Experian Bundle

Who Does Experian Really Serve?

In today's data-driven world, understanding Experian SWOT Analysis is crucial for any business aiming for success. But who exactly are Experian's customers, and how has its target market evolved? This exploration delves into the core of Experian's business, examining its customer demographics and the strategic shifts that have shaped its market presence. We'll uncover the company's journey from a credit bureau to a global information services leader.

Experian's customer demographics and Experian target market have undergone significant transformations. From its early focus on financial institutions to its current reach encompassing both businesses and consumers, Experian's ability to adapt has been key. Understanding the Experian customer profile, including Experian customer age range, Experian customer income levels, and Experian customer location data, is vital for grasping its market position. This analysis will also touch upon Experian target market industries and Experian consumer credit score demographics, providing a comprehensive view of its customer base and Experian market share analysis.

Who Are Experian’s Main Customers?

Understanding the Owners & Shareholders of Experian involves examining its diverse customer base. Experian's customer profile is split between two main segments: Business-to-Business (B2B) and Business-to-Consumer (B2C). This dual approach allows Experian to cater to a wide range of needs, from providing critical data and analytics to businesses to offering individuals tools for managing their financial health.

The Experian target market is strategically segmented to address the unique requirements of each group. The B2B segment focuses on providing services to financial institutions, telecommunications companies, retailers, and government agencies. These entities utilize Experian's data for credit risk management, fraud prevention, and targeted marketing. The B2C segment offers services directly to consumers, including credit reports, credit monitoring, and identity theft protection. This comprehensive approach ensures Experian's relevance and value across various sectors.

The company's ability to adapt to changing market dynamics is crucial. Experian's focus on consumer empowerment and data privacy has led to an expansion of its B2C offerings. This strategic shift reflects a commitment to meeting the evolving needs of its customers and maintaining a strong market position.

Experian's B2B segment includes financial institutions, telecommunications companies, retailers, automotive companies, and government agencies. These businesses use Experian's data and analytics for credit risk management, fraud prevention, and marketing. The demand for advanced analytics and fraud prevention solutions is a key growth area.

The B2C segment targets individuals focused on their financial health and identity security. This includes a broad demographic, from young adults establishing credit to older individuals managing finances. Experian's consumer services provide transparency and control over financial data, with a growing emphasis on digital engagement.

Experian's market share is significant, reflecting its strong position in the credit reporting and data analytics industry. In 2024, the global credit bureau market was valued at approximately $30 billion, with Experian holding a substantial portion. The company's revenue growth is driven by both B2B and B2C segments, with a focus on innovation and customer-centric solutions.

- Market Segmentation: Experian employs sophisticated market segmentation strategies to target specific customer needs.

- Customer Acquisition: The company uses various strategies to acquire new customers, including digital marketing and partnerships.

- Customer Retention: Experian focuses on customer retention through excellent service and value-added products.

- Consumer Behavior: Experian analyzes consumer behavior to refine its offerings and improve customer engagement.

