EVERTEC Bundle

How is EVERTEC Dominating the FinTech Market?

EVERTEC's impressive 22% year-over-year revenue growth in 2024, reaching $845.5 million, signals a powerful sales and marketing engine. This success story, fueled by strategic acquisitions and digital transformation, offers valuable insights for any business. Understanding the EVERTEC SWOT Analysis is key to grasping its market position.

This deep dive into EVERTEC's sales and marketing strategy explores how the company leverages its EVERTEC services to capture market share across Latin America and the Caribbean. We'll examine its EVERTEC business strategy, including its approach to customer acquisition and retention, and its digital marketing strategy. Furthermore, we'll analyze EVERTEC's key marketing initiatives and sales performance metrics, providing a comprehensive EVERTEC market analysis.

How Does EVERTEC Reach Its Customers?

The sales strategy of EVERTEC, a leading financial technology company, is built on a multi-channel approach, focusing on both direct sales and strategic partnerships. This strategy is designed to reach a diverse customer base, including financial institutions, merchants, corporations, and government agencies. The company's success is reflected in its financial performance, with the Merchant Acquiring segment experiencing an 11% growth in Q1 2025, demonstrating the effectiveness of its sales efforts.

EVERTEC's sales channels have evolved to embrace digital adoption and omnichannel integration. The company's 'Blueprint for 2025 Success' underscores a commitment to '360-Degree Digitalization' and an 'Omnichannel' strategy, aiming to provide seamless customer experiences across all touchpoints. This shift is evident in the growth of digital payment solutions like ATH Móvil, which drove a 4% increase in the Payments Puerto Rico & Caribbean segment in Q1 2025 due to higher transaction volumes.

Key partnerships and acquisitions have played a significant role in expanding EVERTEC's market reach and service offerings. These strategic moves allow the company to offer a comprehensive suite of services, acting as a 'one-stop-shop' for clients and enhancing its competitive edge in the region. For a deeper dive into the company's background, you can read the Brief History of EVERTEC.

EVERTEC employs dedicated sales teams to directly engage with clients, particularly for its core payment processing services and business solutions. These teams are crucial for acquiring new clients and maintaining relationships with existing ones. The direct sales approach is a cornerstone of the company's EVERTEC sales strategy, contributing significantly to its revenue growth.

EVERTEC leverages strategic partnerships to broaden its market reach and service offerings. These partnerships are particularly important in Latin America, where the company has expanded its footprint. Collaborations with companies like GetNet Chile have contributed to incremental revenue growth, showcasing the effectiveness of this approach.

EVERTEC is focused on digital adoption and omnichannel integration to enhance customer experience. This includes tools like inventory management for mobile points of sale and Smart POS. The company's digital payment solutions, such as ATH Móvil, have been instrumental in driving growth, reflecting a strategic shift towards seamless customer experiences.

Acquisitions, such as Sinqia in Q4 2023, and contributions from Grandata and Nubity in Q4 2024, have expanded EVERTEC's service offerings. Exclusive distribution deals and acquisitions allow EVERTEC to offer a comprehensive suite of services, enhancing its competitive edge. These moves are a key part of the EVERTEC business strategy.

EVERTEC's sales strategy is multifaceted, combining direct sales with strategic partnerships and a focus on digital transformation. This approach allows the company to effectively reach its target markets and offer a wide range of services. The company's financial technology solutions are designed to meet the evolving needs of its clients, driving growth and market share.

- Direct Sales: Dedicated teams for core services.

- Strategic Partnerships: Expanding market reach.

- Digital Transformation: Omnichannel integration and digital payment solutions.

- Acquisitions: Expanding service offerings and market presence.

EVERTEC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does EVERTEC Use?

The marketing tactics employed by the company, a leader in financial technology, are multifaceted, with a strong emphasis on digital strategies. The company's approach for 2025 is centered around '360-Degree Digitalization' and 'Maximum Personalization', indicating a commitment to leveraging technology for enhanced customer engagement and tailored services.

The company's EVERTEC marketing strategy focuses on building brand awareness, generating leads, and driving sales through a variety of digital and data-driven initiatives. A key component of their strategy involves optimizing payments and offering customized products and services based on customer insights.

The EVERTEC sales strategy is also influenced by digital transformation, with a focus on data-driven marketing and technological innovation to meet evolving consumer and market dynamics. This includes the use of AI in payment solutions for enhanced security and fraud detection, aiming for quicker and more secure transactions.

The company utilizes content marketing to educate its audience on industry trends, including innovations in digital payment methods and key technology trends. Digital marketing expenditures in 2023 totaled $3.2 million, focusing on targeted online advertising platforms.

Social media is recognized as a powerful tool for visibility. Businesses are advised to create engaging content and form alliances with influencers to reach their target audience.

