EVERTEC Bundle

How Does EVERTEC Thrive in the Fintech Arena?

EVERTEC Inc. (NYSE: EVTC) is a key player in the payment processing sector across Latin America and the Caribbean. The company's impressive financial performance, with a 6% revenue increase to $633.9 million in 2023, highlights its strong market position. This growth underscores EVERTEC's critical role in the expanding digital commerce landscape.

EVERTEC offers a wide array of services, solidifying its influence in financial technology. Its extensive reach includes merchant acquiring, payment processing solutions, and business solutions, catering to a diverse clientele. To understand its market position, consider a detailed EVERTEC SWOT Analysis, which can provide deeper insights into its strengths and opportunities.

What Are the Key Operations Driving EVERTEC’s Success?

The EVERTEC company operates as a pivotal player in the digital transaction landscape, providing a suite of payment processing and business solutions. Its core function revolves around enabling electronic transactions through merchant acquiring services, payment processing, and a range of business solutions like core bank processing. This integrated approach allows it to serve a diverse clientele, including financial institutions, retailers, and government entities.

The value proposition of EVERTEC lies in its ability to streamline financial transactions, enhance security, and offer a broad spectrum of payment options. By providing these services, EVERTEC enables businesses to operate more efficiently while also improving the consumer experience. This dual focus on business and consumer needs positions EVERTEC as a key facilitator in the financial technology sector.

The company's operational effectiveness stems from its advanced technological infrastructure and deep understanding of the markets it serves. This combination of technological sophistication and regional expertise allows EVERTEC to offer tailored solutions, superior customer support, and a competitive edge in the fintech industry. The company's commitment to innovation ensures it remains at the forefront of payment processing technologies.

EVERTEC provides merchant acquiring services, enabling businesses to accept electronic payments. It also offers payment processing services, covering credit, debit, and ATM transactions. Furthermore, the company delivers business solutions, including core bank processing and cash management services.

EVERTEC serves a wide array of customers, including financial institutions, major retailers, and small to medium-sized businesses. It also caters to government entities across its key markets. This diverse customer base reflects the broad applicability of its services.

EVERTEC's operations depend on a robust and secure technology infrastructure. This includes proprietary platforms for transaction routing, authorization, clearing, and settlement. Continuous investment in technology enhances security and efficiency.

Unlike many global competitors, EVERTEC has a deep understanding of the Caribbean and Latin American markets. This localized approach allows for tailored solutions and superior customer support. This localized approach allows for tailored solutions and superior customer support.

The core capabilities of EVERTEC translate into enhanced operational efficiency, increased transaction security, and expanded payment options for its customers. This drives market differentiation and reinforces its position as a leading fintech provider in the region. In recent financial reports, EVERTEC has demonstrated consistent revenue growth, reflecting its strong market position and the increasing demand for its services.

- Enhanced Operational Efficiency

- Increased Transaction Security

- Expanded Payment Options

- Market Differentiation

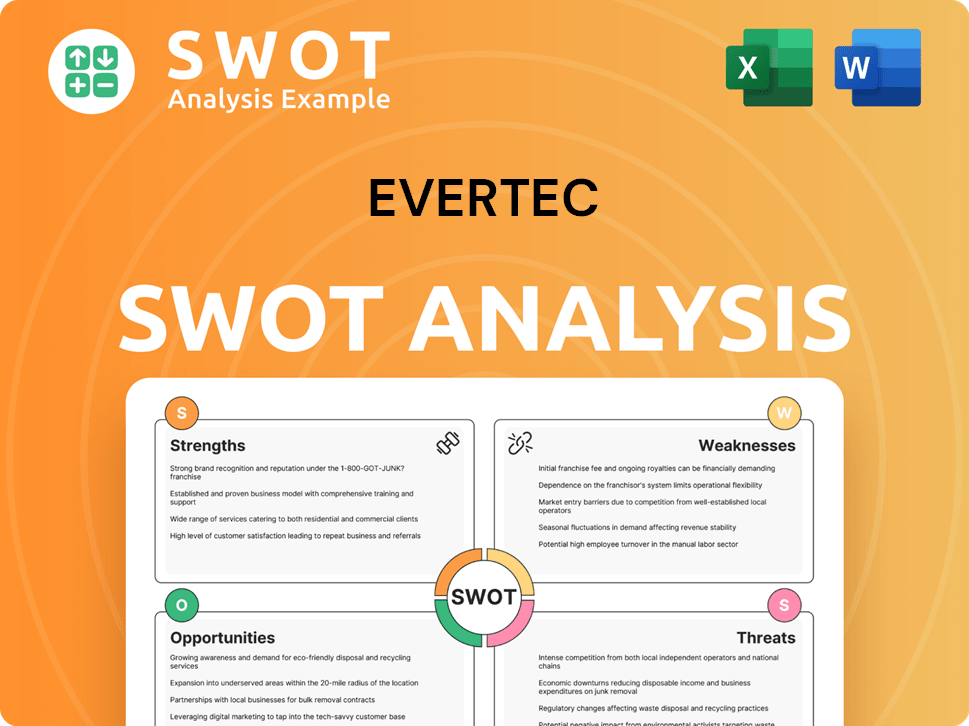

EVERTEC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does EVERTEC Make Money?