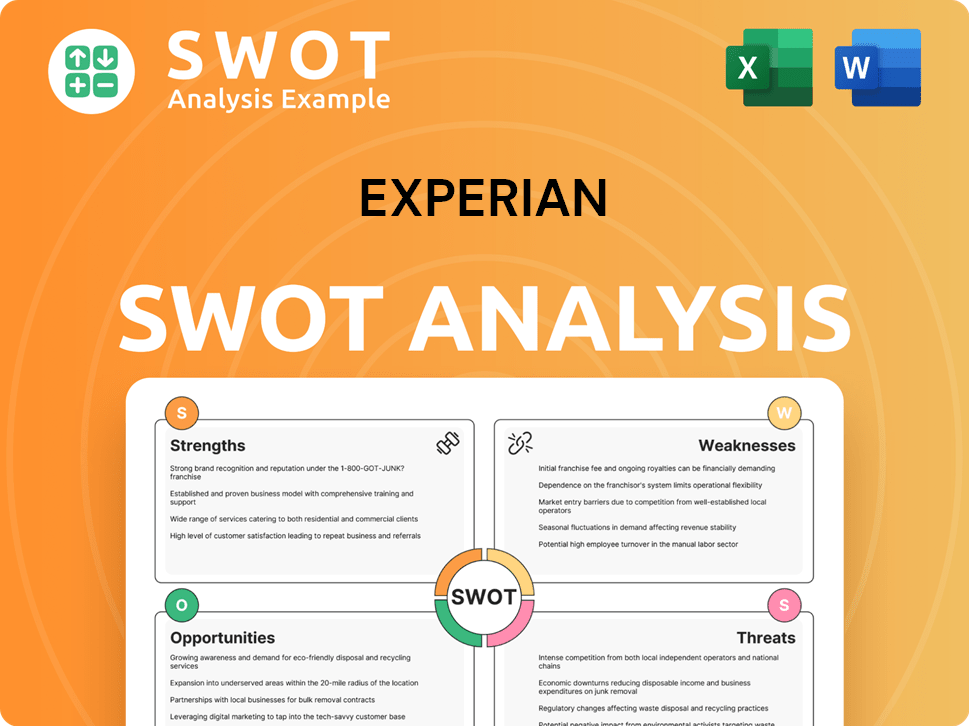

Experian SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Experian’s Customers Want?

Understanding the customer needs and preferences is crucial for Experian to tailor its products and services effectively. The company serves a diverse customer base, including businesses (B2B) and individual consumers (B2C), each with distinct motivations and expectations. This understanding enables Experian to provide solutions that address specific pain points and drive customer satisfaction.

Experian's success hinges on its ability to meet the evolving needs of its customers. By focusing on data accuracy, predictive analytics, and user-friendly interfaces, Experian aims to maintain its competitive edge. This customer-centric approach allows the company to build strong relationships and foster loyalty across its varied market segments.

The Experian customer profile is shaped by the company's commitment to innovation and adaptability. Experian continuously refines its offerings based on customer feedback and market trends. The company's focus on financial empowerment and data security reflects its understanding of the priorities of both businesses and consumers.

Businesses primarily seek risk mitigation, operational efficiency, and revenue growth. Financial institutions require accurate credit data to minimize loan defaults and comply with regulations. Other businesses aim to target profitable customer segments and personalize marketing efforts.

Data accuracy, predictive analytics, and integration capabilities are key factors. Businesses prioritize solutions that enable them to automate decision-making and reduce manual processes. Competitive advantage, brand reputation, and regulatory compliance are also important.

Individual consumers are driven by financial security, transparency, and control over their personal information. They want easy access to credit reports and scores to monitor their financial health. Real-time alerts on credit changes and identity theft protection are also highly valued.

Consumers prefer mobile-friendly interfaces and proactive identity protection services. Experian Boost, which allows consumers to potentially increase their credit scores by factoring in utility and streaming service payments, addresses the need for alternative ways to build credit. The company's focus is on financial empowerment.

Experian addresses B2B pain points like high fraud rates and inefficient customer onboarding. For B2C, Experian provides free credit monitoring and personalized financial insights. These solutions are designed to meet the specific needs of each customer segment.

Product development is influenced by consumer feedback and market trends. The increasing demand for mobile-friendly interfaces and proactive identity protection services drives innovation. Experian continuously adapts to meet the evolving needs of its customers.

Understanding Experian customer demographics and behavior is crucial for effective market segmentation. Experian's ability to provide tailored solutions is based on detailed customer insights. This approach helps the company maintain its market position and drive growth.

- Experian uses market segmentation to target specific customer groups with relevant products and services.

- Target audience analysis helps Experian understand the needs and preferences of various customer segments.

- Experian customer age range and income levels influence product adoption and usage patterns.

- Experian customer location data helps tailor services to local market conditions.

- Experian target market industries include finance, retail, and telecommunications.

- Experian credit report users demographics provide insights into consumer credit behavior.

- Experian consumer behavior analysis helps predict future trends and customer needs.

- Experian customer segmentation strategies involve dividing the market into distinct groups based on various criteria.

- Experian market share analysis helps assess its position relative to competitors.

- Experian competitor analysis target market helps identify opportunities for differentiation.

- Experian consumer credit score demographics provide insights into creditworthiness across different segments.

- Experian data on customer spending habits enables personalized financial advice.

- Experian customer acquisition strategies are tailored to reach specific target groups.

- Experian customer retention strategies focus on building long-term customer relationships.

- Experian business credit report users demographics provide insights into business credit behavior.

- Experian customer lifestyle analysis helps understand customer values and preferences.

