Experian Bundle

How Does Experian Stack Up in the Data Analytics Arena?

Experian, a titan in the global information services sector, is constantly evolving, especially in the crucial fields of credit reporting and data analytics. The company's focus on AI and machine learning for better decision-making and fraud prevention highlights its commitment to staying ahead. Founded in 1826, Experian has grown from a regional credit bureau into a global leader, making it a fascinating subject for market analysis.

This deep dive into the Experian SWOT Analysis and its competitive landscape will explore its position within the financial services industry, highlighting its strengths, weaknesses, and opportunities. We'll dissect Experian's main competitors, analyze its market share, and examine how it compares to other credit reporting agencies. Understanding Experian's business model and its response to competitive threats is crucial for anyone interested in the data analytics companies.

Where Does Experian’ Stand in the Current Market?

Experian's core operations revolve around providing information services, particularly in credit services and data analytics. The company leverages vast datasets and advanced technologies to offer credit reporting, scoring, and decision analytics solutions. These services are crucial for businesses and consumers, supporting credit decisions, fraud prevention, and marketing strategies. Experian's value proposition lies in its ability to provide comprehensive, reliable, and actionable insights derived from its extensive data resources, which helps clients make informed decisions and manage risk effectively.

The company's services are essential for various sectors, including financial institutions, retailers, and marketing agencies. Experian helps these entities assess creditworthiness, prevent fraud, and target marketing efforts. By offering a suite of integrated services, Experian enables clients to streamline processes, reduce costs, and improve overall performance. This integrated approach is a key differentiator within the Growth Strategy of Experian.

Experian's market position is strong within the global information services industry. The company holds a leading position in consumer credit data in the UK and, alongside Equifax and TransUnion, forms a dominant oligopoly in the U.S. consumer credit reporting market. Experian's financial performance reflects its market strength, with organic revenue growth of 7% in the first half of fiscal year 2024, reaching $3.4 billion. This demonstrates its continued financial health and scale, positioning it favorably against industry averages.

Experian, along with Equifax and TransUnion, dominates the U.S. consumer credit reporting market. Precise market share figures vary, but these three companies collectively control a significant portion. Experian's strong revenue growth of 7% in the first half of fiscal year 2024 indicates its continued market strength and expansion.

Experian's financial health is reflected in consistent revenue growth and strategic investments. The company's organic revenue growth of 7% in the first half of fiscal year 2024, reaching $3.4 billion, is a key indicator. This growth is supported by a focus on digital transformation and diversification of offerings, particularly in fraud prevention and identity verification.

Experian's competitive advantages include its extensive data assets, advanced analytics capabilities, and global presence. The company's ability to provide comprehensive, reliable, and actionable insights gives it an edge. Its strategic focus on innovation and digital transformation further strengthens its position.

Experian's growth strategies involve expanding its footprint in emerging markets and diversifying its offerings. The company is focused on digital transformation and innovation in areas like fraud prevention and identity verification. These strategies are aimed at adapting to evolving market needs and consumer behaviors.

Experian holds a leading position in the global information services industry, particularly in credit services and data analytics. It is part of a dominant oligopoly in the U.S. consumer credit reporting market, alongside Equifax and TransUnion. In the UK, Experian leads in consumer credit data.

- Strong market position in developed markets like the U.S. and UK.

- Active expansion into emerging markets.

- Consistent revenue growth, with organic revenue up 7% in the first half of fiscal year 2024.

- Strategic focus on digital transformation and diversification of offerings.