The company leverages data-driven marketing and technological innovation to adapt to changing consumer and market dynamics. AI is used in payment solutions for predicting consumer behavior and enhancing security.

Proprietary platforms like PayStudio play a crucial role in optimizing payment operations and facilitating the entry of acquiring institutions. These platforms are key to the company's service offerings.

In 2023, the company's digital marketing efforts reached 127 financial institutions across Latin America and the Caribbean. This targeted approach is a key element of their EVERTEC marketing strategy.

The company is committed to technological innovation, particularly in payment solutions. This includes the use of AI to enhance security and improve transaction speed.

The company's marketing tactics are designed to support its EVERTEC business strategy, focusing on digital transformation and customer-centric solutions. The emphasis on digital strategies and data-driven approaches is evident in its marketing efforts.

- Content Marketing: Educating the audience on industry trends, including digital payment innovations.

- Digital Advertising: Targeted online advertising platforms, reaching financial institutions across Latin America and the Caribbean.

- Social Media: Utilizing social media to create engaging content and form alliances with influencers.

- AI Integration: Using AI in payment solutions for predicting consumer behavior, enhancing security, and fraud detection.

- Proprietary Platforms: Leveraging platforms like PayStudio to optimize payment operations and facilitate new acquisitions.

To learn more about the company's growth strategy, you can read the Growth Strategy of EVERTEC.

EVERTEC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is EVERTEC Positioned in the Market?

EVERTEC strategically positions itself as a leading provider of financial technology and transaction processing services across Latin America, Puerto Rico, and the Caribbean. The company focuses on delivering integrated, cutting-edge solutions, acting as a 'one-stop-shop' for its diverse clientele, which includes financial institutions, merchants, corporations, and government agencies. This approach allows EVERTEC to differentiate itself by offering a comprehensive suite of services that traditionally would require multiple vendors.

The brand's core message emphasizes innovation, reliability, and regional expertise. This is crucial for success in the dynamic financial technology landscape. By leveraging its strong presence and deep understanding of the Latin American markets, EVERTEC aims to provide a superior customer experience, building trust through advanced anti-fraud technology and a commitment to continuous technological upgrades. This approach is fundamental to EVERTEC's business strategy.

EVERTEC's brand positioning is reinforced by its commitment to technological advancements and sustainability. Recent initiatives include integrating AI into daily operations and adopting tokenization for enhanced cybersecurity. These efforts support its image as a forward-thinking and secure partner. Furthermore, EVERTEC's focus on sustainability, such as promoting digital receipts, resonates with environmentally conscious consumers and businesses. The ability to analyze data across the transaction-processing value chain strengthens its brand, enabling it to offer competitive products and services.

EVERTEC's sales strategy emphasizes acquiring new clients and retaining existing ones through a comprehensive suite of services. The company focuses on building strong customer relationships and providing tailored solutions to meet specific regional needs. This strategy is supported by a robust sales team structure and ongoing sales process optimization.

The marketing strategy of EVERTEC is centered on reinforcing its brand image and promoting its services through various channels. This includes digital marketing initiatives, targeted campaigns, and strategic partnerships. A key element is leveraging its regional expertise and highlighting its commitment to innovation and security.

EVERTEC's key marketing initiatives include digital marketing, content creation, and participation in industry events. The company also focuses on public relations and thought leadership to enhance its brand reputation. These initiatives aim to increase brand awareness and drive customer acquisition.

EVERTEC's competitive analysis involves monitoring industry trends and assessing the strategies of its competitors. The company leverages this analysis to identify opportunities for differentiation and improve its market position. This includes evaluating pricing strategies and service offerings.

EVERTEC tracks several sales performance metrics to evaluate its effectiveness. These include revenue growth, customer acquisition cost, and customer retention rates. The company also monitors sales cycle length and conversion rates to optimize its sales processes. In 2024, EVERTEC reported a revenue increase, reflecting the success of its sales and marketing efforts.

- Revenue Growth: EVERTEC consistently aims for revenue growth, with a focus on expanding its market share in Latin America.

- Customer Acquisition Cost: The company carefully manages its customer acquisition cost to ensure profitability.

- Customer Retention Rates: EVERTEC prioritizes customer retention, as repeat business is crucial for long-term success.

- Sales Cycle Length and Conversion Rates: Monitoring these metrics helps optimize the sales process.

