Ferrovial Bundle

How Did a Spanish Railway Contractor Become a Global Infrastructure Giant?

From a humble attic in Madrid, Spain, in 1952, Ferrovial, a Ferrovial SWOT Analysis, emerged with a vision to reshape infrastructure. Initially focused on railway construction, the

This

What is the Ferrovial Founding Story?

The story of the Ferrovial company begins on December 18, 1952. It was founded by Rafael del Pino y Moreno in an attic in Madrid. This marked the start of what would become a major player in the infrastructure and construction sectors.

Rafael del Pino y Moreno, a civil engineer, saw an opportunity to modernize Spain's infrastructure. Inspired by railway construction methods he observed in other European countries, he aimed to bring these techniques to Spain. This vision led to the creation of Ferrovial, a company initially focused on railway projects.

The name 'Ferrovial' itself reflects the company's early focus on railways. The initial capital outlay for machinery was equivalent to approximately 6,000 euros, showing a resourceful start. The company's early success was built on efficiency and innovation, setting the stage for future growth. For more detailed information, you can check out Owners & Shareholders of Ferrovial.

Ferrovial's founding was driven by the need for infrastructure development in post-Civil War Spain.

- Founded in 1952 by Rafael del Pino y Moreno.

- Initial focus on railway projects.

- First major contract involved mortising wooden rail ties for Renfe.

- Efficient project execution, such as laying 18 miles of track in 30 days in 1958.

- Rafael del Pino y Moreno chaired the company for 48 years.

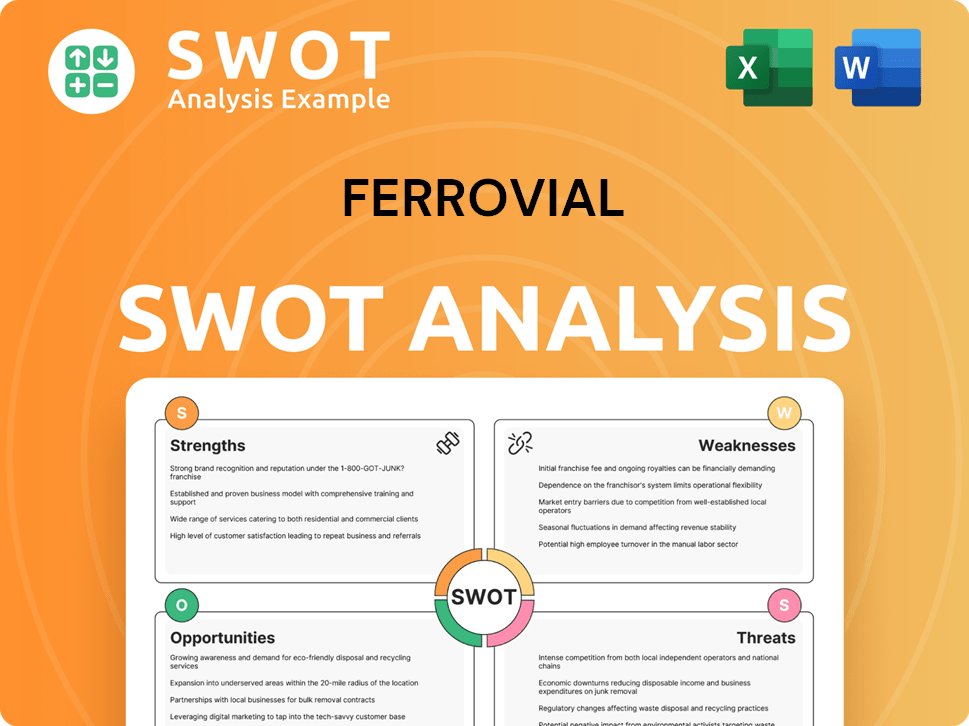

Ferrovial SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Ferrovial?

The early growth of the Ferrovial company was marked by strategic expansion beyond its initial focus on railways. This period included diversification into various construction projects and a significant entry into the toll road concession business. These moves were crucial in establishing the foundation for its future as a global infrastructure operator.

By the early 1960s, the Spanish company had grown to over 500 employees. It expanded its construction activities to include waterworks, roads, and buildings. A key milestone was joining the Redia Plan for road construction in 1964. In 1968, it was awarded the concession for the Bilbao-Behobia highway, Spain's first privately financed toll road.