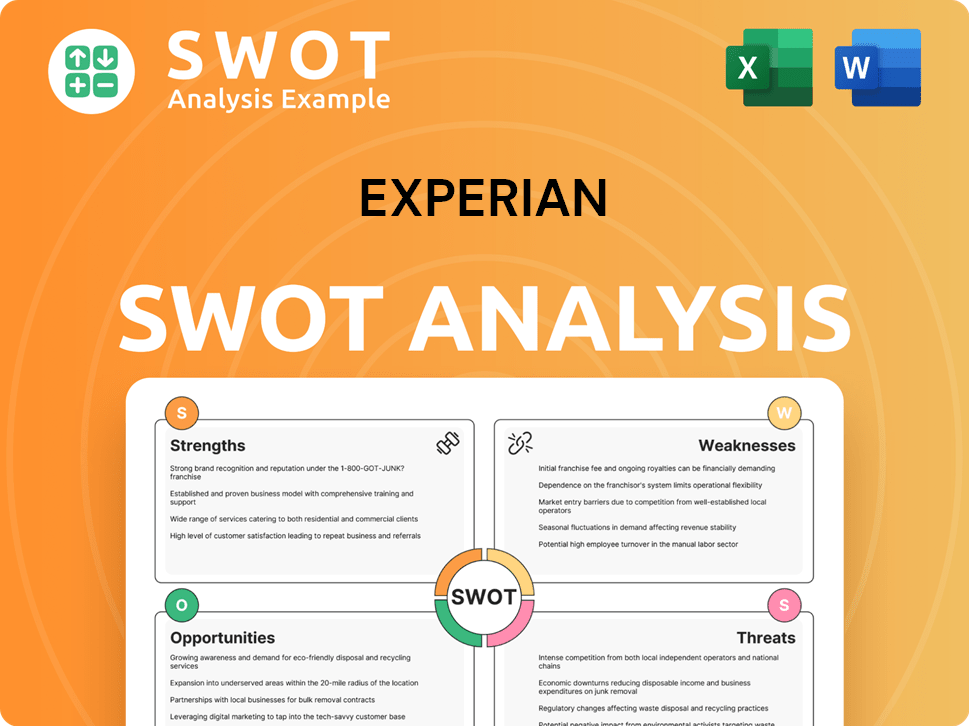

Experian SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Experian?

The Owners & Shareholders of Experian faces a dynamic competitive landscape. Experian's market analysis reveals a complex web of rivals across its various business segments, from credit reporting to data analytics and marketing services. Understanding these competitors is crucial for assessing Experian's strengths, weaknesses, and overall industry position.

Experian's competitive landscape is shaped by both direct and indirect competitors. The financial services industry is highly competitive, with companies constantly vying for market share and innovation. This environment requires Experian to continually adapt and innovate to maintain its competitive edge.

Experian's primary competitors are the major credit reporting agencies, Equifax and TransUnion. These companies offer similar services, including credit reporting, risk management, and fraud prevention, often competing head-to-head for major contracts and market share. Experian's market share analysis in 2024 shows a constant battle for dominance among these three key players.

Equifax and TransUnion are Experian's main competitors in the credit reporting and data analytics space. These companies offer similar services, competing for market share in consumer and business credit services.

LexisNexis Risk Solutions and FICO are indirect competitors, particularly in fraud prevention and decision analytics. They leverage extensive data sets and specialized solutions to challenge Experian's market position.

Fintech and regtech companies are emerging competitors, offering niche solutions for credit assessment and fraud detection. These companies often leverage advanced technologies like AI and blockchain.

Experian's competitive advantages include its extensive data assets, global presence, and diverse service offerings. These factors help Experian maintain a strong position in the market.

Mergers and acquisitions, along with technological advancements, are reshaping the competitive landscape. These changes require Experian to adapt and innovate to stay ahead.

The financial services industry is constantly evolving, with increasing focus on data security, AI, and regulatory compliance. These trends influence Experian's strategic direction.

Experian's main competitors in the US, Equifax and TransUnion, focus on credit reporting and related services. Equifax invests heavily in technology and data assets, while TransUnion differentiates through industry-specific solutions. Other players, like LexisNexis and FICO, offer competing solutions in fraud prevention and decision analytics. Emerging fintech and regtech companies are also entering the market, leveraging new technologies.

- Equifax: Focuses on data and technology investments.

- TransUnion: Specializes in industry-specific solutions and data visualization.

- LexisNexis: Provides comprehensive data and analytics for risk management.