The EVERTEC company generates revenue through a variety of streams, primarily focusing on payment processing and related financial technology services. Its business model is built on providing essential infrastructure and solutions to financial institutions, merchants, and consumers across Latin America and the Caribbean. Understanding these revenue streams is key to grasping how

The company's monetization strategies are diverse, reflecting its broad range of services. These strategies include transaction fees, merchant acquiring services, and business solutions. The company continuously adapts its approach to maximize revenue and expand its market presence.

The main revenue streams for

In 2023,

- Volume-based pricing for transaction processing, where fees are scaled based on the number or value of transactions.

- Interchange plus pricing for merchant acquiring, where a small markup is added to the interchange fees.

- Subscription or service-based fees for its business solutions, often structured as recurring charges for platform access and support.

- The revenue mix can vary slightly by region due to differing market maturities and regulatory frameworks.

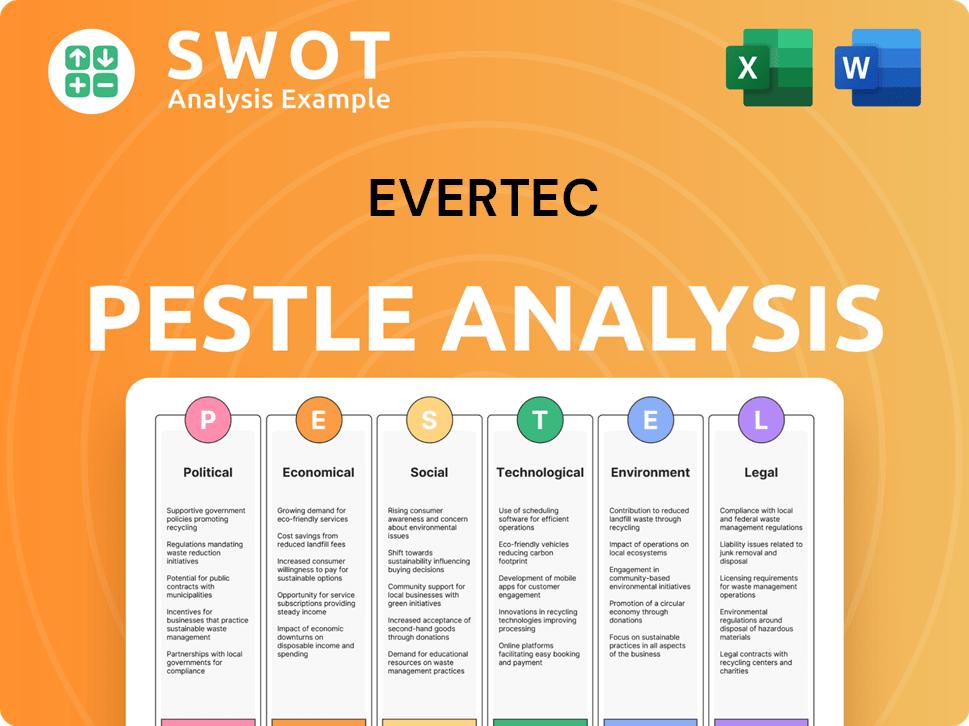

EVERTEC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped EVERTEC’s Business Model?

The journey of the EVERTEC company has been defined by significant milestones and strategic initiatives that have reshaped its operational structure and financial performance. A pivotal moment was its spin-off from Popular, Inc. in 2010, which enabled it to operate independently and explore wider market opportunities. Its subsequent IPO in 2013 further solidified its position and provided capital for expansion. Strategic partnerships, like its long-term service agreements with Popular, Inc., have provided a stable foundation for its business.

Recently, EVERTEC has focused on geographical expansion and digital innovation. The acquisition of PlacetoPay in 2024, a leading digital payment gateway in Latin America, represents a significant strategic move to strengthen its e-commerce capabilities and expand its presence in high-growth markets. The company has navigated various operational and market challenges, including economic downturns in its core markets and the evolving regulatory landscape of the financial industry. Its response has often involved diversifying its service offerings, enhancing its technology infrastructure, and optimizing operational efficiencies.

