Experian Bundle

How Did Experian Become a Data & Analytics Giant?

Journey back to 1826, when the seeds of Experian were sown in London's merchant circles. From those humble beginnings of sharing debtor information, a global data powerhouse emerged. This is the compelling story of Experian, a company that transformed the financial landscape.

Experian's Experian SWOT Analysis reveals a company with deep roots, tracing back to the early credit bureaus. Experian's evolution from its 1996 formation, through mergers and acquisitions, to its current status is a testament to its adaptability. Today, Experian is a leader in data and analytics, serving over a billion people and businesses worldwide, and is a key player in the credit reporting industry.

What is the Experian Founding Story?

The story of the Experian company is a journey through the evolution of credit reporting and data analytics. While the name Experian first appeared in 1996, its roots are deeply embedded in the history of financial information services, tracing back to the early 19th century in the UK and late 19th century in the US.

This Experian history is a testament to the power of data and its ability to shape how businesses and individuals interact with financial systems. From its origins in sharing debt information to becoming a global leader in credit reporting, Experian's evolution reflects the changing landscape of commerce and technology.

The Experian background is a complex tapestry woven from various companies and initiatives. Key elements include the Manchester Guardian Society (1826) in the UK, and in the US, Jim Chilton's credit agency (1897). These early ventures laid the groundwork for the modern credit bureau.

The Experian company, as we know it, emerged from a series of strategic mergers and acquisitions. The UK's CCN (Credit Control Network), established in 1980, played a crucial role.

- In the UK, the Manchester Guardian Society (1826) and Universal Stores (1900) contributed to Experian's foundation.

- In the US, Jim Chilton's credit agency (1897) and TRW's credit data operations were significant precursors.

- CCN, founded in 1980, was a direct precursor to Experian in the UK.

- In November 1996, TRW sold its information systems unit to Bain Capital and Thomas H. Lee Partners.

- In December 1996, Great Universal Stores Limited (GUS) acquired the TRW unit and merged it with CCN, forming Experian.

The Experian timeline shows how the company evolved through acquisitions and mergers. The Experian origins can be traced back to the early 19th century. The 1996 merger of CCN and the TRW unit marked the official formation of Experian.

In the UK, the Manchester Guardian Society, formed in 1826, was among the earliest efforts to share debt information. Universal Stores, founded in 1900, provided extensive data on mail-order customers, later becoming a valuable asset for Experian's UK operations. In the US, Jim Chilton established one of the earliest credit agencies in Dallas, Texas, in 1897, which listed both good and bad credit risks. This business later became part of TRW, a key component that eventually merged into Experian.

The direct precursor to Experian's formation in the UK was CCN (Credit Control Network), established in Nottingham in 1980 by GUS plc. CCN expanded its operations in the UK between 1980 and 1996. In November 1996, TRW Inc. sold its information systems and services unit, including Credit Data Corporation (acquired by TRW in 1968), to Bain Capital and Thomas H. Lee Partners. Just one month later, these firms sold it to The Great Universal Stores Limited, which then merged its credit-information business, CCN, into the newly rebranded Experian. The initial vision was to use data to empower businesses and transform access to services for people and businesses, building upon the concept of collecting credit data into databases.

For a detailed look at the company's evolution, you can explore the Experian's evolution over time further by reading this article: 0.