- FICO: Offers decision management software and analytics.

- Fintech/Regtech: Leverages AI and blockchain for niche solutions.

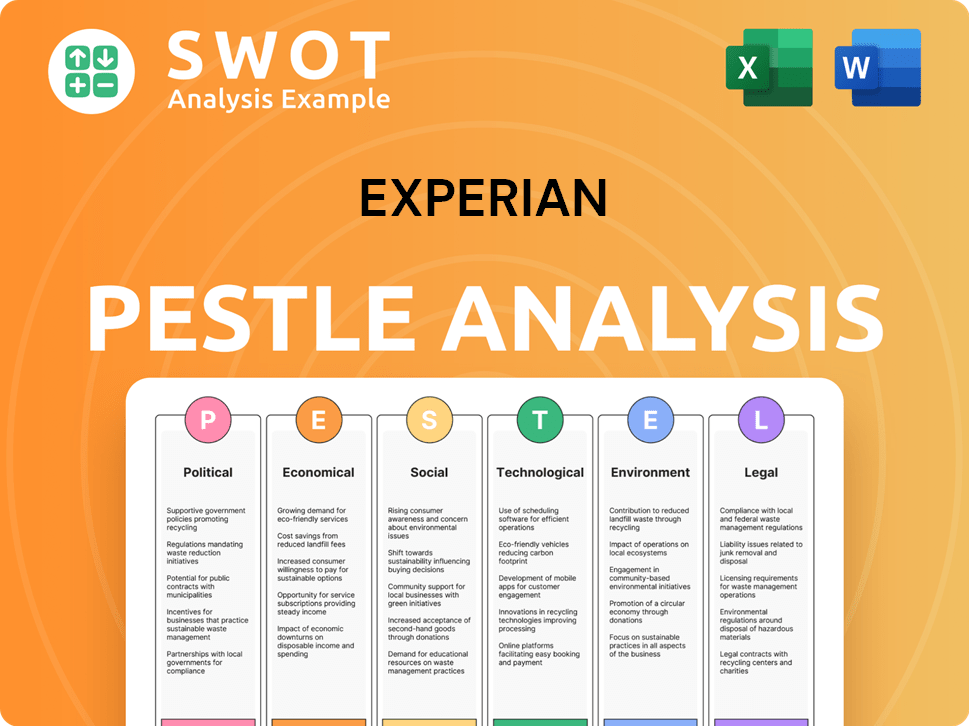

Experian PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Experian a Competitive Edge Over Its Rivals?

Understanding the Experian competitive landscape is crucial for anyone involved in the financial services industry. Experian's position is shaped by its extensive data assets, advanced analytics, and strong brand reputation. This article delves into Experian's competitive advantages, offering insights into its strengths, challenges, and strategies within the credit reporting agencies and data analytics companies sectors.

Experian's market analysis reveals a company that has consistently adapted to the evolving demands of the financial services industry. Its ability to leverage data for credit risk management, fraud prevention, and targeted marketing has solidified its market share. This analysis will explore how Experian's competitive advantages, including its proprietary data and technological advancements, contribute to its sustained success.

For a deeper understanding of the company's origins and evolution, consider reading Brief History of Experian. This provides context for the competitive landscape Experian navigates.

Experian's primary competitive advantage lies in its vast and proprietary data assets. These include consumer and business credit information, along with alternative data sources. This extensive data, continuously updated and refined, creates a significant barrier to entry for Experian's competitors. The depth and scale of this data are hard to replicate.

Experian leverages advanced analytical capabilities, including proprietary algorithms and machine learning models. These tools transform raw data into actionable insights for credit risk management, fraud prevention, and targeted marketing. The company's investment in AI and machine learning allows it to offer more precise and predictive solutions. This technological edge is a key differentiator.

Experian has built a strong, trusted brand over decades, particularly in the credit reporting space. This fosters high customer retention among financial institutions and businesses. For consumers, its well-recognized name makes it a go-to source for credit monitoring and identity protection. This brand recognition translates into a competitive advantage.