The late 1970s saw the first phase of international expansion, driven by the economic recession. The company explored opportunities in Libya, Mexico, Brazil, and Paraguay. The 1980s brought a revival of construction in Spain, with Ferrovial playing a crucial role in modernizing infrastructure. This included highways, ports, airports, and railways.

The 1990s were a period of significant diversification and further internationalization. Rafael del Pino Calvo-Sotelo was appointed CEO in 1992, initiating a company reorganization. In 1995, Ferrovial acquired Agroman, positioning itself as one of Spain's largest construction companies. The company entered the North American market by obtaining the 407 ETR, a Canadian toll road, under a 99-year concession.

In 1999, Ferrovial was floated on the stock exchange, integrating all its construction activity into Ferrovial Agroman. This strategic move highlighted the company's growth and its transformation into a major player in the global infrastructure market. The company's early focus on strategic acquisitions and geographical diversification laid the groundwork for its future expansion.

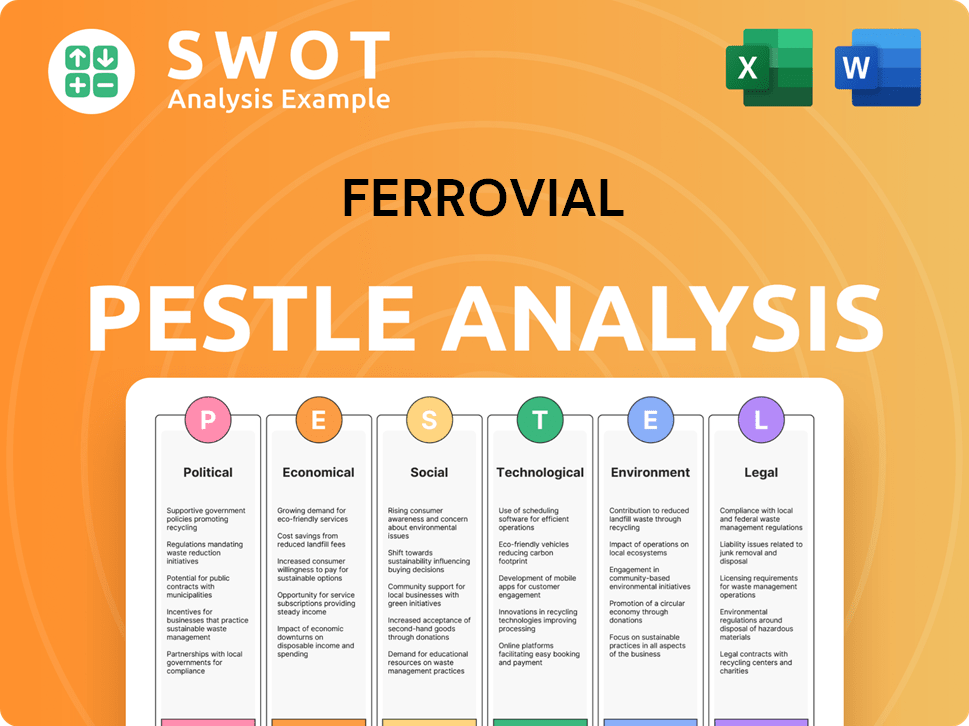

Ferrovial PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Ferrovial history?

The Ferrovial company has a rich history marked by strategic acquisitions, innovative projects, and a commitment to sustainable infrastructure. From its beginnings as a Spanish company, Ferrovial has grown into a global leader in construction and infrastructure management, adapting to market changes and technological advancements.

| Year | Milestone |

|---|---|

| 2002 | Ferrovial acquired a 20% stake in Sydney Airport, marking its initial foray into airport management. |

| 2003 | The company expanded its services by acquiring Amey and Cespa. |

| 2006 | Ferrovial acquired BAA (now Heathrow Airport Holdings), significantly increasing its airport management portfolio. |

| 2008 | The global financial crisis triggered a period of high debt and strategic divestments for many companies, including Ferrovial. |

| 2010-2014 | Ferrovial acquired airports in Aberdeen, Glasgow, and Southampton, expanding its presence in the UK. |

| 2017 | Ferrovial entered the urban mobility sector with the launch of Zity, a carsharing operator, in Madrid. |

| 2021 | Ferrovial launched its new Energy Infrastructure and Mobility business unit and sold its Environmental business in Spain and Portugal. |

| 2024 | Ferrovial strengthened its climate targets, aligning with the 1.5°C pathway under the Science Based Target initiative (SBTi). |

| 2025 | The successful opening of the Silvertown Tunnel in London, a project in which Ferrovial participated through the RiverLinx consortium. |

Innovation has been a constant driver for the

Ferrovial launched Zity, a carsharing operator, in Madrid in 2017, expanding into urban mobility solutions. In 2018, they launched Wondo, a Mobility as a Service startup, further diversifying their offerings.

