment in new technologies and solutions. EVERTEC must stay ahead of the curve to remain competitive.

Market fluctuations can impact the demand for payment processing services and client spending. This requires flexibility and adaptability in business strategies.

Increasing cybersecurity threats require ongoing investments in security measures. EVERTEC must protect its clients' data from cyberattacks.

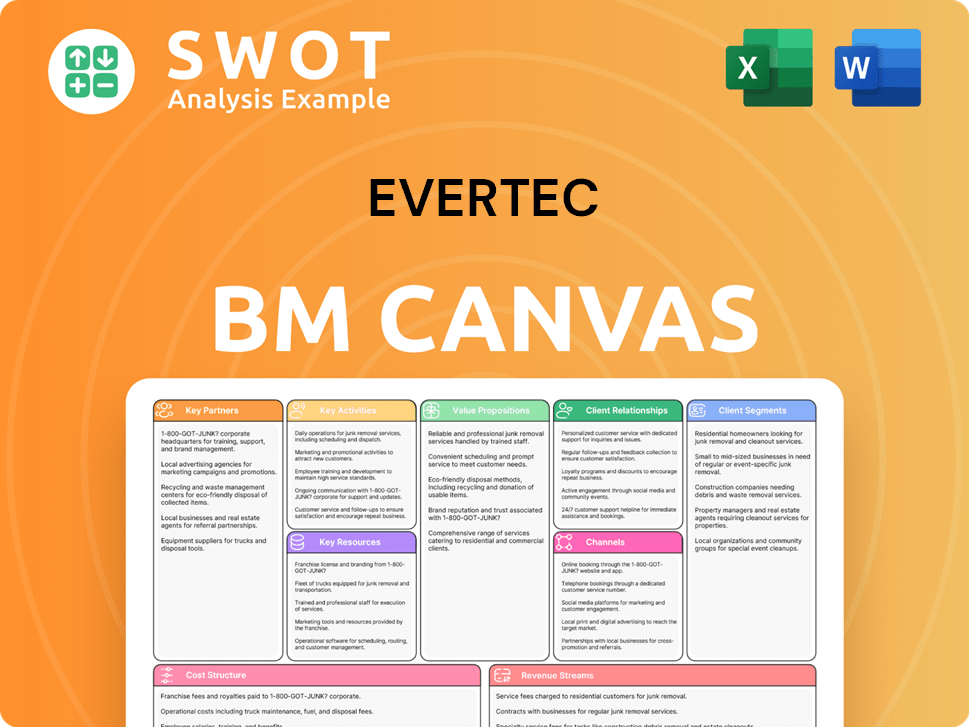

EVERTEC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for EVERTEC?

The EVERTEC history showcases significant milestones, starting with its spin-off from Popular, Inc. and IPO in 2013. Strategic moves, including acquisitions and partnerships, fueled its expansion across Latin America from 2014 to 2017. Innovation in digital payment solutions and mobile capabilities marked 2018. Operational resilience was demonstrated in 2020, adapting to increased e-commerce. New data analytics tools launched in 2022, and in 2023, an AI-powered fraud detection system was implemented. Strategic partnerships continued in 2024 to expand its digital payment infrastructure. The company continues to explore opportunities in emerging fintech areas, including blockchain and open banking, as of 2025.

| Year | Key Event |

|---|---|

| 2013 | EVERTEC spun off from Popular, Inc. and completed its Initial Public Offering (IPO), becoming an independent publicly traded company. |

| 2014-2017 | Expansion into new Latin American markets, including strategic acquisitions and partnerships to grow its merchant acquiring and payment processing footprint. |

| 2018 | Introduction of new digital payment solutions and enhanced mobile payment capabilities, responding to increasing demand for digital transactions. |

| 2020 | Navigated the challenges of the global pandemic, adapting its services to support increased e-commerce and contactless payments, demonstrating operational resilience. |

| 2022 | Launched new data analytics and business intelligence tools for clients, expanding its service offerings beyond core payment processing. |

| 2023 | Implemented an advanced AI-powered fraud detection system, enhancing security and efficiency for its payment platforms, leading to a reported 15% reduction in fraud for clients. |

| 2024 | Announced strategic partnerships with major financial institutions in Latin America to further expand its digital payment infrastructure and market penetration. |

| 2025 | Continued focus on expanding its digital payment ecosystem and exploring opportunities in emerging fintech areas, including blockchain and open banking. |

