Experian Bundle

How Does Experian Shape Your Financial World?

Experian, a global leader in information services, quietly influences financial decisions for millions worldwide. From managing credit risk to preventing fraud, Experian's impact is far-reaching, impacting both businesses and consumers. Understanding Experian's operations is key to navigating today's complex financial landscape, whether you're an investor, consumer, or business owner.

Experian's Experian SWOT Analysis reveals its strengths in the credit bureau industry, including its robust Experian credit report services and its ability to provide credit monitoring. Knowing how Experian calculates credit score is crucial for individuals aiming to improve their credit score. Furthermore, understanding the Experian credit report dispute process and the cost of Experian credit monitoring are essential for managing your financial health effectively. Exploring Experian free credit report options and the differences between Experian vs Equifax vs TransUnion can also empower consumers.

What Are the Key Operations Driving Experian’s Success?

Experian is a global information services company that leverages data, analytics, and technology to create value for a diverse range of customers. Its core operations revolve around providing critical data and insights across various sectors, including financial services, automotive, and telecommunications. The company's services are designed to help businesses make informed decisions and assist consumers in managing their financial health.

The value proposition of Experian lies in its ability to transform complex data into actionable intelligence. This enables businesses to assess risk, optimize decision-making processes, and engage with their target customers more effectively. For consumers, Experian offers tools and services that promote financial literacy, credit monitoring, and identity theft protection. Its comprehensive offerings aim to empower both businesses and individuals to make smarter financial choices.

Experian operates through three primary segments: Credit Services, Decision Analytics, and Marketing Services. These segments work in tandem to provide a holistic suite of products and services. Experian's operations are heavily reliant on technology, data aggregation, and analytical modeling, which allows it to deliver highly accurate and predictive insights. Its extensive data assets and analytical capabilities are key differentiators in the competitive information services market.

Experian provides credit reporting and scoring services, which are essential for businesses to evaluate risk. These services involve collecting and aggregating vast amounts of credit data to generate reports and scores. These reports are crucial in lending decisions, impacting both businesses and consumers. Experian's credit services are a cornerstone of its operations.

Decision Analytics utilizes advanced analytical tools and consulting services to help businesses optimize their decision-making processes. This includes automating and improving loan origination and fraud detection. These services enable businesses to make more efficient and effective decisions. Experian's analytical tools are a valuable asset for its clients.

Marketing Services assist businesses in identifying, understanding, and engaging with their target customers. This is achieved through data-driven insights and marketing platforms. These services help businesses enhance their marketing strategies. Experian's marketing services provide businesses with a competitive edge.

Experian offers direct access to credit reports and scores, credit monitoring, and identity theft protection services. These services empower consumers to manage their financial well-being. This includes tools to monitor their credit health and protect against fraud. Experian helps consumers stay informed and secure.

Experian's operations are built on technology development, data aggregation, and advanced analytical modeling. The company's supply chain is data-driven, focusing on the secure collection and integration of data from various sources. Partnerships with financial institutions and businesses form a robust distribution network. Experian's unique data assets and analytical capabilities set it apart in the market.

- Data Assets: Experian manages vast datasets from lenders, public records, and other sources.

- Analytical Capabilities: Advanced models provide highly accurate and predictive insights.

- Customer Benefits: Businesses benefit from reduced credit risk, while consumers gain enhanced financial literacy.

- Market Differentiation: Experian's comprehensive services differentiate it in the information services market.

Experian's operations are critical to many businesses and consumers. The company's services, including the Experian credit report and credit monitoring, are widely used. For more context on Experian's history and evolution, you can read a Brief History of Experian.

Experian SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Experian Make Money?

Experian's revenue streams are diverse, encompassing subscriptions, transaction fees, and service fees. These streams support its wide range of services across both business and consumer sectors. In fiscal year 2024, Experian's total revenue reached approximately $6.6 billion, demonstrating its significant market presence.