In 2021, Ferrovial launched its new Energy Infrastructure and Mobility business unit, focusing on sustainable energy projects. This pivot reflects a strategic shift towards environmentally conscious infrastructure solutions.

Ferrovial is actively involved in urban air mobility (UAM) and advanced air mobility (AAM). The company has announced plans for vertiport networks and partnerships with companies like Lilium.

Ferrovial launched the AIVIA initiative to develop 5G roads of the future. This initiative aims to integrate advanced technology into road infrastructure for improved efficiency and safety.

The

The 2008 financial crisis led to high debt levels and strategic divestments. Ferrovial navigated these challenges by focusing on core competencies and seeking growth opportunities.

Ferrovial has successfully overcome market downturns through strategic repositioning and diversification. The company's focus on innovation has been key to maintaining its competitive edge.

The infrastructure and construction sectors are highly competitive. Ferrovial addresses these threats by continuously innovating and expanding its portfolio of projects and services.

Ferrovial has strengthened its climate targets, aiming to cut direct emissions by 42% and indirect emissions by 25% by 2030. The company's proactive approach to sustainability has been recognized with its inclusion in prestigious sustainability indexes.

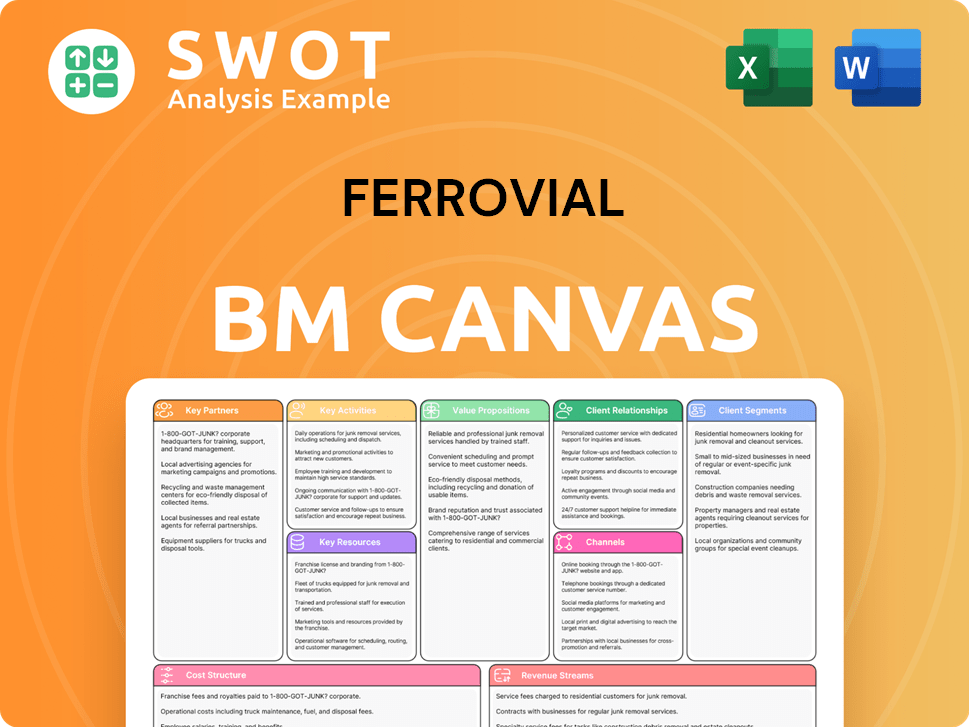

Ferrovial Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Ferrovial?

