EVERTEC Bundle

Who Does EVERTEC Serve?

In the fast-paced world of digital payments, understanding customer demographics and the target market is crucial for companies like EVERTEC. The shift towards digital transactions demands a deep dive into consumer behavior and preferences. This article explores EVERTEC's customer base, providing insights for anyone interested in the financial technology sector.

EVERTEC, a leader in payment processing across the Caribbean and Latin America, has a diverse customer base. This EVERTEC SWOT Analysis can help you understand their strategic positioning. We'll examine their primary customer segments, geographical reach, and the strategies they employ to attract and retain clients. Understanding the EVERTEC target market and customer demographics is key to grasping their market success and future growth potential. The EVERTEC company has a wide range of EVERTEC clients.

Who Are EVERTEC’s Main Customers?

Understanding the customer demographics and target market of the company is crucial for assessing its market position and growth potential. Primarily operating within a Business-to-Business (B2B) model, the company serves a diverse customer base across Puerto Rico, the Caribbean, and Latin America. This focus allows for a deep understanding of regional market dynamics and tailored service offerings.

The company's target audience is primarily composed of financial institutions, merchants, corporations, and government agencies. These segments benefit from the company's comprehensive suite of payment processing services and technology solutions. The company's strategic approach to customer segmentation has enabled it to cater to a broad spectrum of clients, from small local businesses to large multinational corporations.

The company's customer base is a key factor in its market analysis. The company's ability to serve various sectors, including financial institutions and merchants, highlights its adaptability and market reach. The company's expansion into new geographies and its increasing demand from merchants and government agencies suggest a growing diversification of revenue streams. For more information on the company's ownership structure and stakeholders, you can refer to Owners & Shareholders of EVERTEC.

The company supports banks, credit unions, and other financial entities. They provide a full suite of payment processing services. This segment relies on secure, efficient, and reliable infrastructure to manage their payment ecosystems.

This segment includes businesses of all sizes, from small local enterprises to large retail chains. The company provides merchant acquiring services, enabling them to accept electronic payments. The needs vary by industry, but the common need is for seamless payment solutions.

These clients often require more complex and customized solutions. The company tailors its services to meet the specific needs of these larger entities. This segment benefits from the company's technology solutions and payment processing capabilities.

The company's primary geographic focus is Puerto Rico, the Caribbean, and Latin America. This regional concentration allows for a deep understanding of local market dynamics. The company strategically diversified its customer base over time.

The company's customer segmentation strategies are designed to meet the diverse needs of financial institutions, merchants, and corporations. The company's market share and target audience are influenced by its ability to provide tailored solutions. The company's customer acquisition strategies focus on building long-term relationships.

- Financial Institutions: Require secure and reliable payment processing infrastructure.

- Merchants: Need seamless payment solutions to enhance customer experience.

- Corporations and Government Agencies: Often require customized and complex technology solutions.

- Geographic Focus: Concentrated in Puerto Rico, the Caribbean, and Latin America.