A substantial portion of Experian's revenue comes from its Business-to-Business (B2B) segment, serving financial institutions and other enterprises. The Consumer Services segment, offering credit monitoring and identity protection, also contributes significantly through subscription models. Experian employs various monetization strategies, including tiered pricing and cross-selling, to maximize revenue.

The company's global operations further diversify its revenue, with contributions from North America, Latin America, and the UK & Ireland, as well as EMEA/Asia Pacific. Experian continues to invest in new technologies like AI and machine learning to develop new data-driven products and services, expanding its monetization avenues.

Experian's revenue model is built on several key components. The company generates income through subscriptions, transaction fees, and service fees. These different streams are crucial for Experian's financial performance.

- Subscriptions: Recurring revenue from access to credit data, analytical platforms, and consumer services.

- Transaction Fees: Fees for services like credit checks and identity verification.

- Service Fees: Fees associated with specialized products and solutions.

- B2B Segment: Revenue from financial institutions, telecommunication companies, and other businesses.

- Consumer Services: Revenue from direct-to-consumer credit monitoring and identity protection.

Experian PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Experian’s Business Model?

The evolution of Experian has been marked by significant milestones and strategic moves that have solidified its operational strength and financial performance. A key aspect of its development has been the continuous investment in data and analytics capabilities. This includes incorporating advanced technologies such as artificial intelligence and machine learning to improve its predictive models and decision-making platforms.

Strategic partnerships have also been crucial, enabling Experian to expand its data sources and reach new customer segments. For example, collaborations with fintech companies have allowed it to tap into emerging financial services markets and offer more dynamic credit assessment tools. Experian has also focused on launching new products to address evolving market needs, such as enhanced fraud prevention solutions and more sophisticated marketing analytics tools.

Operational and market challenges, like increasing scrutiny of data privacy regulations (such as GDPR and CCPA) and the ever-present threat of cyberattacks, have necessitated robust responses from Experian. The company has invested heavily in cybersecurity infrastructure and data governance frameworks to ensure compliance and maintain customer trust. Economic downturns and credit market fluctuations have also posed challenges, but Experian’s diversified portfolio across various industries and geographies has provided resilience, allowing it to adapt its service offerings to suit changing demand.

Experian's journey includes significant acquisitions and expansions. These moves have broadened its data assets and service offerings. The company has consistently adapted to technological advancements to stay competitive.

Experian has strategically invested in data and analytics. The company has formed partnerships to expand its reach. It has also focused on product innovation to meet market demands.

Experian has a vast and continuously updated data asset. It has a strong brand reputation and economies of scale. The company is adapting to new trends, including open banking.

In fiscal year 2024, Experian reported a revenue increase of 7% at actual exchange rates and 8% at constant exchange rates. The company's underlying profit before tax increased by 7% at constant exchange rates. Experian's business credit report services are also a key component of its financial performance.

Experian's competitive advantages are multifaceted, with its vast and continuously updated data assets being a key differentiator. Its proprietary analytical models and decisioning software create a significant barrier to entry. Brand strength and a long-standing reputation for reliability further bolster its competitive edge. Economies of scale, derived from processing massive volumes of data, allow Experian to operate efficiently.

- Experian continues to adapt to new trends by actively pursuing open banking initiatives.

- The company is exploring alternative data sources for credit assessment.

- Experian is investing in personalized consumer financial tools.

- These strategies ensure its business model remains robust against technological shifts.

Experian Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Experian Positioning Itself for Continued Success?

Experian holds a strong position in the global information services industry, especially in credit reporting and data analytics. It competes with other major credit bureaus, but its comprehensive services and global reach give it a competitive edge. Experian's market share is significant across various regions, and its extensive data assets contribute to high customer loyalty. The company’s global operations, with a presence in many countries, further strengthens its industry position.

