EVERTEC Bundle

Can EVERTEC Continue Its Dominance in the Fintech Realm?

EVERTEC, a key player in payment processing across Latin America and the Caribbean, has built a strong foundation since its inception in 1988. The company's success story isn't about a single event, but rather a consistent evolution through strategic initiatives. This article examines EVERTEC's EVERTEC SWOT Analysis and its plans to navigate the ever-changing fintech landscape.

EVERTEC's consistent EVERTEC growth strategy has solidified its EVERTEC market position, serving a diverse clientele with cutting-edge digital payment solutions. Understanding the EVERTEC business model and its ability to adapt to market dynamics is crucial. This analysis will provide insights into the company's EVERTEC future prospects, including its expansion plans and potential for sustained EVERTEC financial performance in the coming years, exploring its EVERTEC company analysis and recent developments.

How Is EVERTEC Expanding Its Reach?

The EVERTEC growth strategy is centered around a multi-pronged approach to expand its business. This includes entering new geographical markets, enhancing its product and service offerings, and pursuing strategic mergers and acquisitions. These efforts are driven by a desire to access new customer segments and diversify revenue streams.

A key focus for the company has been its continued international expansion within Latin America, building on its strong foundation in Puerto Rico and the Caribbean. The company is actively seeking opportunities to deepen its presence in countries where digital payment adoption is growing, leveraging its expertise in merchant acquiring and payment processing. This strategy aims to capitalize on the increasing demand for digital payment solutions across the region.

The company's strategic focus on the digital transformation of payments in the region has led to the development of new solutions aimed at supporting various payment methods and enhancing the overall customer experience. This includes solutions for e-commerce, real-time payments, and enhanced data analytics for its clients, all designed to meet the increasing demand for secure and efficient digital transactions.

The company is actively expanding its footprint in Latin America. This involves targeting countries with high growth potential in digital payments. The company leverages its existing infrastructure and expertise to gain a competitive advantage in these new markets. This expansion is a key component of the EVERTEC future prospects.

The company continuously enhances its product and service offerings. This includes developing new solutions for e-commerce, real-time payments, and data analytics. These enhancements aim to meet the evolving needs of clients and stay ahead of industry trends. This strategy supports the EVERTEC company analysis and its long-term growth.

The company explores strategic mergers and acquisitions to expand its technological capabilities and market reach. These acquisitions are carefully chosen to align with the company's growth objectives. This approach allows the company to quickly integrate new technologies and expand its customer base.

The company is focused on the digital transformation of payments. This involves developing solutions that support various payment methods and enhance the customer experience. The company is investing in technologies that improve security and efficiency. This focus is crucial for its EVERTEC market position.

While specific financial data for 2024 and 2025 isn't available, the company's historical performance and strategic initiatives suggest a positive outlook. The company's ability to adapt to the evolving digital payments landscape, coupled with its expansion efforts, positions it well for future growth. For more detailed insights, you can refer to an article about the company's performance and strategy. The company's commitment to innovation and strategic partnerships further strengthens its position in the competitive fintech industry.

The company's growth is driven by several key factors. These include expansion into new markets, enhanced product offerings, and strategic acquisitions. These initiatives are designed to increase revenue and market share.

- Geographical Expansion: Expanding its presence in Latin America.

- Product Innovation: Developing new digital payment solutions.

- Strategic Partnerships: Forming alliances to enhance capabilities.

- Mergers and Acquisitions: Acquiring companies to expand market reach.

EVERTEC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does EVERTEC Invest in Innovation?

The company strategically uses technology and innovation to fuel its growth in the competitive fintech sector. This approach involves significant investments in research and development, the creation of proprietary solutions, and collaborations with external innovators. The company is actively involved in digital transformation initiatives, aiming to automate and optimize its payment processing infrastructure.

This includes the strategic adoption of cutting-edge technologies to improve efficiency, security, and the overall customer experience. The company continuously develops new products and platforms, demonstrating its commitment to innovation. This includes advancements in real-time payment processing, enhanced fraud prevention systems, and data analytics tools.

By continuously refining its technological capabilities, the company aims to solidify its market leadership and provide its clients with advanced solutions. Its focus on secure and scalable technology platforms is crucial for handling the increasing volume and complexity of digital transactions across its diverse customer base. To learn more about the company's financial structure, you can explore Revenue Streams & Business Model of EVERTEC.