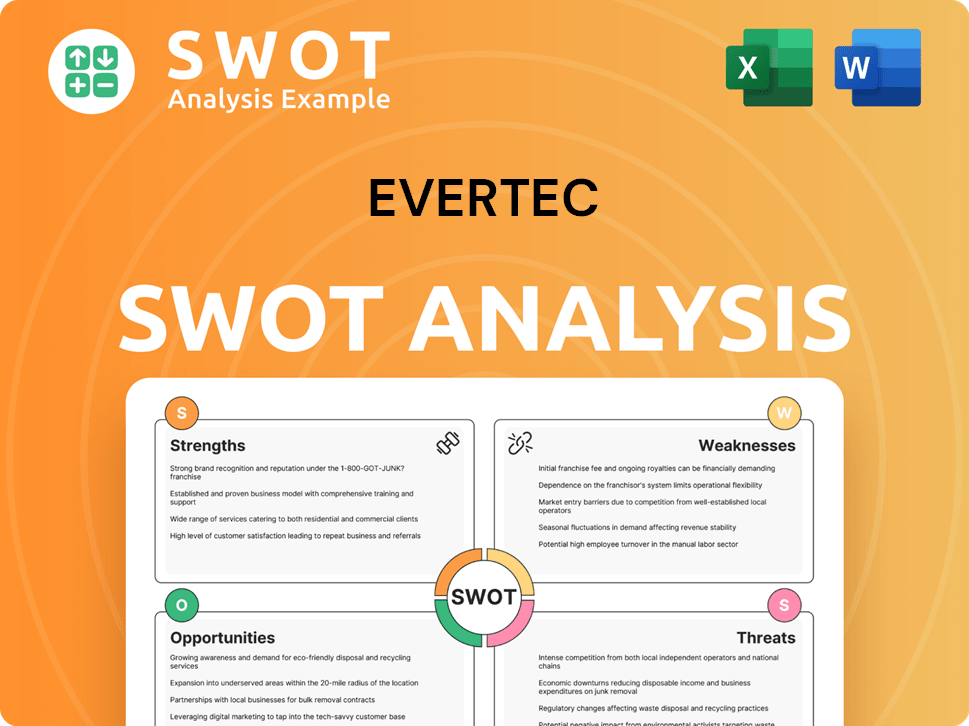

EVERTEC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do EVERTEC’s Customers Want?

Understanding the needs and preferences of its diverse customer base is crucial for the success of the EVERTEC company. This involves a deep dive into the specific requirements of each customer segment, including financial institutions, merchants, corporations, and government agencies. By focusing on these needs, EVERTEC can tailor its services to meet the evolving demands of the market and maintain a competitive edge.

The company's customer base is driven by a variety of factors, including efficiency, security, reliability, and innovation in payment processing. The company's ability to provide scalable and resilient infrastructure to handle high transaction volumes and ensure uninterrupted service is a key factor. This customer-centric approach allows EVERTEC to build strong, long-lasting relationships with its clients.

EVERTEC's customer demographics are varied, encompassing financial institutions, merchants, corporations, and government agencies. Each segment has unique needs and preferences that EVERTEC addresses through tailored solutions. This approach allows EVERTEC to maintain a competitive edge by meeting the diverse demands of its clients.

Financial institutions prioritize robust transaction processing, fraud prevention, and regulatory compliance. They seek partners who offer scalable infrastructure and diverse payment products. Decision-making criteria include technological prowess, data security, and adherence to payment standards.

Merchants focus on ease of integration, competitive pricing, and efficient reporting tools. They aim to streamline sales, reduce costs, and enhance the customer experience. Pain points include slow transactions and complex reconciliation processes.

These entities require secure bulk payments, efficient disbursement solutions, and detailed financial reporting. They often need customized solutions that integrate with their ERP systems. EVERTEC offers tailored solutions to enhance operational efficiency.

Efficiency, security, reliability, and innovation in payment processing are key drivers. The company is actively developing and enhancing digital payment solutions and cybersecurity measures to meet evolving customer demands and market shifts. Market trends include the increasing demand for real-time payments and contactless transactions.

Customer needs include robust transaction processing capabilities, fraud prevention, and the ability to offer diverse payment products. Merchants prioritize ease of integration and competitive pricing. Corporations and government agencies need secure bulk payments and efficient disbursement solutions.

EVERTEC addresses these needs by offering tailored business solutions that enhance operational efficiency and transparency. The company's product development roadmap is influenced by customer feedback and market trends. The company's investment in technology and infrastructure is ongoing.

A thorough market analysis helps EVERTEC understand its target audience and tailor its services. The company employs customer segmentation strategies to identify and cater to specific needs. The geographic location of EVERTEC's customer base is primarily in Latin America and the Caribbean, with a significant presence in Puerto Rico. EVERTEC's market share is substantial in the payment processing and technology solutions sectors within these regions.

- Financial Institutions: Require robust transaction processing, fraud prevention, and regulatory compliance.

- Merchants: Focus on ease of integration, competitive pricing, and comprehensive reporting.

- Corporations and Government Agencies: Need secure bulk payments, efficient disbursement, and detailed financial reporting.

- Market Trends: Increasing demand for real-time payments and contactless transactions.