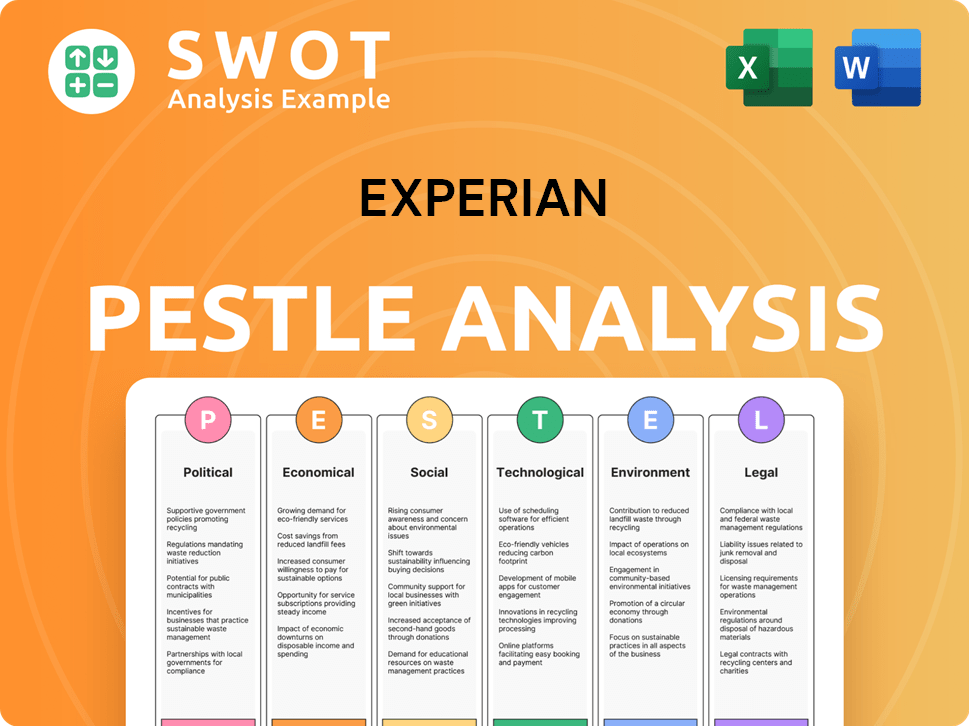

Experian PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Experian operate?

Experian boasts a significant global footprint, with operations across numerous countries. Its primary markets include North America, particularly the United States, the United Kingdom, Latin America, and the Asia Pacific region. Experian holds strong market share and brand recognition in these areas, especially in credit reporting and data analytics services. Understanding the nuances of its Experian customer profile across different geographies is crucial for its strategic approach.

The company's success hinges on its ability to navigate diverse markets. Differences in customer demographics, preferences, and purchasing power across regions necessitate a localized strategy. This involves tailoring products, services, and marketing efforts to meet specific market needs. Experian's ability to adapt to local regulations and consumer behaviors is key to its global competitiveness.

Experian's geographical presence is a testament to its strategic vision and adaptability. The company has consistently expanded its reach, focusing on high-growth markets and leveraging strategic partnerships. This approach allows Experian to tap into local expertise and data, further solidifying its position in the global market.

North America, especially the United States, is a cornerstone of Experian's business, consistently contributing a substantial portion of its revenue. The US market showcases a mature credit infrastructure. Experian focuses on advanced analytics, fraud prevention, and personalized marketing solutions in this region.

In the UK, Experian is a dominant force in the credit referencing industry. The company provides comprehensive credit data and analytics services. Experian's strong market share in the UK is a result of its established presence and trusted brand.

In Latin America, Experian focuses on expanding access to credit and supporting financial inclusion. This involves adapting its data models and product features to local economic conditions. Experian's approach in Latin America highlights its commitment to serving emerging markets.

Experian is also expanding its presence in the Asia Pacific region. This includes strategic partnerships and acquisitions to gain access to local data and expertise. The company's focus on high-growth markets is evident in its Asia Pacific strategy.

Experian's approach to market segmentation involves tailoring its offerings to meet the specific needs of each region. For instance, credit scoring models are adjusted to reflect local economic conditions and consumer behavior. Marketing campaigns are also localized to resonate with cultural nuances and media consumption habits. This localized approach is key to Experian's success in diverse markets. To learn more about how Experian approaches growth, you can read about the Growth Strategy of Experian.

Experian customizes its data models to suit local market conditions. This ensures the accuracy and relevance of its credit scoring and analytics services. Tailoring data models is crucial for effective risk assessment.