Experian benefits from significant economies of scale, allowing it to process vast amounts of data efficiently and offer competitive pricing. Its global distribution network further enhances its reach and ability to serve multinational clients. This operational efficiency and global presence contribute to its competitive edge. In 2024, Experian's global revenue was approximately $6.6 billion, showcasing its extensive reach.

Experian's competitive advantages are multifaceted, including data assets, analytical capabilities, brand equity, and economies of scale. These factors contribute to its strong market position. However, the company faces challenges from evolving regulations and technological changes.

- Extensive and proprietary data assets, creating a high barrier to entry.

- Advanced analytical capabilities, including AI and machine learning, for predictive solutions.

- Strong brand equity and customer loyalty, particularly in the credit reporting space.

- Significant economies of scale and a global distribution network.

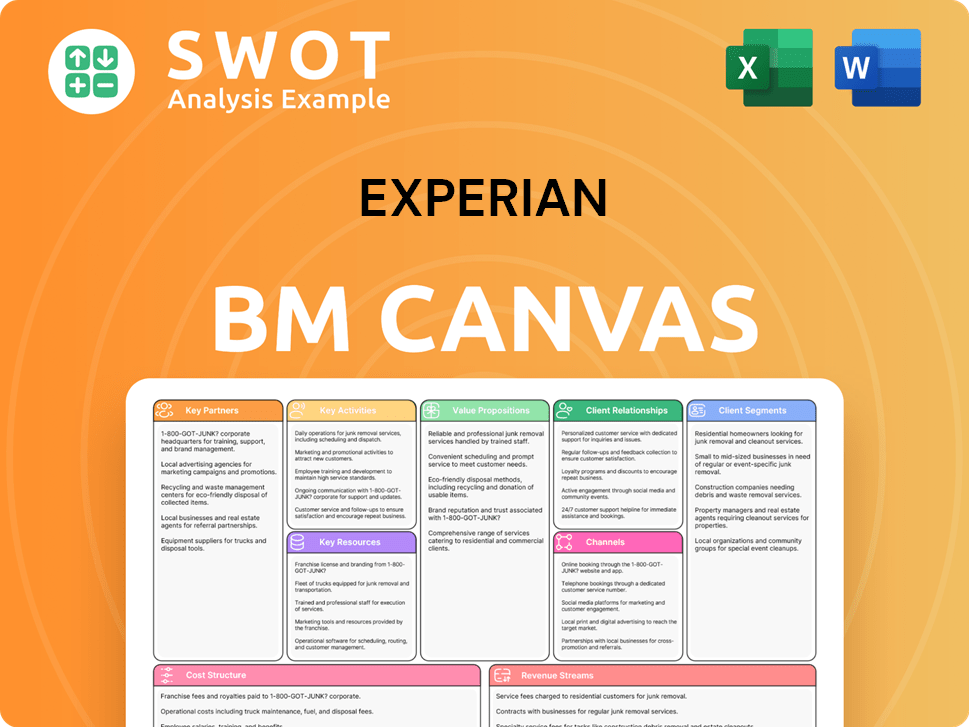

Experian Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Experian’s Competitive Landscape?

The information services industry, where Experian operates, faces dynamic shifts driven by technological advancements, regulatory changes, and evolving consumer expectations. These factors shape the Experian competitive landscape, presenting both challenges and opportunities. Understanding these trends is crucial for assessing the company's future prospects and its ability to maintain a strong market position. The company's success hinges on its capacity to adapt and innovate within this complex environment.

Experian's market analysis reveals a landscape where data analytics and AI are increasingly important. The company must navigate regulatory hurdles, such as data privacy laws, while also responding to consumer demands for greater control over personal data. Furthermore, the rise of alternative data sources and new market entrants poses potential threats to its traditional credit bureau model. The company's ability to leverage its strengths and capitalize on growth opportunities will determine its success.