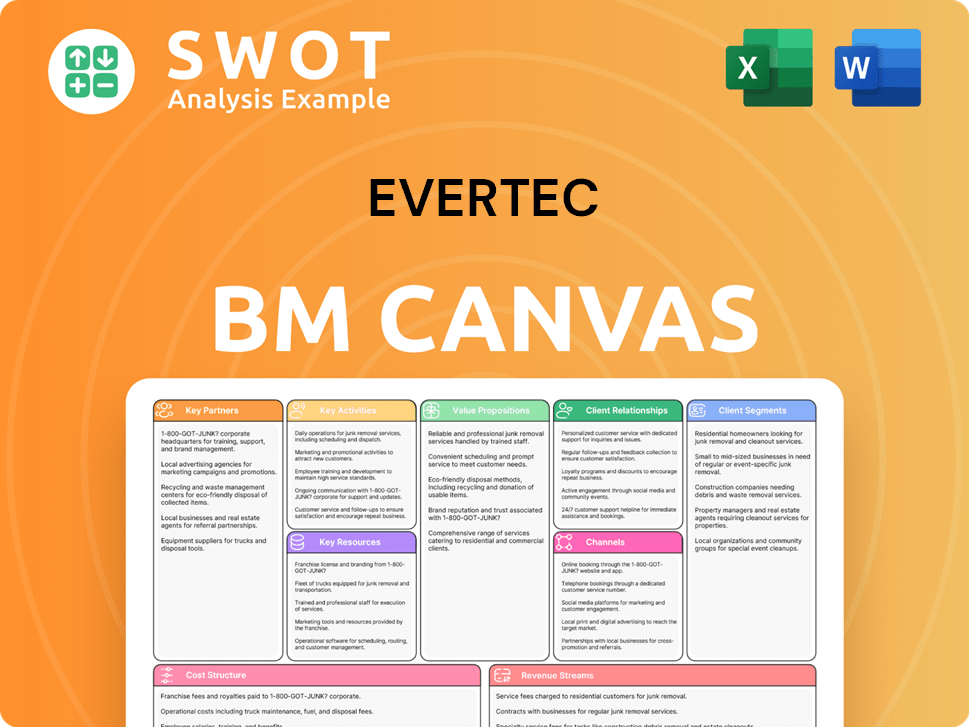

EVERTEC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are EVERTEC’s Most Notable Campaigns?

The EVERTEC sales strategy and marketing strategy are not always presented as traditional, named 'campaigns' in public reports. Instead, the company's key initiatives and strategic moves function as de facto campaigns. These efforts are designed to drive growth and solidify its position in the financial technology sector. EVERTEC's approach focuses on strategic acquisitions, digital payment solutions, and innovation in areas like AI and cybersecurity.

A primary focus for EVERTEC has been aggressive expansion, particularly in Latin America. This expansion strategy is evident in significant acquisitions and the integration of new services. The company also emphasizes the continuous enhancement of its digital payment platforms, such as ATH Móvil, and innovation in financial technology. These initiatives are crucial for EVERTEC's ongoing success.

EVERTEC's commitment to providing exceptional customer experiences through '360-Degree Digitalization' and 'Omnichannel' strategies also reflects its marketing and sales approach. This focus, combined with its dedication to innovation, positions EVERTEC to meet the evolving demands of the financial technology market.

A major aspect of EVERTEC's business strategy involves expanding its footprint in Latin America through acquisitions. The successful integration of Sinqia, completed in Q4 2023, was a critical initiative in 2024. This strategic move aimed to diversify revenue streams and foster growth.

EVERTEC continues to enhance and promote its digital payment solutions. A key example is ATH Móvil in Puerto Rico, which drives strong performance. The focus on '360-Degree Digitalization' and 'Omnichannel' experiences is an ongoing campaign to optimize payments.

EVERTEC's focus on innovation, including AI and cybersecurity, represents a continuous campaign to stay at the forefront of financial technology. The integration of AI for personalized recommendations and fraud detection highlights its commitment to staying competitive.

EVERTEC emphasizes '360-Degree Digitalization' and 'Omnichannel' strategies to provide excellent customer experiences. These initiatives help optimize payment processes and create convenient shopping experiences, supporting its sales and marketing efforts.

Here's a look at some key metrics and data points related to EVERTEC's performance and strategy:

- The LATAM segment experienced a 62% year-over-year revenue increase due to acquisitions, most notably Sinqia.

- LATAM now accounts for approximately 33% of EVERTEC's total revenue.

- The Payments Puerto Rico & Caribbean segment saw a 4% growth in Q1 2025.

- EVERTEC is exploring integrating AI into daily business operations, including personalized recommendations and real-time fraud detection.

EVERTEC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EVERTEC Company?

- What is Competitive Landscape of EVERTEC Company?

- What is Growth Strategy and Future Prospects of EVERTEC Company?

- How Does EVERTEC Company Work?

- What is Brief History of EVERTEC Company?

- Who Owns EVERTEC Company?

- What is Customer Demographics and Target Market of EVERTEC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.