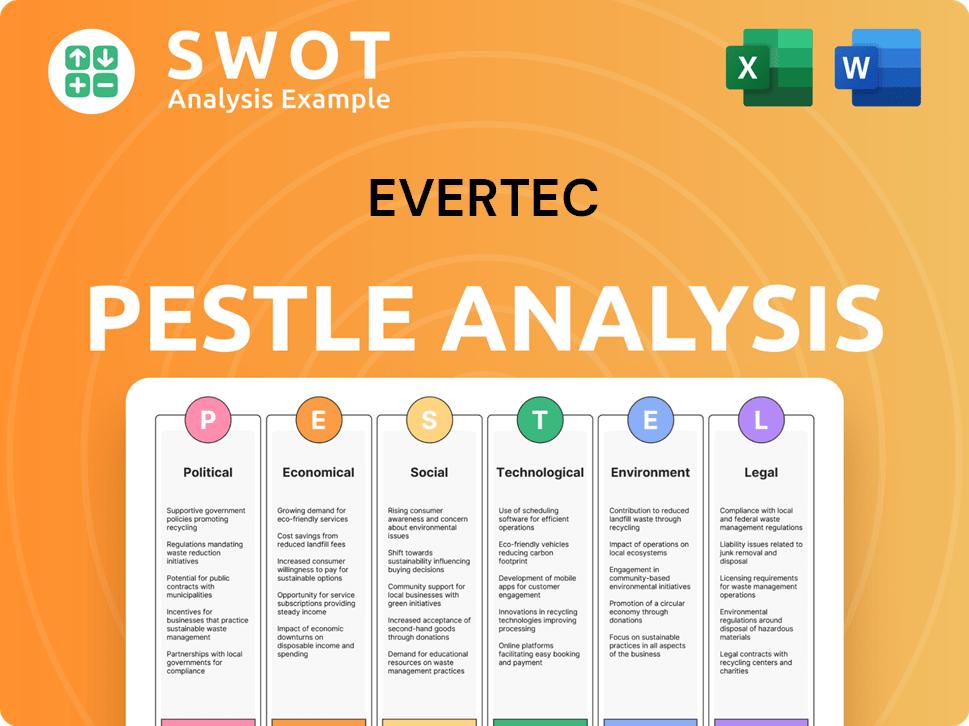

EVERTEC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does EVERTEC operate?

The geographical market presence of the company is primarily concentrated in Puerto Rico, the Caribbean, and Latin America. This focus allows the company to leverage its established infrastructure and brand recognition in payment processing. The company's strategic expansion includes key markets in the Dominican Republic, Central America, and select South American countries, demonstrating a commitment to regional growth.

Puerto Rico remains a core market for the company, where it operates a robust technology infrastructure. This strong presence is a legacy of its founding and sustained investment in the island's payment ecosystem. The company's presence in these regions is a strategic advantage, allowing it to tailor its services to meet the specific needs of each market.

The company's approach involves adapting its payment solutions to local regulatory environments, currency requirements, and cultural nuances. This includes providing multilingual support and integrating with local banking systems. Recent expansions focus on deepening its presence in high-growth markets and exploring new opportunities in payment processing and business solutions. This strategic approach is crucial for capturing market share and ensuring sustainable growth.

The company's primary focus is on Puerto Rico, the Caribbean, and Latin America. This strategic concentration allows for leveraging existing infrastructure and brand recognition within these regions. The company's market share and customer base are significant in these areas.

Key markets include the Dominican Republic, Central America, and select South American countries. These regions are targeted for strategic growth and expansion. The company is consistently growing its customer base and market share in these areas.

The company adapts its payment solutions to local regulatory environments, currency requirements, and cultural nuances. This includes multilingual support and integration with local banking systems. This approach enhances customer satisfaction and market penetration.

Recent expansions focus on deepening its presence in high-growth markets and exploring new opportunities. This includes payment processing and business solutions. The company's geographic distribution of sales indicates a strong reliance on its established markets.

The company's market analysis highlights the importance of understanding the diverse customer demographics across its geographical markets. Differences in customer preferences and buying power necessitate localized strategies.

- The target audience includes financial institutions, merchants, and government agencies.

- The company's customer demographics vary across the Caribbean and Latin America.

- EVERTEC's target market for payment processing adapts to local needs.

- The company's customer segmentation strategies focus on regional preferences.