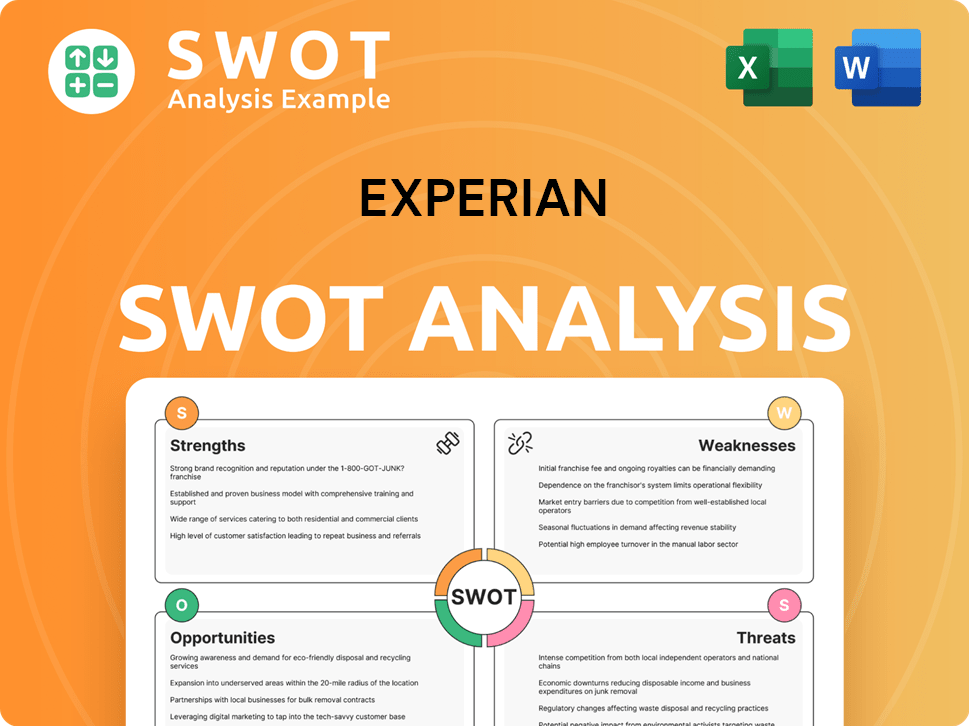

Experian SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Experian?

The early growth of the Experian company, following its formal establishment in 1996, was marked by strategic diversification and global expansion. The merger of CCN and TRW information businesses under the Experian brand immediately created a significant presence in the credit reporting industry. A key early strategic priority was to evolve Experian's perception in North America beyond just a credit data business. This involved integrating data with value-added analytics and decision support software.

This period saw major acquisitions aimed at boosting the marketing services side of the US business. Experian also focused on expanding its global reach, extending existing capabilities into new geographic and vertical markets. For instance, the company entered the Brazilian market through acquisition, which has since developed into a dominant position. These moves were crucial for building a robust business model.

By 2007, Experian began providing analytical insights to clients in addition to credit scores, marking a significant evolution in its service offerings. The company became a publicly traded entity on the London Stock Exchange in October 2006, demerged from GUS, to increase shareholder value and growth potential. This strategic move enhanced its market presence and operational capabilities. Understanding the company's structure is key, and you can learn more about the Owners & Shareholders of Experian.

This early phase set the stage for Experian's transformation into a global data and analytics powerhouse, with a focus on both organic growth and strategic acquisitions to expand its portfolio and market presence. In fiscal year 2024, Experian generated approximately 66% of its revenue from North America, showcasing the continued importance of this market while highlighting ongoing geographic diversification efforts. This demonstrates a strong financial foundation.

The company's early ventures, including acquisitions and market entries, significantly shaped its trajectory. These early decisions were critical to Experian's evolution over time. The shift towards offering analytical insights alongside credit scores was a key milestone. These strategic moves helped establish Experian as a leader in its industry.