Experian faces risks, including regulatory changes concerning data privacy and consumer protection. New competitors and technological disruptions also pose challenges. Changing consumer preferences, like increased demand for data transparency, require continuous adaptation of consumer-facing services. For more information, you can check out the Target Market of Experian.

Experian is a leading credit bureau, providing Experian services globally. They offer credit reports and data analytics. Their extensive data assets contribute to high customer loyalty.

Key risks include regulatory changes, competition from fintechs, and technological disruptions. Data privacy and consumer protection regulations are ongoing challenges. Adapting to changing consumer preferences is also crucial.

Experian focuses on innovation, data security, and responsible data use. They invest in platforms like Experian Ascend. Strategic partnerships and enhanced value to both businesses and consumers are key.

They are expanding credit access via open banking and alternative data. Commitment to innovation and data security is a priority. They aim to reinforce trust and drive future growth.

Experian is focused on strategic initiatives to sustain and expand its ability to make money. This includes continued investment in its Experian Ascend platform, which leverages advanced analytics and AI to deliver deeper insights and automate decision-making for businesses. The company is also exploring new growth avenues through open banking and the use of alternative data to expand credit access for underserved populations.

- Continued investment in Experian Ascend.

- Exploring open banking opportunities.

- Using alternative data for credit access.

- Focus on data security and responsible use.

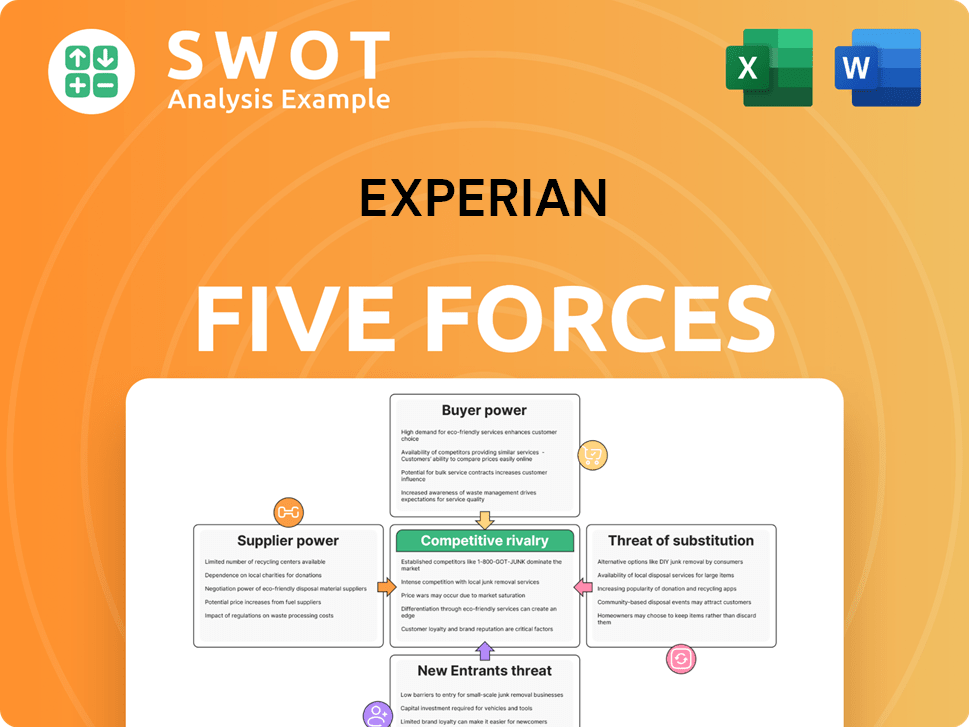

Experian Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Experian Company?

- What is Competitive Landscape of Experian Company?

- What is Growth Strategy and Future Prospects of Experian Company?

- What is Sales and Marketing Strategy of Experian Company?

- What is Brief History of Experian Company?

- Who Owns Experian Company?

- What is Customer Demographics and Target Market of Experian Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.