AI and ML are becoming increasingly important for credit scoring, fraud detection, and personalized marketing. Big data analytics continues to drive demand for sophisticated data processing and insights. Experian is investing in these areas to maintain its competitive edge. The use of alternative data sources is also growing, especially for underserved populations.

Data privacy regulations like GDPR and CCPA require significant investment in data governance. Consumer preferences are shifting towards greater transparency and control over personal data. These changes impact how data is collected, stored, and utilized. The company must adapt to these evolving consumer expectations.

Aggressive new competitors in AI-driven analytics and fraud prevention pose a threat. Data breaches and maintaining data accuracy are ongoing challenges. The rise of alternative data and blockchain could disrupt traditional credit bureau models. Experian needs to defend its market share against these potential disruptors.

Emerging markets offer significant growth potential due to less developed credit infrastructure. Product innovations in open banking and real-time data analytics create expansion opportunities. Strategic partnerships with fintech companies and e-commerce platforms can unlock new revenue streams. Experian can expand its ecosystem through strategic moves.

Experian's future likely involves a more integrated, AI-driven platform approach, emphasizing advanced analytics and consumer empowerment. The company's ability to manage and leverage data effectively will be crucial. For a deeper understanding of the company's target audience, consider reading about the Target Market of Experian.

- Experian's main competitors in the US include Equifax and TransUnion.

- The company's growth strategies focus on innovation and strategic partnerships.

- Experian's competitive advantages include its extensive data assets and global presence.

- The company's financial performance indicators are key to assessing its success.

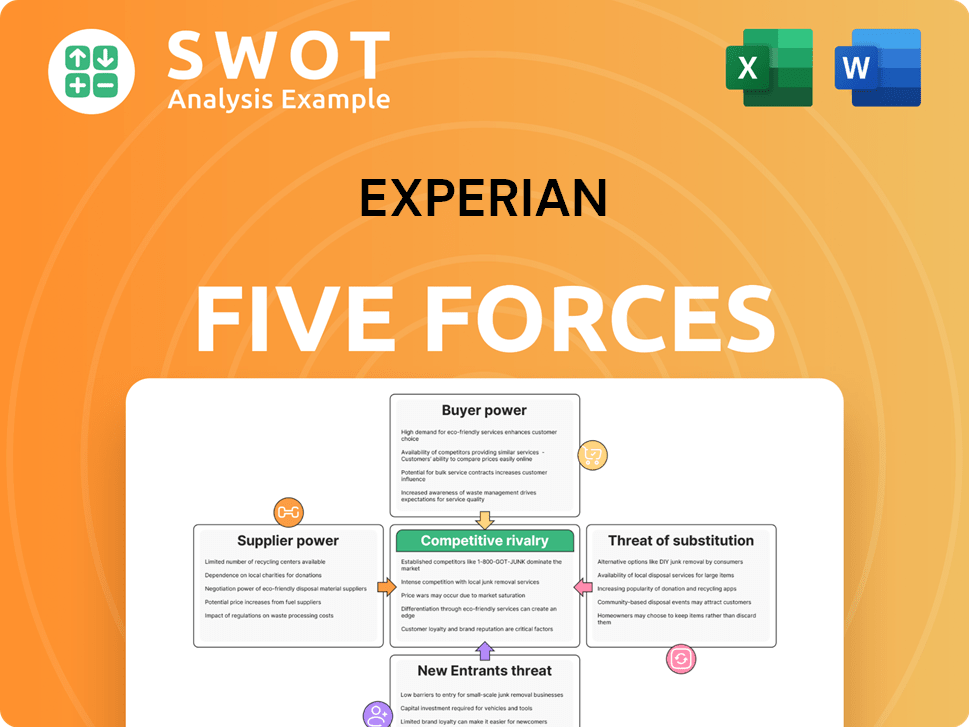

Experian Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Experian Company?

- What is Growth Strategy and Future Prospects of Experian Company?

- How Does Experian Company Work?

- What is Sales and Marketing Strategy of Experian Company?

- What is Brief History of Experian Company?

- Who Owns Experian Company?

- What is Customer Demographics and Target Market of Experian Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.