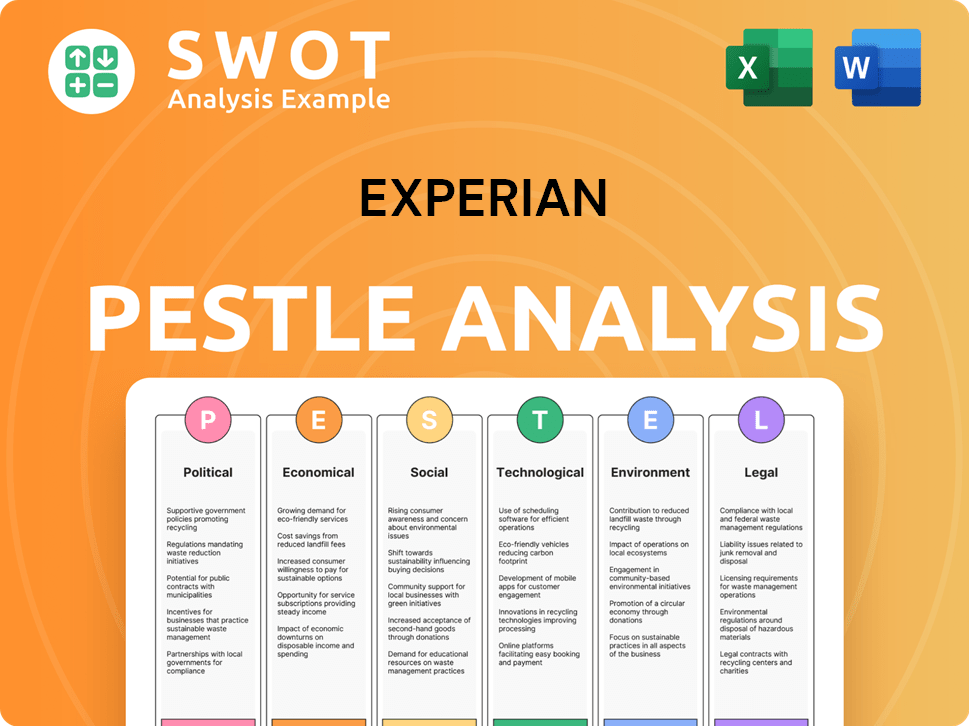

Experian PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Experian history?

The Experian history is marked by significant achievements and strategic shifts that have shaped its position in the credit reporting and data analytics industry. The company has evolved from its Experian origins to become a global leader, constantly adapting to market changes and technological advancements.

| Year | Milestone |

|---|---|

| 2007 | Shifted from providing credit reports to offering analytical insights to clients. |

| 2016 | Expanded business strategy to include services aimed at improving consumer financial health. |

| 2019 | Launched Experian Boost, allowing consumers to improve their credit scores by adding positive payment history. |

| 2021 | Expanded into Verification and Employer Services, launching real-time income and employment verification solutions. |

| April 2025 | Launched major enhancements to its Aperture Data Studio, introducing features like a data catalogue and Gen AI capabilities. |

| May 2025 | Issued a warning about soaring identity fraud, highlighting its ongoing role in fraud prevention. |

Over time, Experian has consistently innovated to meet evolving market demands. A key innovation was the introduction of Experian Boost, a groundbreaking tool that allowed consumers to instantly improve their credit scores.

Experian Boost allowed consumers to improve their credit scores by incorporating positive payment history from accounts like mobile phone bills and streaming services. As of June 2023, over 12 million people had registered for Experian Boost, with an average FICO score increase of 13 points.

Experian transitioned from simply providing credit reports to offering analytical insights, helping clients make data-driven decisions. This shift enhanced the value proposition for clients, providing them with deeper understanding and predictive capabilities.

In April 2025, Experian launched major enhancements to its Aperture Data Studio, including a data catalogue, business impact analysis, and Gen AI capabilities. These enhancements are designed to help businesses with data-driven decision-making.

Experian expanded into Verification and Employer Services, launching new real-time income and employment verification solutions. These solutions provide instant and accurate verification of employment and income information.

Despite its successes, Experian has faced several challenges throughout its Experian timeline. The global financial crisis of around 2008 brought new competitors to the market, impacting its consumer services business.

Experian has contended with market downturns and competitive threats, requiring the company to continuously innovate and adapt its strategies. This includes investments in new products and strategic growth initiatives.

Experian has experienced several data breaches, including incidents in 2015, 2020, 2021, and 2022, impacting millions of individuals and raising concerns about data security. These incidents have led to increased scrutiny and the need for enhanced security measures.

The emergence of free credit scores from competitors impacted Experian's consumer services business, which traditionally relied on member fees. This led to the company re-evaluating its approach and modernizing its technology to stay competitive.