The company dedicates resources to research and development to stay ahead in the fintech industry. These investments support the creation of new products and the enhancement of existing services. Continuous innovation is key to maintaining a strong market position and meeting evolving customer needs.

The company develops its own unique solutions to gain a competitive edge. This includes creating platforms and technologies that are specifically tailored to its business needs. These proprietary solutions help differentiate the company's offerings in the market.

The company forms partnerships with other innovators and technology providers. These collaborations allow it to access new technologies and expertise. Strategic partnerships enhance the company's ability to offer cutting-edge solutions.

The company is actively undergoing a digital transformation to modernize its operations. This involves automating processes and optimizing its infrastructure. Digital transformation initiatives improve efficiency and enhance the customer experience.

The company strategically uses advanced technologies to improve its services. This includes technologies that enhance security and improve overall performance. These technologies help the company stay competitive and meet industry standards.

The company focuses on real-time payment processing to meet customer demands. This allows for faster and more efficient transactions. Real-time processing is a key area of innovation for the company.

The company is focused on several key technological advancements to improve its services and maintain its market position. These include improvements in real-time payment processing, enhanced fraud prevention systems, and data analytics tools. These advancements are essential for supporting the company's growth strategy and improving its financial performance.

- Real-Time Payment Processing: Enables faster transactions.

- Enhanced Fraud Prevention Systems: Protects against financial crimes.

- Data Analytics Tools: Provides insights for clients.

- Secure and Scalable Platforms: Handles increasing transaction volumes.

EVERTEC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is EVERTEC’s Growth Forecast?

The financial outlook for EVERTEC is largely shaped by its consistent performance and strategic initiatives. The company's commitment to sustained financial performance is evident in its historical revenue growth and healthy profit margins. This growth is driven by the increasing adoption of digital payments within its core markets. For a detailed understanding of the company's financial health and growth capacity, it's essential to review the most recent quarterly and annual reports.

EVERTEC's financial strategy includes prudent capital allocation to support its growth initiatives, potentially involving mergers and acquisitions. The company's investments are strategically directed towards enhancing its technology infrastructure, expanding its market reach, and developing innovative solutions. The company's management consistently communicates its dedication to maximizing shareholder value while investing in the long-term sustainability and expansion of its business. The company's commitment to innovation and expansion is a key factor in its future prospects.

Analyst forecasts generally reflect a positive outlook, anticipating continued growth driven by market expansion and new product offerings. Key financial metrics, such as revenue figures, net income, and cash flow, are crucial for assessing its financial health and capacity for future growth. For a deeper dive, consider reading about the Marketing Strategy of EVERTEC to understand how they position themselves in the market.

EVERTEC's revenue growth is primarily driven by the increasing adoption of digital payments, expansion into new markets, and the introduction of innovative payment solutions. These factors contribute to its sustained financial performance. The company's business model is designed to capitalize on the growing demand for digital financial services.

EVERTEC strategically invests in technology infrastructure, market expansion, and the development of new products and services. These investments are crucial for maintaining its competitive edge and fostering long-term growth. The company's focus on innovation is a key element of its growth strategy.

Key financial metrics, including revenue, net income, and cash flow, are essential for evaluating EVERTEC's financial health. Analyzing these metrics provides insights into the company's profitability and its ability to generate cash. Reviewing recent financial reports offers the most up-to-date data.

EVERTEC's expansion plans involve targeting new markets and increasing its presence in existing regions. This strategic approach is designed to capitalize on growth opportunities and diversify its revenue streams. Market expansion is integral to EVERTEC's long-term success.

Understanding EVERTEC's financial performance involves analyzing several key areas. These include revenue growth drivers, strategic investments, and market expansion plans. The company's financial performance is a critical factor in assessing its long-term investment potential.

- Reviewing recent financial reports for up-to-date data.

- Analyzing revenue growth trends and profit margins.

- Assessing the impact of strategic investments on future growth.

- Evaluating market expansion plans and their potential.

EVERTEC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow EVERTEC’s Growth?

The growth trajectory of the company faces several risks, primarily stemming from the dynamic nature of the financial technology sector. These include intense competition from both established players and emerging fintech companies, particularly across the Caribbean and Latin American markets. Additionally, the company must navigate evolving regulatory landscapes in various jurisdictions, which can impact operational procedures and require significant platform adjustments.

Technological disruption also presents a continuous challenge. Rapid advancements in payment technologies could potentially render existing systems obsolete if the company does not continuously innovate and adapt. The company's ability to maintain its EVERTEC market position depends on its capacity to anticipate and respond to these technological shifts effectively.