Experian adapts to different regulatory frameworks across various regions. This ensures compliance with local laws and regulations. Adhering to local laws is vital for maintaining trust and avoiding legal issues.

The company modifies its product features to meet the specific needs of each market. This includes offering services relevant to the local financial landscape. Adapting features ensures the products are useful and competitive.

Experian localizes its marketing strategies to resonate with the cultural nuances of each region. This includes tailoring messaging and media consumption habits. Localized marketing enhances brand engagement.

The company forms strategic partnerships to strengthen its presence in high-growth markets. These partnerships provide access to local data and expertise. Strategic alliances are key for market expansion.

North America consistently contributes a substantial portion of Experian's revenue. The geographic distribution of sales reflects the company's strategic focus. Revenue distribution highlights key market performance.

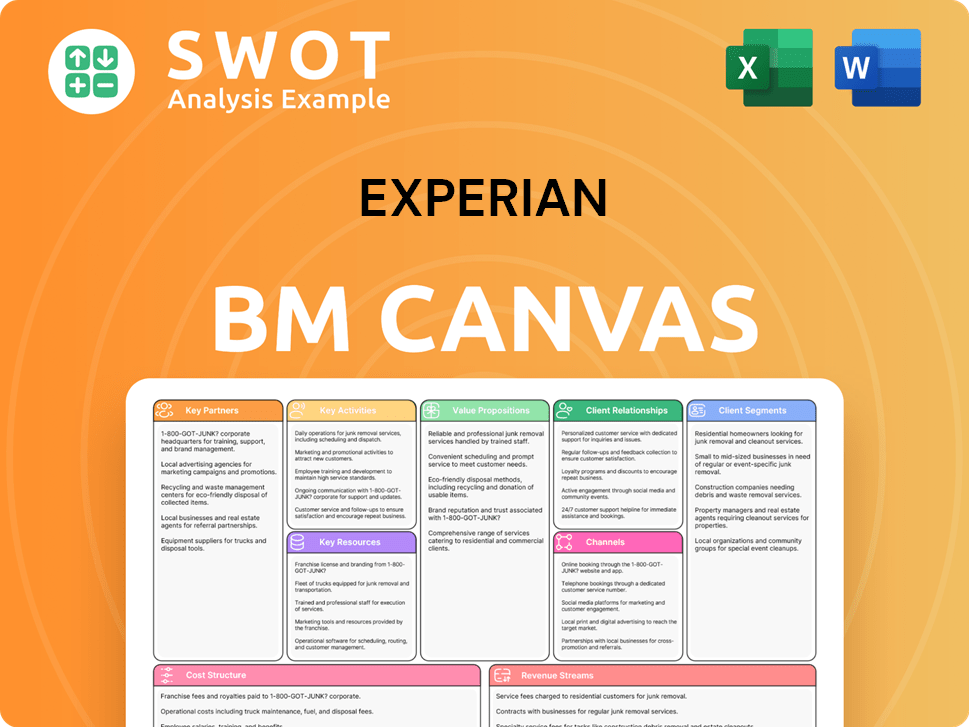

Experian Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Experian Win & Keep Customers?

The company employs distinct strategies for acquiring and retaining customers in both its B2B and B2C segments. This approach is heavily influenced by the nature of its services, which involve data and analytics solutions. The company's customer acquisition and retention strategies are data-driven, leveraging various channels to reach its target market and maintain customer loyalty.

For business clients, the company focuses on direct sales, industry partnerships, and participation in financial and technology conferences. Digital marketing, including targeted advertising and content marketing, plays a crucial role in attracting individual consumers. The company's ability to tailor solutions and communications based on detailed customer profiles is a key factor in its success. The strategies are designed to meet the needs of a diverse customer base, from large financial institutions to individual consumers.

The company's customer acquisition strategies are designed to attract both businesses and individual consumers through a variety of channels. Retention efforts aim to build long-term relationships by providing ongoing value and personalized services. Understanding the customer demographics and tailoring strategies accordingly is crucial for the company's growth.

The company uses direct sales teams, industry partnerships, and participation in conferences to acquire business clients. They utilize targeted digital advertising, content marketing, and thought leadership to establish themselves as experts in data and analytics. This approach focuses on building relationships and demonstrating the value of their services.

Retention strategies for business clients rely on account management, product innovation, and demonstrating a clear return on investment (ROI). They leverage their own data and CRM systems to segment clients and offer personalized solutions. This ensures that clients continue to see value and remain loyal.