The Ferrovial history began in 1952, when Rafael del Pino y Moreno founded the Spanish company. Over the decades, Ferrovial evolved from railway construction to become a global infrastructure leader. Key milestones include expansion into international markets, acquisitions of major companies, and significant infrastructure projects worldwide, solidifying its position in the construction and infrastructure sectors.

| Year | Key Event |

|---|---|

| 1952 | Rafael del Pino y Moreno founded Ferrovial in Madrid, initially focused on railway construction. |

| 1968 | Awarded the concession for the Bilbao-Behobia highway, Spain's first privately financed toll road. |

| 1998 | Entered the North American market with the 407 ETR concession in Canada. |

| 1999 | Ferrovial went public on the stock exchange. |

| 2006 | Acquired airport operator BAA (now Heathrow Airport Holdings). |

| 2024 | Ferrovial shares began trading on the Nasdaq Stock Exchange; the company reported adjusted EBITDA of €1.3 billion and net profit of €3.2 billion. |

| 2025 (Q1) | Reported a 19.1% increase in adjusted EBITDA to €309 million and a 7.4% increase in revenue to €2.1 billion. |

Ferrovial is heavily focused on North America as a key growth engine. The company plans to continue expanding its North American asset base, with a focus on high-return and cash-generating projects, particularly in highways and airports. The New Terminal One (NTO) at JFK International Airport, a $9 billion project, is nearing completion.

The Spanish company is investing in renewable energy projects, such as a $72 million solar photovoltaic plant in Leon County, Texas. Ferrovial's commitment to sustainability remains a key focus, with its Airports division launching a 2024-2030 sustainability strategy aligned with broader company objectives. This includes reducing carbon emissions and promoting sustainable practices.

Ferrovial is leveraging automation, AI, and data-driven tools to enhance efficiency and safety in construction. The company aims for all employees to use AI to develop new skills and optimize collaboration. This focus on technology is designed to improve project delivery and operational performance.

Ferrovial plans to distribute €570 million in dividends and has authorized an additional €500 million buyback program for 2025. These actions demonstrate a shareholder-friendly approach, reflecting the company's financial health and commitment to returning value to its investors. The company's financial performance is a key factor.

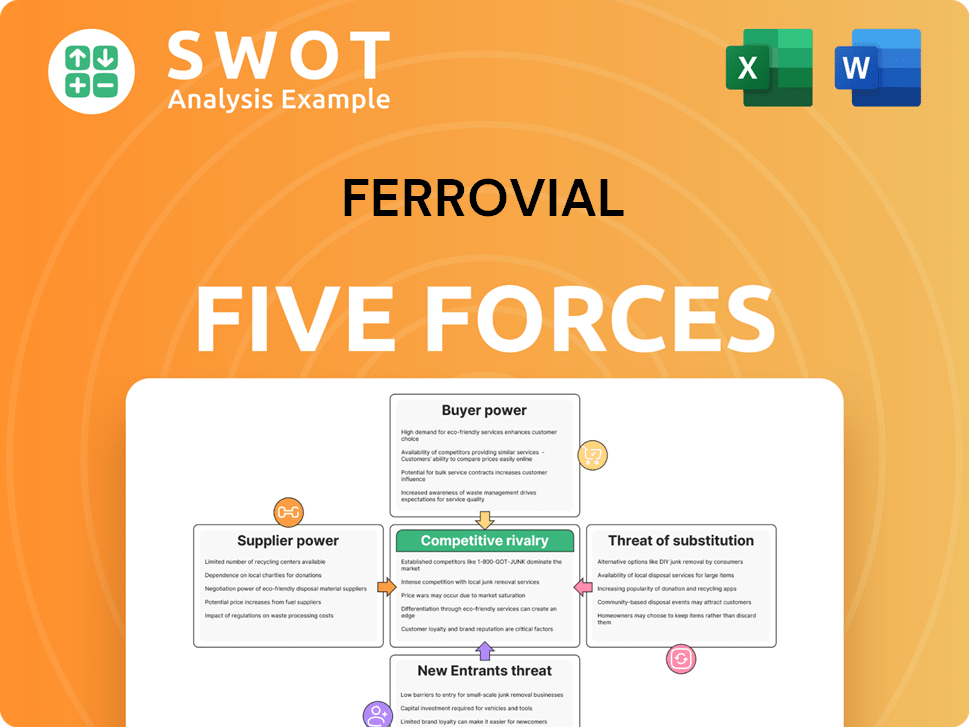

Ferrovial Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Ferrovial Company?

- What is Growth Strategy and Future Prospects of Ferrovial Company?

- How Does Ferrovial Company Work?

- What is Sales and Marketing Strategy of Ferrovial Company?

- What is Brief History of Ferrovial Company?

- Who Owns Ferrovial Company?

- What is Customer Demographics and Target Market of Ferrovial Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.