To mitigate these challenges, the company employs a multi-faceted approach. This includes strategic diversification across service offerings and geographical markets, alongside the implementation of robust risk management frameworks. Proactive scenario planning and investment in resilient technology infrastructure are also crucial in safeguarding against cyber threats and system outages, which are critical in the payment processing industry. This approach helps bolster the company's EVERTEC business model.

The financial technology sector is highly competitive. Numerous companies are vying for market share, especially in Latin America and the Caribbean. Understanding the Competitors Landscape of EVERTEC is crucial for navigating this environment effectively.

Operating across various countries means complying with diverse and evolving regulations. Changes in compliance requirements can significantly impact operational procedures and require continuous adaptation of services.

Rapid advancements in payment technologies pose a constant threat. The company must continuously innovate to avoid obsolescence and stay ahead of the curve in EVERTEC's future prospects.

Economic fluctuations in Latin America and the Caribbean directly influence EVERTEC financial performance. Economic downturns can reduce transaction volumes and impact revenue growth.

The payment processing industry is a prime target for cyberattacks. Protecting sensitive financial data requires robust cybersecurity measures and continuous investment in infrastructure.

As the fintech market matures, there is a risk of saturation. This could lead to increased competition, potentially affecting profit margins and EVERTEC growth strategy.

The company focuses on diversification to reduce risk, spreading its services across different markets. This approach aims to create a more stable revenue stream and lessen the impact of economic downturns in any single region. Strategic partnerships also play a crucial role in expanding market reach and accessing new technologies.

Investing in robust technology infrastructure is essential to protect against cyber threats and system outages. Continuous innovation and adaptation to new payment technologies are crucial to maintaining a competitive edge and ensuring EVERTEC digital payments solutions remain relevant. This involves significant investment in research and development.

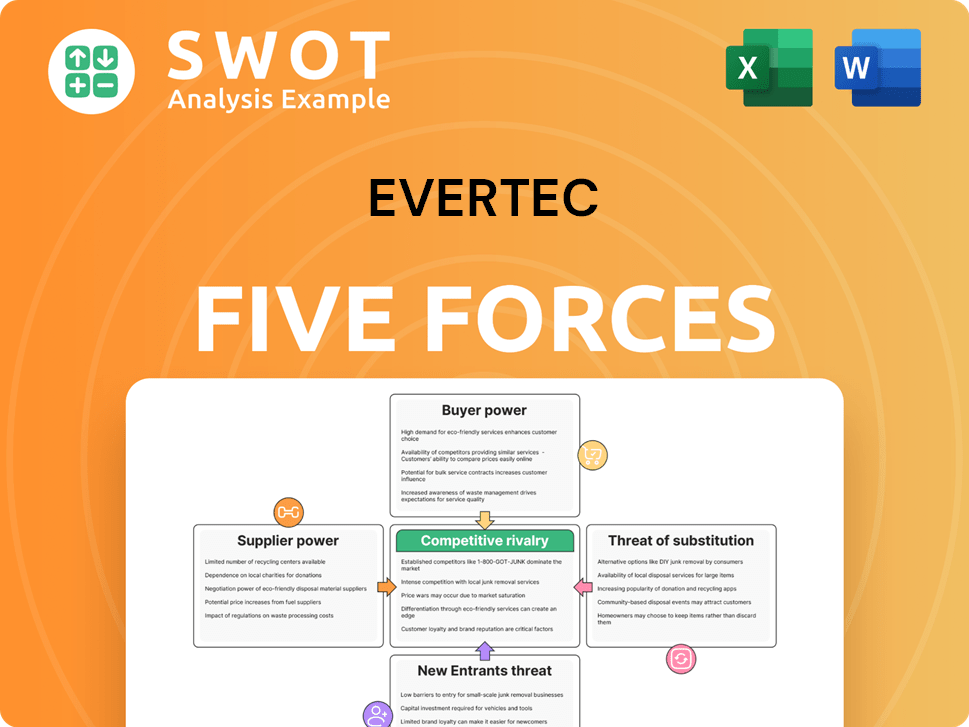

EVERTEC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EVERTEC Company?

- What is Competitive Landscape of EVERTEC Company?

- How Does EVERTEC Company Work?

- What is Sales and Marketing Strategy of EVERTEC Company?

- What is Brief History of EVERTEC Company?

- Who Owns EVERTEC Company?

- What is Customer Demographics and Target Market of EVERTEC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.