EVERTEC is focused on expanding its presence in underserved markets within the Caribbean and Latin America. This strategy includes forming new partnerships and potentially acquiring businesses to broaden its reach. The aim is to capitalize on the increasing adoption of digital payments across the region.

Investment in cutting-edge technologies like artificial intelligence and machine learning is a key part of EVERTEC’s future plans. These technologies will enhance service offerings, improve fraud detection, and provide better data analytics for clients. The company aims to stay at the forefront of fintech innovation.

The Latin American digital payments market is predicted to grow at a compound annual growth rate (CAGR) of over 18% through 2028. EVERTEC plans to take advantage of this growth by focusing on innovation and strategic partnerships. The company is committed to providing comprehensive solutions that meet the changing needs of its clients.

EVERTEC’s long-term vision is to remain a leading technology and payment processing solutions provider in the region. The company's strategy is aligned with its founding vision. The company will continue to build on its history of innovation and expansion. You can read more about the EVERTEC's history and its impact on the industry in this article.

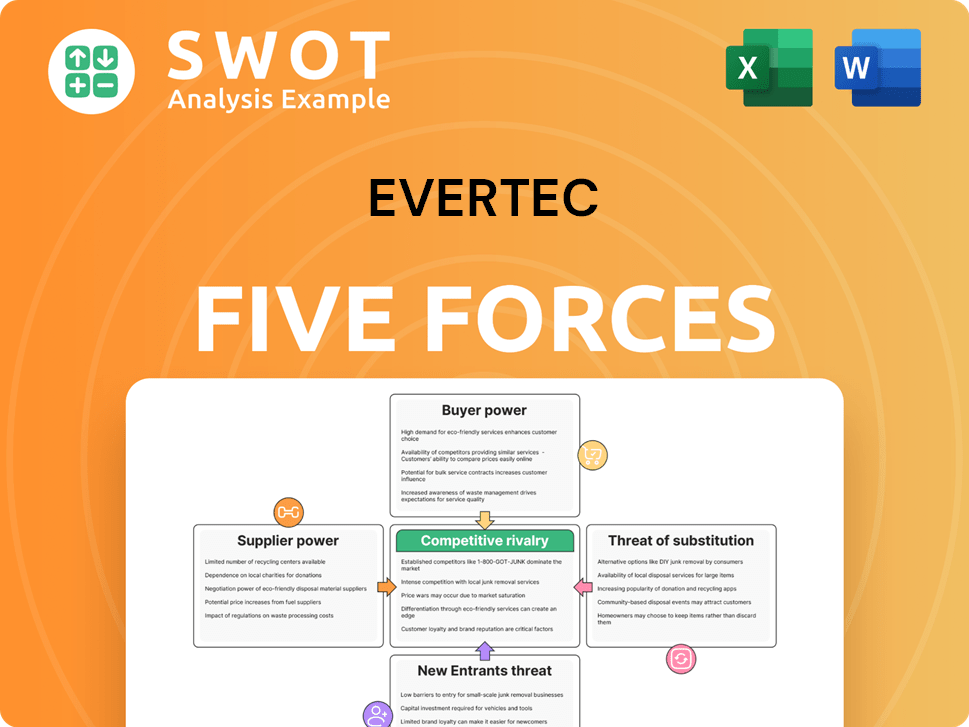

EVERTEC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of EVERTEC Company?

- What is Growth Strategy and Future Prospects of EVERTEC Company?

- How Does EVERTEC Company Work?

- What is Sales and Marketing Strategy of EVERTEC Company?

- What is Brief History of EVERTEC Company?

- Who Owns EVERTEC Company?

- What is Customer Demographics and Target Market of EVERTEC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.