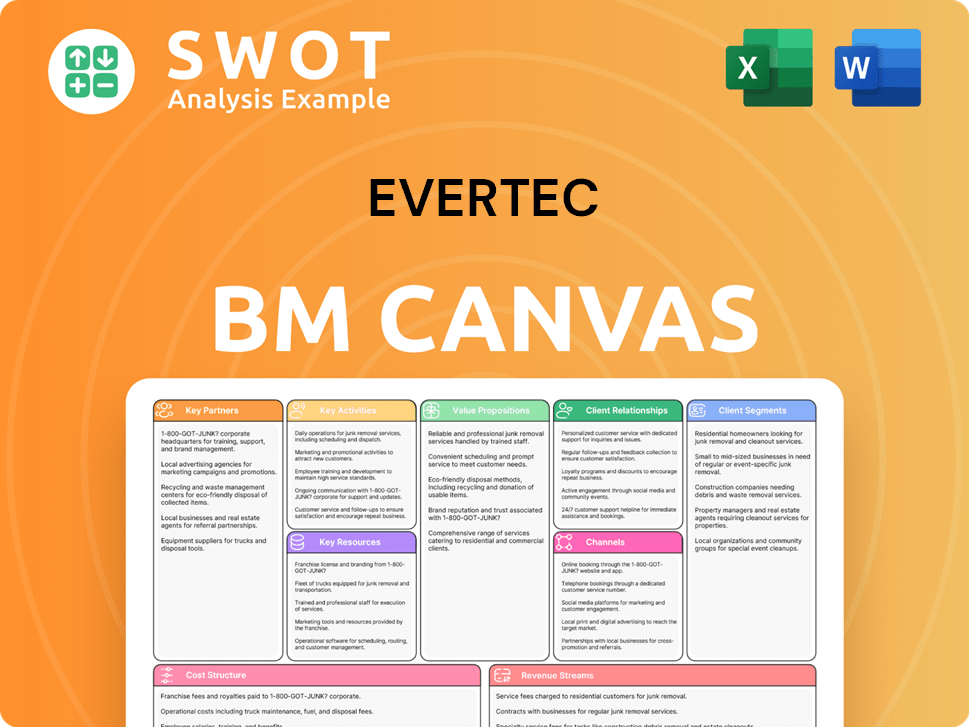

EVERTEC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does EVERTEC Win & Keep Customers?

Acquiring and retaining customers is a core focus for the company, utilizing a blend of direct sales, strategic partnerships, and technology-driven solutions. The company's success hinges on its ability to attract and keep clients within the financial services and merchant sectors. Effective customer acquisition and retention strategies are essential for sustained growth and market leadership.

The company's approach to customer acquisition involves leveraging its strong industry reputation and established relationships. Direct sales teams actively engage with potential clients, highlighting the company's comprehensive payment processing platforms, robust infrastructure, and security protocols. The company also uses targeted digital campaigns and industry conferences to showcase its expertise.

Retention strategies emphasize exceptional customer service, continuous innovation, and building long-term partnerships. This includes proactive support, regular client engagement, and providing value-added services such as data analytics and fraud prevention tools. The company's commitment to advanced technology and cybersecurity is also a key factor in retaining clients, as they rely on the company for secure and reliable payment processing. The company's strategies are designed to enhance customer lifetime value and reduce churn rates.

The company utilizes direct sales teams to engage with financial institutions and merchants, showcasing its services and infrastructure. Partnerships with financial institutions, where the company's services are white-labeled, expand its reach. Marketing includes targeted digital campaigns, industry events, and thought leadership content to attract and inform potential clients.

The company uses targeted digital campaigns, including SEO and social media marketing, to reach potential clients. Participation in industry conferences and events provides opportunities for direct engagement and networking. Thought leadership content, such as webinars and white papers, positions the company as an expert in payment technology.

The company segments its customer base to tailor outreach efforts effectively. This includes segmenting by industry, such as financial institutions and merchants, and by size, from small businesses to large enterprises. Data and CRM systems are crucial for identifying specific needs and pain points of different customer types.

The company focuses on providing exceptional customer service and proactive support to address client needs. Continuous innovation in product offerings, including the latest payment technologies and security features, ensures clients remain satisfied. Building long-term partnerships and offering value-added services like data analytics and fraud prevention tools are also key.

Direct sales teams are crucial for acquiring new clients, particularly within the financial sector. Partnerships with financial institutions that white-label services expand the company's market reach. These collaborations leverage existing relationships and trust within the industry.