EVERTEC's competitive advantages are multifaceted. Its strong brand recognition and deep-rooted relationships with financial institutions and merchants in the Caribbean and Latin America provide a significant barrier to entry for new competitors. The company benefits from economies of scale in transaction processing, allowing it to offer competitive pricing. Furthermore, its proprietary technology platform and continuous investment in research and development provide a technological edge, enabling it to offer innovative and secure payment solutions. For more insights into the company's approach, consider reading about the Marketing Strategy of EVERTEC.

Spin-off from Popular, Inc. in 2010, IPO in 2013, and strategic acquisitions like PlacetoPay in 2024 have been pivotal. These moves have helped EVERTEC expand its market presence and service offerings. These milestones have been crucial for EVERTEC's growth and adaptability in the fintech sector.

Focus on geographical expansion, particularly in Latin America, and digital innovation. The acquisition of PlacetoPay in 2024 enhanced its e-commerce capabilities. These moves reflect EVERTEC's commitment to growth and staying competitive in the fintech industry.

Strong brand recognition, deep-rooted relationships, and economies of scale in transaction processing. Continuous investment in technology and adaptation to digital trends. These factors enable EVERTEC to offer competitive pricing and innovative payment solutions.

In recent financial reports, EVERTEC has shown consistent revenue growth, with a focus on expanding its services. The company's strategic acquisitions and partnerships have contributed to its financial performance. These financial results highlight EVERTEC's stability and growth potential.

EVERTEC's competitive edge stems from several key factors, including its strong market presence and technological capabilities. These advantages enable the company to maintain its leadership position in the fintech industry.

- Strong brand recognition and established relationships with financial institutions.

- Economies of scale in transaction processing, leading to competitive pricing.

- Proprietary technology platform and continuous investment in R&D.

- Adaptation to digital trends, such as digital wallets and contactless payments.

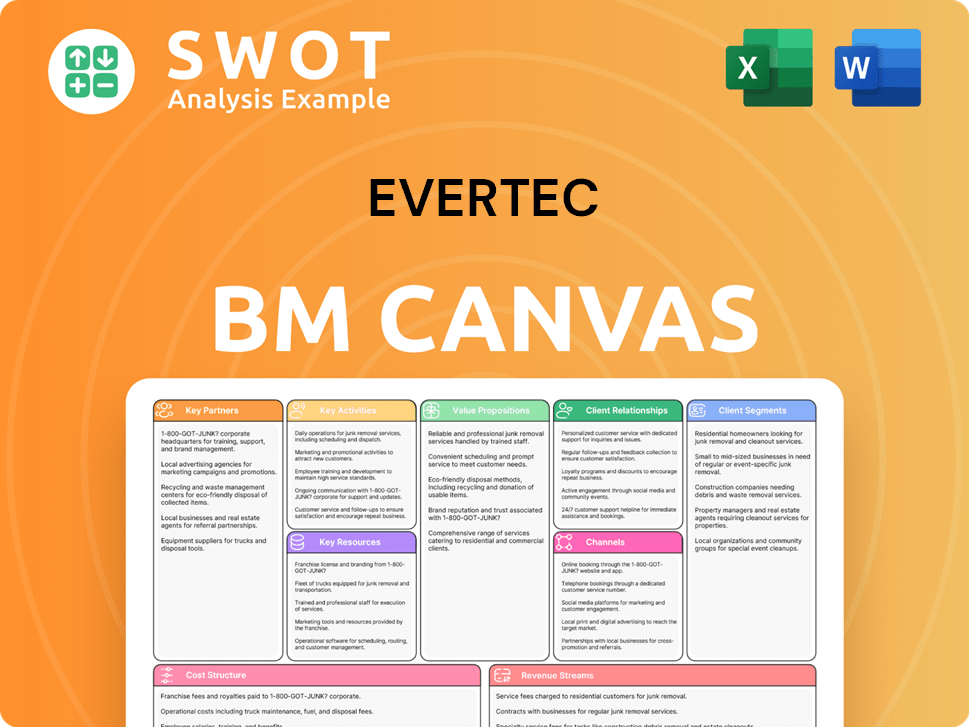

EVERTEC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is EVERTEC Positioning Itself for Continued Success?

Understanding the industry position, risks, and future outlook of the EVERTEC company is crucial for anyone looking into the fintech landscape. The company, known for its extensive payment processing solutions, holds a strong market position, particularly in its core regions. However, like all businesses, it faces various challenges and opportunities that will shape its future.