The company focuses on digital marketing, including SEO, paid search, social media campaigns, and affiliate marketing. Free credit reports and scores serve as a significant lead generation tool. This attracts individuals seeking to understand and improve their financial standing.

Retention strategies for consumers focus on providing ongoing value through credit monitoring, identity theft protection, and personalized financial insights. Loyalty programs, though not explicitly detailed, are often embedded in subscription models. The goal is to keep consumers engaged and informed.

The company's approach to customer acquisition and retention is dynamic, adapting to market changes and technological advancements. A deeper understanding of the company's Growth Strategy of Experian reveals how the company aligns its strategies with its target market and customer demographics.

The company segments its market based on various factors, including industry, company size, and consumer financial behavior. This allows for tailored solutions and marketing messages. Effective segmentation is crucial for reaching the right audience with the right products.

The company uses its own data and CRM systems to personalize interactions with both business and consumer clients. This includes customized product recommendations and tailored support. Personalization enhances customer satisfaction and loyalty.

The company is increasingly focusing on mobile-first experiences to cater to evolving consumer preferences. This includes optimizing its services for mobile devices and enhancing the user experience. This strategy is designed to improve customer engagement and accessibility.

The company emphasizes direct-to-consumer digital channels to improve customer lifetime value and reduce churn. This involves providing online access to products and services. This shift aims to create a more engaged and empowered customer base.

The company focuses on strategies to improve customer lifetime value, aiming to maximize the long-term profitability of its customer relationships. By understanding customer needs and behaviors, the company tailors its offerings to increase customer loyalty and spending over time.

The company implements strategies to reduce churn rate by fostering a more engaged and empowered customer base. This includes providing value-added services and personalized support to retain customers and prevent them from switching to competitors.

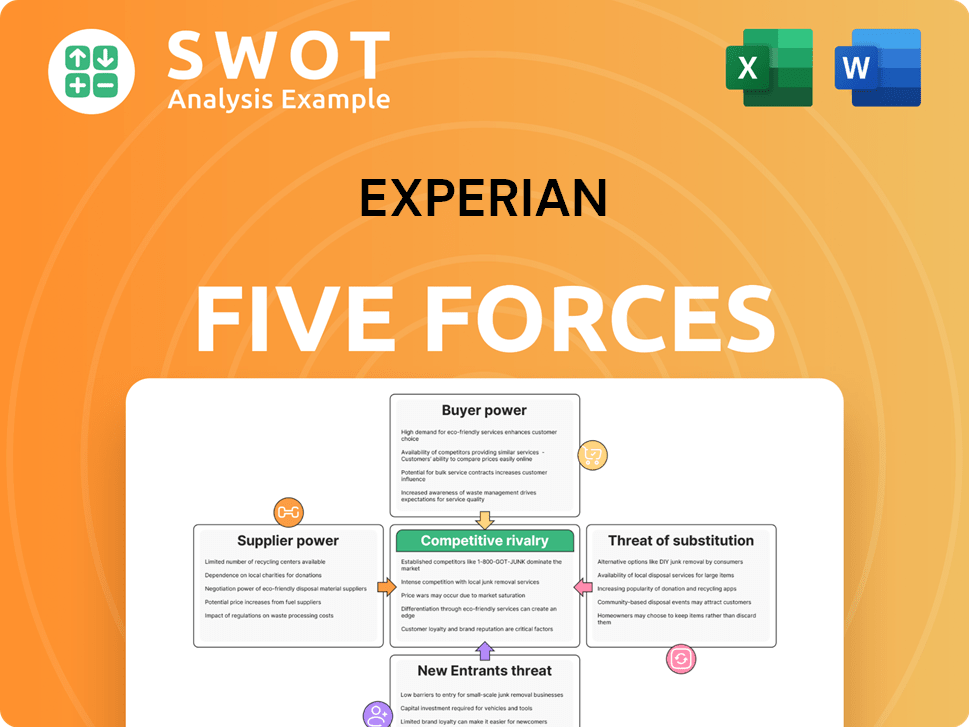

Experian Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Experian Company?

- What is Competitive Landscape of Experian Company?

- What is Growth Strategy and Future Prospects of Experian Company?

- How Does Experian Company Work?

- What is Sales and Marketing Strategy of Experian Company?

- What is Brief History of Experian Company?

- Who Owns Experian Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.