Targeted digital campaigns and content marketing are vital for attracting potential clients. Industry conferences and webinars showcase the company's expertise in payment technology. These efforts position the company as a leader in the market.

Exceptional customer service is a cornerstone of the company's retention strategy. Proactive support and regular engagement with clients ensure their evolving needs are met. This approach builds strong, lasting relationships.

Continuous innovation in product offerings, including advanced security features, keeps clients satisfied. Value-added services such as data analytics and fraud prevention tools enhance the client experience. These services are crucial for customer retention.

While not explicitly consumer-focused, loyalty manifests through preferential pricing for long-standing clients. Bundled service offerings provide added value and incentivize clients to stay. This approach enhances customer lifetime value.

Investing in technology infrastructure and cybersecurity is a key retention factor. Clients rely on the company for secure and reliable payment processing. This commitment ensures client trust and long-term partnerships.

The company likely monitors key metrics to assess the effectiveness of its customer acquisition and retention strategies. These metrics include customer acquisition cost (CAC), customer lifetime value (CLTV), and churn rate. These metrics provide insights into the company’s performance and the value it delivers to its clients.

- Customer Acquisition Cost (CAC): Measures the cost of acquiring a new customer.

- Customer Lifetime Value (CLTV): Predicts the net profit attributed to the entire future relationship with a customer.

- Churn Rate: Indicates the rate at which customers stop doing business with the company.

- Net Promoter Score (NPS): Gauges customer loyalty and satisfaction.

For more detailed insights into the company's strategic direction, consider exploring the Growth Strategy of EVERTEC.

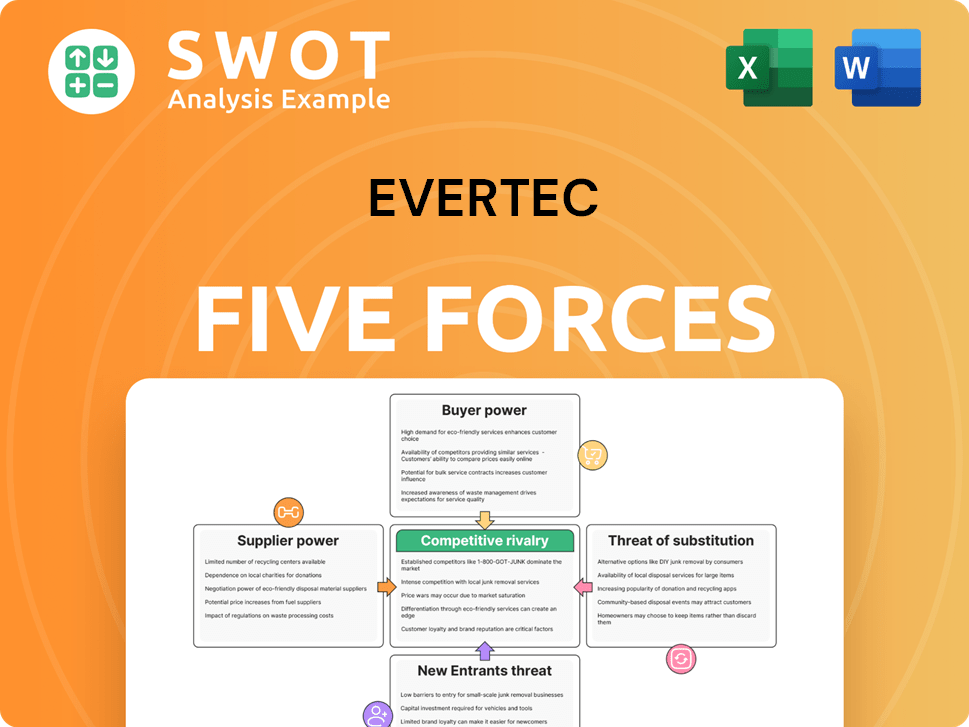

EVERTEC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EVERTEC Company?

- What is Competitive Landscape of EVERTEC Company?

- What is Growth Strategy and Future Prospects of EVERTEC Company?

- How Does EVERTEC Company Work?

- What is Sales and Marketing Strategy of EVERTEC Company?

- What is Brief History of EVERTEC Company?

- Who Owns EVERTEC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.