EVERTEC, a key player in the financial technology sector, operates with a business model that focuses on providing services across Latin America and the Caribbean. This analysis delves into the company's current standing, potential risks, and strategic plans for growth, offering insights into its long-term prospects.

EVERTEC has a dominant market presence, especially in Puerto Rico, where it is a critical part of the payment infrastructure. Its long-standing relationships and extensive network with financial institutions and merchants contribute to its significant market share. The company's reach extends throughout the Caribbean and into Latin America, with its market share varying by region and service.

EVERTEC faces risks such as regulatory changes in the financial services and payments industries. Competition from global fintech players and local startups could increase pressure. Technological advancements, like new payment methods, demand continuous innovation. Economic volatility in its operating regions can also impact transaction volumes and business spending.

EVERTEC aims for geographical expansion, particularly in high-growth Latin American markets. The company is committed to enhancing its digital offerings, including e-commerce solutions and digital wallets. Leadership emphasizes leveraging its infrastructure to support the digital transformation of payments in the region. The company is focused on capitalizing on the increasing adoption of electronic payments.

Strategic initiatives include geographical expansion through organic growth and acquisitions. The company is also focused on enhancing its digital offerings to meet evolving market demands. EVERTEC aims to deepen relationships with existing clients and strategically expand its service portfolio to maintain its leadership. For more details on the company's growth strategy, refer to this article: Growth Strategy of EVERTEC.

EVERTEC's position in the market is strong, especially in Puerto Rico, but it faces risks such as regulatory changes and competition. The company's future involves geographical expansion and enhancing digital offerings. Recent financial data shows continued growth in transaction volumes, reflecting the increasing adoption of electronic payments.

- Dominant market share in key regions.

- Strategic focus on digital transformation.

- Expansion into high-growth Latin American markets.

- Commitment to enhancing e-commerce and digital wallet solutions.

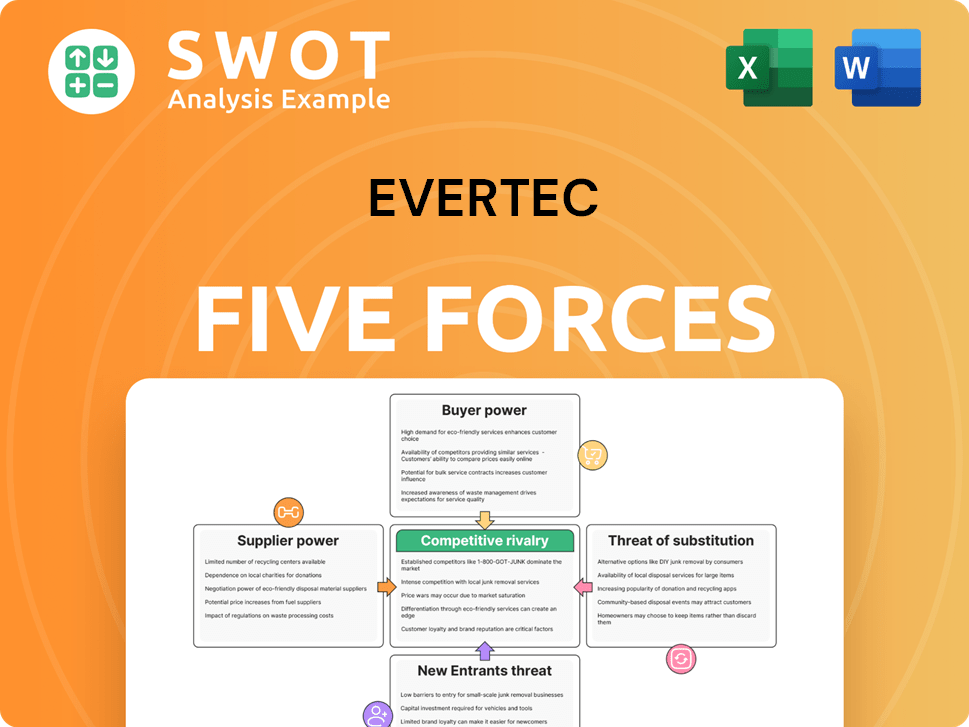

EVERTEC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EVERTEC Company?

- What is Competitive Landscape of EVERTEC Company?

- What is Growth Strategy and Future Prospects of EVERTEC Company?

- What is Sales and Marketing Strategy of EVERTEC Company?

- What is Brief History of EVERTEC Company?

- Who Owns EVERTEC Company?

- What is Customer Demographics and Target Market of EVERTEC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.