In May 2025, Experian issued a warning about soaring identity fraud, highlighting the continuous nature of these challenges. This underscores the need for ongoing investment in fraud prevention and data security measures.

For more insights into the company's strategic moves, consider reading about the Growth Strategy of Experian.

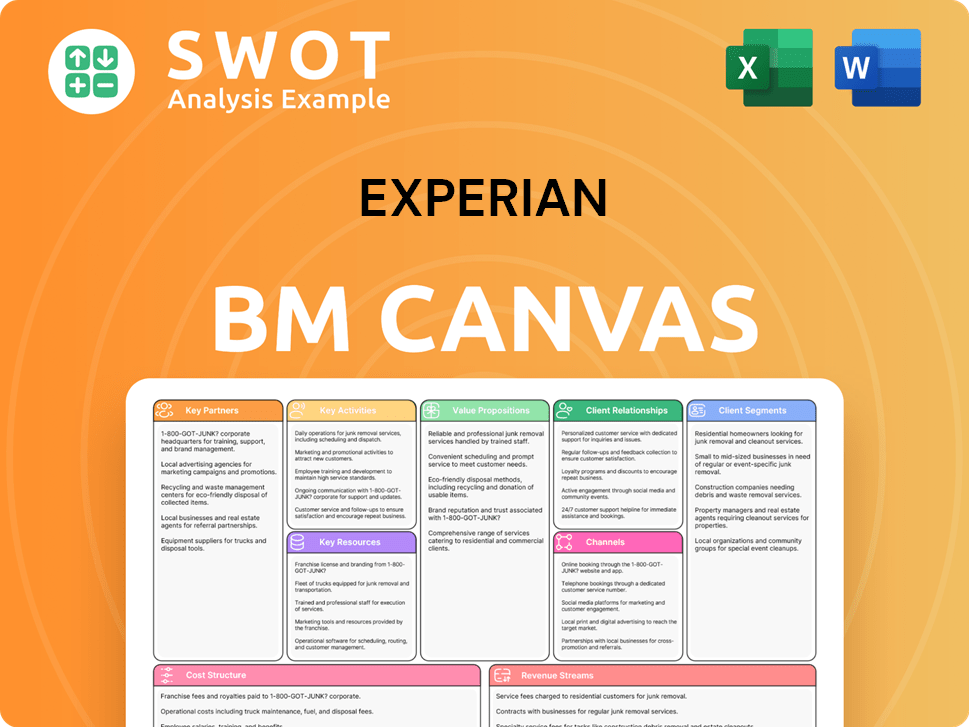

Experian Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Experian?

The Experian company has a rich history, evolving from early credit information exchanges to a global data and analytics leader. Its origins trace back to the 19th century with the establishment of credit agencies, followed by significant mergers and acquisitions that shaped its modern structure. Experian's journey reflects technological advancements and strategic expansions that have solidified its position in the financial services industry.

| Year | Key Event |

|---|---|

| 1826 | London merchants begin exchanging credit information, a precursor to credit bureaus. |

| 1897 | Jim Chilton establishes an early credit agency in Dallas, Texas, later becoming part of Experian. |

| 1900 | Abraham Rose founds Universal Stores in Manchester, UK, whose data forms the basis of Experian's UK operations. |

| 1968 | TRW Inc. acquires Credit Data Corporation, a predecessor to Experian in the US. |

| 1980 | CCN (Credit Control Network), a direct precursor to Experian, is established in Nottingham, UK. |

| 1996 | Experian is formally created through the merger of CCN and TRW's information systems businesses, rebranded under GUS ownership. |

| 2006 | Experian demerges from GUS and lists on the London Stock Exchange (LSE: EXPN). |

| 2007 | Experian begins to provide analytical insights to clients in addition to credit scores. |

| 2019 | Experian Boost is launched, allowing consumers to instantly improve credit scores by adding positive payment history. |

| 2020 | Experian acquires Tapad, a marketing data company, for $280 million. |

| 2021 | Experian expands into Verification and Employer Services, launching real-time income and employment verification. |

| April 2024 | Experian announces the acquisition of Illion, an Australian and New Zealand-based credit bureau, for AU$820 million (£427.2 million). |

| May 2024 | Experian reports full-year revenue of US$7.097 billion for FY2024, with organic revenue growth of 6%. |

| April 2025 | Experian completes its acquisition of ClearSale. |

| May 2025 | Experian reports full-year revenue of US$7.523 billion for FY2025, with organic revenue growth of 7%. |

Experian is focused on data and analytics to drive continued growth. The company is expanding its global reach and fostering sustained innovation to meet evolving market demands. Experian's strategy includes further expansion into new geographic and vertical markets.

Experian is actively pursuing both organic growth and targeted acquisitions. Recent acquisitions, like ClearSale, support its strategic priorities. The company expects continued new product development and productivity gains.

For fiscal year 2026, Experian anticipates total revenue growth of 9-11% and organic revenue growth of 6-8%. Margin expansion is expected in the range of 30-50 basis points at constant currency. The company's strong financial performance reflects its robust business model.

Experian is committed to empowering individuals and organizations with data and analytical insights. This vision, rooted in its earliest beginnings, guides its future trajectory. Experian's focus on innovation and expansion will continue to shape its role in the financial landscape.

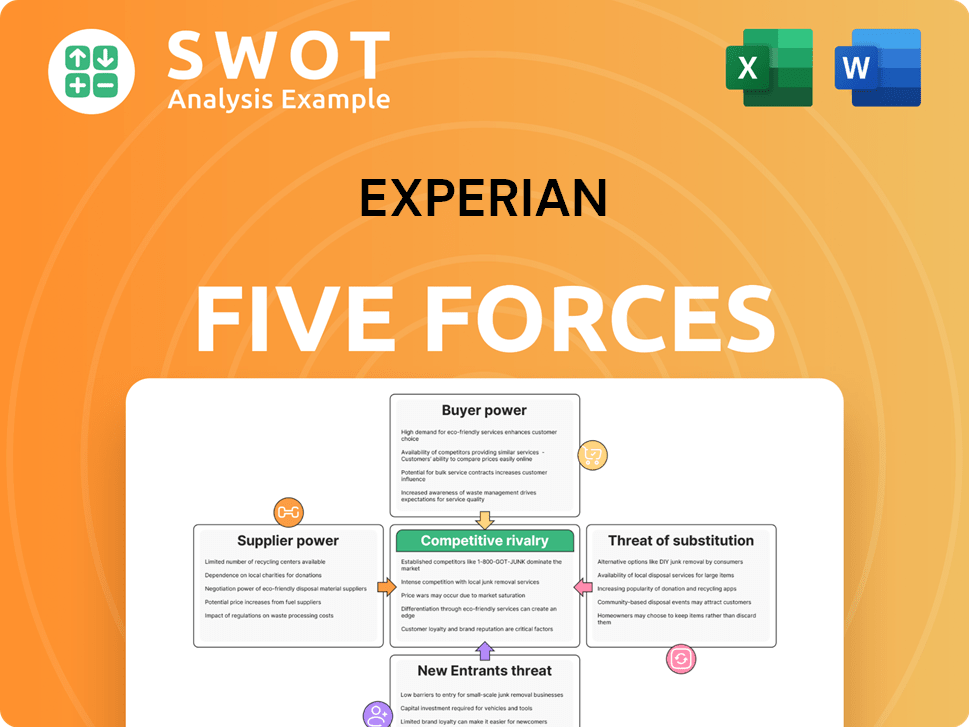

Experian Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Experian Company?

- What is Growth Strategy and Future Prospects of Experian Company?

- How Does Experian Company Work?

- What is Sales and Marketing Strategy of Experian Company?

- What is Brief History of Experian Company?

- Who Owns Experian Company?

- What is Customer Demographics and Target Market of Experian Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.